Forex Calls Recap for 5/14/14

The EURUSD stuck in a 30 pip range for the session, so neither of our calls triggered. All pairs are shown below anyway, as usual. Let's hope tomorrow is better for movement, although I'd rather have no triggers than a trigger and stop.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 5/13/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered, which is actually preferred in this scenario.

From the Messenger/Tradesight_st Twitter Feed, Rich's DXPE triggered short (with market support) and worked:

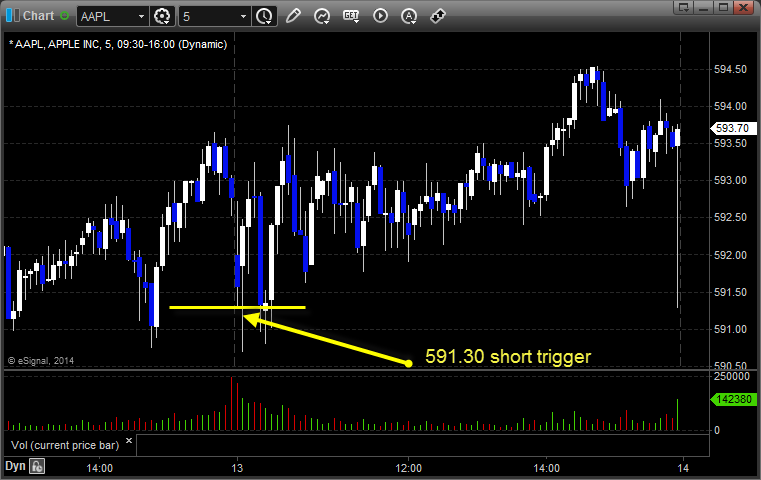

His AAPL triggered short (with market support) and didn't work:

NTAP triggered long (with market support) and didn't work as the market rolled to the downside, worked later:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not. Although only 3 trades triggered (about as few as we ever have), this was one of very few days with a win ratio under 50%, although Rich's DXPE worked nicely.

Futures Calls Recap for 5/13/14

Well, we call that a "measuring day," where the market does literally nothing and overtrading chops you apart. We had a nice setup on the NQ and one on the ES, but the markets barely moved an inch and volume slipped all session, closing at 1.6 billion NASDAQ shares. On to options unraveling, hopefully tomorrow.

Net ticks: -21 ticks.

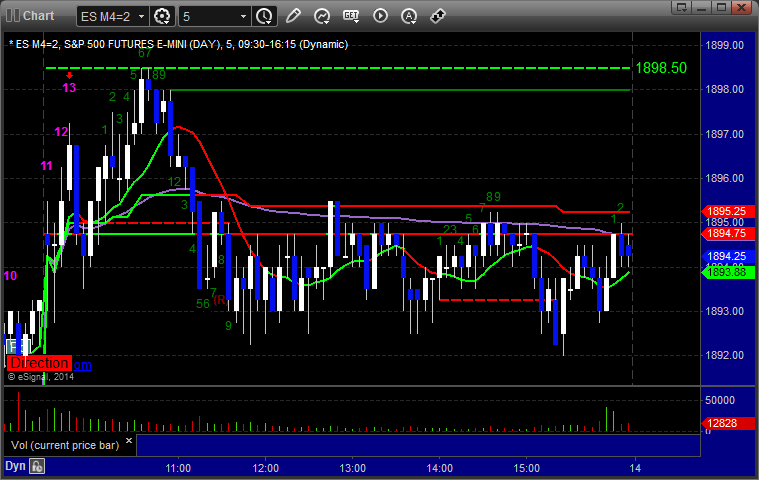

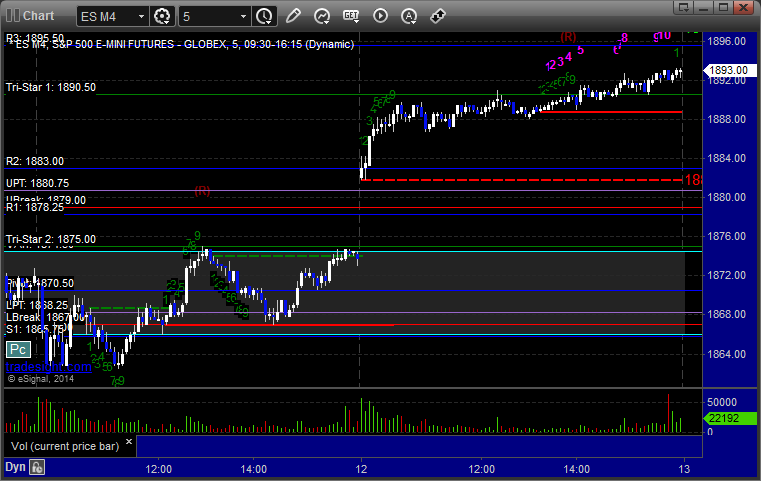

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1897.50 and stopped. Did not re-enter, and it would have stopped again. We had a great Value Area setup, almost perfect, with the ES basing above the VAH all day, and against my better judgement due to lack of volume and action, I went ahead and posted it. It triggered at B and stopped:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3604.00 and stopped:

Forex Calls Recap for 5/13/14

Another slow session, although the EURUSD moved faster and further than the GBPUSD this time. Our trades were in GBPUSD, see that section below.

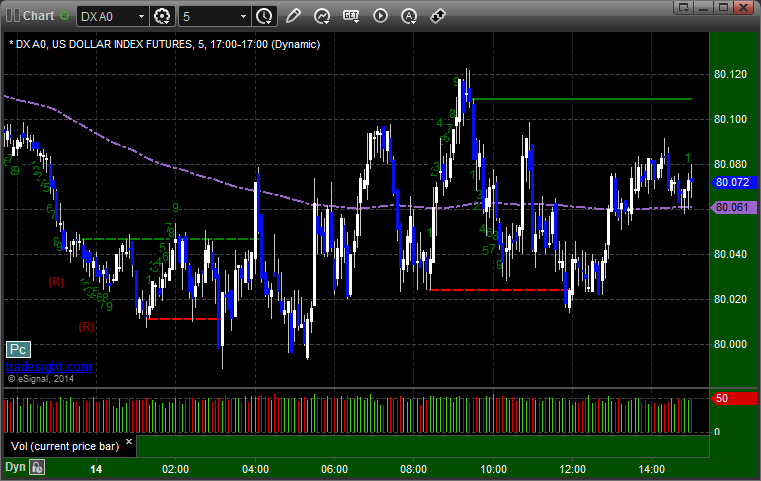

Here's a look at the US Dollar Index intraday with our market directional lines:

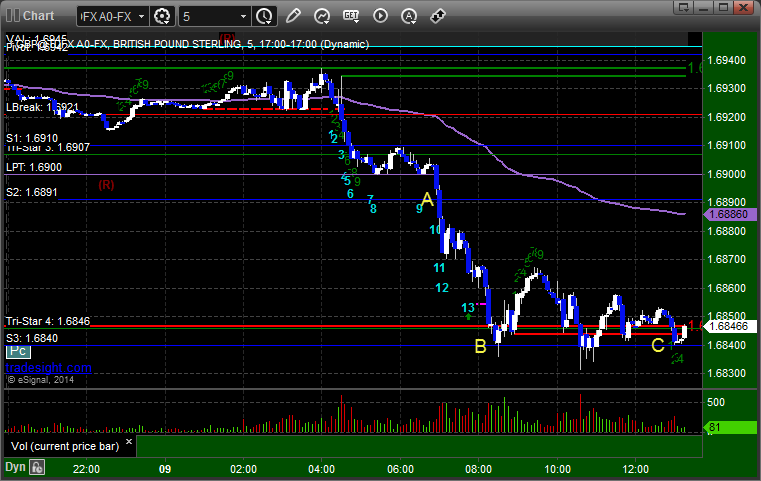

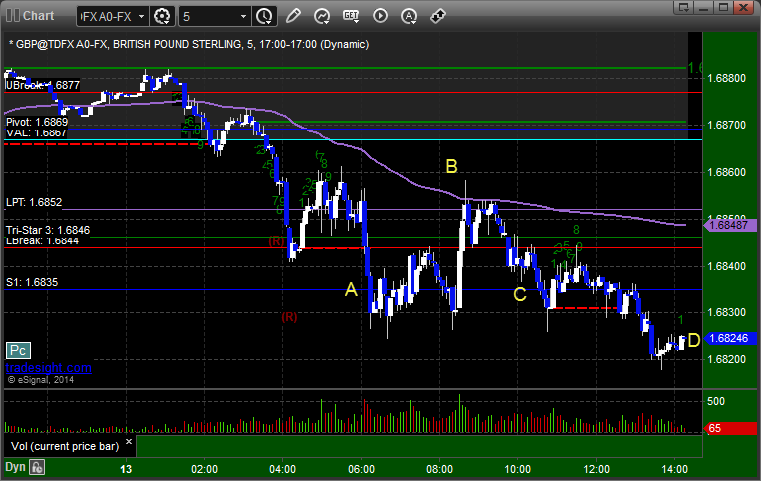

GBPUSD:

Triggered short at A and stopped (just barely) at B. Triggered again at C and closed at D for end of session:

Stock Picks Recap for 5/12/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered long (with market support) and worked great:

SHLD triggered long (with market support) and worked:

CELG triggered long (with market support) and worked:

Rich's QIHU triggered long (with market support) and worked:

His ICPT triggered long (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, all 5 of them worked.

Futures Calls Recap for 5/12/14

The markets gapped up and pushed higher for the first 45 minutes to an hour. The ES only touched the R2 level at the open and then got glued to a new tri-star level at 1890.50 and basically flatlined for the rest of the session. NASDAQ volume closed at only 1.6 billion shares. Our trade call didn't trigger as range was too narrow for the rest of the session.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 5/12/14

Another dull session with the EURUSD in a 25 pip range and the GBPUSD not much better. See the GBPUSD section for the trade result, which wasn't much.

Here's a look at the US Dollar Index intraday with our market directional lines:

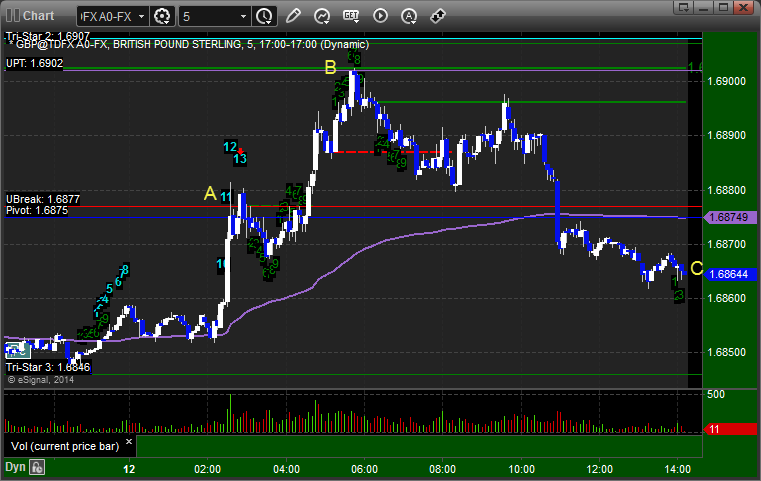

GBPUSD:

Triggered long at A, did not quite make it to first target and stalled out at UPT at B, closed at C for end of session 12 pips under trigger level:

Stock Picks Recap for 5/9/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FINL triggered long (with market support) and worked:

KERX triggered short (without market support due to opening 5 minutes) and worked enough for a partial, but basically was all too fast to take:

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered short (without market support due to opening 5 minutes) and didn't work, but then triggered in the next bar with market support and worked:

Rich's TSLA triggered long (with market support) and didn't work:

His GLD triggered short (ETF, so no market support needed) and worked:

Mark's ALNY triggered long (with market support) and worked:

Lots of other calls, but nothing else triggered.

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 5/9/14

We had a small winner on the NQ and that was it. Markets opened flat and traded both ways, never quite covering average daily range. NASDAQ volume closed at 1.7 billion shares, although it looked much stronger out of the gate. Typical Friday.

Net ticks: +2.5 ticks.

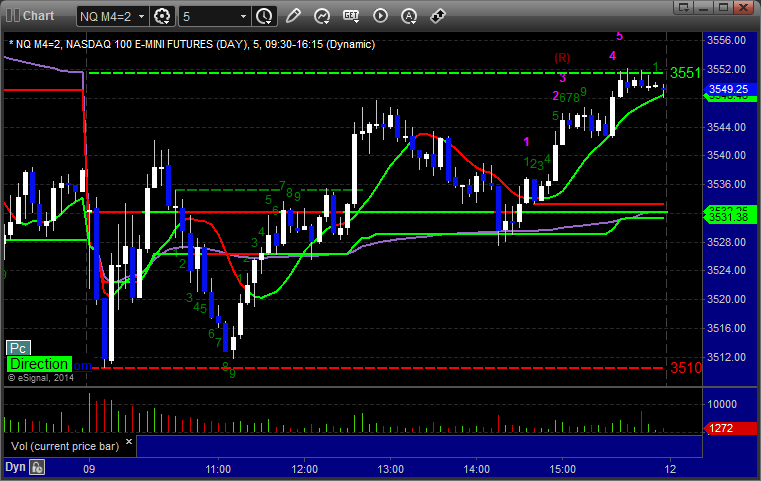

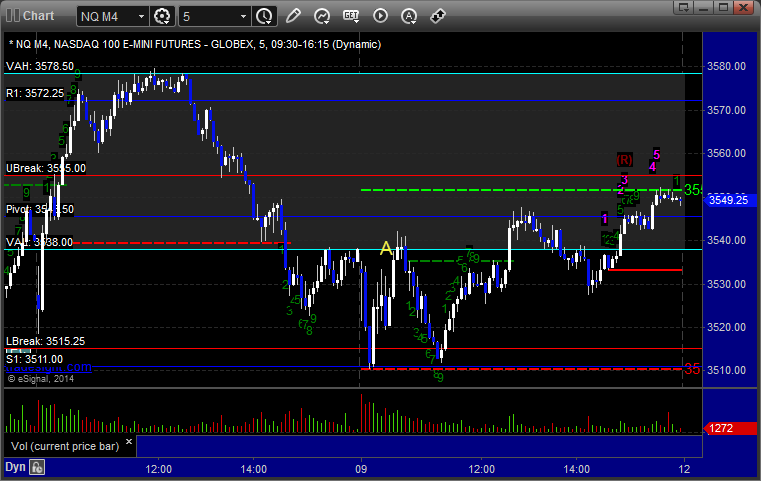

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long into the Value Area at 3538.50, hit first target for 6 ticks, and stopped second half under the entry:

Forex Calls Recap for 5/9/14

A nice winner again to close out the week. Even though we saw narrow ranges 3 of the days this week, we had 2 nice winners. That's the first time in a while that we've seen 2 in a week due to lack of movement. See GBPUSD section below.

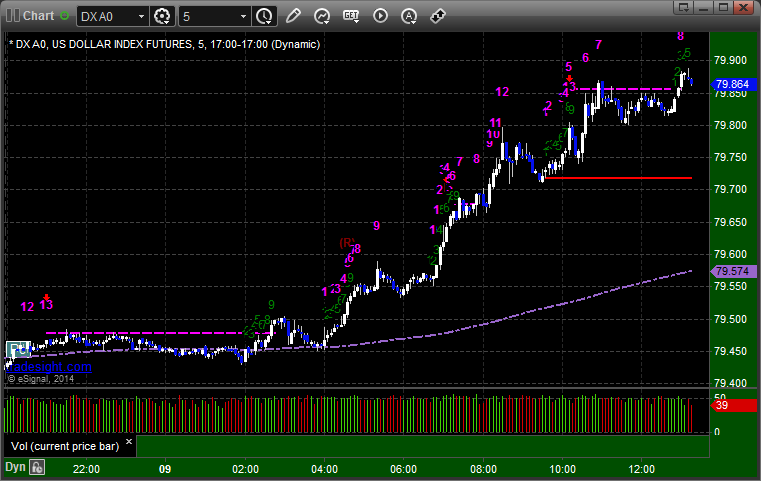

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. There are some interesting things to see in the daily charts regarding Seeker and Comber counts, but not much for patterns. Have a look below.

GBPUSD:

Triggered short at A, hit first target for 45 pips at B, closed second half at C (also 45 pips) for end of week: