Stock Picks Recap for 5/8/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FINL triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's FEYE triggered long (with market support) and worked:

His EA triggered long (with market support) and worked:

I was on a plane, so I don't know if this was a real print or not, but we count it, AAPL triggered long (with market support) and didn't work:

Mark's SNDK triggered long (with market support) and worked enough for a partial:

Rich's FSLR triggered short (without market support) and worked great:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 5/8/14

Mark's call swept once and stopped, then he put it back in and it worked for a nice gain. See NQ below.

Net ticks: +4 ticks.

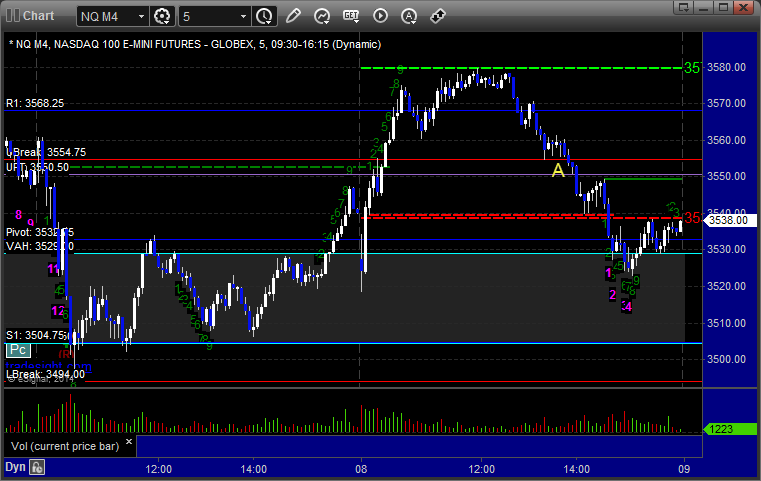

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at A at 3554.00, stopped exactly to the tick right away (a sweep), so Mark re-entered, this time worked for a partial and much more, stopped the final piece at 3546 for 16 ticks:

Forex Calls Recap for 5/8/14

Another night without a trigger. The Forex market remains as slow and limited as I have seen it in ten years of trading it.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 5/7/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ISIS triggered short (with market support) and worked:

ZLTQ triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's EA triggered long (without market support) and worked enough for a quick partial, but had to be fast:

His SNDK triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked enough for a partial:

Rich's AAPL triggered short (with market support) and worked:

Mark's COF triggered long (with market support) and worked;

Rich's IBM triggered long (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

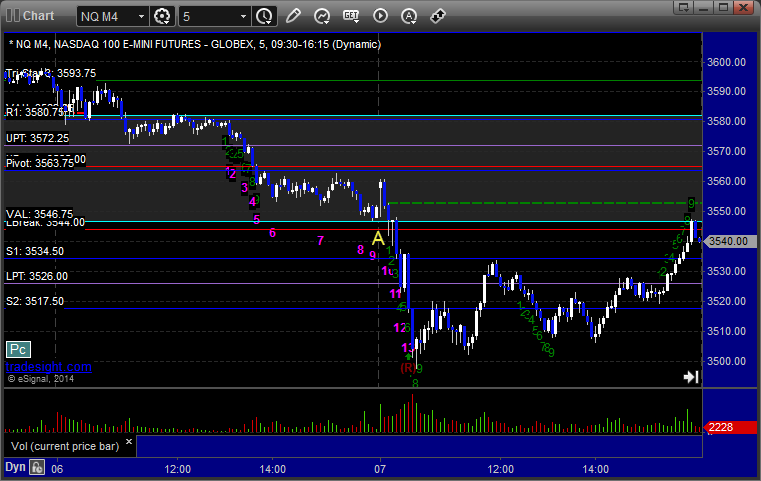

Futures Calls Recap for 5/7/14

A trade that swept the trigger and stopped once, then worked a little. Unfortunately, the second half just barely stopped out before the market tanked. Could have been a huge winner. See NQ section below.

Net ticks: -4.5 ticks.

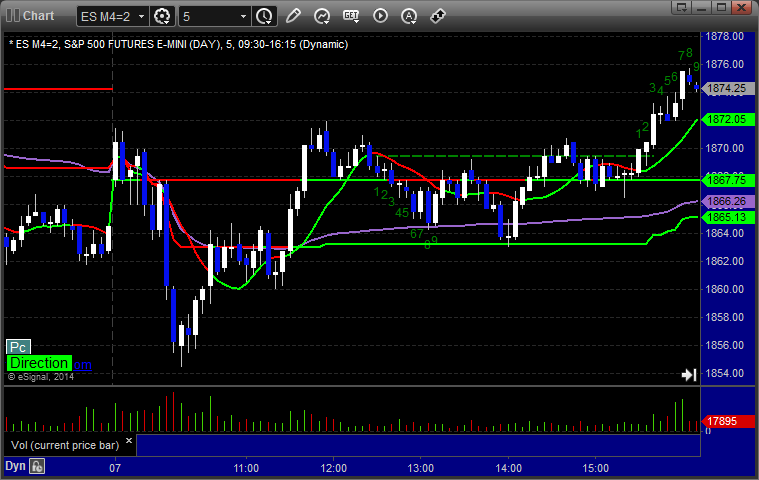

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3543.50 and stopped. Put it back in and it triggered, hit first target, and second half stopped over entry. That barely stopped or else it would have been a huge winner:

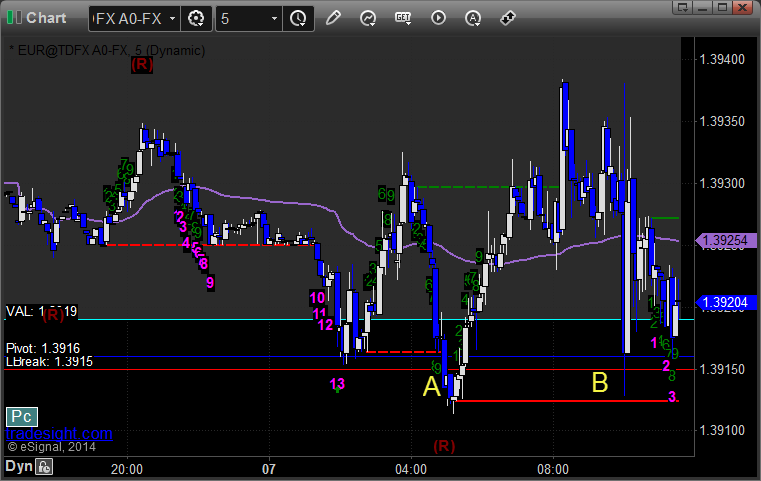

Forex Calls Recap for 5/8/14

Back to a narrow session. We had two partial triggers on the EURUSD using our order staggering and that was it. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

Two legs (out of three) triggered at A and stopped. Only one leg (out of three) triggered at B and stopped:

Stock Picks Recap for 5/6/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ZBRA triggered long (with market support) and went $0.20, which is exactly enough for a partial, but we'll say it didn't work since it didn't go a penny more the first time:

IMGN triggered short (with market support) and didn't go enough in either direction to count:

From the Messenger/Tradesight_st Twitter Feed, KLAC triggered short (with market support) and didn't work:

Rich's GS triggered short (with market support) and didn't go enough in either direction to stop or get a partial, closed the session at the trigger:

EBAY triggered short (with market support) and worked:

COST triggered short (with market support) and ended up working, but I posted to close it at the entry because market direction went green:

Rich's FEYE triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not. That doesn't count the couple that didn't do anything or that we closed at the entry in the Messenger/Twitter feed on a dull day.

Futures Calls Recap for 5/6/14

A sweep that stopped and then worked on the ER, and another nice setup on the ES that worked for the session. See both sections below for recaps. It wasn't a very exciting day to start, with the market contained in a very narrow range on light volume (and a volume warning) for the first several hours. We did get a move later to the downside, and that stalled out in the last hour. NASDAQ volume was 1.6 billion shares.

Net ticks: +14.5 ticks.

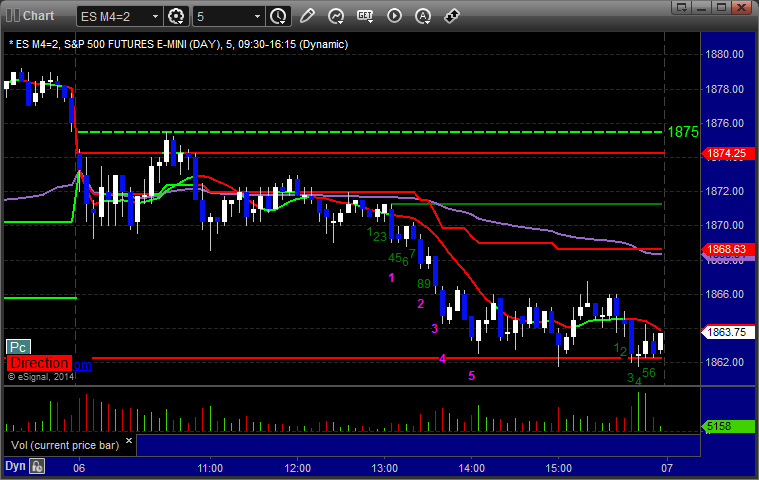

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1868.00, hit first target for 6 ticks, stopped second half 12 ticks in the money at 1865.00:

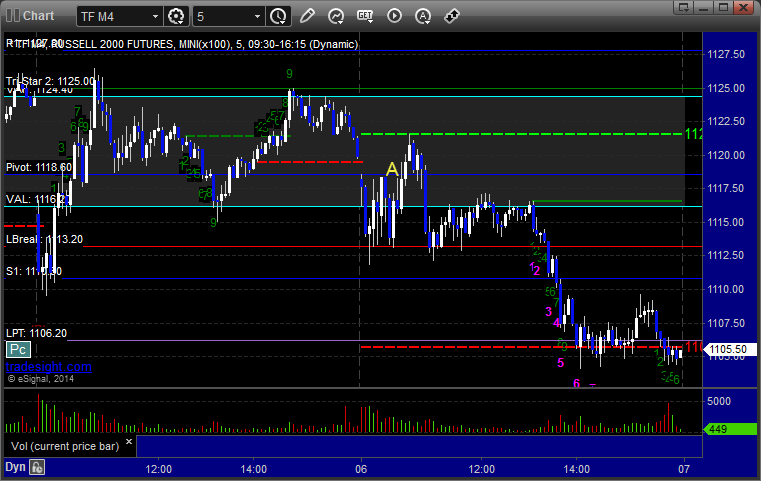

ER:

Triggered long at A at 1118.70 and stopped immediately (a sweep), then triggered again in the next bar, hit first target for 9 ticks, raised stop twice and stopped the second half at 1120.70 for 20 ticks at the final exit:

Forex Calls Recap for 5/6/14

A nice winner that is still going in the GBPUSD. See that section below. Reminds me of how Forex always used to be before the last couple of months. The US Dollar Index also broke the base to lows, so maybe things start moving finally.

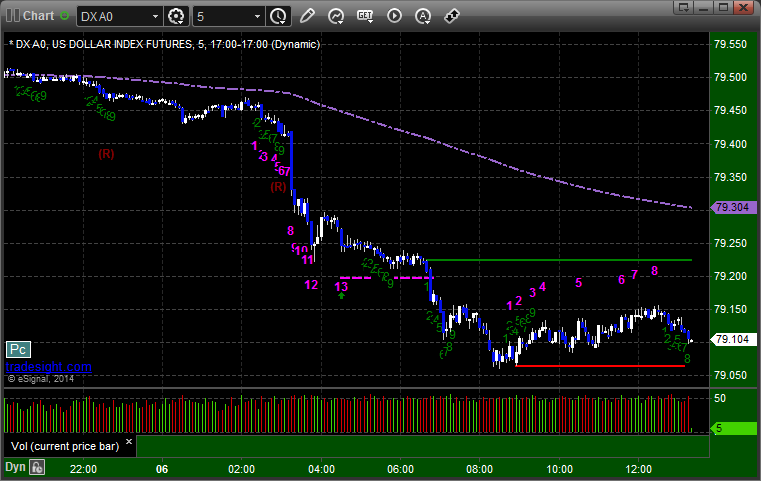

Here's a look at the US Dollar Index intraday with our market directional lines:

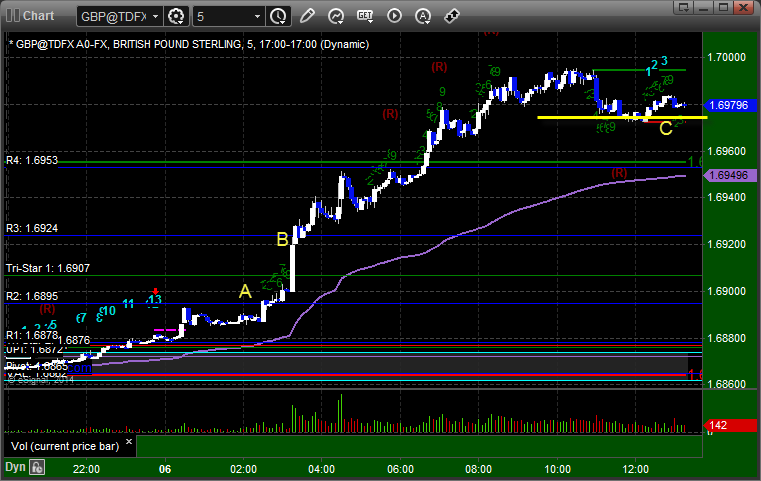

GBPUSD:

Triggered long at A, hit first target at B, still holding second half about 100 pips in the money with a stop 5 pips under the yellow line at C:

Stock Picks Recap for 5/5/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ZBRA triggered long (with market support) over lunch and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's GS triggered short (with market support) and worked enough for a partial:

Rich's AMZN triggered long (with market support) and worked enough for a partial:

AAPL triggered long (with market support) and worked:

NFLX triggered long (with market support) and worked for a couple of points very quick for a partial before reversing back just as quickly:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.