Futures Calls Recap for 5/5/14

The markets gapped down, and we had a nice futures play on the ES using the LPT and heading back for the gap fill to our 1875.00 magnet area. The NQ also had a nice Value Area play.

Net ticks: +17.5 ticks.

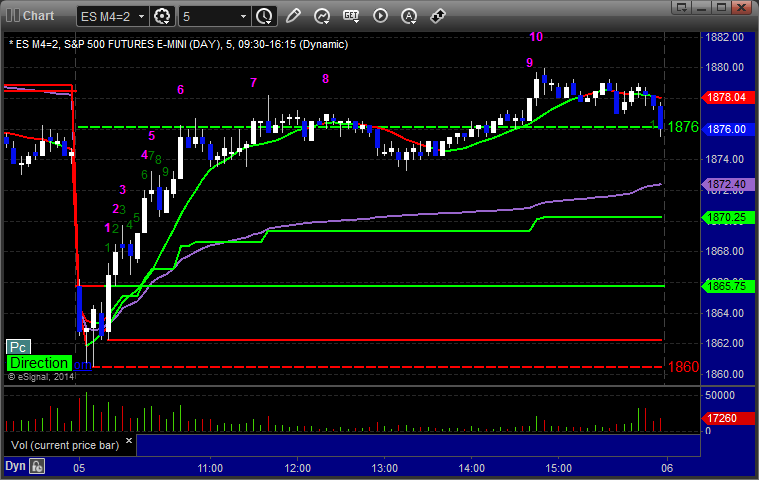

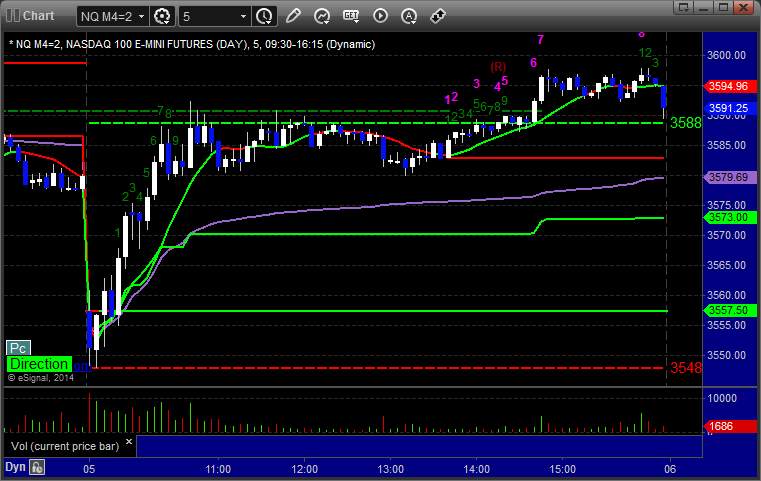

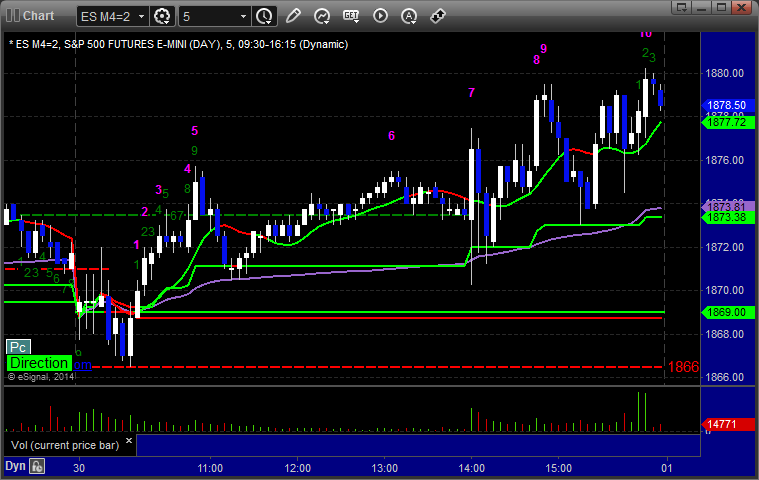

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1866.75, hit first target for 6 ticks, raised the stop 5 times and stopped the final piece for 31 ticks at 1884.50:

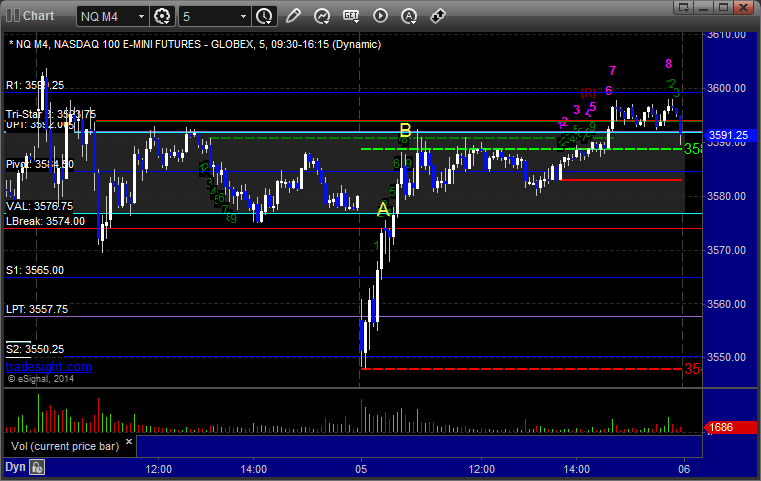

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Note the Value Area play from A to B, perfect:

Forex Calls Recap for 5/5/14

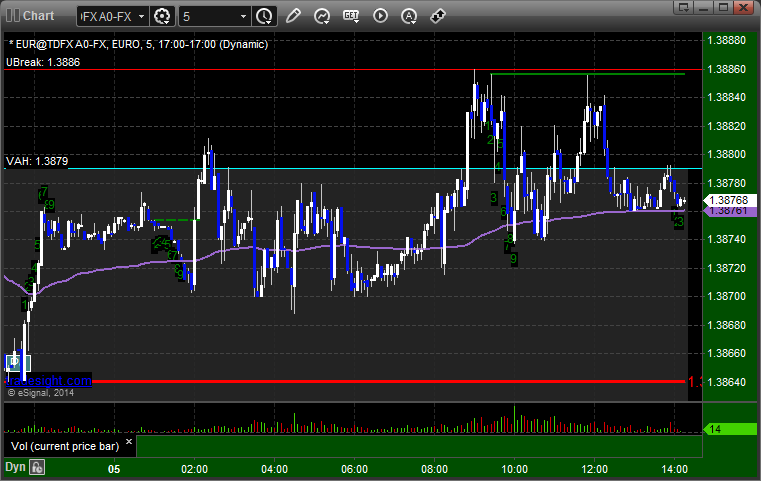

The bank Holiday in the UK kept anything from triggering for the session. Levels will be very bunched tonight. Have a look at the EURUSD anyway and note the high of the session was the UBreak exactly.

Here's a look at the US Dollar Index intraday with our market directional lines:

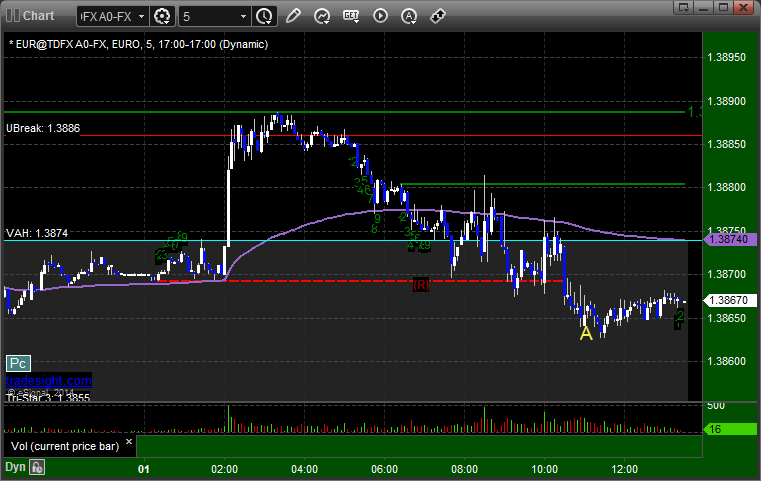

EURUSD:

UBreak was the high, 30 pips of range total:

Stock Picks Recap 5/2/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TASR triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's DXCM triggered short (without market support) and worked:

Rich's GILD triggered short (without market support) and eventually worked enough for a partial and more, waited until market direction headed down:

I posted an incorrect trigger on NTES, should have been over 51.07, but we have to count it based on what I put, so triggered long (with market support) and didn't work, you can see where the number was wrong on the chart as the earlier high was 51.07):

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not. The pattern from the report daily chart (TASR) that triggered with market support is, of course, what worked.

Futures Calls Recap for 5/2/14

A winner and a loser for nothing interesting as we had another dull, choppy session early. Usually, I retake a trade a second time, and the ES would have worked the second time, but I passed on a Friday. See ES and NQ sections below. In the end, we went nowhere on 1.7 billion NASDAQ shares.

Net ticks: -2.5 ticks.

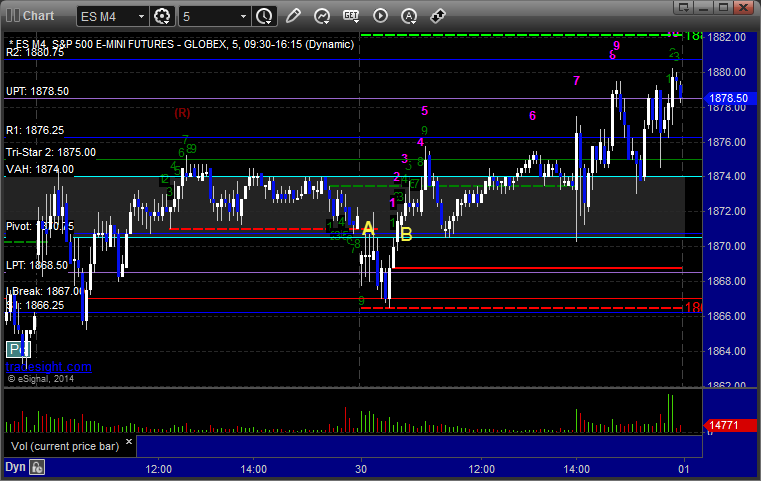

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

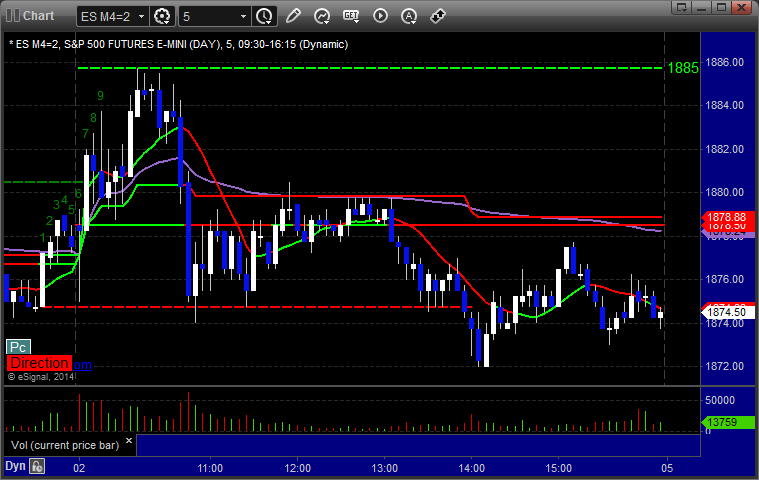

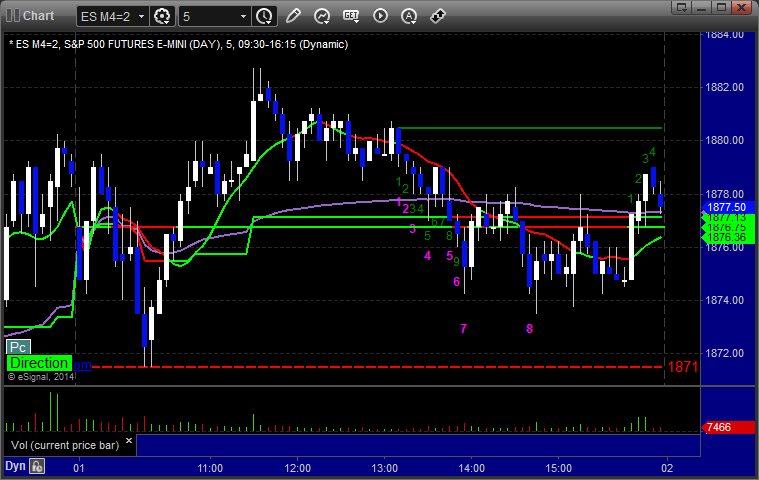

ES:

ES triggered long at A at 1883.25 and stopped, would have worked the second time, but I passed, and note that the exact high is the UPT:

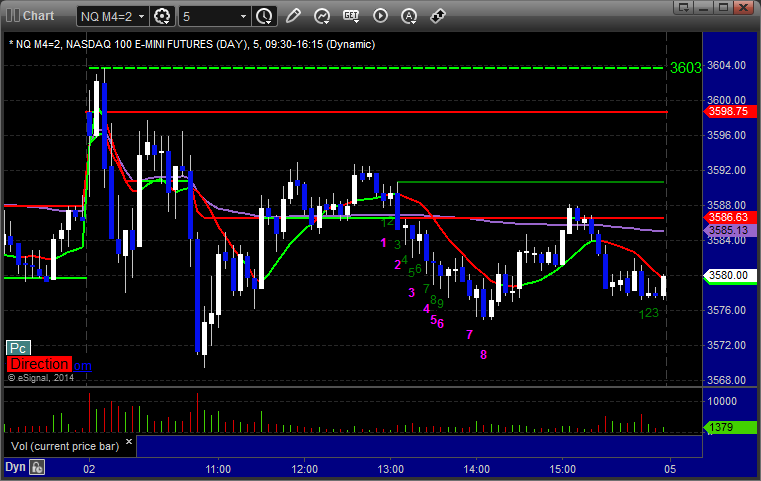

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

NQ triggered short at A at 3577.50, hit first target, adjusted the stop twice and stopped the second half 4 ticks in the money:

Forex Calls Recap for 5/2/14

A winner to close out the week. See the GBPUSD section below.

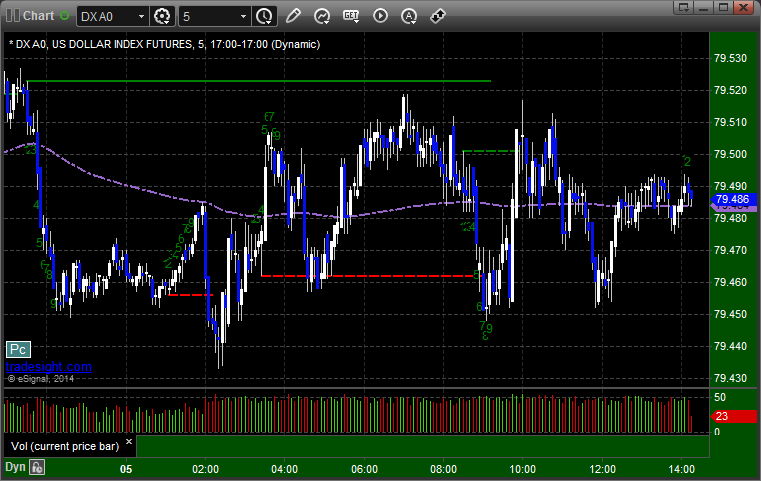

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

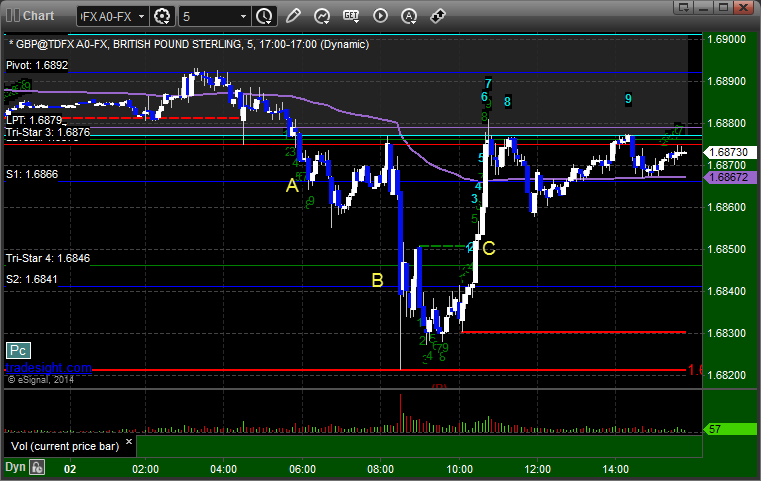

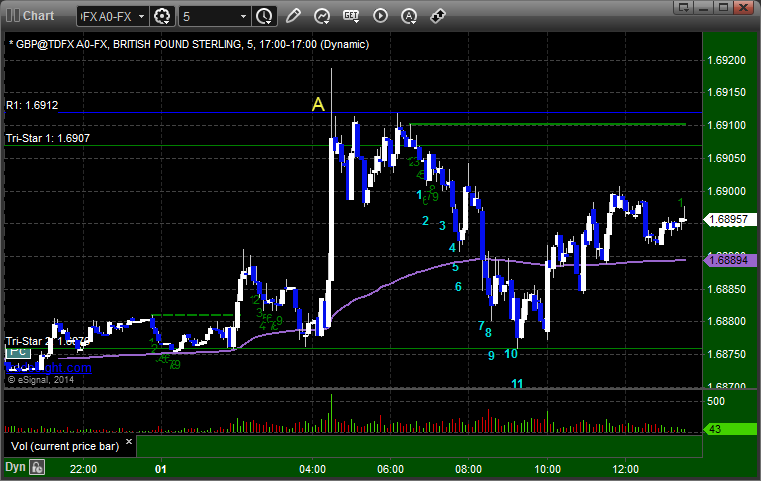

GBPUSD:

Triggered short at A, hit first target at B, closed final piece at C in the money:

Stock Picks Recap for 5/1/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ENOC triggered long (with market support but barely any volume at all at the time or for the session) and didn't work:

ICON triggered long (without market support due to opening 5 minutes) and didn't work, worked later on a clean trigger:

![]()

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered long (without market support) and didn't work initially, worked better later when the market turned up:

GOOG triggered long (with market support) and worked enough for a partial:

CELG triggered long (with market support) and worked great:

Rich's AMZN triggered long (with market support) and didn't work initially, worked later:

His GDX triggered short (ETF, so no market support needed) and didn't go enough in either direction to count, closed pennies in the money:

Mark's SNDK triggered long (with market support) and worked:

Rich's GLD triggered short (ETF, so no market support needed) and didn't work:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.

Futures Recap for 5/1/14

Mark called a nice setup on the NQ that swept once and worked the second time, but the overall day was disappointingly slow. We traded about 2/3rds of average daily range on the ES and NQ. NASDAQ volume closed at 1.8 billion shares. See NQ section below.

Net ticks: -1.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

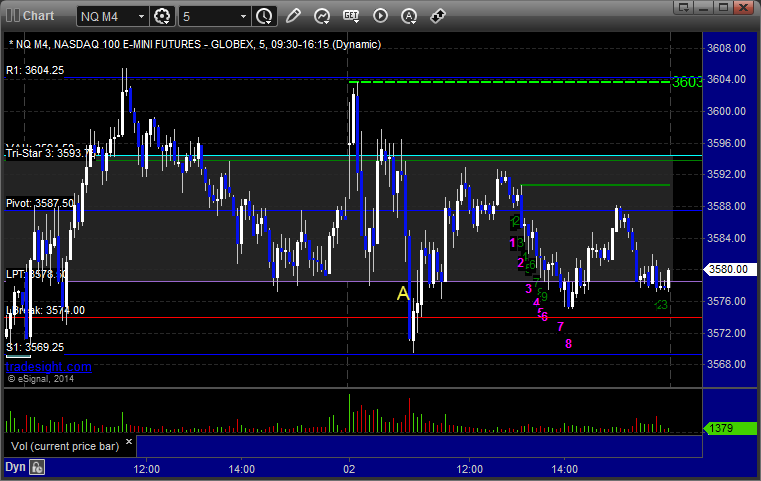

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered long at A at 3589.50 and stopped on a sweep. The re-entry triggered a little later, hit first target and more, Mark raised the stop and stopped the second half in the money:

Forex Calls Recap for 5/1/14

An interesting session in a lot of ways. First, the US Dollar Index topped out exactly at a 13 Comber sell signal, which you will see marked with an A in the chart immediately below. Then, we stopped out of the second half of the prior day's long on the EURUSD in the money. Then we got stopped out of a new GBPUSD trade. And finally, I pointed out in the Lab a NZDUSD 13 Comber signal in the morning that worked beautifully. See all of those sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

The second half of the prior day's long trade stopped out in the money at A:

GBPUSD:

Triggered long at A and stopped:

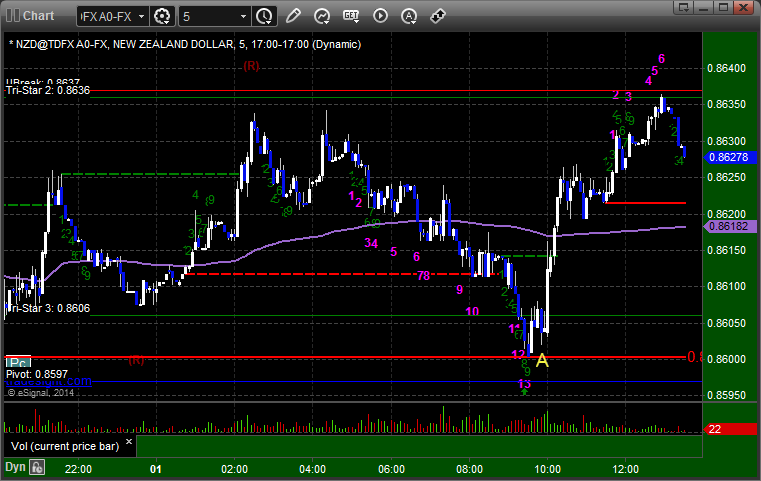

NZDUSD:

Note the Comber 13 buy signal right at the low of the session that we discussed in the Lab:

Stock Picks Recap for 4/30/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BBBY triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's MDCO triggered long (with market support) and didn't work:

Rich's QIHU triggered short (with market support) and didn't work:

His GILD triggered long (with market support) and worked:

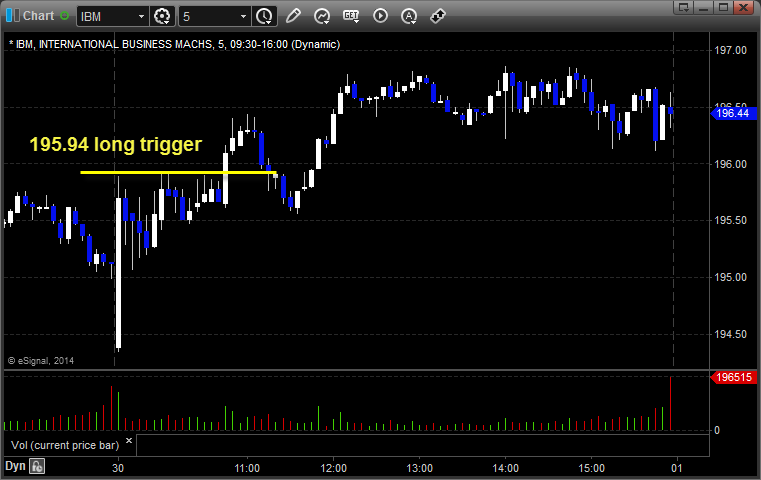

His IBM triggered long (with market support) and worked:

His AAPL triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

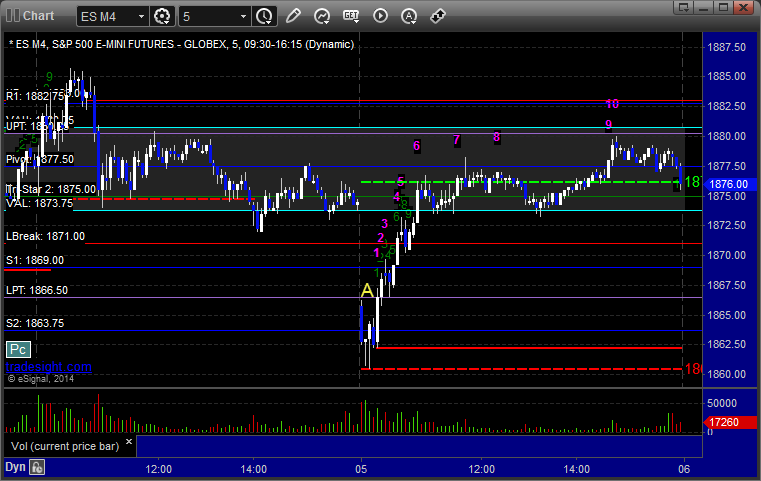

Futures Calls Recap for 4/30/14

A nice Value Area setup in the ES that once again swept and stopped once before working the second time. Meanwhile, most of the session was flat waiting for the Fed, and then after some mild fluctuations on the announcement, the market didn't do much, which we expected for end of month. NASDAQ volume closed at 1.7 billion shares.

Net ticks: +2 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1871.00 and filled the gap but didn't get enough for the partial. Triggered again at B, hit first target, Mark adjusted the stop twice and closed at VAH: