Stock Picks Recap for 4/24/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NVDA gapped over, no play. Nothing triggered off of the report, which is usually good on a gap and reverse day.

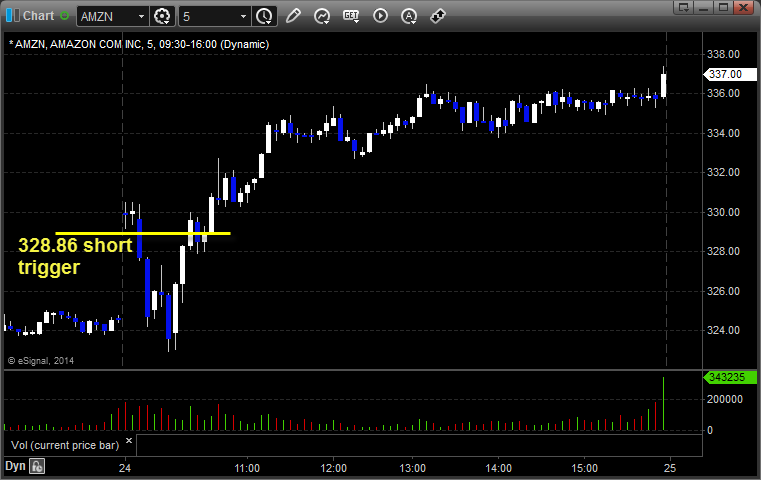

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered short (with market support) and worked:

GOOG triggered short (with market support) and worked:

Rich's REGN triggered short (with market support) and worked enough for a partial:

In total, that's 3 trades triggering with market support, all 3 of them worked.

Futures Calls Recap for 4/24/14

Well, with volatility comes the bigger chance of getting stopped with a tight stop. Unfortunately, the initial setup that I wanted, which was the NQ short under the opening 5 minute bar into the gap, went too fast to call. Everything else was a problem. See ES and NQ below.

Net ticks: -21 ticks.

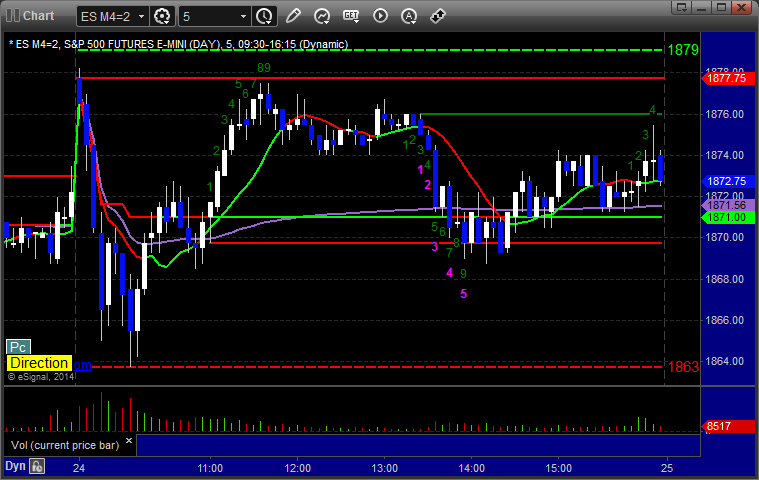

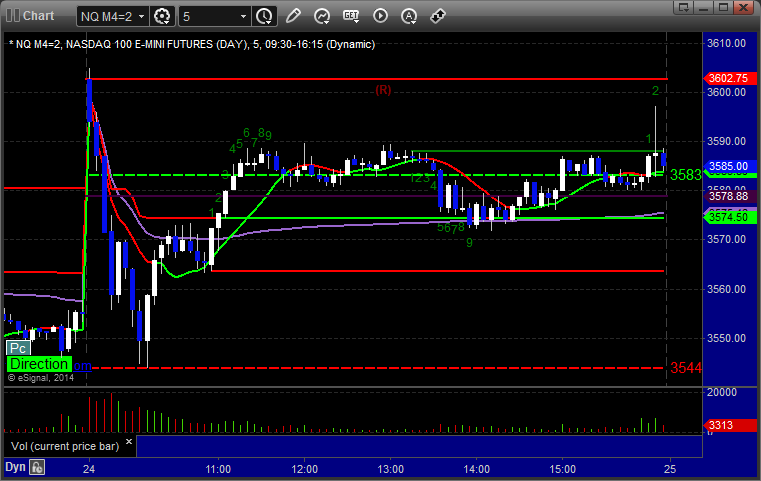

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1864.75 and stopped. Triggered again 5 minutes later and stopped:

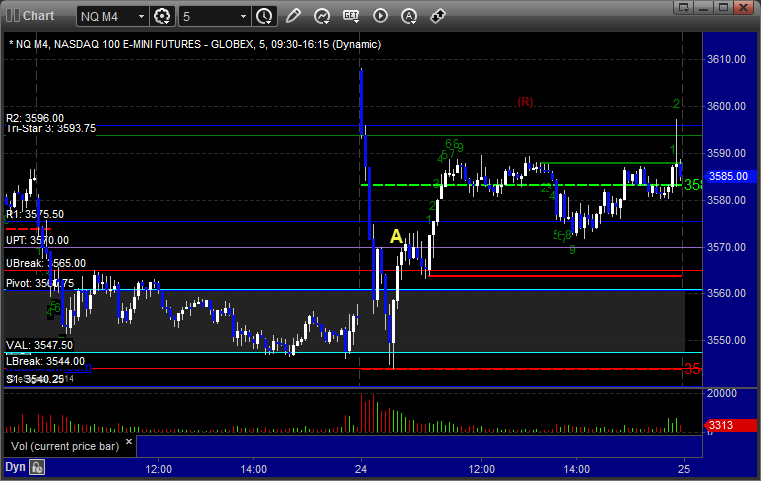

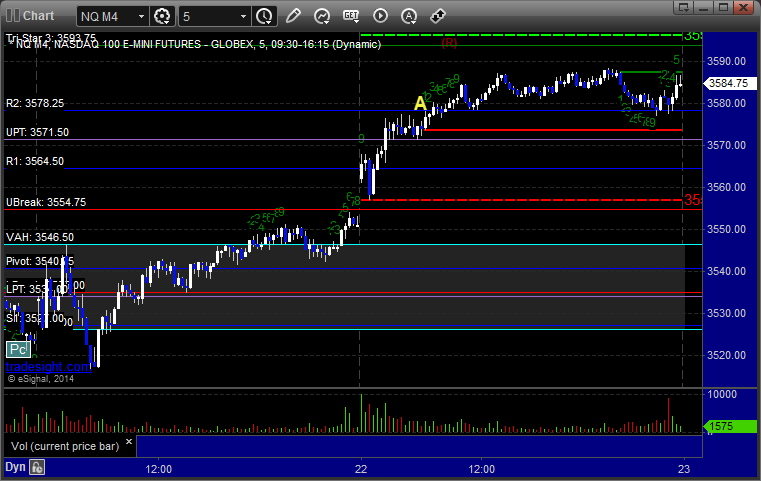

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long over UPT at A at 3570.50 and stopped. Did not reenter:

Forex Calls Recap for 4/24/14

Another dull session. When will it end? See GBPUSD for the triggers.

Here's a look at the US Dollar Index intraday with our market directional lines:

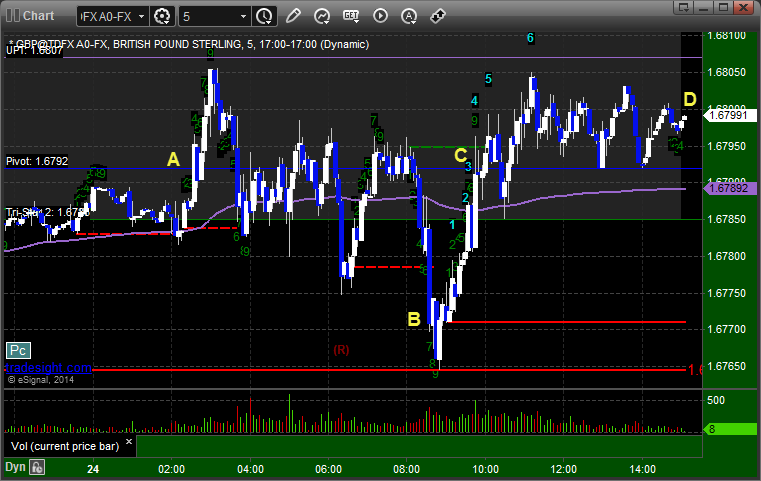

GBPUSD:

Triggered long at A and stopped at B. Triggered long at C and closed for a few pips at D because it hadn't gone anywhere:

Stock Picks Recap for 4/23/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FLEX triggered long (without market support) and barely went a nickel in either direction:

From the Messenger/Tradesight_st Twitter Feed, Rich's ALXN triggered short (with market support) and worked:

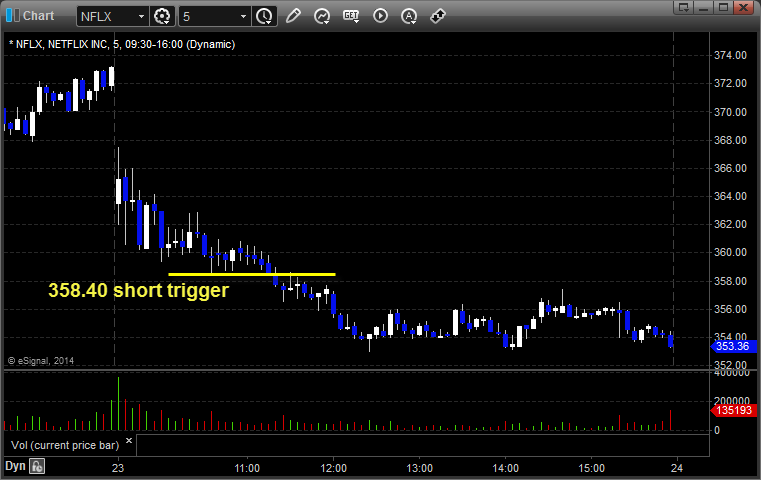

My NFLX triggered short (with market support) and didn't work:

Rich's NFLX triggered short (with market support) and worked:

Rich's WDAY triggered short (with market support) and worked:

His NOC triggered long (without market support) and didn't work:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 4/23/14

Two stop outs and a small winner on the ES in a day that saw only 1.55 billion NASDAQ shares traded and the ES stuck in about a 5 point range as we get close to wrapping up core earnings season.

Net ticks: -11.5 ticks.

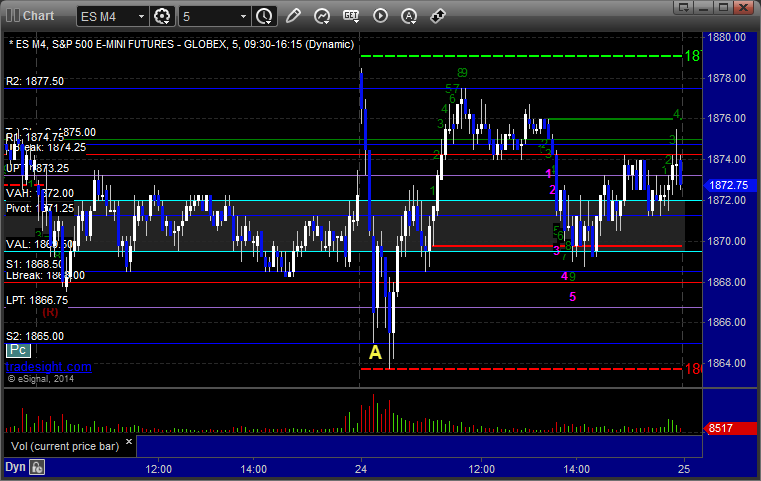

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

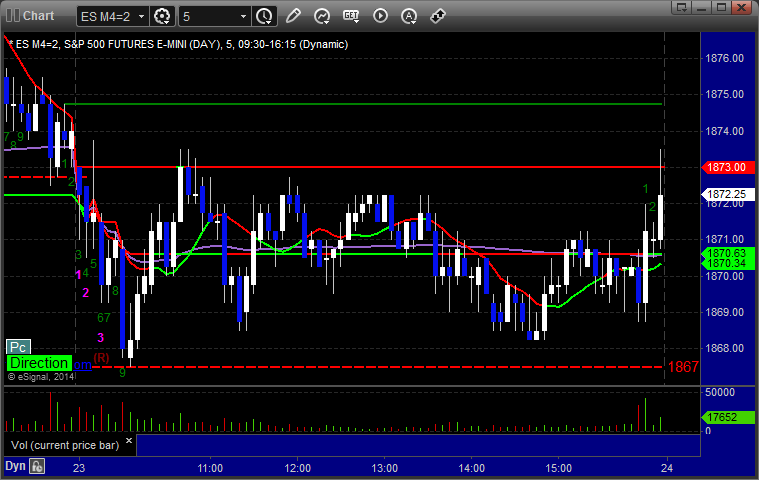

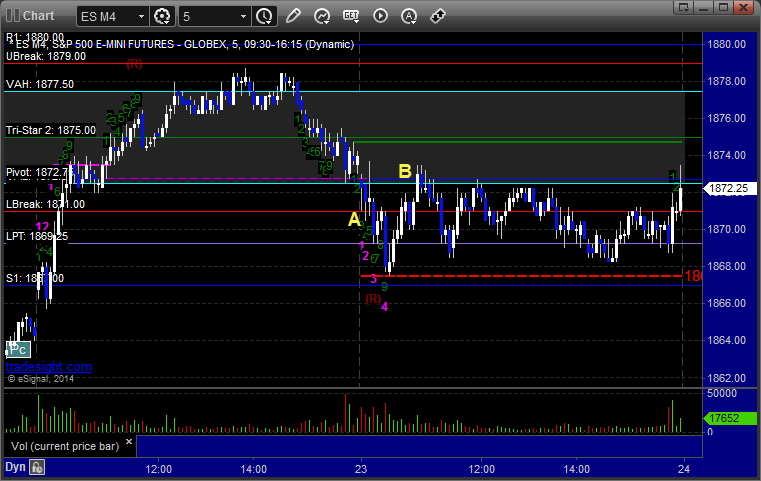

ES:

Triggered short at A at 1870.75 and stopped. Put it back in, triggered, hit first target, stopped second half over entry. Triggered long at B over Pivot at 1873.00 and stopped. Did not re-enter as it was clear at that point that the market was not doing anything for the session:

Forex Calls Recap for 4/23/14

A winner on the GBPUSD despite another slow session. See that section below.

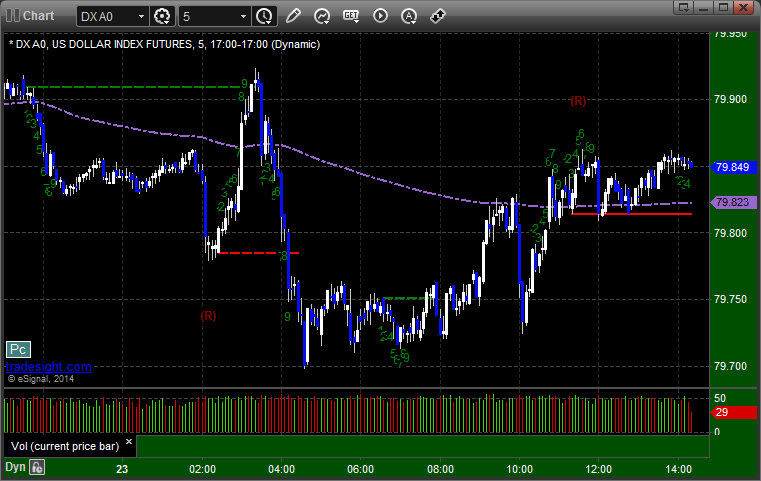

Here's a look at the US Dollar Index intraday with our market directional lines:

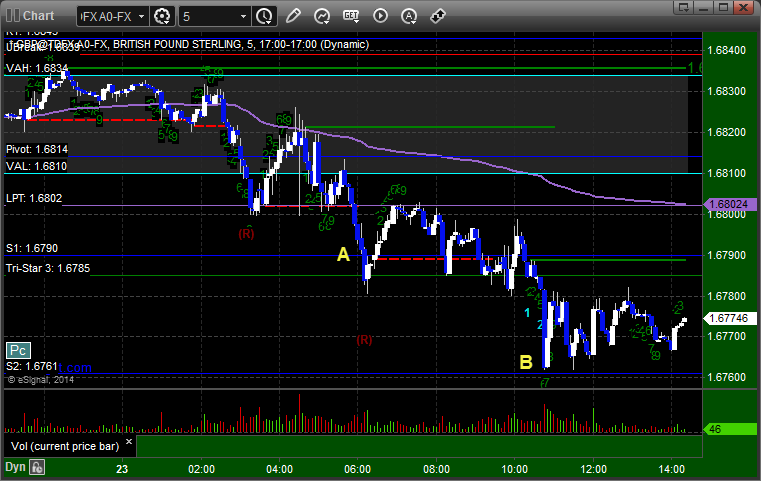

GBPUSD:

Triggered short at A, hit first target at B, holding second half with a stop over S1:

Stock Picks Recap for 4/22/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SYNA triggered long (with market support) and worked enough for a partial:

MXWL triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

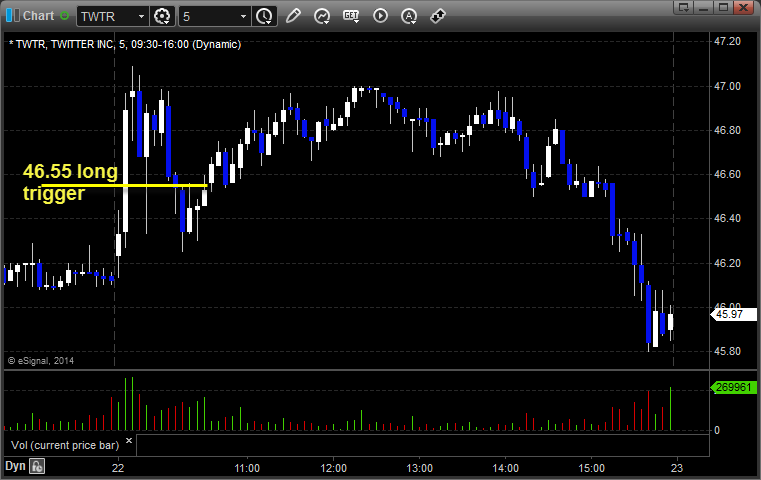

From the Messenger/Tradesight_st Twitter Feed, TWTR triggered long (with market support) and worked:

LOCK triggered long (without market support due to opening 5 minutes) and worked:

Rich's LNKD triggered long (with market support) and worked:

GOOG triggered long (with market support) and worked:

SHLD triggered long (with market support) and didn't work:

Rich's XONE triggered long (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 4/22/14

One call that triggered and slowed down heading into lunch. See NQ section below. The markets left behind gaps, did not trade average range, and volume was only 1.65 billion NASDAQ shares. Two days left of core earnings. Note that the ES closed right on the VWAP.

Net ticks: +2 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered long at A at 3578.50 and stalled out heading into lunch. He closed it two ticks in the money when things appeared to be slowing down:

Forex Calls Recap for 4/22/14

The Holiday weekend may be over, but no one told the Forex markets. The EURUSD traded 35 pips of range for the session, even worse than the day before. See that section below for our call that triggered and stopped.

Here's a look at the US Dollar Index intraday with our market directional lines:

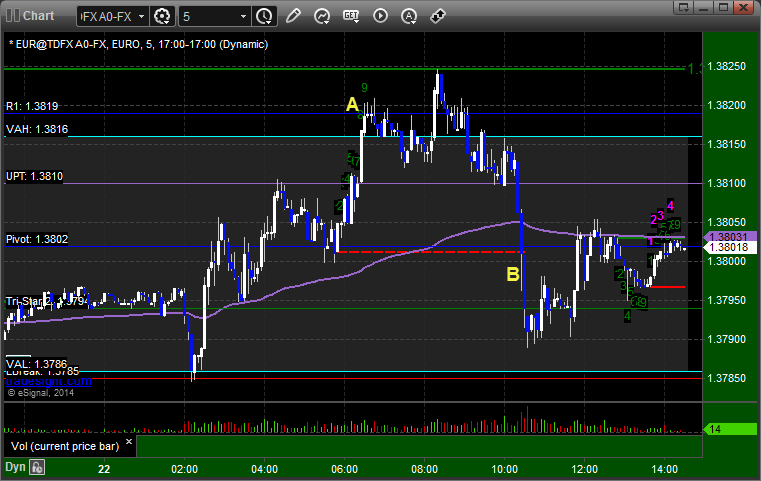

EURUSD:

Triggered long at A and stopped at B in narrow range:

Stock Picks Recap for 4/21/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, POZN triggered long (with market support) and worked:

FNSR triggered long (with market support) and worked:

HUBG gapped over the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's HAL triggered long (with market support) and worked:

His NEM triggered short (without market support) and worked eventually, a sleeper:

His CMG triggered short (without market support) and worked enough for a partial:

FB triggered long (with market support) and didn't work on a sweep, worked later:

Rich's BIIB triggered long (with market support) and worked enough for a partial:

His TSLA triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.