Futures Calls Recap for 4/21/14

Market volume was horrible as expected with Europe on bank Holiday for Easter. We only got to 1.35 billion NASDAQ shares. There was a set up in the futures early on the ES, but it fell away instead. We start the week tomorrow.

Net ticks: +0 ticks.

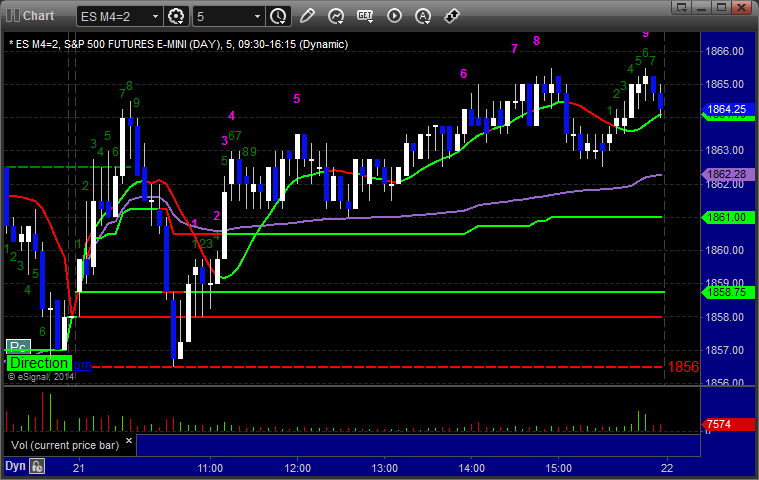

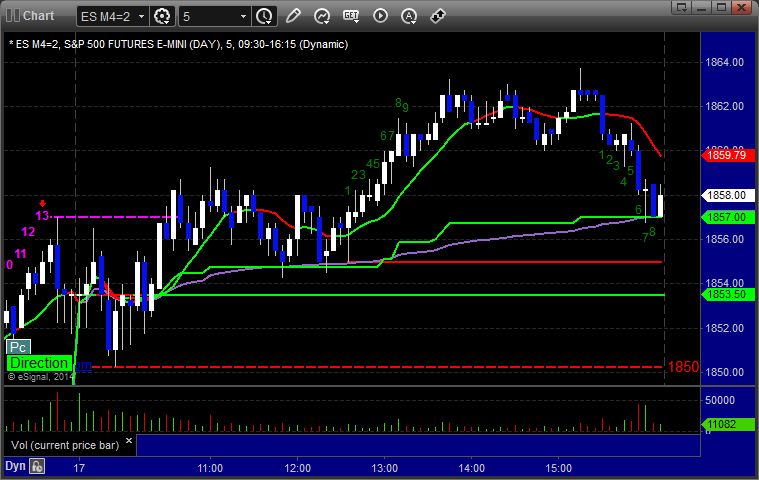

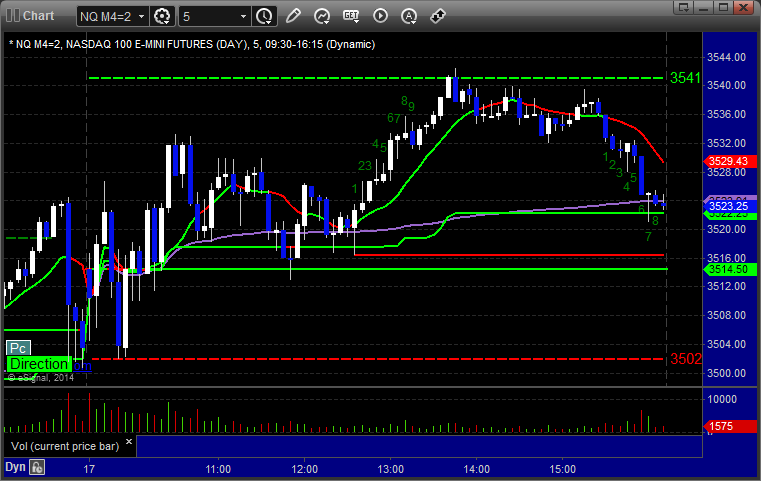

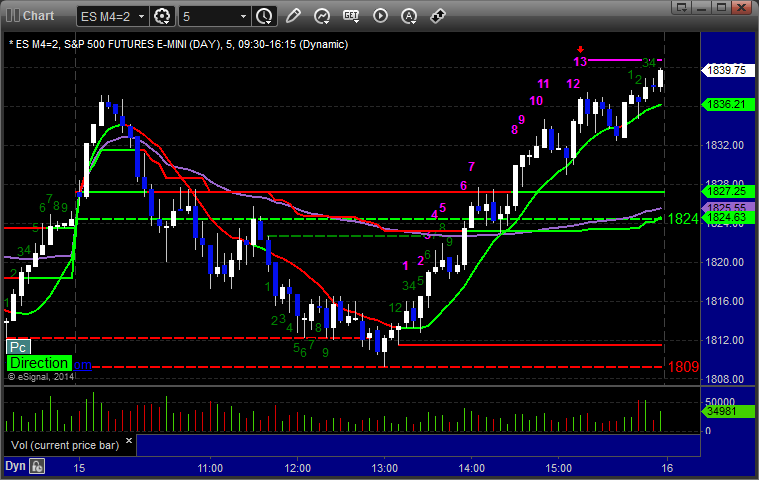

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 4/21/14

After some consideration and after watching the early action, it became clear that nothing was going to happen with Europe on bank Holiday, so no calls. GBPUSD only traded 40 pips and the EURUSD traded 55, so the Levels will be tight tonight but we will get back to work.

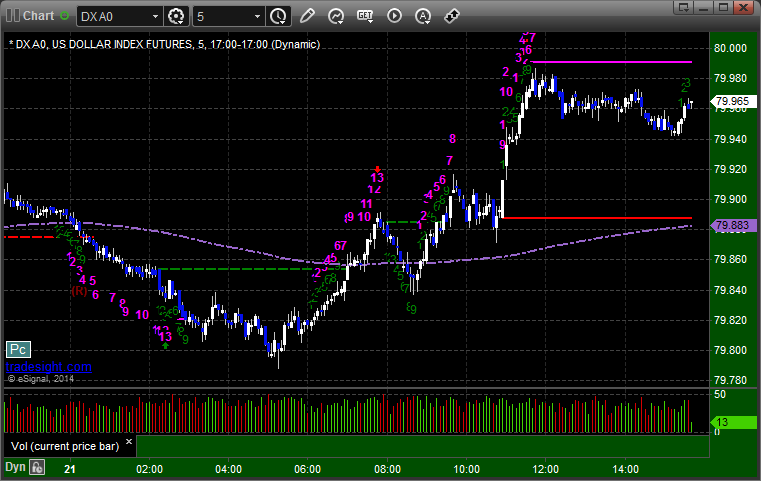

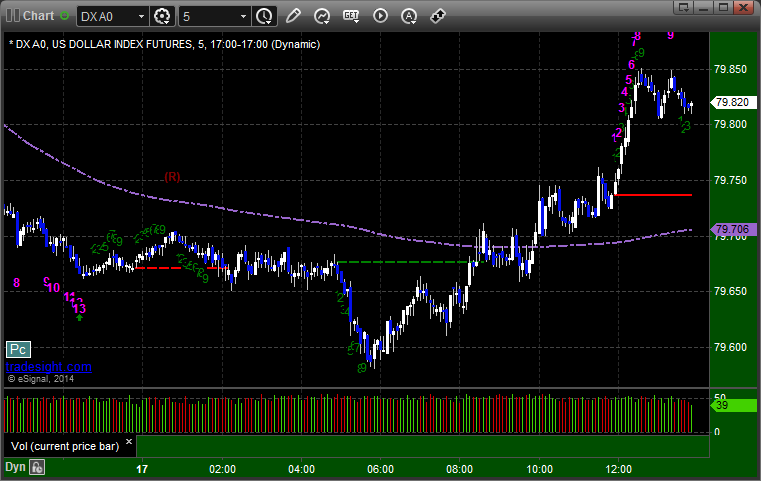

Here's a look at the US Dollar Index intraday with our market directional lines:

Stock Picks Recap for 4/17/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered short (with market support) and worked for a couple of points:

His CMG triggered short (without market support) and worked enough for a partial:

NTAP triggered short (with market support) and didn't work:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 4/17/14

A complete waste of a session as expected between expiration and the Holiday. See ES section below if you took the one call anyway. Even though options expired, which usually causes some big volume that doesn't do much, we closed with NASDAQ volume at 1.7 billion shares.

Net ticks: -7 ticks.

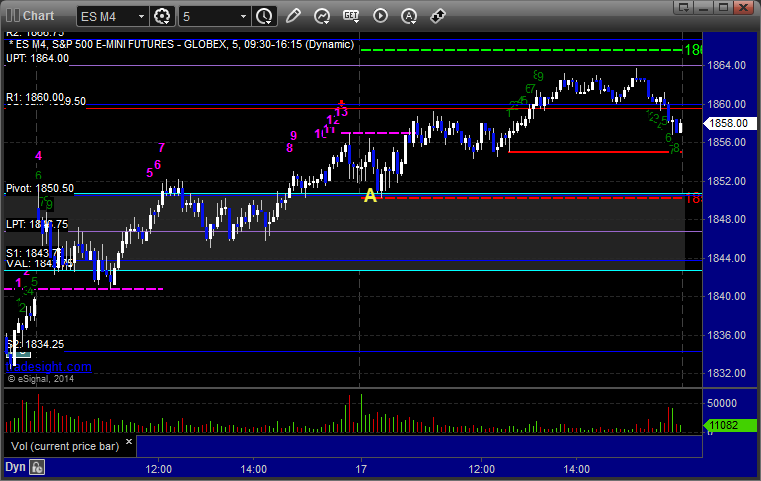

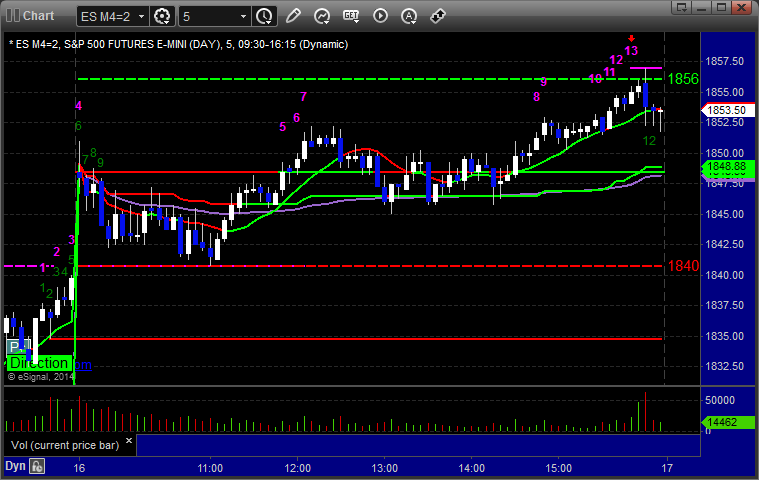

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

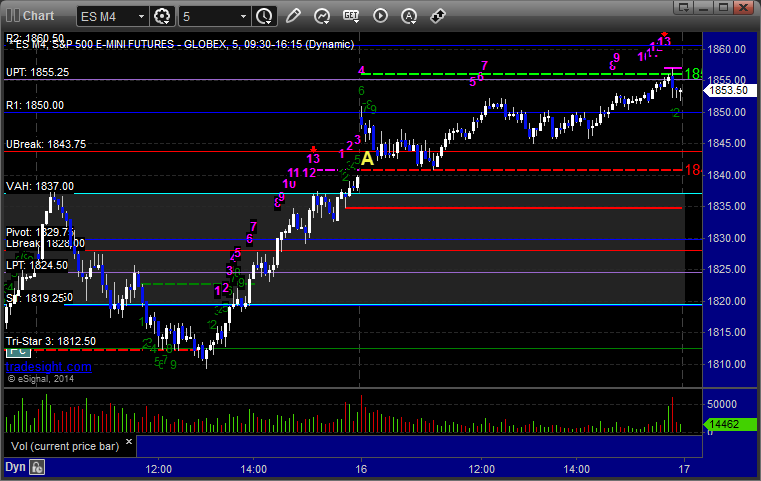

Mark's call triggered short at A at 1850.25 and stopped:

Forex Calls Recap for 4/17/14

We closed out a trade from the prior session in the money, and a new trade triggered and stopped (see GBPUSD below). NZDUSD also had a perfect Value Area play as pointed out.

Here's a look at the US Dollar Index intraday with our market directional lines:

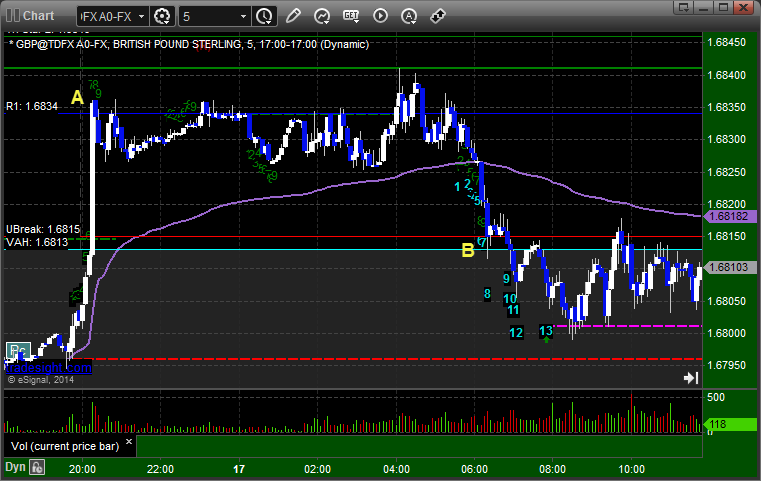

GBPUSD:

Triggered long at A and stopped. Second half of the prior session's trade stopped at B for 50 pips in the money:

Stock Picks Recap for 4/16/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered long (without market support due to opening 5 minutes) and worked:

SINA triggered short (with market support) and worked:

CELG triggered long (without market support) and worked enough for a clean partial:

COST triggered long (without market support) and worked, although I sold it slightly in the money after the market broke to new lows:

In total, that's 1 trades triggering with market support, it worked, but all three of the other calls worked too.

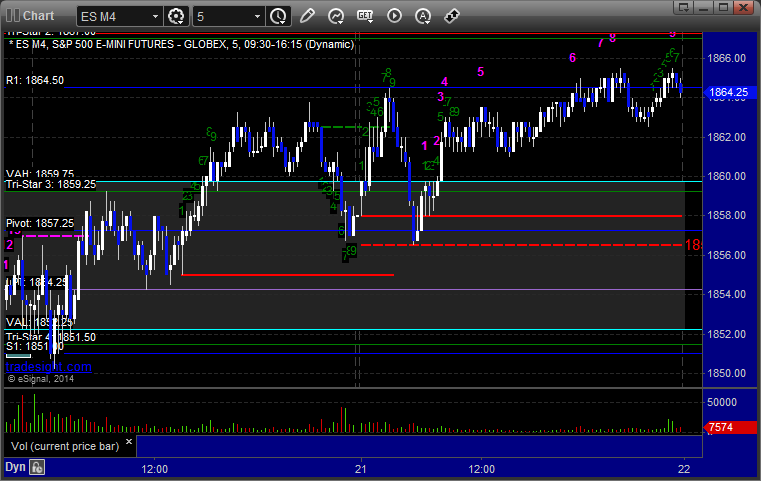

Futures Calls Recap for 4/16/14

A nice day for the calls with 3 winners out of 4 triggers even though none followed through. See the ES, ER, and NQ sections below. The markets gapped up and headed lower initially, with the NQ filling the gap, but not the ES. NASDAQ volume started strong but stalled out and never came back in the afternoon, closing at 1.6 billion shares, the lowest of the week. Doesn't bode well for Thursday and expiration leading into the Holiday weekend.

Net ticks: +7.5 ticks.

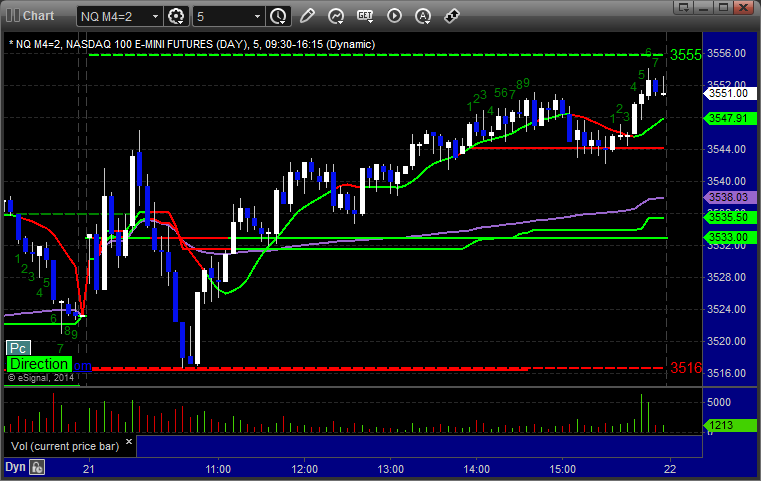

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1843.50 and stopped for 7 ticks. He did not re-enter:

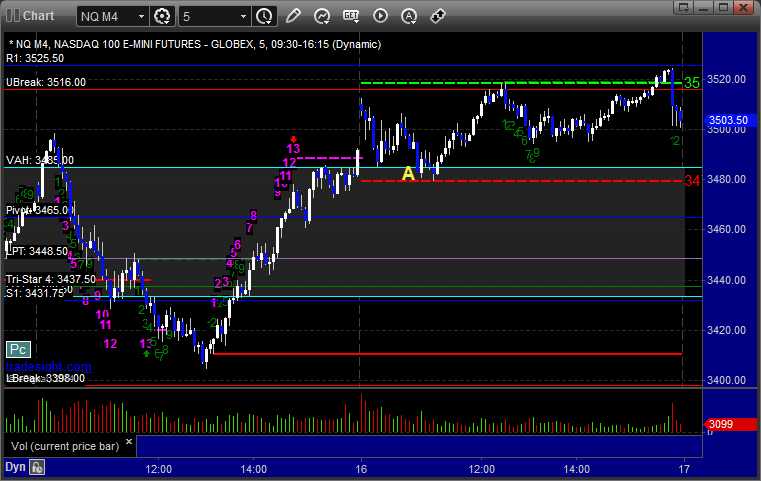

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3484.50, hit first target for 6 ticks, stopped second half over entry:

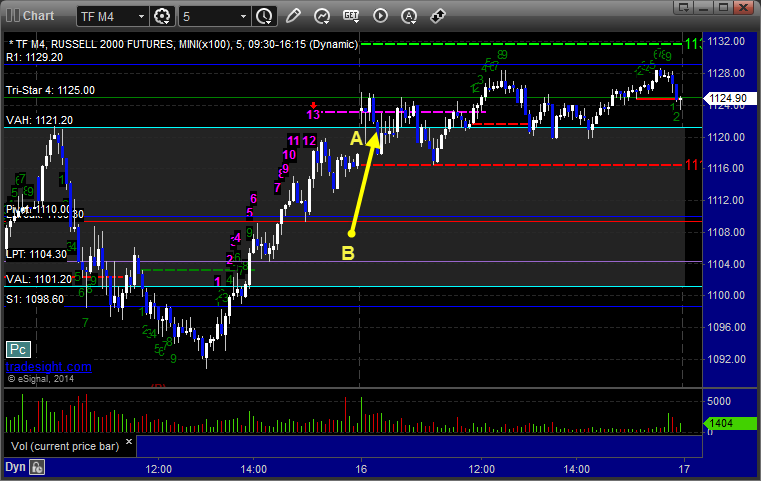

ER:

Triggered short at A at 1121.10, hit first target for 8 ticks, stopped second half over entry. Because that went so far, I put the same call back in, and it triggered 15 minutes later at B, hit first target for 8 ticks, and stopped second half after two adjustments for 10 ticks:

Forex Calls Recap for 4/16/14

A nice clean winner on the GBPUSD, and we are still holding the second half in the money. See that section below. One more day of calls for the week before we head into the long weekend and Friday bank holiday.

Here's a look at the US Dollar Index intraday with our market directional lines:

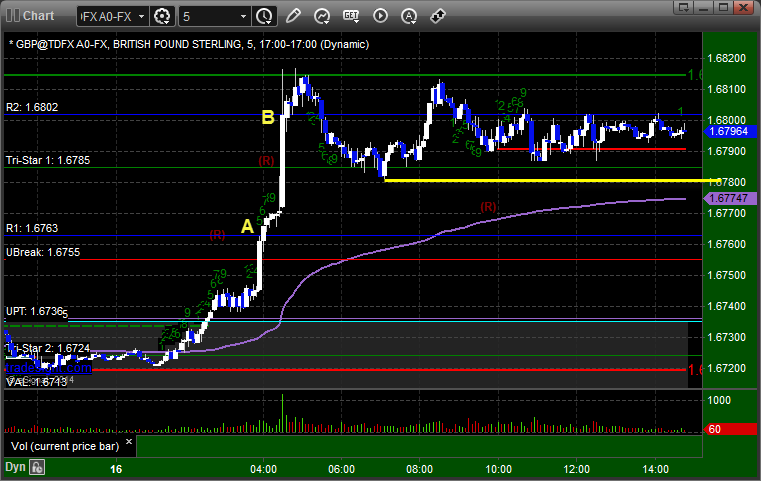

GBPUSD:

Triggered long at A, hit first target at B, holding with a stop under the yellow line:

Stock Picks Recap for 4/15/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, RPRX triggered short (with market support) and didn't work:

CBST triggered short (with market support) and worked:

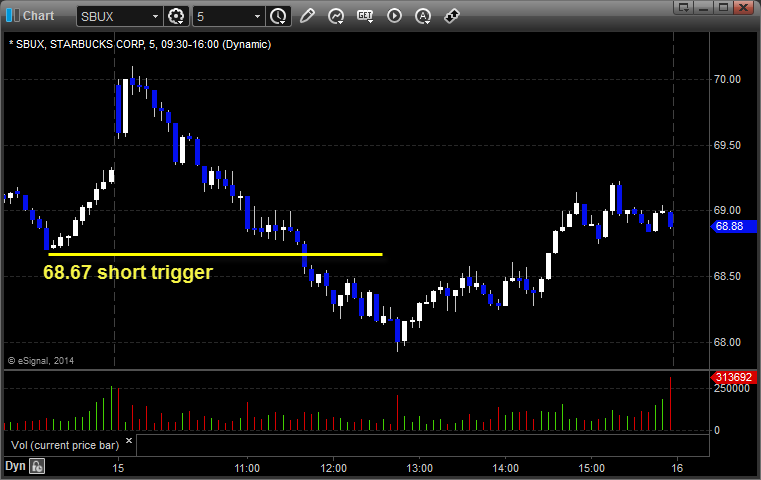

SBUX triggered short (with market support) and worked:

UCTT triggered short (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's PETM triggered long (with market support) and worked enough for a partial:

His IBM triggered long (with market support) and didn't work:

TSLA triggered short (with market support) and worked great:

Rich's SCTY triggered short (with market support) and didn't work initially, worked later:

BIIB triggered long (with market support) and worked for a couple of points:

GILD triggered long (with market support) and worked enough for a partial:

Rich's AAPL triggered short (with market support) and worked big:

NFLX triggered short (with market support) and worked:

Rich's GOOG triggered short (with market support) and worked enough for a partial:

In total, that's 13 trades triggering with market support, 10 of them worked, 3 did not.

Futures Calls Recap for 4/15/14

For Tax Day, the markets gapped up, headed higher initially, then rolled. Market volume was extremely poor early but picked up during the day, so the NASDAQ closed at 2 billion shares. We headed much lower and then got a strangely strong rebound in the afternoon. This might have been options unraveling related, but it is still a strange move. See NQ section below for our sample trade winner.

Net ticks: +7.5 ticks.

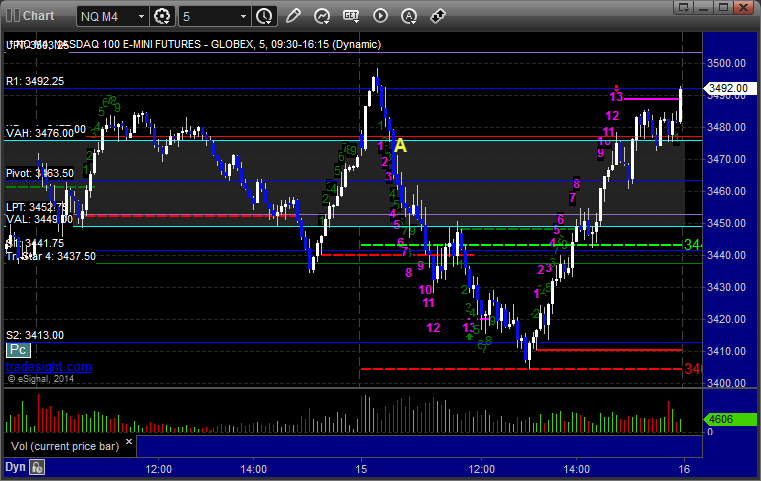

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3475.00, hit first target for 6 ticks, lowered stop twice and stopped second half at 3470.50 for 9 ticks: