Forex Calls Recap for 4/15/14

Based on the prior day's narrow range, our triggers on the EURUSD were long over R1 or short under S2. Instead, it spent the session in a 40 pip range between the Pivot and S1, so nothing triggered, which is fine when there is no range.

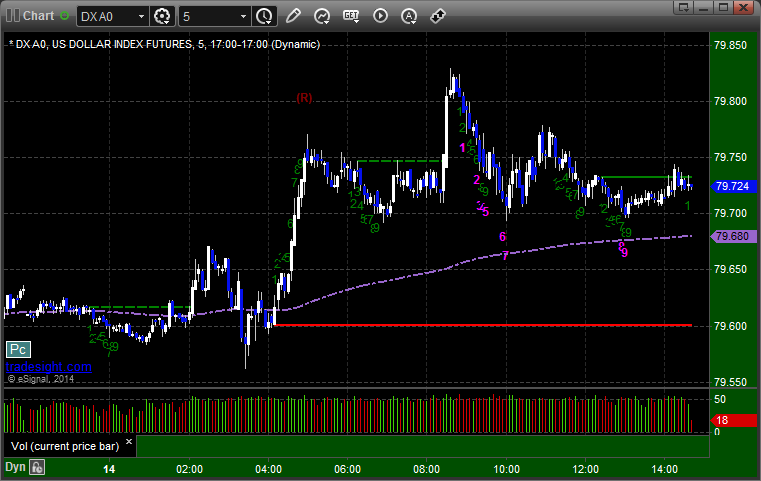

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

No triggers from our calls:

Stock Picks Recap for 4/14/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CHRW gapped over, no play.

IMGN triggered short (with market support late in the session) and didn't go enough for a partial, didn't do much:

CROX triggered short (with market support) and never went against the trigger, although it didn't go far either with market volume so poor:

From the Messenger/Tradesight_st Twitter Feed, Rich's DDD triggered short (with market support) and worked:

His BIIB triggered long (without market support) and worked enough for a partial:

His GMCR triggered short (with market support) and worked enough for a partial:

NFLX triggered short (with market support) and worked:

His SNDK triggered long (with market support just barely) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not. Most of the afternoon was a waste.

Futures Calls Recap for 4/14/14

Two trades on the ES, both worked, although the second one should have been a bigger winner than recorded. My screen had timed out and my update didn't hit the feed. See that section below. The market gapped up and tried to fill early, couldn't do it, volume was the lightest day of the year after an hour, and then we broke in the afternoon, dropped to fill the gap, and rebounded hard. NASDAQ volume closed at 1.7 billion shares.

Net ticks: +5.5 ticks.

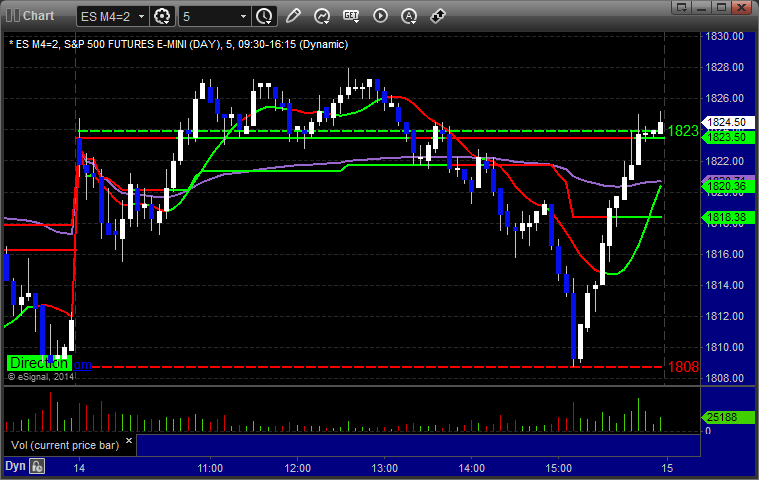

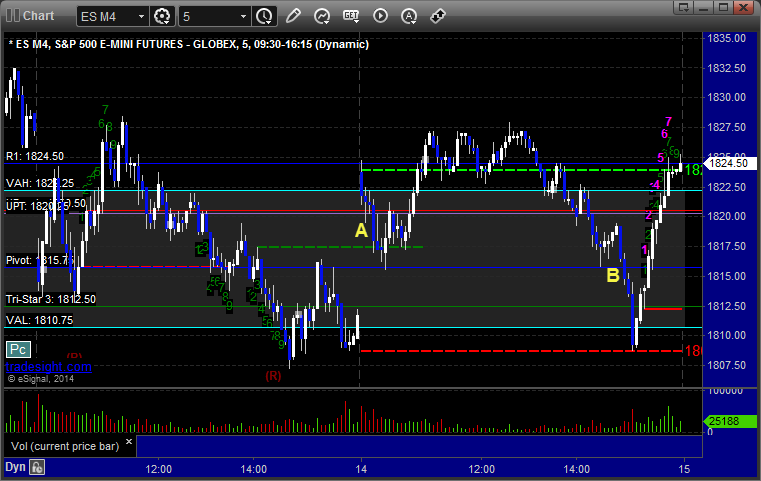

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1819.25, hit first target for 6 ticks, stopped second half over the entry. We set the Pivot twice after that, then triggered short at B at 1815.25, hit first target for 6 ticks. I lowered the stop to 1812.50, but that didn't hit the feed due to a browser timeout, so we ended up stopping at the entry officially, but when something moves that far, you should have lowered your stop per the rules of our course:

Forex Calls Recap for 4/14/14

A fairly tame session again, and one loser. See the GBPUSD below.

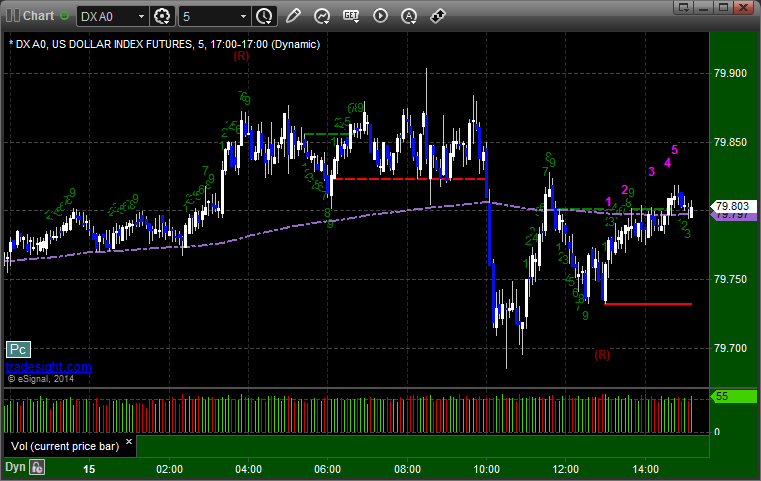

Here's a look at the US Dollar Index intraday with our market directional lines:

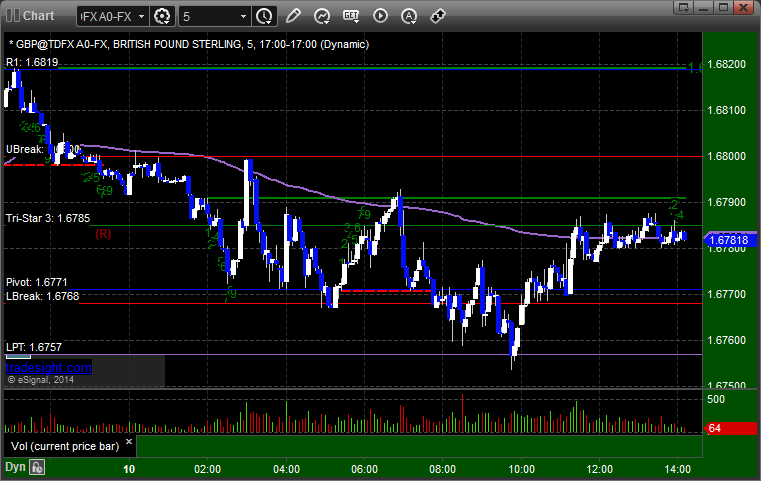

GBPUSD:

Triggered short at A and stopped. Note the perfect use of the Pivot for the high:

Stock Picks Recap for 4/11/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, UBNT and GMCR gapped under their triggers, no plays.

SHLD triggered short (with market support) and didn't work:

UNFI triggered short (without market support due to opening 5 minutes) and worked enough for a partial, but this isn't really a play to take and had to be quick:

From the Messenger/Tradesight_st Twitter Feed, Rich's PCLN triggered long (with market support) and worked:

TWTR triggered long (with market support) and worked enough for a partial, nothing special:

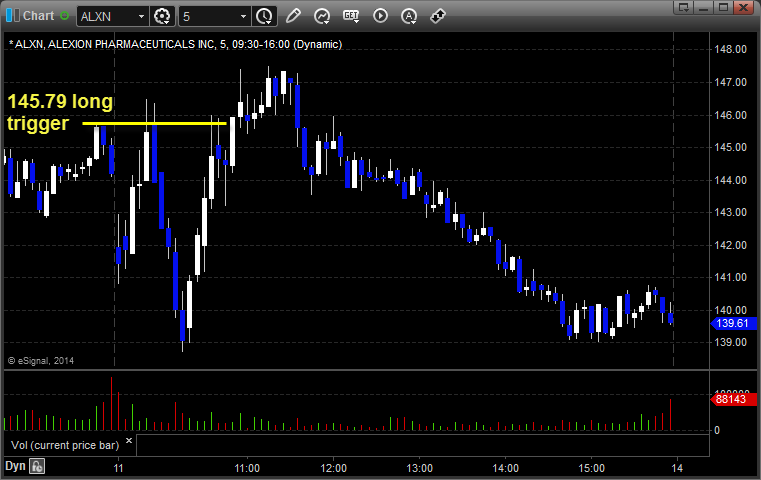

Rich's ALXN triggered long (with market support) and again worked only enough for a quick partial:

GOOG triggered long (with market support) and ALSO worked only enough for a quick partial:

Rich's FEYE triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not. Most of them barely worked enough for partial though.

Futures Calls Recap for 4/11/14

A winner and a loser in a much more contained session, as expected on a Friday. See ES and NQ sections below. There were nice setups in ER as well that worked.

Net ticks: -4 ticks.

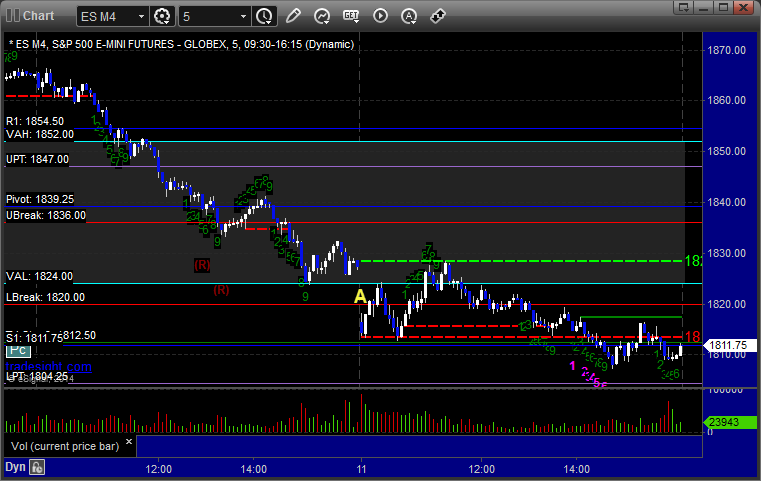

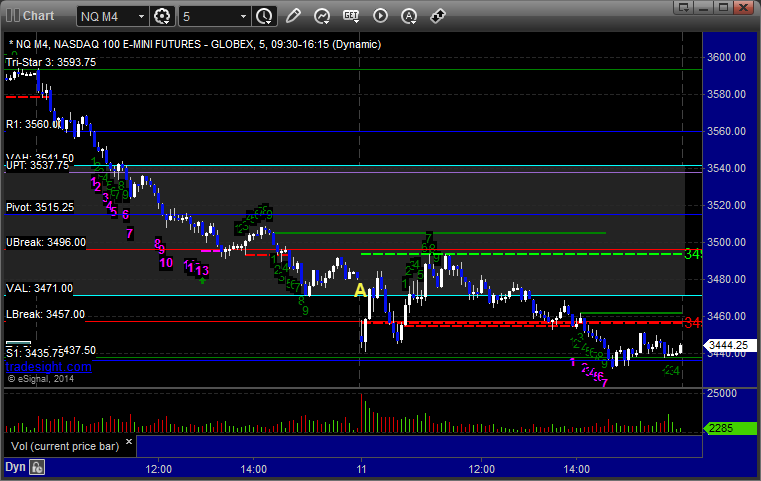

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at 1820.25 at A and stopped, didn't re-enter, although that would have worked:

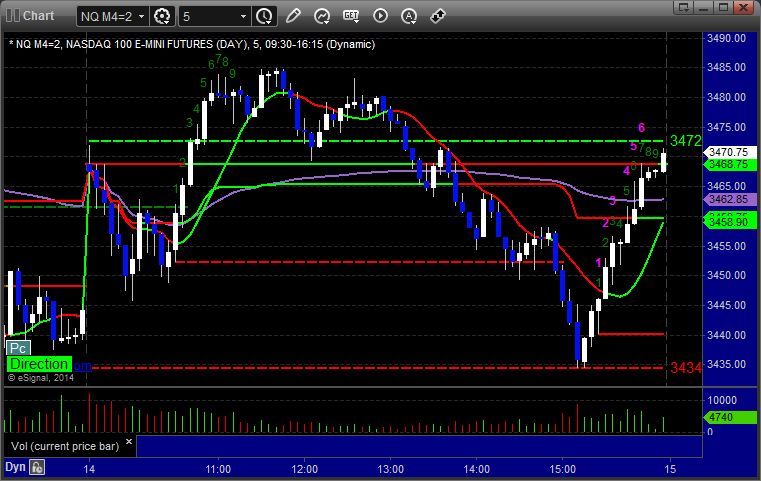

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's Value Area call triggered at A at 3471.50, hit first target for 6 ticks, stopped second half at entry:

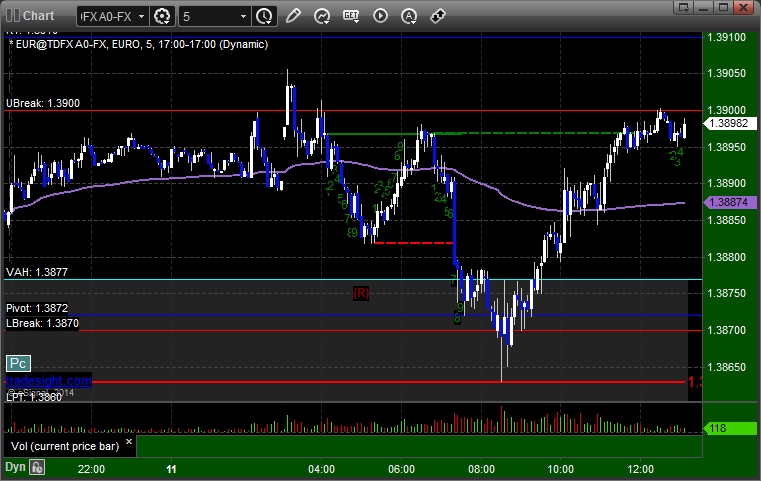

Forex Calls Recap for 4/11/14

We stopped out of the EURUSD call from the prior session and we had a new winner in the GBPUSD. See that section below.

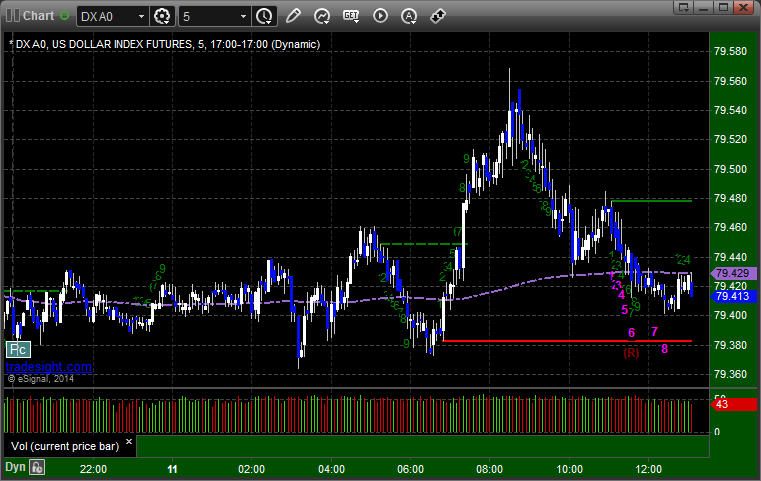

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. See NZDUSD and GBPUSD daily charts.

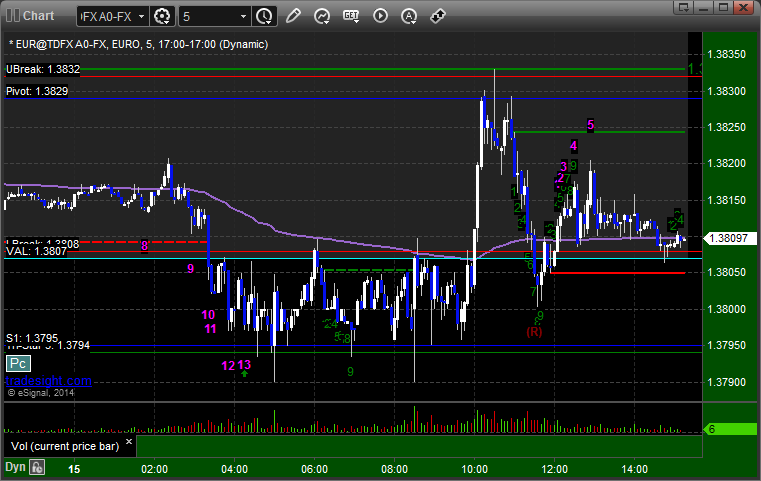

EURUSD:

GBPUSD:

Triggered short at A, hit first target at B, closed second half at C for end of week:

Stock Picks Recap for 4/10/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no triggers. Interesting.

From the Messenger/Tradesight_st Twitter Feed, SHLD triggered short (with market support) and worked:

Rich's TSLA triggered short (with market support) and worked:

His CAT triggered long (without market support) and didn't work much:

His VXX triggered long (ETF, so no market support needed) and didn't work, triggered again and worked later:

His GOOG triggered short (with market support) and worked:

AMGN triggered short (with market support) and worked:

My EBAY triggered short (with market support) and it was late in the day and not doing much while the market kept going, so I closed it slightly in the money, we won't count it:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 4/10/14

Couple of nice winners, one of which could have been even better on the NQ but we stopped to the tick before the next rollover. See ER and NQ sections below.

Net ticks: +19.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

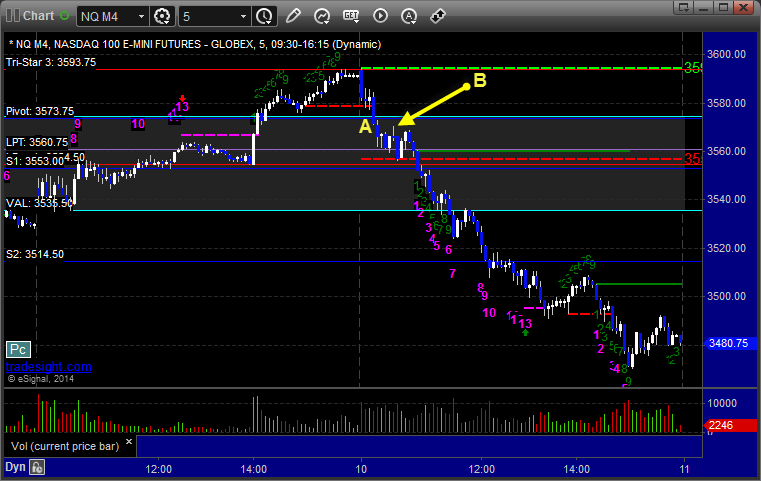

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3574, hit first target for 6 ticks, stopped second half at the tip of the arrow at B, just barely, otherwise, would have been a huge winner across the Value Area:

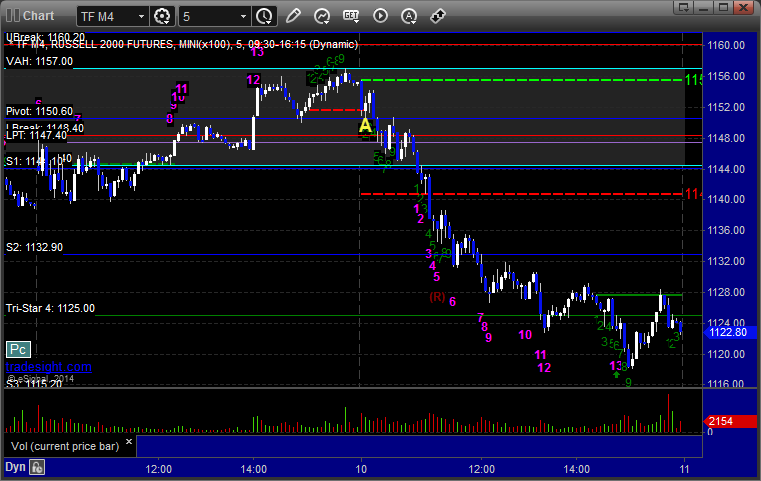

ER:

Triggered short at A under Pivot at 1150.40, hit first target for 8 ticks, lowered stop twice and stopped at 1148.60:

Forex Calls Recap for 4/10/14

Locked in a 150 pip winner to the final exit on GBPUSD from two days ago. New trade on EURUSD finally triggered late in the morning after a slow overnight. We're carrying it with a tight stop at this point. See both sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

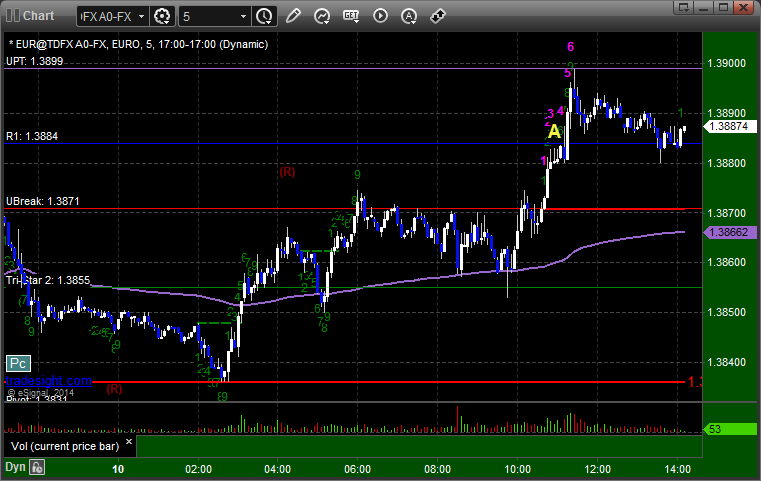

EURUSD:

Triggered long at A late in the session. Moved stop under 1.3880 and holding for now, little risk, hasn't hit first target:

GBPUSD:

The second half of our long from two days ago (1.6635 entry) stopped at 1.6785, 150 pips in the money: