Tradesight March 2014 Futures Results

Before we get to March’s numbers, here is a short reminder of the results from February. The full report from February can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for February 2014

Number of trades: 24

Number of losers: 11

Winning percentage: 54.1%

Net ticks: -8.5 ticks

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for March 2014

Number of trades: 27

Number of losers: 25

Winning percentage: 48.1%

Net ticks: +31 ticks

A very interesting month for futures. Things were much improved as volume returned to the market. Our only negative week was the week of options expiration, which was the only week where volume dropped down, averaging only 1.7 billion shares a day on the NASDAQ. Beyond that, remember that the results above include partials of just 6 ticks averaged into the numbers. It was a solid month, and on top of these main calls, there were plenty of setups and several Comber signals. Our win/loss ratio was actually a little lower than normal, which is interesting, but with market volume up, we had several trades that moved nicely and gave us solid gains. I continue to inch my size back up in futures as volume is holding in the markets better than 2013.

Stock Picks Recap for 4/4/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SOHU triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TQQQ triggered short (ETF, so no market support needed) and worked great:

BIDU triggered short (with market support) and worked:

AMZN triggered short (with market support) and worked:

Rich's NFLX triggered short (with market support) and worked:

CELG triggered short (with market support) and didn't work, worked later if you took the second try (we only count the first):

Rich's VXX triggered long (ETF, so no market support needed) and worked a little:

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not.

Futures Calls Recap for 4/4/14

A day with a lot of setups for our Levels traders. Our one main call didn't work due to the Pivot (missed first target by a single tick), but there were other options. See ES below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

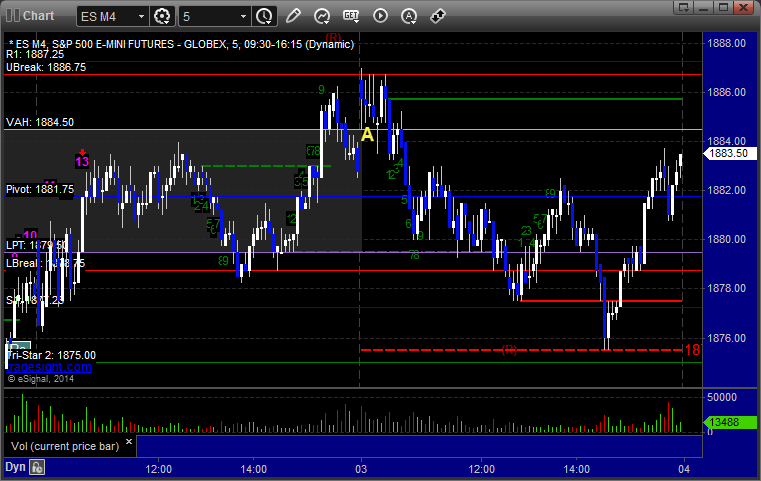

ES:

Our call triggered short at A at 1883.00, missed the first target by a tick, and I had warned about the Pivot being there, and then stopped. Lots of other opportunities, including a short under the opening 5 minute bar that was lined up with R1 and heading into the gap, and a short under the Pivot later. Also got a bounce play off the Comber 13:

Forex Calls Recap for 4/4/14

Absolutely amazing. Despite the NFP data and a 50 pip spike in two directions, neither of our calls even triggered, which is fine since the market didn't go anywhere, but just amazing. We did close out the second half of the prior day's EURUSD short in the money.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. There is absolutely nothing new to see in terms of counts or chart patterns.

Stock Picks Recap for 4/3/14

Not as many triggers as the prior session, but all 4 worked, mostly very well.

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered since we had no short ideas in the overnight scans coming in.

From the Messenger/Tradesight_st Twitter Feed, Rich's QIHU triggered short (with market support) and worked:

SINA triggered short (with market support) and worked enough for a partial early and even better later:

Rich's FEYE triggered short (with market support) and worked:

NFLX triggered short (with market support) and worked:

Afternoon triggers did not trigger as the market bounced.

In total, that's 4 trades triggering with market support, and all 4 of them worked.

Futures Calls Recap for 4/3/14

A perfect setup failed once but then worked. See ES section below. The broad market was impossibly slow in the opening 30 minutes and then closed the small gap. The NASDAQ side was much weaker. NASDAQ volume closed at 1.8 billion shares. ES closed right on the VWAP.

Net ticks: +0 ticks.

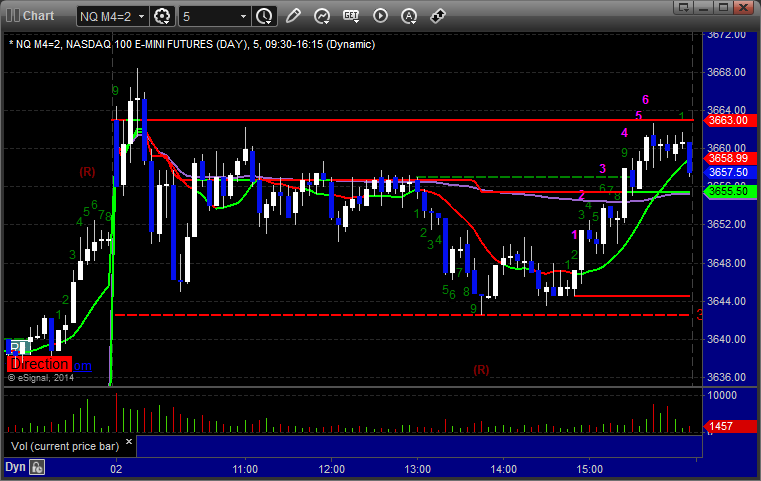

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

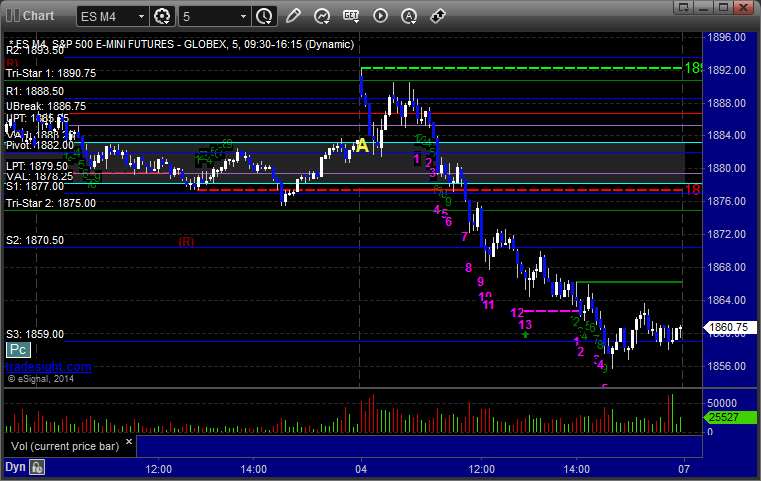

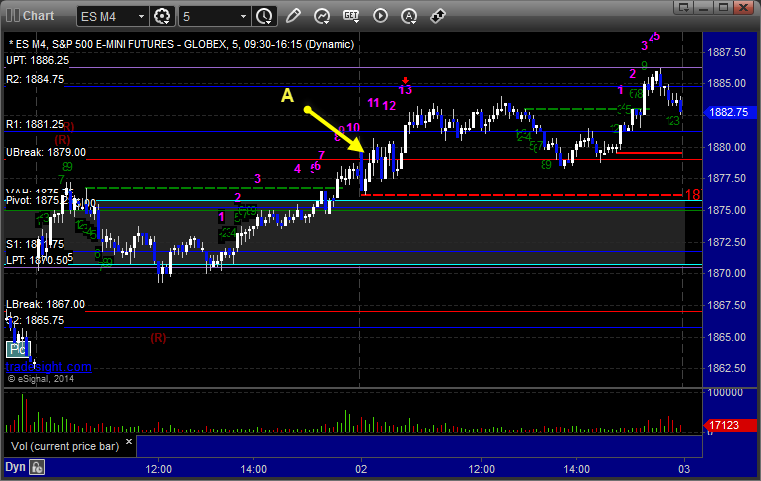

ES:

ES triggered short at 1884.25 at A and stopped unfortunately (great setup), but we put it back in and it retriggered 15 minutes later, hit first target for 6 ticks, and stopped second half 8 ticks in the money (and crossed the Value Area) for an exact wash:

Forex Calls Recap for 4/3/14

The is a reason that we reduce size ahead of certain economic numbers, and Trade Balance is one of them. The market behaved VERY technically on the data, but the initial spike makes it hard to get. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

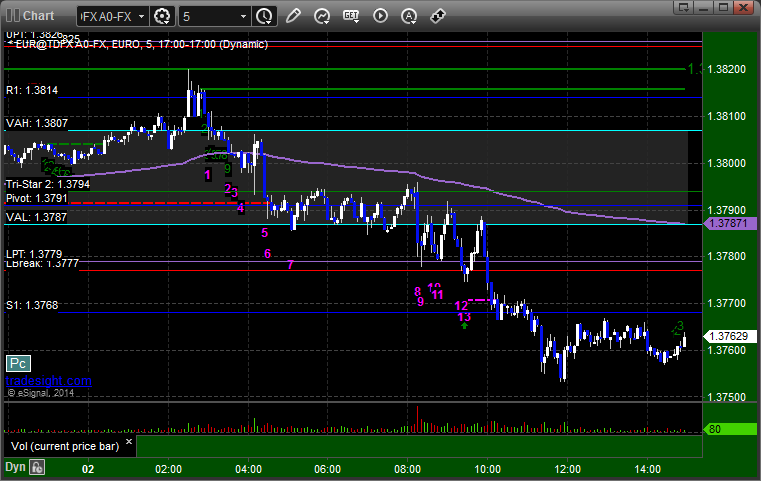

EURUSD:

Triggered long at A, hit first target at B (if you got it), stopped second half. Triggered short at C, hit first target at D, and still holding with a stop over LPT:

Stock Picks Recap for 4/2/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FWLT gapped over the long trigger, no play.

LINTA triggered long (with market support) and worked:

LULU triggered long (with market support) and worked:

INFI triggered short (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered long (with market support) and worked enough for a partial:

BIIB triggered long (with market support) and didn't work:

SHLD triggered long (with market support) and worked:

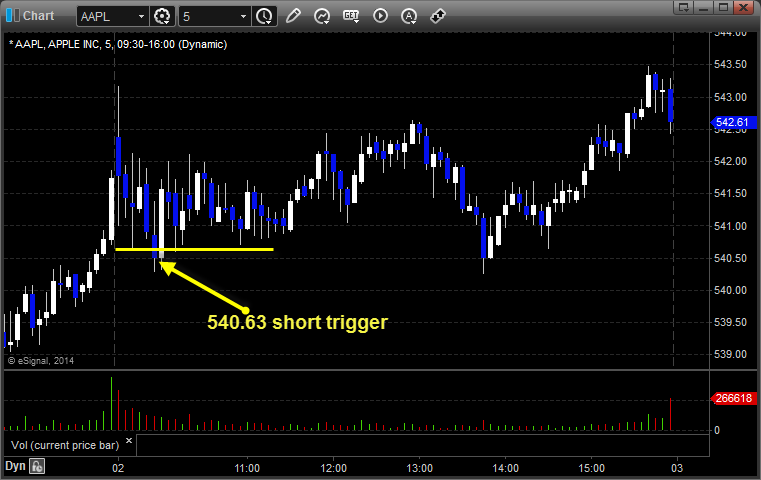

Rich's AAPL triggered short (without market support) and didn't work:

His QIHU triggered short (without market support) and worked:

His LVS triggered short (without market support) and didn't work:

Rich's GLD triggered short (ETF, so no market support needed) and worked, although just a little, never went against:

SINA triggered short (with market support) and worked:

Rich's ISRG triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 7 of them worked, 1 did not.

Futures Calls Recap for 4/2/14

One winner for a partial and that's it after a very dull and choppy opening hour of play. The markets pulled back to the VWAP over lunch and then pushed up a little late. NASDAQ volume closed at 2 billion shares. Overall, this was not an interesting session even though the ES saw a Comber 13 sell signal that also worked.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

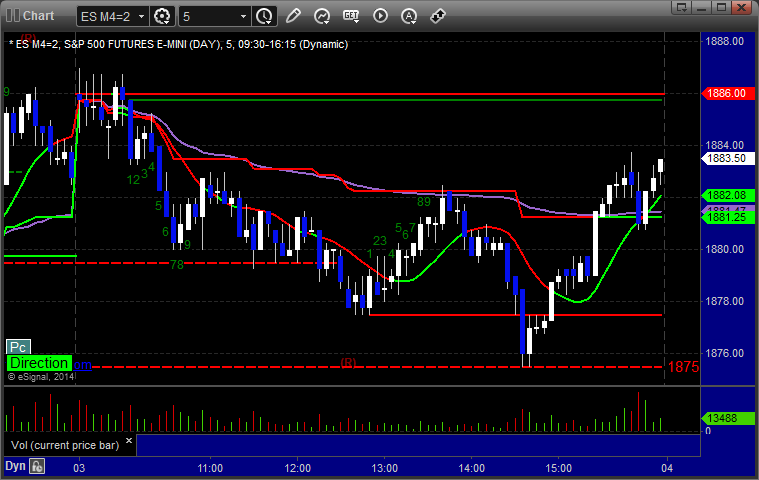

ES:

Triggered long at A at 1879.25, hit first target for 6 ticks, second half stopped under the entry, which was good in that mess:

Forex Calls Recap for 4/2/14

No calls for the session because the setups and distance to other Levels were too narrow due to the last couple of days of confined ranges. Doesn't look like it mattered, but we will see what we find tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD: