Stock Picks Recap for 4/1/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, HWAY triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's LVS triggered short (without market support) and worked:

His MPEL triggered short (without market support) and didn't work:

KLAC triggered long (with market support) and worked:

FB triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, all 3 of them worked.

Futures Calls Recap for 4/1/14

A gap up and push higher in the markets, although more on the NASDAQ side than the broad market. We did get a nice inverted cup and handle setup, but it triggered over lunch and didn't get going. The rest of the session was a flat waste of time. Volume was 1.8 billion NASDAQ shares.

Net ticks: -7 ticks.

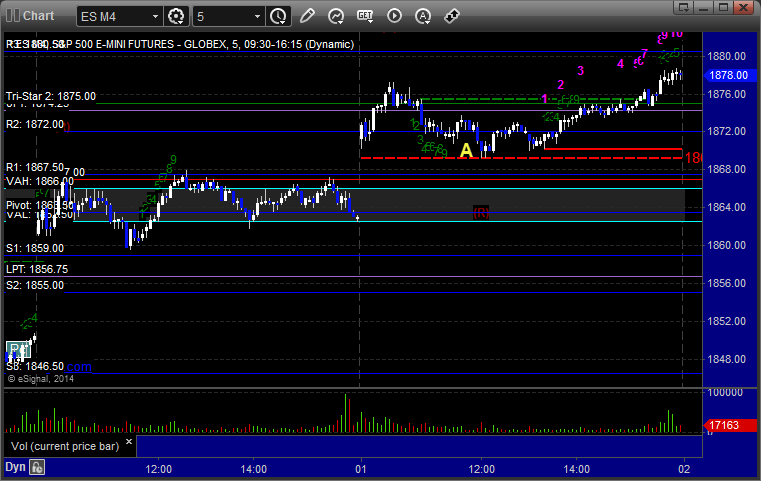

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1870 with a nice setup and stopped for 7 ticks:

Forex Calls Recap for 4/1/14

A clean Value Area play on the GBPUSD gave us a nice winner to close out the month of March. By "nice," I mean that it worked perfectly, not that it went far, as nothing does right now in Forex. See that section below.

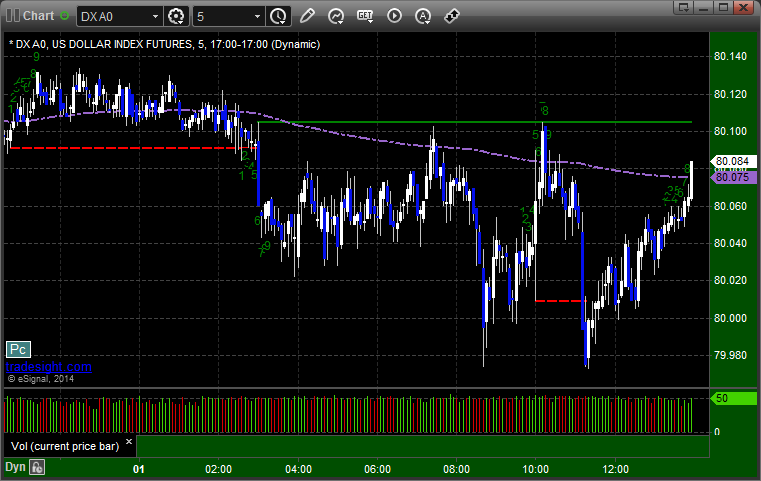

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, stopped second half at C:

Stock Picks Recap for 3/31/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's SPY triggered short (ETF, so no market support needed) and didn't work:

His TSLA triggered short (with market support) and worked:

BIDU triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

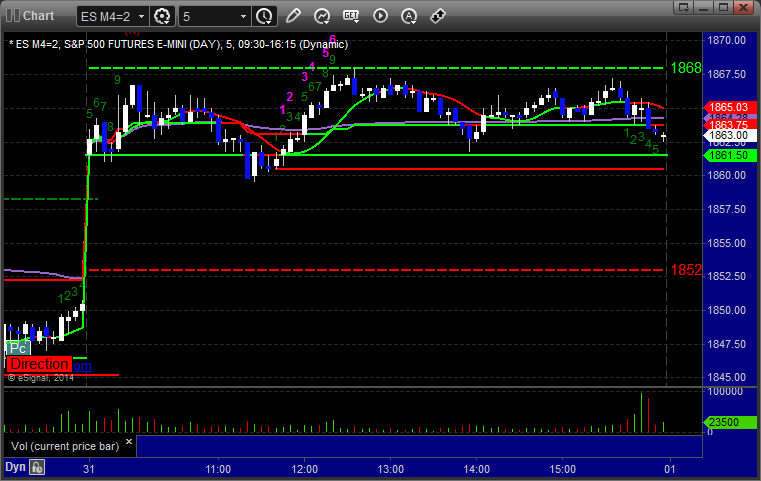

Futures Calls Recap for 3/31/14

As expected for end of quarter, the market was mostly flat for the session, but we squeezed out a nice winner to wrap up the month. See the NQ section below. NASDAQ volume was only 1.9 billion shares, and we have gaps below.

Net ticks: +8 ticks.

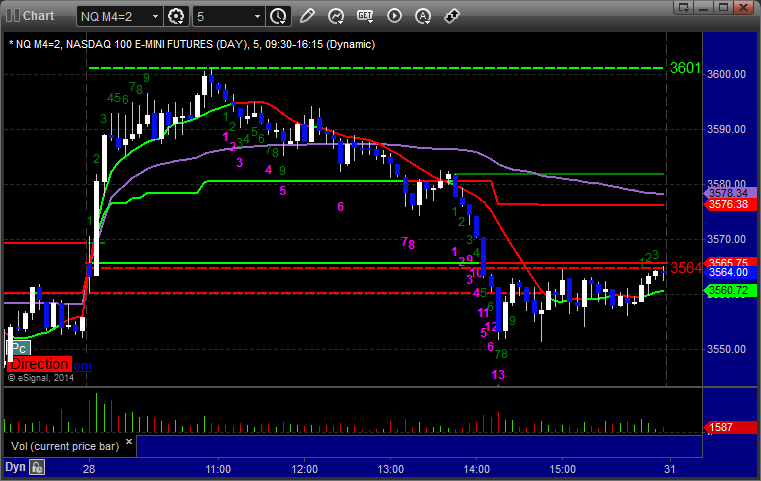

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

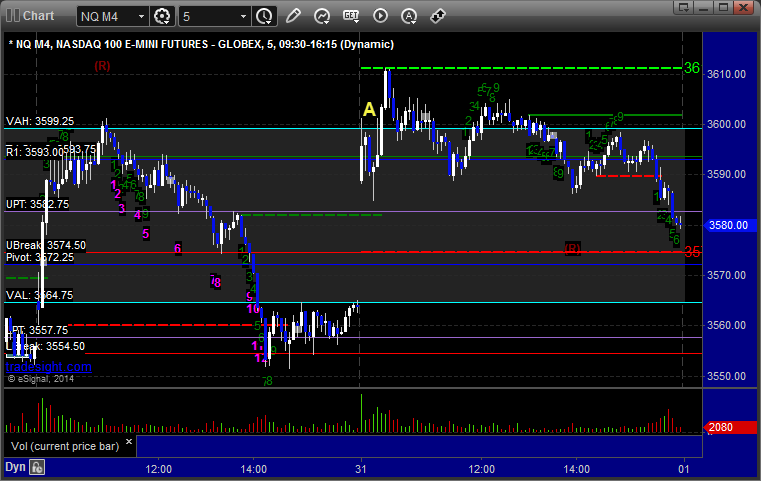

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 3602.00, hit first target for 6 ticks, raised stop twice and closed second half 10 ticks in the money:

Forex Calls Recap for 3/31/14

One trade that moved to the first target and that's it. See EURUSD section below. Also, have a look at the USDCAD, GBPJPY, USDJPY, and AUDUSD charts below, all of which had Comber 13 signals that were tops/bottoms.

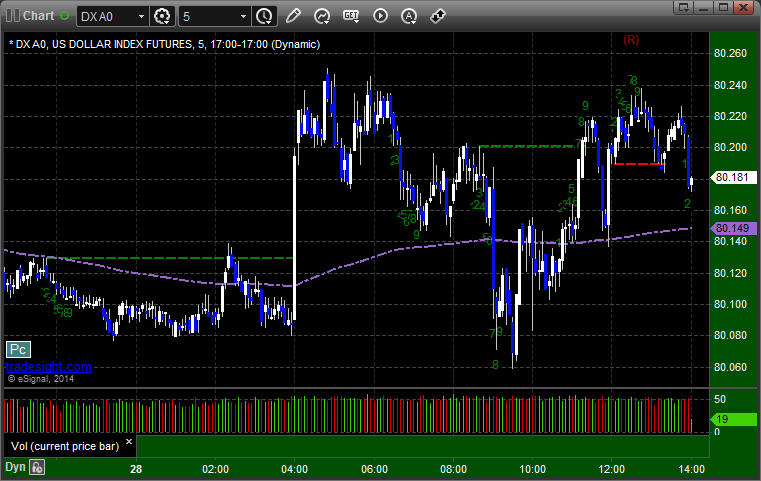

Here's a look at the US Dollar Index intraday with our market directional lines:

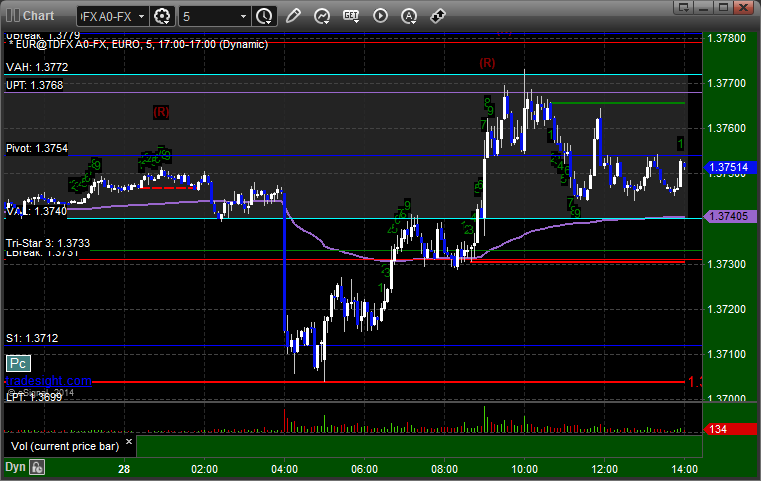

EURUSD:

Triggered long at A, hit first target at B, stopped second half under entry:

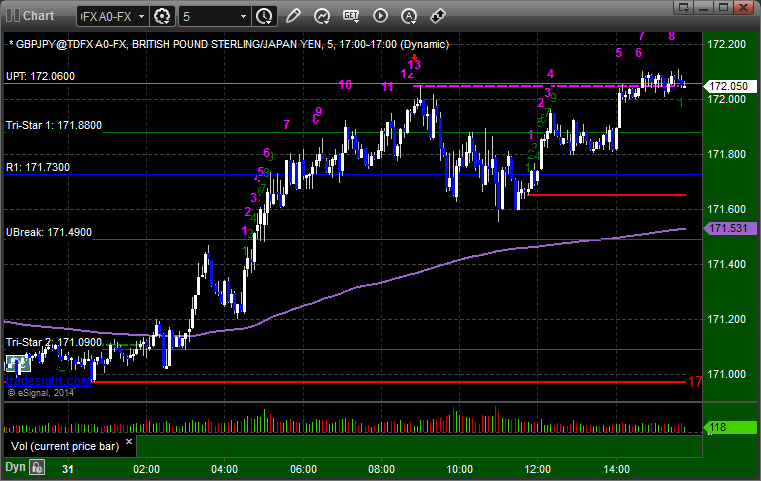

GBPJPY 13 signal:

Stock Picks Recap for 3/28/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

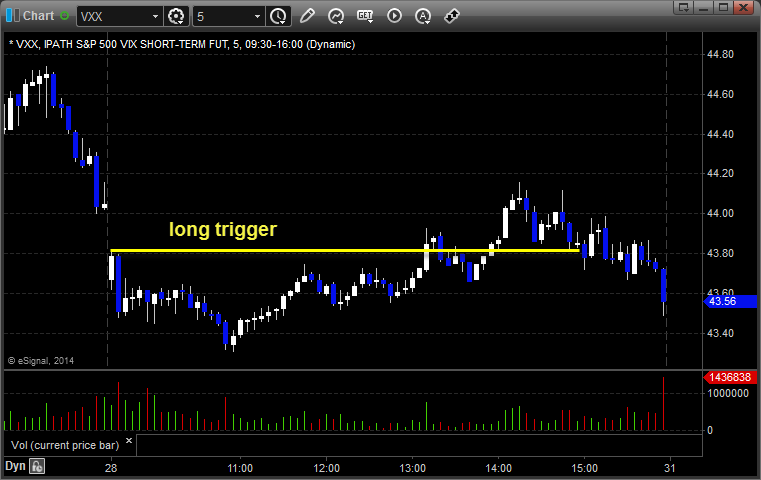

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and worked:

His TQQQ triggered short (ETF, so no market support needed) and worked:

GOOG triggered long (with market support) and worked:

KLAC triggered long (with market support) and worked:

AMGN triggered long (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not. GOOG and KLAC early were the main draws.

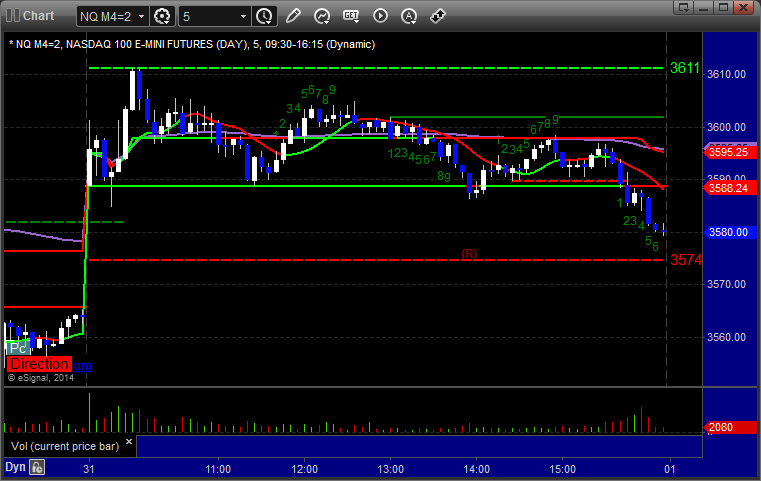

Futures Calls Recap for 3/28/14

A nice winner and a stop out for gains for the session on the ES calls. Other nice technical moves in the NQ and ER. The markets gapped up, surged higher, flattened over lunch, and came back to the opening level without quite filling the ES gap as we head into end of quarter on Monday.

Net ticks: +4.5 ticks.

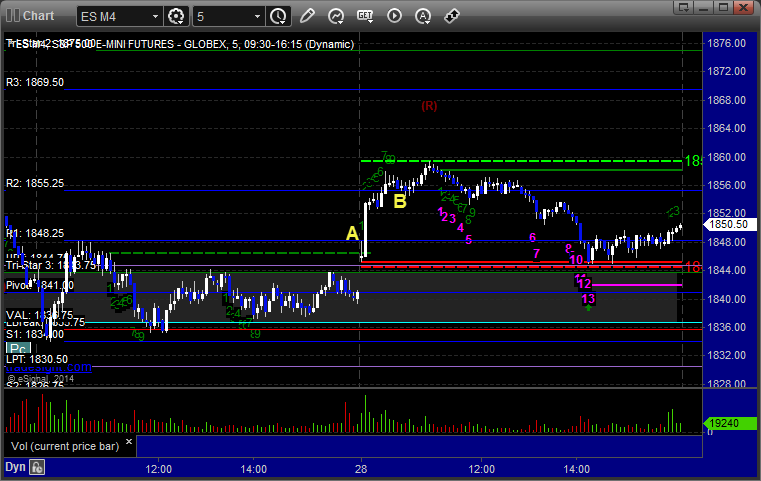

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

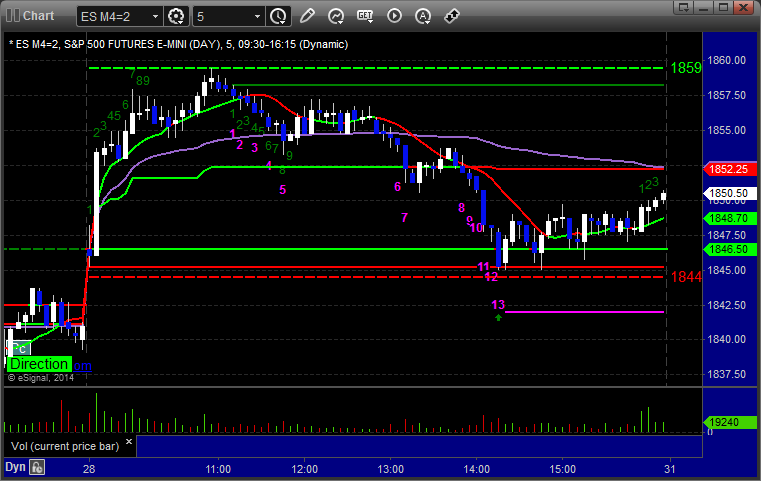

ES:

Triggered long at A at 1848.50, hit first target for 6 ticks, raised the stop several times and stopped second half at 1852.75 in the money. A short call triggered at B at 1855.00 and stopped:

Forex Calls Recap for 3/28/14

Wow, two days in a row without even any triggers (I believe that is a record in almost 10 years of making Forex calls) as the GBPUSD stuck in a 40 pip range and the EURUSD stuck in a 60 pip range. But, with those ranges, you'd rather nothing triggers, frankly.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

EURUSD:

Stock Picks Recap for 3/27/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AMAG triggered short (with market support) and worked:

ANGI triggered short (with market support) and didn't work:

FNGN triggered short (with market support) and worked:

FB triggered short (with market support) and worked:

NKTR triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, my BIIB triggered short (with market support) and worked:

Rich's GS triggered long (with market support) and worked:

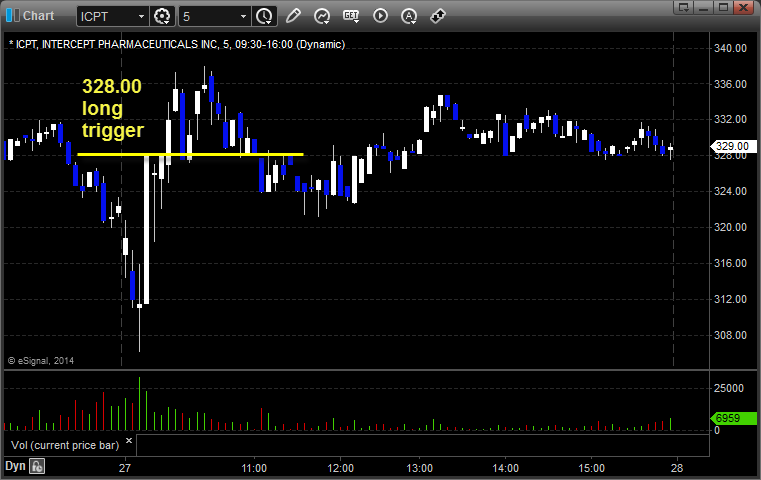

His ICPT triggered long (with market support) and worked:

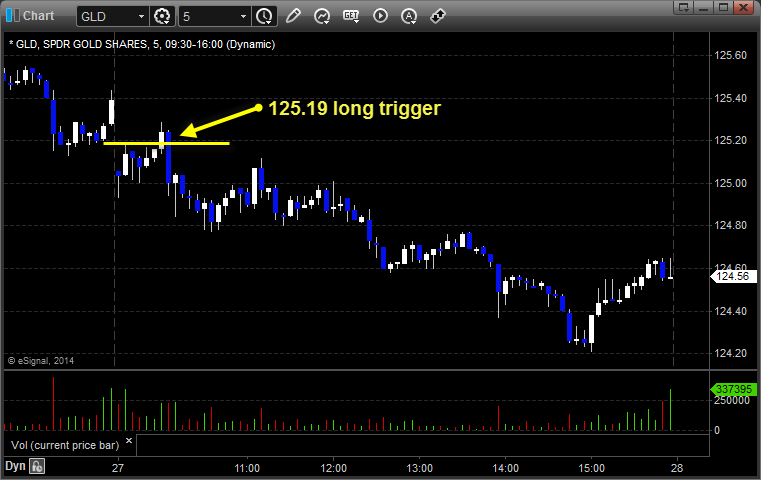

His GLD triggered long (ETF, so no market support needed) and didn't work:

AMGN triggered long (with market support) and didn't work:

Rich's HLF triggered long (with market support) and worked:

Rich's VXX triggered short (ETF, so no market support needed) and worked:

His CXO triggered long (without market support) and worked:

In total, that's 12 trades triggering with market support, 8 of them worked, z did not.