Futures Calls Recap for 3/27/14

A small winner on the ES as there was no follow through. The markets opened flat and traded almost exactly average daily range early, but with one move down and another back up. The rest of the day just got narrower and narrower. NASDAQ volume closed strong at 2.1 billion.

Net ticks: +2.5 ticks.

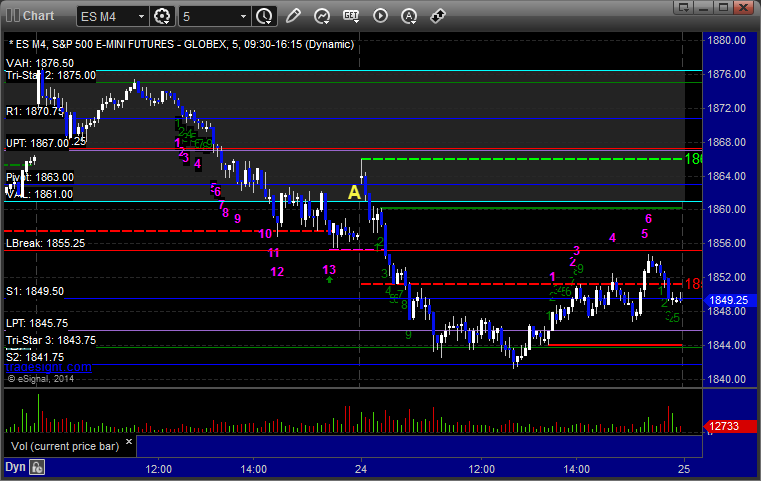

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1843.50, hit first target, stopped second half over entry:

Forex Calls Recap for 3/27/14

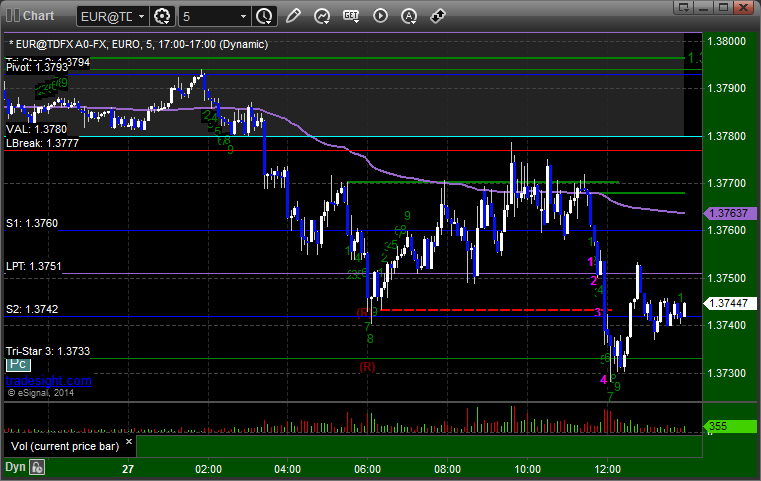

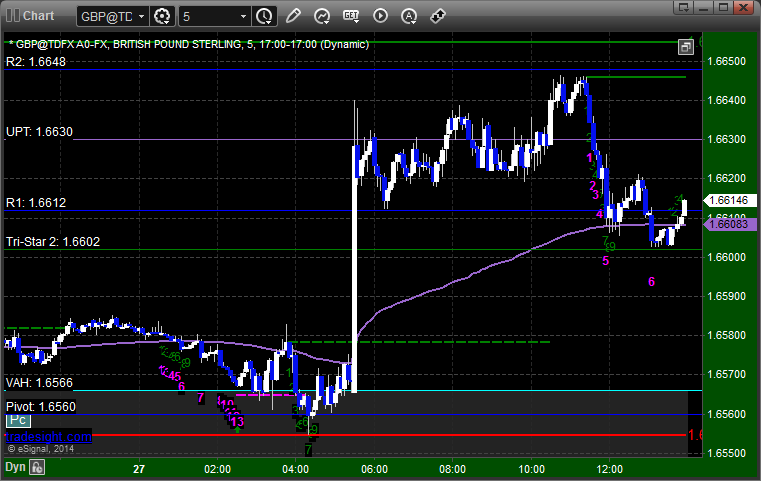

The EURUSD went one way and the GBPUSD went the other, so neither of our trades triggered. Always a risk when we don't have good setups on the same pair in both directions. The EURUSD didn't do anything again. The GBPUSD spiked on news and probably wouldn't have gotten you a fill in that move even if we had a trade there. See both sections below.

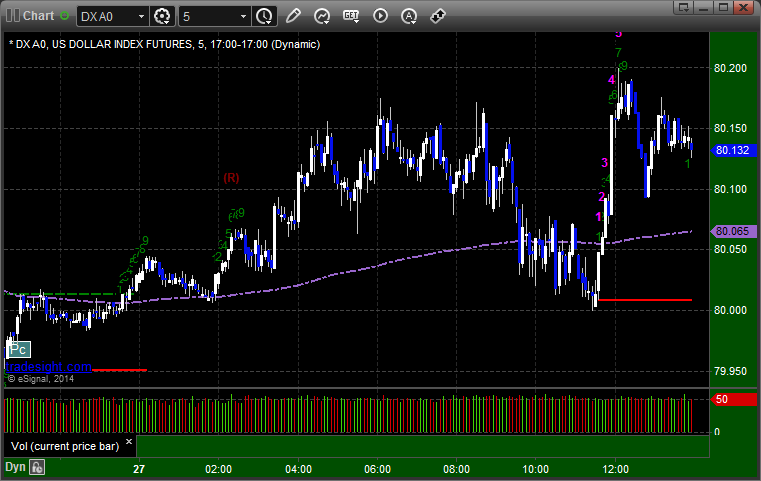

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

GBPUSD:

Stock Picks Recap for 3/26/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, STKL triggered long (without market support) and worked:

CRUS gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, TSLA triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

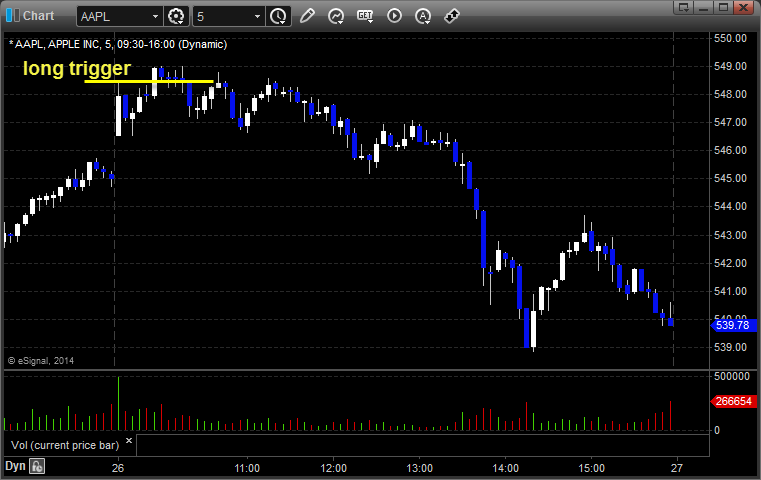

His AAPL triggered long (without market support) and didn't work:

His AMGN triggered short (with market support) and worked enough for a partial:

His YELP triggered long (with market support) and didn't work:

His GLD triggered short (ETF, so no market support needed) and worked:

TWTR triggered short (with market support) and worked:

Rich's CLF triggered short (with market support) and didn't work:

His CMG triggered short (with market support) and didn't work:

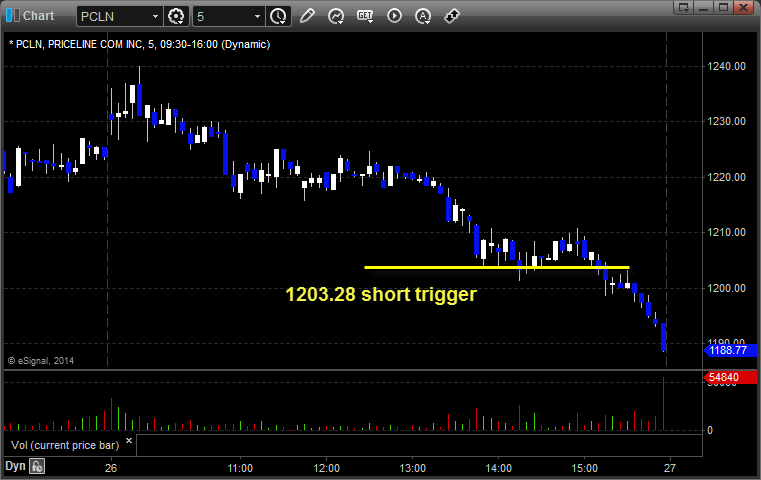

His PCLN triggered short (with market support) and worked enough for a partial:

In total, that's 7 trades triggering with market support, 4 of them worked, 3 did not.

Futures Calls Recap for 3/26/14

Following some nice days, we ended up with a triple losing session as the markets gapped up and slow walked back down to fill the gap over lunch but mostly ignored the technicals. We sold off sharply later in the lunch hour and closed near the lows on 2.3 billion NASDAQ shares.

Net ticks: -25 ticks.

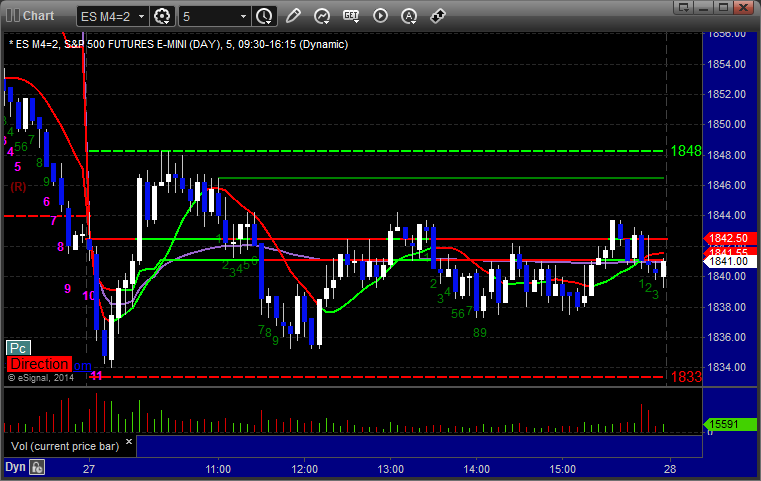

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

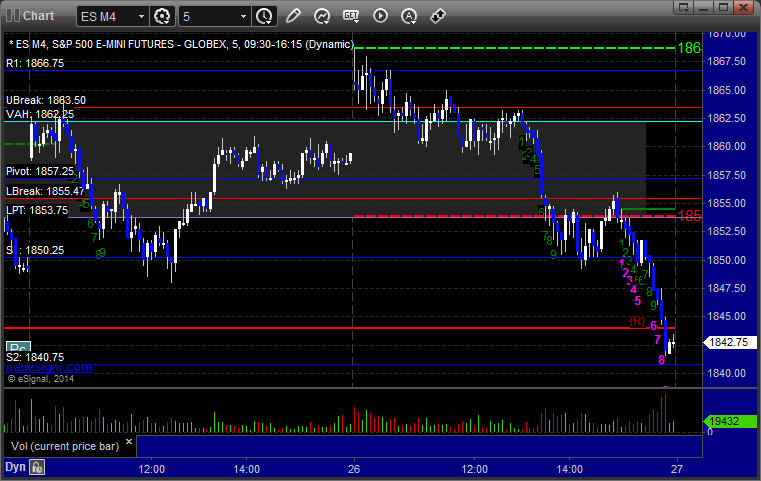

ES:

Mark's call triggered short at A at 1862.00 and stopped. Very choppy after that, and he didn't put it back in:

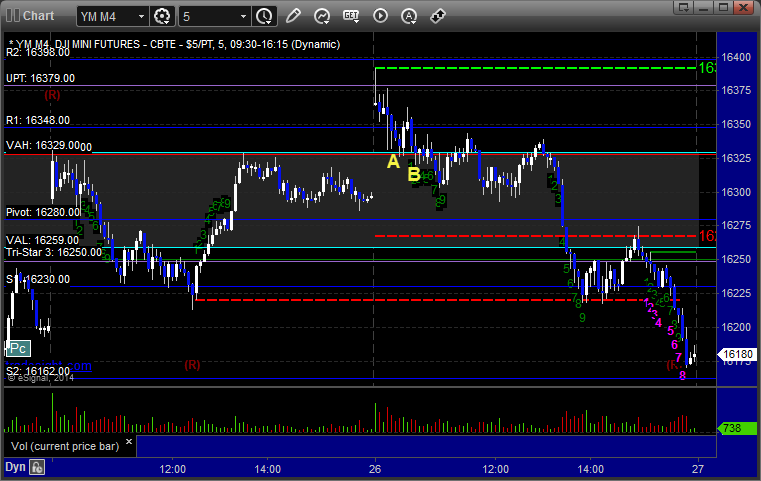

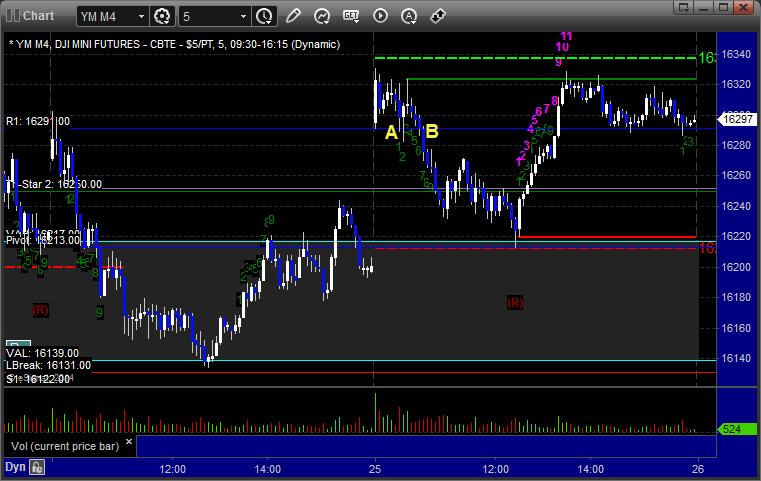

YM:

Triggered short at 16327 at A and stopped. Triggered again over B and stopped. Gave up on it and then it worked:

Forex Calls Recap for 3/26/14

Another dull session. Small winner in the EURUSD. See that section below. No 13's on most pairs because of the lack of momentum.

Here's a look at the US Dollar Index intraday with our market directional lines:

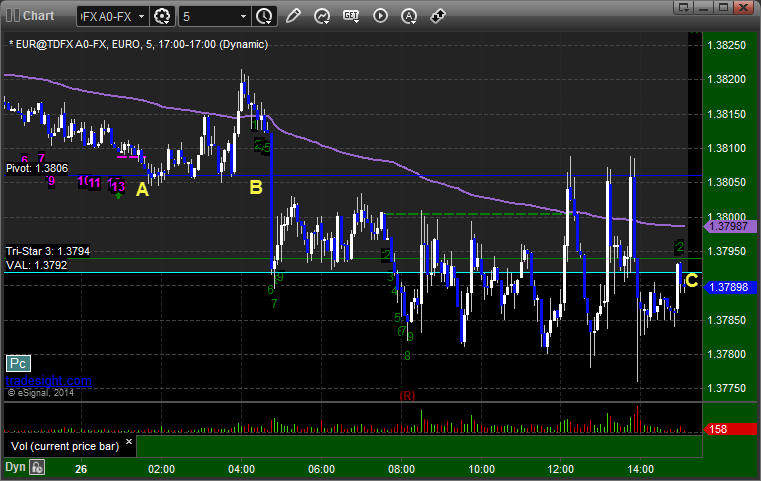

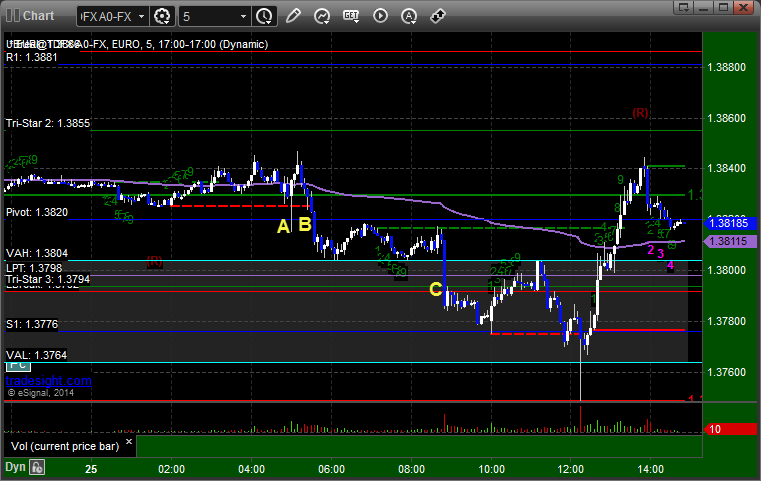

EURUSD:

Triggered a piece of the trade short at A and the rest at B, never stopped, and closed the whole thing 10 pips in the money at C for end of session:

Stock Picks Recap for 3/25/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MHLD triggered long (with market support) and didn't quite go enough for a partial:

CTCT triggered short (with market support) and didn't work:

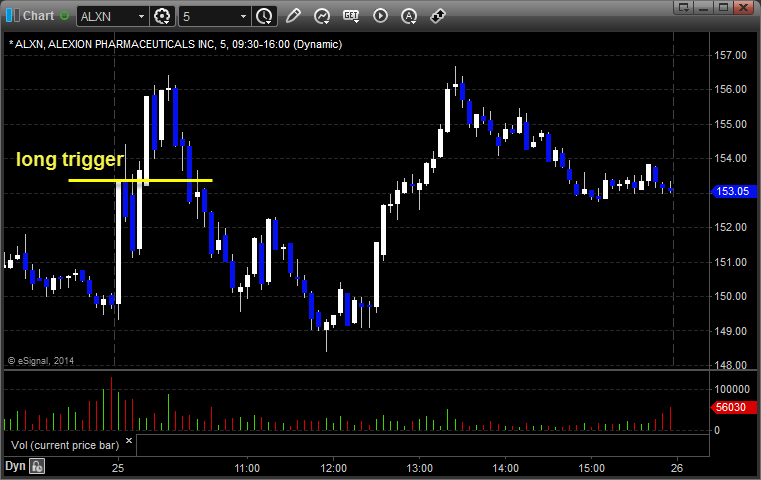

From the Messenger/Tradesight_st Twitter Feed, Rich's ALXN triggered long (with market support) and didn't work:

His LNKD triggered short (with market support) and didn't work:

His CELG triggered long (with market support) and worked:

His PCLN triggered short (with market support) and worked enough for a partial:

His ICPT triggered short (with market support) and worked:

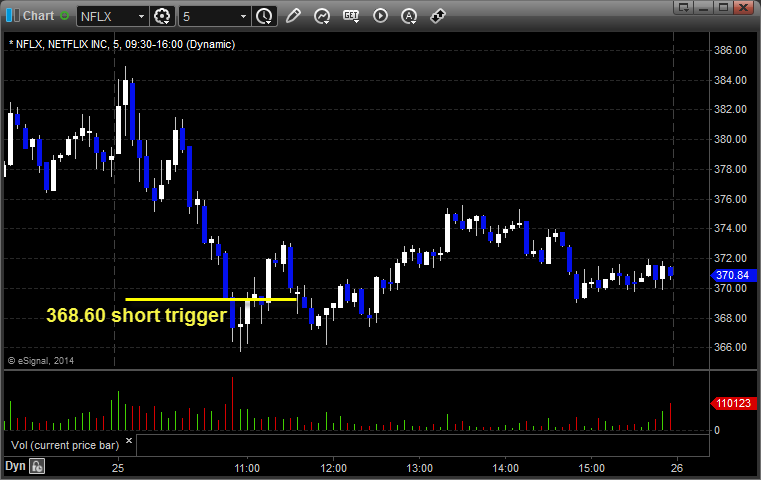

His NFLX triggered short (with market support) and worked enough for a partial:

His AAPL triggered long (with market support in the afternoon) and worked:

In total, that's 8 trades triggering with market support, 4 of them worked, 4 did not.

Futures Calls Recap for 3/25/14

A nice day, although back to having a trade sweep once before working a second time. See ES, NQ, and YM sections below for all of the trades.

Net ticks: +22 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Long call triggered over R1 at 1863.25 at A after some excellent basing action and then stopped for 7 ticks. I put the trade back in but it never triggered again:

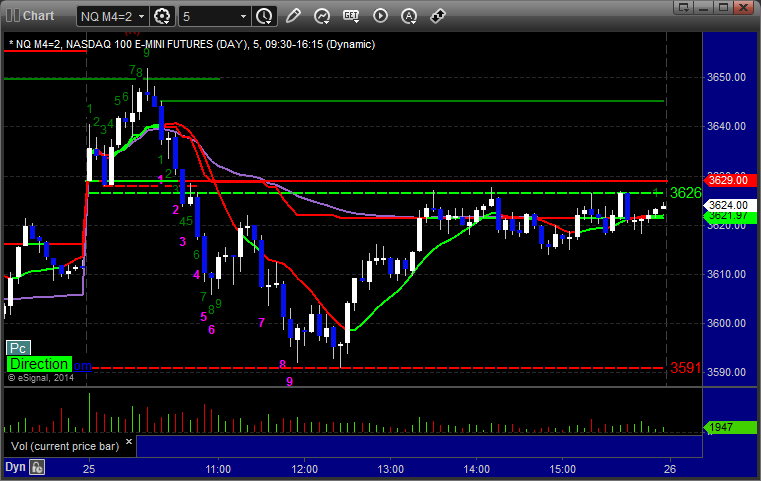

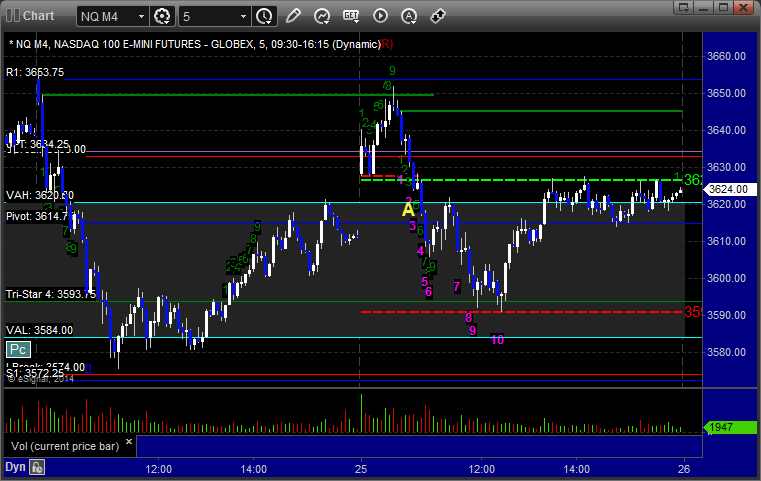

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at A at 3620.00, hit first target for 6 ticks, he lowered the stop several times and stopped the final piece at 3611.25:

YM:

Short call triggered at A at 16290 and stopped for 10 ticks. Triggered again at B, hit first target for 10 ticks, lowered the stop a few times and closed final piece at 16251:

Forex Calls Recap for 3/25/14

Really slow action for the session and a spike that stopped the EURUSD short initially before it went on to work. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A on a spike down and stopped on the reversal of that spike just barely, all of which was a bummer as the basing action above that level was great. It then went on to trigger at B and hit first target at C if you were awake to put it back in:

Stock Picks Recap for 3/24/14

What a great session for us.

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CLDX triggered short (without market support due to opening 5 minutes) and worked:

FB triggered short (with market support) and worked:

TSLA triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered short (with market support) and worked:

TEVA triggered short (with market support) and worked:

Rich's VXX (ETF, so no market support needed) triggered long and worked:

His ALXN triggered short (with market support) and worked:

SINA triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, all 6 of them worked, as did the other 2 that triggered in the opening 5 minutes.

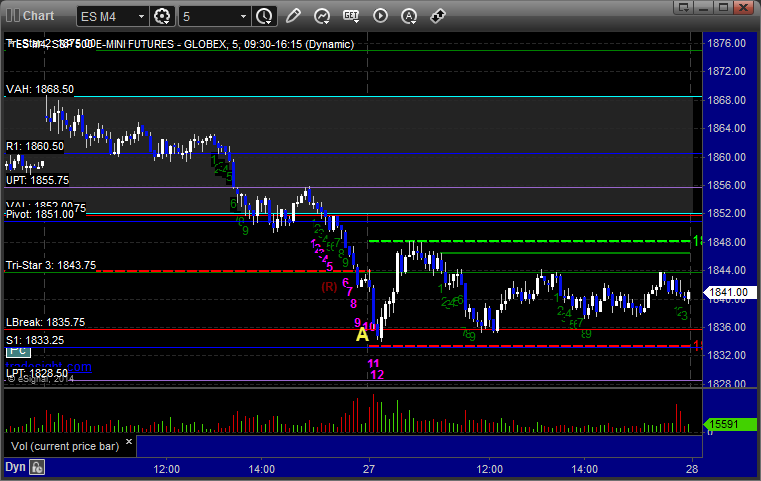

Futures Calls Recap for 3/24/14

The markets gapped up, the ES set the Pivot from above, and we had a beautiful technical trigger that ran well. See ES section below. NASDAQ volume was also greatly improved at 2.2 billion shares.

Net ticks: +13.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

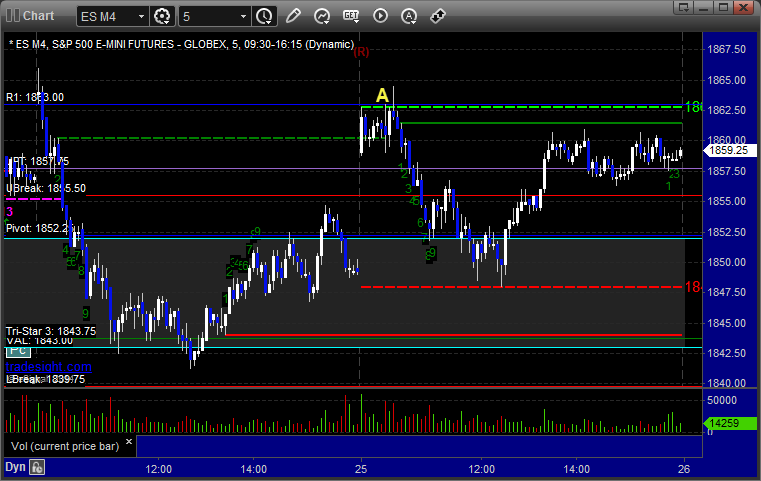

ES:

My call triggered short at A at 1862.75, hit first target for 6 ticks, and we lowered the stop several times and closed the final half at the gap fill at 1857.50 for 21 ticks: