Forex Calls Recap for 3/24/14

A really slow overnight session with nothing that triggered, and then a very late-day move on the GBPUSD from the trigger to the first target if you left your orders in that long. See GBPUSD below.

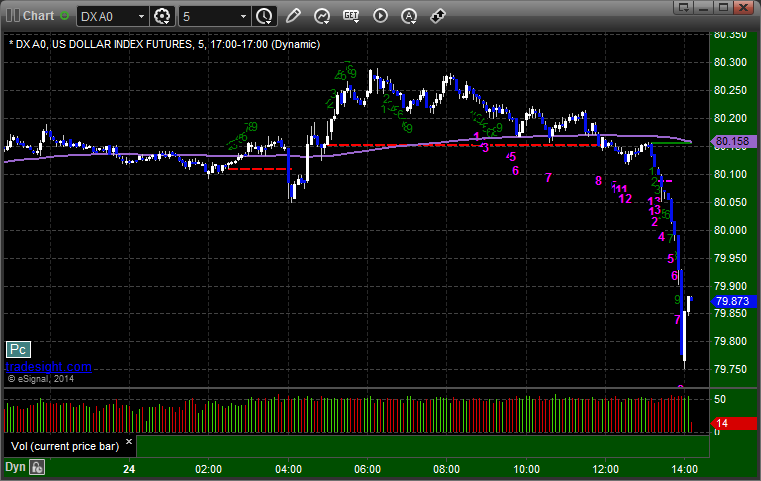

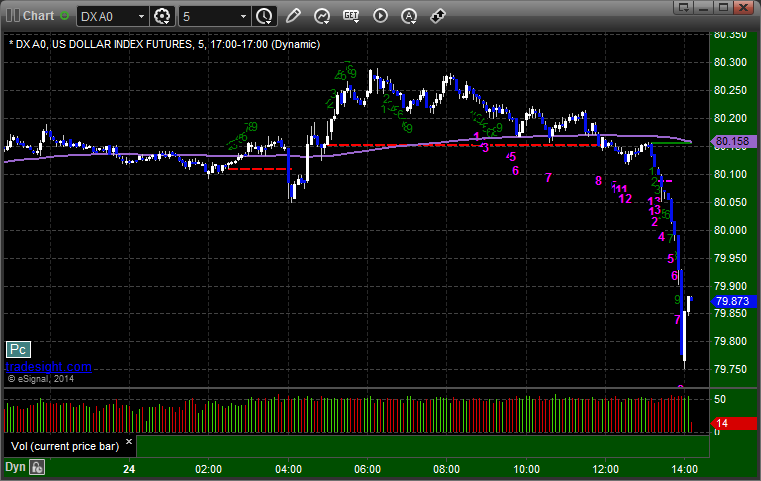

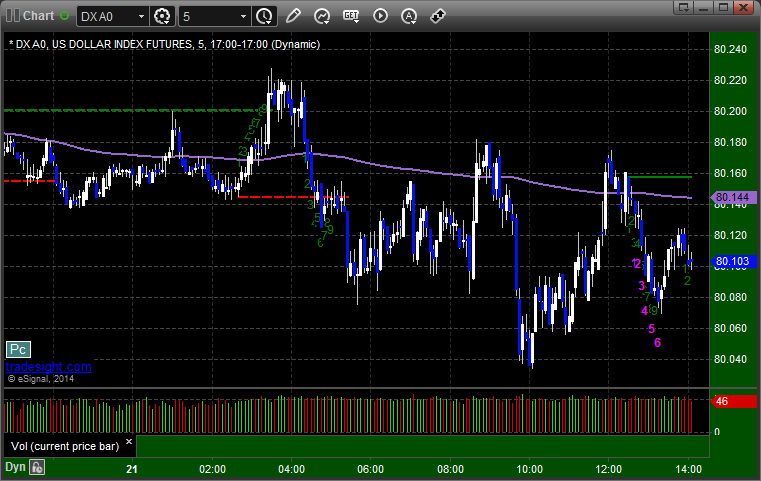

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Set the trigger at A but didn't break it. Triggered long at B late in the session, headed straight to the first target at C. Should have a stop under R1 if you took it:

Forex Calls Recap for 3/24/14

A really slow overnight session with nothing that triggered, and then a very late-day move on the GBPUSD from the trigger to the first target if you left your orders in that long. See GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Set the trigger at A but didn't break it. Triggered long at B late in the session, headed straight to the first target at C. Should have a stop under R1 if you took it:

Stock Picks Recap for 3/21/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, WETF triggered short (with market support) and didn't go enough in either direction to count:

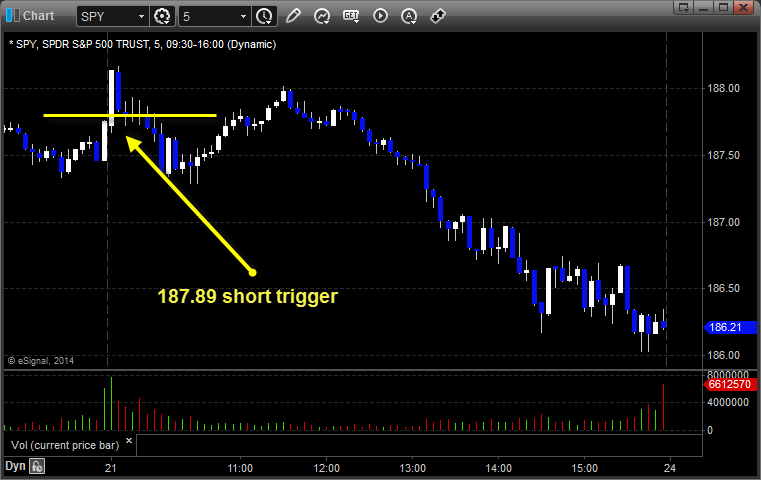

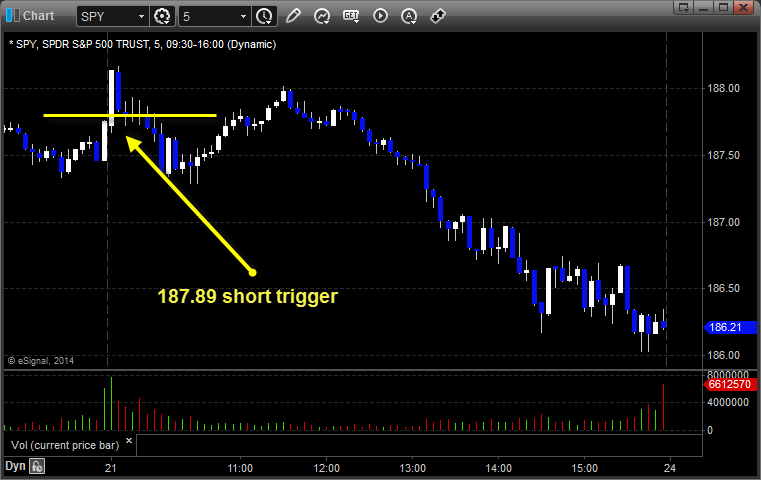

From the Messenger/Tradesight_st Twitter Feed, Rich's SPY triggered short (ETF, so no market support needed) and worked:

His GLD triggered short (ETF, so no market support needed) and worked:

CELG triggered short (with market support) and worked:

Rich's REGN triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Stock Picks Recap for 3/21/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, WETF triggered short (with market support) and didn't go enough in either direction to count:

From the Messenger/Tradesight_st Twitter Feed, Rich's SPY triggered short (ETF, so no market support needed) and worked:

His GLD triggered short (ETF, so no market support needed) and worked:

CELG triggered short (with market support) and worked:

Rich's REGN triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 3/21/14

Another trade that set up nice, swept first, then worked. We got options expiration as expected. The broad market was flat for hours after a gap up and then came back to fill the gap. The NASDAQ side was more negative. NASDAQ volume closed at 2.2 billion shares.

Net ticks: -4.5 ticks.

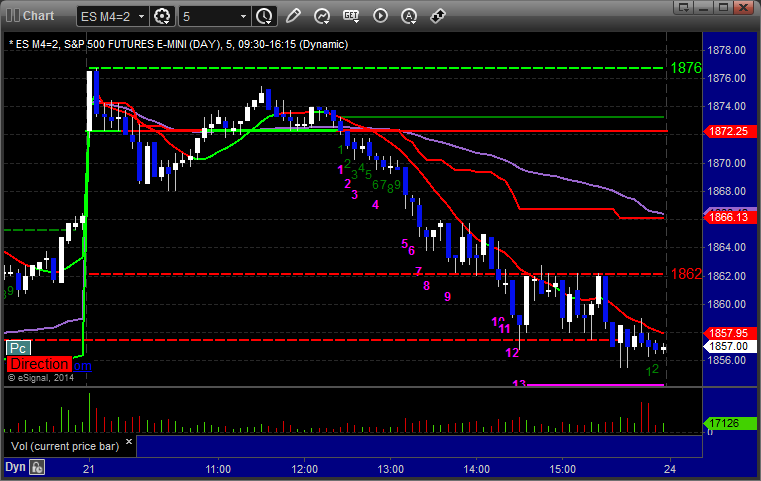

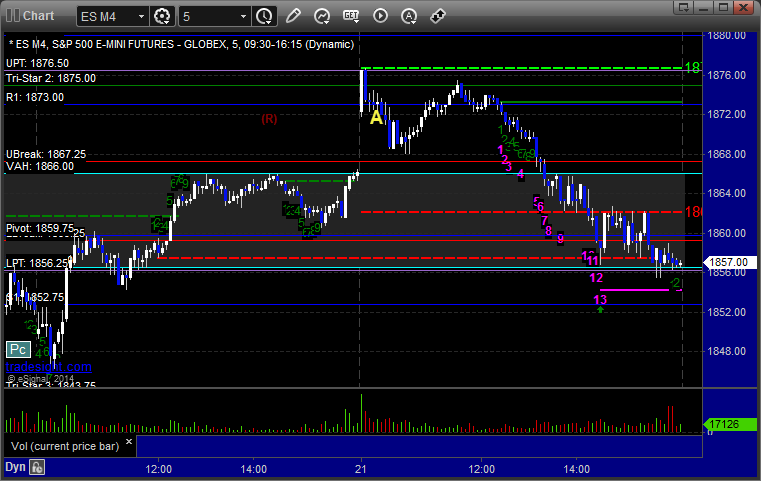

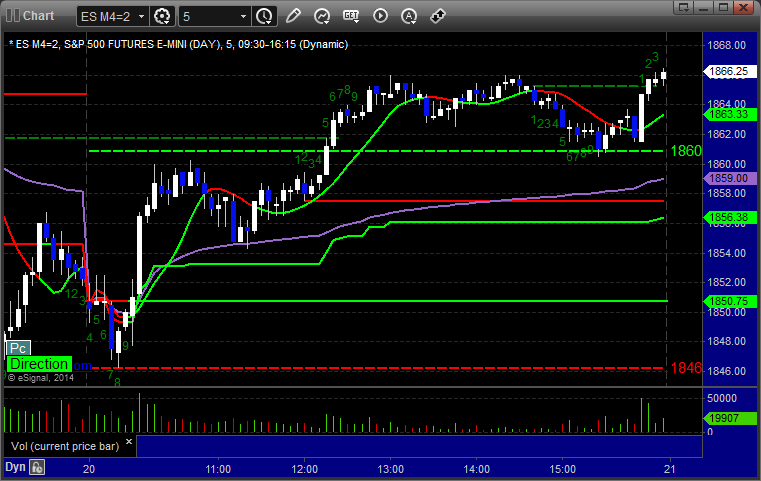

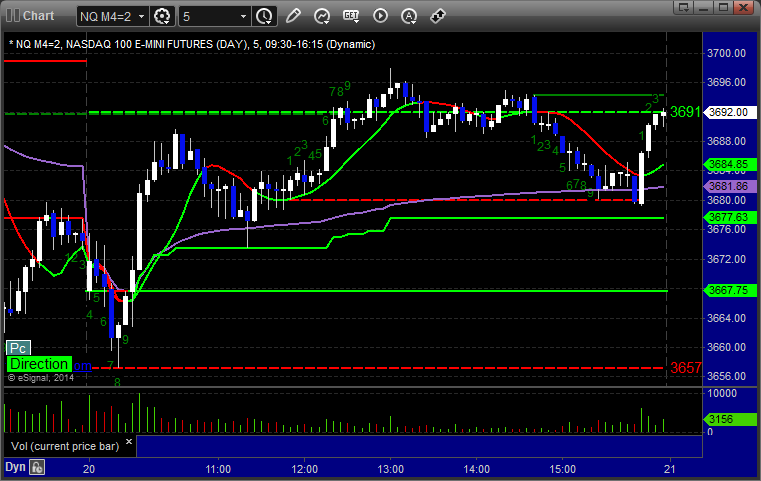

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1871.50 and stopped for 7 ticks. Went again, hit first target, and stopped second half over entry. We had a perfect Value Area play here from 1866 to 1857, and also note the Comber 13 buy signal right at the low:

Forex Calls Recap for 3/21/14

Back to 50 pips of range or less on the EURUSD and GBPUSD, which isn't a complete surprise on triple expiration any quarter. See EURUSD section below for the trade review and note the Comber signal. Also, note the Comber signal on the low of the GBPJPY.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Not much to see again. There are a couple of static trendlines in play on the EURUSD and GBPUSD.

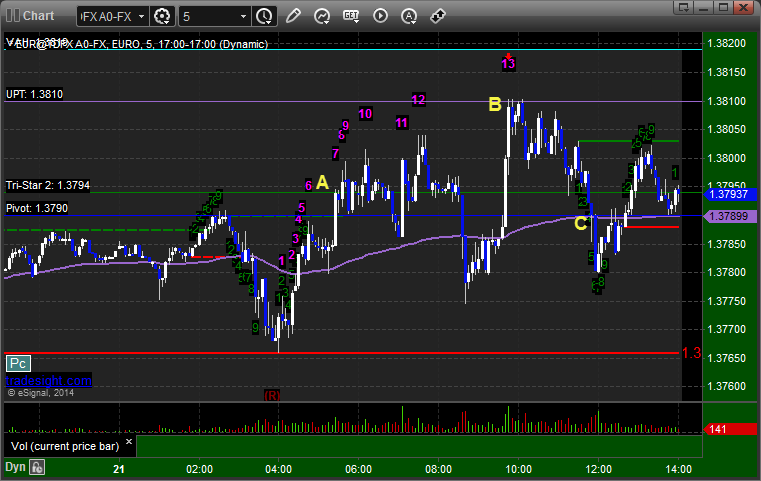

EURUSD:

Triggered long at A, finally hit UPT and gave a Comber 13 sell signal so I tightened up the stop right under Pivot and stopped at B:

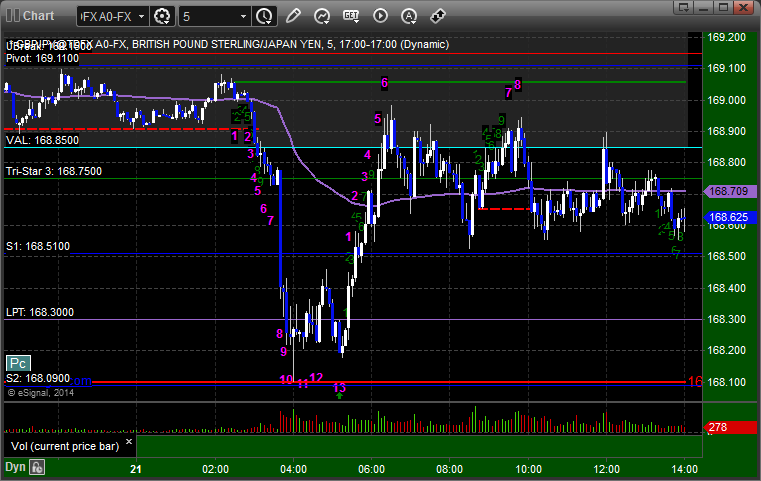

GBPJPY:

Note the Comber 13 buy signal was the low:

Stock Picks Recap for 3/20/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, JBHT triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, TWTR triggered short (with market support) and didn't work:

Rich's NFLX triggered long (with market support) and worked:

His VXX triggered short (ETF, so no market support needed) and didn't work:

His BIIB triggered short (without market support) and didn't work:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not. JBHT triggered out of the gate and worked.

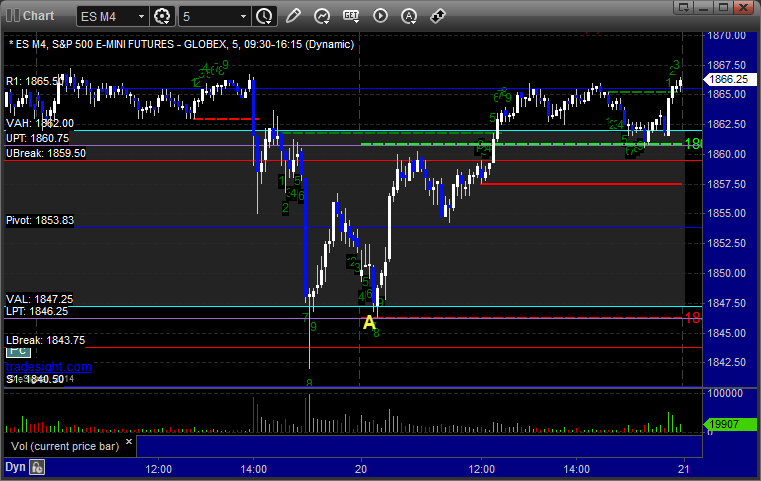

Futures Calls Recap for 3/20/14

Well, we did not get the options unraveling move that we were looking for. Instead, the markets opened flat, didn't do much initially, spiked up on the news 30 minutes in, and then started to roll after an hour (when options unraveling should start), but then reversed higher and held the level that they were at before the Fed comments the prior session. NASDAQ volume was only 1.7 billion shares. Looks like we're where we need to be for triple expiration Friday. See ES section below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at 1846.75 at A and stopped. I cancelled his long call because we were heading into lunch and it looked like direction was rolling for unraveling, but that call would have worked:

Forex Calls Recap for 3/20/14

Nice setups and almost enough of a move. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Clean trigger at A, hit the LPT but not quite the S2 first target at B, bounced around, and we closed at C a couple of pips in the money as it hadn't gone enough to hold:

Stock Picks Recap for 3/19/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, QUIK triggered long (without market support due to opening 5 minutes) and didn't work:

EXAS gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's SCTY triggered short (with market support) and didn't work:

His HLF triggered short (with market support) and didn't work:

SHLD triggered long (with market support) and worked great:

Rich's LNKD triggered long (with market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not. Couldn't make additional calls due to our tech problems.