Futures Calls Recap for 3/19/14

We apologize for the tech issues today. Our site was taken down by a node issue at Godaddy for six hours. Everything is restored, but we couldn't post calls and eSignal tools would have been disabled.

We did make a call in the morning that didn't trigger (hit the UBreak on ES exactly but didn't get through). The rest of the session was dull ahead of the Fed and then spiked. We might have tried to trade if we could have made calls after the Fed, but the site problem made that impossible.

Net ticks: +0 ticks.

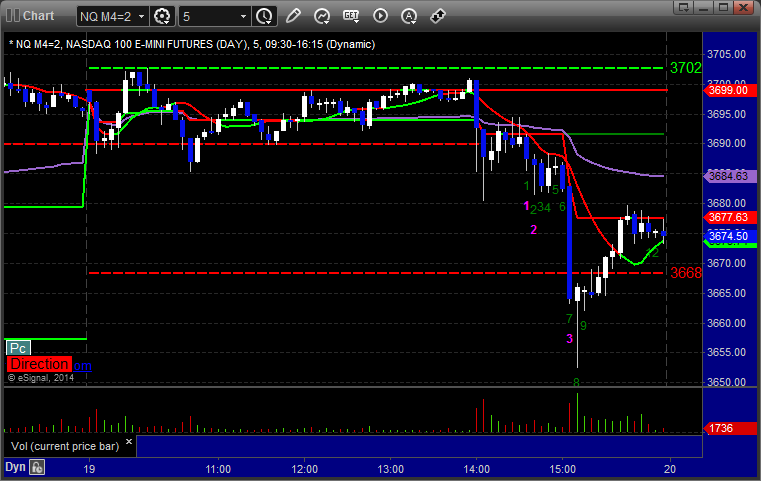

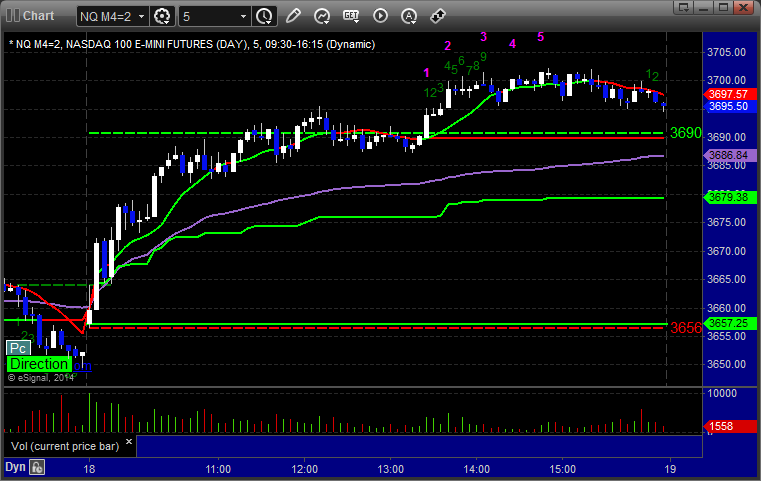

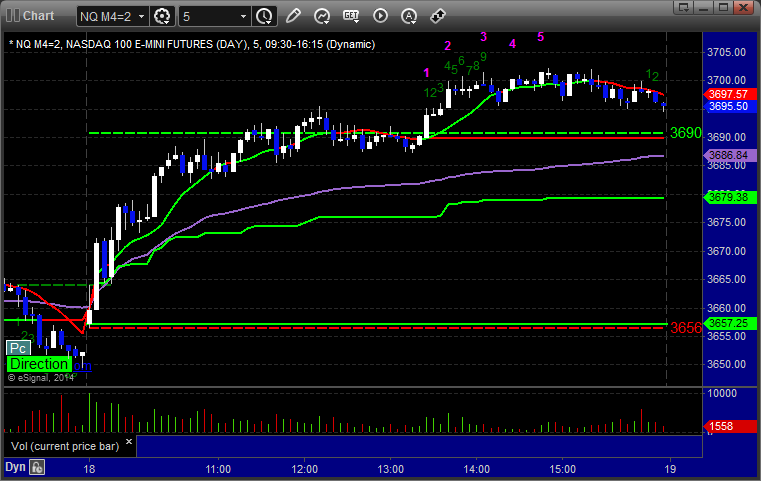

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Our long entry was over the UBreak, which set but never broke as the high of the day:

Forex Calls Recap for 3/19/14

At least a winner and almost a second one, although we cut the EURUSD off ahead of the Fed announcement (would have worked). See EURUSD and GBPUSD sections below. We apologize for any tech issues today. Our site was down for 6 hours due to a node issue at Godaddy.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, never quite made it to the first target, closed it at B at the entry ahead of the Fed. Could have rolled the dice (and it would have worked) on the Fed announcement, but we aren't here to gamble. Would have been different if it had hit the first target:

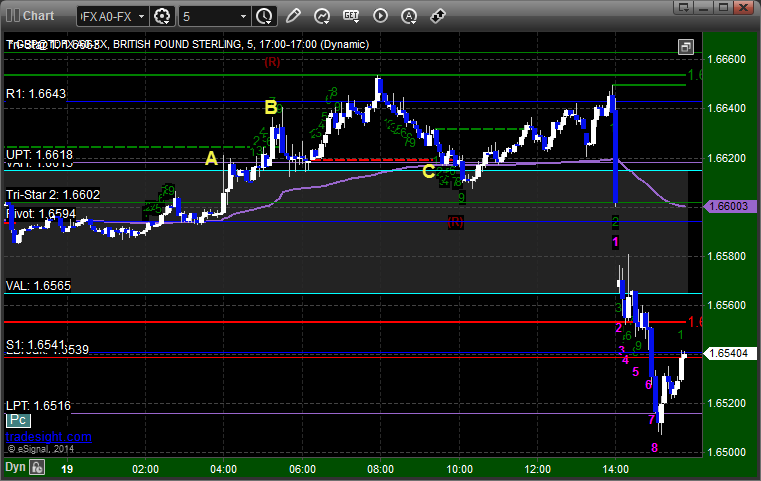

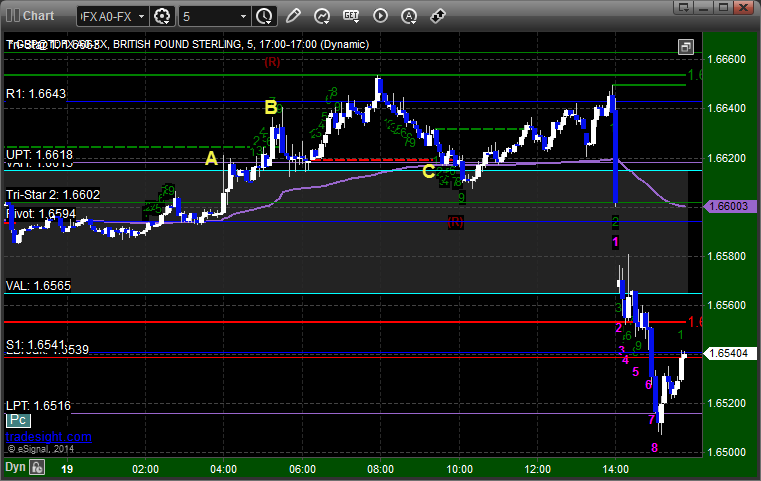

GBPUSD:

Trigggered long at A, hit first target at B, and stopped second half under the entry at C:

Forex Calls Recap for 3/19/14

At least a winner and almost a second one, although we cut the EURUSD off ahead of the Fed announcement (would have worked). See EURUSD and GBPUSD sections below. We apologize for any tech issues today. Our site was down for 6 hours due to a node issue at Godaddy.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, never quite made it to the first target, closed it at B at the entry ahead of the Fed. Could have rolled the dice (and it would have worked) on the Fed announcement, but we aren't here to gamble. Would have been different if it had hit the first target:

GBPUSD:

Trigggered long at A, hit first target at B, and stopped second half under the entry at C:

Stock Picks Recap for 3/18/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ACTG triggered long (with market support) and worked:

ULTA triggered long (with market support) and worked:

IDTI triggered long (with market support) and worked:

EGHT triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered long (with market support) and worked:

His BWLD triggered long (with market support) and worked enough for a partial:

KLAC triggered long (with market support) and worked, I killed it off early at a small gain because it was slow:

Rich's KORS triggered short (without market support) and didn't work:

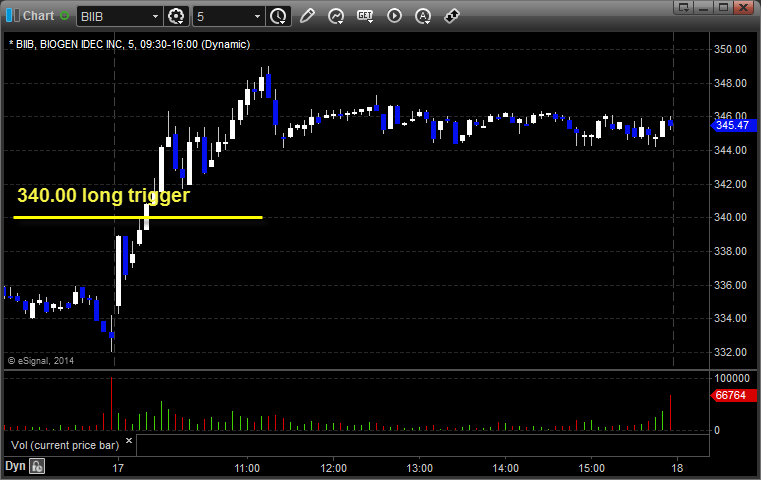

His BIIB triggered long (with market support) and worked:

GS triggered long (with market support) and didn't work:

CELG triggered long (with market support) and didn't go enough in either direction to count:

Rich's TSLA triggered long (with market support) and worked:

In total, that's 10 trades triggering with market support, 8 of them worked, 2 did not.

Stock Picks Recap for 3/18/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ACTG triggered long (with market support) and worked:

ULTA triggered long (with market support) and worked:

IDTI triggered long (with market support) and worked:

EGHT triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered long (with market support) and worked:

His BWLD triggered long (with market support) and worked enough for a partial:

KLAC triggered long (with market support) and worked, I killed it off early at a small gain because it was slow:

Rich's KORS triggered short (without market support) and didn't work:

His BIIB triggered long (with market support) and worked:

GS triggered long (with market support) and didn't work:

CELG triggered long (with market support) and didn't go enough in either direction to count:

Rich's TSLA triggered long (with market support) and worked:

In total, that's 10 trades triggering with market support, 8 of them worked, 2 did not.

Futures Calls Recap for 3/18/14

Two winners to the firs target only and a loser for the session. Couldn't quite stick in the trade for what looked like good upward construction. NASDAQ volume closed at 1.8 billion shares. The Fed announcement is tomorrow.

Net ticks: -1.5 ticks.

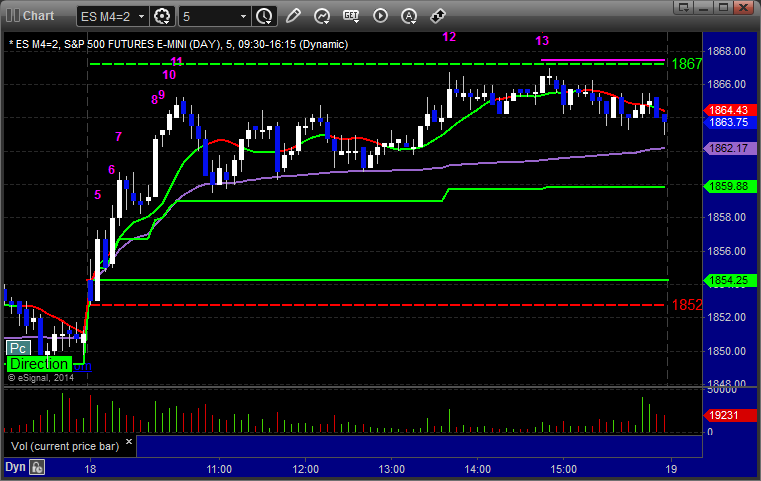

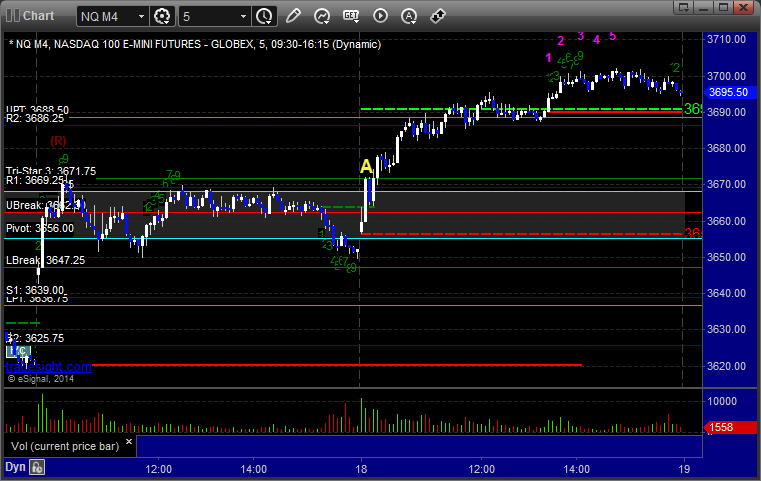

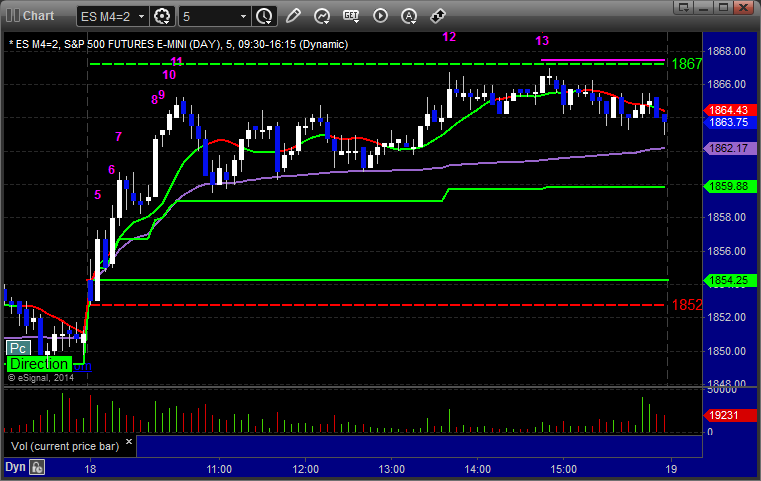

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1855.75, hit first target for 6 ticks, stopped second half under the entry:

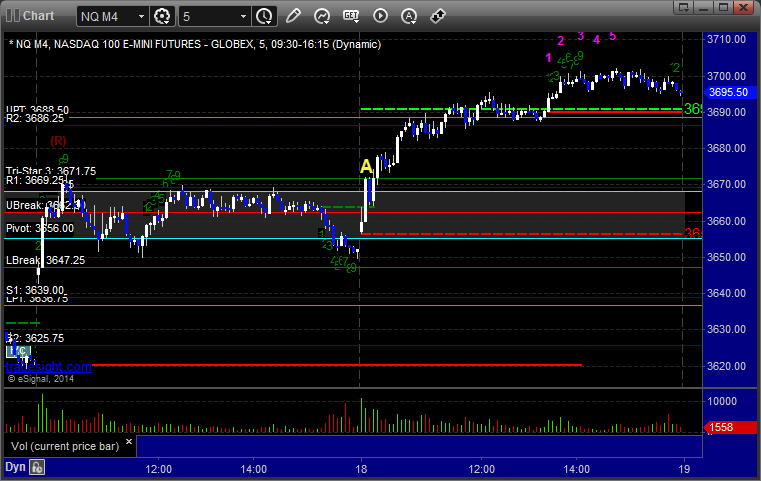

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 3673.75 and stopped for 7 ticks. Put it back in and it triggered and hit first target for 6 ticks, stopped second half at entry:

Futures Calls Recap for 3/18/14

Two winners to the firs target only and a loser for the session. Couldn't quite stick in the trade for what looked like good upward construction. NASDAQ volume closed at 1.8 billion shares. The Fed announcement is tomorrow.

Net ticks: -1.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1855.75, hit first target for 6 ticks, stopped second half under the entry:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 3673.75 and stopped for 7 ticks. Put it back in and it triggered and hit first target for 6 ticks, stopped second half at entry:

Forex Calls Recap for 3/18/14

Another dull session that went nowhere as the Fed starts a 2-day meeting and we had the CPI. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, didn't quite get to first target of S1, stopped at B, if you were awake you go back in at C, hit first target at D:

Forex Calls Recap for 3/18/14

Another dull session that went nowhere as the Fed starts a 2-day meeting and we had the CPI. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, didn't quite get to first target of S1, stopped at B, if you were awake you go back in at C, hit first target at D:

Stock Picks Recap for 3/17/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, amazingly, not only did nothing trigger, but none of the 5 long ideas gapped over their triggers.

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered long (with market support) and worked:

AMZN triggered long (with market support) and didn't work:

Rich's WYNN triggered long (with market support) and worked:

BIIB triggered long (with market support) and worked big:

TWTR triggered short (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.