Futures Calls Recap for 3/17/14

A couple of nice setups from the morning action never triggered and then we got swept on one in the afternoon as the market just vacillated around the VWAP for the back half or more of the day. Volume was much lower than we have seen recently at only 1.6 billion NASDAQ shares.

Net ticks: -7 ticks.

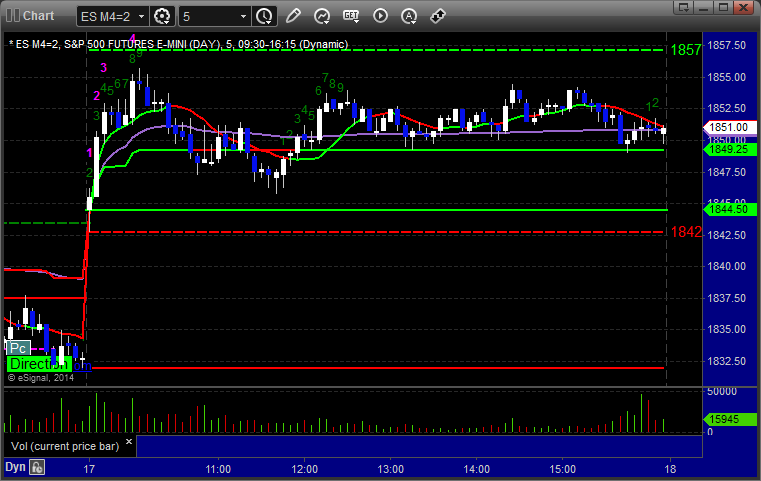

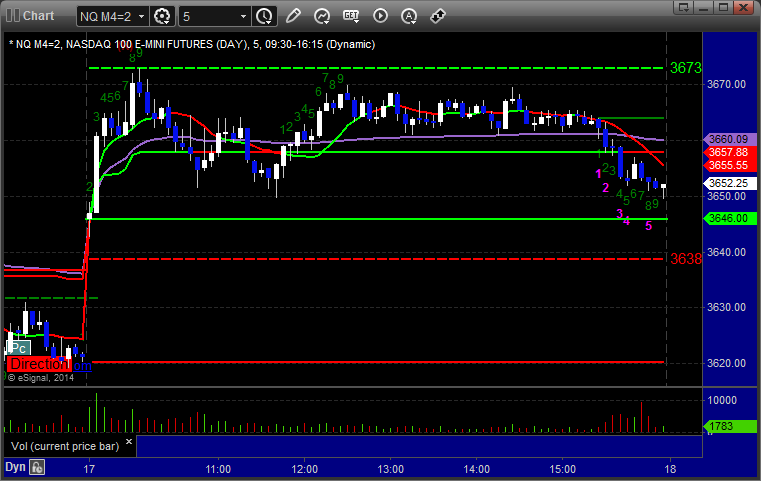

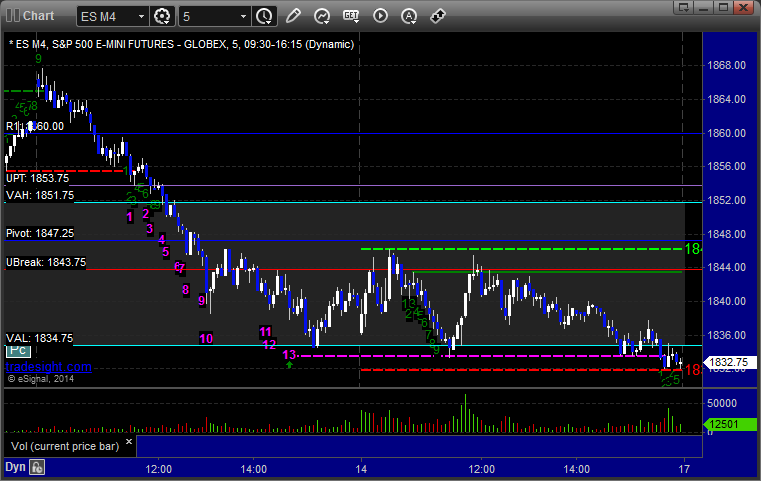

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1849.00 and stopped for 7 ticks:

Forex Calls Recap for 3/17/14

A stop out on the short side of the EURUSD, and then our long trigger ended up being the exact high. Those Break levels sure are important. See EURUSD below.

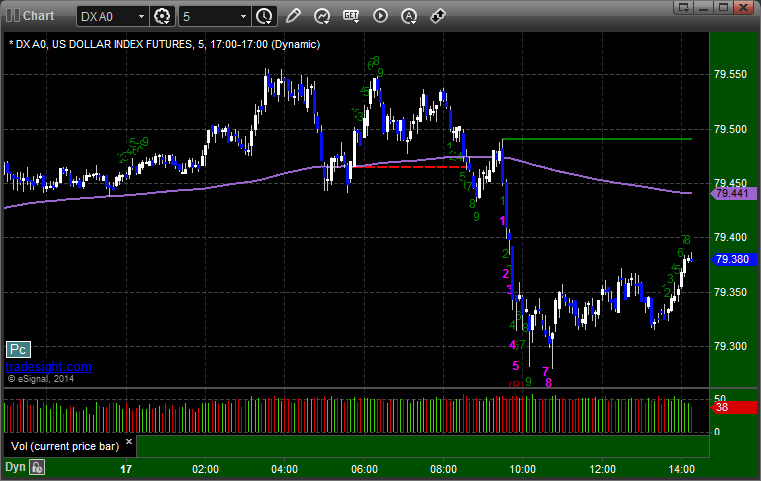

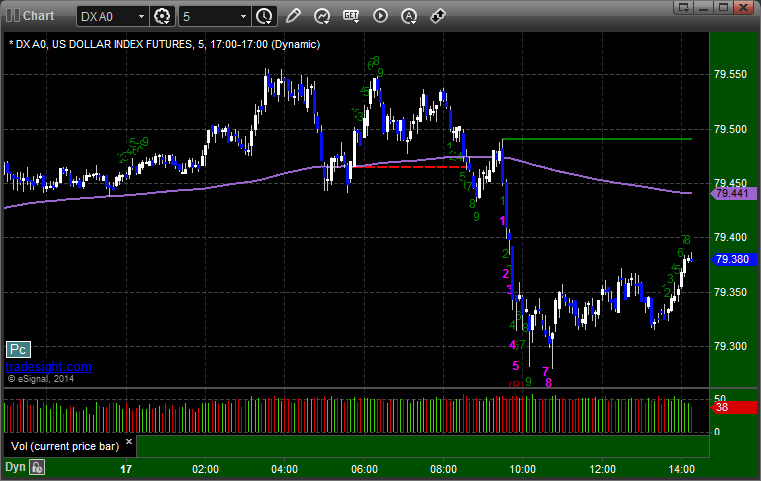

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, never did much either way, and finally stopped in the morning before heading up and exactly hitting the UBreak as the high. Note that one more higher bar would have been a 13 sell signal:

Forex Calls Recap for 3/17/14

A stop out on the short side of the EURUSD, and then our long trigger ended up being the exact high. Those Break levels sure are important. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, never did much either way, and finally stopped in the morning before heading up and exactly hitting the UBreak as the high. Note that one more higher bar would have been a 13 sell signal:

Stock Picks Recap for 3/14/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, QGEN triggered short (with market support) and didn't go enough in either direction to count, actually triggered against a Comber 13 Buy Signal on the 5-minute chart:

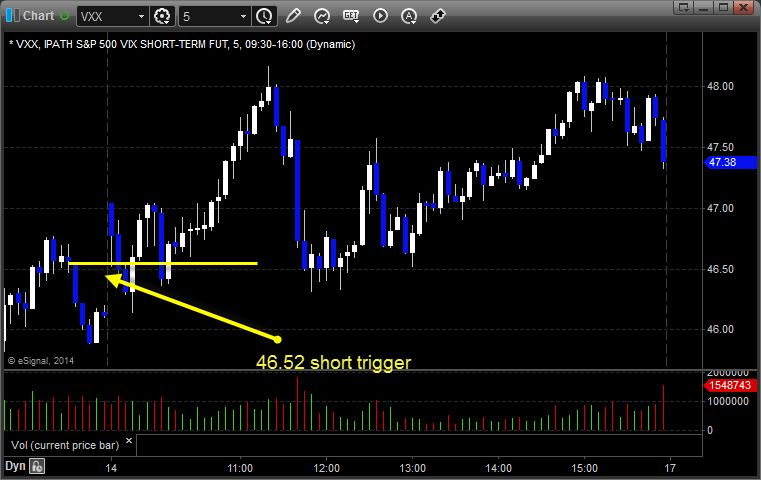

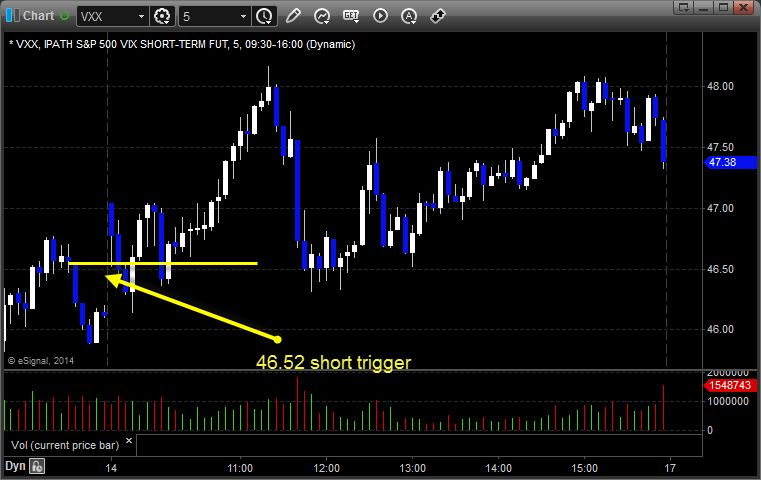

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered short (ETF, so no market support needed) and worked enough for a partial:

TWTR triggered short (with market support) and worked:

Rich's TSLA triggered short (with market support) and didn't work:

EBAY triggered short (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Stock Picks Recap for 3/14/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, QGEN triggered short (with market support) and didn't go enough in either direction to count, actually triggered against a Comber 13 Buy Signal on the 5-minute chart:

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered short (ETF, so no market support needed) and worked enough for a partial:

TWTR triggered short (with market support) and worked:

Rich's TSLA triggered short (with market support) and didn't work:

EBAY triggered short (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

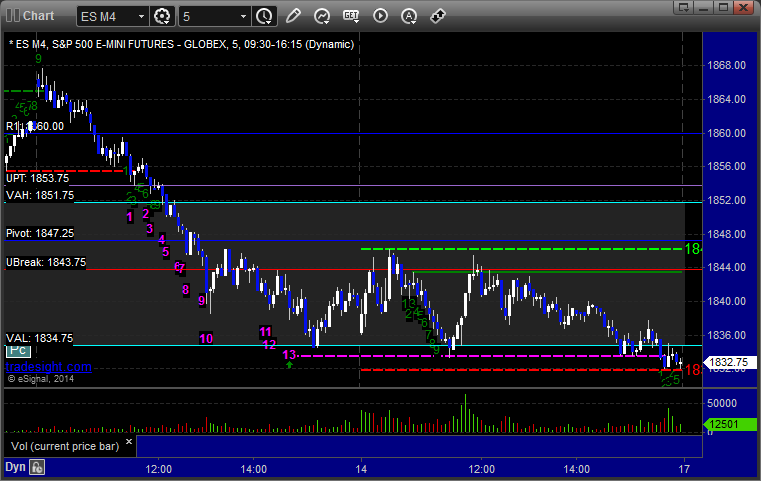

Futures Calls Recap for 3/14/14

Well, unlike Thursday, Friday was much slower. Nothing triggered. The market was glued to the VWAP most of the day and didn't go anywhere despite the situation in the Ukraine. Just shows that quarterly contract roll trumps world events.

Net ticks: +0 ticks.

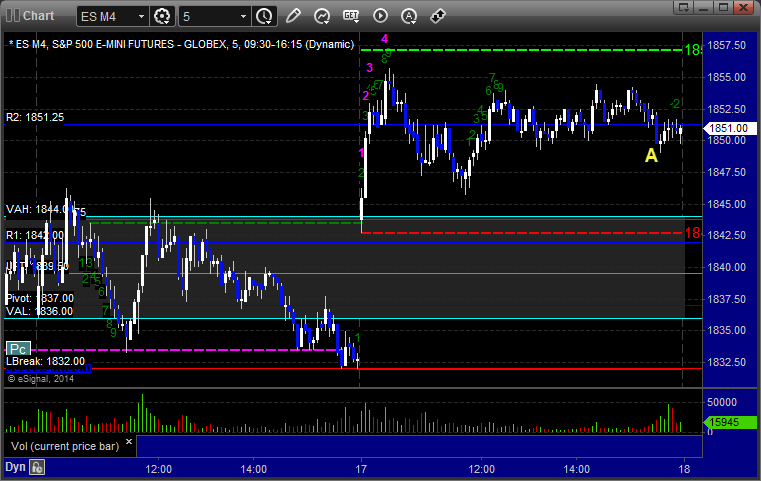

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Futures Calls Recap for 3/14/14

Well, unlike Thursday, Friday was much slower. Nothing triggered. The market was glued to the VWAP most of the day and didn't go anywhere despite the situation in the Ukraine. Just shows that quarterly contract roll trumps world events.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 3/14/14

A session so flat, nothing triggered.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Absolutely nothing to see on the charts in terms of patterns or counts, but see EURUSD section in the daily charts below, plus the US Dollar section.

EURUSD:

Forex Calls Recap for 3/14/14

A session so flat, nothing triggered.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Absolutely nothing to see on the charts in terms of patterns or counts, but see EURUSD section in the daily charts below, plus the US Dollar section.

EURUSD:

Stock Picks Recap for 3/13/14

WHAT A GREAT DAY!

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, STKL triggered long (with market support) and didn't work:

AMRI triggered long (without market support due to opening 5 minutes) and worked great:

SYMC triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GLD triggered long (ETF, so no market support needed) and worked:

NTAP triggered short (with market support) and worked:

Rich's JAZZ triggered short (with market support) and worked:

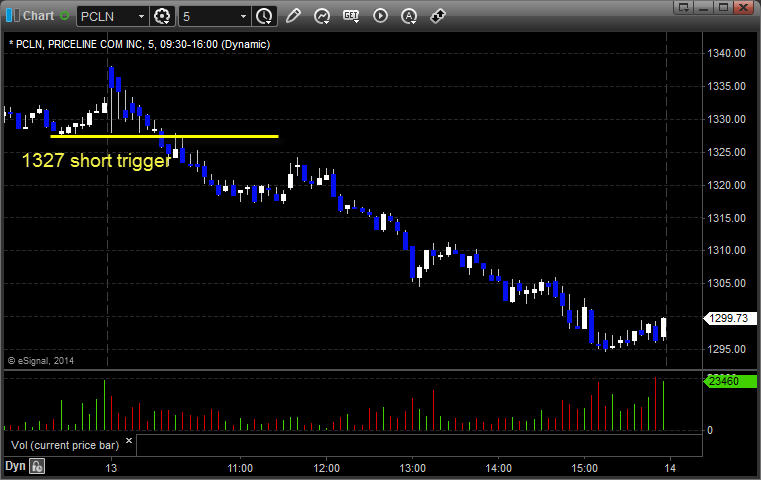

His PCLN triggered short (with market support) and worked:

His DDD triggered long (without market support) and didn't work:

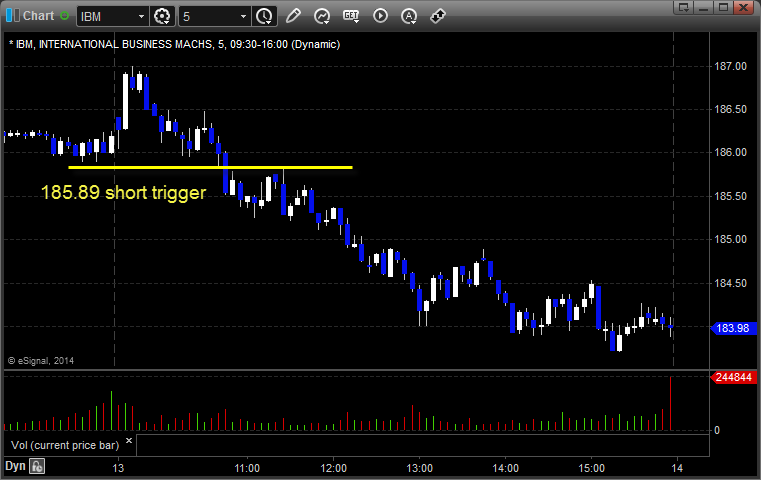

His IBM triggered short (with market support) and worked:

His WYNN triggered short (with market support) and worked:

TEVA triggered short (with market support) and worked:

In total, that's 9 trades triggering with market support, 8 of them worked, 1 did not.