Stock Picks Recap for 3/13/14

WHAT A GREAT DAY!

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, STKL triggered long (with market support) and didn't work:

AMRI triggered long (without market support due to opening 5 minutes) and worked great:

SYMC triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's GLD triggered long (ETF, so no market support needed) and worked:

NTAP triggered short (with market support) and worked:

Rich's JAZZ triggered short (with market support) and worked:

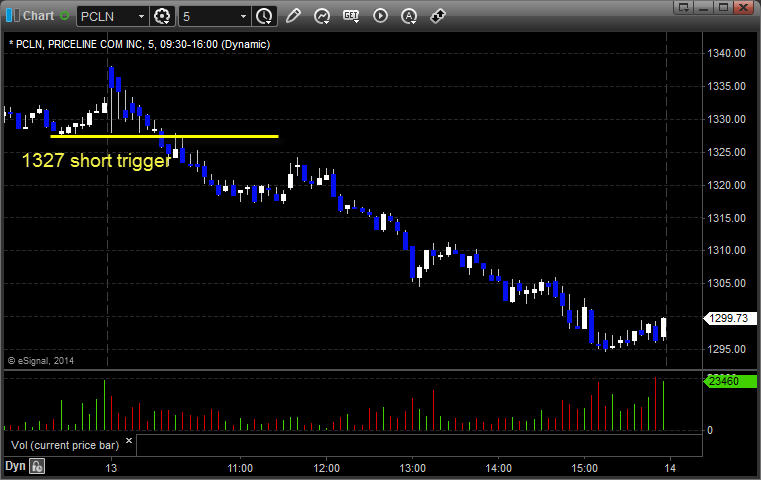

His PCLN triggered short (with market support) and worked:

His DDD triggered long (without market support) and didn't work:

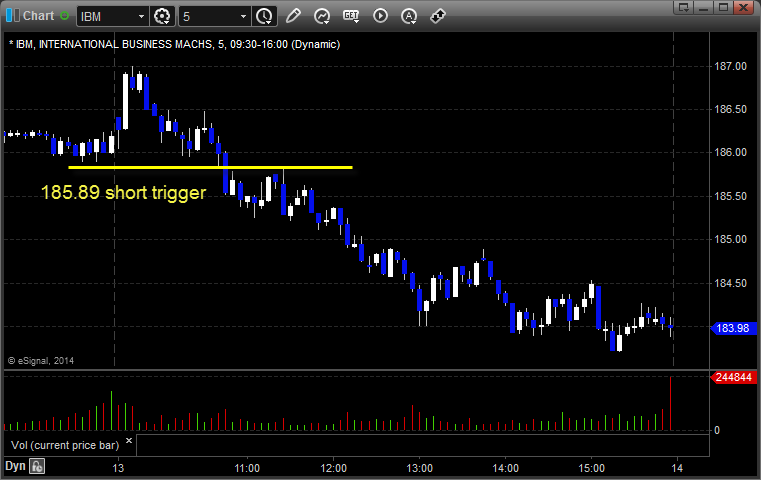

His IBM triggered short (with market support) and worked:

His WYNN triggered short (with market support) and worked:

TEVA triggered short (with market support) and worked:

In total, that's 9 trades triggering with market support, 8 of them worked, 1 did not.

Futures Calls Recap for 3/13/14

A nice day finally with good range and a big winner after the ES set the UPT coming back down. NASDAQ volume was 2.1 billion shares.

Net ticks: +39 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

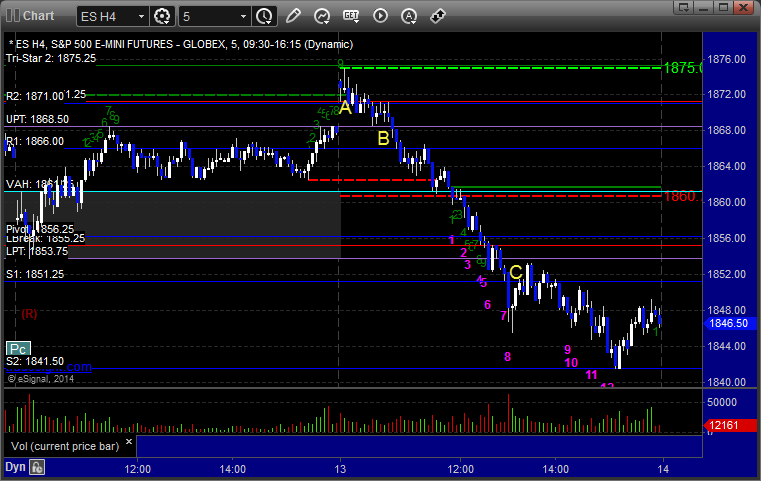

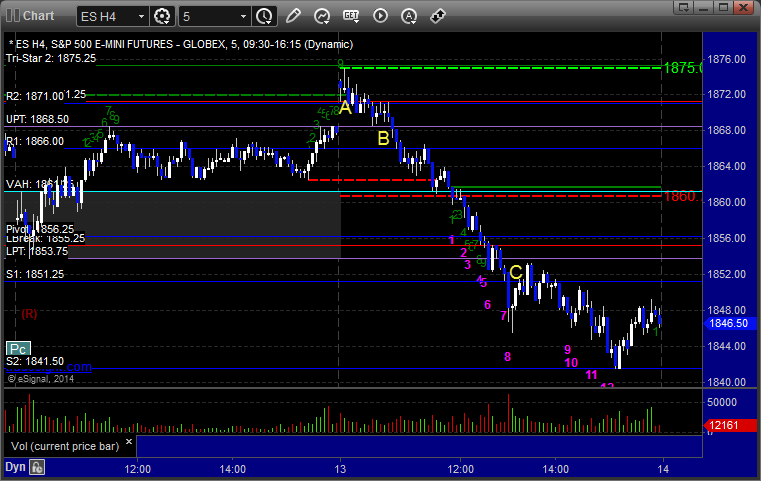

ES:

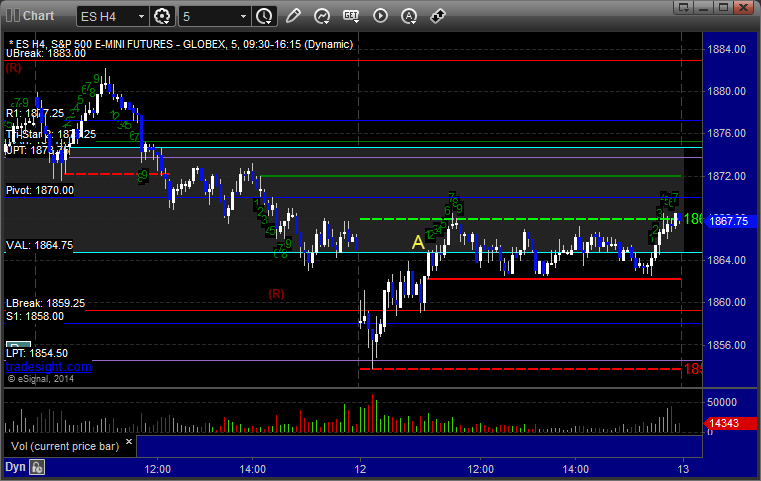

Mark's call triggered short at 1870.75 at A and stopped. Put it back in and retriggered shortly after, hit first target for 6 ticks, and stopped second half at entry. My call triggered short under UPT at B, hit first target for 6 ticks, adjusted the stop repeatedly as it kept dropping, and stopped the final piece at C at 1848.25 for 80 ticks:

Futures Calls Recap for 3/13/14

A nice day finally with good range and a big winner after the ES set the UPT coming back down. NASDAQ volume was 2.1 billion shares.

Net ticks: +39 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at 1870.75 at A and stopped. Put it back in and retriggered shortly after, hit first target for 6 ticks, and stopped second half at entry. My call triggered short under UPT at B, hit first target for 6 ticks, adjusted the stop repeatedly as it kept dropping, and stopped the final piece at C at 1848.25 for 80 ticks:

Forex Calls Recap for 3/13/14

A winner in the GBPUSD. See that section below. Better ranges, but we ended up coming back to where we started.

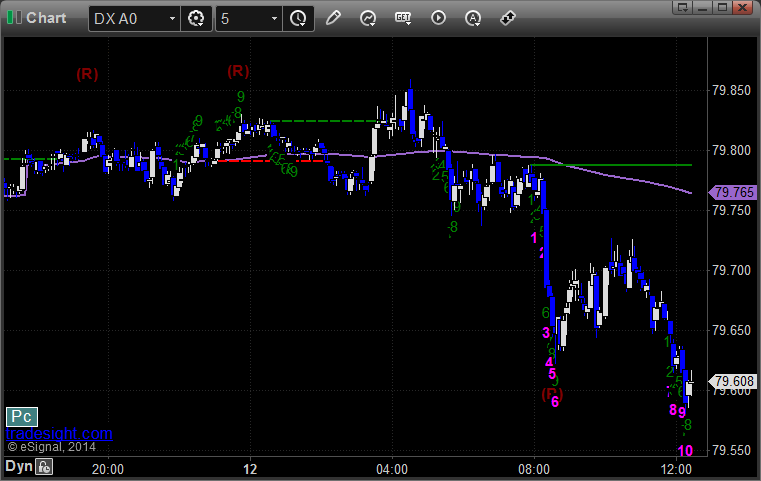

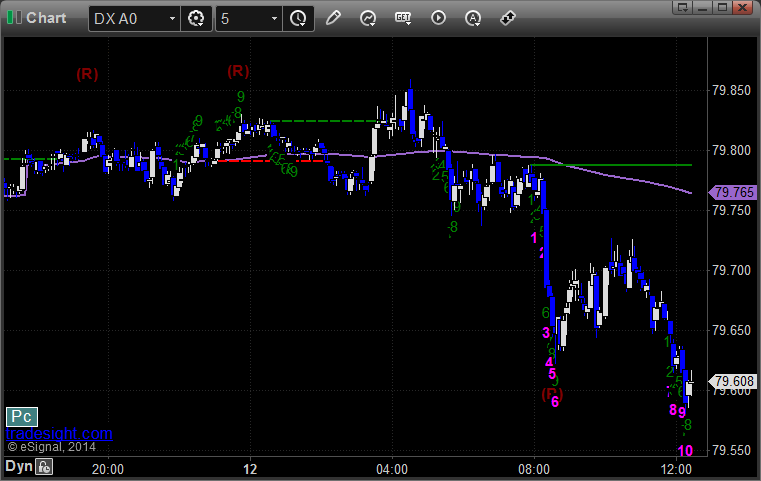

Here's a look at the US Dollar Index intraday with our market directional lines:

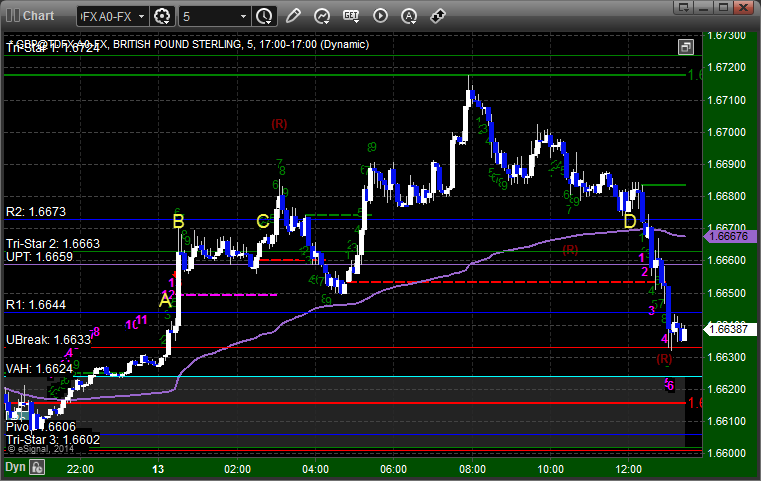

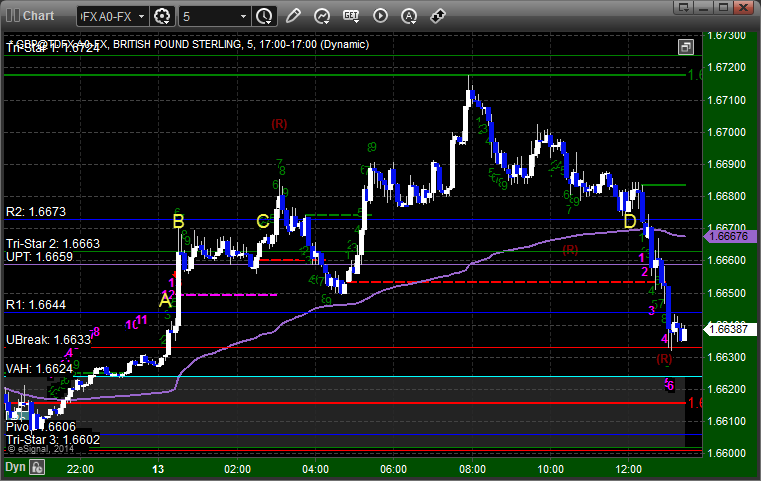

GBPUSD:

Triggered long at A, hit first target at B (or C if you had the order too high), raised stop twice and stopped final piece at D under R2. If you were awake overnight, you should have adjusted higher:

Forex Calls Recap for 3/13/14

A winner in the GBPUSD. See that section below. Better ranges, but we ended up coming back to where we started.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B (or C if you had the order too high), raised stop twice and stopped final piece at D under R2. If you were awake overnight, you should have adjusted higher:

Stock Picks Recap for 3/12/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IRDM finally triggered long (without market support due to opening 5 minutes) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (with market support) and didn't work:

His PCLN triggered short (without market support due to opening 5 minutes) and didn't work:

His GOOG triggered short (with market support) and worked great:

His VMW triggered long (with market support) and worked:

His GLD triggered short (ETF, so no market support needed) and didn't work:

His SSYS triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not. The one you didn't want to miss though after so many days was IRDM.

Futures Calls Recap for 3/12/14

A false start/sweep loser that then retriggered and worked. See the ES section below. Not a very exciting session. Gapped down, filled the gap early, and that was the range for the day on 2.0 billion NASDAQ shares.

Net ticks: +0 ticks.

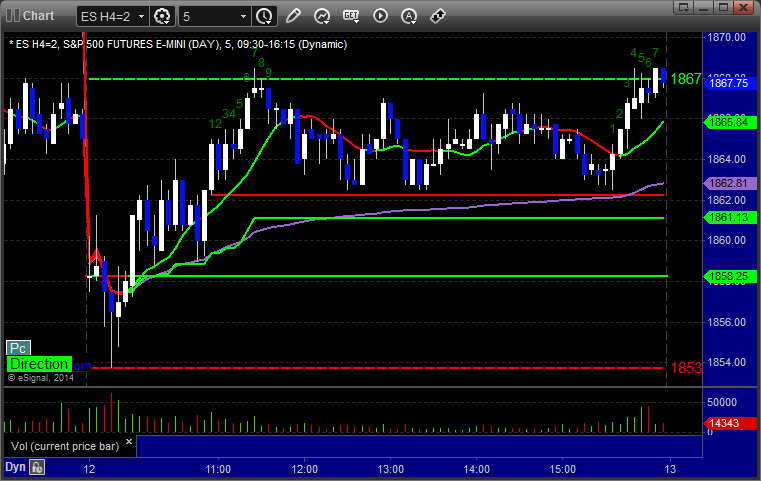

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1865.00 and stopped for 7 ticks. Triggered again shortly after, hit first target for 6 ticks, he raised the stop twice and stopped the last piece at 1867 for 8 ticks:

Forex Calls Recap for 3/12/14

A fairly unexciting session again with 50 pips of range on the EURUSD and GBPUSD. See both sections below. Calls will be just a little late tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Late session call after the EURUSD set the R2 triggered long at A, but ended up going nowhere so late that I closed at end of chart:

GBPUSD:

Mark's call triggered short at A, didn't quite hit first target, and stopped overnight:

Forex Calls Recap for 3/12/14

A fairly unexciting session again with 50 pips of range on the EURUSD and GBPUSD. See both sections below. Calls will be just a little late tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Late session call after the EURUSD set the R2 triggered long at A, but ended up going nowhere so late that I closed at end of chart:

GBPUSD:

Mark's call triggered short at A, didn't quite hit first target, and stopped overnight:

Stock Picks Recap for 3/11/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BONA triggered long (with market support) and worked great:

THRX triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered short (with market support) and worked:

Rich's GS triggered short (with market support) and worked enough for a partial:

His VMW triggered long (with market support) and worked:

His GLD triggered short (ETF, so no market support needed) and worked:

His EOG triggered short (with market support) and worked:

Nothing else triggered.

In total, that's 7 trades triggering with market support, 6 of them worked, 1 did not