Futures Calls Recap for 3/3/14

A bad start to the month as our entries got swept several times, proving that the entry points were valid, but getting us nowhere. See ES and NQ sections below.

Net ticks: -15.5 ticks.

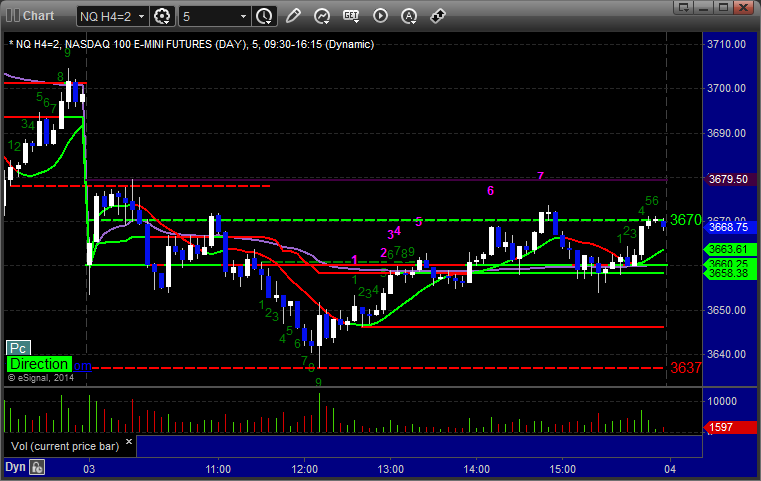

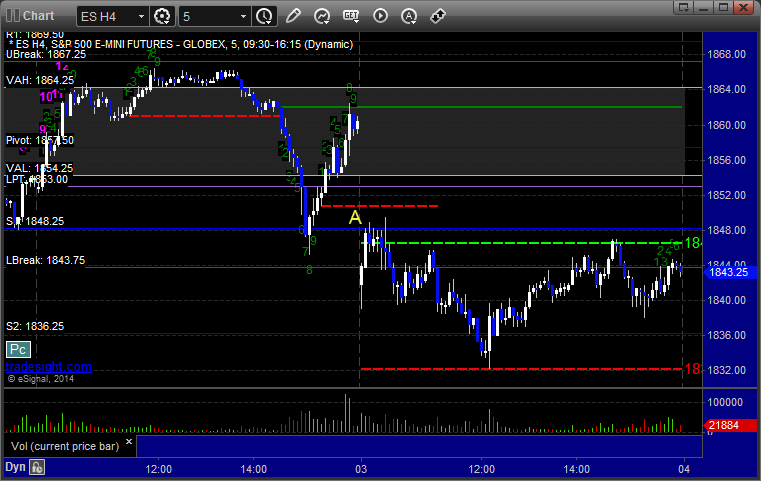

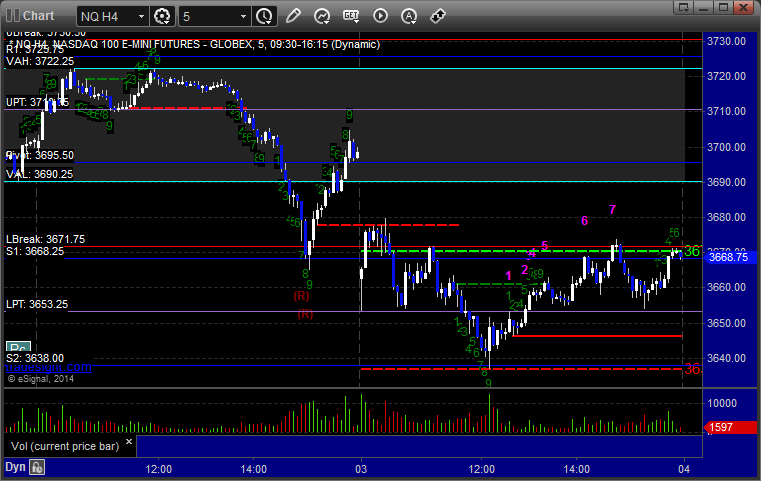

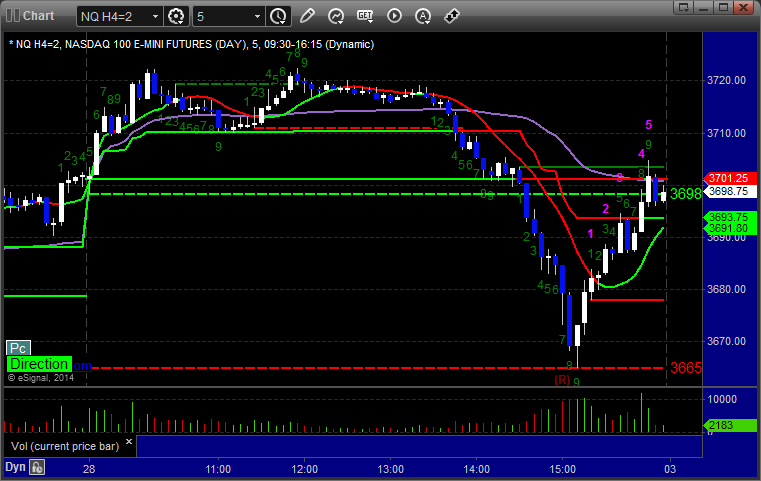

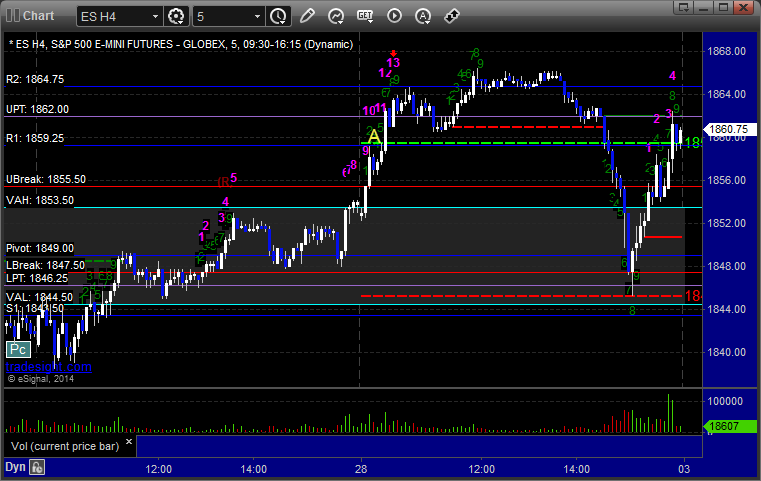

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1848.50 and stopped. Triggered again and stopped:

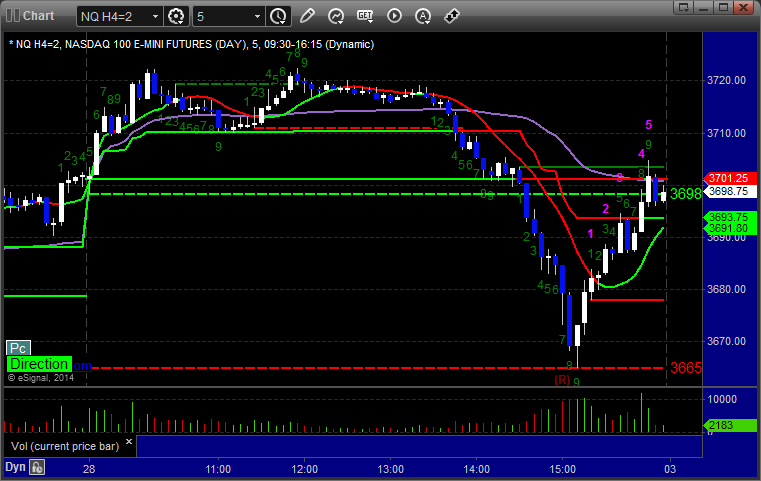

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at 3632.50 at A and stopped on a sweep. Triggered again, hit first target for 6 ticks, second half stopped 5 ticks in the money:

Forex Calls Recap for 3/3/14

Wow, I woke up to a 30 pip range on the EURUSD again. Looked like the market was closed. We did get a trigger later in the US session that worked a little, but this is getting crazy seeing no movement like this. See EURUSD section below.

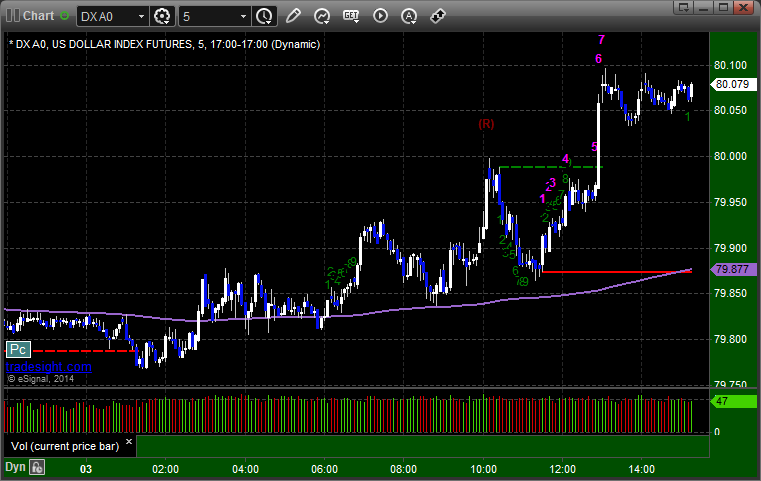

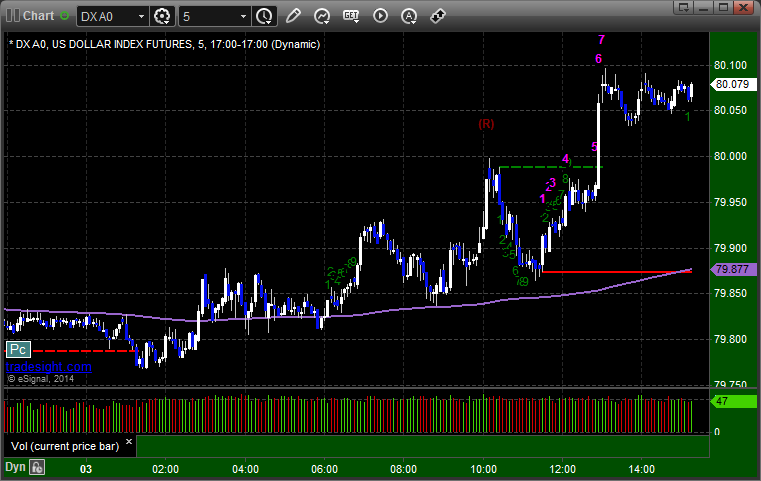

Here's a look at the US Dollar Index intraday with our market directional lines:

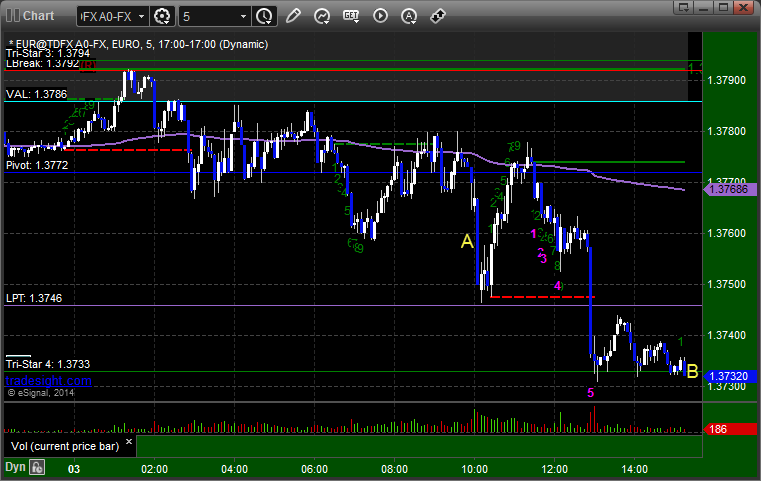

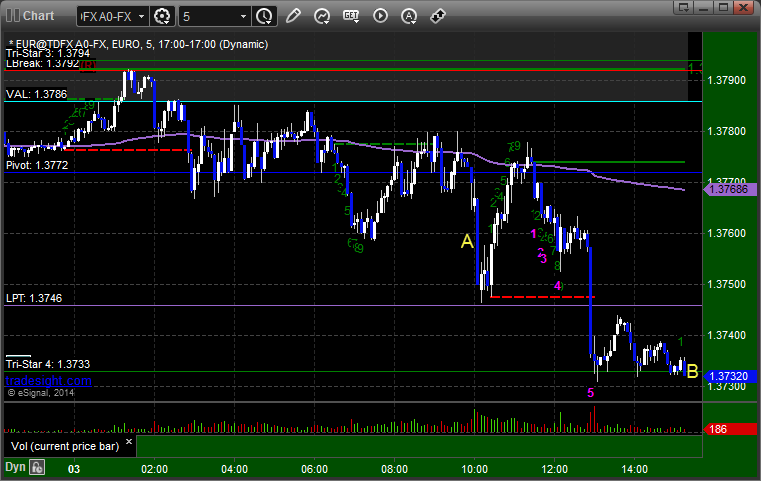

EURUSD:

Triggered short at A, never stopped or hit first target, got stuck to the tri-star level (green line) and closed at B in the money for end of session:

Forex Calls Recap for 3/3/14

Wow, I woke up to a 30 pip range on the EURUSD again. Looked like the market was closed. We did get a trigger later in the US session that worked a little, but this is getting crazy seeing no movement like this. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, never stopped or hit first target, got stuck to the tri-star level (green line) and closed at B in the money for end of session:

Tradesight February 2014 Forex Results

Before we get to February’s numbers, here is a short reminder of the results from January. The full report from January can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for January 2013

Number of trades: 27

Number of losers: 15

Winning percentage: 55.5%

Worst losing streak: 4 in a row

Net pips: +155 pips

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for February 2014

Number of trades: 22

Number of losers: 8

Winning percentage: 63.6%

Worst losing streak: 2 in a row

Net pips: +50 pips

This was just a poor month for the Forex markets in terms of range and action. The US Dollar Index has now been stuck in this impossible 1.50 point range for FOUR FULL MONTHS now, which is a record in all of my years of trading. In addition, the 6-month Average Daily Range on the EURUSD is now down to 80 pips. The GBPUSD is 103. That 80 pip number, as opposed to the 10 year average of 120-130 pips, is a real problem, and all of the pairs are just as bad. The fact that we had 63.6% winners in the month is deceiving because less calls triggered than normal AND absolutely not a single trade followed through for a couple of days to give us big winners. In addition, we're seeing news spikes, which we didn't really see much of for a long time, probably because there's no liquidity in the market since it isn't moving. We need to get out of this parity that the US Dollar and other currencies are in. We need some macro-economic change to get this going. After a stellar 2013 despite the poor movement late in the year, this is really dull to watch and trade. Won't last forever, but we remain half size until the market starts to behave again.

Tradesight February 2014 Forex Results

Before we get to February’s numbers, here is a short reminder of the results from January. The full report from January can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for January 2013

Number of trades: 27

Number of losers: 15

Winning percentage: 55.5%

Worst losing streak: 4 in a row

Net pips: +155 pips

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for February 2014

Number of trades: 22

Number of losers: 8

Winning percentage: 63.6%

Worst losing streak: 2 in a row

Net pips: +50 pips

This was just a poor month for the Forex markets in terms of range and action. The US Dollar Index has now been stuck in this impossible 1.50 point range for FOUR FULL MONTHS now, which is a record in all of my years of trading. In addition, the 6-month Average Daily Range on the EURUSD is now down to 80 pips. The GBPUSD is 103. That 80 pip number, as opposed to the 10 year average of 120-130 pips, is a real problem, and all of the pairs are just as bad. The fact that we had 63.6% winners in the month is deceiving because less calls triggered than normal AND absolutely not a single trade followed through for a couple of days to give us big winners. In addition, we're seeing news spikes, which we didn't really see much of for a long time, probably because there's no liquidity in the market since it isn't moving. We need to get out of this parity that the US Dollar and other currencies are in. We need some macro-economic change to get this going. After a stellar 2013 despite the poor movement late in the year, this is really dull to watch and trade. Won't last forever, but we remain half size until the market starts to behave again.

Tradesight February 2014 Futures Results

Before we get to February’s numbers, here is a short reminder of the results from January. The full report from January can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for January 2014

Number of trades: 29

Number of losers: 15

Winning percentage: 51.7%

Net ticks: -1 tick

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for February 2014

Number of trades: 24

Number of losers: 11

Winning percentage: 54.1%

Net ticks: -8.5 ticks

Generally speaking, I'm a little disappointed in these results. We had a rough opening two weeks of the month, not because the market didn't end up moving, but because we didn't re-enter several trades that triggered and stopped because the early action in the morning didn't look good. A lot of those trades ended up retriggering and working great. The market is seeing enough volume that even though we still are seeing some dull session, we need to start taking the futures trading seriously again. For most of 2013, since market volume was so light, we put futures trading third in the order of priority for our trading (stocks first, then Forex, then futures). At this point, as long as market volume holds up, and given the complete lack of action in Forex, I think futures should take the second slot. It still isn't as easy as stocks, but things are happening. Our win ratio ended up right in our target range (50-60%) but we didn't have a lot of trades with follow through, even the retriggers would have worked big.

Stock Picks Recap for 2/28/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SOHU gapped way over the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's MDVN triggered short (without market support due to opening 5 minutes) and didn't work:

His TSLA triggered short (without market support) and worked:

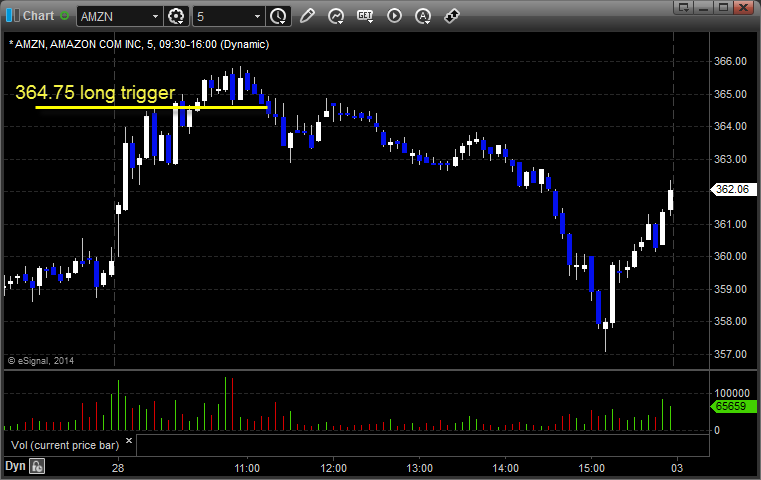

AMZN triggered long (with market support) and worked:

SINA triggered short (with market support in the afternoon) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

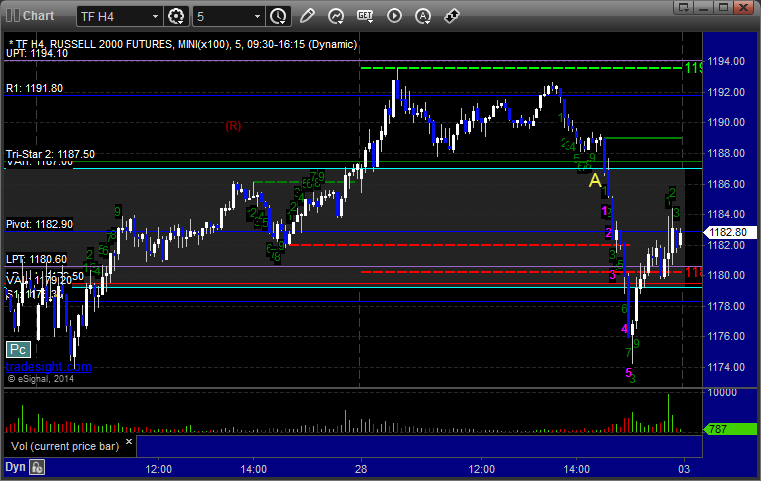

Futures Calls Recap for 2/28/14

Another winner to close out the week and month. See ES section below. The markets opened flat and then surged higher early. We topped out over lunch with a solid Comber sell signal on the 5-minute ES. It's risk level matched the ADR and the market couldn't get through. We then rolled hard in the afternoon, probably because of the situation in Ukraine, and then bounce back to the VWAP right before the close. I also called an ER short in the room for the Value Area play that surprisingly worked all the way across the Value Area quickly for 80 ticks, but I didn't put it in the Messenger/Twitter feed because it was late on the last day of the month. See that section below too. Volume was 2.3 billion NASDAQ shares at the close.

Net ticks: +8 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

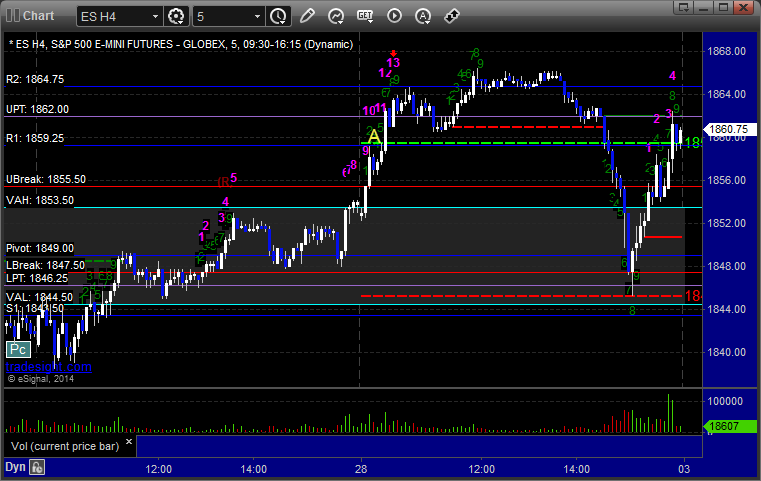

ES:

Triggered long at A at 1859.50, hit first target for 6 ticks, and closed final piece at 1862.00:

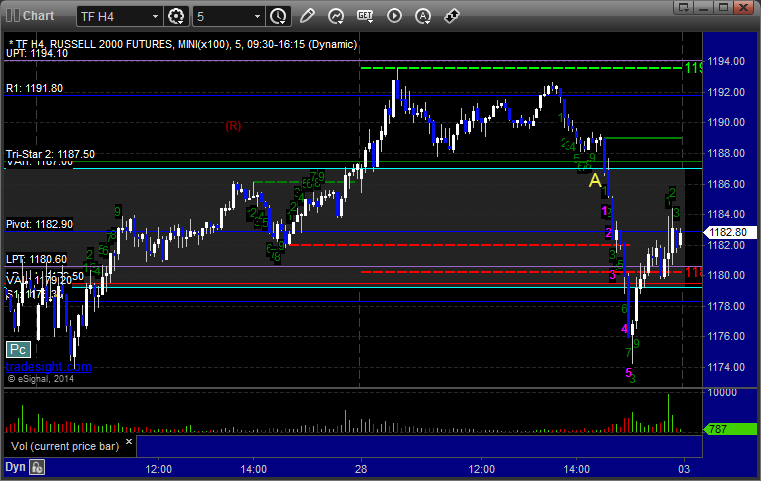

ER:

Called the break into the Value Area in the Lab at A late in the session, which worked all the way across the Value Area:

Futures Calls Recap for 2/28/14

Another winner to close out the week and month. See ES section below. The markets opened flat and then surged higher early. We topped out over lunch with a solid Comber sell signal on the 5-minute ES. It's risk level matched the ADR and the market couldn't get through. We then rolled hard in the afternoon, probably because of the situation in Ukraine, and then bounce back to the VWAP right before the close. I also called an ER short in the room for the Value Area play that surprisingly worked all the way across the Value Area quickly for 80 ticks, but I didn't put it in the Messenger/Twitter feed because it was late on the last day of the month. See that section below too. Volume was 2.3 billion NASDAQ shares at the close.

Net ticks: +8 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1859.50, hit first target for 6 ticks, and closed final piece at 1862.00:

ER:

Called the break into the Value Area in the Lab at A late in the session, which worked all the way across the Value Area:

Forex Calls Recap for 2/28/14

Another session where the whole move occurred on a price spike. Very strange that we have seen several of these the last month or so and nothing prior. I think it is a function of the fact that not much trading is occurring, thus the poor ranges, so when the news hits, there isn't much size in either direction and the market spikes. See EURUSD below for the recap.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Not much new as we aren't going anywhere.

EURUSD:

Triggered long at A on a spike. If you got filled on any of your pieces, hit first target at B and stopped last piece at C, but fills are questionable in a move like that: