Stock Picks Recap for 2/27/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls found.

From the Messenger/Tradesight_st Twitter Feed, Rich's WYNN triggered long (with market support) and worked:

His AMZN triggered short (without market support) and worked enough for a partial:

His FSLR triggered long (with market support) and didn't work initially, worked on a second try:

Mark;s THOR triggered long (with market support) and worked:

His CHKP triggered long (with market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 2/27/14

Two small winners, a bigger winner, and a loser for the session. See ES and ER sections below. NASDAQ volume dipped a bit from the prior sessions to 1.8 billion shares. The markets opened flat and were pretty choppy all day.

Net ticks: +8 ticks.

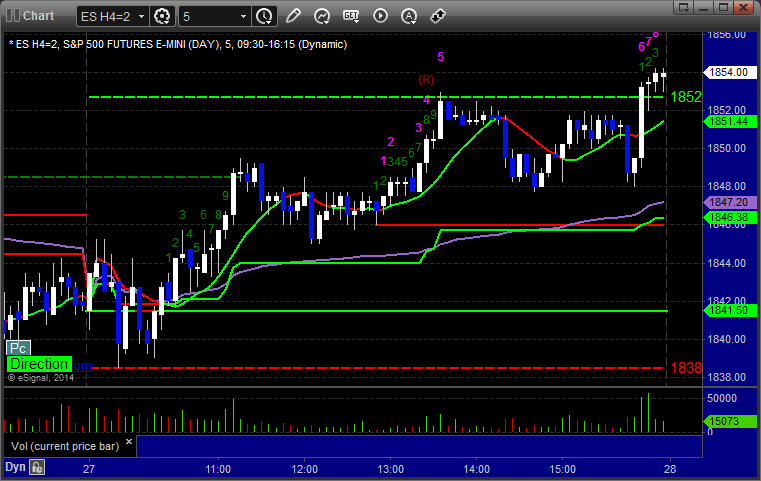

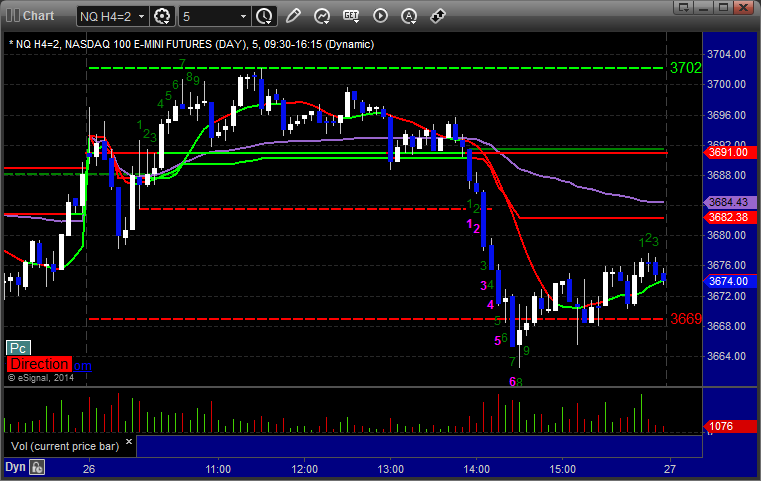

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's called triggered long at A at 1848.00, hit first target for 6 ticks, and stopped the second half at the entry:

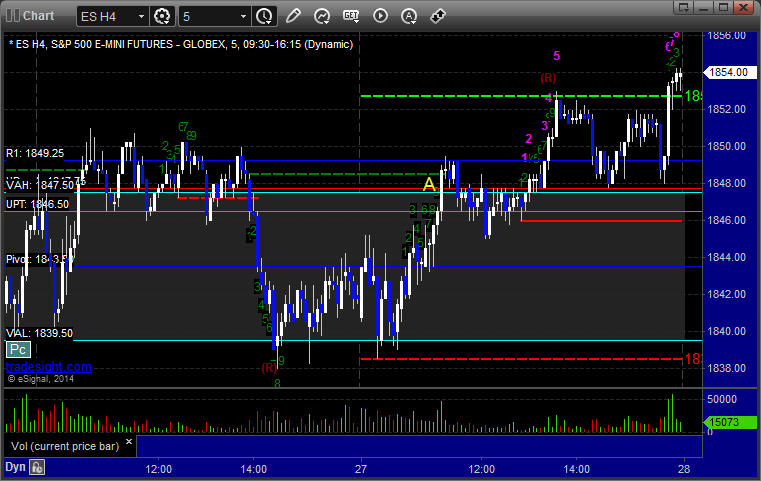

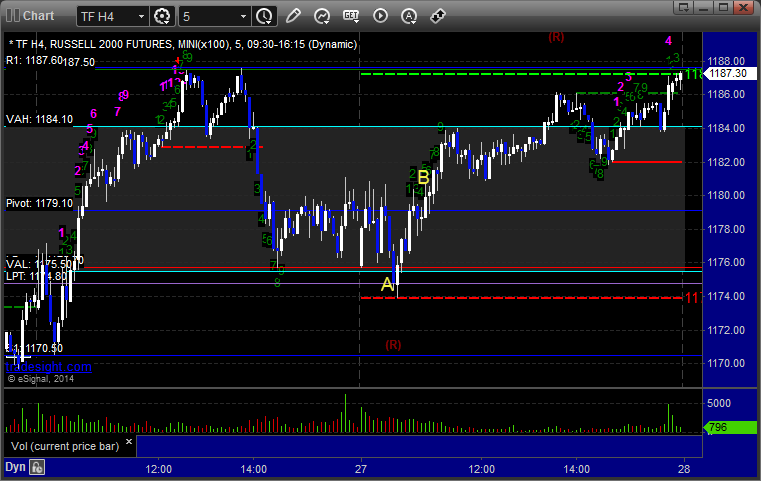

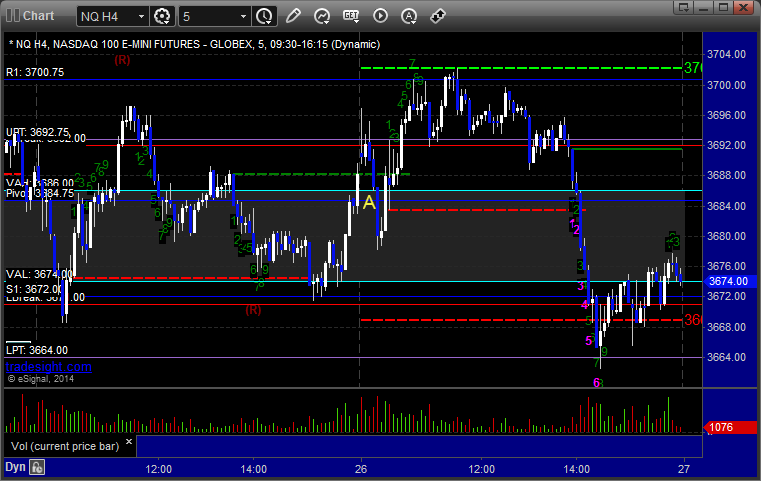

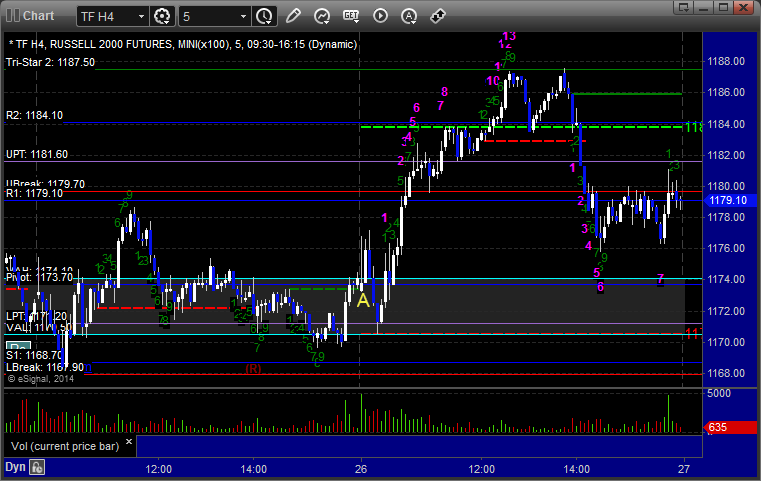

ER:

My short triggered at A at 1174.70, hit first target for 7 ticks, and stopped second half at 1174.90. Long triggered at B at 1181.20 and stopped for 8 ticks on a sweep, then retriggered, hit first target for 8 ticks and stopped second half 13 ticks in the money:

Forex Calls Recap for 2/27/14

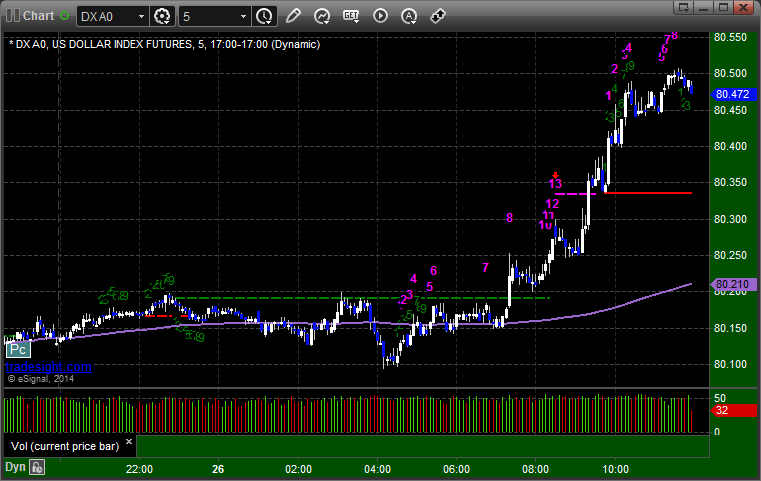

Another waste of a session with 70 pips of ranges on the EURUSD and GBPUSD. See EURUSD section below for the triggers.

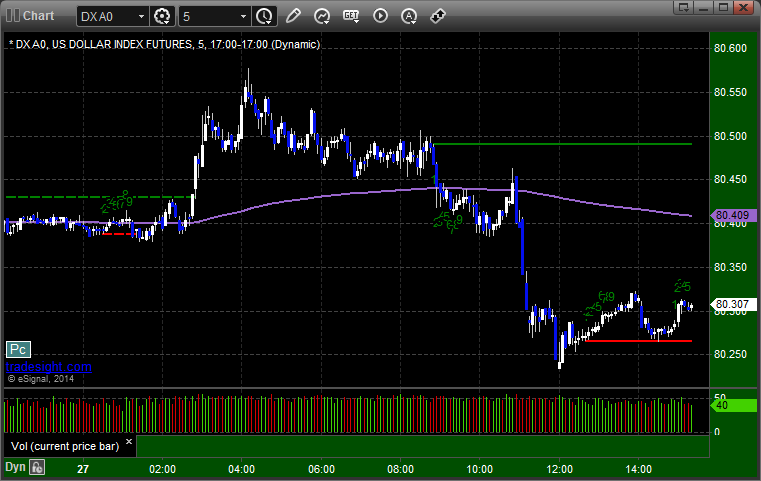

Here's a look at the US Dollar Index intraday with our market directional lines:

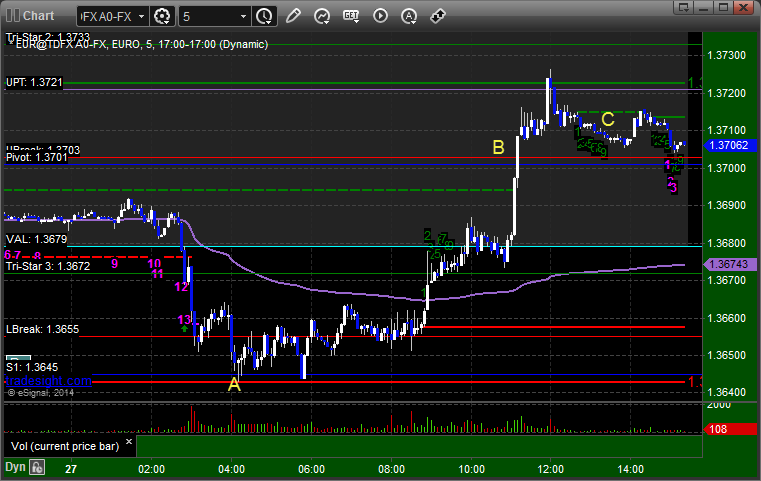

EURUSD:

If you used our order staggering rules, one piece out of three of our trade triggered short under S1 at A (never went 3 pips under) and stopped. Triggered long at B, eventually gave up on it 10 pips in the money at C for end of session:

Stock Picks Recap for 2/26/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EBAY triggered long (with market support) and worked:

NWBO triggered long (with market support) and worked:

VNDA triggered long (without market support) and didn't work:

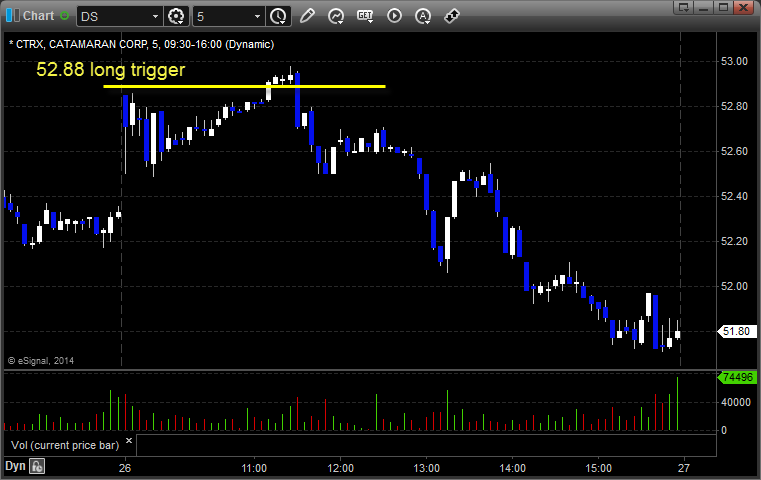

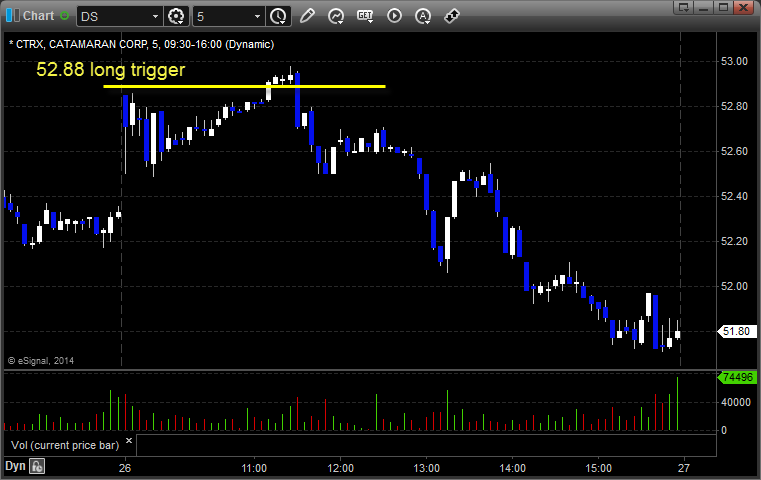

CTRX triggered long (with market support) and didn't work:

CGEN gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and worked:

His NFLX triggered short (with market support) and worked enough for a partial:

His BIDU triggered short (with market support) and worked enough for a partial:

His MS triggered short (with market support) and didn't work:

GOOG triggered short (with market support) and didn't work on a sweep, it did work later:

Mark's PANW triggered long (with market support) and worked:

Mark's RGLD triggered long (without market support) and didn't work:

Rich's AAPL triggered short (with market support) and worked:

His TSLA triggered short (with market support) and worked:

His FB triggered short (with market support) and didn't work:

In total, that's 12 trades triggering with market support, 8 of them worked, 4 did not.

Stock Picks Recap for 2/26/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EBAY triggered long (with market support) and worked:

NWBO triggered long (with market support) and worked:

VNDA triggered long (without market support) and didn't work:

CTRX triggered long (with market support) and didn't work:

CGEN gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered long (ETF, so no market support needed) and worked:

His NFLX triggered short (with market support) and worked enough for a partial:

His BIDU triggered short (with market support) and worked enough for a partial:

His MS triggered short (with market support) and didn't work:

GOOG triggered short (with market support) and didn't work on a sweep, it did work later:

Mark's PANW triggered long (with market support) and worked:

Mark's RGLD triggered long (without market support) and didn't work:

Rich's AAPL triggered short (with market support) and worked:

His TSLA triggered short (with market support) and worked:

His FB triggered short (with market support) and didn't work:

In total, that's 12 trades triggering with market support, 8 of them worked, 4 did not.

Futures Calls Recap for 2/26/14

Two winners as the market moved pretty well early, despite some back and forth again. Volume closed at 1.9 billion NASDAQ shares, and the S&P closed dead flat for the session. See NQ and ER sections below.

Net ticks: +13 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

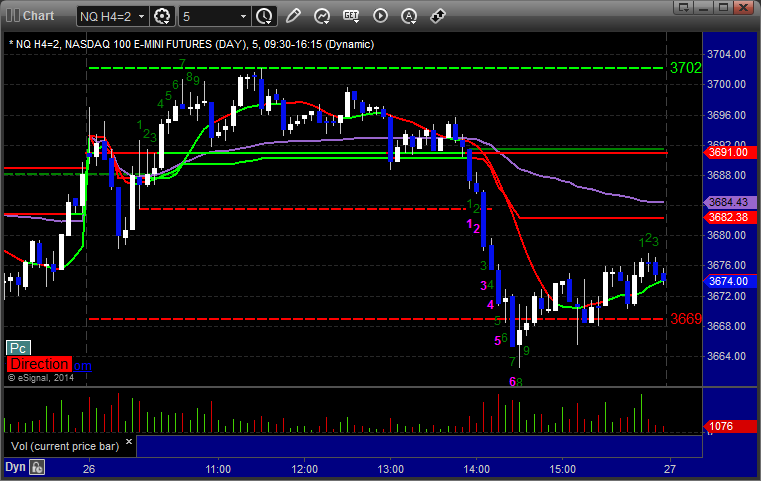

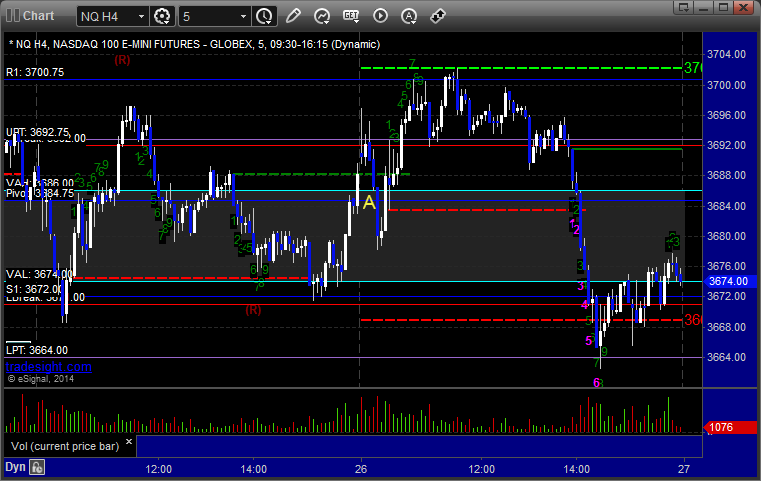

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at 3685.50 at A, hit first target for 6 ticks, and stopped second half for 6 ticks also:

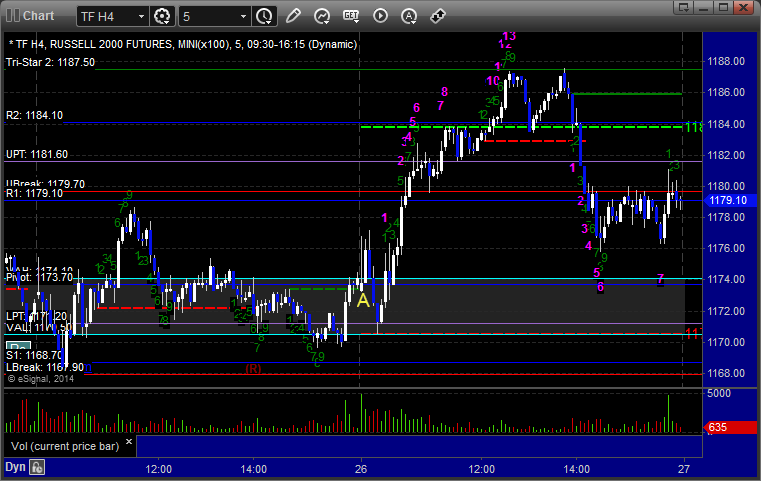

ER:

Triggered short at A at 1173.10, hit first target for 8 ticks, and stopped second half in the money for 6 ticks. Note the 13 Comber sell signal right at the high:

Futures Calls Recap for 2/26/14

Two winners as the market moved pretty well early, despite some back and forth again. Volume closed at 1.9 billion NASDAQ shares, and the S&P closed dead flat for the session. See NQ and ER sections below.

Net ticks: +13 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered short at 3685.50 at A, hit first target for 6 ticks, and stopped second half for 6 ticks also:

ER:

Triggered short at A at 1173.10, hit first target for 8 ticks, and stopped second half in the money for 6 ticks. Note the 13 Comber sell signal right at the high:

Forex Calls Recap for 2/26/14

Another really dull session, especially during European hours, and then we finally got a little move in the US session, but not much. See GBPUSD section below.

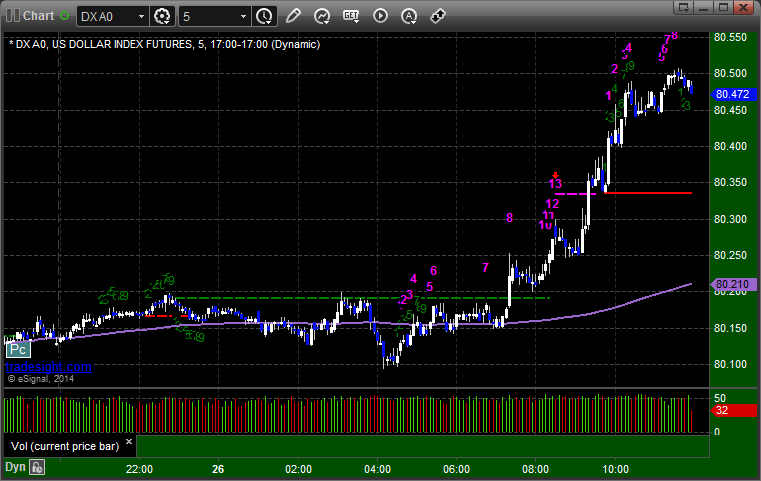

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A late in the session after a dead overnight that sat in the Value Area until the US session. Never did anything so I closed at end of chart for a 10 pip loss for end of session:

Forex Calls Recap for 2/26/14

Another really dull session, especially during European hours, and then we finally got a little move in the US session, but not much. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A late in the session after a dead overnight that sat in the Value Area until the US session. Never did anything so I closed at end of chart for a 10 pip loss for end of session:

Stock Picks Recap for 2/25/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NWBO gapped over, no play.

CRZO triggered long (with market support) and actually stopped once first before running later:

SCHN triggered short (with market support, right at what ended up being the low of the trading session) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Mark's JAZZ triggered short (with market support) and didn't quite work enough for a partial:

BIDU triggered short (with market support) and worked:

Rich's TSLA triggered short (with market support) and worked:

His PCLN triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.