Stock Picks Recap for 2/25/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NWBO gapped over, no play.

CRZO triggered long (with market support) and actually stopped once first before running later:

SCHN triggered short (with market support, right at what ended up being the low of the trading session) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Mark's JAZZ triggered short (with market support) and didn't quite work enough for a partial:

BIDU triggered short (with market support) and worked:

Rich's TSLA triggered short (with market support) and worked:

His PCLN triggered short (with market support) and worked:

In total, that's 6 trades triggering with market support, 3 of them worked, 3 did not.

Futures Calls Recap for 2/25/14

No triggers again. Much less movement than Monday even though volume still hit almost 2 billion NASDAQ shares.

Net ticks: +0 ticks.

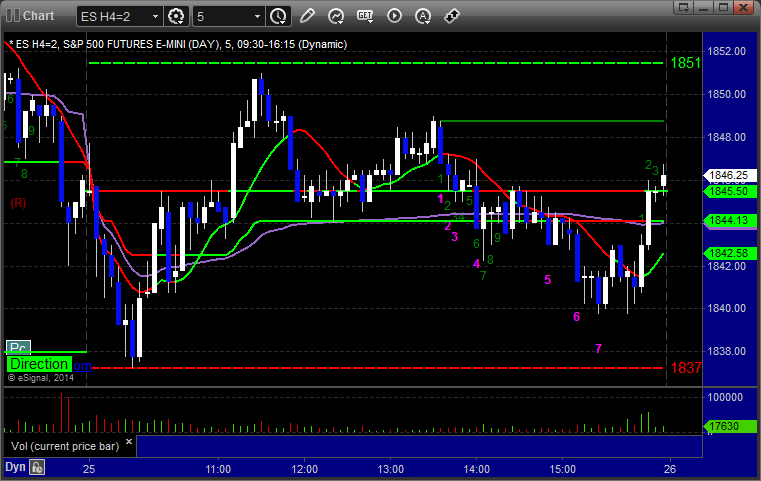

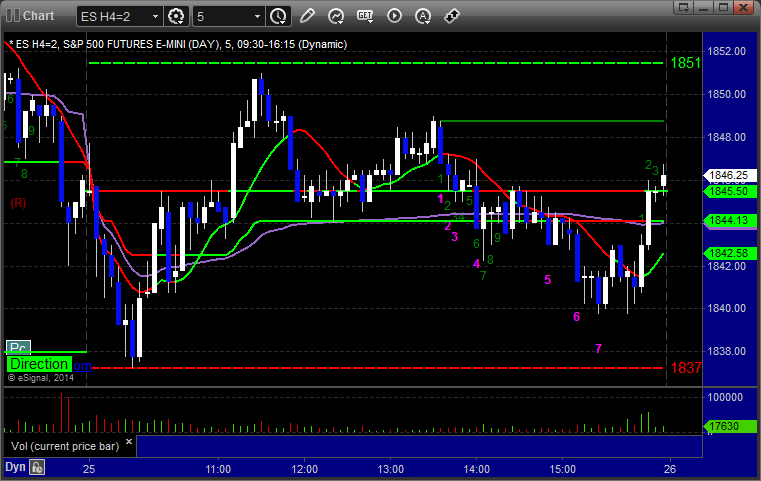

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Futures Calls Recap for 2/25/14

No triggers again. Much less movement than Monday even though volume still hit almost 2 billion NASDAQ shares.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 2/25/14

A winner on the GBPUSD, see that section below. Overall, another tame night of Forex trading and movement.

Here's a look at the US Dollar Index intraday with our market directional lines:

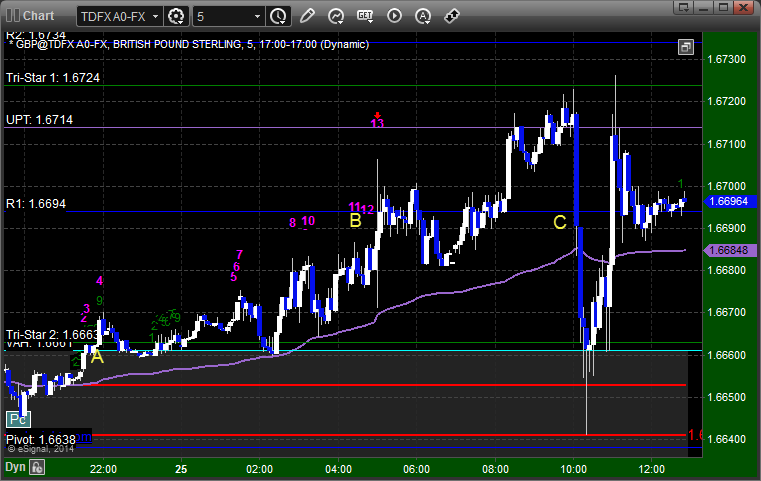

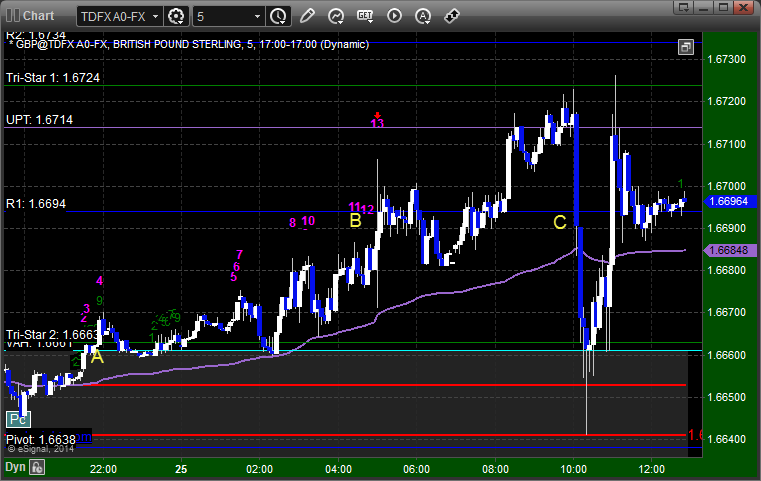

GBPUSD:

Triggered long at A, hit first target at B, and adjusted the stop under R1 and stopped at C on the spike:

Forex Calls Recap for 2/25/14

A winner on the GBPUSD, see that section below. Overall, another tame night of Forex trading and movement.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, and adjusted the stop under R1 and stopped at C on the spike:

Stock Picks Recap for 2/24/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MEOH triggered long (without market support due to opening 5 minutes) and didn't work:

XOMA triggered long (with market support) and didn't work:

SRPT triggered long (without market support due to opening 5 minutes) and worked:

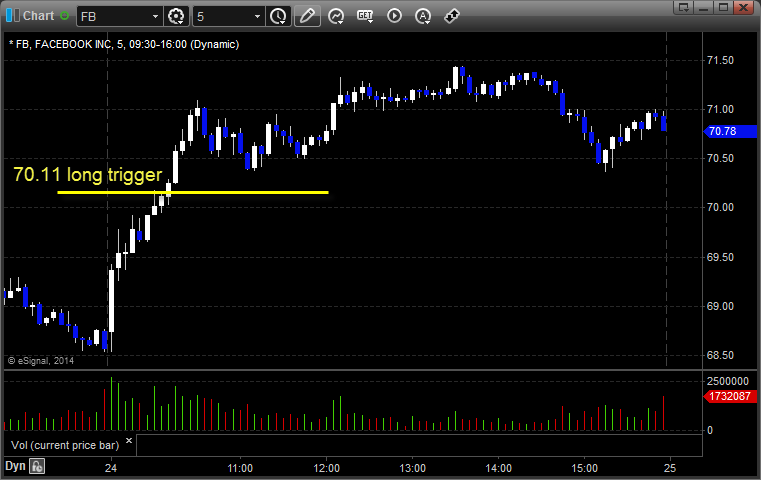

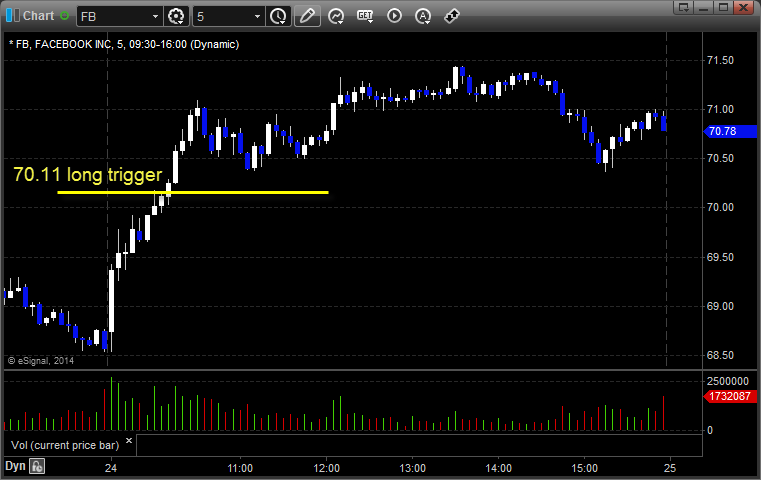

From the Messenger/Tradesight_st Twitter Feed, FB triggered long (with market support) and worked:

Rich's GOOG triggered long (with market support) and worked:

SHLD triggered short (without market support) and worked:

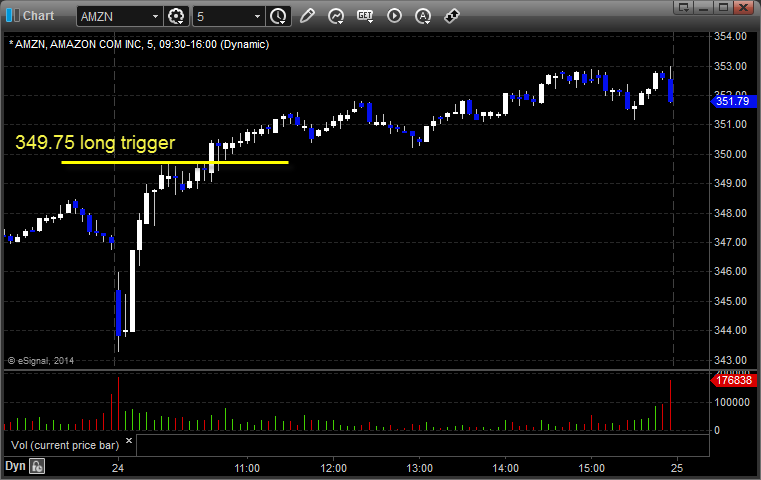

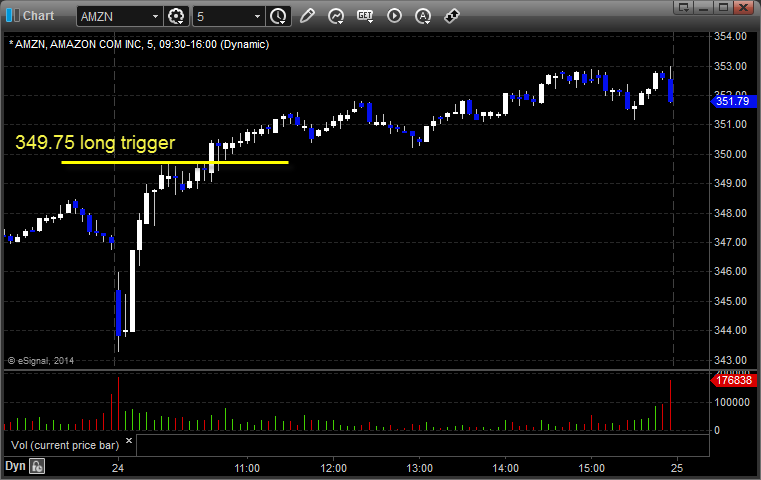

Rich's AMZN triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Stock Picks Recap for 2/24/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MEOH triggered long (without market support due to opening 5 minutes) and didn't work:

XOMA triggered long (with market support) and didn't work:

SRPT triggered long (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, FB triggered long (with market support) and worked:

Rich's GOOG triggered long (with market support) and worked:

SHLD triggered short (without market support) and worked:

Rich's AMZN triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

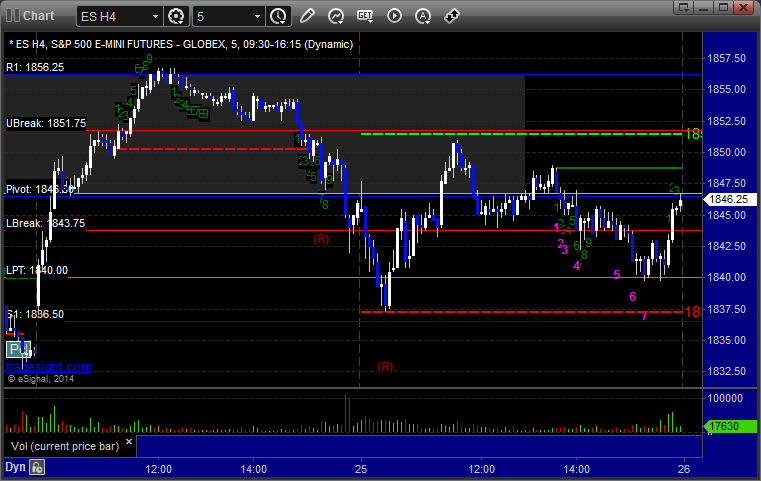

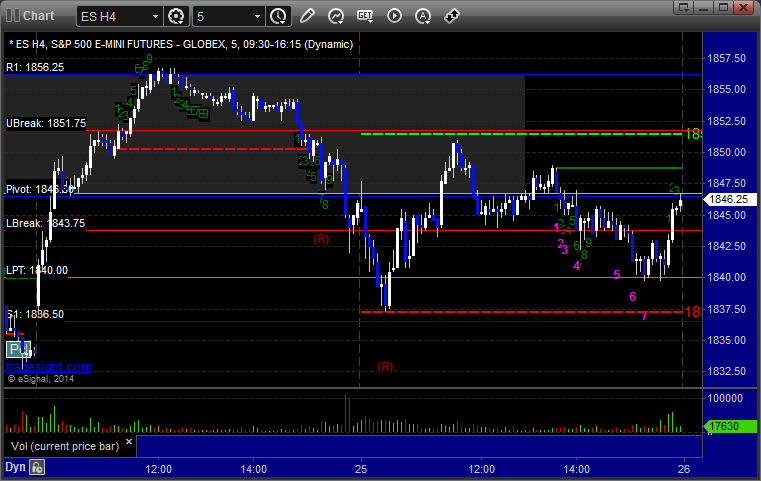

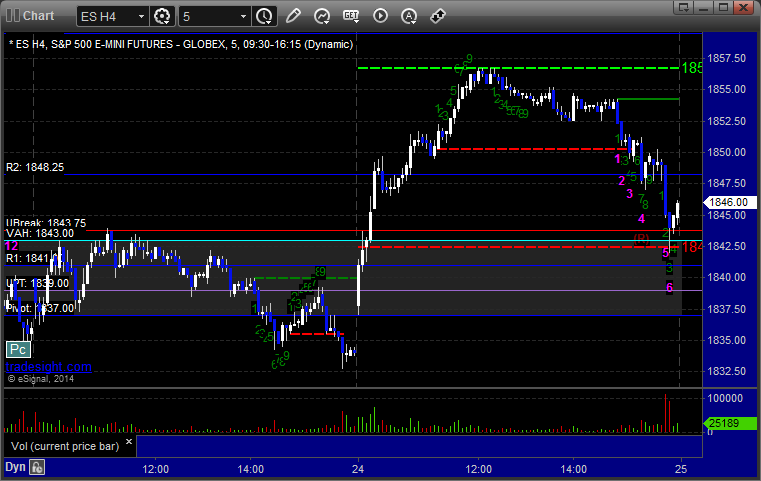

Futures Calls Recap for 2/24/14

No triggers, although the ES set the UBreak perfectly early and then cracked it and ran.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Note the ES setting the UBreak (red line) and then breaking through for a run:

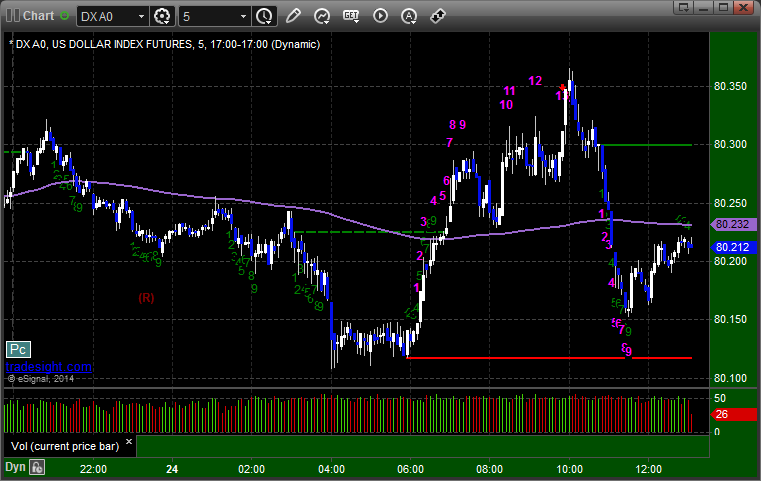

Forex Calls Recap for 2/24/14

Not much of a session to start the week. One trigger that went nowhere that we closed around the entry. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

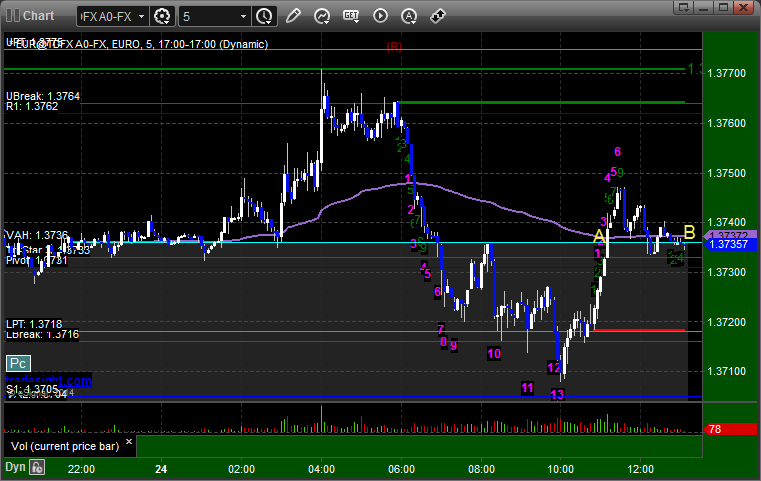

EURUSD:

Triggered long at A, didn't hit first target, closed at entry at B:

Stock Picks Recap for 2/20/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, FNSR triggered long (with market support) and worked because it never went against the trigger, but it never got up $0.20 either:

ALGN triggered short (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, FSLR triggered long (with market support) and worked enough for a partial:

AMZN triggered long (with market support) and didn't work (a great pattern that would have worked just about any day, but it looks like $350 is the strike for expiration on AMZN):

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not. Nothing did much.