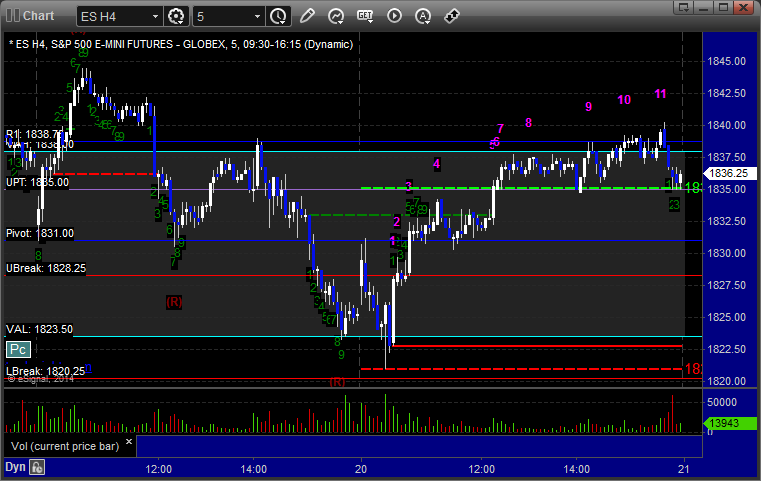

Futures Calls Recap for 2/20/14

A nice setup in the futures did not trigger as the markets gapped up a little, filled the gaps, and then just barely drifted higher all session in a very boring session on 1.7 billion NASDAQ shares. Nothing (stocks, forex, futures) was behaving technically at all as the markets are clearly set for options expiration tomorrow. I posted the charts, but there were no triggers.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 2/20/14

That was interesting. Neither of our Forex calls triggered, but all of the markets were so dull that almost nothing triggered in futures or stocks either as we head into options expiration. I've posted the charts for review anyway.

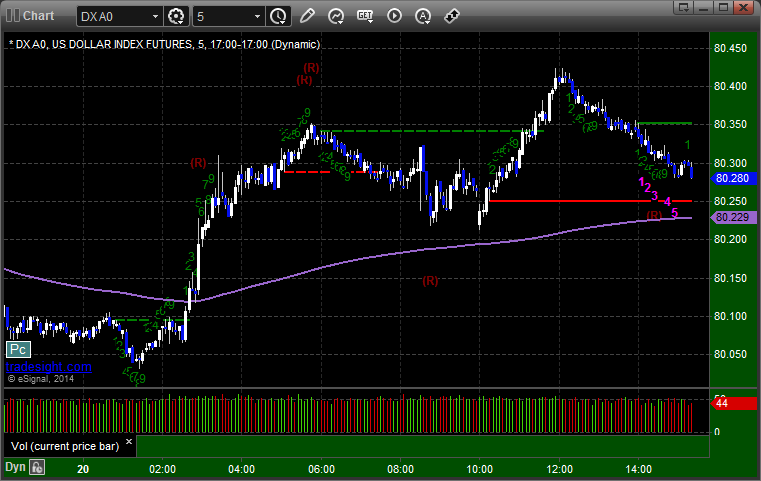

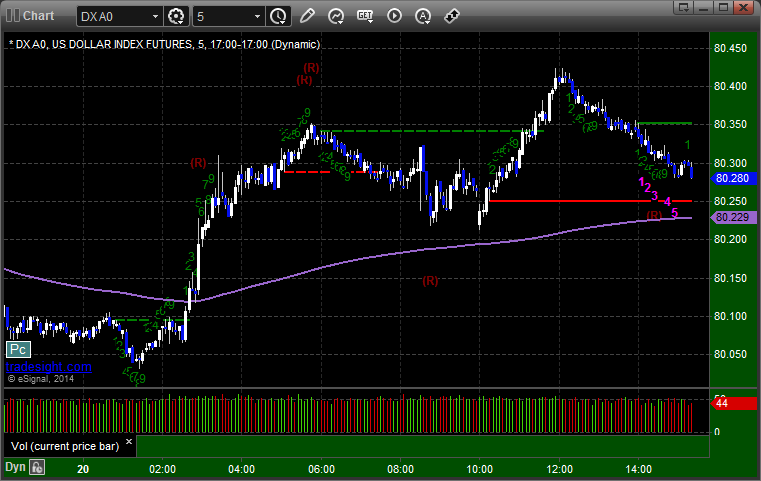

Here's a look at the US Dollar Index intraday with our market directional lines:

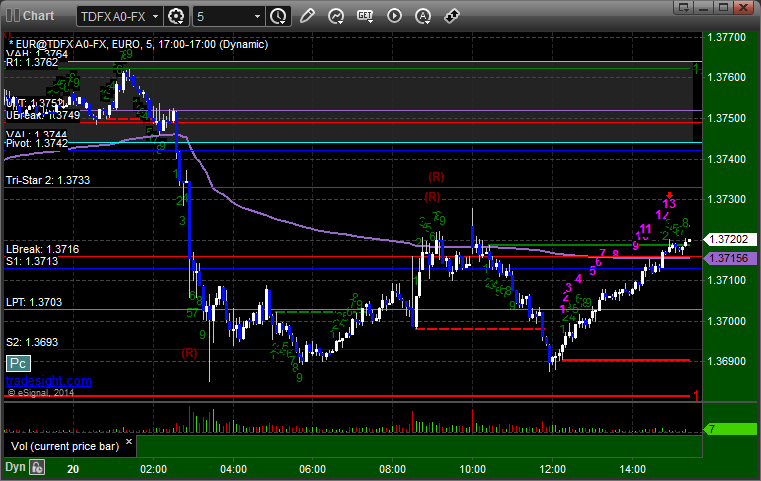

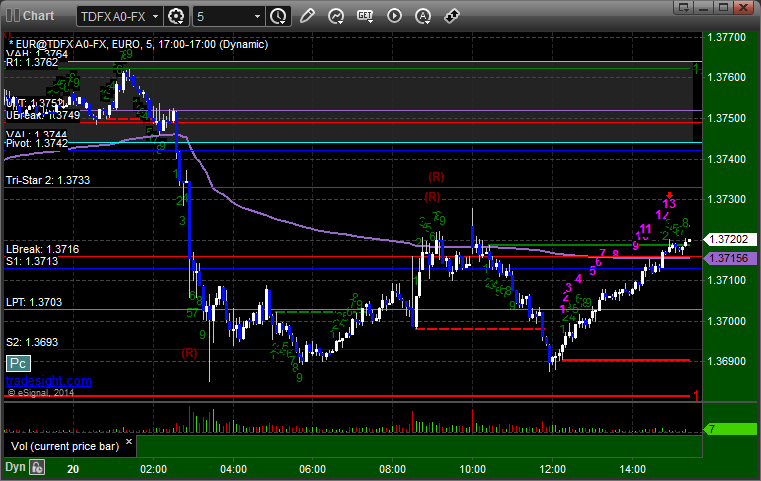

EURUSD:

Forex Calls Recap for 2/20/14

That was interesting. Neither of our Forex calls triggered, but all of the markets were so dull that almost nothing triggered in futures or stocks either as we head into options expiration. I've posted the charts for review anyway.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 2/19/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, OMER triggered long (with market support) and worked great:

TASR triggered long (with market support) well after the main move and right when the options unravel started, and didn't work:

From the Messenger/Tradesight_st Twitter Feed, SHLD triggered short (without market support, although the NASDAQ futures were supporting it) and worked:

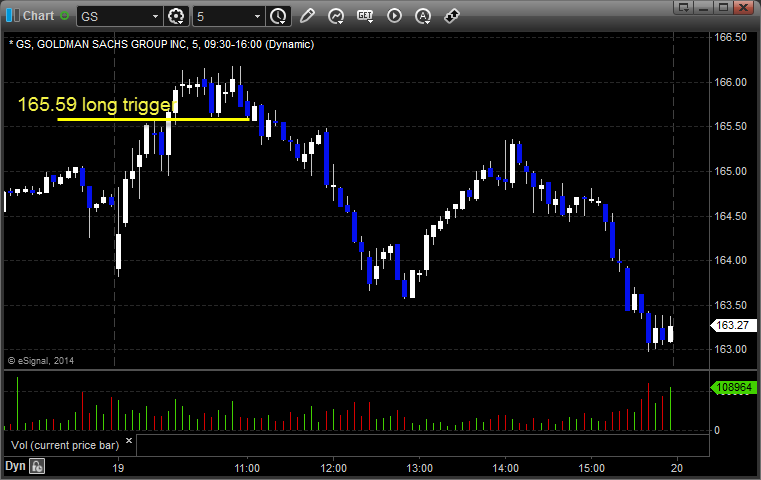

GS triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Stock Picks Recap for 2/19/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, OMER triggered long (with market support) and worked great:

TASR triggered long (with market support) well after the main move and right when the options unravel started, and didn't work:

From the Messenger/Tradesight_st Twitter Feed, SHLD triggered short (without market support, although the NASDAQ futures were supporting it) and worked:

GS triggered long (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

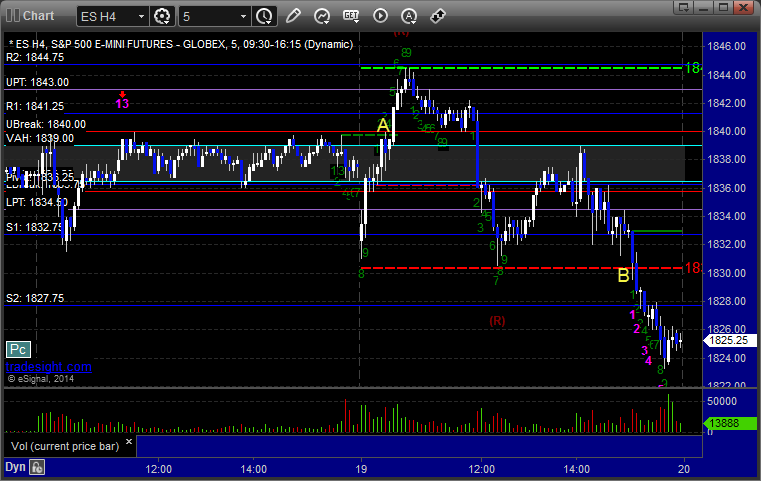

Futures Calls Recap for 2/19/14

Two winners and a loser on a nice day in futures, and there were some more clean setups for those that have taken the course, such as the ES long over LPT after the opening 5 minutes. NASDAQ volume was 1.7 billion shares. See the ES section below.

Net ticks: +8 ticks.

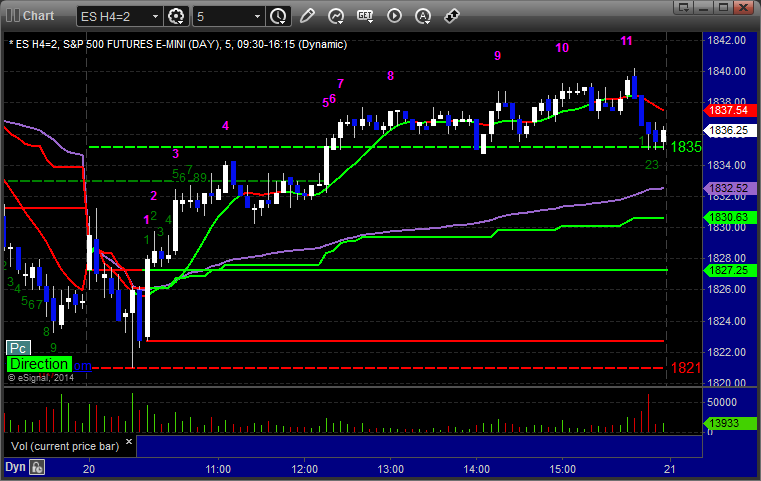

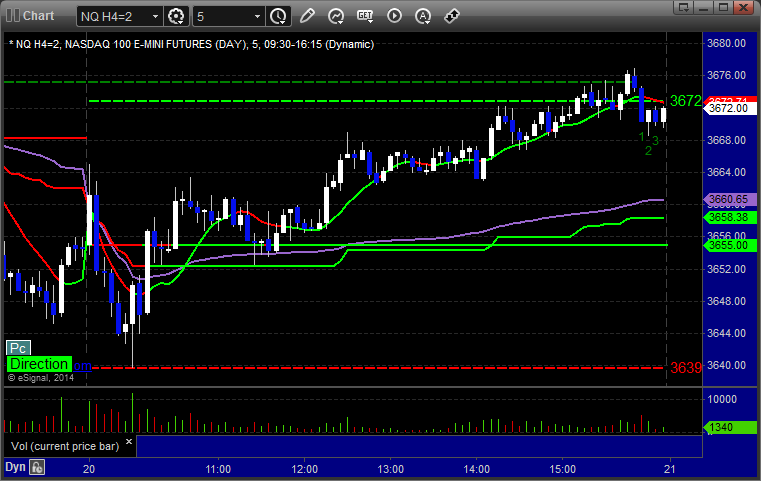

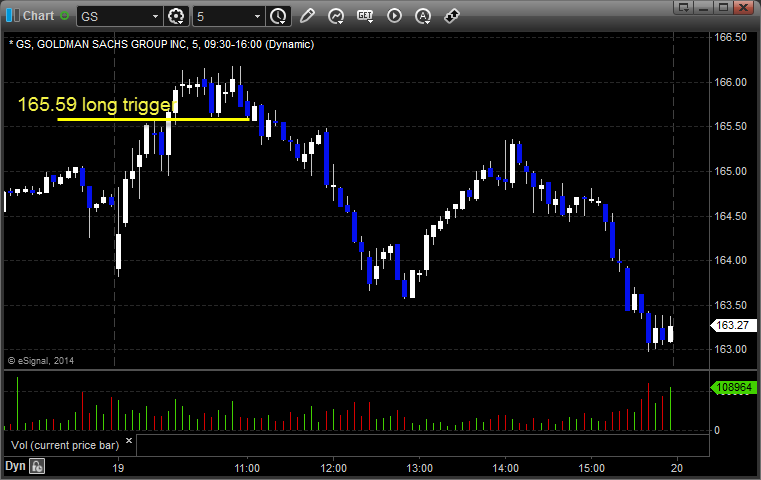

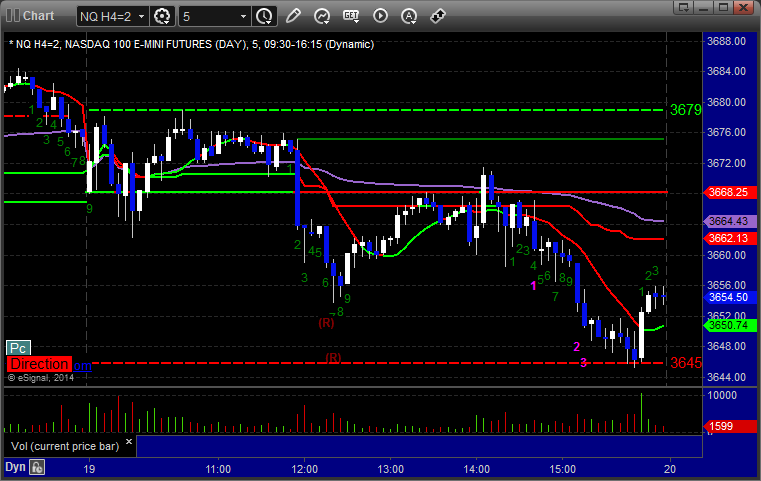

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1840.25 after setting the UBreak, hit first target for 6 ticks, he adjusted the stop a couple of times and stopped the second piece at 1843.00. Later, his short triggered at B at 1829.75, stopped quickly on a sweep, and then triggered again, hit first target for 6 ticks, and stopped the second half at 1828.00 after the stop was adjusted twice:

Forex Calls Recap for 2/19/14

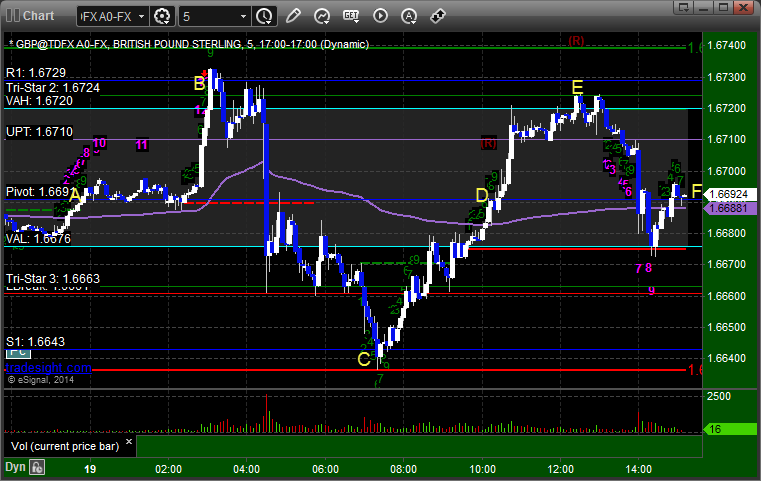

Three triggers on the GBPUSD with mixed results in a session that ended up going nowhere. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, second half stopped. Triggered short at C and stopped. Triggered long at D, if you spaced your exits you should have gotten out of a piece or so at E as we came within 3 pips of the R1 level, closed remainder at F for end of session:

Stock Picks Recap for 2/18/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, RGEN triggered long (with market support) and didn't work, but note this is an interesting case where it had gapped up, went back and filled the gap exactly, and you could have taken it again later:

OREX triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered long (with market support) and worked for a point and a half, but I think we need to establish a bigger partial for GOOG and PCLN since they are over $1000 these days, so we won't count that one. It did work better later:

NFLX triggered short (with market support) and worked:

TSLA triggered long (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Stock Picks Recap for 2/18/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, RGEN triggered long (with market support) and didn't work, but note this is an interesting case where it had gapped up, went back and filled the gap exactly, and you could have taken it again later:

OREX triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered long (with market support) and worked for a point and a half, but I think we need to establish a bigger partial for GOOG and PCLN since they are over $1000 these days, so we won't count that one. It did work better later:

NFLX triggered short (with market support) and worked:

TSLA triggered long (with market support) and didn't work:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Futures Calls Recap for 2/18/14

A very dull session with a gap up that filled after about 45 minutes and then rebounded into a narrow 4 point range on the ES for the last 5 hours or so. Volume was weak at 1.6 billion NASDAQ shares. See NQ section below.

Net ticks: -14 ticks.

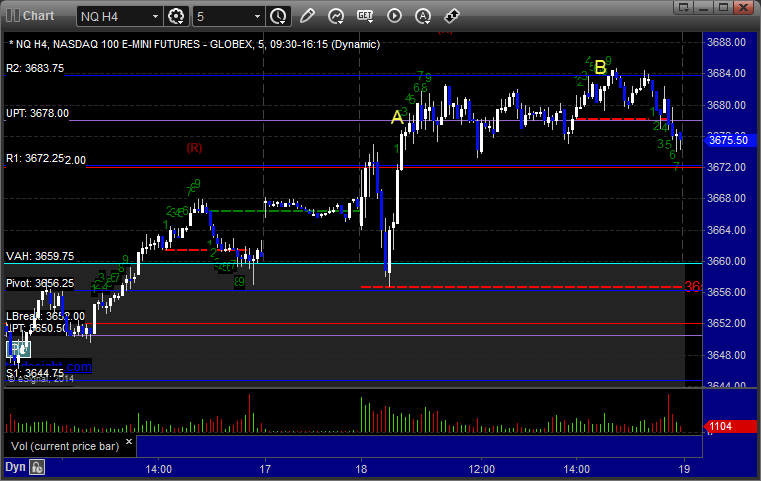

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

My ES call didn't trigger as it was long over the UBreak, and that was exactly the high of the session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark typo'd his first call, but the intent was long at A at 3678.50, and that stopped for 7 ticks. His second call was a long at 3684.00 that triggered at B and stopped: