Futures Calls Recap for 2/13/14

Well, our bad. The market gapped down and was struggling early to do much, but ended up filling the gap, crossing the Value Area and more on volume and we didn't make any calls. I have to say that the move is pretty shocking since we finally got a gap DOWN day, but anyone that took the Value Area plays would have been happy. On to tomorrow where we head into a 3-day weekend.

Net ticks: +0 ticks.

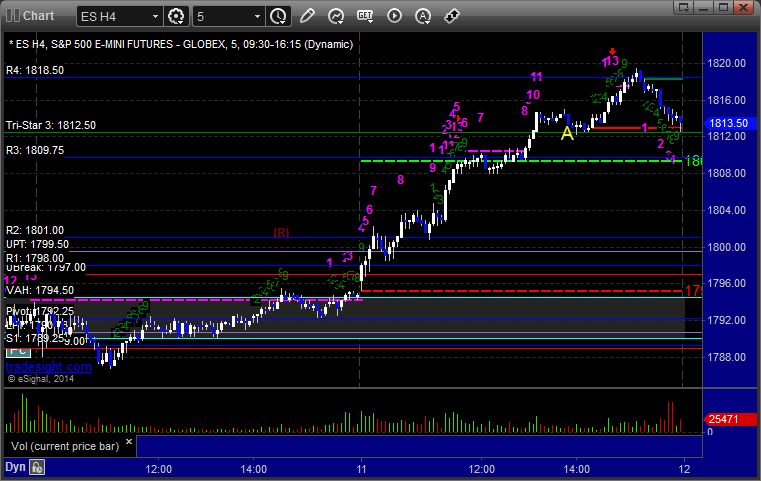

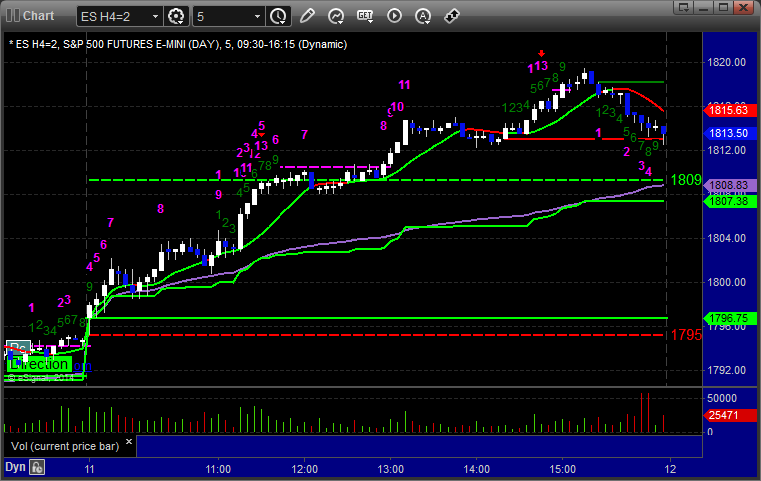

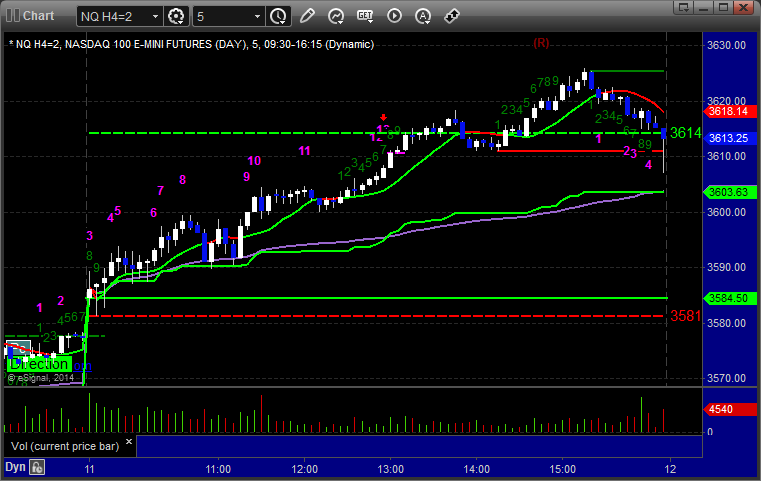

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 2/13/14

A nice session with a clean trigger on the EURUSD that worked, and we are still holding the second half. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

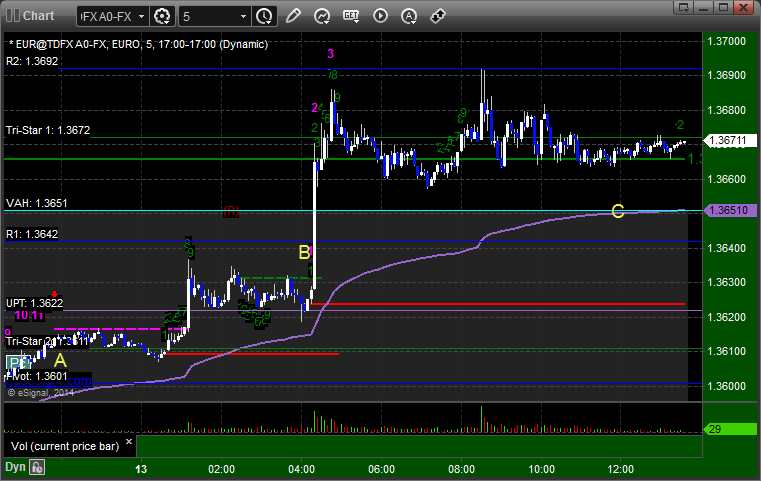

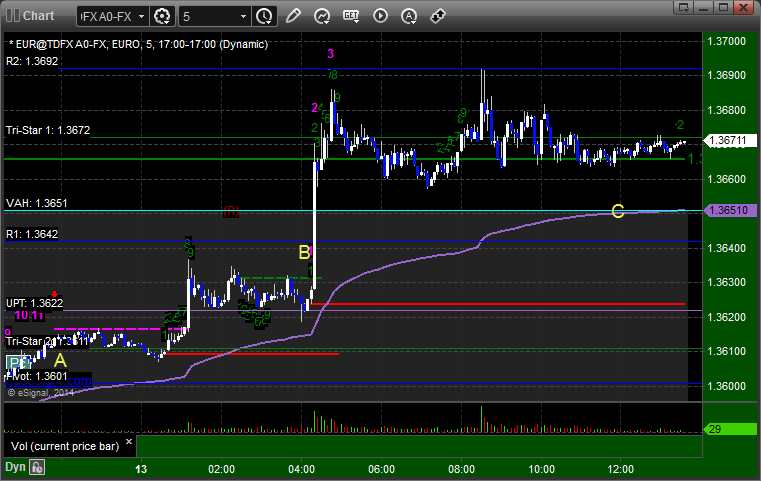

EURUSD:

Triggered long at A, hit first target at B on a spike (nice to be in ahead of the spike), and still holding the second half with a stop under VAH:

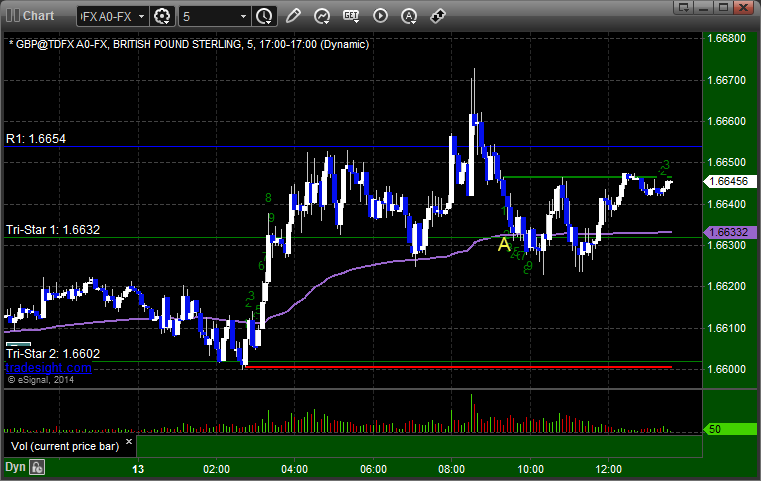

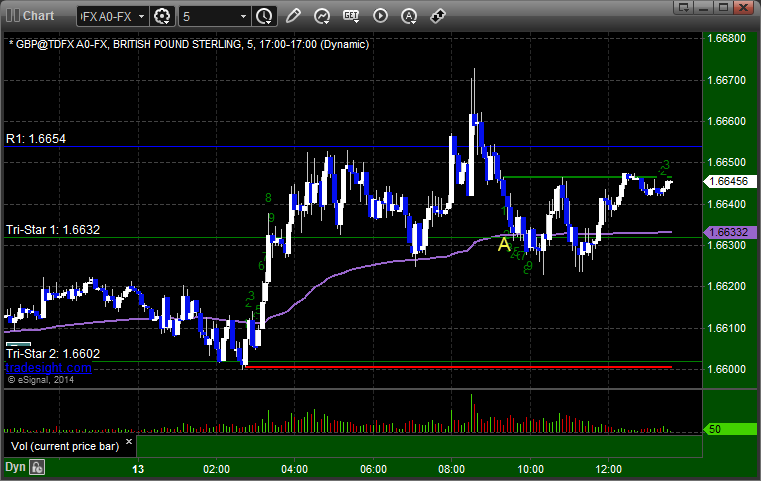

GBPUSD:

We adjusted the stop again on anything left from the trade from the prior session and it stopped at A:

Forex Calls Recap for 2/13/14

A nice session with a clean trigger on the EURUSD that worked, and we are still holding the second half. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B on a spike (nice to be in ahead of the spike), and still holding the second half with a stop under VAH:

GBPUSD:

We adjusted the stop again on anything left from the trade from the prior session and it stopped at A:

Stock Picks Recap for 2/12/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SIAL triggered long (without market support due to opening 5 minutes) and worked:

ECYT triggered long (with market support) and worked:

STXS triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered short (without market support) and didn't work:

Rich's LNKD triggered short (with market support) and worked:

His ALXN triggered short (with market support) and didn't work:

His FEYE triggered short (with market support) and worked:

His WYNN triggered short (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Stock Picks Recap for 2/12/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SIAL triggered long (without market support due to opening 5 minutes) and worked:

ECYT triggered long (with market support) and worked:

STXS triggered long (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered short (without market support) and didn't work:

Rich's LNKD triggered short (with market support) and worked:

His ALXN triggered short (with market support) and didn't work:

His FEYE triggered short (with market support) and worked:

His WYNN triggered short (with market support) and didn't work:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 2/12/14

Three trades, one winner, in another session that gapped up and started to go higher but finally failed and filled the gap on 1.9 billion NASDAQ shares.

Net ticks: -11.5 ticks.

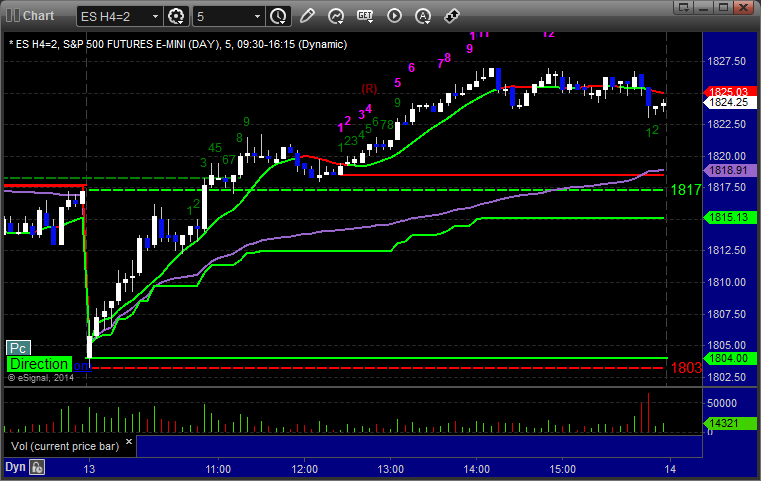

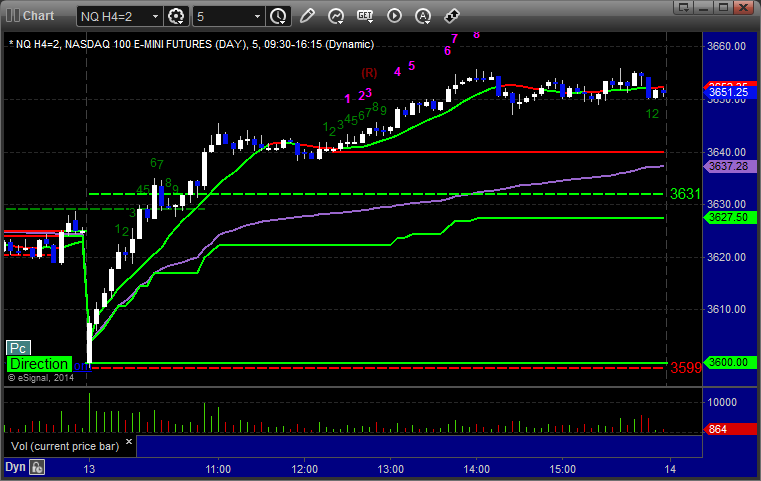

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1820.75 and stopped. Did not put it back in:

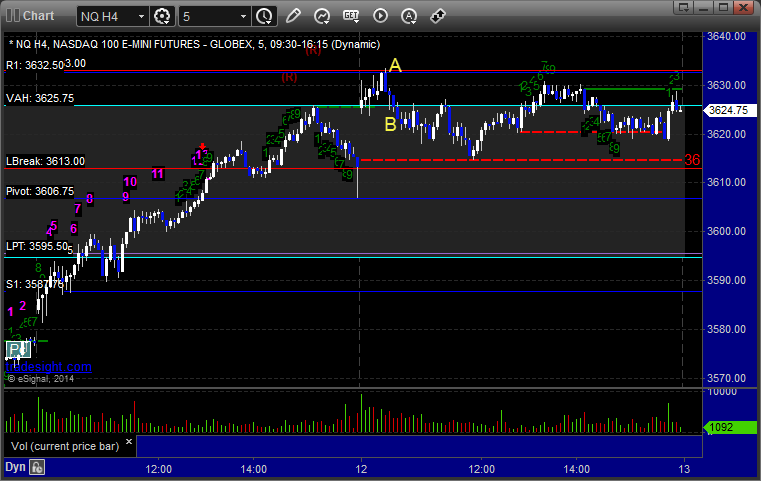

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered long at A at 3633.50 and stopped. My short triggered at B at 3623.50, hit first target for 6 ticks, stopped second half over the entry:

Forex Calls Recap for 2/12/14

Another day, another trigger on news. See GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

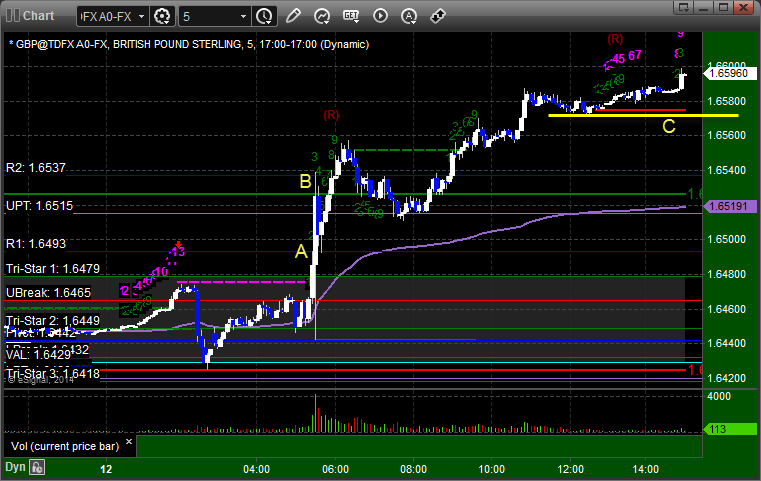

GBPUSD:

Another spike on the trigger. Not sure if it is a good sign or a bad one that the market is spiking again on news. Either way, set the trigger 3 minutes before the news and then triggered at A, depending on your fills and the way your broker handled the spreads, you could have been stopped, not filled initially, or hit first target at B. Anything you're still holding, stop is under the line at C:

Stock Picks Recap for 2/11/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SLXP triggered long (with market support) and worked:

ALXS triggered long (with market support) and didn't work, worked on the retrigger but we don't count that for official results:

ALTR triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's KLAC triggered long (with market support) and worked:

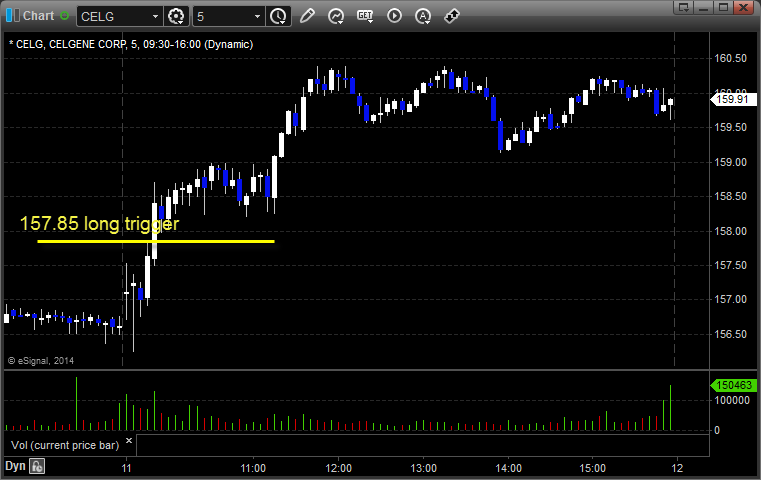

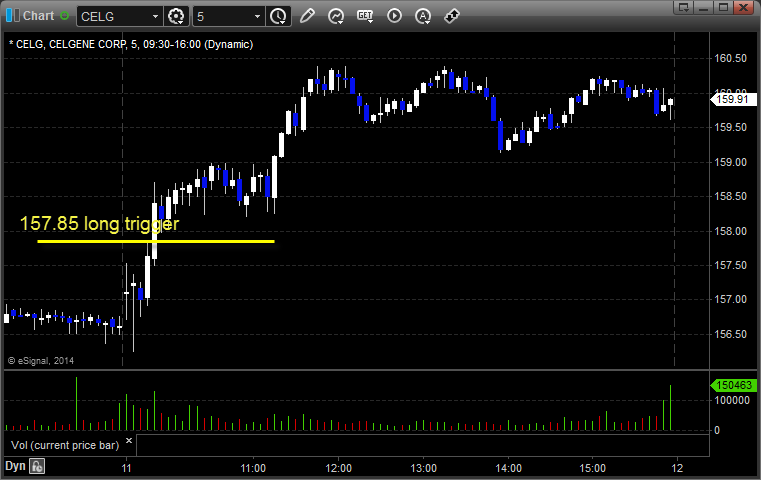

CELG triggered long (with market support) and worked:

Rich's GOOG triggered short (without market support) and didn't work:

His AMZN triggered short (without market support) and worked:

BIIB triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Stock Picks Recap for 2/11/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SLXP triggered long (with market support) and worked:

ALXS triggered long (with market support) and didn't work, worked on the retrigger but we don't count that for official results:

ALTR triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Mark's KLAC triggered long (with market support) and worked:

CELG triggered long (with market support) and worked:

Rich's GOOG triggered short (without market support) and didn't work:

His AMZN triggered short (without market support) and worked:

BIIB triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 2/11/14

The markets gapped up and just kept going. One loser looking for the reversal after we were over extended. Volume started out strong but slowed, closing at 1.8 billion NASDAQ shares. See ES section below. That move was pretty unexpected from a futures perspective. We will try to get back to it tomorrow.

Net ticks: -7 ticks.

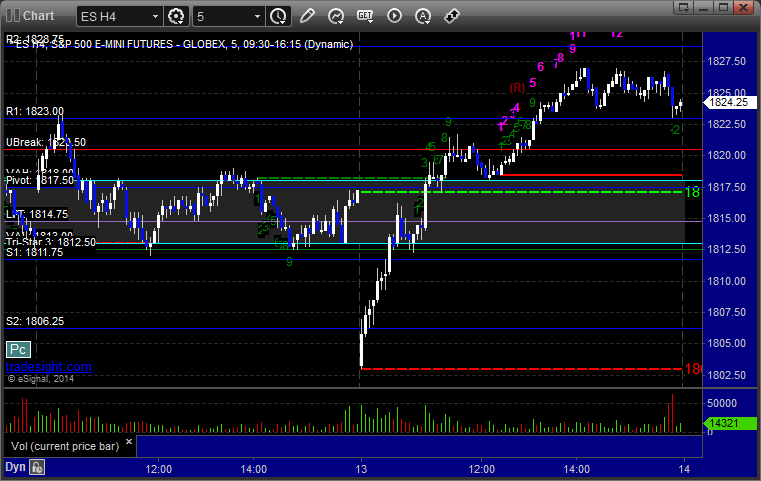

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at 1813.00 at A, didn't quite hit first target, stopped for 7 ticks: