Stock Picks Recap for 2/6/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ICLR triggered long (with market support) and worked great:

INFI triggered short (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered long in the morning (with market support) and didn't work:

A new call in GOOG later triggered long (with market support) and worked:

LNKD triggered long (with market support) and worked:

Rich's DDD triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Stock Picks Recap for 2/6/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ICLR triggered long (with market support) and worked great:

INFI triggered short (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, GOOG triggered long in the morning (with market support) and didn't work:

A new call in GOOG later triggered long (with market support) and worked:

LNKD triggered long (with market support) and worked:

Rich's DDD triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 2/6/14

What a difference eSignal makes. For the first time I can remember, eSignal had login issues and we couldn't get into the platform for the first hour of trading. I was able to trade stocks fine use my broker's platform, but it is just amazing how little you see on a futures chart without the Levels and tools that I'm used to. By the time eSignal came up, the move was over, so no calls. Back to it Friday.

Net ticks: +0 ticks.

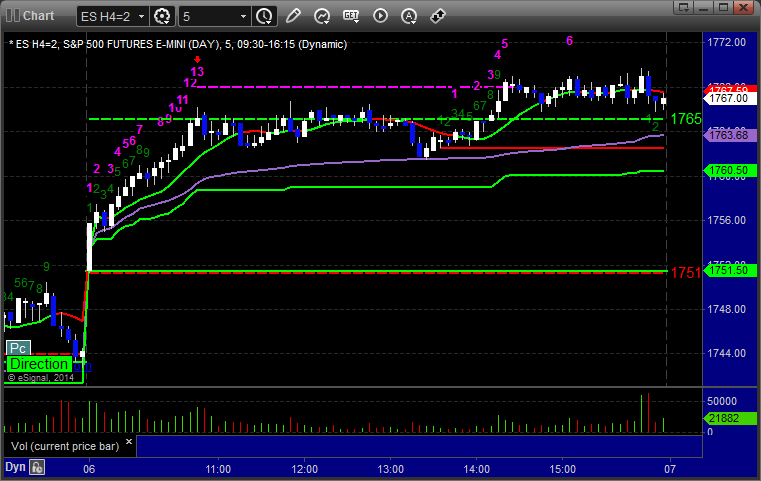

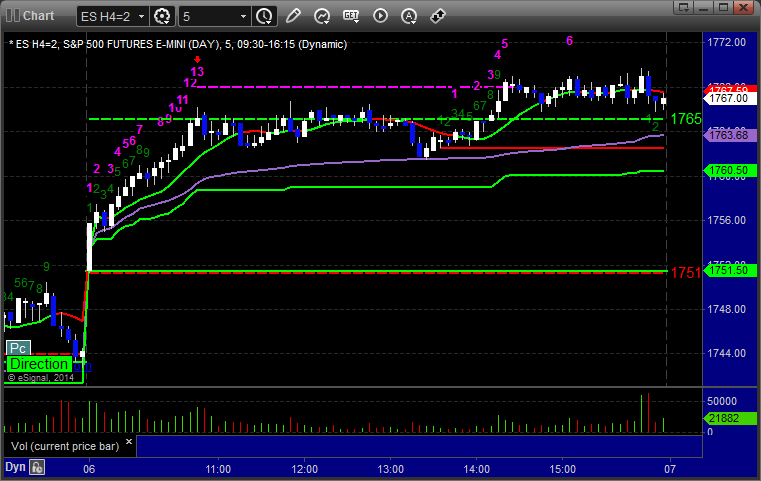

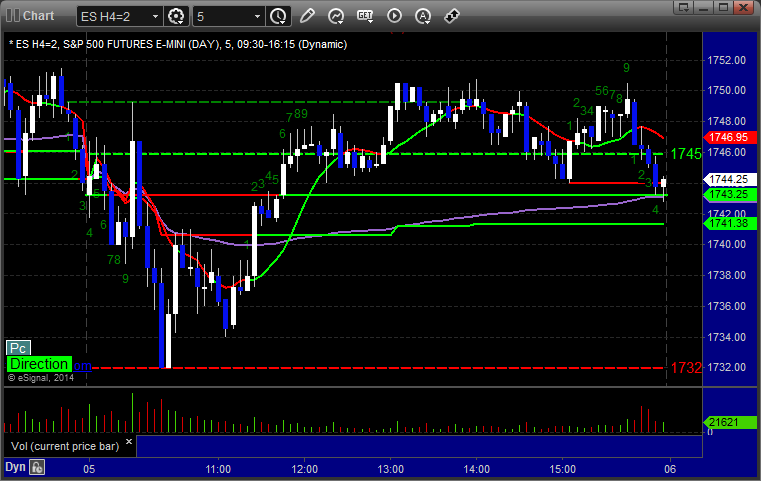

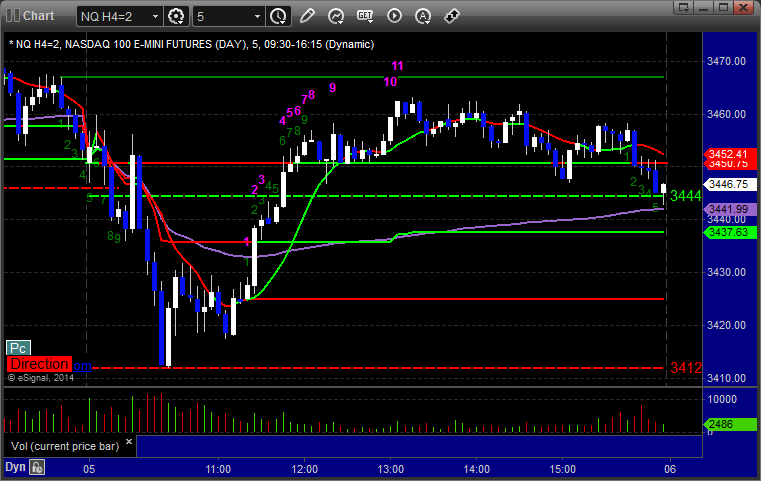

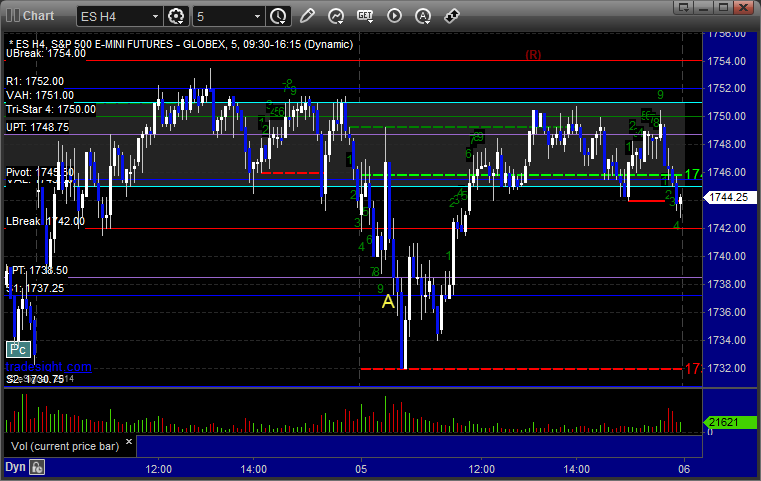

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

| Previous Day | Next Day | | View in Print Format | |

| Other reports for this day [ Daily Picks | Small Caps | Forex Reports ] | |||

Report Results

Expand All / Collapse All

Market commentary Market commentaryWhat a difference eSignal makes. For the first time I can remember, eSignal had login issues and we couldn't get into the platform for the first hour of trading. I was able to trade stocks fine use my broker's platform, but it is just amazing how little you see on a futures chart without the Levels and tools that I'm used to. By the time eSignal came up, the move was over, so no calls. Back to it Friday. Net ticks: +0 ticks. As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:   |

Intraday ES

Intraday ES

Forex Calls Recap for 2/6/14

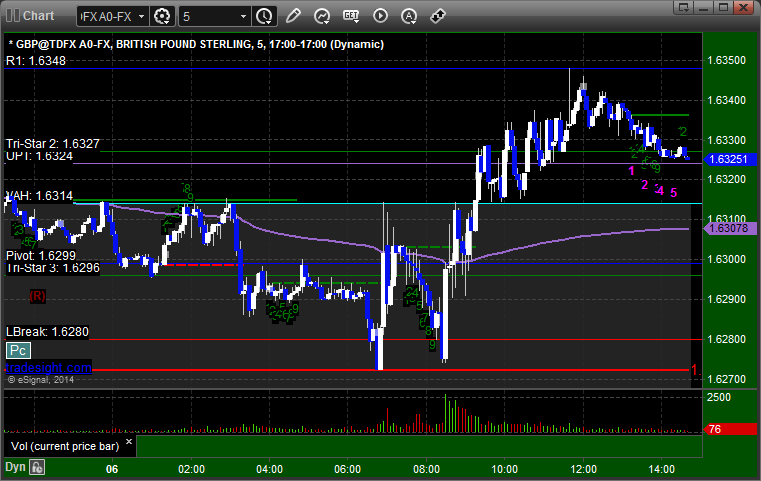

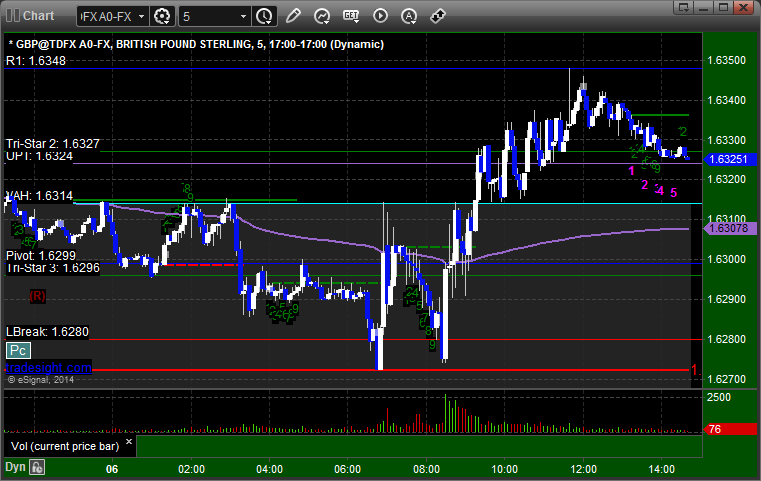

That's amazing, no triggers for the session. GBPUSD hit the R1 trigger exactly and never got through. Pretty much means we were in a contained session. Trade balance didn't cause a spike in the GBPUSD, although it did on the EURUSD. All charts posted below anyway. Note the Comber 13 signals.

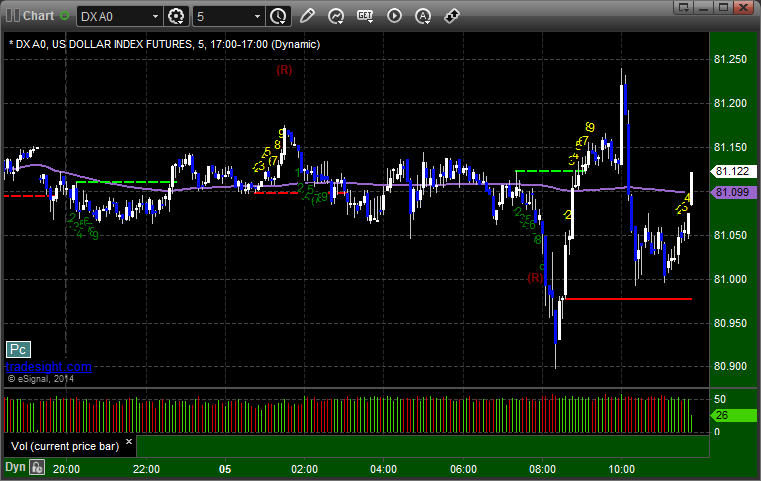

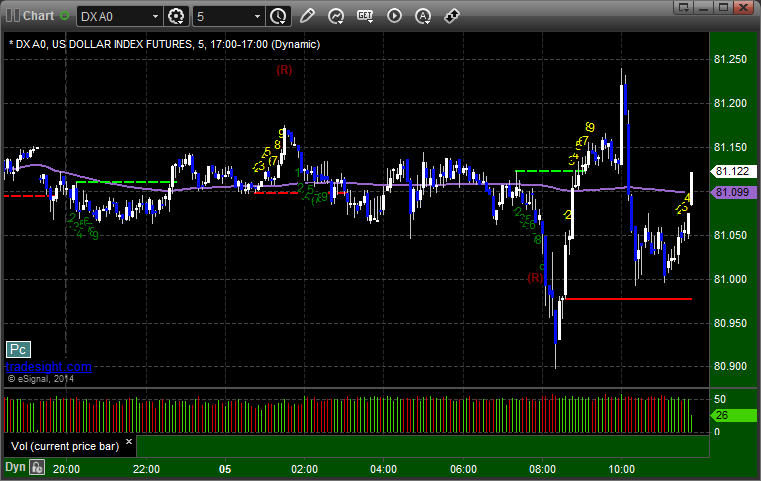

Here's a look at the US Dollar Index intraday with our market directional lines:

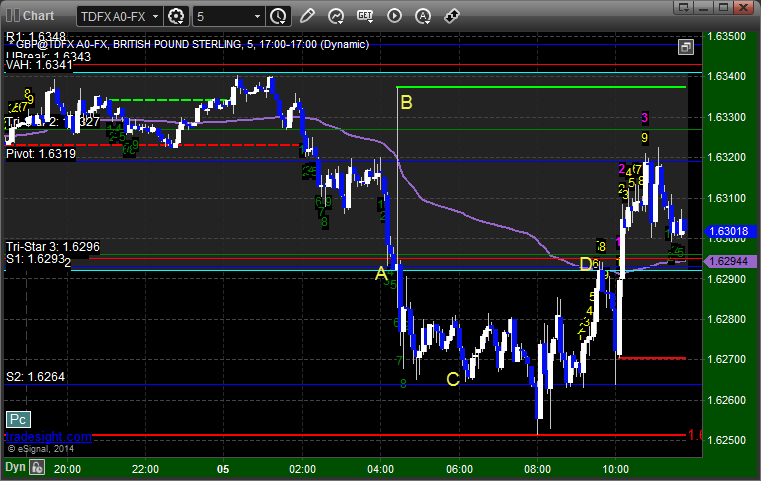

GBPUSD:

Forex Calls Recap for 2/6/14

That's amazing, no triggers for the session. GBPUSD hit the R1 trigger exactly and never got through. Pretty much means we were in a contained session. Trade balance didn't cause a spike in the GBPUSD, although it did on the EURUSD. All charts posted below anyway. Note the Comber 13 signals.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Stock Picks Recap for 2/5/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, XONE gapped under the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and worked:

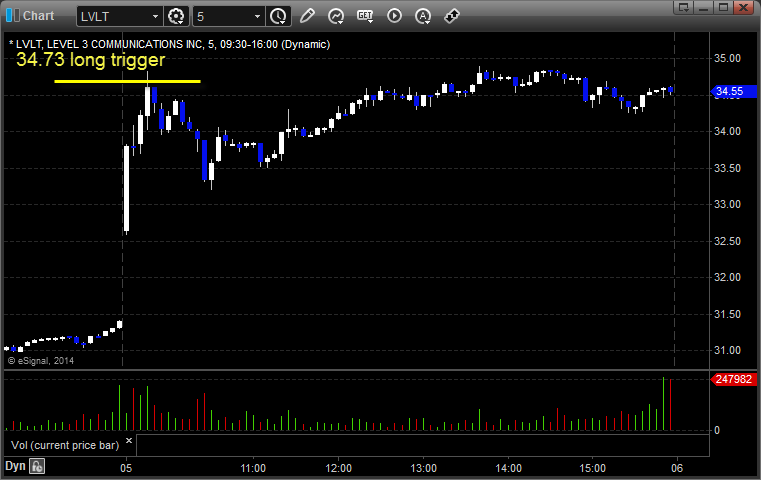

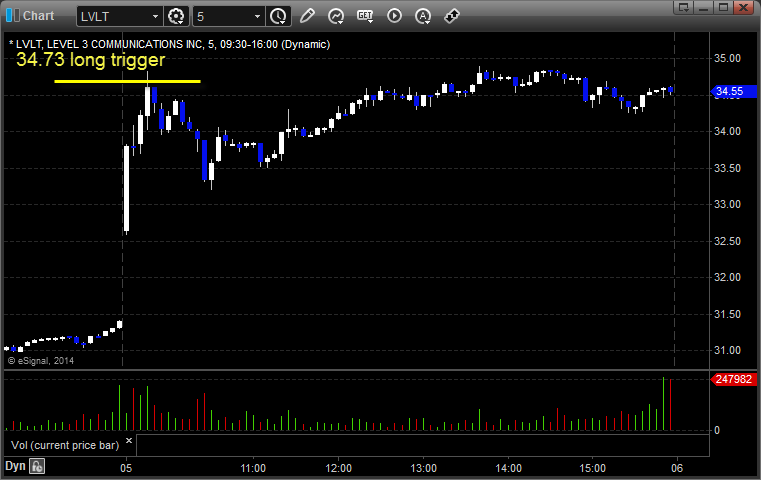

His LVLT triggered long (without market support) and didn't work:

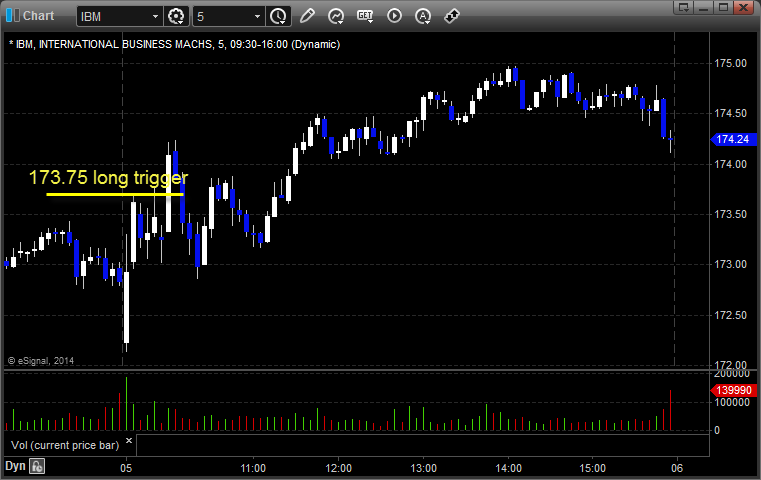

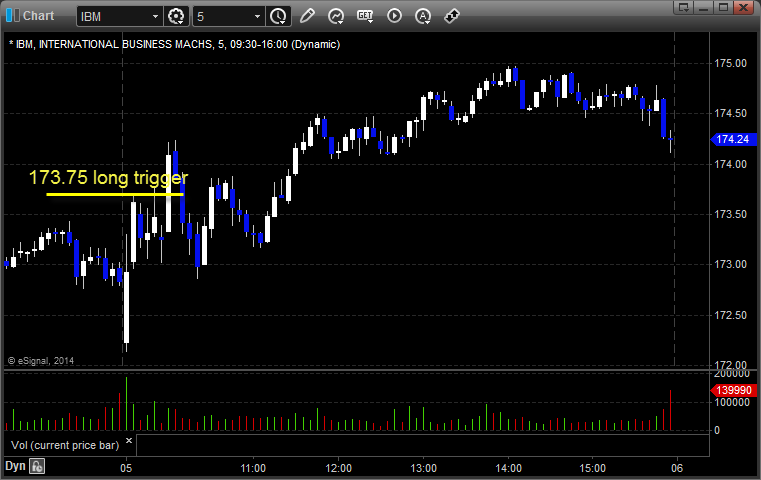

His IBM triggered long (without market support) and didn't work:

TSLA triggered short (with market support) and worked:

Rich's AAPL triggered long (with market support) and worked enough for a partial:

His LNKD triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, and all 4 of them worked.

Stock Picks Recap for 2/5/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, XONE gapped under the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and worked:

His LVLT triggered long (without market support) and didn't work:

His IBM triggered long (without market support) and didn't work:

TSLA triggered short (with market support) and worked:

Rich's AAPL triggered long (with market support) and worked enough for a partial:

His LNKD triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, and all 4 of them worked.

Futures Calls Recap for 2/5/14

Once again, a trade swept the trigger and stopped before triggering again and working. See ES section below. NASDAQ volume was 2.0 billion shares, and the market filled the gap from the prior session.

Net ticks: +0 ticks.

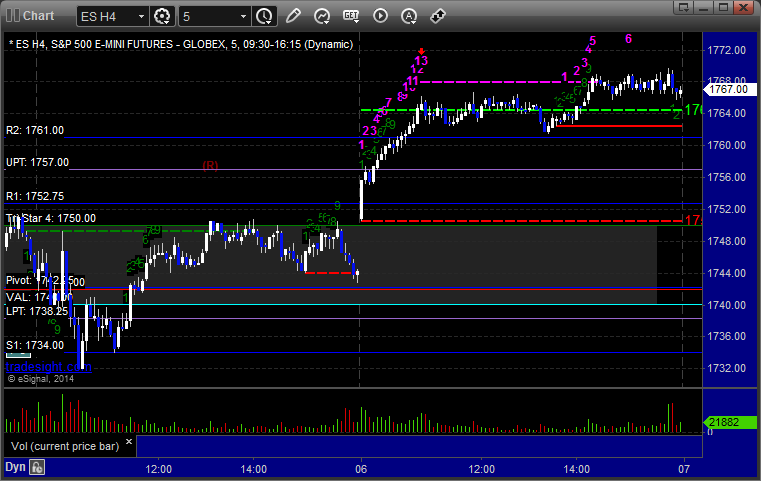

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at 1737.00 at A and stopped for 7 ticks. Took it again and hit first target for 6 ticks and stopped second half 7 ticks in the money:

Forex Calls Recap for 2/5/14

A dull session with a strange trigger. See GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines, notice how flat most of the session was:

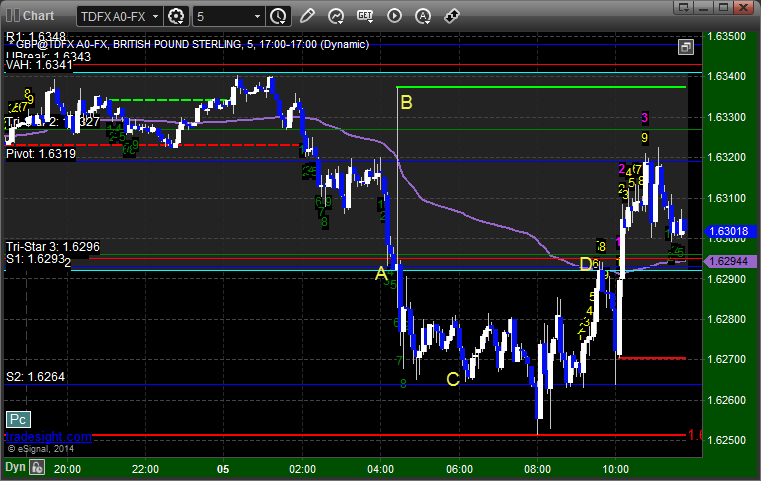

GBPUSD:

The GBPUSD was right at our short trigger when the news hit, and you'll notice a spike from the trigger at A to B. These spikes have been rare over the last couple of years, but we have seen a couple the last few weeks for whatever reason. Depending on how your orders were staggered and how far you spaced the stops and limits on your entries and how you got filled, you could have entered parts of the trade before the spike or parts after. Either way, at best, part of the trade worked to the first target at C before stopping anything left over D, and that's not counting whatever stopped on the spike to B. This is why you never want to be right at a trade trigger when news hits:

Forex Calls Recap for 2/5/14

A dull session with a strange trigger. See GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines, notice how flat most of the session was:

GBPUSD:

The GBPUSD was right at our short trigger when the news hit, and you'll notice a spike from the trigger at A to B. These spikes have been rare over the last couple of years, but we have seen a couple the last few weeks for whatever reason. Depending on how your orders were staggered and how far you spaced the stops and limits on your entries and how you got filled, you could have entered parts of the trade before the spike or parts after. Either way, at best, part of the trade worked to the first target at C before stopping anything left over D, and that's not counting whatever stopped on the spike to B. This is why you never want to be right at a trade trigger when news hits: