Tradesight January 2014 Forex Results

Before we get to January’s numbers, here is a short reminder of the results from December. The full report from December can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for December 2013

Number of trades: 24

Number of losers: 10

Winning percentage: 58.3%

Worst losing streak: 3 in a row

Net pips: +95 pips

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for January 2014

Number of trades: 27

Number of losers: 15

Winning percentage: 55.5%

Worst losing streak: 4 in a row

Net pips: +155 pips

Despite the fact that the US Dollar Index has been in a one and a half point range for 3 months and ranges have been poor, we continue to scratch out winners. Our trading system simply works, even when things aren't as exciting as they could be. I'll leave it at that for January. We hope for better ranges in February so we can get back to full size. It would be nice if the US Dollar Index would break the range either way.

Tradesight January 2014 Futures Results

Before we get to January’s numbers, here is a short reminder of the results from December. The full report from December can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for December 2013

Number of trades: 17

Number of losers: 10

Winning percentage: 58.8%

Net ticks: +23 ticks

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for January 2014

Number of trades: 29

Number of losers: 15

Winning percentage: 51.7%

Net ticks: -1 tick

Even though volume came back heavy in the stock market, the indices didn't move around as much as you would have expected, which leads to poor futures trading action. Since stocks were so good and easy to trade, we concentrated more there. Several calls this month that triggered once and stopped went on to work great on a second trigger, but we didn't call the retrigger because there was so much else to do. Still, we finally got a clean Comber signal on the last day of the month on the ES that gave us a nice winner. Very few trades prior to that followed through beyond the first target even if they worked. In general, it's an unexciting month for futures to start the year unless you really sat down to focus on it using the techniques taught in the course. Those that trade other asset classes should have found stocks and Forex easier to make money.

Stock Picks Recap for 1/31/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TKMR gapped over, no play unfortunately.

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered long (with market support) and worked enough for a partial:

His GLD triggered long (ETF, so no market support needed) and didn't work:

None of the other calls triggered.

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Stock Picks Recap for 1/31/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TKMR gapped over, no play unfortunately.

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered long (with market support) and worked enough for a partial:

His GLD triggered long (ETF, so no market support needed) and didn't work:

None of the other calls triggered.

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 1/31/14

My early call on the NQ didn't trigger, but we took a short on the ES using our Comber tool that worked well. See that section below. NASDAQ volume closed at 2.1 billion shares, surging in the last 20 minutes after being slow mid-day.

Net ticks: +26 ticks.

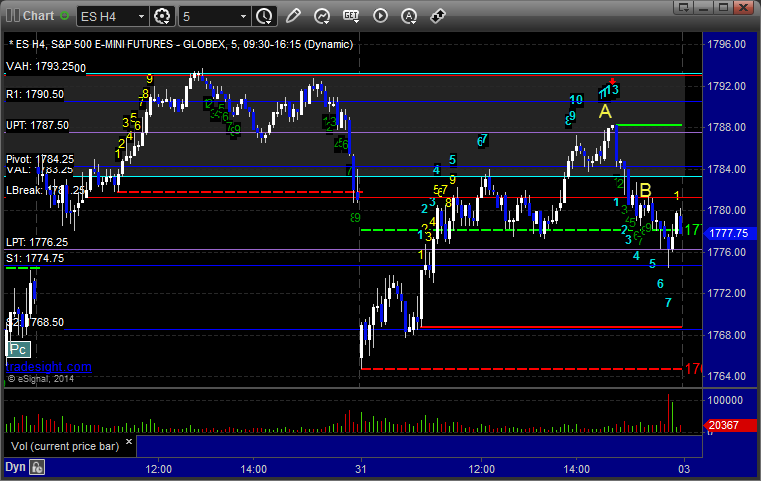

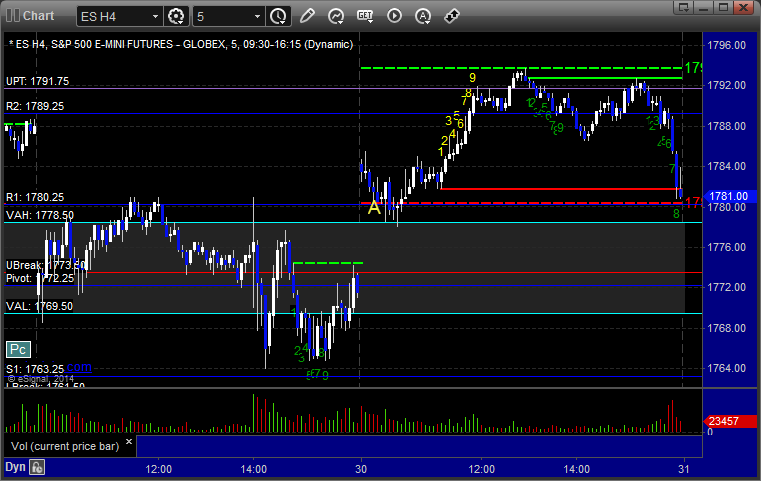

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

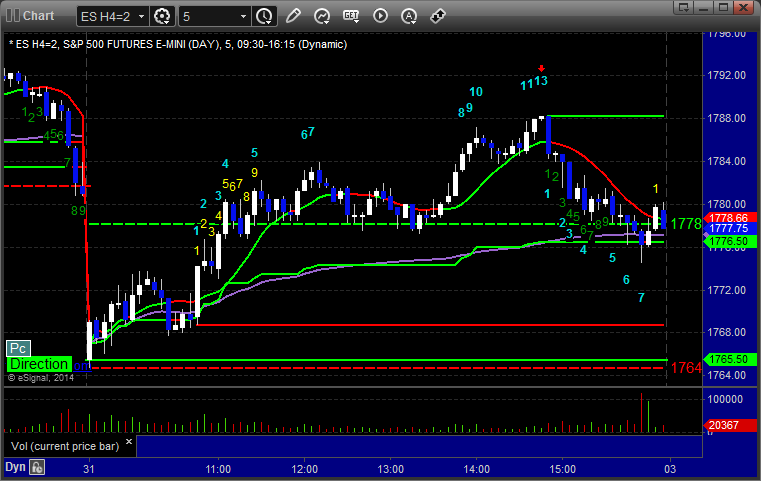

ES:

Posted a call to short the ES at 1788 on the Comber 13 sell signal on the 5-minute chart at A. Trade worked beautifully and closed at 1781.50 at B:

Forex Calls Recap for 1/31/14

Closed out a nice winner from the prior session (see EURUSD below) and had basically a flat trade on the GBPUSD (see that section) to wrap the week and month.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Nothing at all new to see.

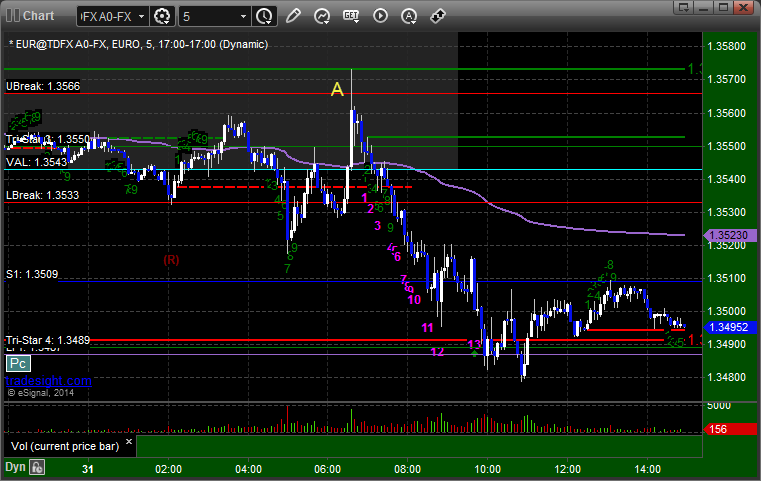

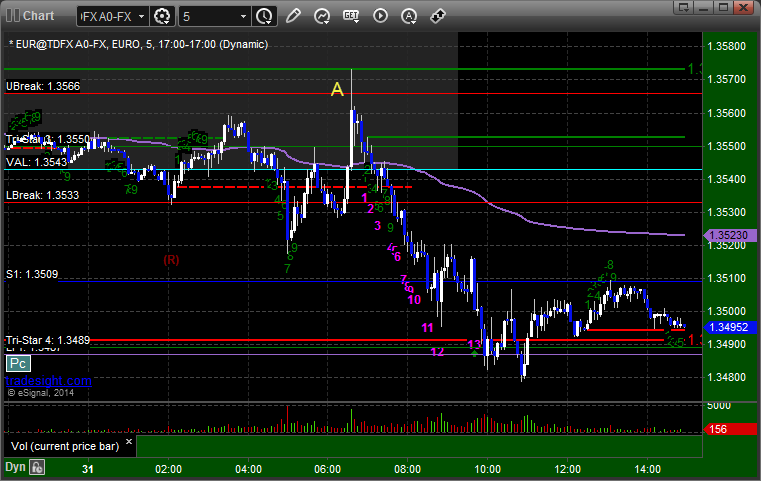

EURUSD:

Unfortunately, our EURUSD short from the prior session stopped on a spike at A. It was well in the money, but without that spike would have been even better:

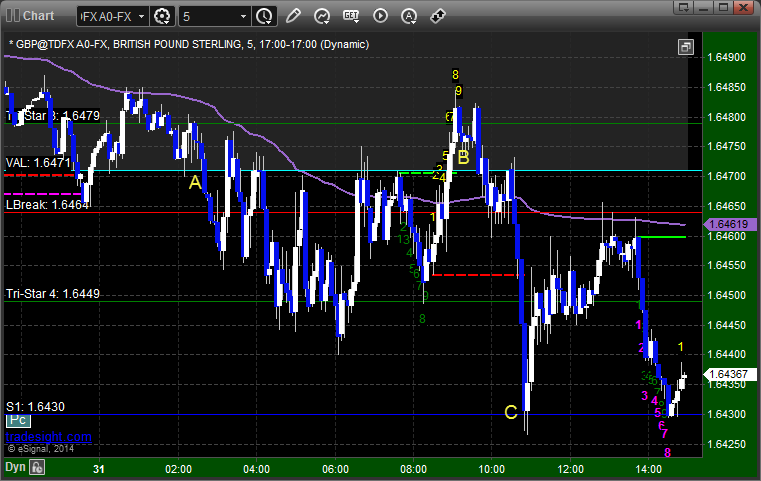

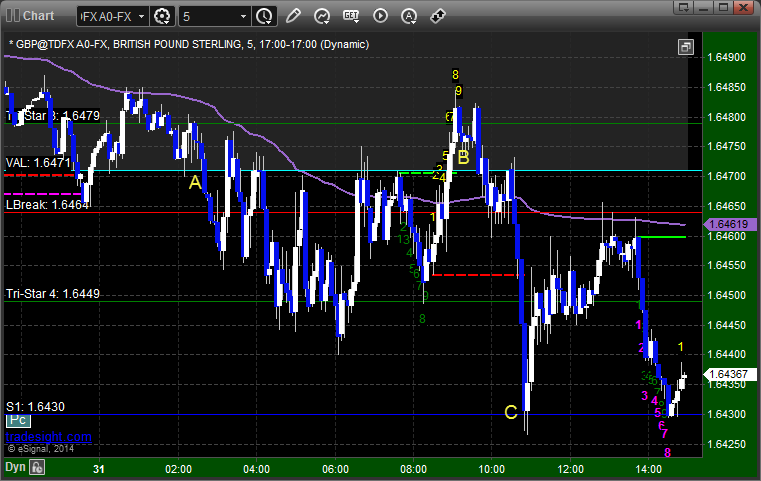

GBPUSD:

New call triggered short at A, didn't hit first target overnight. I woke up and it was above the trigger after all of that, so I closed at B for a couple of pips loss. Ultimately, it would have worked to the first target at C:

Forex Calls Recap for 1/31/14

Closed out a nice winner from the prior session (see EURUSD below) and had basically a flat trade on the GBPUSD (see that section) to wrap the week and month.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Nothing at all new to see.

EURUSD:

Unfortunately, our EURUSD short from the prior session stopped on a spike at A. It was well in the money, but without that spike would have been even better:

GBPUSD:

New call triggered short at A, didn't hit first target overnight. I woke up and it was above the trigger after all of that, so I closed at B for a couple of pips loss. Ultimately, it would have worked to the first target at C:

Stock Picks Recap for 1/30/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PRXL and AUXL gapped over, no triggers unfortunately.

TRMK triggered short (with market support) and worked enough for a partial:

SKYW triggered short (with market support) and didn't do enough either way to count, closed near the trigger:

From the Messenger/Tradesight_st Twitter Feed, TSLA triggered long (without market support) and worked:

NFLX triggered long (with market support) and worked:

GOOG triggered long (with market support) and didn't work initially, worked later ahead of earnings:

BIDU triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 1/30/14

Another not-so-interesting session on a gap up during earnings. Three trades trigger, 2 winners, and 1 loser. See ES and NQ sections below.

Net ticks: -2.5 ticks.

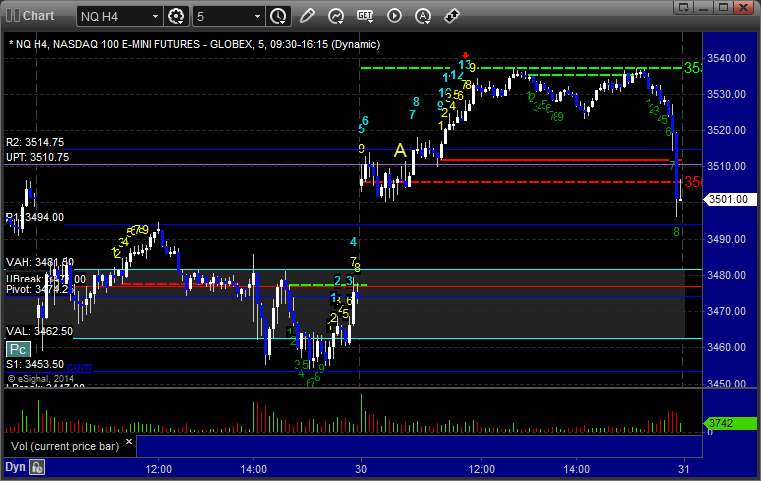

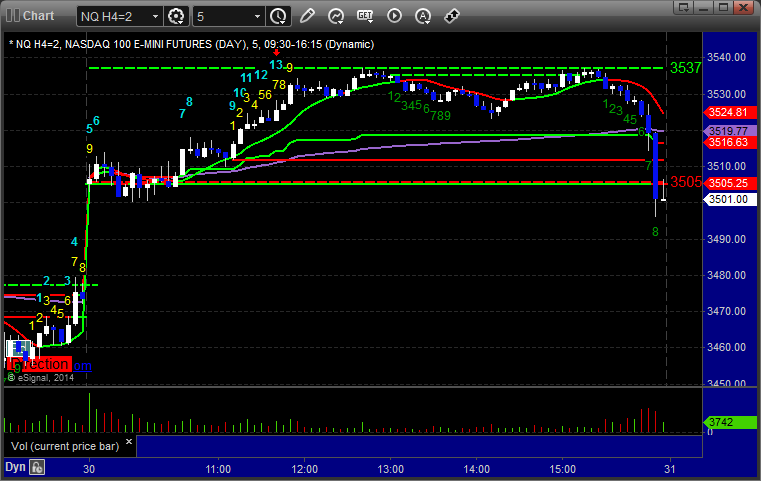

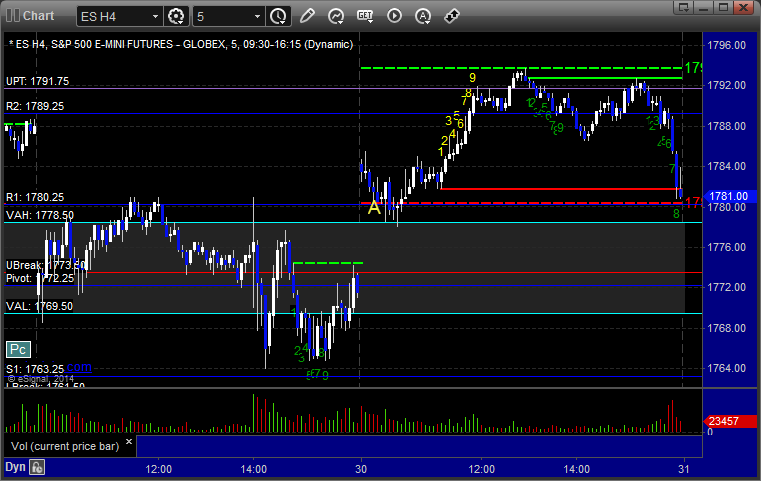

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1780.00 and stopped for 7 ticks. Triggered again, hit first target, second half stopped over entry. The better play was the cup and handle long breakout over 1785.50:

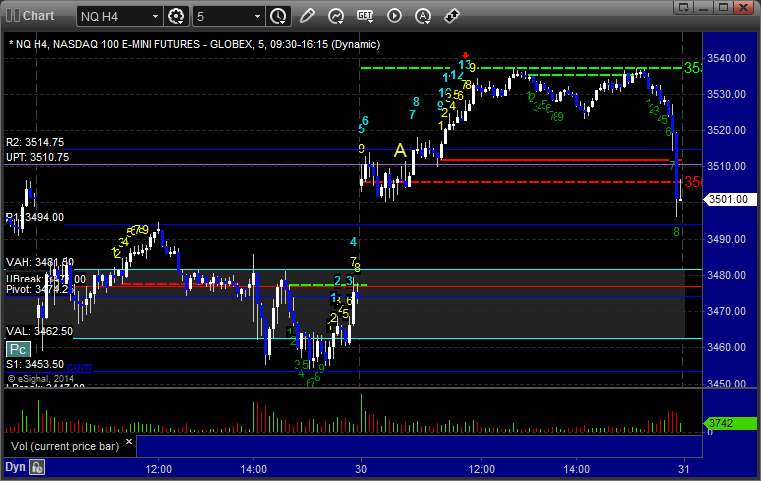

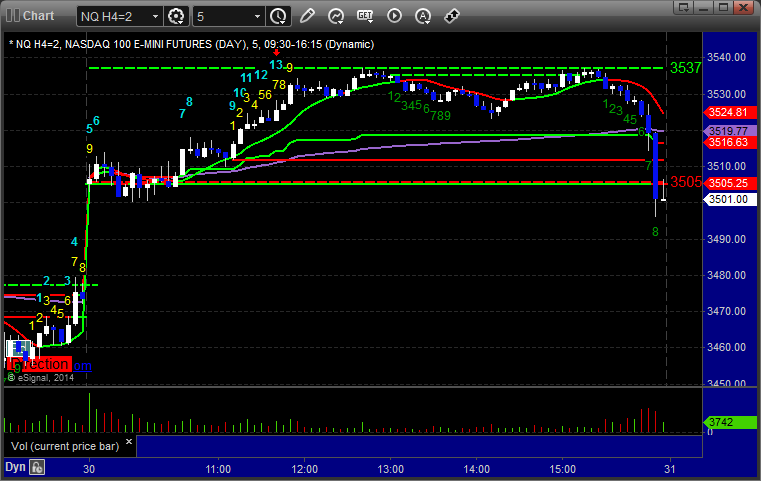

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered long at 3515.00 at A, hit first target for 6 ticks, and stopped second half under the entry:

Futures Calls Recap for 1/30/14

Another not-so-interesting session on a gap up during earnings. Three trades trigger, 2 winners, and 1 loser. See ES and NQ sections below.

Net ticks: -2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1780.00 and stopped for 7 ticks. Triggered again, hit first target, second half stopped over entry. The better play was the cup and handle long breakout over 1785.50:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered long at 3515.00 at A, hit first target for 6 ticks, and stopped second half under the entry: