Forex Calls Recap for 1/30/14

We had a nice winner short the EURUSD that is still going and currently about 100 pips in the money. See that section below. The market didn't really even spike on the GDP number.

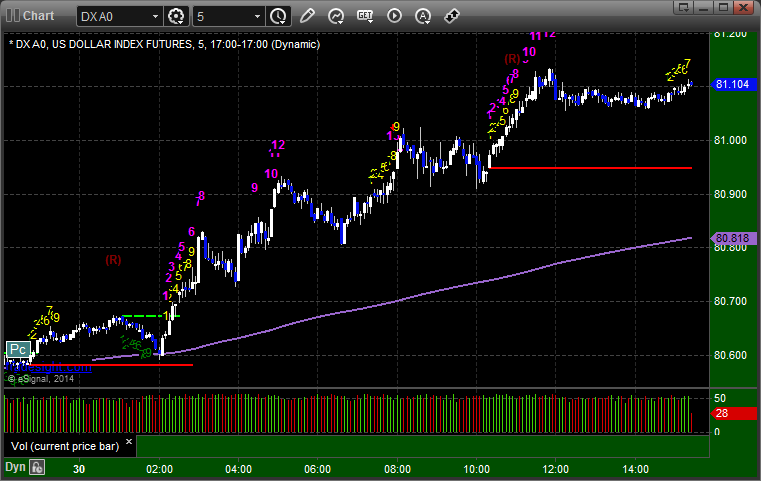

Here's a look at the US Dollar Index intraday with our market directional lines:

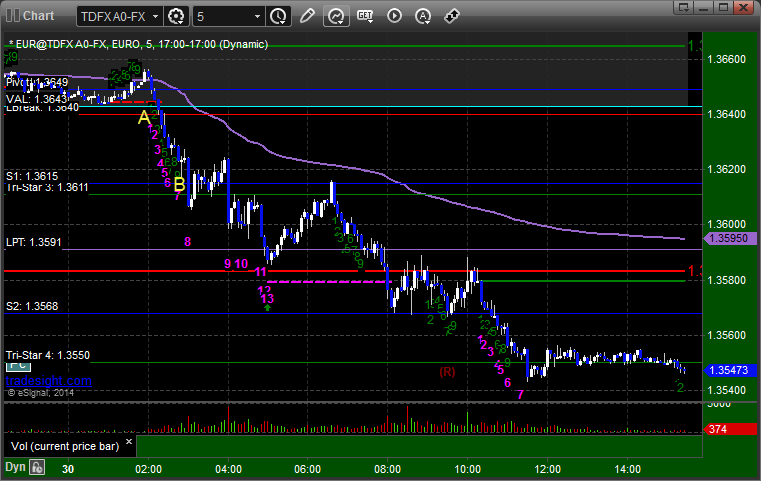

EURUSD:

Triggered short at A, hit first target at B, still holding with a stop over S2:

Forex Calls Recap for 1/30/14

We had a nice winner short the EURUSD that is still going and currently about 100 pips in the money. See that section below. The market didn't really even spike on the GDP number.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, still holding with a stop over S2:

Stock Picks Recap for 1/29/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Our usual rule for Fed announcement days is to do little trading and wait for the Fed. We added some intraday calls today because of the gap on the news out of Turkey but would have been much better sitting. It's just not worth trading the Fed meeting sessions heavily.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's MDVN triggered short (with market support) and worked enough for a partial:

His FDX triggered short (with market support) and didn't work:

His GDX triggered long (ETF, so no market support needed) and didn't work:

AAPL triggered short (without market support) and worked:

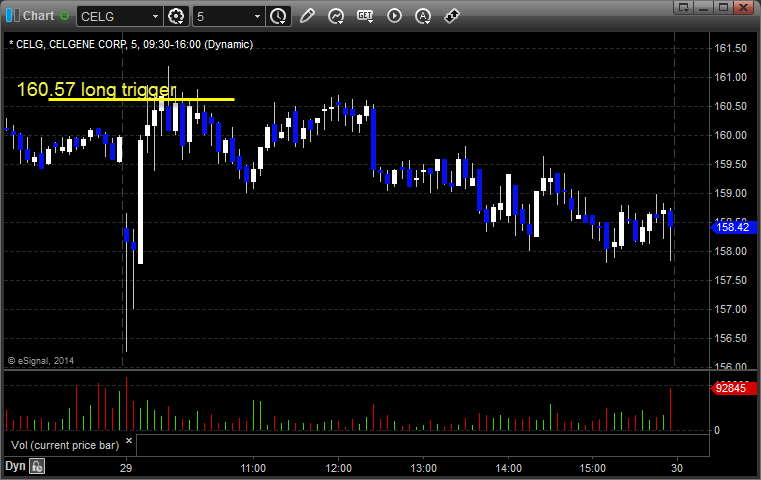

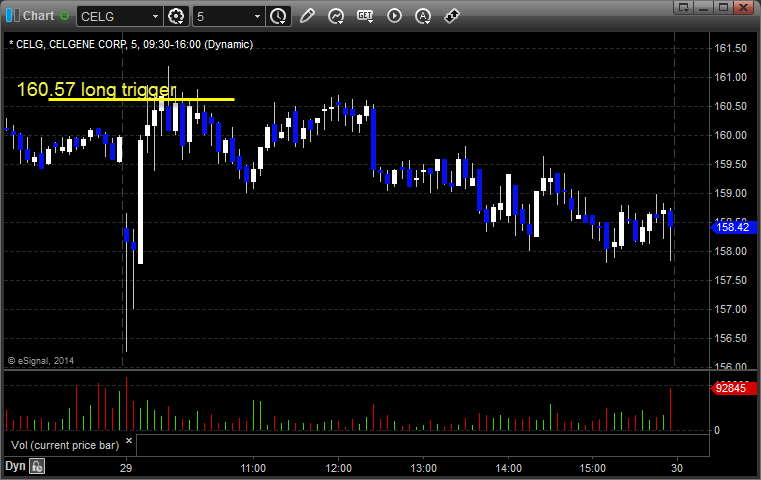

CELG triggered long (with market support) and didn't work:

Rich's NKE triggered short (with market support) and didn't work:

His PCLN triggered short (with market support) and worked:

FB triggered short (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 2 of them worked, 5 did not.

Stock Picks Recap for 1/29/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Our usual rule for Fed announcement days is to do little trading and wait for the Fed. We added some intraday calls today because of the gap on the news out of Turkey but would have been much better sitting. It's just not worth trading the Fed meeting sessions heavily.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's MDVN triggered short (with market support) and worked enough for a partial:

His FDX triggered short (with market support) and didn't work:

His GDX triggered long (ETF, so no market support needed) and didn't work:

AAPL triggered short (without market support) and worked:

CELG triggered long (with market support) and didn't work:

Rich's NKE triggered short (with market support) and didn't work:

His PCLN triggered short (with market support) and worked:

FB triggered short (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 2 of them worked, 5 did not.

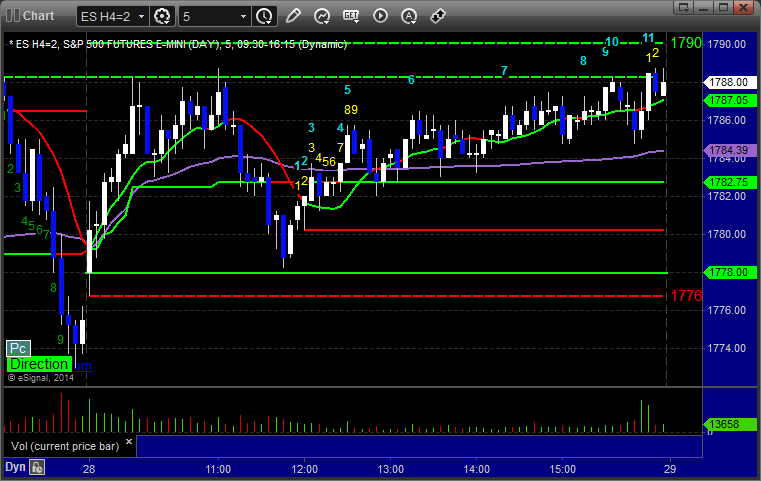

Futures Calls Recap for 1/29/14

What should have been one of the least interesting days of the year waiting for the Fed turned into one of the choppiest days in a while after the Turkish Central Bank took extreme steps to protect their currency. We ended up with a gap down in the market and some extremely wild (though still somewhat narrow) swings back and forth early, then slowed down until the Fed, and then spiked both ways again, settling on a downward direction for a bit, and then rising to close on the VWAP after all of that. NASDAQ volume was 2 billion shares. See ES and NQ sections below for trade recaps.

Net ticks: -8 ticks.

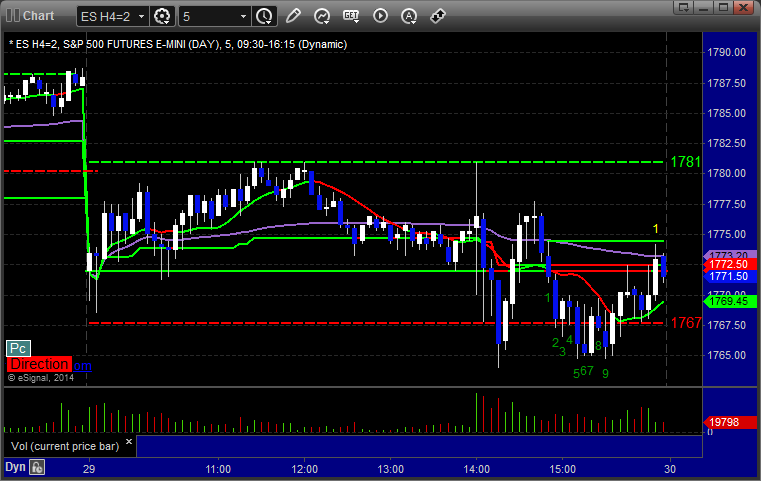

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

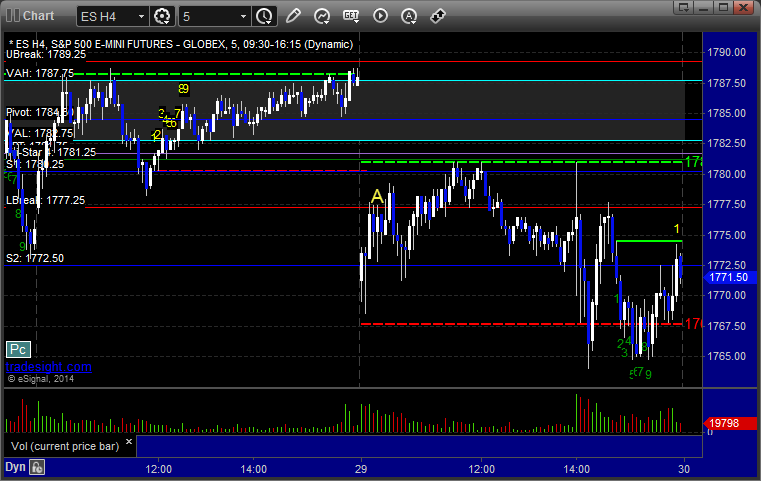

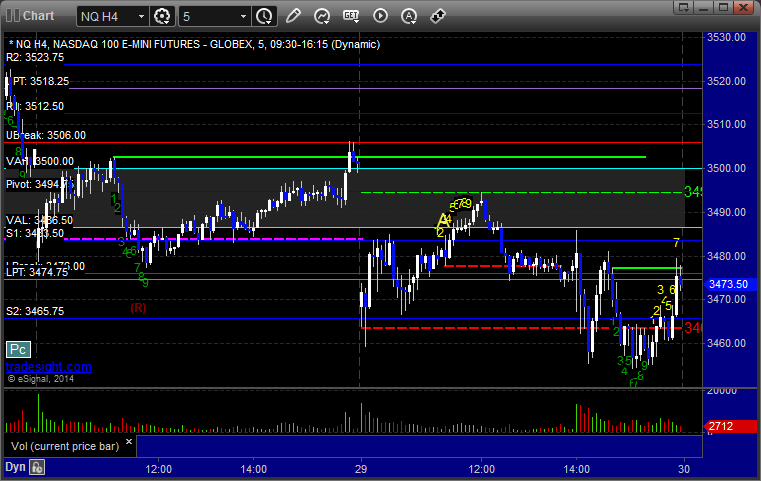

ES:

Triggered long at A at 1778.00 and stopped for 7 ticks. Put it right back in and it triggered again and came within a tick of the first target but then stopped:

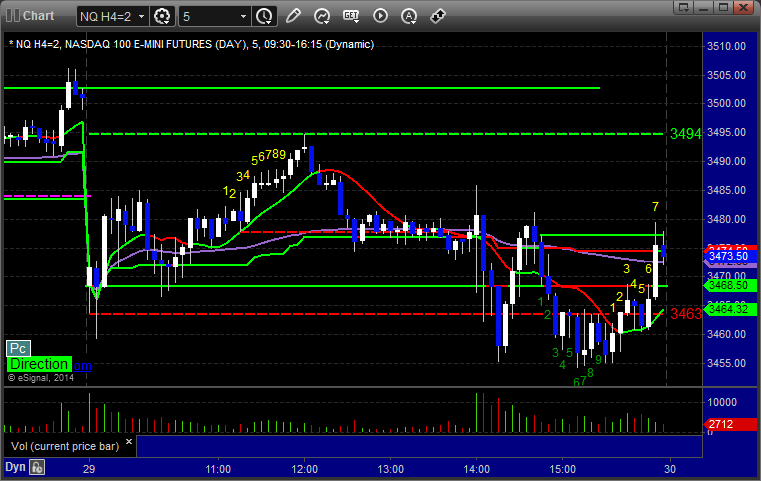

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered long at 3487.00 at A, hit first target for 6 ticks, and stopped second half at the same number, 6 ticks in the money:

Forex Calls Recap for 1/29/14

Ahead of the Fed meeting, we triggered a trade in the EURUSD that worked to the first target exactly and nothing beyond. See that section below. The market then returned to the starting point. The Fed announcement itself did little to move the pairs.

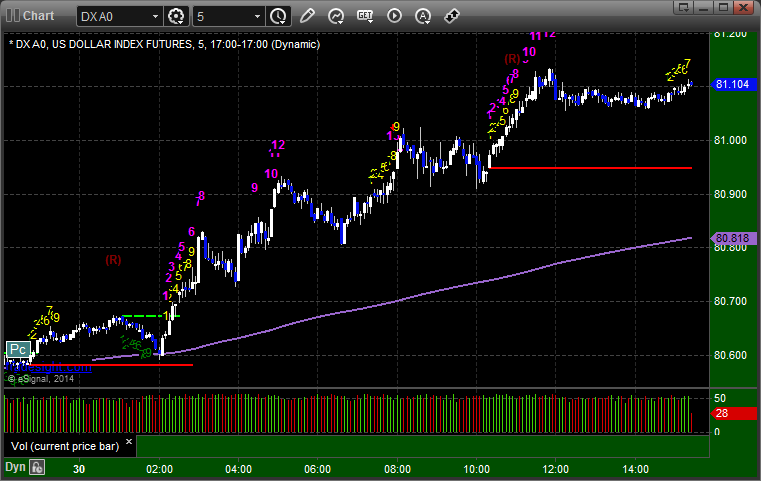

Here's a look at the US Dollar Index intraday with our market directional lines:

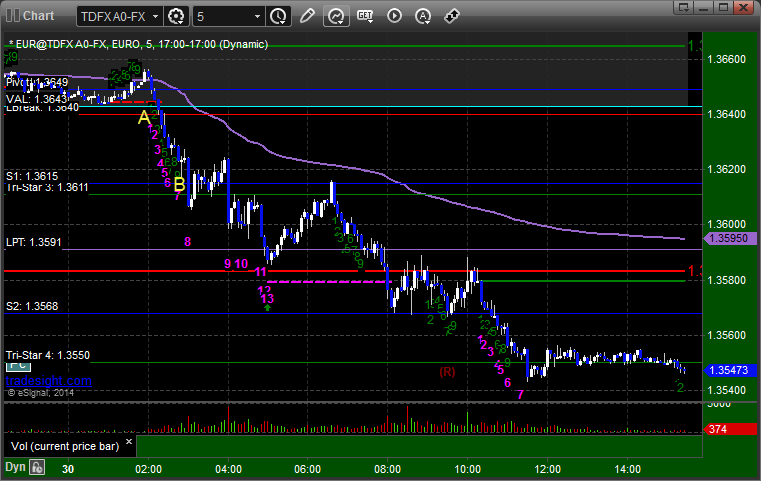

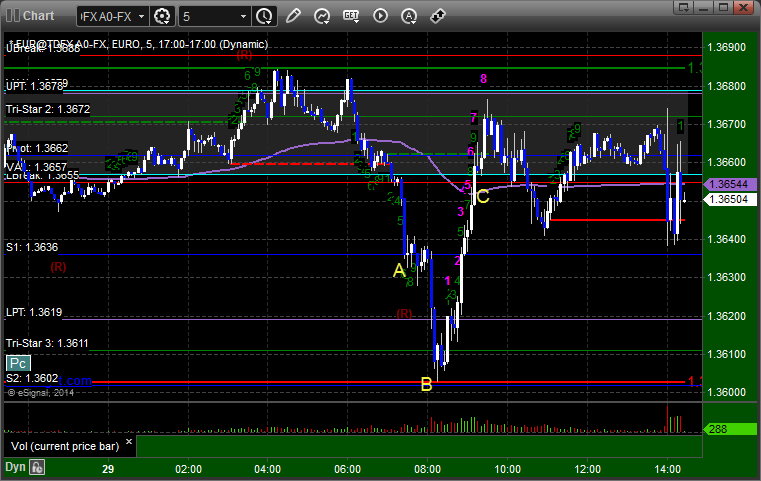

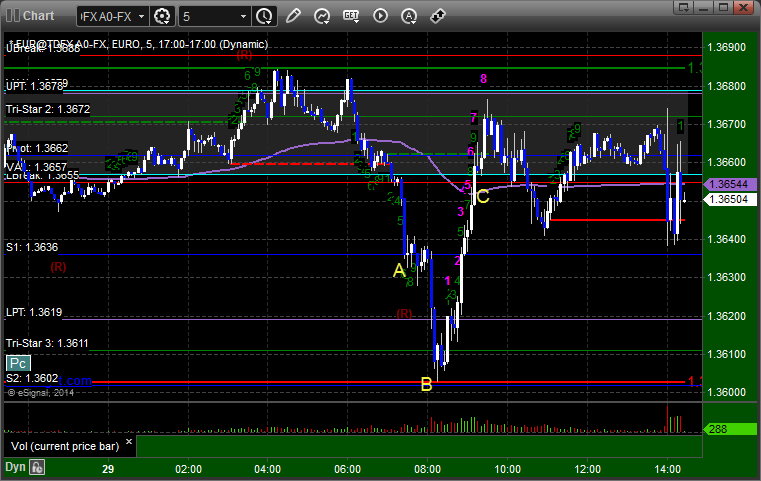

EURUSD:

Triggered short at A, hit first target at B, woke up and closed at C because it was above the entry but hadn't quite reached the non-adjusted stop (if you were awake, should have adjusted stop just over the entry):

Forex Calls Recap for 1/29/14

Ahead of the Fed meeting, we triggered a trade in the EURUSD that worked to the first target exactly and nothing beyond. See that section below. The market then returned to the starting point. The Fed announcement itself did little to move the pairs.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, woke up and closed at C because it was above the entry but hadn't quite reached the non-adjusted stop (if you were awake, should have adjusted stop just over the entry):

Stock Picks Recap for 1/28/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EA triggered long (without market support due to opening 5 minutes) and worked enough for a partial if you wanted to grab it:

From the Messenger/Tradesight_st Twitter Feed, Rich's DDD triggered long (with market support) and worked:

His CAT triggered long (with market support) and worked:

TWTR triggered long (with market support) and worked:

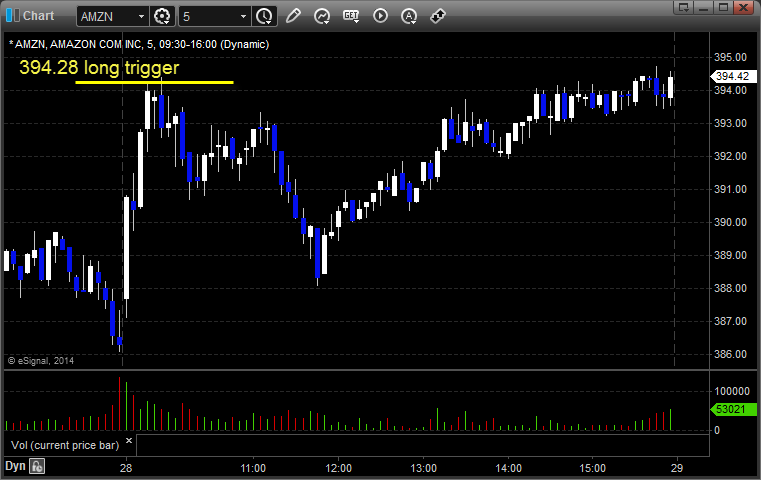

AMZN triggered long (with market support) and didn't work:

Several other nice calls didn't trigger in a flat session.

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 1/28/14

A winner and a loser for about a wash on the NQ. The NASDAQ side gapped down due to AAPL and the broad market gapped up and never filled. The action was early as expected as the market settled in for the Fed announcement Wednesday. NASDAQ volume was 1.9 billion shares.

Net ticks: -1 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered long at A at 3492.50 and stopped for 7 ticks. He re-entered and it triggered, hit first target for 6 ticks, and stopped at the same point:

Forex Calls Recap for 1/28/14

We closed out the prior session's long at a nice gain after a new long triggered and worked a little, and then a short stopped out. Lots of action for nothing.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

The new long triggered at A, hit first target at B, and the second half stopped (whether you were awake to adjust or not). The second half of the prior day's long then stopped at C in the money. The short triggered at D and stopped: