Forex Calls Recap for 1/16/14

Another winner that hit the first target exactly to the pip but nothing more. See GBPUSD below. We were less than half size ahead of the CPI anyway.

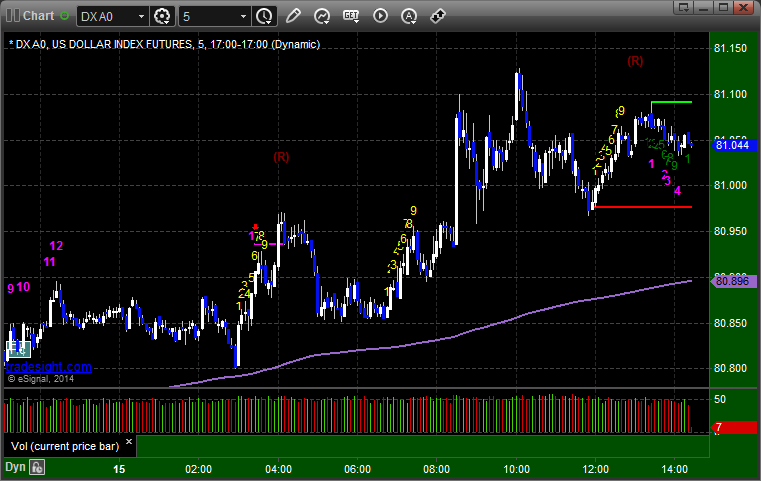

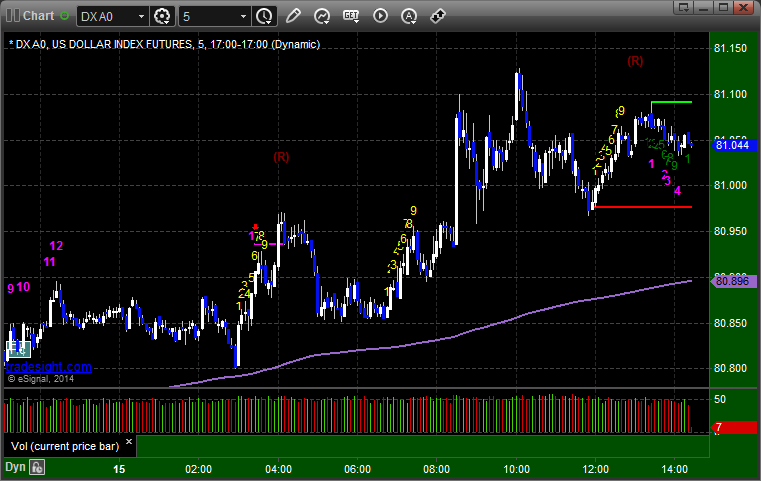

Here's a look at the US Dollar Index intraday with our market directional lines:

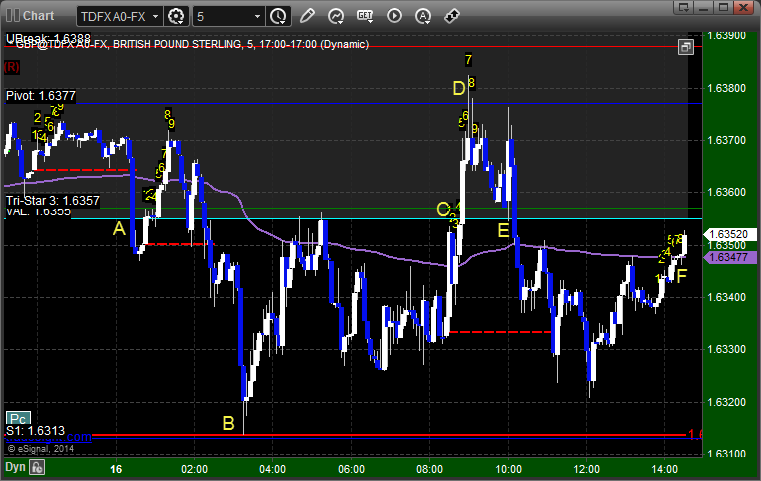

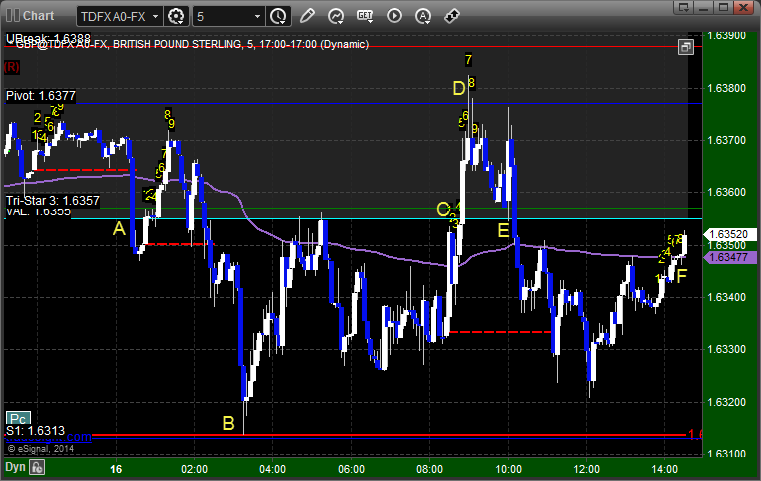

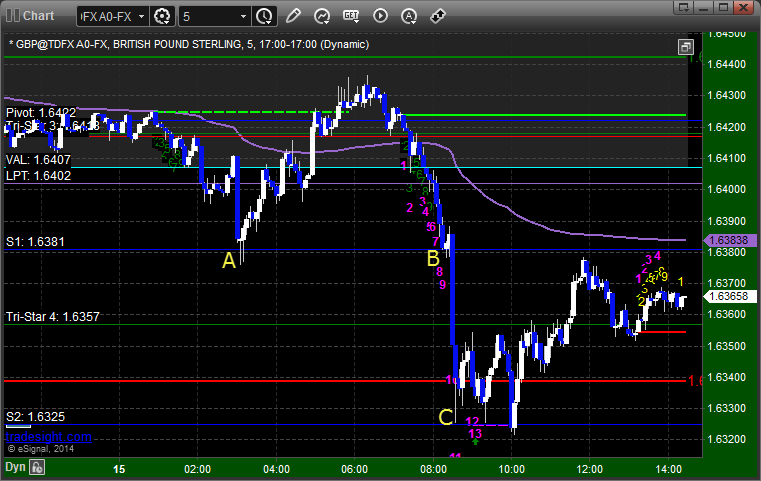

GBPUSD:

Triggered short at A, hit first target exactly at B, if you were awake you lowered the stop and stopped at C, otherwise the second half stopped at D. Triggered again at E, didn't hit first target closed at F for end of session:

Forex Calls Recap for 1/16/14

Another winner that hit the first target exactly to the pip but nothing more. See GBPUSD below. We were less than half size ahead of the CPI anyway.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target exactly at B, if you were awake you lowered the stop and stopped at C, otherwise the second half stopped at D. Triggered again at E, didn't hit first target closed at F for end of session:

Stock Picks Recap for 1/15/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SYNA triggered long (with market support) and didn't work initially, worked later:

SLAB triggered long (without market support due to opening 5 minutes) and worked great:

BABY gapped over the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, CERN triggered long (with market support) and worked enough for a partial:

NFLX triggered short (without market support) and initially didn't work, but we took the next breakdown again that worked huge for the session:

Rich's DDD triggered short (without market support) and worked:

His BIDU triggered short (without market support) and didn't work:

Nothing else triggered.

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not, but NFLX was the real winner.

Stock Picks Recap for 1/15/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SYNA triggered long (with market support) and didn't work initially, worked later:

SLAB triggered long (without market support due to opening 5 minutes) and worked great:

BABY gapped over the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, CERN triggered long (with market support) and worked enough for a partial:

NFLX triggered short (without market support) and initially didn't work, but we took the next breakdown again that worked huge for the session:

Rich's DDD triggered short (without market support) and worked:

His BIDU triggered short (without market support) and didn't work:

Nothing else triggered.

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not, but NFLX was the real winner.

Futures Calls Recap for 1/15/14

A winner on the ES after the market gapped up and pushed higher for the session. See that section below. NASDAQ volume was 1.9 billion shares.

Net ticks: +6.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

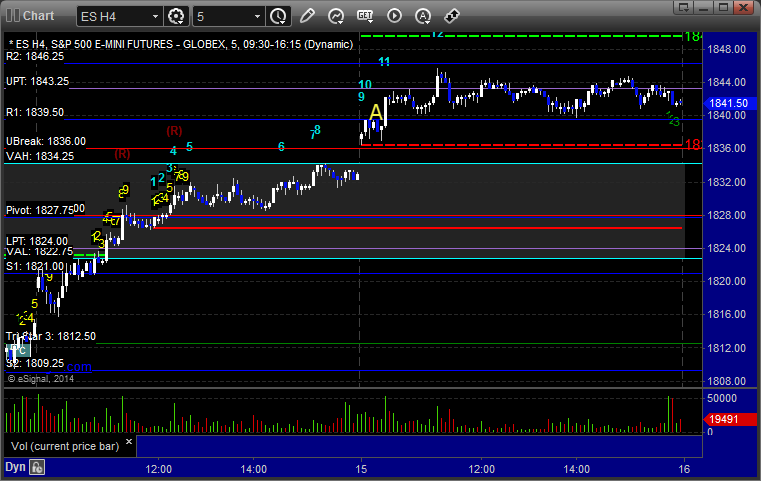

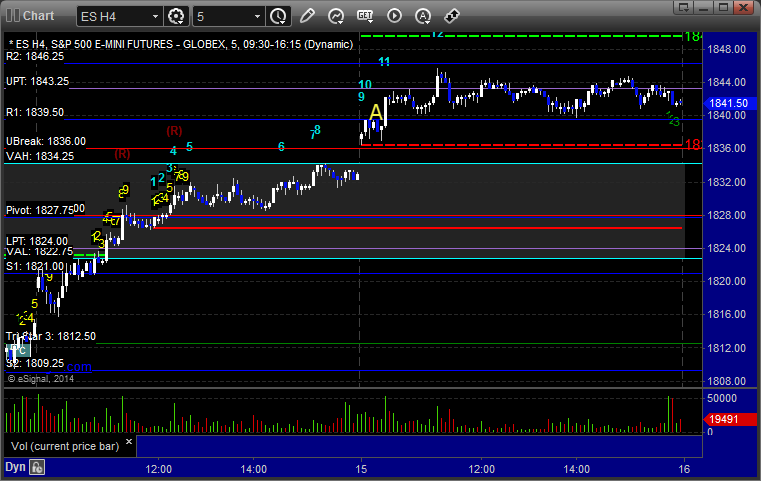

ES:

Triggered long at A at 1839.75, hit first target for 6 ticks, moved stop twice and stopped final piece in the money at 1841.50:

Futures Calls Recap for 1/15/14

A winner on the ES after the market gapped up and pushed higher for the session. See that section below. NASDAQ volume was 1.9 billion shares.

Net ticks: +6.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1839.75, hit first target for 6 ticks, moved stop twice and stopped final piece in the money at 1841.50:

Forex Calls Recap for 1/15/14

A nice setup in the GBPUSD that ended up working perfectly to our target, but first swept the trigger and stopped. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

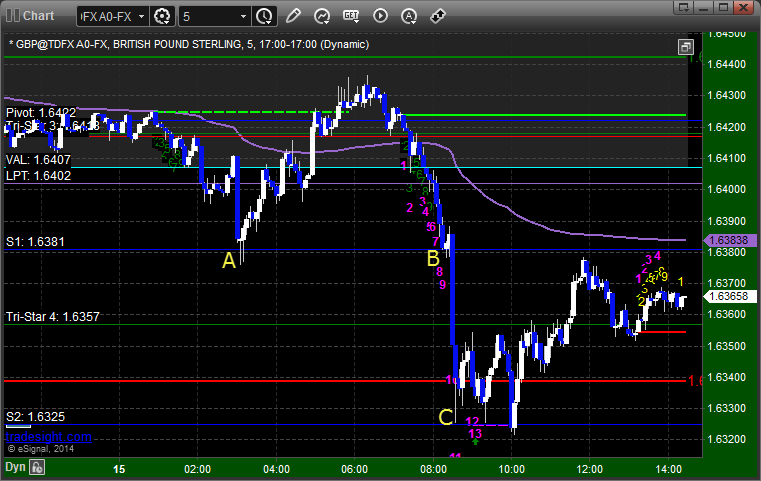

GBPUSD:

Came down and fully triggered, but just barely, at A, and stopped. If you were awake, that trade goes back in and triggers cleanly at B and hit first target exactly at C:

Forex Calls Recap for 1/15/14

A nice setup in the GBPUSD that ended up working perfectly to our target, but first swept the trigger and stopped. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Came down and fully triggered, but just barely, at A, and stopped. If you were awake, that trade goes back in and triggers cleanly at B and hit first target exactly at C:

Stock Picks Recap for 1/14/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, RPTP triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's LULU triggered short (with market support) and didn't work (before the market reversed up):

His XONE triggered short (with market support) and worked:

His HD triggered short (with market support) and worked enough for a partial:

CELG triggered short (without market support) and didn't work:

Nothing else triggered from the calls.

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Stock Picks Recap for 1/14/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, RPTP triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's LULU triggered short (with market support) and didn't work (before the market reversed up):

His XONE triggered short (with market support) and worked:

His HD triggered short (with market support) and worked enough for a partial:

CELG triggered short (without market support) and didn't work:

Nothing else triggered from the calls.

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.