Futures Calls Recap for 1/14/14

Two days in a row with a stop out that if we'd taken the retrigger, we would have done great. But, the action is coming well after the first hour, which is unusual. NASDAQ volume was 1.8 billion shares.

Net ticks: -7 ticks.

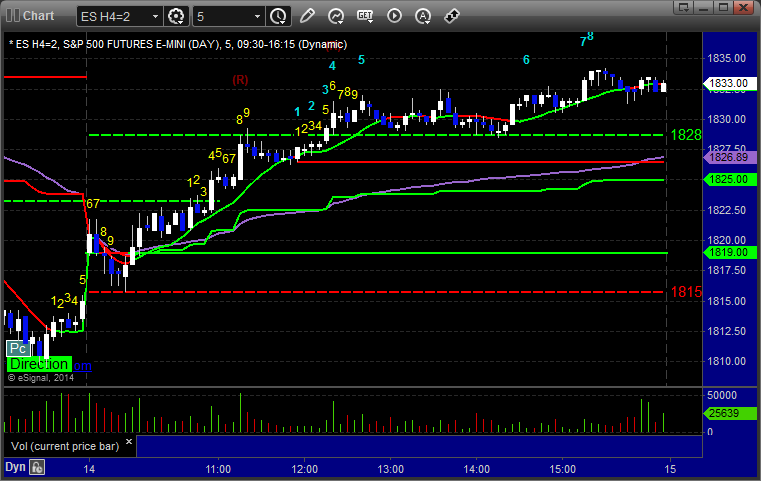

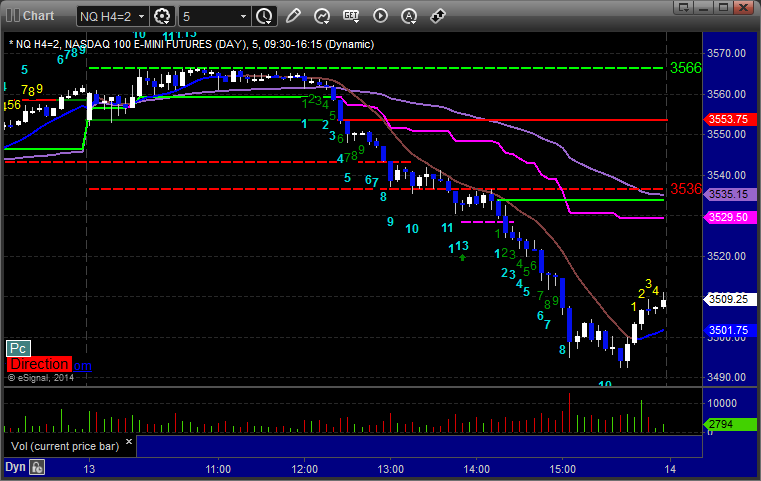

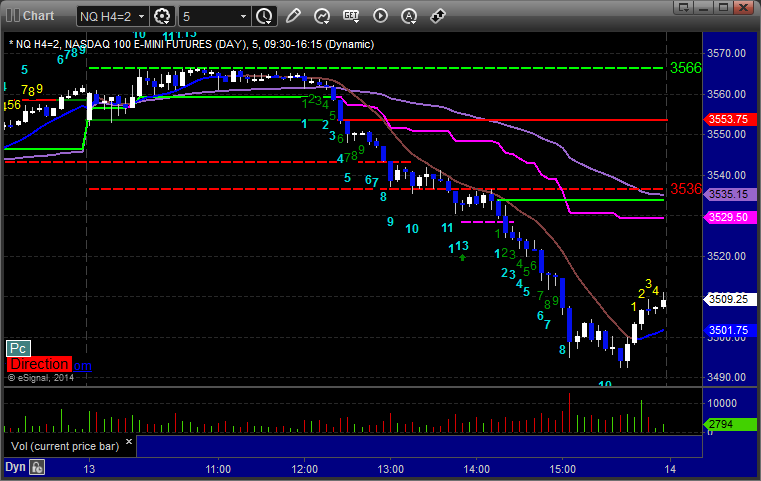

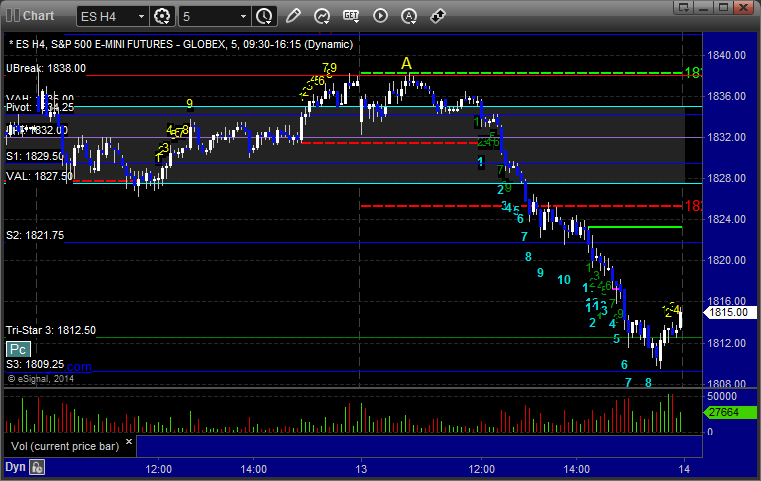

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1822.50 and stopped. Didn't put it back in, but it would have worked:

Forex Calls Recap for 1/14/14

A quick winner (that you could have done 3 times in one session) on the GBPUSD, but no continuation. See that section below.

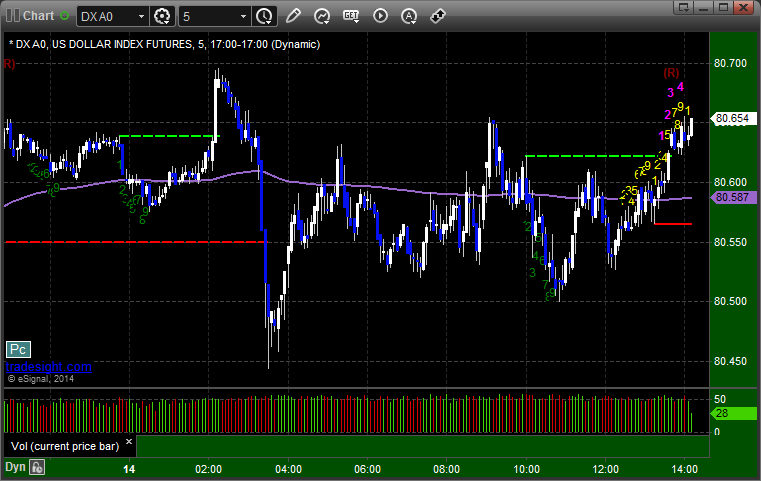

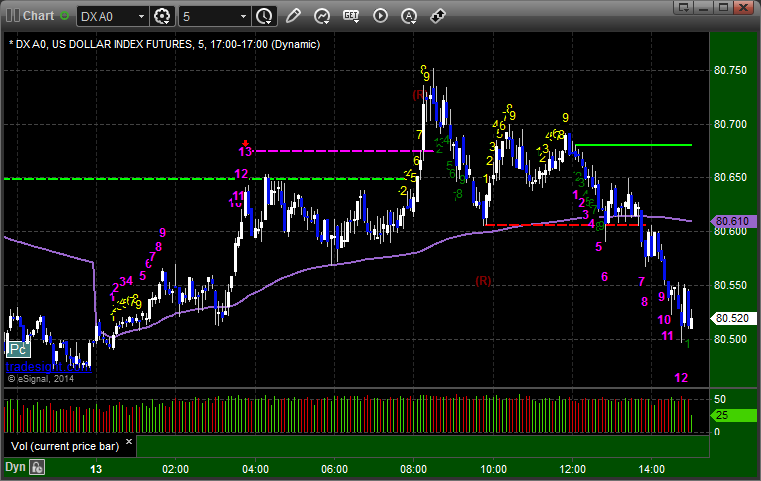

Here's a look at the US Dollar Index intraday with our market directional lines:

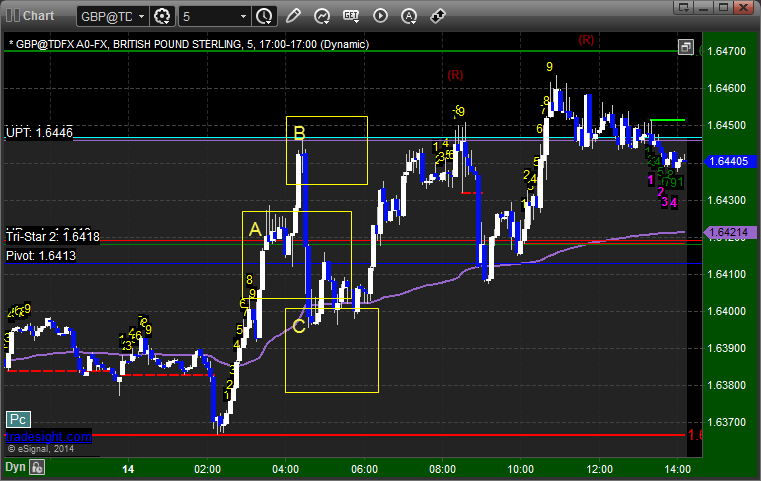

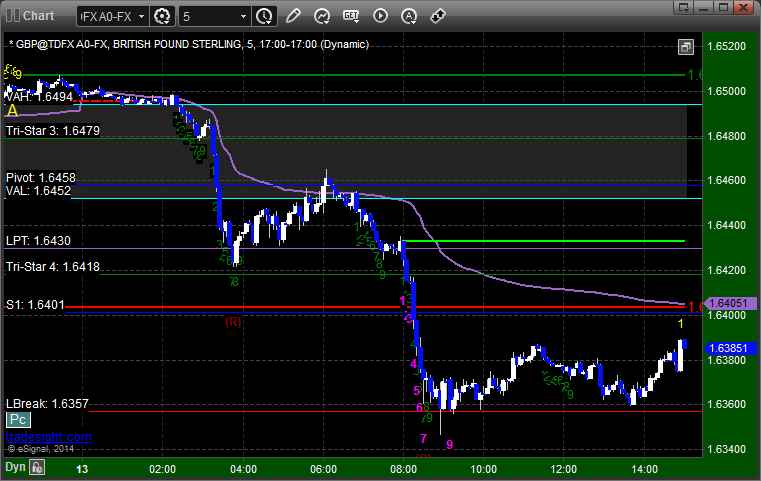

GBPUSD:

Triggered long at A, hit first target exactly at B, stopped second half at C (should have adjusted under the entry if you were aware). The same call would have been valid again and worked two more times, which is unique:

Stock Picks Recap for 1/13/14

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BIIB triggered long (without market support due to opening 5 minutes) and spiked for a couple of points but came right back:

NKTR triggered long (with market support) and didn't work:

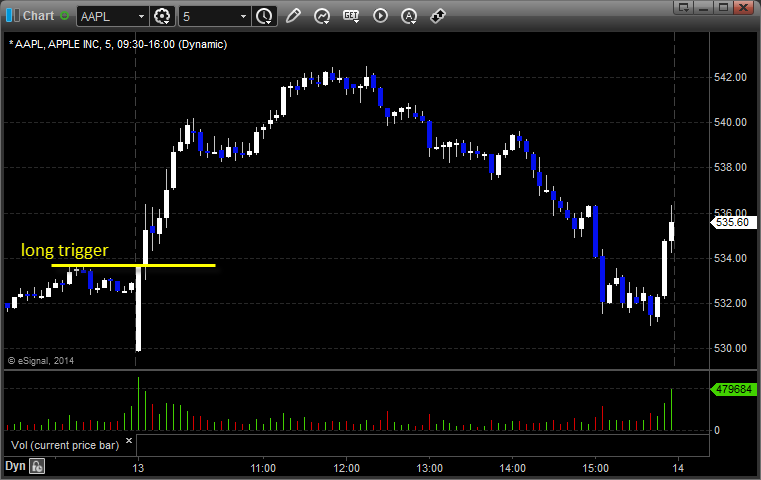

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (with market support) and worked:

His GOOG triggered long (without market support due to opening 5 minutes) and worked big:

SHLD triggered short (without market support) and didn't work early, but triggered much cleaner with market support later and worked:

FSLR triggered short (with market support) and worked:

Rich's MA triggered short (with market support) and worked:

GS triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 1/13/14

One call stopped and the market was so dull for the first 90 minutes that we didn't have any calls on the short side. ES < LPT was set and would have worked great, for example. See that section below.

Net ticks: -7 ticks.

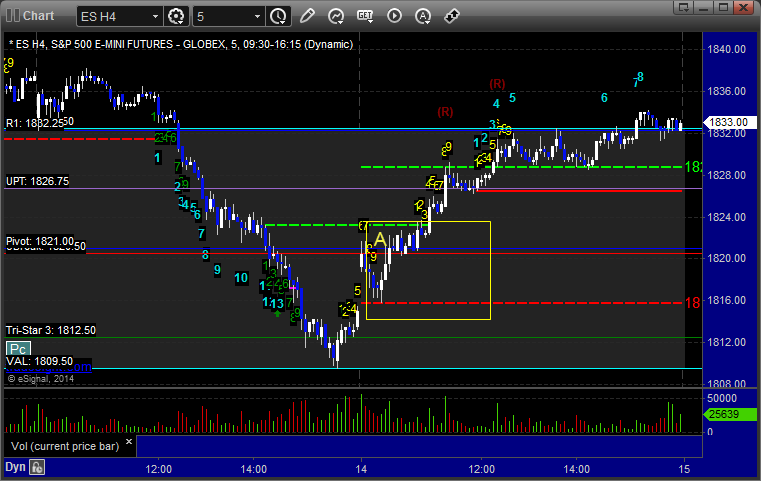

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

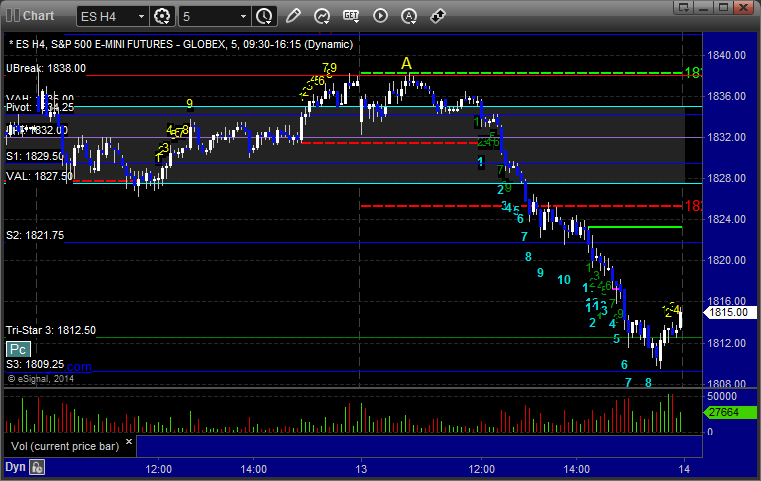

ES:

Mark's call triggered long at A at 1838.25 and stopped:

Futures Calls Recap for 1/13/14

One call stopped and the market was so dull for the first 90 minutes that we didn't have any calls on the short side. ES < LPT was set and would have worked great, for example. See that section below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1838.25 and stopped:

Forex Calls Recap for 1/13/14

Poor session to start the week with two stop outs. See EURUSD and GBPUSD below. Should have done the GBPUSD short too.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and stopped:

GBPUSD:

Triggered long very early (to the left of this chart) and stopped:

Tradesight Forex End of 2013 Summary and Results

One of the things that I preach when it comes to trading is that it doesn't matter what you do in a day, or a week, or even a month. You're putting together a year. If you can't make money in a year, then your system isn't working. But even a good system is going to come up against an environment for a while that it isn't ideally suited for. And we're now 8 years into our Forex service, and I have always said that each year, I would expect one or two months of losses, and if it is August or September, don't be surprised, because those are typically slow months. In 2012, for example, I believe we had 3 negative months at the end of the year when the Forex markets dried up ahead of the "Fiscal Cliff" nonsense. We still made 700 pips for the year that year.

Our goal is to target a win ratio between 50-60 percent for the YEAR. Our system already keeps stops tight and let's winners run if they want to.

Well, all of that said, 2013 was interesting. The ranges weren't great for parts of the year, including the last four months again. We went half size in August as usual and, like 2012, we never pushed the size back up because of the ranges. That has only happened in 2012 and 2013. And, we only had 1 negative month, which was November. And the bottom line number is quite good. Let's dig in.

In 2013, we had 306 triggers off of our main trade calls (again, if you have taken the courses, you can find much more to do, including trading some of the pairs beyond the EURUSD and GBPUSD, using Value Areas, the Seeker/Comber etc., but this is just about the main calls that we make in the Messenger/Twitter feed). 175 were winners. That’s at 57.2% win ratio, which is in the high side of our targeted range of 50-60%, and I'm frankly shocked that it happened in 2013 with the ranges not ideal.

If you take the 12 months in order, here were the pip gains or losses: +95, -93, +275, +175, +120, +135, +210, +390, +65, +185, +325, and +10.

The net gains for the year were 1892 pips!

You can browse the net results of each month by clicking here and scrolling down.

I am also posting a year-in-review report for all markets that will discuss the trading environment of the markets throughout the year.

Tradesight Futures End of 2013 Summary and Results

My view of trading is always that a successful trading system must have a good risk management system, a good entry procedure, and the opportunity for big winners to occur. Within that, your entry points have to be good enough that you win between 50 and 60 percent of your trades at a minimum. We don't try to build a single day, week, or even month. We try to put together a successful year. At Tradesight, we do that in all asset classes (Stocks, Futures, and Forex), and we increase our size in each market based on the environment.

2013 was not a very exciting year for volume and range in the stock markets, and thus the futures trading was not as robust as we have seen in the past, and I commented on this a few times during the year in articles recommending that futures trading be kept to smaller size until the volume picked up. On average, this was the lightest volume in the markets in almost two decades, and that means that the indices aren't moving much. The futures lead by reflect the indices. We did close out the year with 5 out of 6 months of net gains, but we had a couple of months in the first half of the year where ranges were so poor, the futures market was just a dead end. May in particular was a killer for futures, costing us 76 ticks. We made fewer calls than normal this year.

Our monthly results reflect only our main calls that we make, which is basically the 1 or 2 best setups that we see each day on the major futures contracts based on the stuff that we teach in our courses. I always expect to have a couple of negative months, but we had 4 this year, and the combination of April and May really slowed the year down if you didn't lower your size. My concentration was definitely on stocks with Forex as the second area, but we still track raw results. These do not include Value Area plays, which still managed to work great, and Seeker/Comber signals, which were actually quite awesome when they occurred. I remember one week in the summer where we had 5 days in a row with Comber 13 sell signals on the 5-minute ES, and it was the high of the day each time.

In terms of raw trades, we called 305 trades that triggered in 2013. 175 of those worked, which puts us into our 50-60 percent success range at 57.3%. However, without range, the number of trades that followed through was much lower than normal, so even though we didn't lose more than we would like, there were less big winners. Usually, you'd like to see around 33% losers (with tight stops), 33% small winners, and 33% that make the big money and put you ahead. I would say we had less than 20% of that last category. Net gains for the year add up to 41.5 ticks, although in the second half, it was more like 134 ticks. If volume continues to expand, I expect to make more official calls in 2014, and while I don't need the win ratio to change much, the big difference would be seen if more plays carried forward.

For those that trade futures exclusively, you could certainly have done well playing with the Seeker/Comber lined up against levels as we teach and using the Value Areas, but waiting for that on a couple of symbols is less interesting to me unless I happen to be there when it happens than just trading stocks, which worked great. Let's hope the light volume and narrow ranges are behind us.

Tradesight December 2013 Forex Results

Before we get to December’s numbers, here is a short reminder of the results from November. The full report from November can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for November 2013

Number of trades: 24

Number of losers: 13

Winning percentage: 45.8%

Worst losing streak: 5 in a row

Net pips: -93 pips

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for December 2013

Number of trades: 24

Number of losers: 10

Winning percentage: 58.3%

Worst losing streak: 3 in a row

Net pips: +95 pips

A reasonable end to the year, although not one winner was over 100 pips because the market was fairly flat and contained. Still, happy to drift through the Holidays without issues. Note that the SIX MONTH average daily range on the EURUSD dropped from 89 to 83 pips on the EURUSD and from 113 to 103 on the GBPUSD, which is a big drop for a one month shift. It indicates that things were pretty flat.

Tradesight December 2013 Futures Results

Before we get to December’s numbers, here is a short reminder of the results from November. The full report from November can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for November 2013

Number of trades: 22

Number of losers: 14

Winning percentage: 36%

Net ticks: +35 ticks

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for December 2013

Number of trades: 17

Number of losers: 10

Winning percentage: 58.8%

Net ticks: +23 ticks

That was a poor month with the two weeks of basically wasted activity with Christmas and New Year's on Wednesdays. We also had a poor run in the second week of the month where we lost 5 trades in a row. Still, we pulled out a winning month to wrap the year and ended the year with winning months 5 out of 6 months. Volume has been poor, and we will want to see that pick up in January before we really get forceful in our futures trading, which has been the slowest of the three asset classes (Stocks, Futures, and Forex) in 2013.