Stock Picks Recap for 12/10/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BRCM gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered long (with market support) and worked great:

His GDX triggered long (ETF, so no market support needed) and worked enough for a partial:

COST triggered short (with market support) and worked:

TSLA triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Stock Picks Recap for 12/10/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BRCM gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered long (with market support) and worked great:

His GDX triggered long (ETF, so no market support needed) and worked enough for a partial:

COST triggered short (with market support) and worked:

TSLA triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

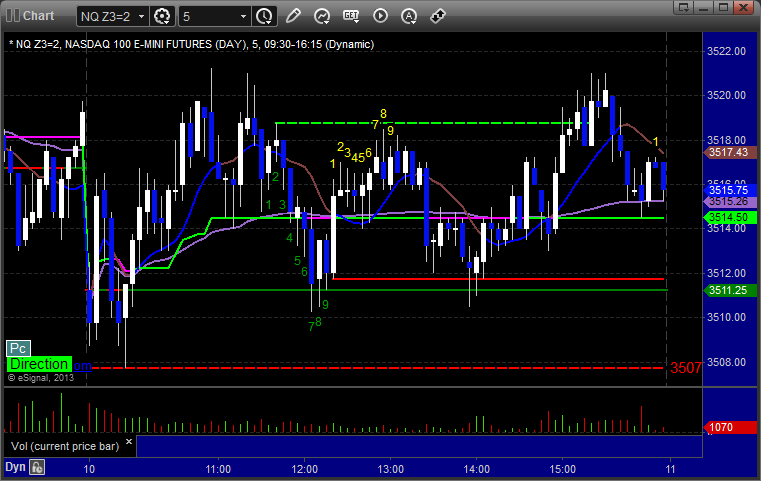

Futures Calls Recap for 12/10/13

It's really looking like the world is done trading for the year as we had another choppy and very narrow trading session. Volume on the NASDAQ was 1.6 billion shares. See ES section below.

Net ticks: -14 ticks.

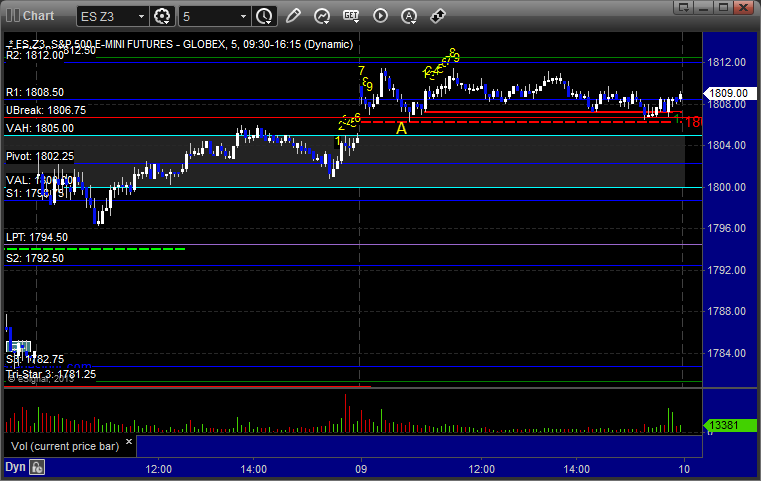

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

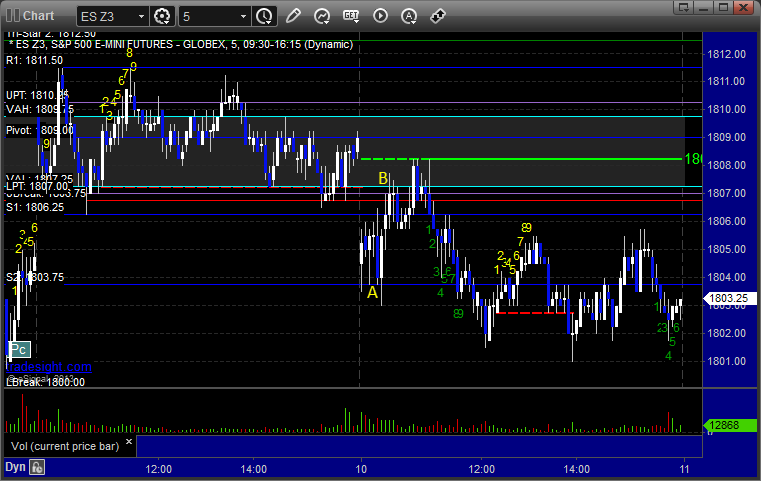

ES:

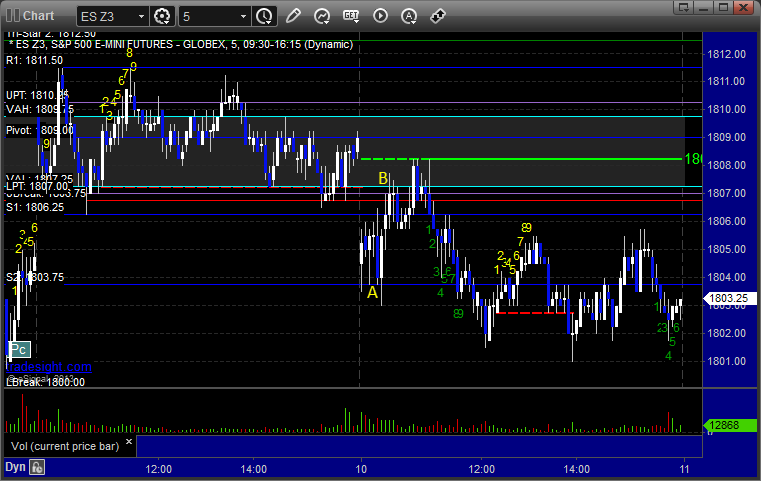

Mark's call triggered short at A at 1803.50 and stopped for 7 ticks. His long triggered at B at 1807.50 and stopped for 7 ticks. We did not retake anything because the action was so poor:

Futures Calls Recap for 12/10/13

It's really looking like the world is done trading for the year as we had another choppy and very narrow trading session. Volume on the NASDAQ was 1.6 billion shares. See ES section below.

Net ticks: -14 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1803.50 and stopped for 7 ticks. His long triggered at B at 1807.50 and stopped for 7 ticks. We did not retake anything because the action was so poor:

Forex Calls Recap for 12/10/13

A new trade in the GBPUSD that was a winner, and we adjusted the stop on the prior session's GBPUSD second half twice and stopped out for 70 pips there as well. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

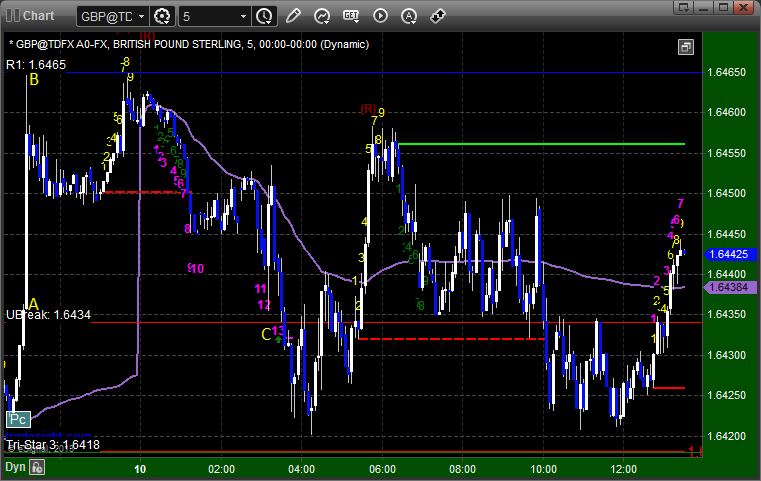

Came into the session still long the second half of the prior day's trade, and then a new long triggered at A, hit first target at B, and moved stop and stopped at C both trades:

Stock Picks Recap for 12/9/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SAPE triggered long (without market support due to opening 5 minutes) and worked:

FSLR triggered short (without market support due to opening 5 minutes) and worked enough for a partial, and then ultimately worked later with a clean trigger with market support:

From the Messenger/Tradesight_st Twitter Feed, Rich's JKS triggered short (with market support) and worked:

His TQQQ triggered short (ETF, so no market support needed) and didn't work:

GILD triggered short (with market support) and worked enough for a partial:

Rich's SCTY triggered short (with market support) and technically didn't work:

His GLD triggered long (ETF, so no market support needed) and worked:

His BIDU triggered long (with market support) and worked:

EBAY triggered short (with market support) and didn't work:

Mark's TSLA triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 5 of them worked, 3 did not.

Stock Picks Recap for 12/9/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SAPE triggered long (without market support due to opening 5 minutes) and worked:

FSLR triggered short (without market support due to opening 5 minutes) and worked enough for a partial, and then ultimately worked later with a clean trigger with market support:

From the Messenger/Tradesight_st Twitter Feed, Rich's JKS triggered short (with market support) and worked:

His TQQQ triggered short (ETF, so no market support needed) and didn't work:

GILD triggered short (with market support) and worked enough for a partial:

Rich's SCTY triggered short (with market support) and technically didn't work:

His GLD triggered long (ETF, so no market support needed) and worked:

His BIDU triggered long (with market support) and worked:

EBAY triggered short (with market support) and didn't work:

Mark's TSLA triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 5 of them worked, 3 did not.

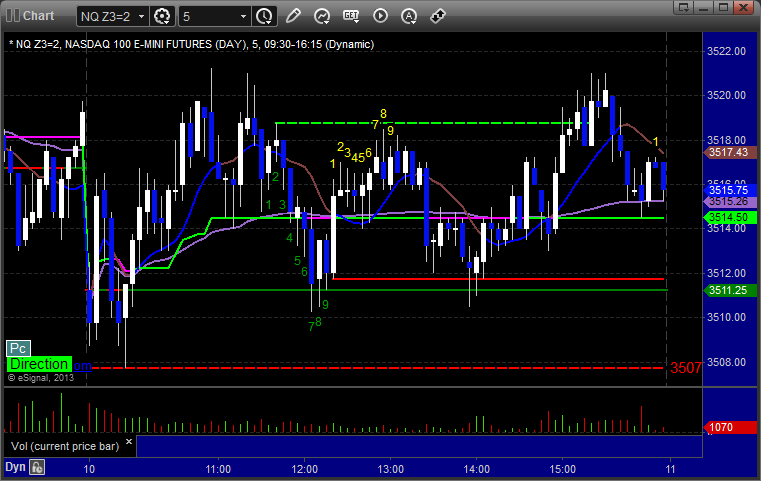

Futures Calls Recap for 12/9/13

Horrible market action. Hope this isn't already what the rest of the year looks like. It was just a Monday though. One nice call that triggered and stopped. We didn't put it back in, which was a good thing as it would have done the same. Market in a 4-point ES range for the day. See ES below.

Net ticks: -7 ticks.

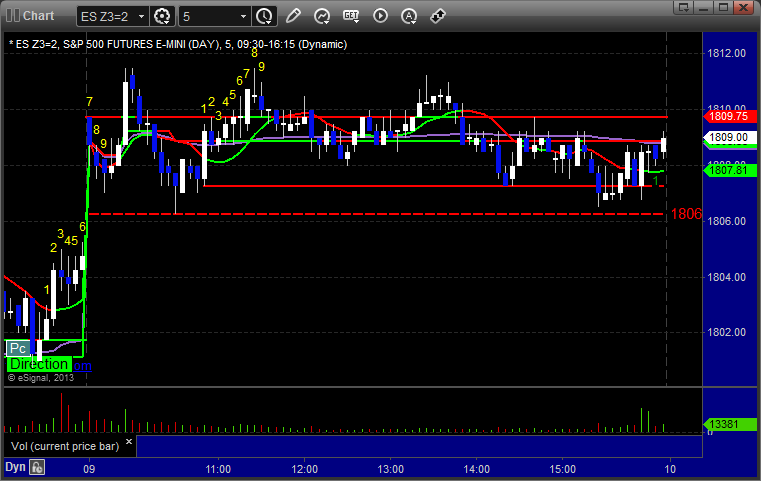

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

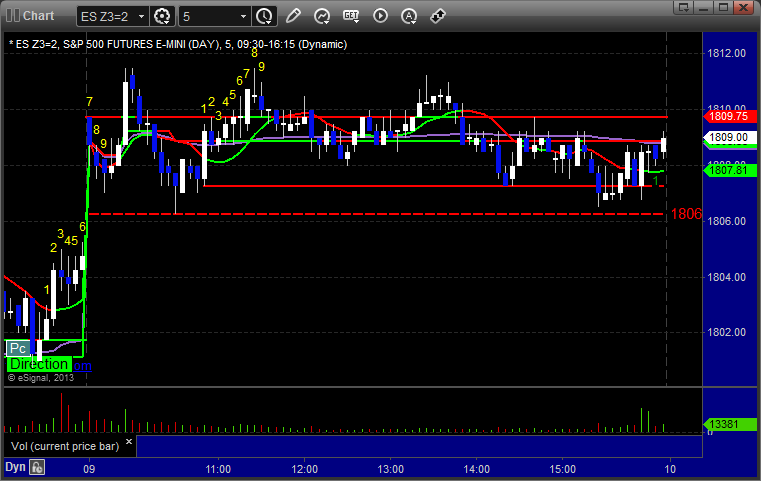

Mark's call triggered short at A at 1806.50 and stopped:

Futures Calls Recap for 12/9/13

Horrible market action. Hope this isn't already what the rest of the year looks like. It was just a Monday though. One nice call that triggered and stopped. We didn't put it back in, which was a good thing as it would have done the same. Market in a 4-point ES range for the day. See ES below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1806.50 and stopped:

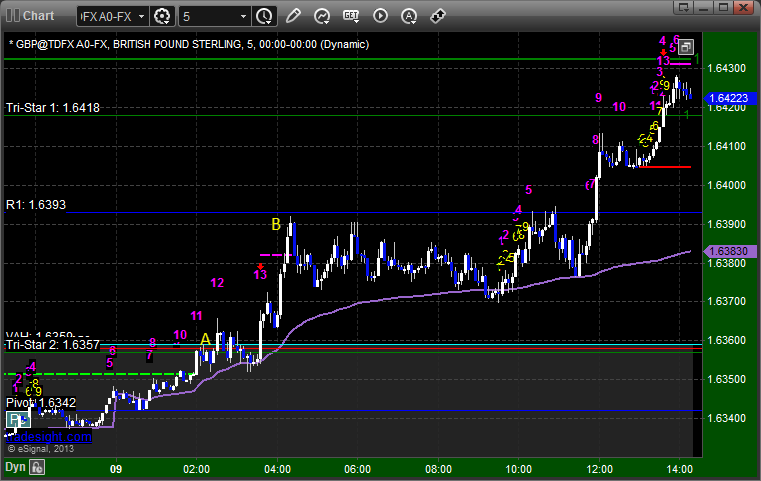

Forex Calls Recap for 12/9/13

A nice winner for the session to start the week. We still have the second half of the trade going as I write this. See the GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

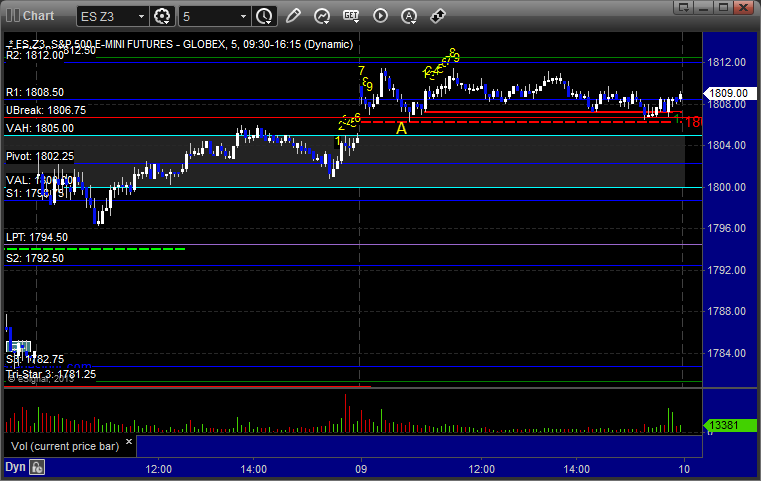

Triggered long at A, hit first target at B, moved stop twice and still holding with a stop under 1.6410 by a few: