Stock Picks Recap for 12/4/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SGEN triggered long (with market support) and didn't work, worked later:

ADSK triggered long (with market support) and worked:

ROST gapped under the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's VXX triggered short (ETF, so no market support needed) and worked:

His BA triggered short (without market support) and didn't work:

His OMED triggered long (with market support) and worked enough for a partial:

NFLX triggered long (with market support) and didn't work:

COST triggered short (with market support) and worked:

AMZN triggered long (with market support) and worked:

Rich's SSYS triggered short (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

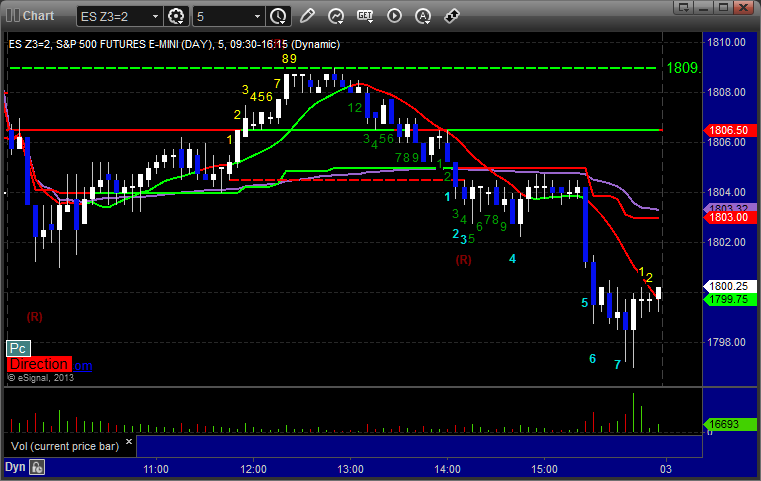

Futures Calls Recap for 12/4/13

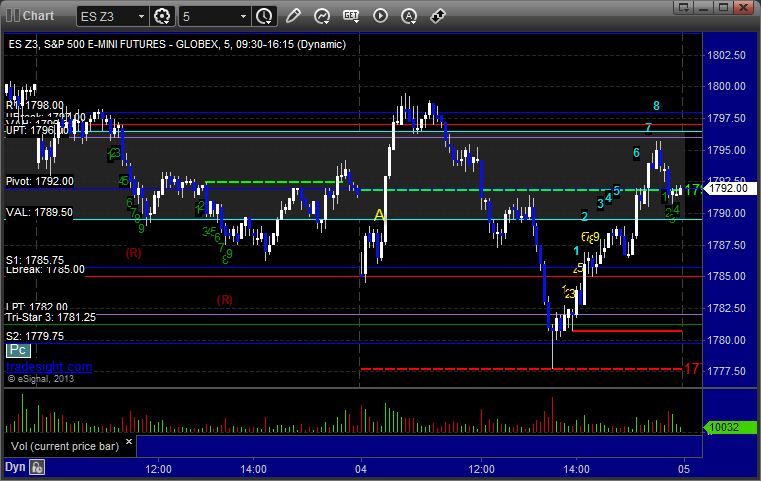

A big winner on the ES today as we got a nice Value Area setup that triggered and worked all the way across the Value Area perfectly and quickly. NASDAQ volume was 1.8 billion, slowly climbing each day.

Net ticks: +18.5 ticks.

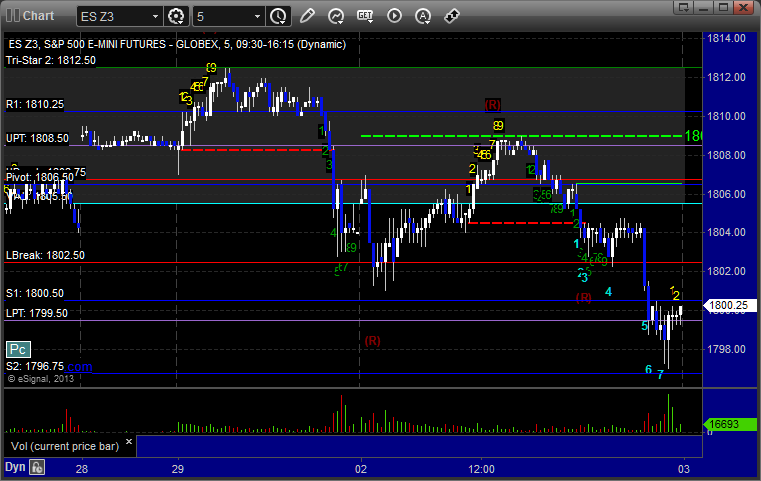

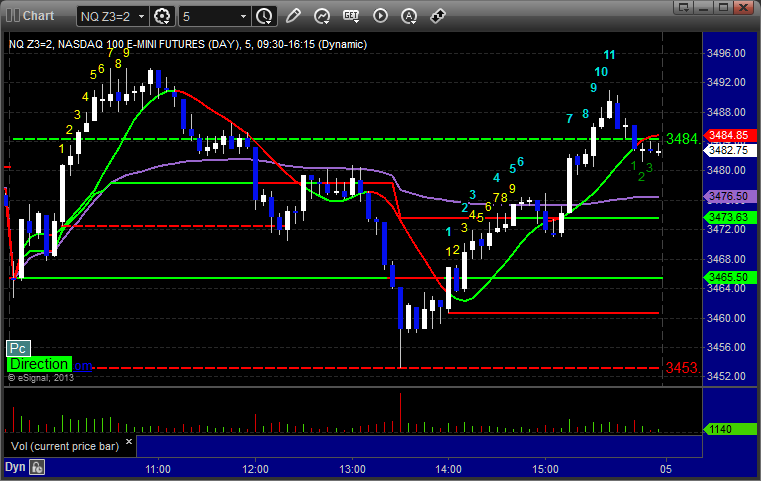

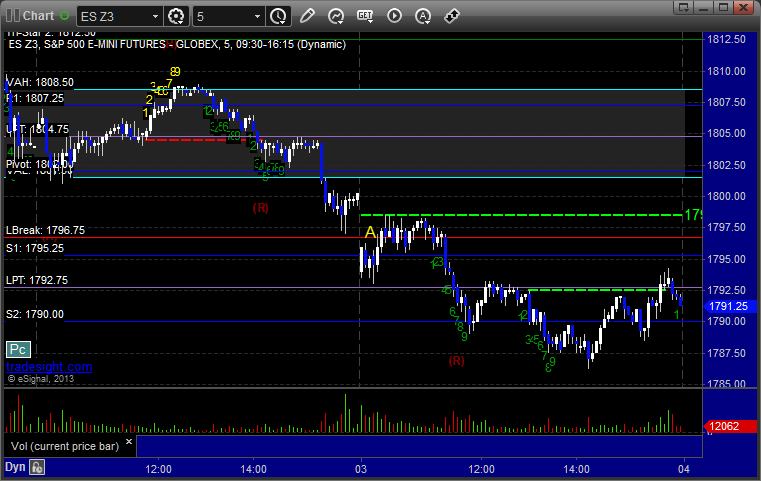

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call into the Value Area triggered at 1789.75 at A, hit first target for 6 ticks, crossed the Value Area and more, and he raised the stop several times and finally stopped at 1797.50:

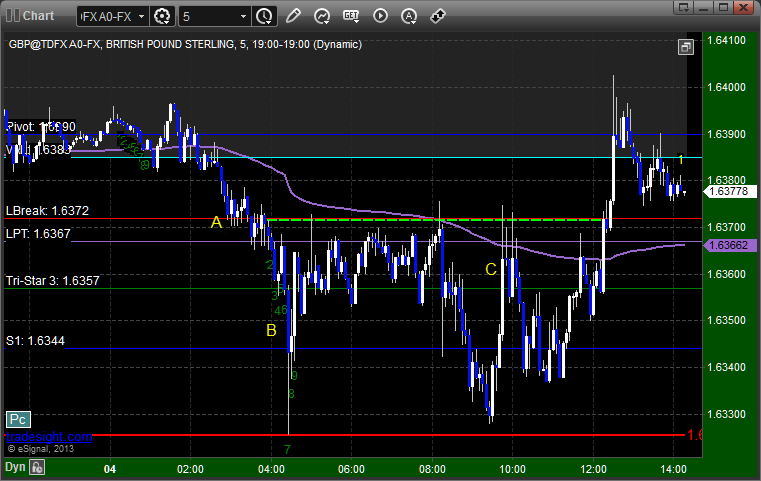

Forex Calls Recap for 12/4/13

Closed the second half of a winner from the prior session (see EURUSD below) and had a new winner (see GBPUSD below).

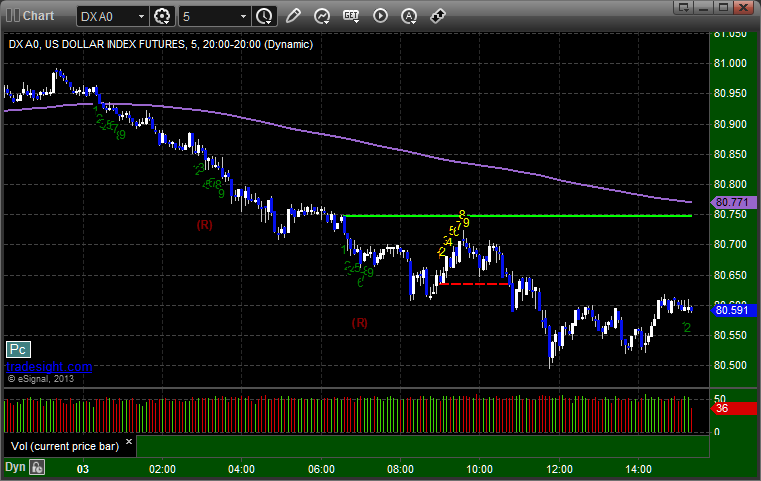

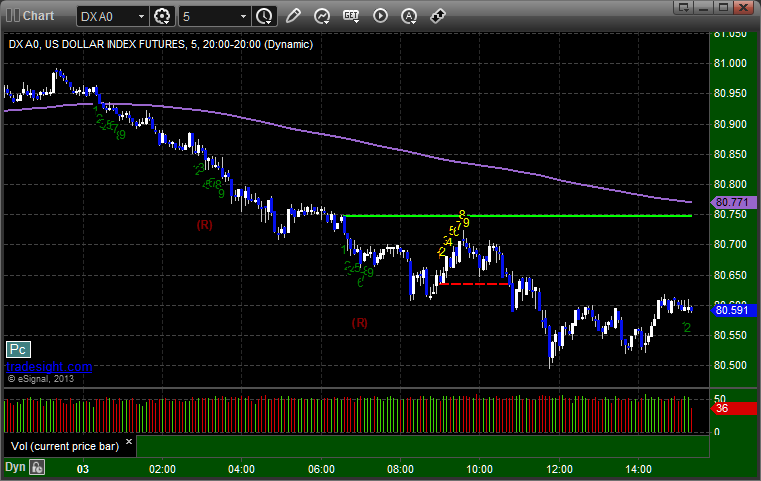

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, stopped second half at C:

Stock Picks Recap for 12/3/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GOGO gapped over the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered short (without market support) and worked:

NTES triggered short (without market support) and worked great:

First time I can remember this in a while. Despite many calls, no trades triggered with market support. The two that did trigger without market support worked.

Stock Picks Recap for 12/3/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GOGO gapped over the trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered short (without market support) and worked:

NTES triggered short (without market support) and worked great:

First time I can remember this in a while. Despite many calls, no trades triggered with market support. The two that did trigger without market support worked.

Futures Calls Recap for 12/3/13

Another tame day, but there was a setup, so we took it. It at least worked to the first target. See ES below. NASDAQ volume closed at 1.7 billion shares.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1797.00, hit first target for 6 ticks, and stopped the second half under the entry:

Forex Calls Recap for 12/3/13

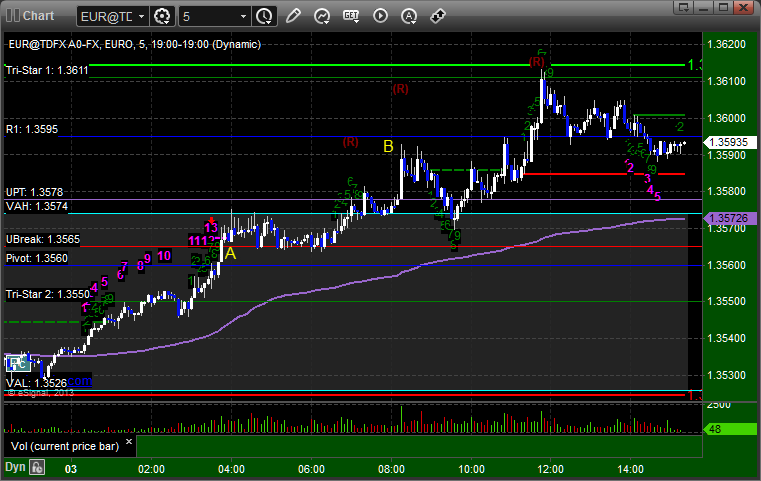

A better winner for the session and one that we are still holding the second half of. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

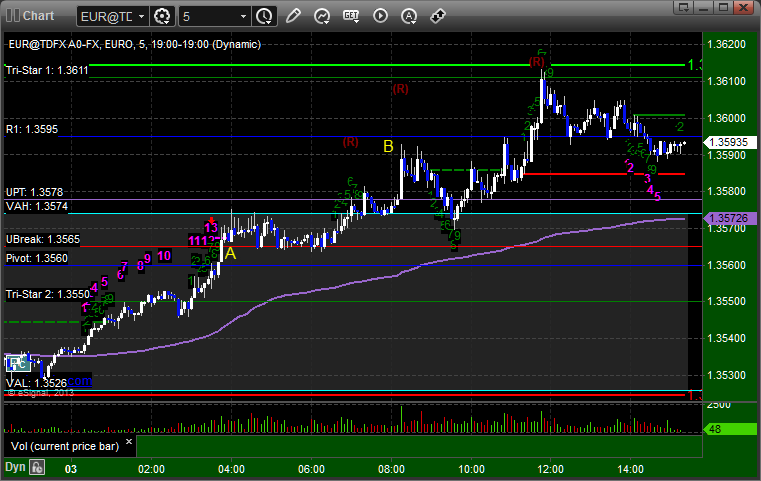

EURUSD:

Triggered long at A, hit first target at B, still holding second half with a stop under UBreak (entry):

Forex Calls Recap for 12/3/13

A better winner for the session and one that we are still holding the second half of. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, still holding second half with a stop under UBreak (entry):

Stock Picks Recap for 12/2/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's TIF triggered short (with market support) and didn't work:

His LOW triggered short (with market support) in the afternoon and didn't do enough either way to count:

His AAPL triggered short (with market support) and worked enough for a partial:

TSLA triggered short (with market support) and worked enough for a partial:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Futures Calls Recap for 12/2/13

No calls for the first day back as we got an early volume warning and no movement, although there was a drop in the last 30 minutes out of the blue on volume.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES: