Forex Calls Recap for 11/26/13

A loser and a winner for almost a wash on the session. See GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

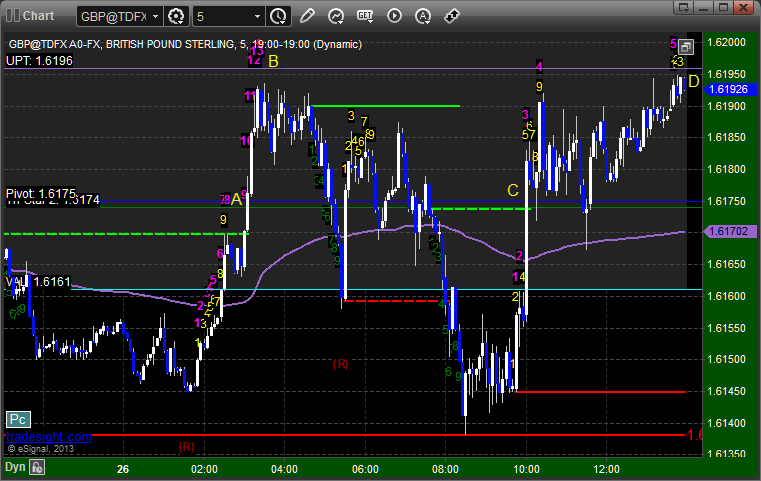

GBPUSD:

Triggered long at A and ultimately stopped, but note the Comber 13 sell signal at the high at B. Triggered long again in the morning at C and closed at D never UPT for end of session:

Stock Picks Recap for 11/25/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LBTYA triggered long (with market support) and worked:

ESRX gapped over the trigger, no play.

NWBI triggered long (with market support) and worked:

SYNA gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered long (with market support) and didn't work:

His GS triggered long (without market support) and didn't work:

His OIH triggered short (ETF, so no market support needed) and worked:

FSLR triggered short (with market support) and worked:

QCOM triggered long (with market support) and worked enough for a partial:

AMZN triggered long (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Stock Picks Recap for 11/25/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, LBTYA triggered long (with market support) and worked:

ESRX gapped over the trigger, no play.

NWBI triggered long (with market support) and worked:

SYNA gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered long (with market support) and didn't work:

His GS triggered long (without market support) and didn't work:

His OIH triggered short (ETF, so no market support needed) and worked:

FSLR triggered short (with market support) and worked:

QCOM triggered long (with market support) and worked enough for a partial:

AMZN triggered long (with market support) and didn't work:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

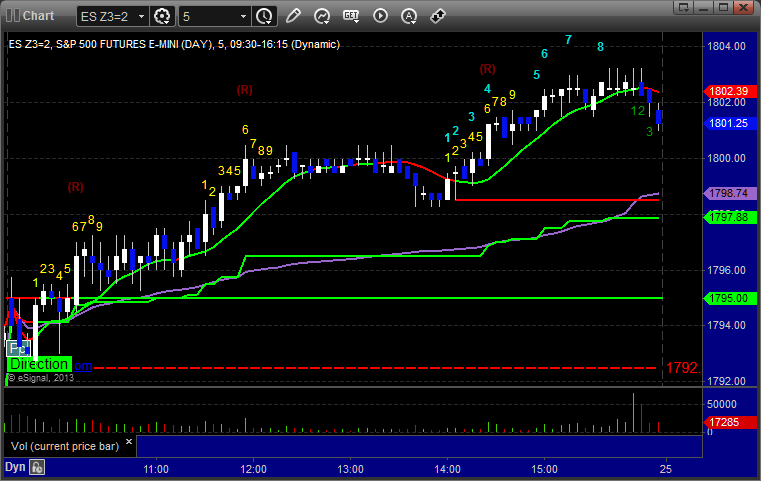

Futures Calls Recap for 11/25/13

Not a good sign for the week with the ES in a 4 point range for most of the session even though volume was decent early. See ES section below for the trade recap.

Net ticks: -7 ticks.

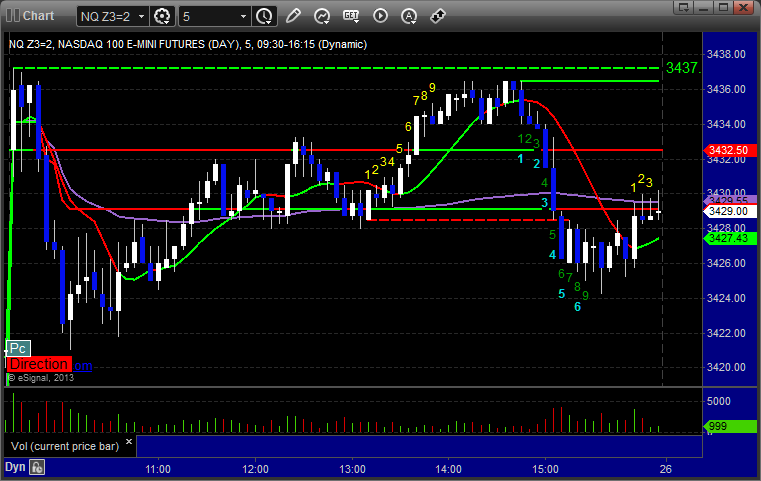

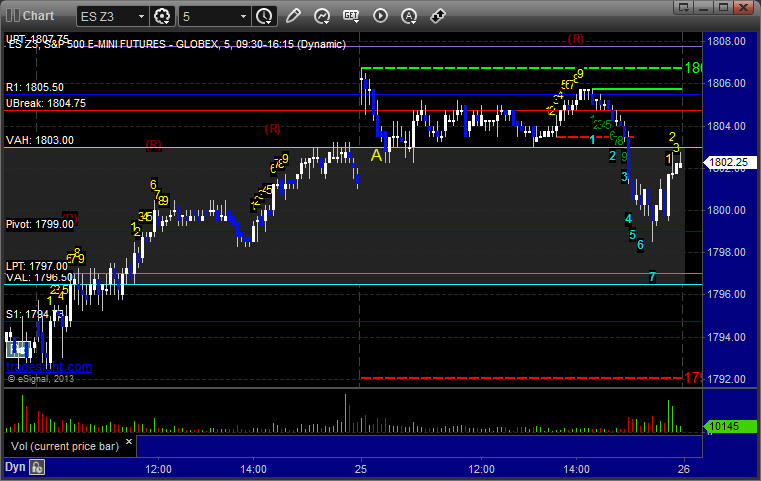

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short nicely into the Value Area at A at 1802.75 and stopped for 7 ticks:

Forex Calls Recap for 11/25/13

One clean trigger and winner for the session, and we're still holding the second half. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, hit first target at B, holding second half with a stop over the Pivot/entry at C:

Stock Picks Recap for 11/22/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NXST triggered long (without market support due to opening 5 minutes) and worked great:

AGNC triggered short (without market support) and didn't do enough either way to count:

From the Messenger/Tradesight_st Twitter Feed, TSLA triggered short (without market support) and worked enough for a partial:

Rich's NUS triggered long (with market support) and worked great:

SINA triggered short (without market support) and worked enough for a partial:

In total, that's 1 trades triggering with market support, it worked, and so did the top pick out of the gate.

Futures Calls Recap for 11/22/13

Started out the week strong in the futures and then everything just deteriorated as we ran into some of the most lackluster market action I've seen in a while. See ER section below for the trade recaps.

Net ticks: -16 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

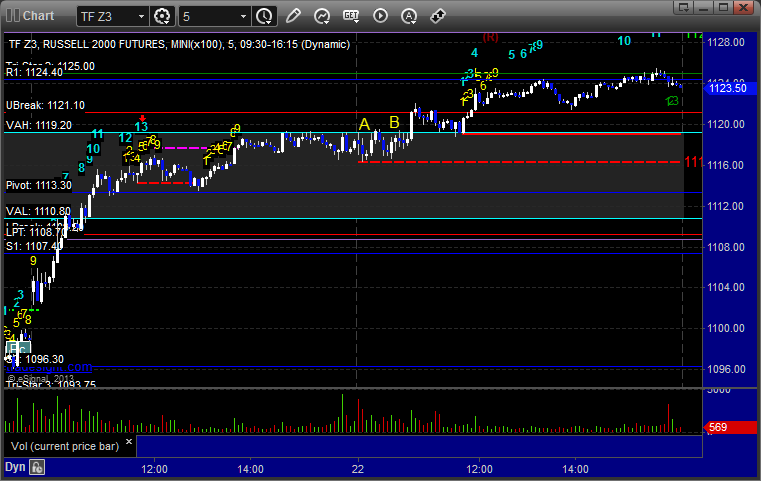

ER:

Triggered long at A at 1119.30 and stopped for 8 ticks. Triggered again at B and did the same. Third time would have worked, didn't take:

Forex Calls Recap for 11/22/13

Another dull session, although this one saw more action in the EURUSD than the GBPUSD. But our calls were in the GBPUSD, so see that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

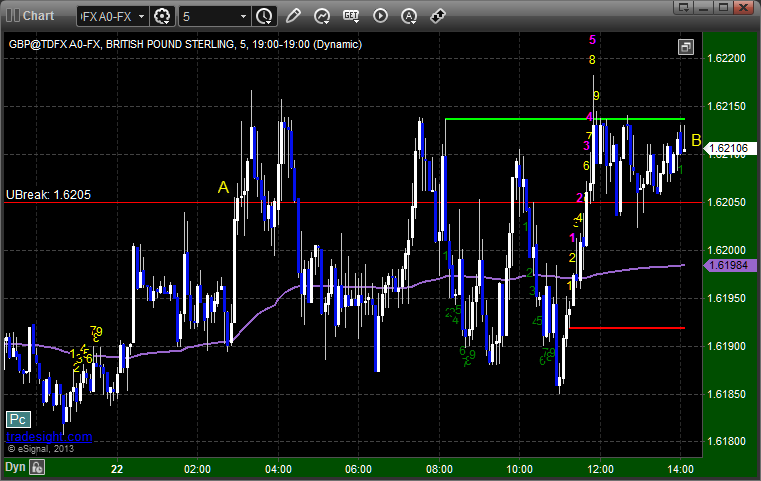

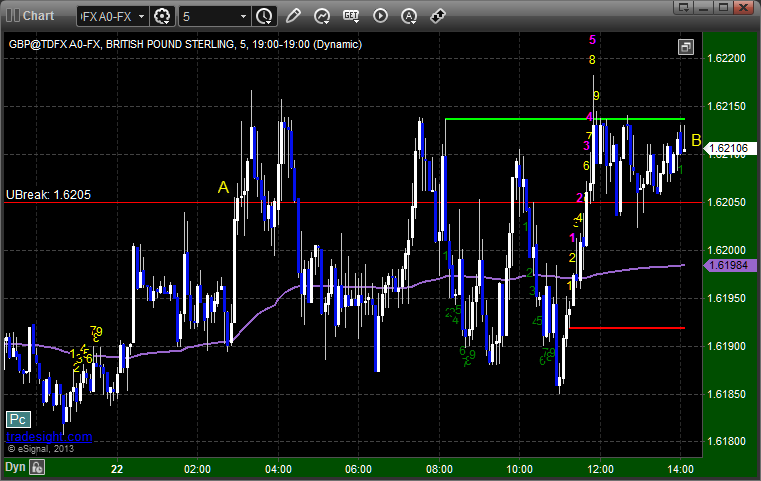

GBPUSD:

Triggered long at A, never stopped or hit first target for hours, finally closed at B a couple of pips in the money for end of week:

Forex Calls Recap for 11/22/13

Another dull session, although this one saw more action in the EURUSD than the GBPUSD. But our calls were in the GBPUSD, so see that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

Triggered long at A, never stopped or hit first target for hours, finally closed at B a couple of pips in the money for end of week:

Stock Picks Recap for 11/21/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

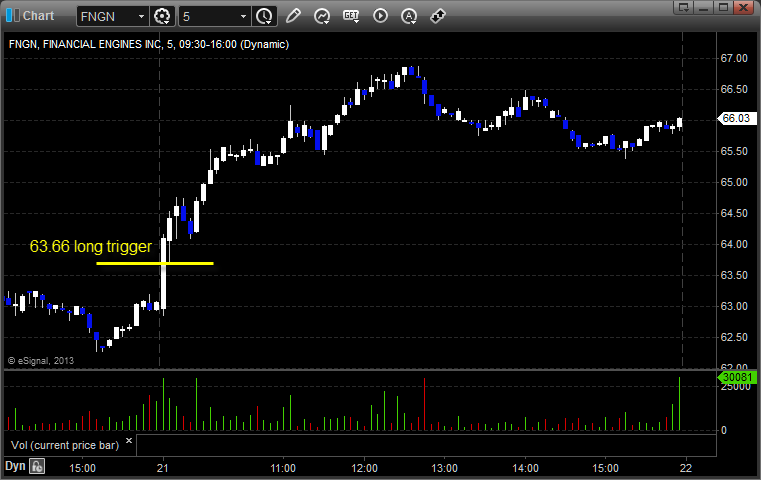

From the report, FNGN triggered long (with market support) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's RGLD triggered short (without market support due to opening 5 minutes) and didn't work:

AMZN triggered long (with market support) and didn't do enough in either direction to count. I closed at a small gain after a long wait:

Nothing else triggered, although YHOO and TEVA came close.

In total, that's 1 trade triggering with market support, and it worked. Boring day.