Stock Picks Recap for 11/14/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, QCOM triggered long (without market support) and worked great:

ANAC and NKTR gapped over, no plays.

From the Messenger/Tradesight_st Twitter Feed, Mark's TEVA triggered long (with market support) and worked:

COST triggered long (with market support) and didn't do enough either way to count:

TWTR triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked, but the QCOM top pick worked best even though it triggered without market support.

Stock Picks Recap for 11/14/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, QCOM triggered long (without market support) and worked great:

ANAC and NKTR gapped over, no plays.

From the Messenger/Tradesight_st Twitter Feed, Mark's TEVA triggered long (with market support) and worked:

COST triggered long (with market support) and didn't do enough either way to count:

TWTR triggered long (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked, but the QCOM top pick worked best even though it triggered without market support.

Futures Calls Recap for 11/14/13

One trigger that stopped. The second half of the day was dead flat as we head into options expiration Friday. NASDAQ volume was 1.8 billion shares, helped by heavy volume in CSCO.

Net ticks: -7 ticks.

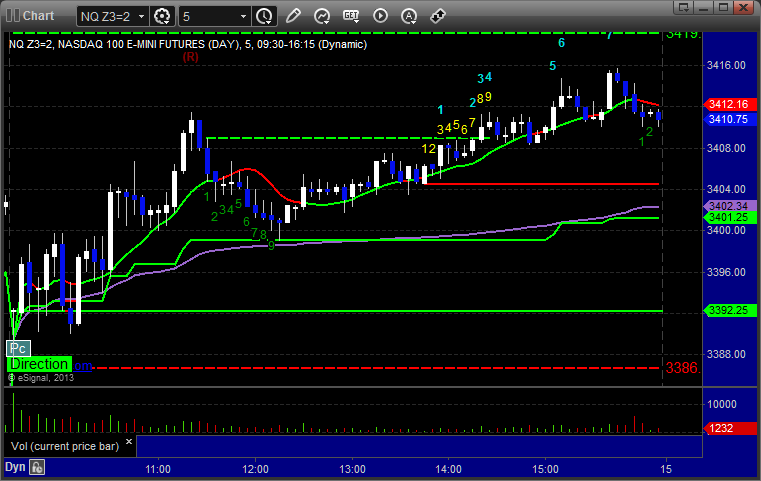

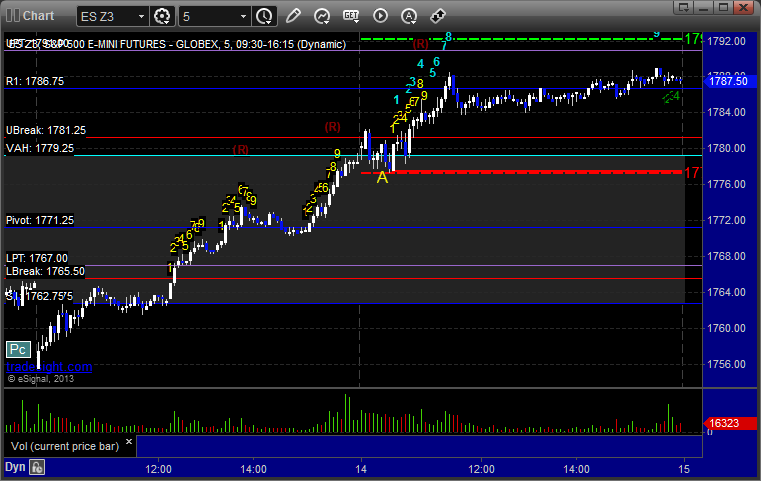

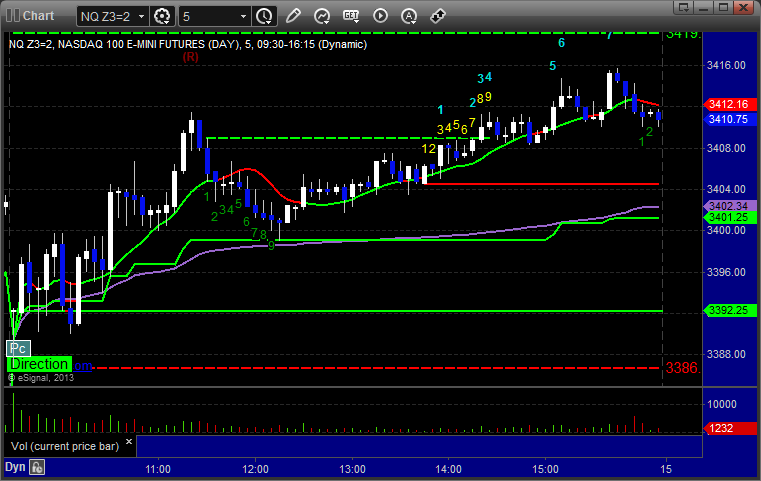

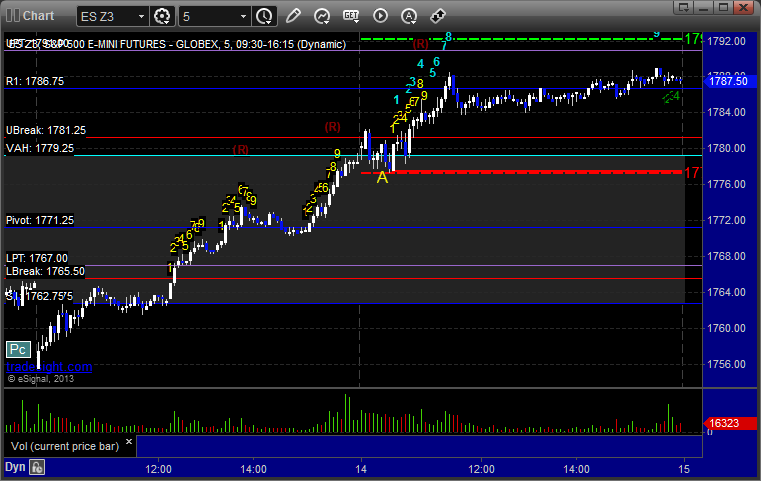

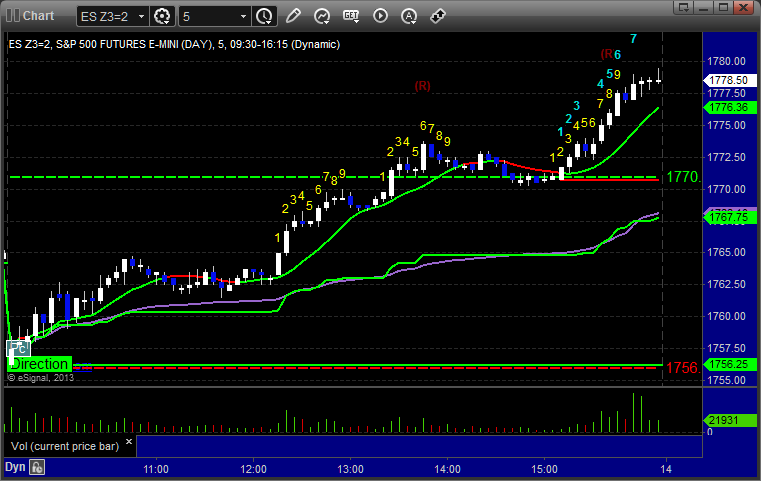

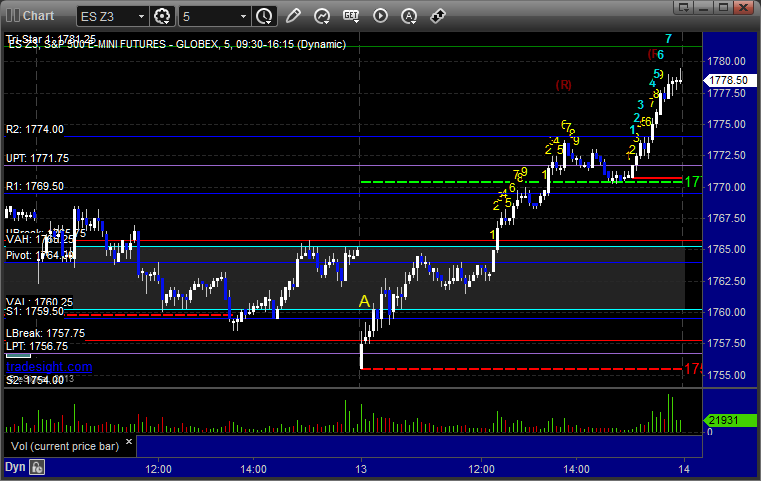

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at 1777.50 at A and stopped:

Futures Calls Recap for 11/14/13

One trigger that stopped. The second half of the day was dead flat as we head into options expiration Friday. NASDAQ volume was 1.8 billion shares, helped by heavy volume in CSCO.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at 1777.50 at A and stopped:

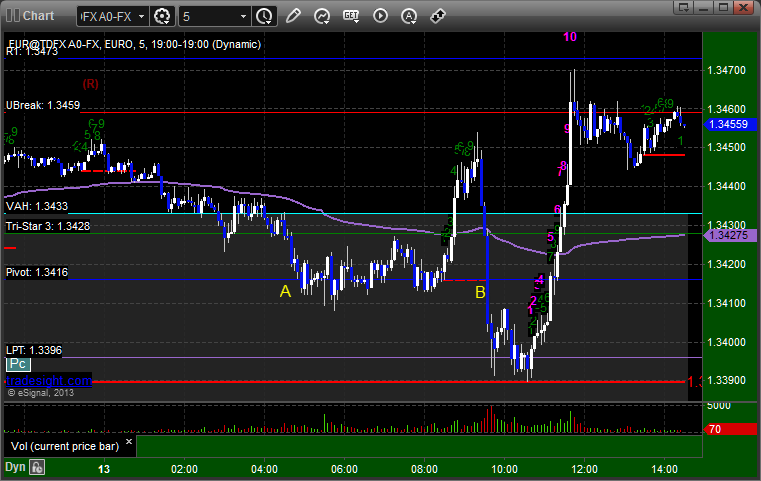

Forex Calls Recap for 11/14/13

One winner for the session that highlights how our Levels work as the low on the EURUSD was our first target exactly. See that section below.

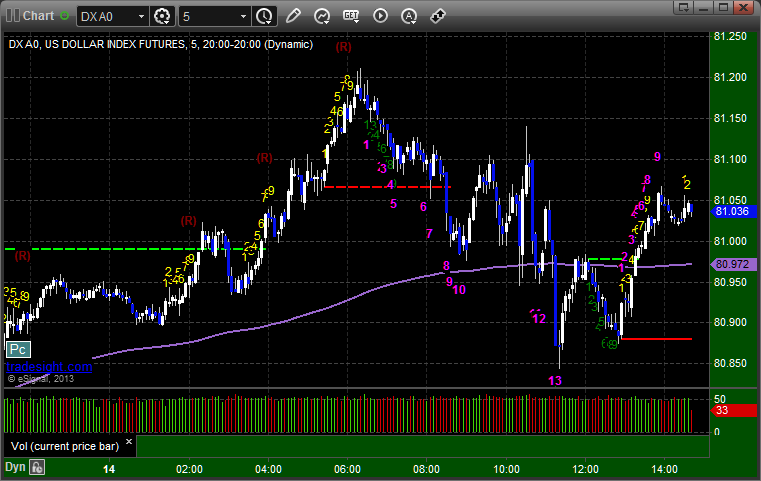

Here's a look at the US Dollar Index intraday with our market directional lines:

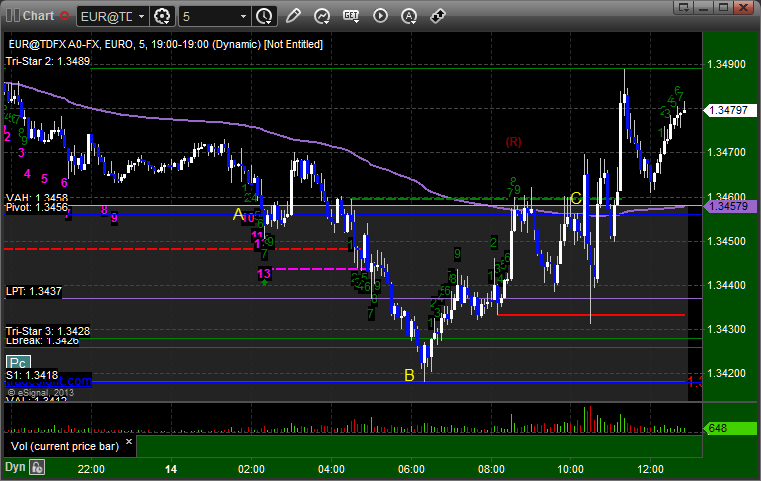

EURUSD:

Triggered short at A, hit first target exactly at B, and stopped second half over the entry in the morning at C:

Stock Picks Recap for 11/13/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, INCY triggered long (with market support) and worked great:

VDNA triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's FSLR triggered long (with market support) and worked:

SHLD triggered long (with market support) and worked:

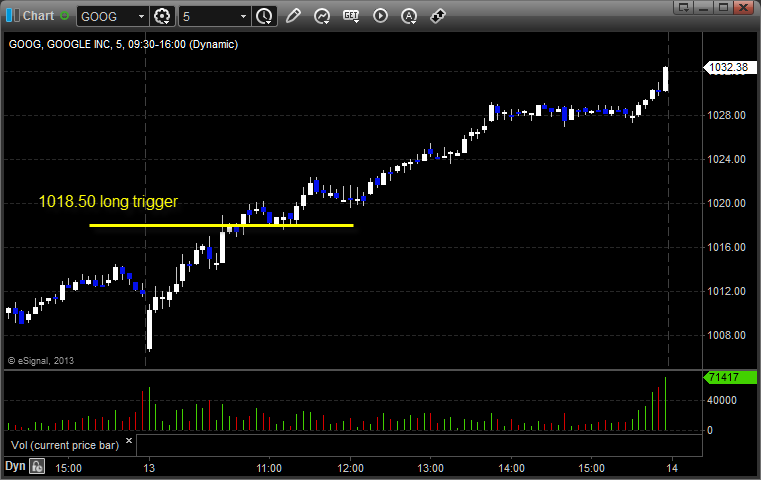

GOOG triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

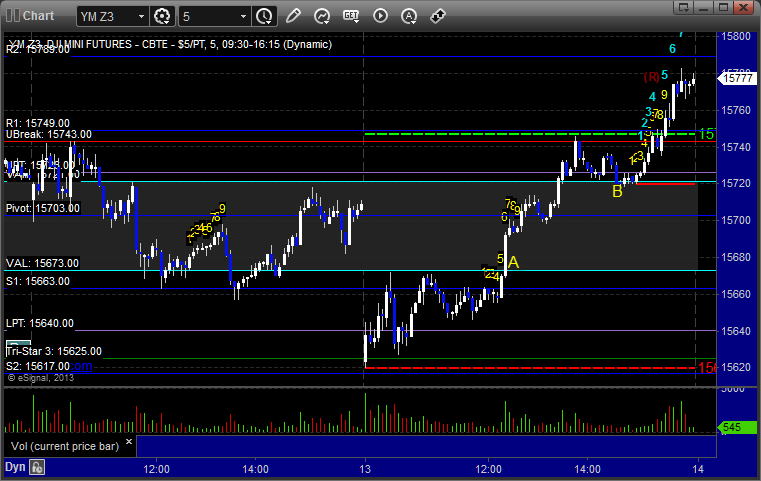

Futures Calls Recap for 11/13/13

A nice winner on the YM and a trade-off on the ES. See both sections below as we got a decent move from what looks like options unraveling. The markets gapped down and rallied into the close on 1.75 billion NASDAQ shares.

Net ticks: +22 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1760.50 and stopped for 7 ticks on a sweep, then triggered again 10 minutes later, hit first target for 6 ticks, and Mark raised the stop and stopped at 1760.75:

YM:

Very nice cup and handle setup against the VAL, triggered long at A at 15674, hit first target for 6 ticks, and moved straight across the Value Area. Then based above the VAH and stopped under it at 15719 for 45 ticks to the final exit at B:

Forex Calls Recap for 11/13/13

Finally had two stops out in one session. See EURUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and stopped. Triggered short again in the morning at B, didn't quite hit first target, and stopped:

Stock Picks Recap for 11/12/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MRVL triggered long (with market support) and worked:

AUXL triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered long (with market support) and worked:

AMZN triggered long (with market support) and didn't work:

Rich's IBM triggered long (with market support) and worked enough for a partial:

Mark's NTAP triggered long (without market support) and didn't work:

Rich's PXD triggered short (with market support) and worked:

Mark's QCOM triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Stock Picks Recap for 11/12/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MRVL triggered long (with market support) and worked:

AUXL triggered long (without market support due to opening 5 minutes) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's GOOG triggered long (with market support) and worked:

AMZN triggered long (with market support) and didn't work:

Rich's IBM triggered long (with market support) and worked enough for a partial:

Mark's NTAP triggered long (without market support) and didn't work:

Rich's PXD triggered short (with market support) and worked:

Mark's QCOM triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.