Futures Calls Recap for 11/12/13

A bit slower than I was expecting, with NASDAQ volume closing just over 1.6 billion shares coming off the Monday Holiday. One stop out, see ES below.

Net ticks: -7 ticks.

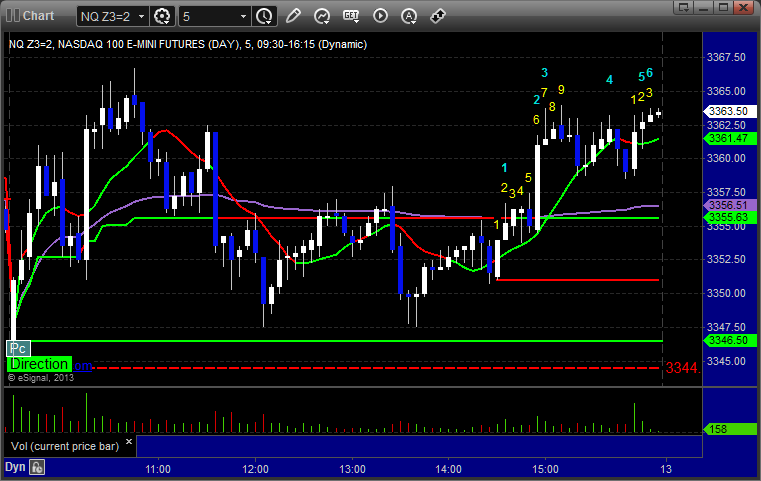

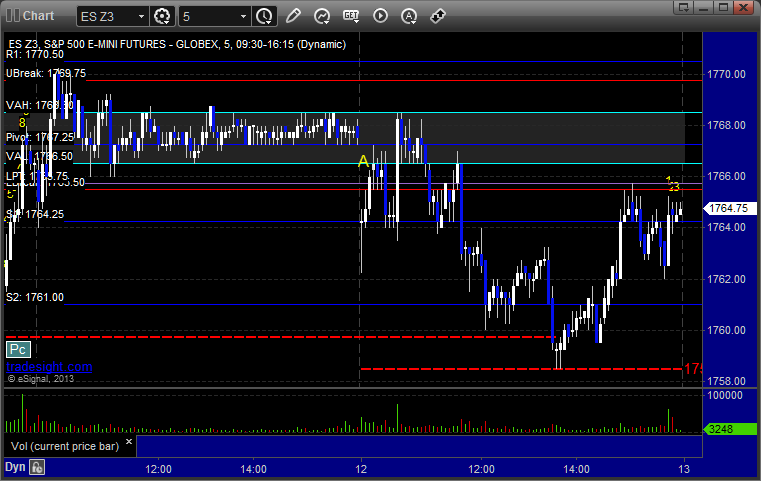

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at 1766.75 at A and stopped for 7 ticks:

Forex Calls Recap for 11/12/13

Well, we got better range than the prior day's Holiday action, but it wasn't the way we like to see it, with a move in favor of the Dollar early and then a complete reversal and move the other direction, triggering parts or all of both our trades. In the end, basically, a tiny loss.

See EURUSD section below.

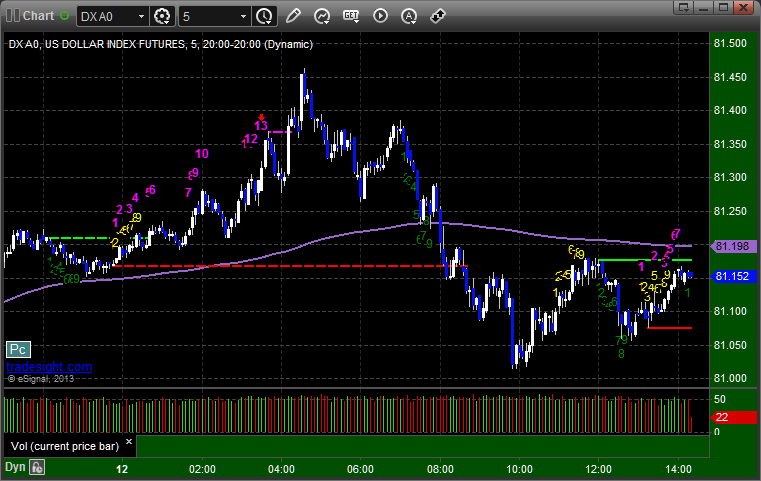

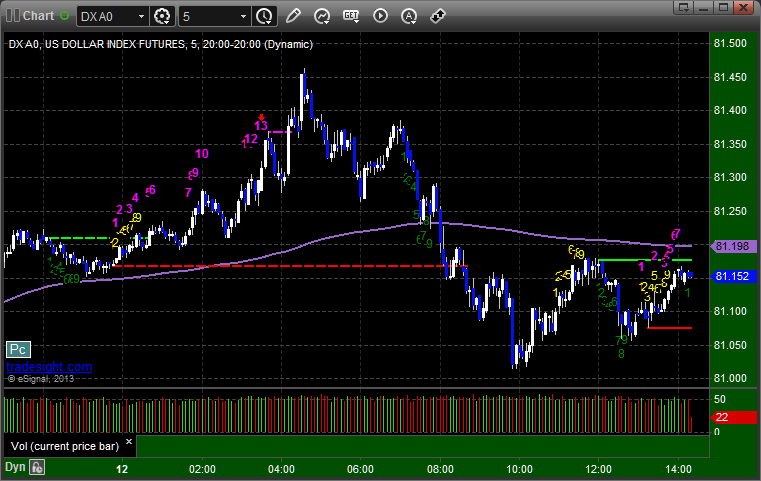

Here's a look at the US Dollar Index intraday with our market directional lines:

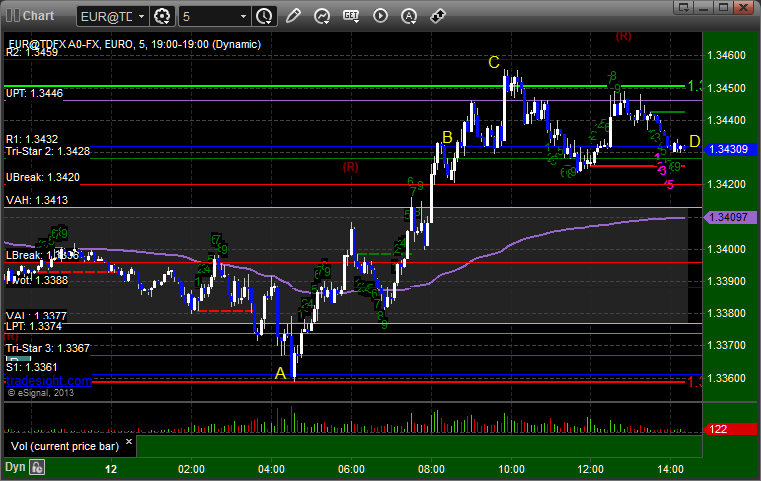

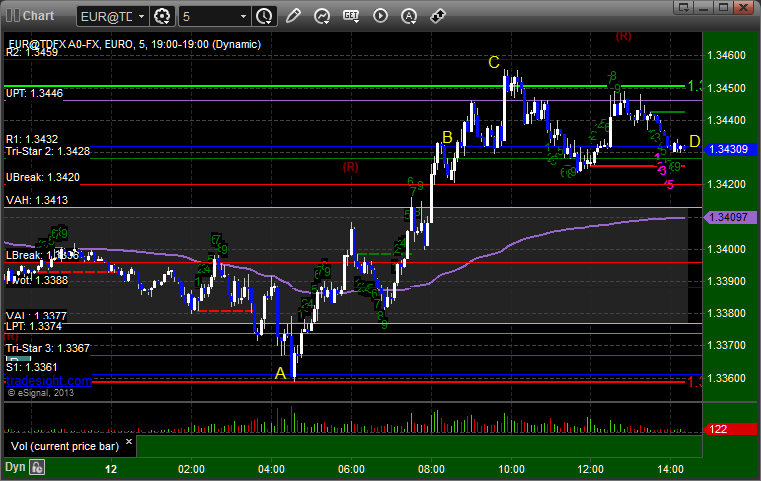

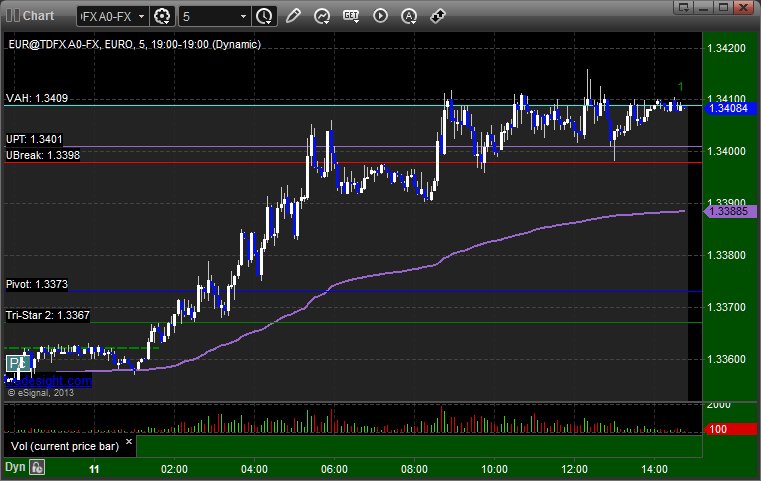

EURUSD:

1 out of 3 legs of our trade under our order staggering rules triggered short at A and stopped. The long triggered at B, didn't quite hit the first target at C, and closed it out basically at the entry at D:

Forex Calls Recap for 11/12/13

Well, we got better range than the prior day's Holiday action, but it wasn't the way we like to see it, with a move in favor of the Dollar early and then a complete reversal and move the other direction, triggering parts or all of both our trades. In the end, basically, a tiny loss.

See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

1 out of 3 legs of our trade under our order staggering rules triggered short at A and stopped. The long triggered at B, didn't quite hit the first target at C, and closed it out basically at the entry at D:

Stock Picks Recap for 11/11/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, PDLI triggered long (with market support) and worked:

ETFC triggered long (with market support) and worked:

URBN triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered long (with market support) and worked:

SINA triggered short (without market support) and didn't work:

Rich's SSYS triggered long (with market support) and worked:

GS triggered long (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 11/11/13

Shouldn't have bothered posting a call, but there was a nice setup in the ER futures. But, with the US Bank Holiday, nothing happened after the first 30 minutes. See ER section below.

Net ticks: -8 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ER:

Nice setup with an entry at 1100.30 at A, missed first target by a tick, and stopped:

Futures Calls Recap for 11/11/13

Shouldn't have bothered posting a call, but there was a nice setup in the ER futures. But, with the US Bank Holiday, nothing happened after the first 30 minutes. See ER section below.

Net ticks: -8 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ER:

Nice setup with an entry at 1100.30 at A, missed first target by a tick, and stopped:

Forex Calls Recap for 11/11/13

No calls for the session due to the US bank holiday. As expected, not much range on the pairs. Back to normal tonight.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

| Previous Day | Next Day | | View in Print Format | |

| Other reports for this day [ Daily Picks | Small Caps | Forex Reports ] | |||

Report Results

Expand All / Collapse All

Market Commentary Market CommentaryNo calls for the session due to the US bank holiday. As expected, not much range on the pairs. Back to normal tonight. Here's a look at the US Dollar Index intraday with our market directional lines:  |

Schedule for next session Schedule for next sessionNew calls and Chat tonight after 5 pm EST when the new levels come out after global rollover. |

24 Hour EUR/USD

24 Hour EUR/USD

Stock Picks Recap for 11/8/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SINA triggered short (without market support) and worked:

JDSU triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's SCTY triggered short (without market support) and worked:

His QCOM triggered long (with market support) and worked enough for a partial:

GOOG triggered long (with market support) and didn't work:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 11/8/13

A small winner in the NQ to wrap the week. See that section below. NASDAQ volume closed at 1.8 billion shares.

Net ticks: +2.5 ticks.

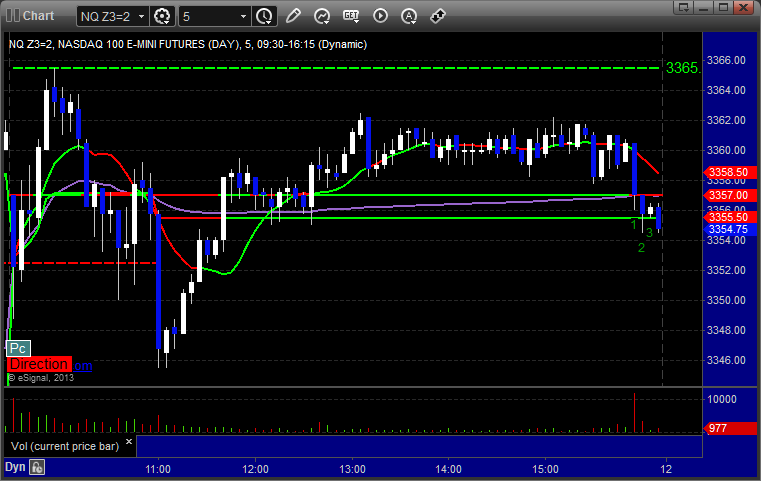

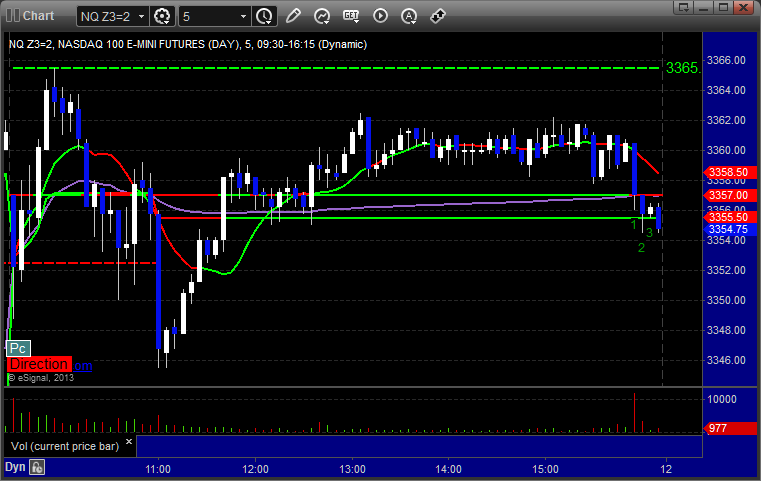

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at 3340.50 at A, hit first target for 6 ticks, and stopped second half under the entry:

Futures Calls Recap for 11/8/13

A small winner in the NQ to wrap the week. See that section below. NASDAQ volume closed at 1.8 billion shares.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at 3340.50 at A, hit first target for 6 ticks, and stopped second half under the entry: