Futures Calls Recap for 10/31/13

Two stop outs and a winner on the ES to wrap up the month of October. See that section below. We closed out right on the VWAP almost unchanged, which is not surprising considering the

Net ticks: -8 ticks.

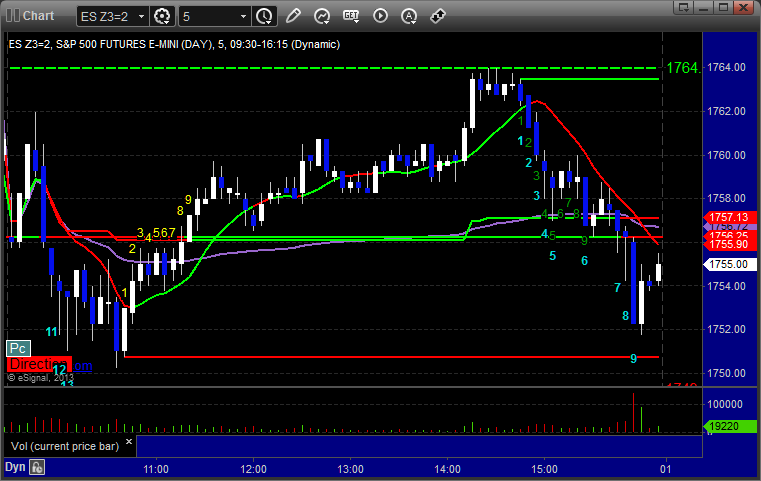

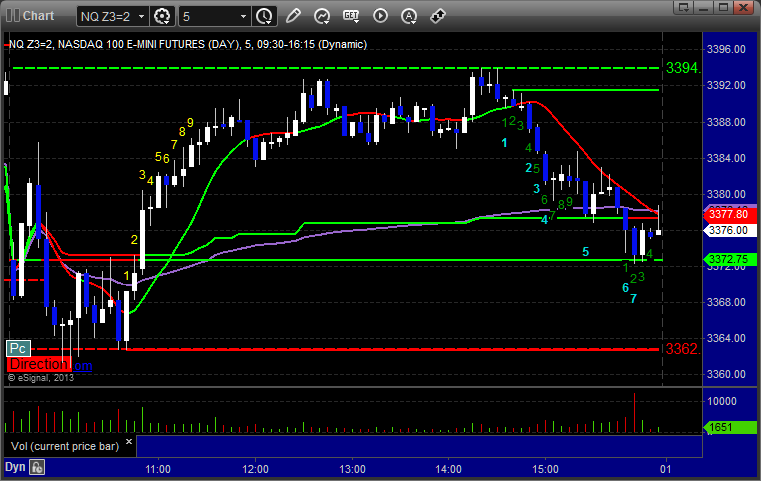

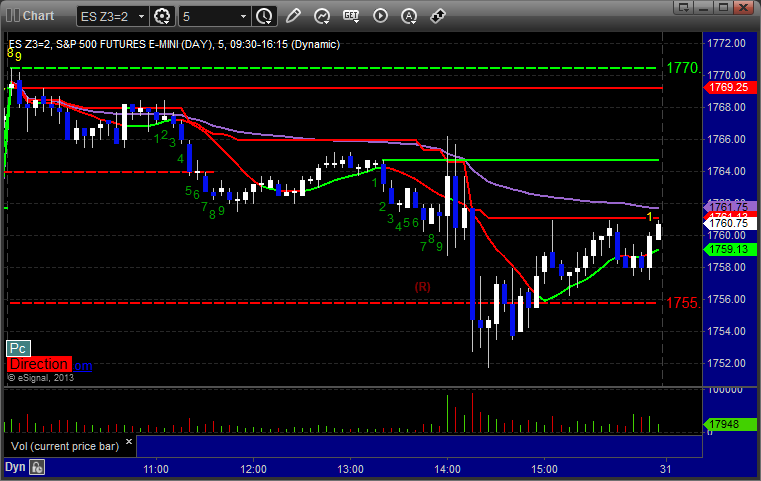

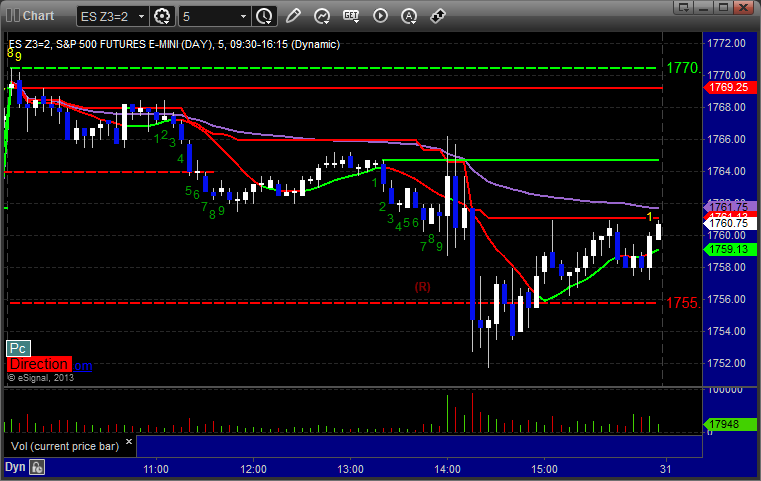

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1751.25 and stopped for 7 ticks. Triggered again at B and did the same. Mark's call triggered long at C at 1761.50, hit first target for 6 ticks and stopped the second half also 6 ticks in the money:

Forex Calls Recap for 10/31/13

A nice winner to close out the week. Tonight's action will be the last official action for October 2013. See EURUSD section below, and we're still short and well in the money as I post this report.

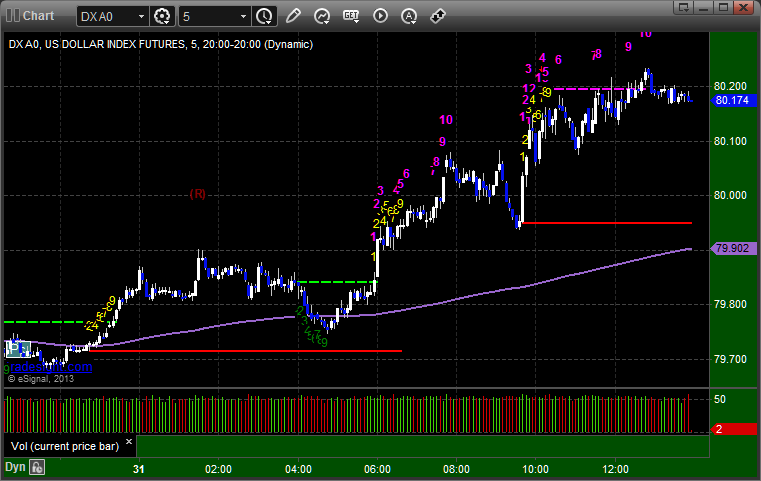

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

If you followed our order staggering rules, one piece of the EURUSD triggered at A and stopped. The other two triggered at B, hit first target at C, and we're still holding with a stop over 1.3600 at D:

Stock Picks Recap for 10/30/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TRIP gapped over the trigger, no play.

CPHD triggered long (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's BWLD triggered short (with market support) and worked:

His QCOR triggered short (with market support) and worked:

His LNKD triggered short (with market support) and worked:

Rich's AEGR triggered short (with market support) and worked:

His GOOG triggered long (without market support) and didn't work:

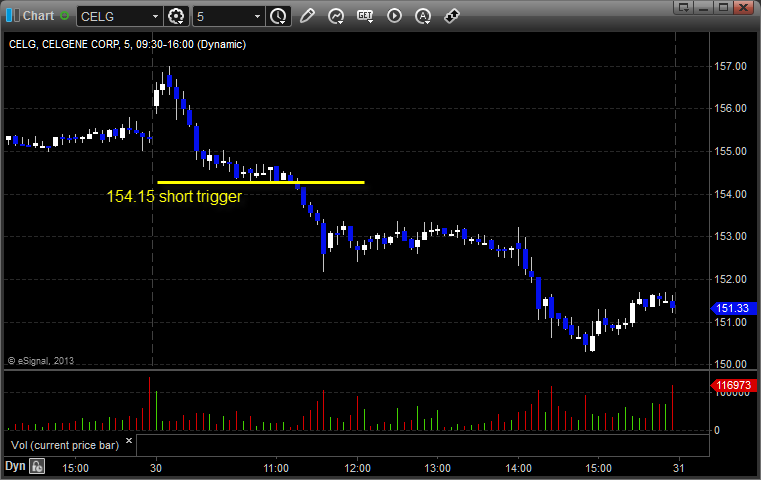

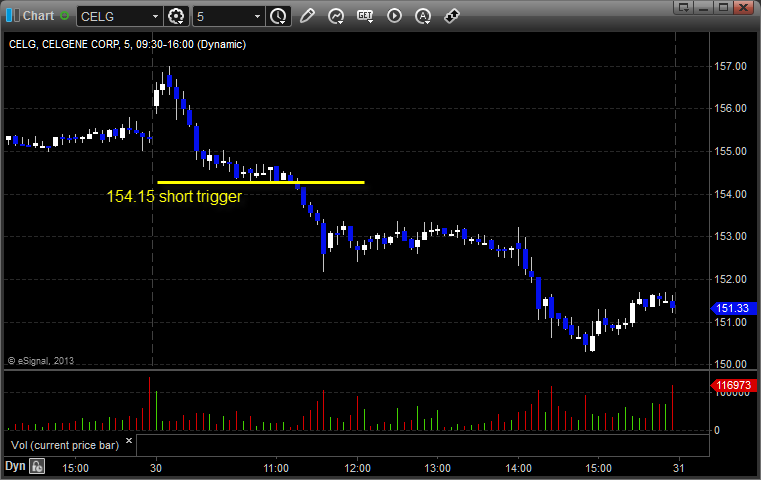

CELG triggered short (with market support) and worked great:

In total, that's 5 trades triggering with market support, all 5 of them worked.

Stock Picks Recap for 10/30/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TRIP gapped over the trigger, no play.

CPHD triggered long (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's BWLD triggered short (with market support) and worked:

His QCOR triggered short (with market support) and worked:

His LNKD triggered short (with market support) and worked:

Rich's AEGR triggered short (with market support) and worked:

His GOOG triggered long (without market support) and didn't work:

CELG triggered short (with market support) and worked great:

In total, that's 5 trades triggering with market support, all 5 of them worked.

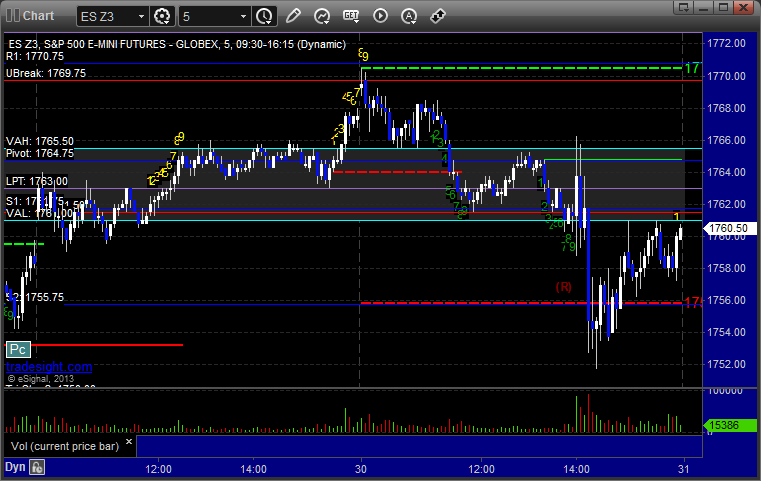

Futures Calls Recap for 10/30/13

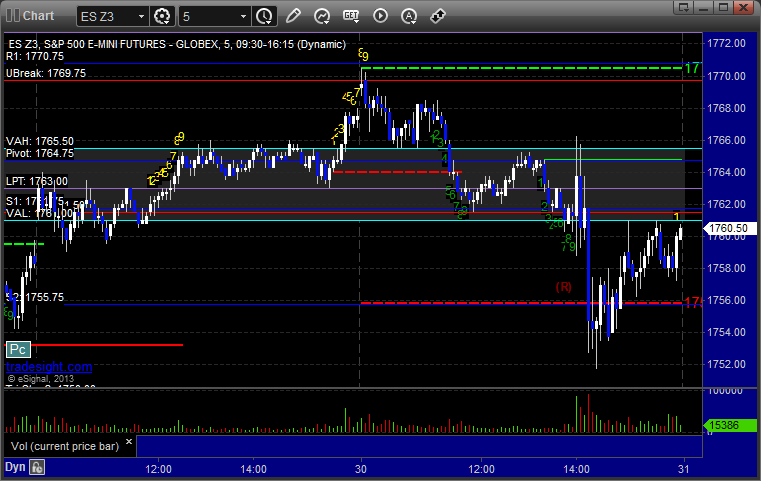

No calls for the session ahead of the Fed. I would have made the Value Area call on the ES, which I pointed out in the Lab as it set the VAH perfectly, but the Pivot was just inside. Ended up working perfectly anyway, see ES section below.

Net ticks: +0 ticks.

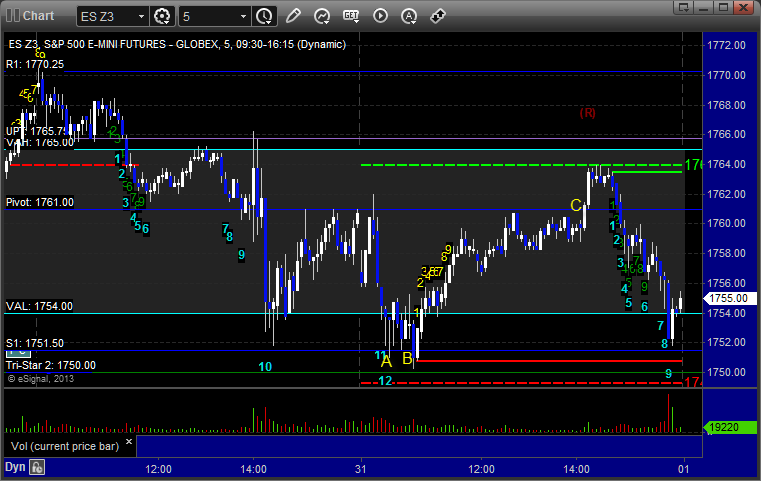

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Futures Calls Recap for 10/30/13

No calls for the session ahead of the Fed. I would have made the Value Area call on the ES, which I pointed out in the Lab as it set the VAH perfectly, but the Pivot was just inside. Ended up working perfectly anyway, see ES section below.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 10/30/13

A dull session as expected, although no reaction to the CPI, and then we closed out a trade ahead of the Fed, which was a good thing. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

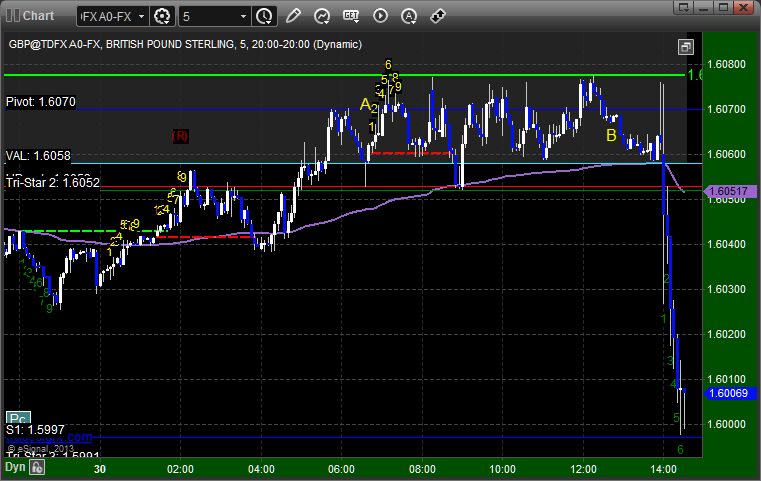

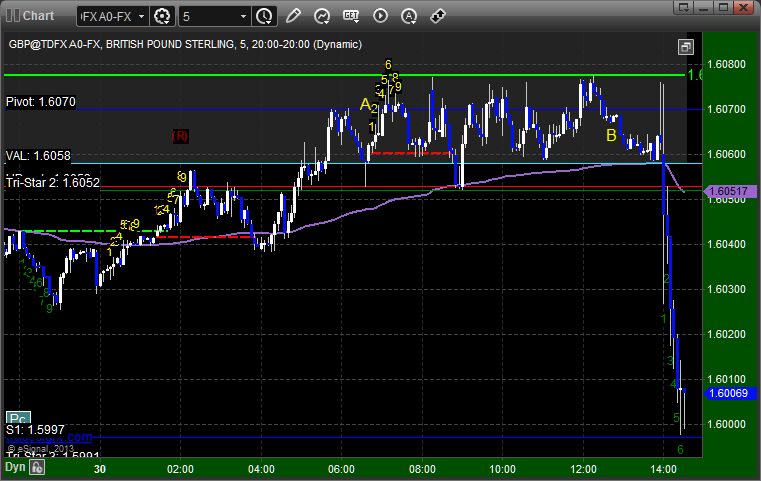

GBPUSD:

Trgiggered long at A overnight, never hit stop or first target, and I closed at B for a small loss ahead of the Fed announcement, which was the right thing to do, obviously:

Forex Calls Recap for 10/30/13

A dull session as expected, although no reaction to the CPI, and then we closed out a trade ahead of the Fed, which was a good thing. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Trgiggered long at A overnight, never hit stop or first target, and I closed at B for a small loss ahead of the Fed announcement, which was the right thing to do, obviously:

Stock Picks Recap for 10/29/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and didn't work:

His AAPL triggered short (with market support) and worked:

SINA triggered short (with market support) and worked enough for a partial:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.

Stock Picks Recap for 10/29/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered short (with market support) and didn't work:

His AAPL triggered short (with market support) and worked:

SINA triggered short (with market support) and worked enough for a partial:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.