Forex Calls Recap for 10/16/13

A winner on the EURUSD again. Note that the other trade stopped right at the trigger. See that section below, and also note the GBPUSD low was the Comber buy signal.

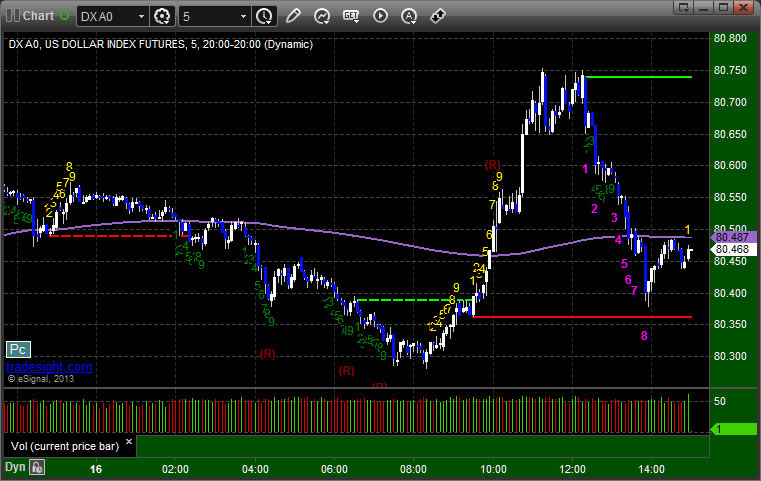

Here's a look at the US Dollar Index intraday with our market directional lines:

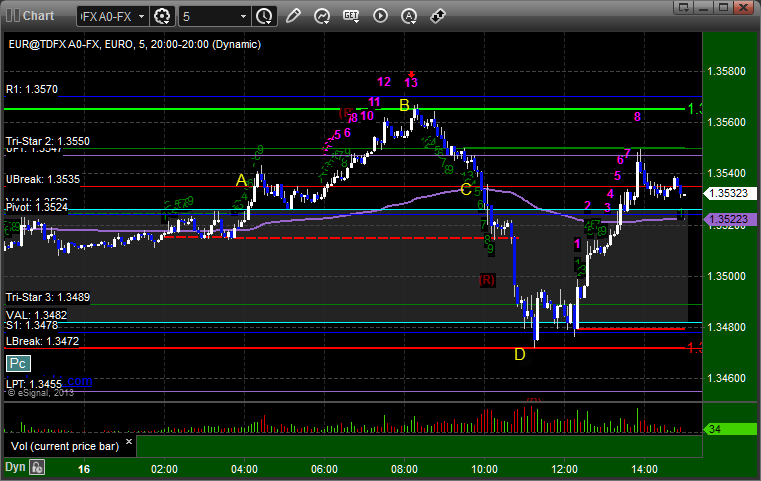

EURUSD:

Triggered long at A, hit first target at B, stopped second half under the entry at C. The short entry was under the LBreak, which was the exact low at D and never triggered. The Breaks are the most powerful levels on the charts for institutional traders. Also note the 13 sell signal at the high:

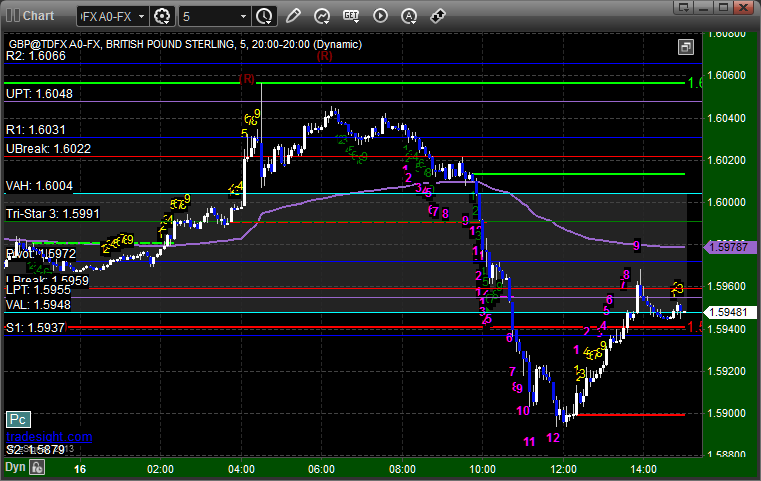

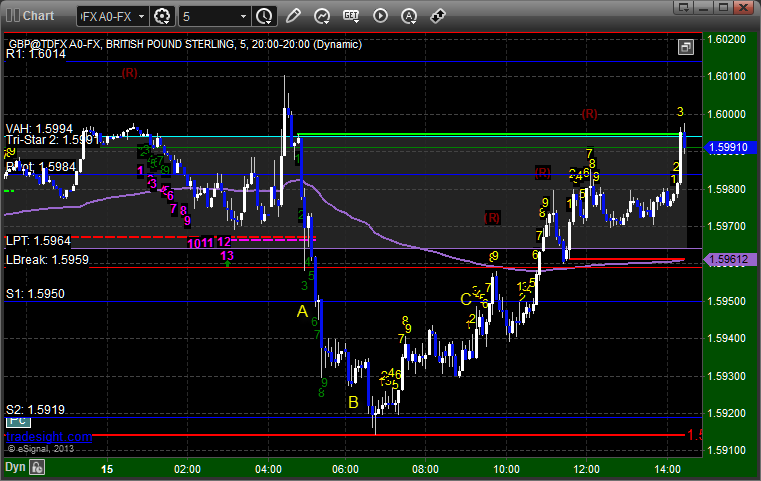

GBPUSD:

Note the 13 buy signal at the low:

Stock Picks Recap for 10/15/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NUAN finally triggered short (been the top pick on the short side for a week) (without market support just barely) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's YHOO triggered short (with market support) and worked enough for a partial:

FSLR triggered long (with market support) and worked:

AMGN triggered long (with market support) and didn't work:

Rich's SSYS triggered long (with market support) and worked enough for a partial:

There were several other calls, but none of them triggered.

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Stock Picks Recap for 10/15/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NUAN finally triggered short (been the top pick on the short side for a week) (without market support just barely) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's YHOO triggered short (with market support) and worked enough for a partial:

FSLR triggered long (with market support) and worked:

AMGN triggered long (with market support) and didn't work:

Rich's SSYS triggered long (with market support) and worked enough for a partial:

There were several other calls, but none of them triggered.

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

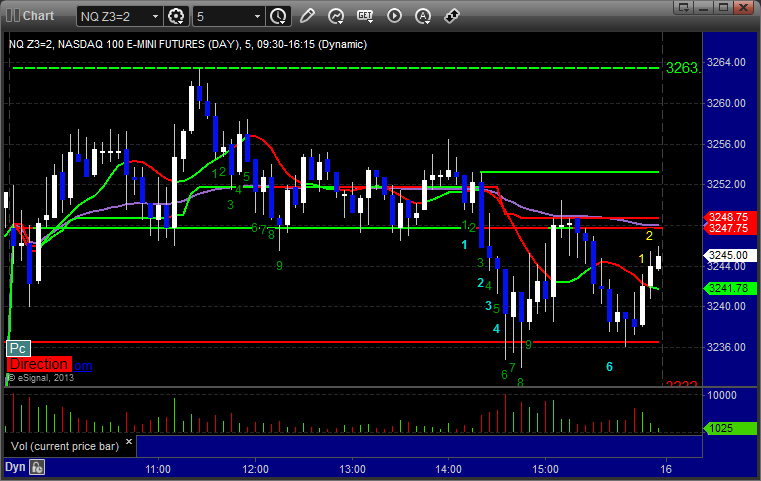

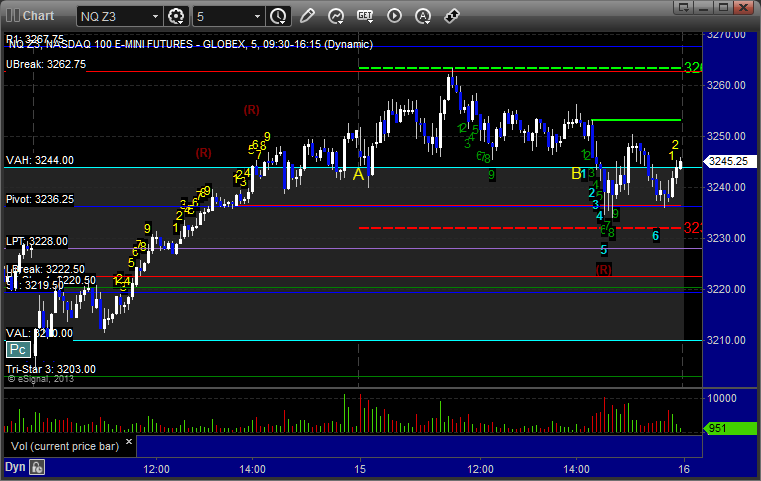

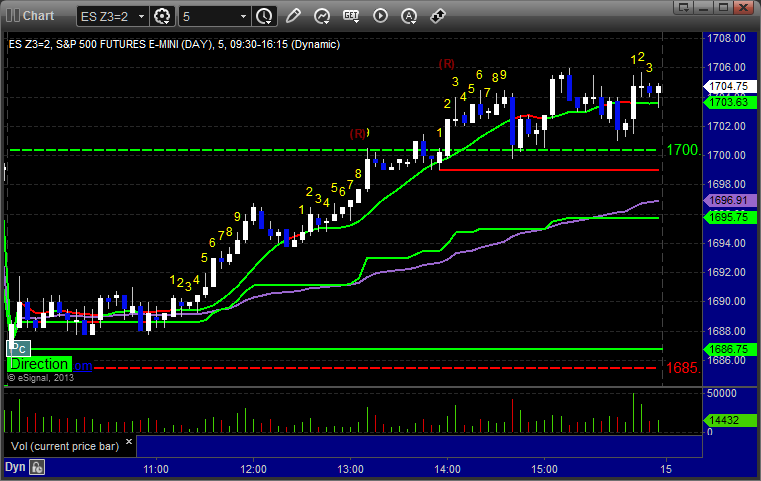

Futures Calls Recap for 10/15/13

An interesting session. Usually, if a trade triggers and stops quickly, we put it back in. Today, a trade triggered and worked a little, and then much later in the day, the exact same trade was set up and worked better. See NQ section below.

Net ticks: +8 ticks.

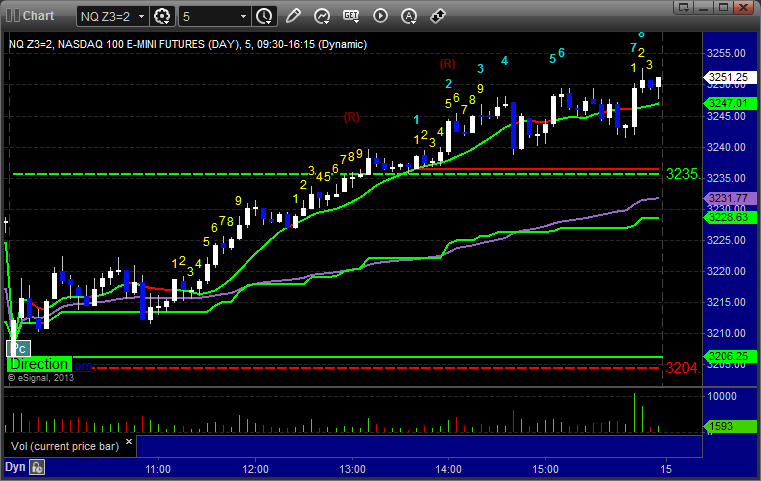

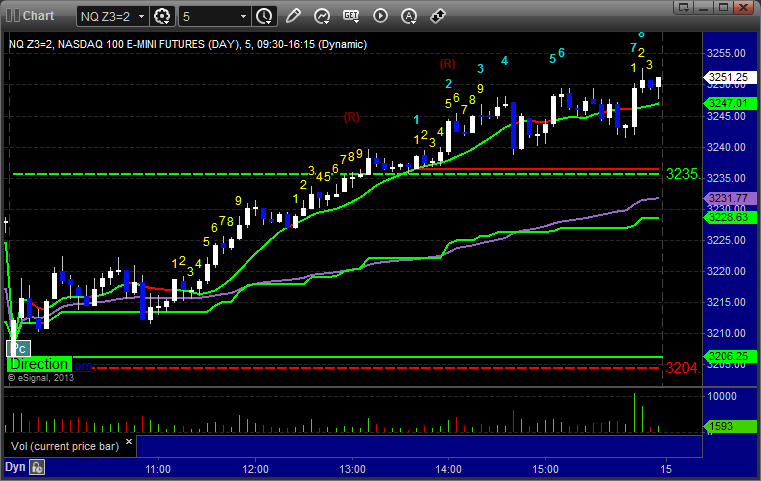

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

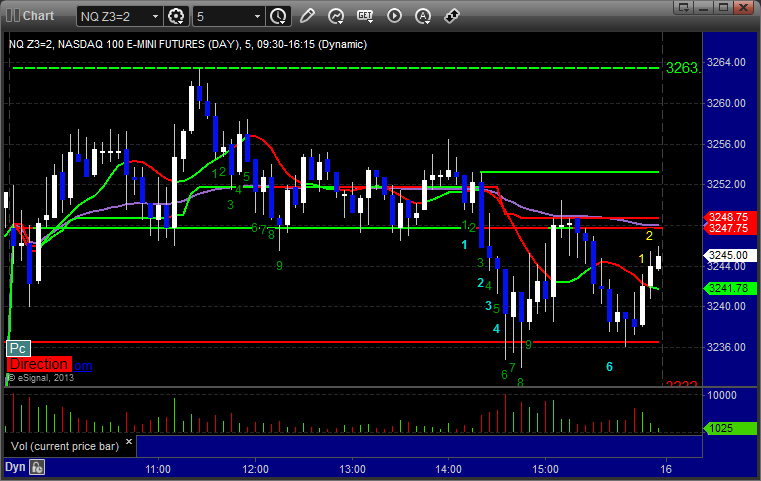

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3243.50, hit first target for 6 ticks, and stopped second half over the entry. In the afternoon, the same trade was called as we started to head lower after lunch. Triggered short at B at 3243.50, hit first target for 6 ticks, lowered the stop and stopped the second half 5 ticks in the money:

Futures Calls Recap for 10/15/13

An interesting session. Usually, if a trade triggers and stops quickly, we put it back in. Today, a trade triggered and worked a little, and then much later in the day, the exact same trade was set up and worked better. See NQ section below.

Net ticks: +8 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short at A at 3243.50, hit first target for 6 ticks, and stopped second half over the entry. In the afternoon, the same trade was called as we started to head lower after lunch. Triggered short at B at 3243.50, hit first target for 6 ticks, lowered the stop and stopped the second half 5 ticks in the money:

Forex Calls Recap for 10/15/13

A small winner in another narrow session. Check the GBPUSD section below for the trade recap.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, closed second half over the entry at C:

Stock Picks Recap for 10/14/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CHKP triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (with market support) and worked:

Stock Picks Recap for 10/14/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CHKP triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (with market support) and worked:

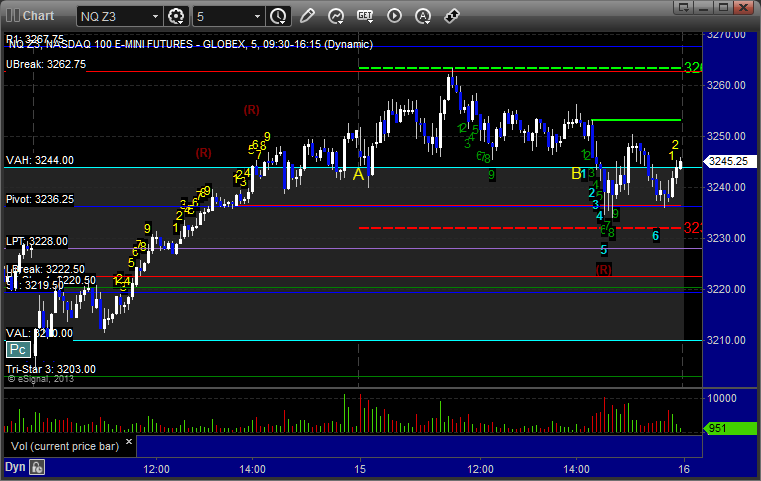

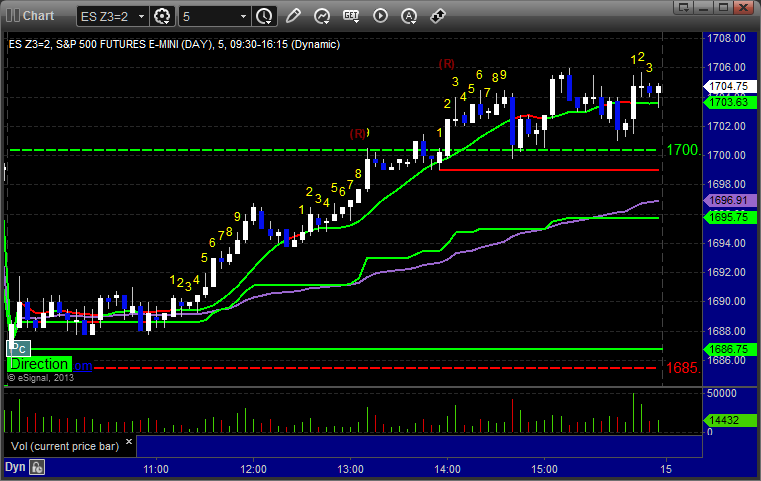

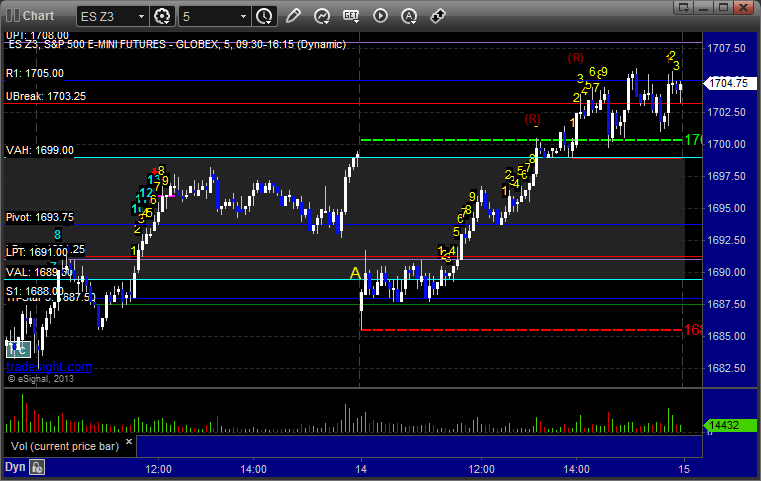

Futures Calls Recap for 10/14/13

Light volume for the US bank Holiday as expected. The first 2 hours were dead flat, and then the market drifted up to fill the gap. NASDAQ volume closed at 1.35 billion shares, and we had a small winner on the ES. See that section below. We ended up covering average daily range and more despite all of that.

Net ticks: +2.5 ticks.

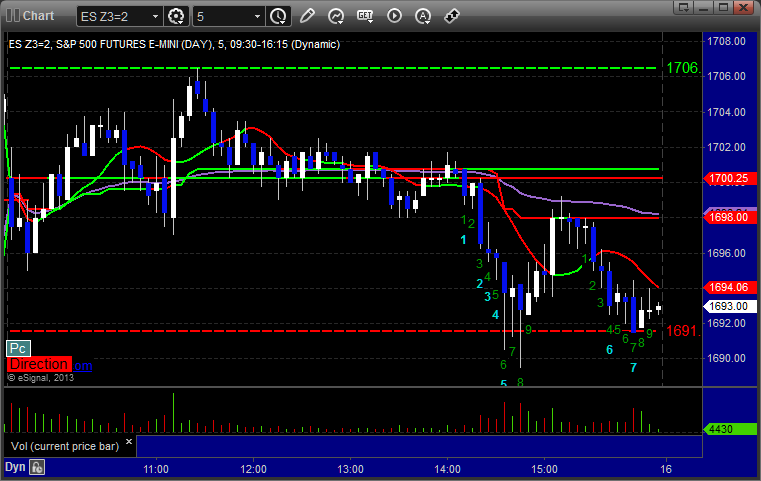

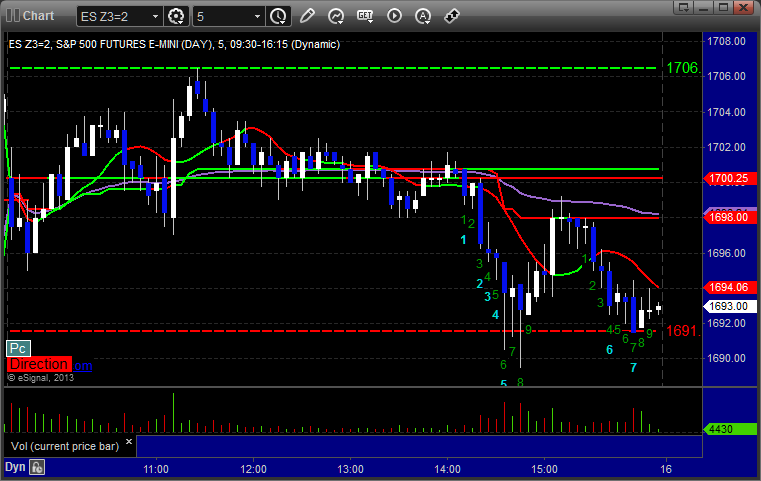

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

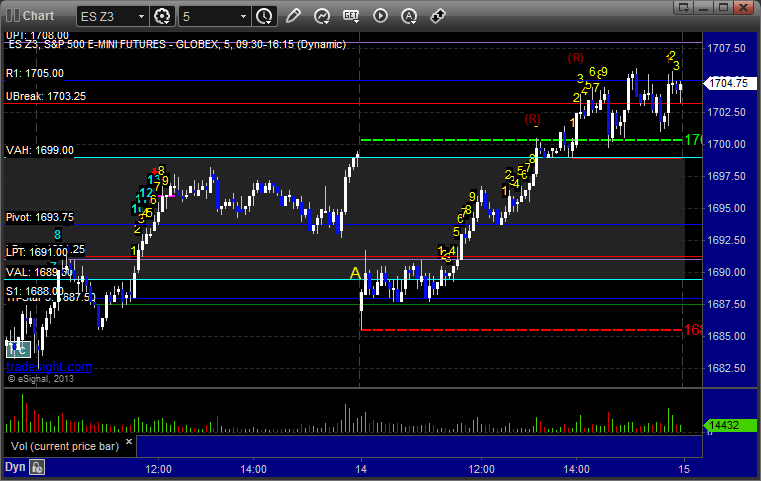

ES:

Mark's call triggered long at A at 1690.00, hit first target for 6 ticks, and stopped second half under the entry. Unfortunately, the actual move to fill the gap didn't come until lunch:

Futures Calls Recap for 10/14/13

Light volume for the US bank Holiday as expected. The first 2 hours were dead flat, and then the market drifted up to fill the gap. NASDAQ volume closed at 1.35 billion shares, and we had a small winner on the ES. See that section below. We ended up covering average daily range and more despite all of that.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1690.00, hit first target for 6 ticks, and stopped second half under the entry. Unfortunately, the actual move to fill the gap didn't come until lunch: