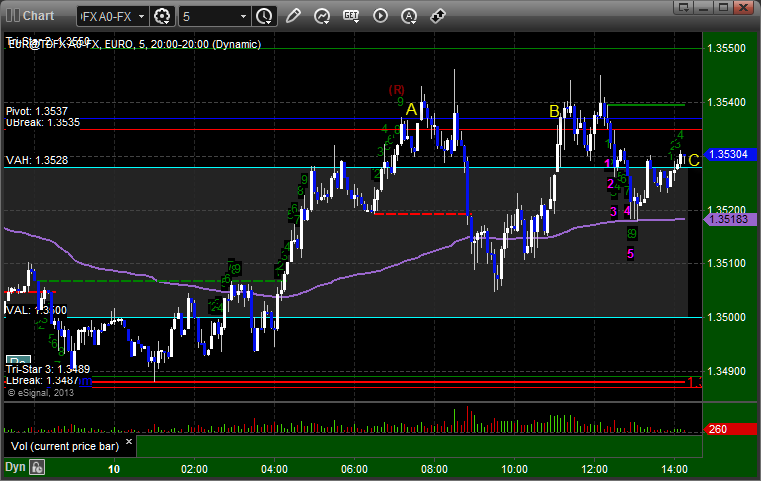

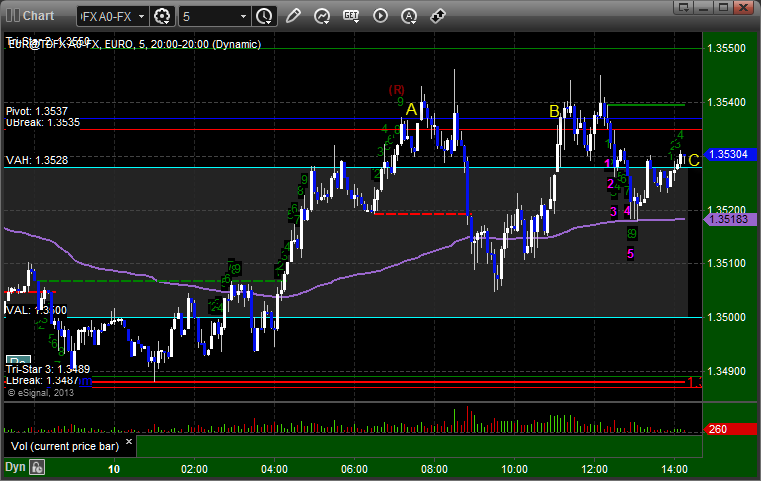

Forex Calls Recap for 10/10/13

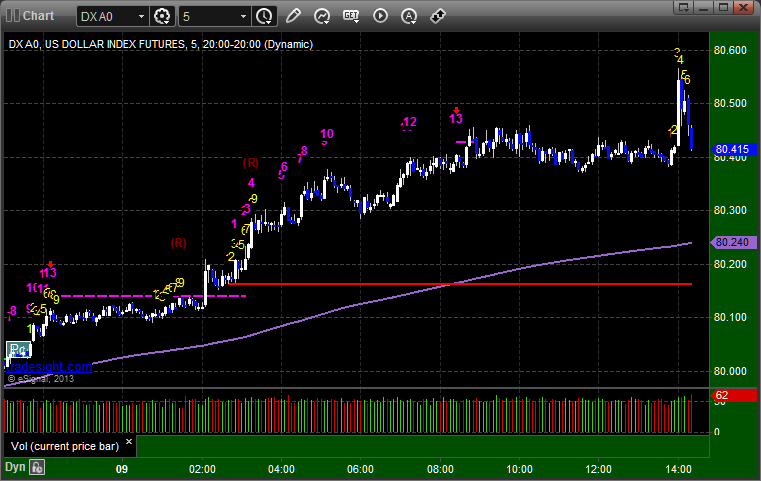

A stop out and a retrigger with a partial loser on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped. Triggered long again at B, did not stop 20 pips under Pivot, bounced off the VWAP, and eventually I closed at C for end of session since it wasn't in the money:

Forex Calls Recap for 10/10/13

A stop out and a retrigger with a partial loser on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped. Triggered long again at B, did not stop 20 pips under Pivot, bounced off the VWAP, and eventually I closed at C for end of session since it wasn't in the money:

Stock Picks Recap for 10/9/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, WETF triggered short (with market support) and didn't work:

SNTS triggered short (with market support) and didn't work:

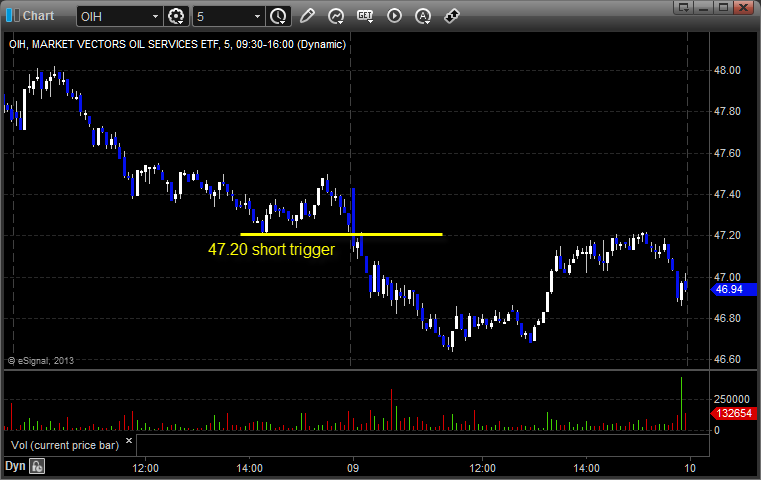

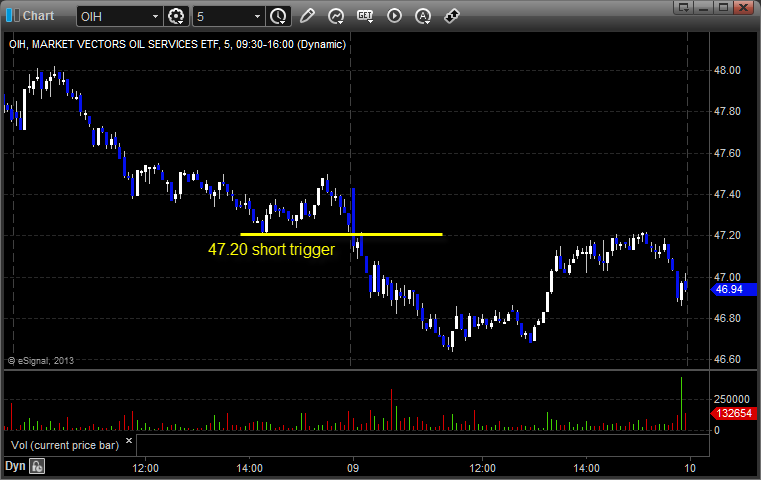

From the Messenger/Tradesight_st Twitter Feed, Rich's OIH triggered short (ETF, so no market support needed) and worked:

His PCLN triggered short (with market support) and worked:

His AAPL triggered short (with market support) and worked:

His GS triggered long (without market support) and didn't work:

His WYNN triggered long (without market support) and didn't work:

His TSLA triggered long (without market support) and didn't work:

His LNKD triggered long (with market support) and worked enough for a partial (over a point):

His GOOG triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Stock Picks Recap for 10/9/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, WETF triggered short (with market support) and didn't work:

SNTS triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's OIH triggered short (ETF, so no market support needed) and worked:

His PCLN triggered short (with market support) and worked:

His AAPL triggered short (with market support) and worked:

His GS triggered long (without market support) and didn't work:

His WYNN triggered long (without market support) and didn't work:

His TSLA triggered long (without market support) and didn't work:

His LNKD triggered long (with market support) and worked enough for a partial (over a point):

His GOOG triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

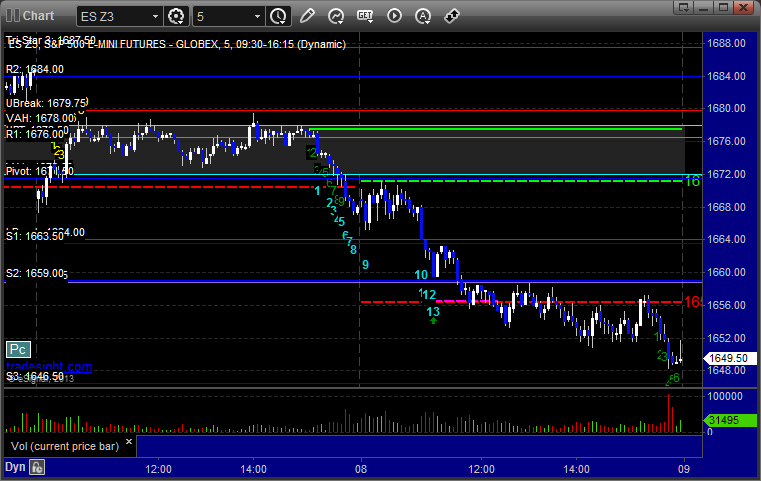

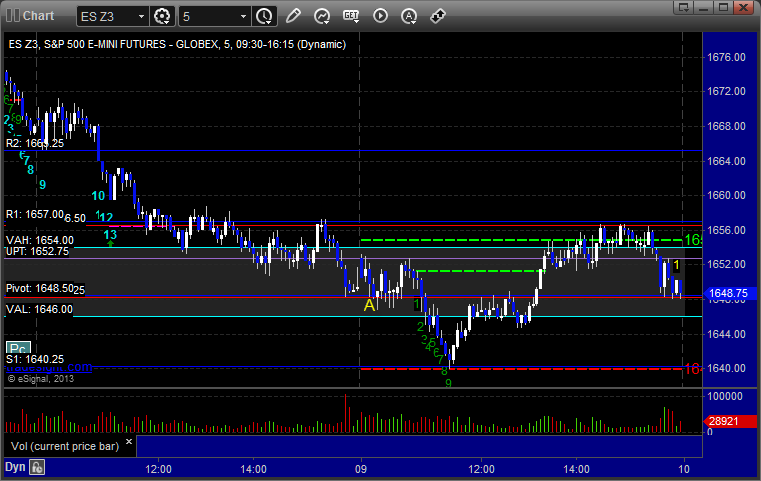

Futures Calls Recap for 10/9/13

One stop out on another day where volume is up (2.1 billion NASDAQ shares), but the markets are doing nothing while we wait for Washington. See ES below.

Net ticks: -7 ticks.

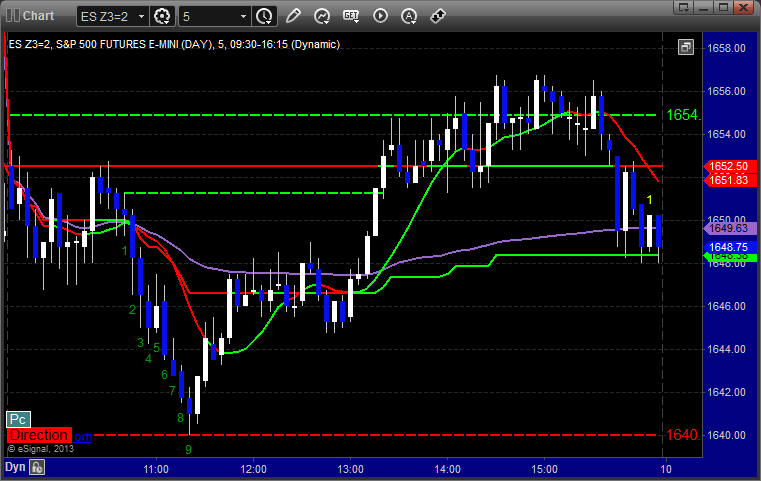

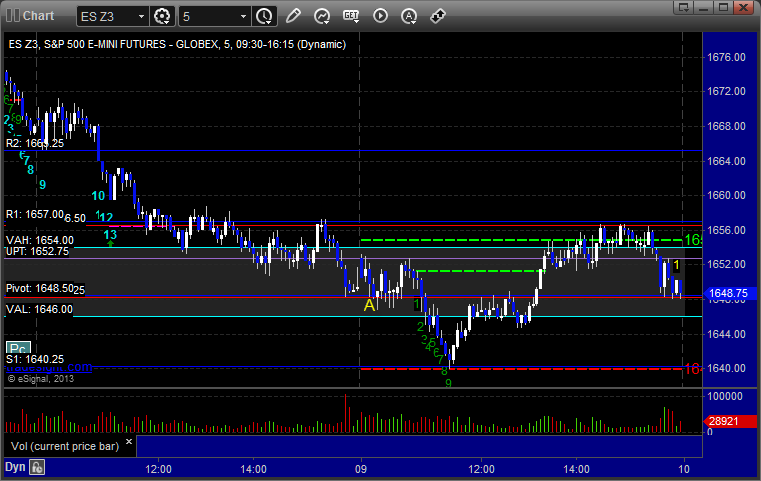

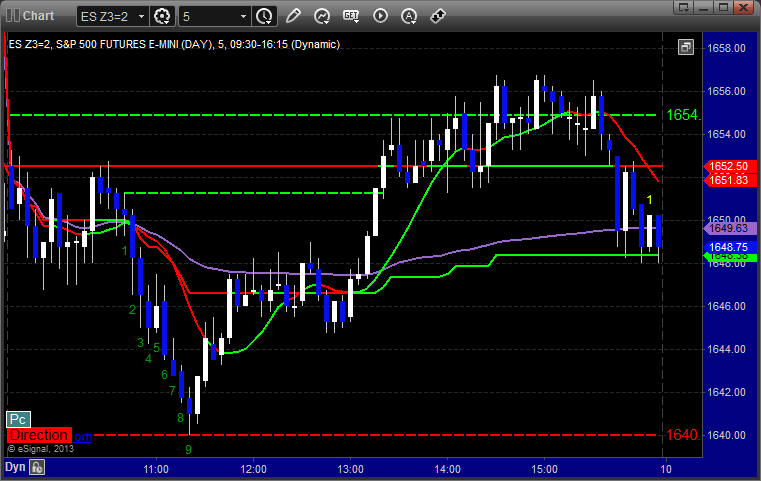

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1648.00 and stopped for 7 ticks. He did not re-enter. A later setup was called but didn't trigger:

Futures Calls Recap for 10/9/13

One stop out on another day where volume is up (2.1 billion NASDAQ shares), but the markets are doing nothing while we wait for Washington. See ES below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1648.00 and stopped for 7 ticks. He did not re-enter. A later setup was called but didn't trigger:

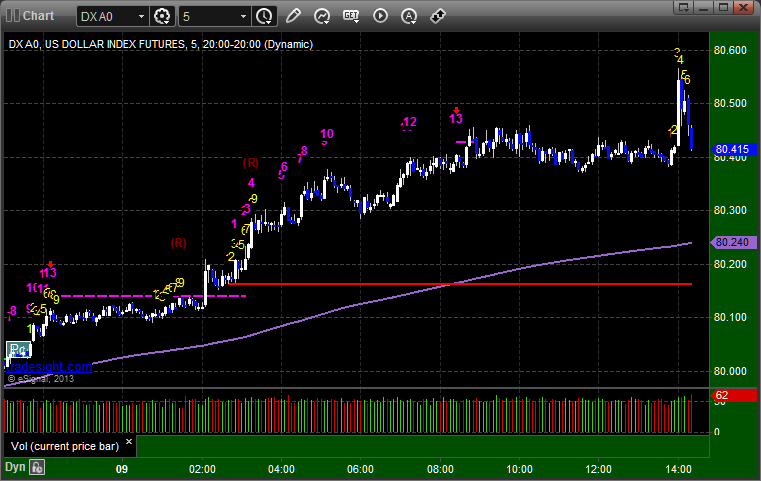

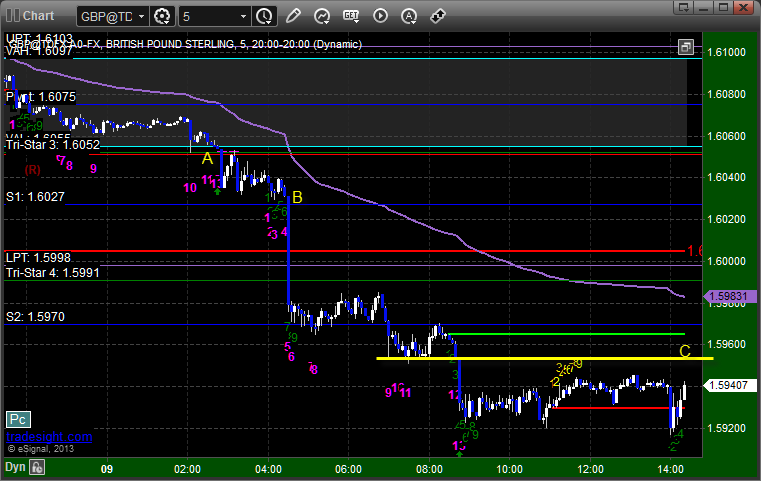

Forex Calls Recap for 10/9/13

A nice trade for the session with the second half still going. See GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

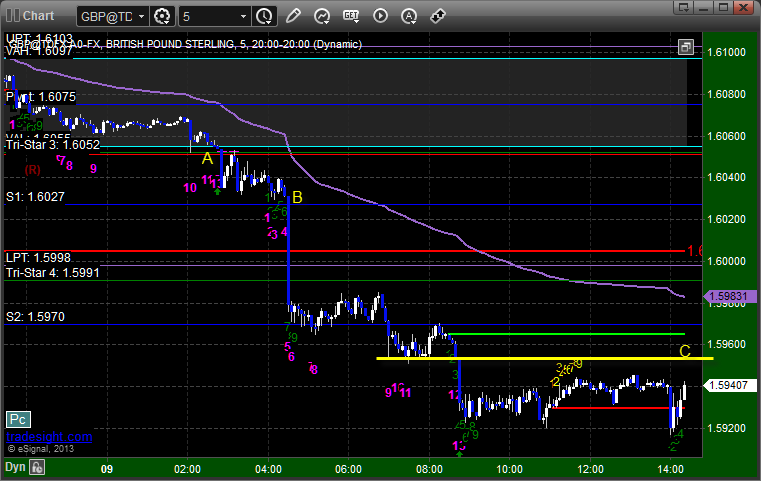

GBPUSD:

Triggered short at A, hit first target at B, and still holding second half well in the money with a stop over the yellow line at C:

Forex Calls Recap for 10/9/13

A nice trade for the session with the second half still going. See GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, and still holding second half well in the money with a stop over the yellow line at C:

Stock Picks Recap for 10/8/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, SCSS triggered long (with market support) and didn't work:

SCTY triggered long (without market support due to opening 5 minutes) and worked:

VNDA triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's XONE triggered long (without market support) and worked:

His KKD triggered long (with market support) and worked:

His VMW triggered short (with market support) and worked:

His BMRN triggered short (with market support) and worked:

His JMBA triggered short (without market support) and didn't work:

FAS triggered short (ETF, so no market support needed) and worked:

His GLD triggered long (ETF, so no market support needed) and didn't work:

His AAPL triggered long (without market support) and didn't work:

His LNKD triggered short (with market support) and worked great:

NTAP triggered short (with market support) and worked:

In total, that's 9 trades triggering with market support, 7 of them worked, 2 did not.

Futures Calls Recap for 10/8/13

A couple of calls made, but nothing triggered today as the market opened fairly flat and did nothing for over an hour, then dropped lower at a strange time of day on word that...shocker...nothing had changed in Washington. The rest of the session was flat after that.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session: