Futures Calls Recap for 10/2/13

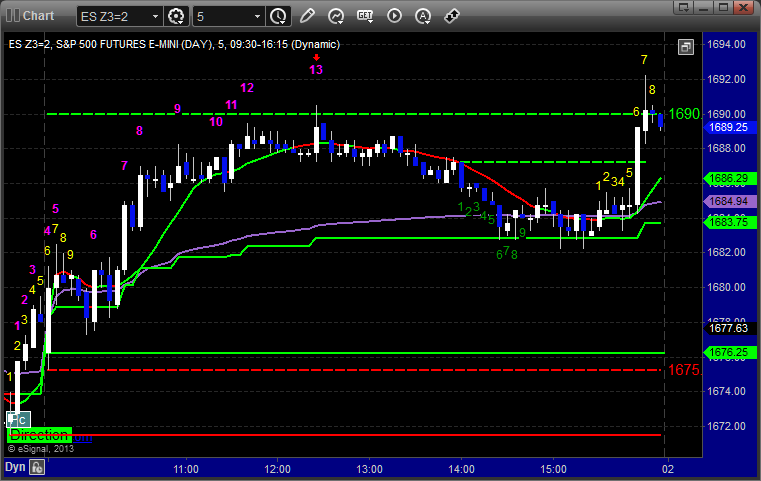

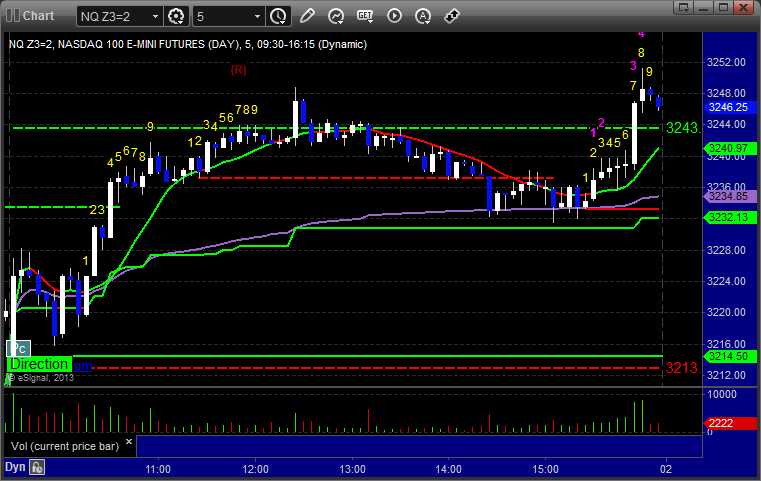

Markets gapped down, headed back up, NQ filled, ES didn't. The VAH was the high exactly on the NQ. The Comber 13 sell signal was the high on the ES. We had a winner on the ES, see that section below.

Net ticks: +4 ticks.

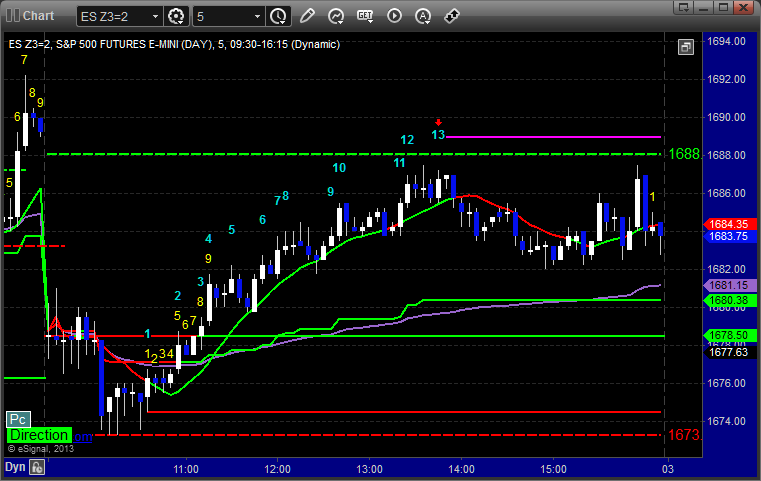

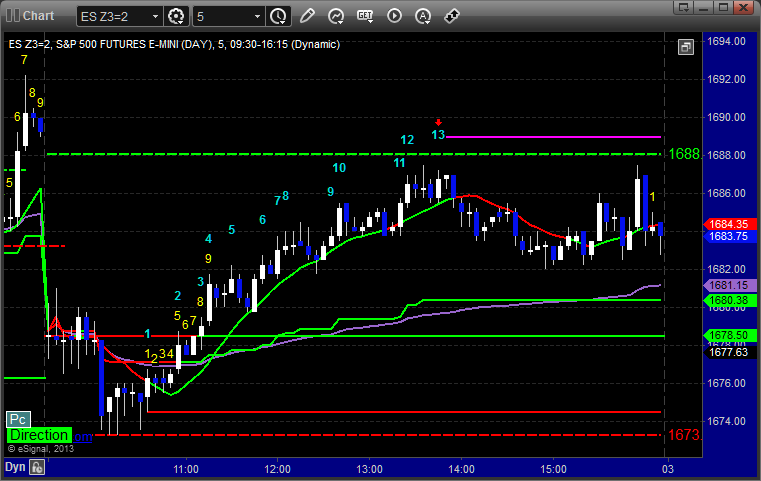

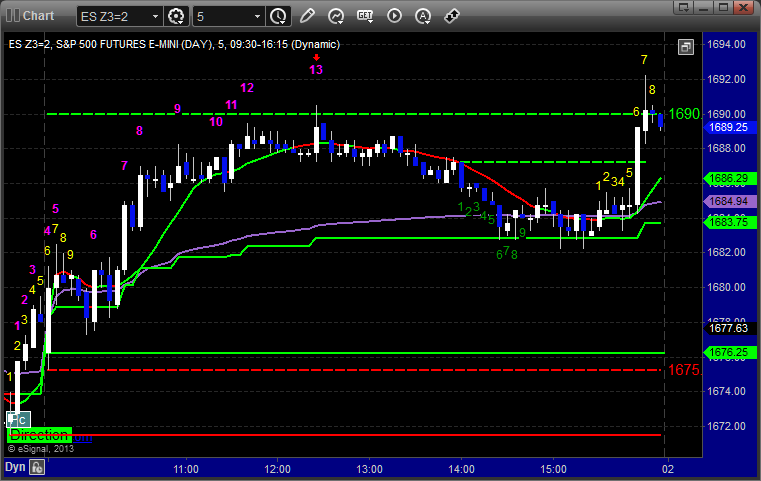

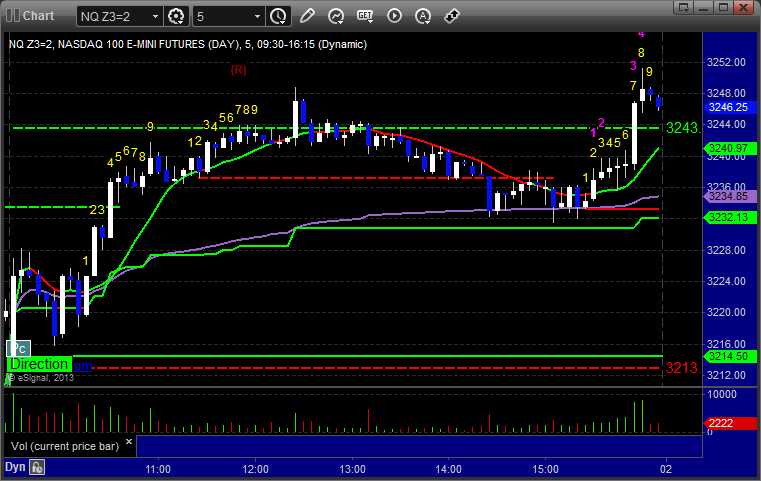

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1683.00, hit first target for 6 ticks, adjusted the stop and stopped 2 ticks in the money on the second half at B:

Futures Calls Recap for 10/2/13

Markets gapped down, headed back up, NQ filled, ES didn't. The VAH was the high exactly on the NQ. The Comber 13 sell signal was the high on the ES. We had a winner on the ES, see that section below.

Net ticks: +4 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1683.00, hit first target for 6 ticks, adjusted the stop and stopped 2 ticks in the money on the second half at B:

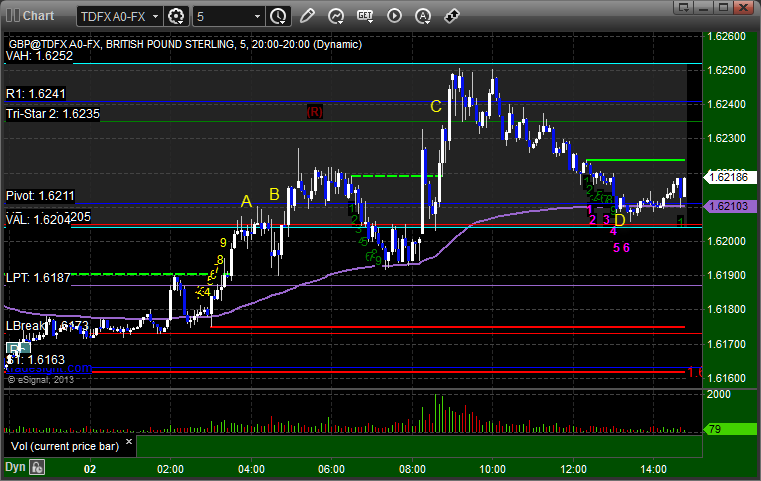

Forex Calls Recap for 10/2/13

A winner, but nothing special, for the session in the GBPUSD as the ranges continue to be poor and net movement is zero. See that section below.

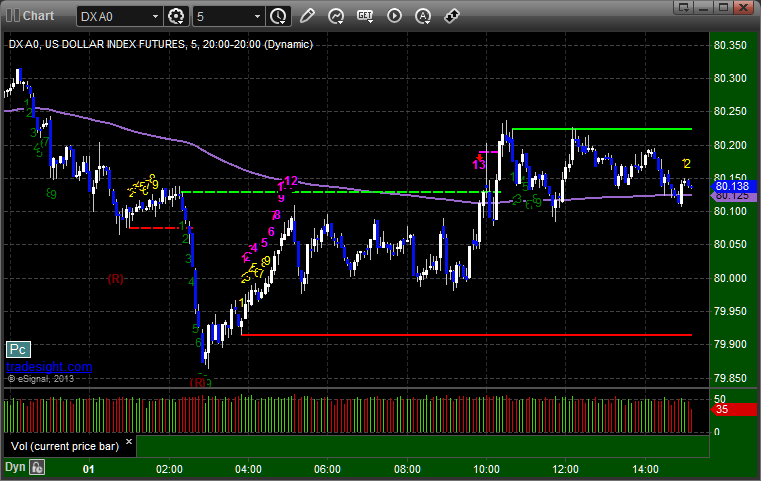

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

First we bounced off of the S1 level early without triggering through the level.

Then, we set the Pivot at A and then triggered over it at B, never stopped, hit first target at C, and closed second half under entry at D. Note that the high was the Value Area High:

Stock Picks Recap for 10/1/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EWBC and GPOR gapped over their triggers, no play.

ACAS triggered long (with market support) and didn't work:

AWAY triggered short (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered long (with market support) and worked:

CELG triggered long (with market support) and worked:

Rich's GLD triggered short (ETF, so no market support needed) and didn't work:

GS triggered short (without market support) and didn't work:

COST triggered short (without market support) and didn't work:

Rich's DECK triggered short (without market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not. Not a very exciting session.

Stock Picks Recap for 10/1/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EWBC and GPOR gapped over their triggers, no play.

ACAS triggered long (with market support) and didn't work:

AWAY triggered short (without market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered long (with market support) and worked:

CELG triggered long (with market support) and worked:

Rich's GLD triggered short (ETF, so no market support needed) and didn't work:

GS triggered short (without market support) and didn't work:

COST triggered short (without market support) and didn't work:

Rich's DECK triggered short (without market support) and worked enough for a partial:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not. Not a very exciting session.

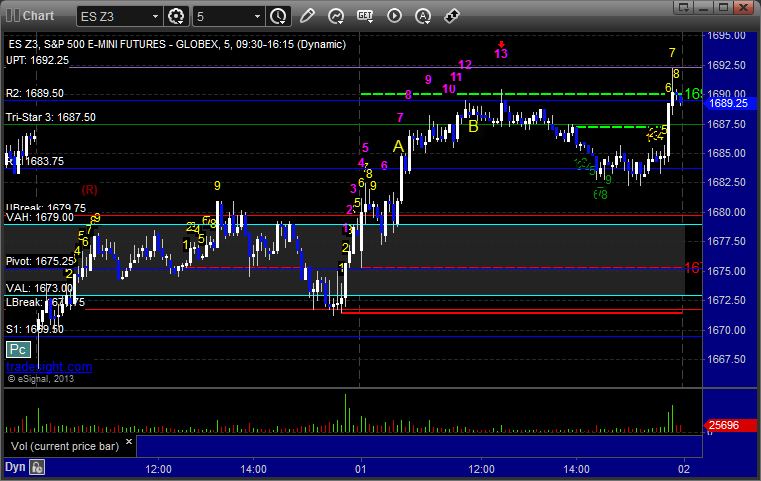

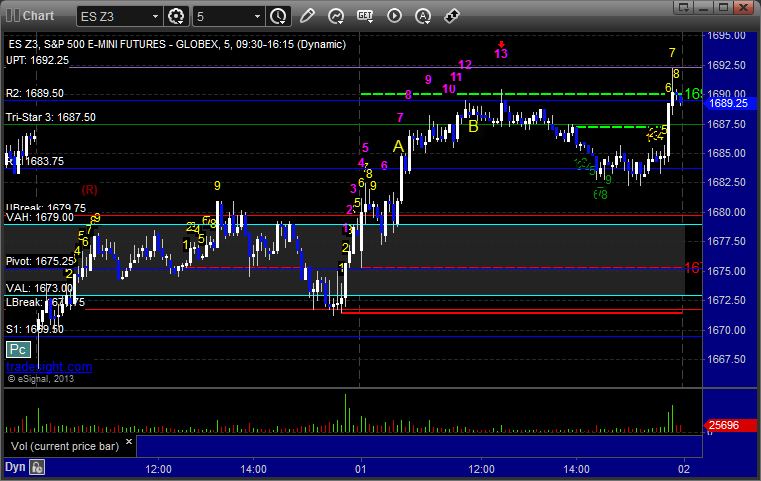

Futures Calls Recap for 10/1/13

A nice start to the month with a solid winner in the ES. See that section below.

Net ticks: +10 ticks.

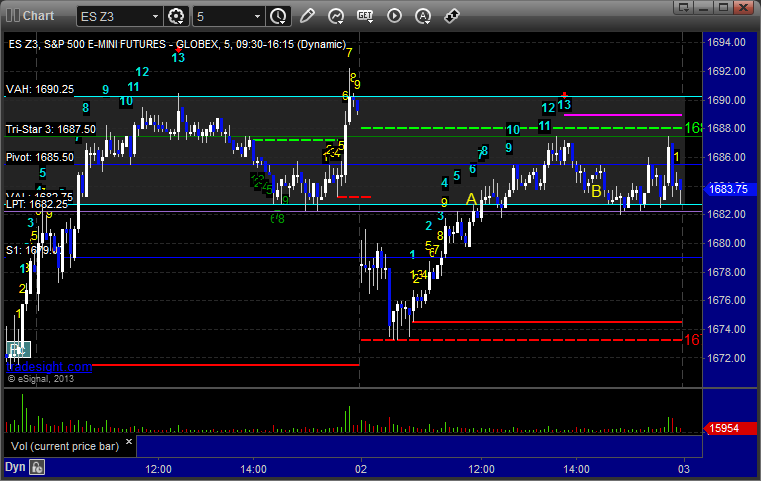

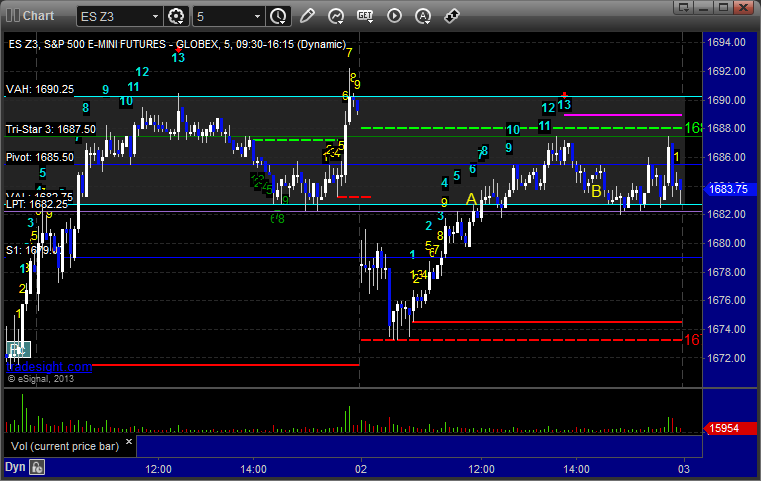

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1684.50, hit first target for 6 ticks, and he raised the stop several times and stopped at B at 1688.00:

Futures Calls Recap for 10/1/13

A nice start to the month with a solid winner in the ES. See that section below.

Net ticks: +10 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1684.50, hit first target for 6 ticks, and he raised the stop several times and stopped at B at 1688.00:

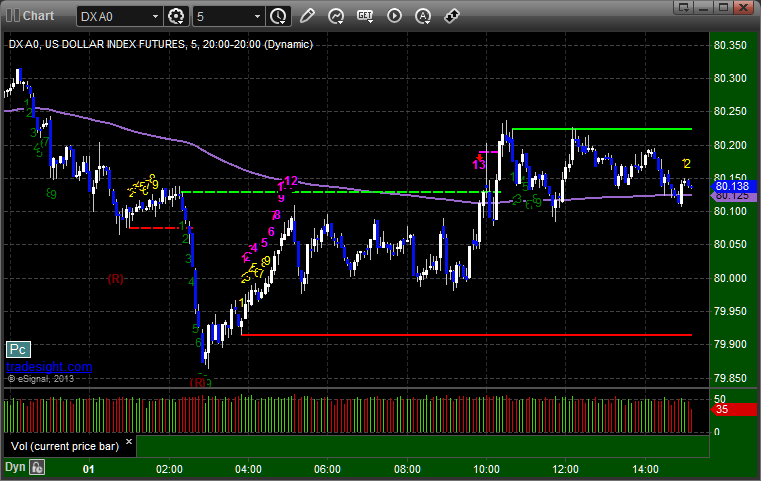

Forex Calls Recap for 10/1/13

Another winner, this time on the GBPUSD, and the second half of the EURUSD from the prior session stopped in the money. See both sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

The second half of the trade from the prior session stopped out slightly in the money at A:

GBPUSD:

Triggered long at A, hit first target at B, stopped second half under entry at C:

Forex Calls Recap for 10/1/13

Another winner, this time on the GBPUSD, and the second half of the EURUSD from the prior session stopped in the money. See both sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

The second half of the trade from the prior session stopped out slightly in the money at A:

GBPUSD:

Triggered long at A, hit first target at B, stopped second half under entry at C:

Stock Picks Recap for 9/30/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, ICLR triggered long (with market support) and worked enough for a partial:

MELI triggered long (with market support) and didn't work:

HMSY triggered short (without market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, AAPL triggered long (with market support) and worked:

TSLA triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.