Stock Picks Recap for 9/20/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VNDA triggered long (without market support) and didn't work:

BPOP triggered short (with market support) and worked enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, Rich's RNA triggered long (without market support due to opening 5 minutes) and worked nicely (doesn't look like much due to the gap, but it went from $6.50 to $8.00 quickly):

His TIBX triggered short (with market support) and didn't work, worked later:

BIDU triggered long (without market support) and didn't work:

Rich's Z triggered short (with market support) and worked:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not. Plus Rich's RNA out of the gate.

Futures Calls Recap for 9/20/13

No calls for triple expiration Friday, although we did end up with better range, which is unusual. It almost looks like they saved options unraveling for the last day as the move down started after the first hour.

Net ticks: +0 ticks.

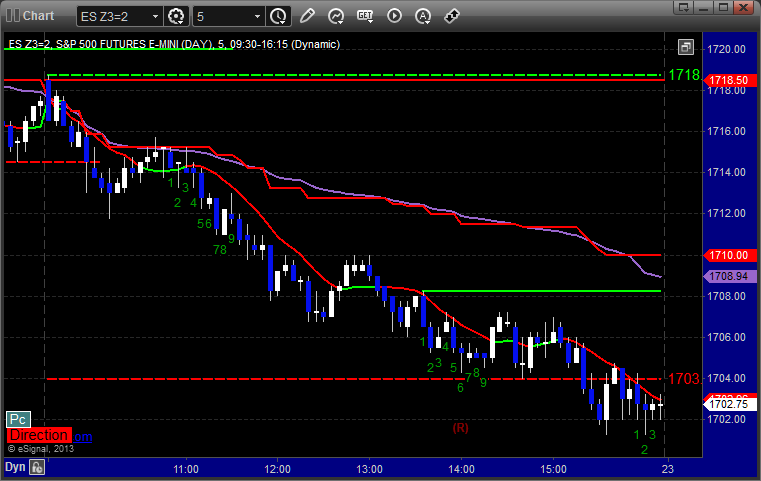

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 9/20/13

Amazingly, no triggers again to close out the session, and to prove that we had the right entry point, the GBPUSD hit the trigger exactly but never got through. That's fine though because I wasn't expecting much for triple expiration, so I'd rather not enter than get stopped.

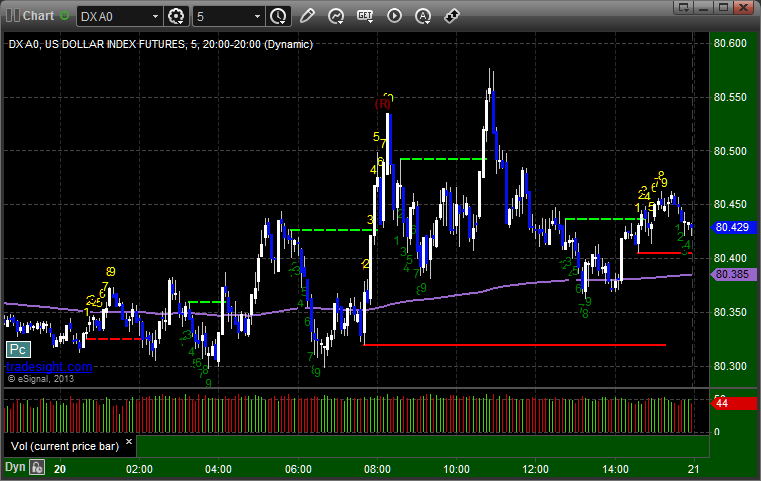

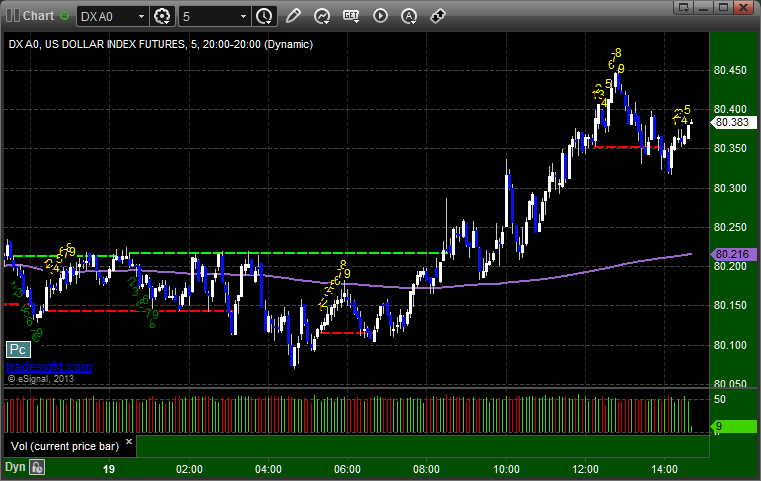

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. There are a lot of signals indicating a reversal in favor of the US Dollar.

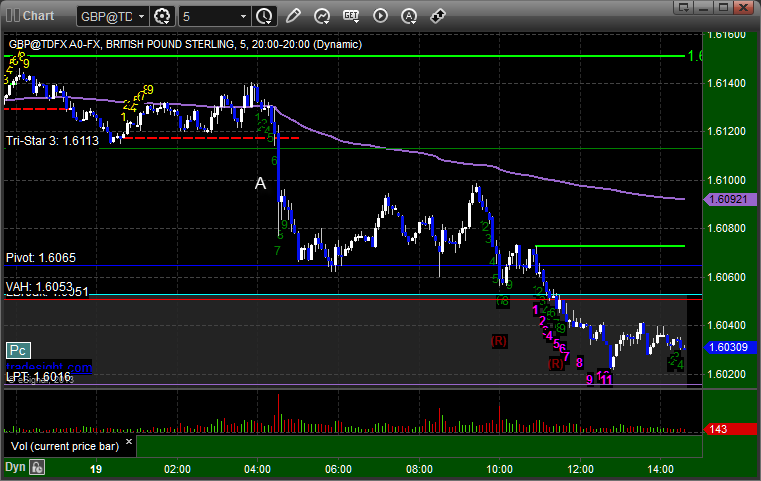

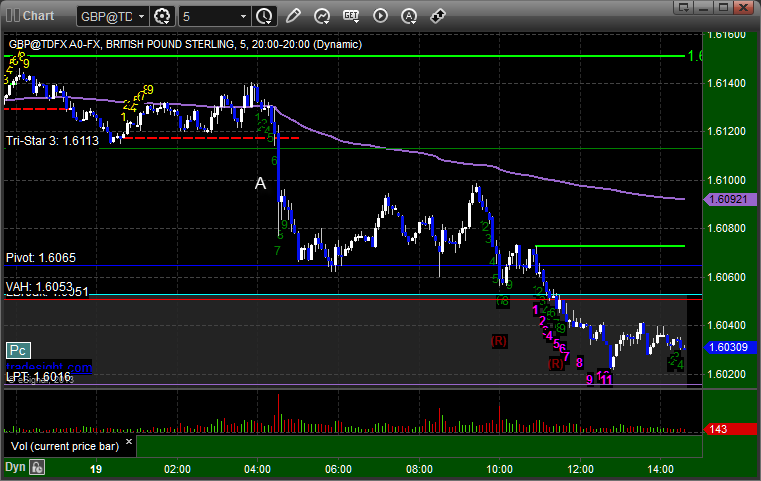

GBPUSD:

Forex Calls Recap for 9/20/13

Amazingly, no triggers again to close out the session, and to prove that we had the right entry point, the GBPUSD hit the trigger exactly but never got through. That's fine though because I wasn't expecting much for triple expiration, so I'd rather not enter than get stopped.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. There are a lot of signals indicating a reversal in favor of the US Dollar.

GBPUSD:

Stock Picks Recap for 9/19/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, NXST triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered long (with market support) and worked great:

His SCTY triggered long (with market support) and worked:

His DIS triggered short (with market support) and didn't work, worked later:

His FAS triggered short (ETF, so no market support needed) and worked:

AMGN triggered short (with market support) and worked:

GS triggered short (with market support) and worked enough for a partial:

COST triggered long (without market support) and didn't do enough to count either way, ran out of time:

Rich's GOOG triggered short (with market support) and didn't work:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

Futures Calls Recap for 9/19/13

No calls as no Levels were even touched on the NQ and barely on the ES in a flat session ahead of triple expiration (so Friday will probably be worse).

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 9/19/13

Stopped out of our GBPUSD trade 170 pips in the money and then had a loser on the EURUSD. See both sections below.

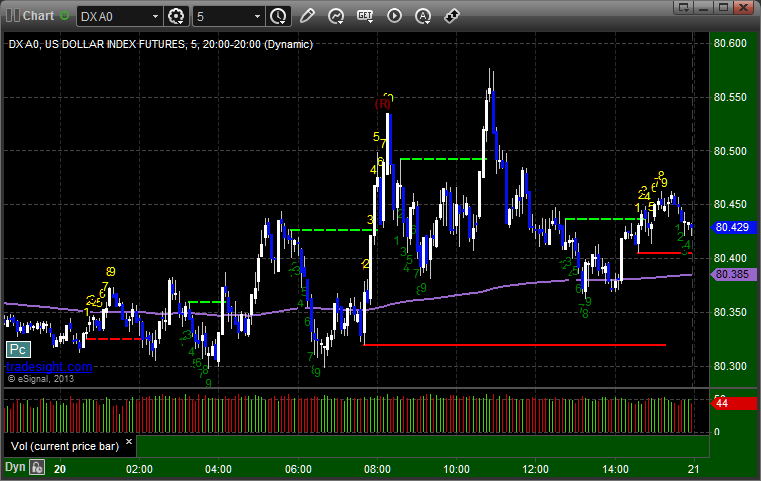

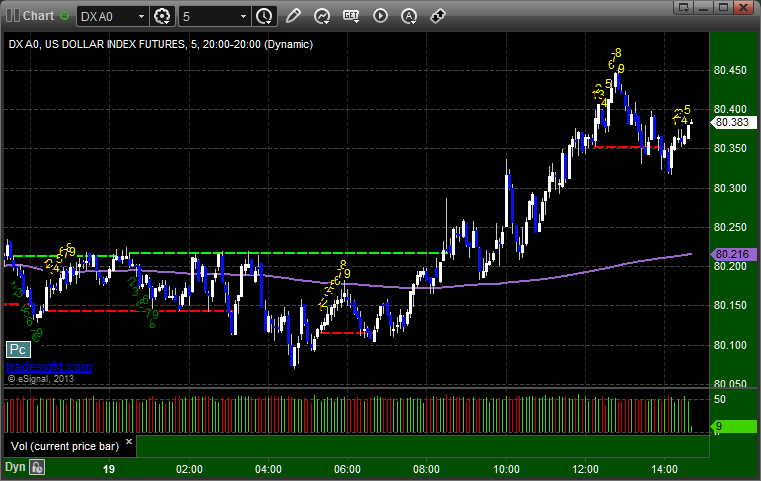

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped:

GBPUSD:

Stopped out of the second half from our 1.5930 entry at A at 1.6100:

Forex Calls Recap for 9/19/13

Stopped out of our GBPUSD trade 170 pips in the money and then had a loser on the EURUSD. See both sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped:

GBPUSD:

Stopped out of the second half from our 1.5930 entry at A at 1.6100:

Stock Picks Recap for 9/18/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BMRN gapped over, no play, but it did fill the gap and work later.

FINL triggered long (with market support) and eventually worked after the Fed:

From the Messenger/Tradesight_st Twitter Feed, Rich's TWGP triggered short (with market support) and worked:

Rich's SOHU triggered long (with market support) and worked:

His CF triggered long (without market support) and didn't work:

His YHOO triggered long (with market support) and worked:

TSLA triggered long (with market support) and didn't work:

There were a lot more calls, but nothing else triggered. In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Stock Picks Recap for 9/18/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BMRN gapped over, no play, but it did fill the gap and work later.

FINL triggered long (with market support) and eventually worked after the Fed:

From the Messenger/Tradesight_st Twitter Feed, Rich's TWGP triggered short (with market support) and worked:

Rich's SOHU triggered long (with market support) and worked:

His CF triggered long (without market support) and didn't work:

His YHOO triggered long (with market support) and worked:

TSLA triggered long (with market support) and didn't work:

There were a lot more calls, but nothing else triggered. In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.