Stock Picks Recap for 9/16/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, Rich's SOHU triggered short (with market support) and worked:

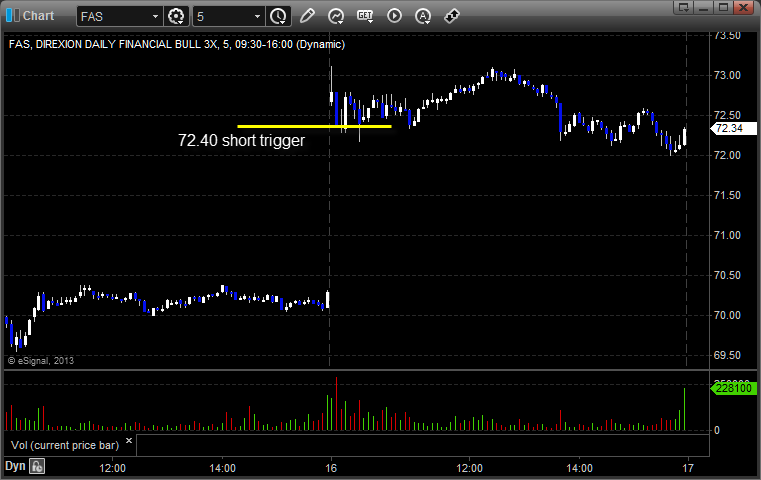

His FAS triggered short (ETF, so no market support needed) and didn't work:

His CELG triggered short (with market support) and worked:

TEVA triggered short (with market support) and worked:

My CELG triggered short (with market support) and didn't work:

Rich's GOOG triggered short (with market support) and worked enough for a partial:

His FB triggered short (with market support) and worked:

In total, that's 7 trades triggering with market support, 5 of them worked, 2 did not.

Futures Calls Recap for 9/16/13

Couple of triggers on the YM. Didn't work twice, then worked a little. Not a very exciting day at 1.4 billion NASDAQ shares. See that section below.

Net ticks: -11 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

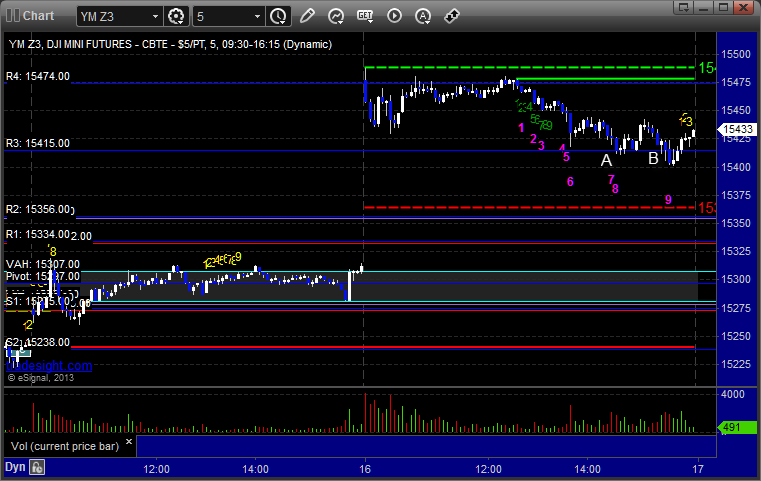

YM:

Triggered short at A under R3 at 15414 and stopped. Triggered short again at B and stopped. Triggered again right after that, hit first target for 8 ticks, and then stopped second half over R3:

Forex Calls Recap for 9/16/13

A big gap against the US Dollar to start the week (which didn't fill), and then a fairly narrow session again with a winner and a loser on the GBPUSD. The EURUSD set the trigger exactly but didn't trigger. See GBPUSD below.

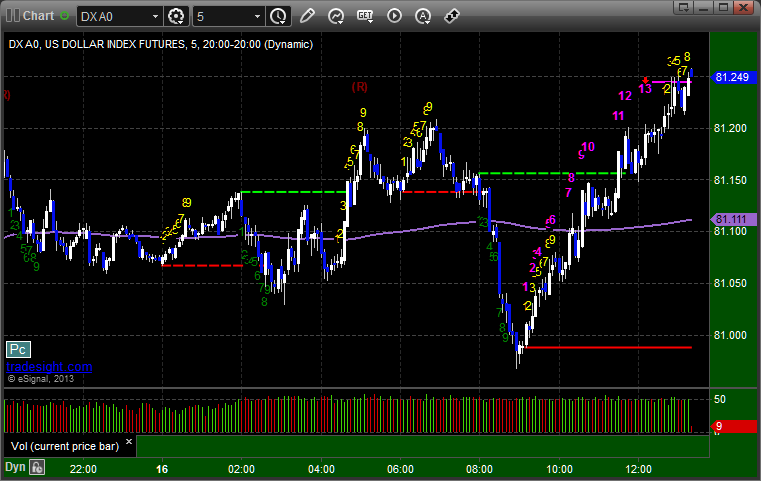

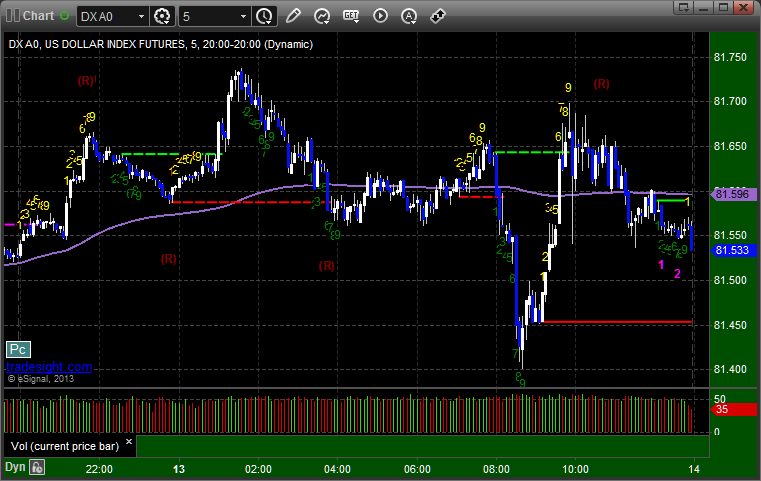

Here's a look at the US Dollar Index intraday with our market directional lines:

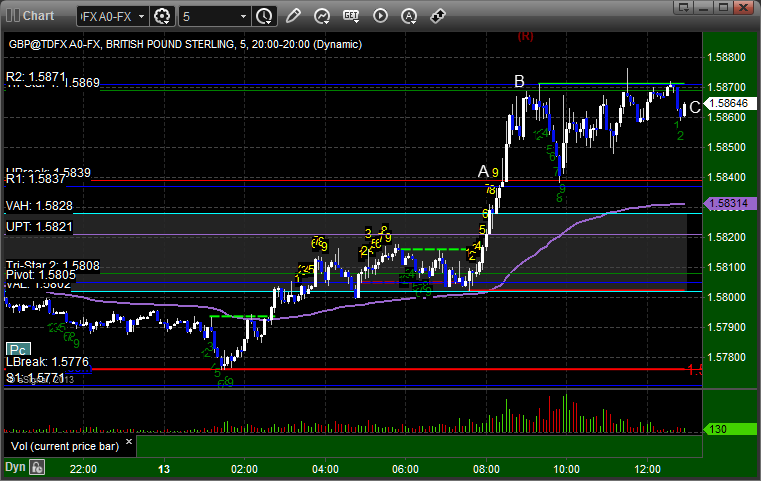

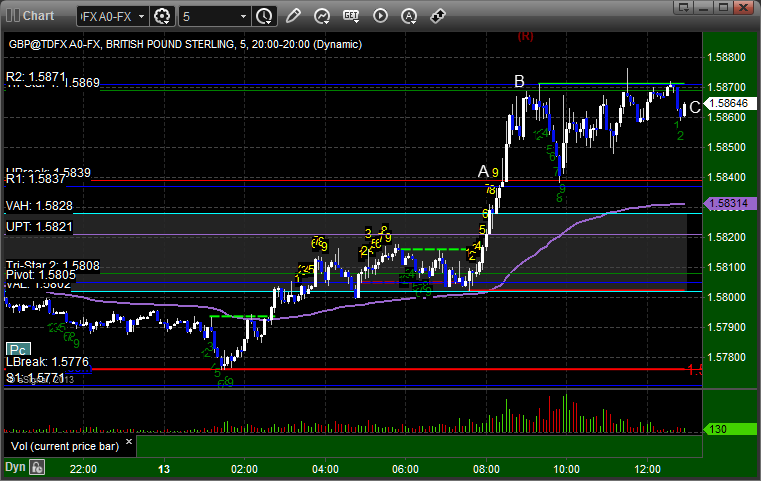

GBPUSD:

Triggered short at A and stopped. Triggered short at B, closed at C in the money for end of session as it wasn't far enough in the money to hit first target and hold:

Stock Picks Recap for 9/13/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no triggers (couple of days in a row without a trigger off of the report pretty much tells you how the market is doing).

From the Messenger/Tradesight_st Twitter Feed, Rich's REGN triggered long (with market support) and worked:

His OIH triggered short (ETF, so no market support needed) and didn't work:

His XONE triggered long (with market support) and worked enough for a partial:

AMZN triggered short (with market support) and worked:

Rich's Z triggered short (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 9/13/13

A small winner early to close out the week and then the session fell into a 5 point range, glued to the VWAP, as is often the case on Fridays. We ended up trading 1.4 billion NASDAQ shares, and we stayed in the 10-point range on the S&P/ES from Tuesday just after the open through Friday's close, which is not fun for trading.

Net ticks: +2.5 ticks.

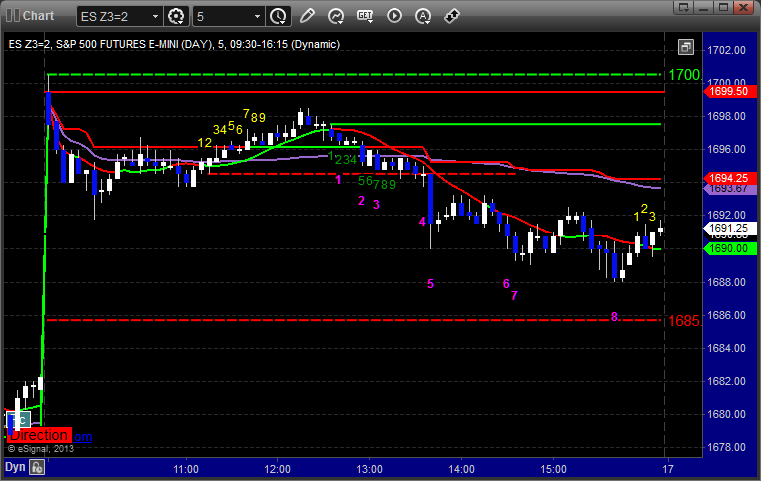

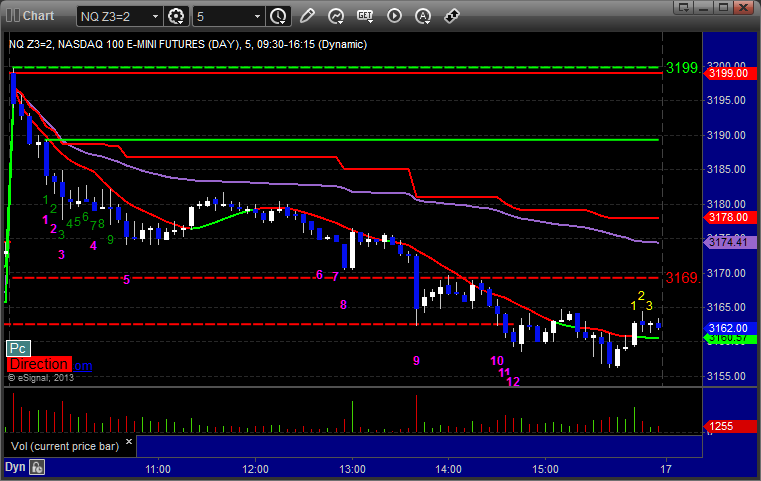

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

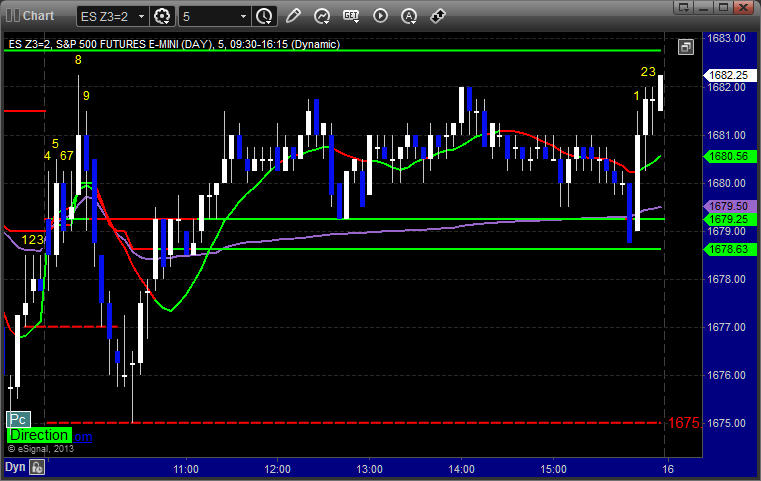

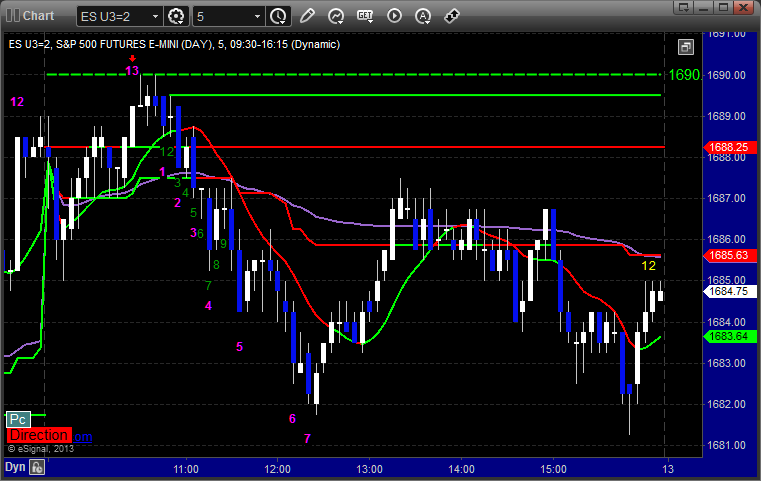

ES:

Triggered long at A at 1680.75, hit first target for 6 ticks, stopped second half under the entry:

Forex Calls Recap for 9/13/13

A winner to close out the week in the GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

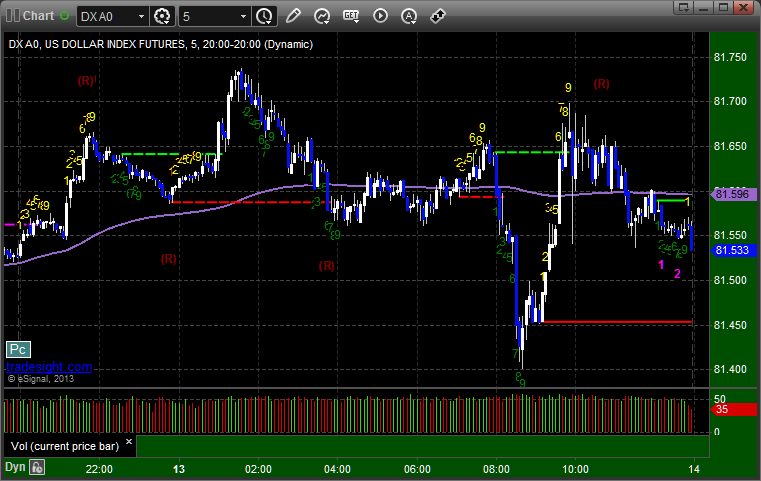

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. We do have some 9-bar setups, but that's about it.

GBPUSD:

Triggered long at A, hit first target at B, closed final half at end of chart for end of week:

Forex Calls Recap for 9/13/13

A winner to close out the week in the GBPUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. We do have some 9-bar setups, but that's about it.

GBPUSD:

Triggered long at A, hit first target at B, closed final half at end of chart for end of week:

Stock Picks Recap for 9/12/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (without market support) and worked:

His OIH triggered short (without market support due to opening 5 minutes) and didn't work:

His QCOM triggered long (without market support) and worked:

His NFLX triggered short (with market support) and worked:

His TSLA triggered short (with market support) and worked:

FSLR triggered short (with market support) and worked:

AMZN triggered long (with market support) and didn't work:

Lots of other calls posted, but nothing triggered in narrow range.

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Stock Picks Recap for 9/12/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered long (without market support) and worked:

His OIH triggered short (without market support due to opening 5 minutes) and didn't work:

His QCOM triggered long (without market support) and worked:

His NFLX triggered short (with market support) and worked:

His TSLA triggered short (with market support) and worked:

FSLR triggered short (with market support) and worked:

AMZN triggered long (with market support) and didn't work:

Lots of other calls posted, but nothing triggered in narrow range.

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

Futures Calls Recap for 9/12/13

Another dull session. We've basically been trapped in a 10-point range on the ES for 3 days when the average single day's range is usually 16 points. Not great. Volume was 1.6 billion NASDAQ shares.

Net ticks: -7 ticks.

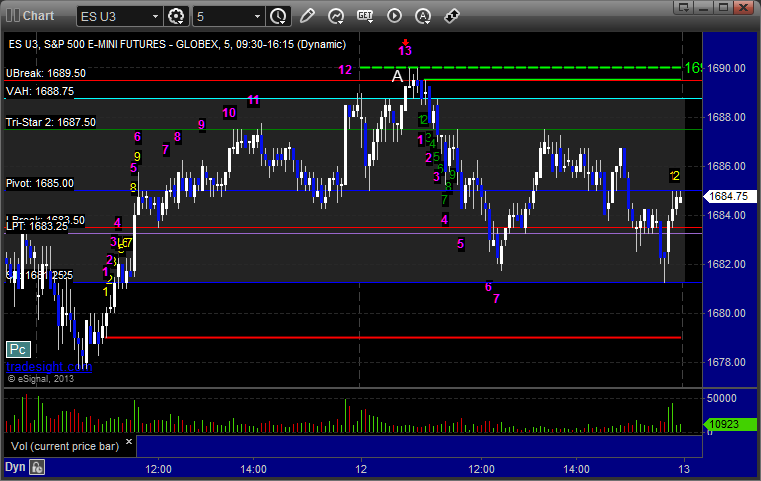

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1689.75. Should have really closed it when it didn't go immediately since we had a Comber 13 sell signal right there: