Stock Picks Recap for 9/9/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, EXEL triggered long (with market support) and didn't work. Frankly, didn't do almost anything yet and still might:

ELGX triggered long (with market support) and worked enough for a partial:

CTSH triggered long (with market support) and worked:

MAKO triggered long (with market support) and worked:

IRWD triggered long (with market support) and worked:

ACHN triggered long (with market support) and worked, although it triggered late and was just getting started:

From the Messenger/Tradesight_st Twitter Feed, Mark's GILD triggered long (with market support) and worked:

CELG triggered long (with market support) and didn't go enough in either direction to count, closed basically at the trigger:

Mark's AAPL triggered long (with market support) and didn't work:

Rich's GMCR triggered long (with market support) and worked:

AMZN triggered long (with market support) and didn't do enough in either direction to count, closed at the trigger:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not (if you count EXEL as not working down a dime).

Futures Calls Recap for 9/9/13

A nice winner to start the week again. See the NQ section below.

Net ticks: +18.5 ticks.

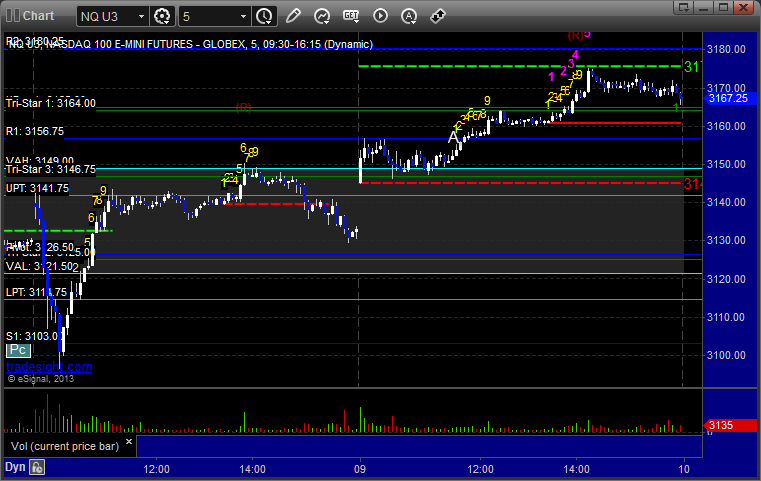

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Mark's call triggered long at A at 3157.50, hit first target for 6 ticks, and he adjusted the stop several times and stopped the final piece at 3173.00 at B for 31 of our ticks (half point):

Forex Calls Recap for 9/9/13

A winner to start the week in the GBPUSD, and we're technically still holding the second half but it is very close to stopping out in the money. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

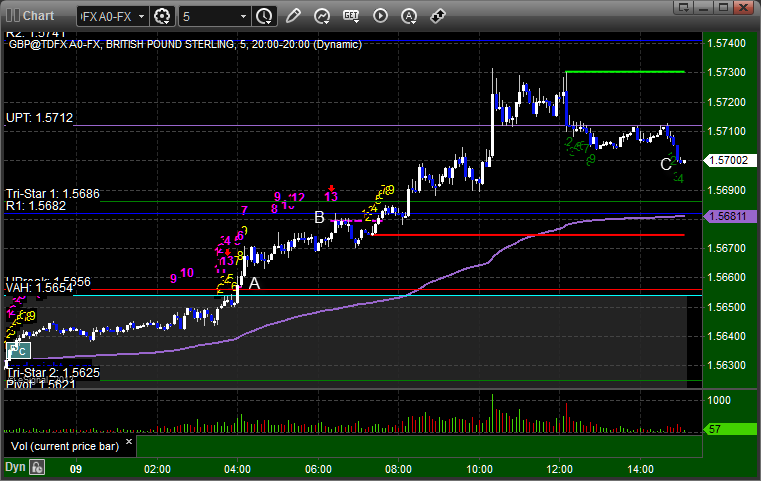

GBPUSD:

Triggered long at A, hit first target at B, and probably about to stop out of the final piece around C (1.5695 would do it):

Stock Picks Recap for 9/6/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BMRN triggered long (with market support) and worked:

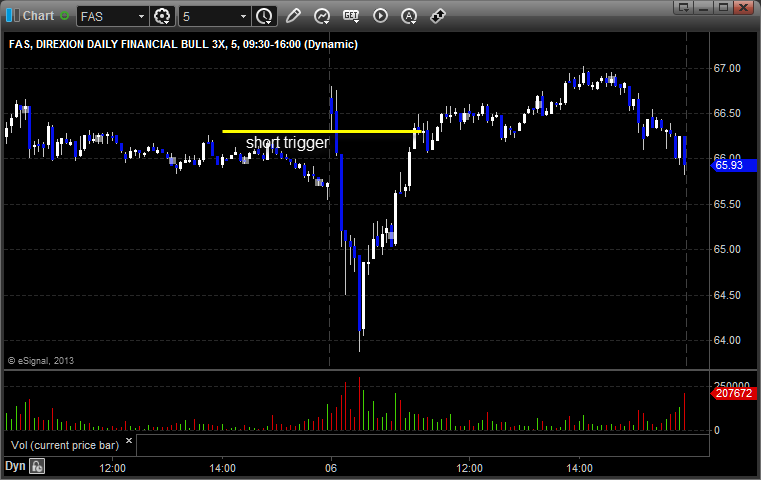

From the Messenger/Tradesight_st Twitter Feed, Rich's FAS triggered short (ETF, so no market support needed) and worked:

NTAP triggered short (with market support) and worked:

Rich's GLD triggered long (ETF, so no market support needed) and worked enough for a partial:

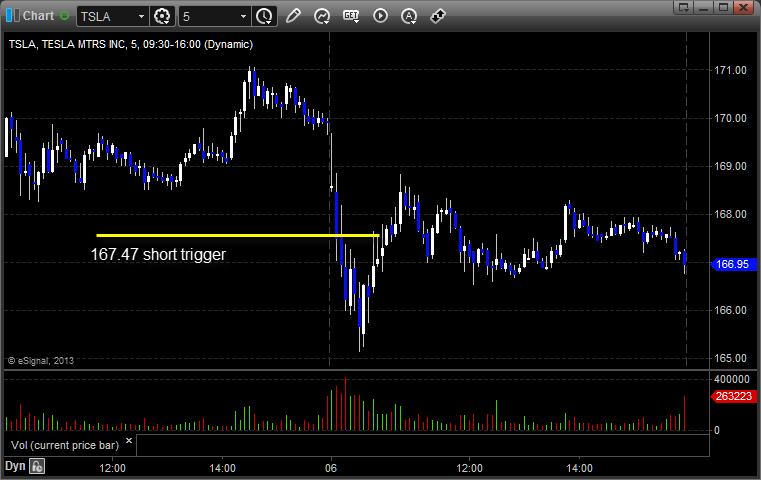

TSLA triggered short (with market support) and worked:

Rich's AMGN triggered short (with market support) and worked:

NFLX triggered short (with market support) and worked:

FB triggered long (with market support) and worked:

Rich's VXX triggered long (ETF, no market support needed) and worked:

His AAPL triggered in the last 10 minutes, not enough time remaining.

In total, that's 9 trades triggering with market support, and all 9 of them worked. For the record, that's 27 for 27 this week. That is quite amazing.

Futures Calls Recap for 9/6/13

What a great session with a huge winner in the ES for 40 ticks to the final target after a gap up. See that section below. Really nice for a Friday. NASDAQ volume closed at 1.6 billion shares. What's amazing is that after all of that, the ES and NQ closed on their VWAPs. Wow.

Net ticks: +23 ticks.

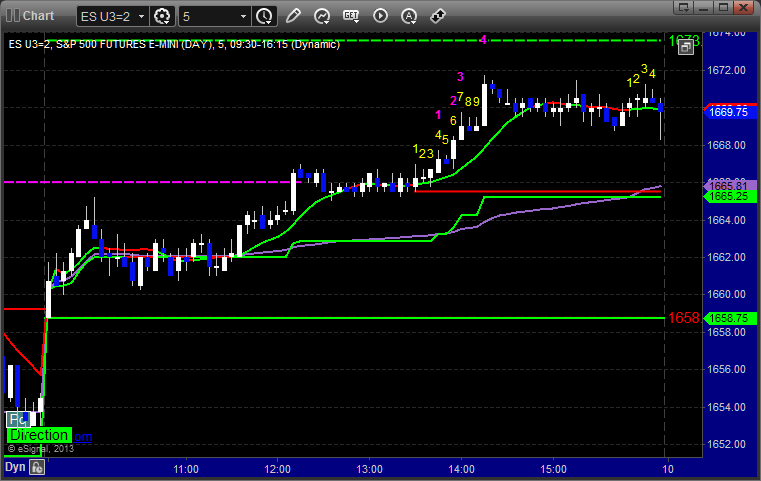

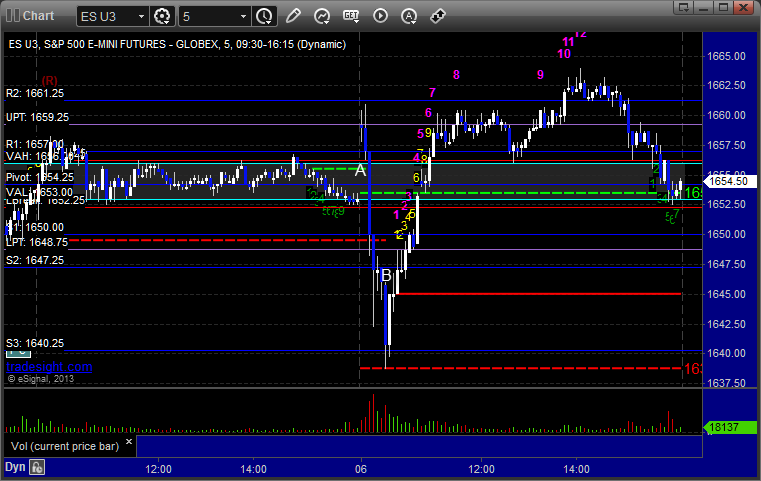

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

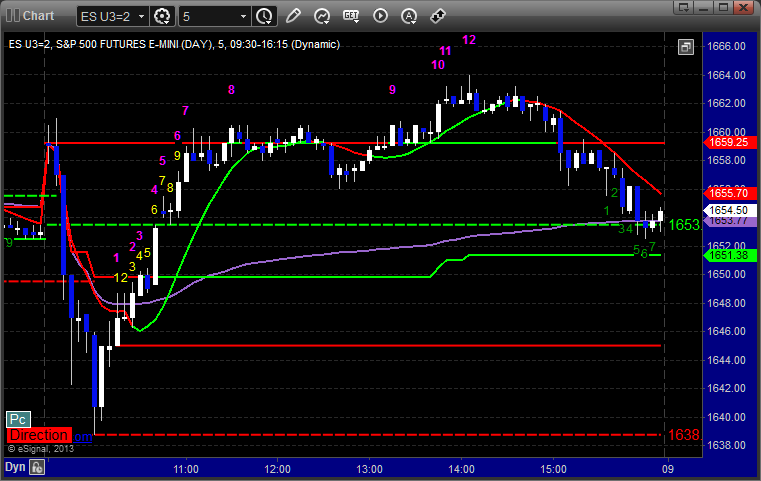

ES:

Triggered short at A into the Value Area at 1655.75, hit first target for 6 ticks, and then picked up speed to the downside on Putin's comments. We lowered the stop many times and stopped the final piece at 1645.75 for a 40 tick gain from the entry on the second half at B:

Forex Calls Recap for 9/6/13

Half size or less ahead of the NFP data. We had a loser and a winner in the EURUSD to close out the week. See that section below.

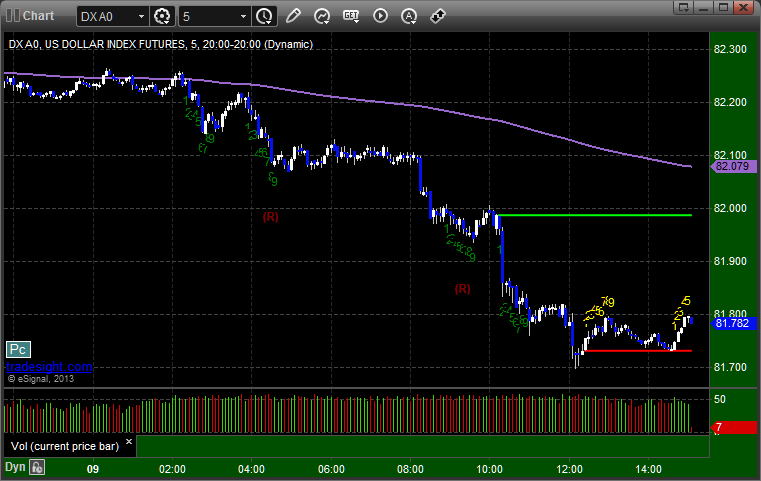

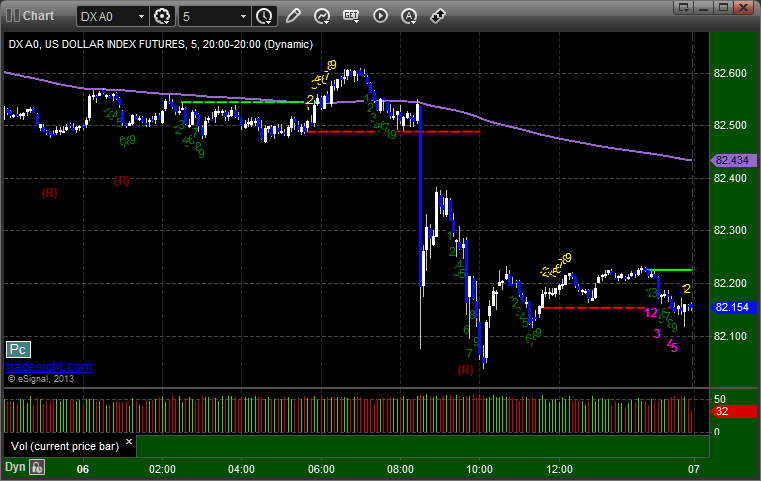

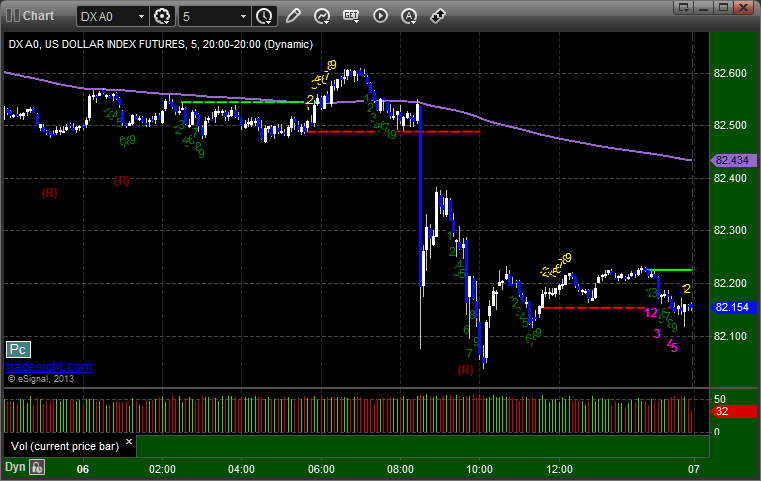

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Still nothing to see.

EURUSD:

Triggered long at A and stopped. Triggered long at B, hit first target at C, and closed final piece at D for end of week:

Forex Calls Recap for 9/6/13

Half size or less ahead of the NFP data. We had a loser and a winner in the EURUSD to close out the week. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Still nothing to see.

EURUSD:

Triggered long at A and stopped. Triggered long at B, hit first target at C, and closed final piece at D for end of week:

Stock Picks Recap for 9/5/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, HIMX triggered long (with market support) and worked:

NKTR triggered long (with market support) and worked:

CIEN triggered long (with market support) and worked:

BIDU triggered short (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (with market support) and worked:

Rich's GOOG triggered long (with market support) and worked:

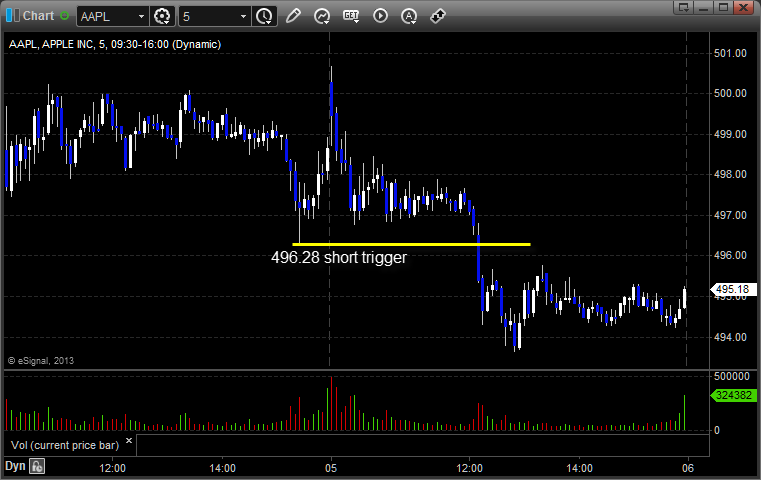

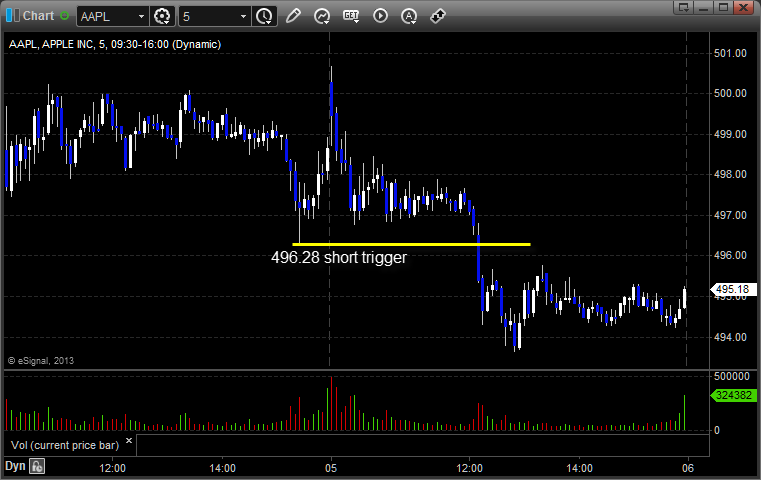

AAPL triggered short (with market support) and worked:

Rich's SCTY triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, all 7 of them worked again.

Stock Picks Recap for 9/5/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, HIMX triggered long (with market support) and worked:

NKTR triggered long (with market support) and worked:

CIEN triggered long (with market support) and worked:

BIDU triggered short (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMZN triggered long (with market support) and worked:

Rich's GOOG triggered long (with market support) and worked:

AAPL triggered short (with market support) and worked:

Rich's SCTY triggered long (with market support) and worked:

In total, that's 7 trades triggering with market support, all 7 of them worked again.

Futures Calls Recap for 9/5/13

A disappointing session coming off of the prior one as the market opened flat and barely did anything. Volume closed at 1.4 billion NASDAQ shares. We did pull off two winners in the ES. See that section below.

Net ticks: +5 ticks.

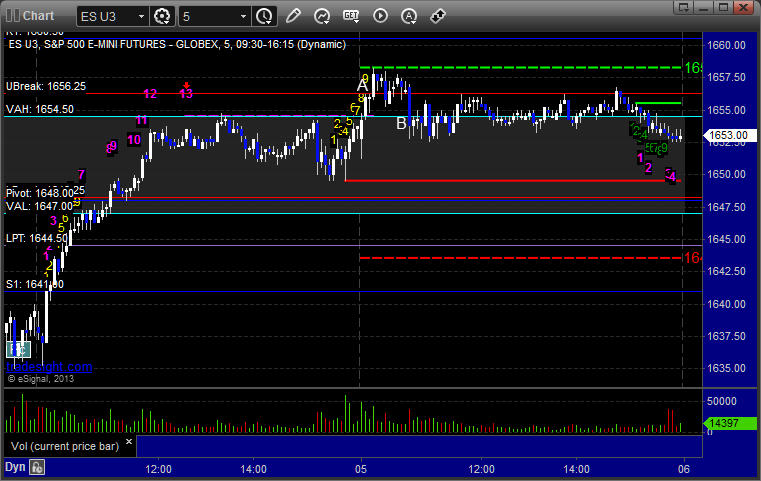

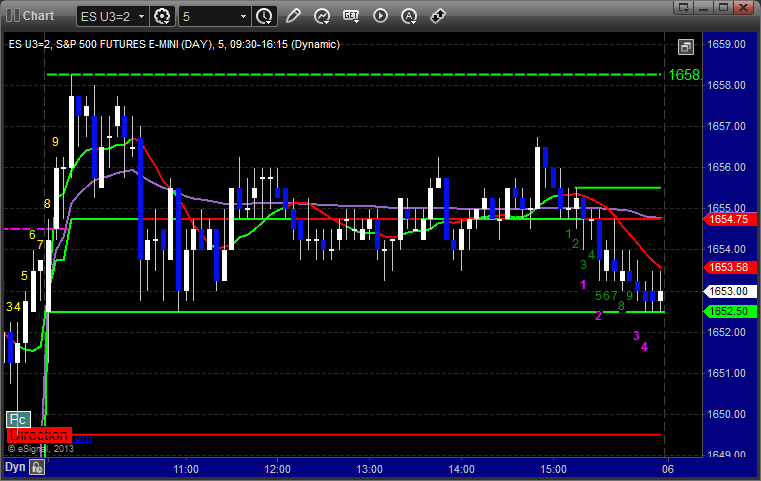

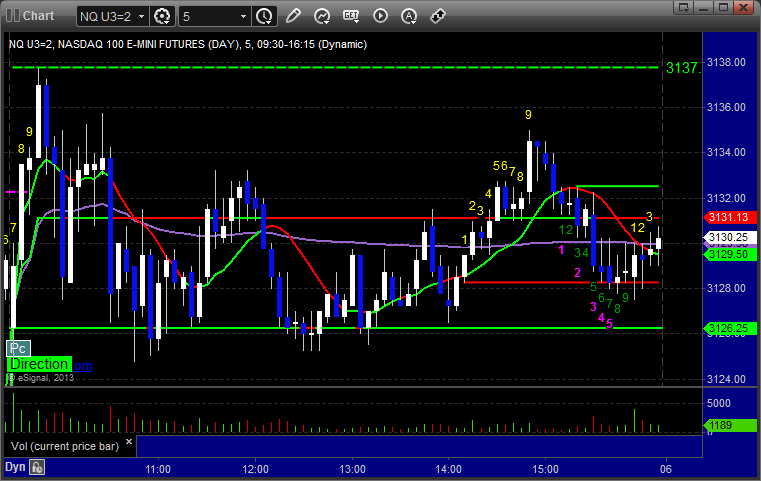

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Long triggered at A at 1656.50, hit first target for 6 ticks, stopped second half under the entry. Mark's short triggered at B at 1654.25, hit first target for 6 ticks, stopped second half over the entry: