Forex Calls Recap for 9/3/13

Not much range but we got a little trade to the first target. See GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

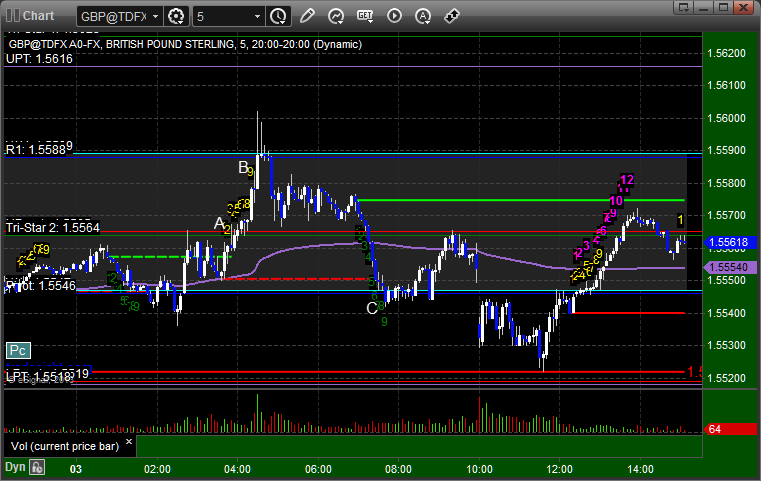

GBPUSD:

Triggered long at A, hit first target at B, which wasn't as far as we usually like to see, and stopped second half at C:

Introducing Plume for Android and iOS

We've been pretty excited the last few weeks at Tradesight about the new Trading Lab technology that allows people to view our Lab on the go (at least via Android devices for now) and also eliminates the need for Java on your desktop, which was heavily requested by many due to the security issues with Java found in the last year.

However, for those that haven't yet made the switch to our private Twitter feeds from the Desktop-based (and up to 60-second delayed) Tradesight Messenger (now on its EIGHTH YEAR in existence), I highly recommend that you give it a try. And in the process, whether you have an iPhone or Android device, I suggest you take a look at Plume as a Twitter client for your phone or tablet. I've been using it recently, and I really, really like it.

Let's start at the beginning. What is a Twitter client? Twitter is basically a service where you sign up by creating a username and profile, and then follow others. Using 140-characters at a time, people can type things that they want you to know about them (or their company), and you receive the "Tweets" of those that you choose to follow.

The question is, how do you decide how to receive the tweets? You can use the generic Twitter application, and you can also set your Twitter account to text tweets to your phone. However, I have found a new little app called Plume to be my favorite at the moment for a few reasons.

First of all, it is extremely appealing to the eyes. I love the font, the color scheme, the background color, etc. I have the new Droid Maxx for Verizon, and it has a really nice HD screen where Plume looks very sharp. When you install it and then log into it with your Twitter username and password, you get all of the tweets you follow, plus your "Feeds" that you created. For example, I have one called Trading that is just all of the Tradesight feeds. This way, when I step away from my desk, I know if Mark or Rich post a call immediately. I also know when things like the Futures and Forex Levels are ready.

Here's a screenshot of Plume with my Trading feed:

But, even nicer, the newer Twitter clients are starting to show small images when pictures or YouTube videos are referenced in a tweet. So for example, when we tweet the daily market previews, you get something that looks like this:

Or if we just put a chart in there, you'll see it right away. It's just really nice. The notification sound is great, and on the latest Android with the new "non-swiped" home page notifications, it is just really simple to use. We highly recommend that you try it out.

Introducing Plume for Android and iOS

We've been pretty excited the last few weeks at Tradesight about the new Trading Lab technology that allows people to view our Lab on the go (at least via Android devices for now) and also eliminates the need for Java on your desktop, which was heavily requested by many due to the security issues with Java found in the last year.

However, for those that haven't yet made the switch to our private Twitter feeds from the Desktop-based (and up to 60-second delayed) Tradesight Messenger (now on its EIGHTH YEAR in existence), I highly recommend that you give it a try. And in the process, whether you have an iPhone or Android device, I suggest you take a look at Plume as a Twitter client for your phone or tablet. I've been using it recently, and I really, really like it.

Let's start at the beginning. What is a Twitter client? Twitter is basically a service where you sign up by creating a username and profile, and then follow others. Using 140-characters at a time, people can type things that they want you to know about them (or their company), and you receive the "Tweets" of those that you choose to follow.

The question is, how do you decide how to receive the tweets? You can use the generic Twitter application, and you can also set your Twitter account to text tweets to your phone. However, I have found a new little app called Plume to be my favorite at the moment for a few reasons.

First of all, it is extremely appealing to the eyes. I love the font, the color scheme, the background color, etc. I have the new Droid Maxx for Verizon, and it has a really nice HD screen where Plume looks very sharp. When you install it and then log into it with your Twitter username and password, you get all of the tweets you follow, plus your "Feeds" that you created. For example, I have one called Trading that is just all of the Tradesight feeds. This way, when I step away from my desk, I know if Mark or Rich post a call immediately. I also know when things like the Futures and Forex Levels are ready.

Here's a screenshot of Plume with my Trading feed:

But, even nicer, the newer Twitter clients are starting to show small images when pictures or YouTube videos are referenced in a tweet. So for example, when we tweet the daily market previews, you get something that looks like this:

Or if we just put a chart in there, you'll see it right away. It's just really nice. The notification sound is great, and on the latest Android with the new "non-swiped" home page notifications, it is just really simple to use. We highly recommend that you try it out.

Tradesight August 2013 Forex Results

Before we get to August’s numbers, here is a short reminder of the results from July. The full report from July can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for July 2013

Number of trades: 30

Number of losers: 13

Winning percentage: 56.7%

Worst losing streak: 3 in a row

Net pips: +135

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for August 2013

Number of trades: 27

Number of losers: 13

Winning percentage: 51.8%

Worst losing streak: 3 in a row

Net pips: +120

We were half size the whole month of August as usual, and yet things didn't turn out so bad even though the gains were stacked in the first half of the month. We still netted 120 pips, which is nothing to complain about, but being half size is still the safe bet. In news that will shock nobody, average daily ranges dipped a couple of pips on all of the pairs. As usual, now that Labor Day and summer are behind us, we will start looking for ranges to expand consistently and then move our size back up. Stay tuned.

Tradesight August 2013 Forex Results

Before we get to August’s numbers, here is a short reminder of the results from July. The full report from July can be found here and you can get the last several months in a row vertically by clicking here and scrolling down.

Tradesight Pip Results for July 2013

Number of trades: 30

Number of losers: 13

Winning percentage: 56.7%

Worst losing streak: 3 in a row

Net pips: +135

Reminder: Here are the rules.

1) Calls made in the calendar month count. In other words, a call made on August 31 that triggered the morning of September 1 is not part of September. Calls made on Thursday, September 30 that triggered between then and the morning of October 1 ARE part of September.

2) Trades that triggered before 8 pm EST / 5 pm PST (i.e. pre Asia) and NEVER gave you a chance to re-enter are NOT counted. Everything else is counted equally.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 40 pips on one half and 60 on the second, that’s a 50-pip winner. If we made 40 pips on one half, never adjusted our stop, and the second half stopped for the 25 pip loser, then that’s a 7 pip winner (15 divided by 2 is 7.5, and I rounded down).

4) Pure losers (trades that just stop out) are considered 25 pip losers. In some cases, this can be a few more or a few less, but it should average right in there, so instead of making it complicated, I count them as 25 pips.

5) Trade re-entries are valid if a trade stops except between 3 am EST and 9 am EST (when I’m sleeping). So in other words, even if you are awake in those hours and you could have re-entered, I’m only counting things that I would have done. This is important because otherwise the implication is that you need to be awake 24/6. Triggers that occur right on the Big Three news announcements each month don’t count as you shouldn’t have orders in that close at that time.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Pip Results for August 2013

Number of trades: 27

Number of losers: 13

Winning percentage: 51.8%

Worst losing streak: 3 in a row

Net pips: +120

We were half size the whole month of August as usual, and yet things didn't turn out so bad even though the gains were stacked in the first half of the month. We still netted 120 pips, which is nothing to complain about, but being half size is still the safe bet. In news that will shock nobody, average daily ranges dipped a couple of pips on all of the pairs. As usual, now that Labor Day and summer are behind us, we will start looking for ranges to expand consistently and then move our size back up. Stay tuned.

Tradesight August 2013 Futures Results

Before we get to August’s numbers, here is a short reminder of the results from July. The full report from June can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for July 2013

Number of trades: 21

Number of losers: 7

Winning percentage: 66.7%

Net ticks: +34 ticks

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for August 2013

Number of trades: 16

Number of losers: 8

Winning percentage: 50%

Net ticks: -33 ticks

We came into the month warning that volume in the markets had gotten so low that futures trading would be hazardous. We had the least number of triggers ever for the service and the most days without anything triggering. Basically, it was a "stay on the sidelines" idea with market volume so poor. There really isn't even much else to talk about. The few Comber 13 signals on the 5-minute charts still worked this month, including one on the last day of the month, but those aren't captured in the results. We hope volume picks up so we can get back to work on the Futures stuff with confidence.

Tradesight August 2013 Futures Results

Before we get to August’s numbers, here is a short reminder of the results from July. The full report from June can be found here. You can also go back indefinitely by clicking here and scrolling down.

Tradesight Tick Results for July 2013

Number of trades: 21

Number of losers: 7

Winning percentage: 66.7%

Net ticks: +34 ticks

Reminder: Here are the rules.

1) Totals for the month are based on trades that occurred on trading days in the calendar month.

2) Trades are based on the calls in the Messenger exactly as we call them and manage them and do not count everything you could have done from taking our courses and using our tools.

3) All trades are broken into two pieces, with the assumption that one half is sold at the first target and one half is sold at the final exit. These are then averaged. So if we made 6 ticks on one half and 12 on the second, that’s a 9-tick winner.

4) Pure losers (trades that just stop out) are considered 7 tick losers. We don’t risk more than that in the Messenger calls.

You can go through the reports and compare the breakdown that I give as each trade is reviewed.

Tradesight Tick Results for August 2013

Number of trades: 16

Number of losers: 8

Winning percentage: 50%

Net ticks: -33 ticks

We came into the month warning that volume in the markets had gotten so low that futures trading would be hazardous. We had the least number of triggers ever for the service and the most days without anything triggering. Basically, it was a "stay on the sidelines" idea with market volume so poor. There really isn't even much else to talk about. The few Comber 13 signals on the 5-minute charts still worked this month, including one on the last day of the month, but those aren't captured in the results. We hope volume picks up so we can get back to work on the Futures stuff with confidence.

Stock Picks Recap for 8/30/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered short (with market support) and didn't work:

AAPL triggered short (with market support) and gave us a decent gain:

COST triggered long (without market support) and worked:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Stock Picks Recap for 8/30/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, NFLX triggered short (with market support) and didn't work:

AAPL triggered short (with market support) and gave us a decent gain:

COST triggered long (without market support) and worked:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Futures Calls Recap for 8/30/13

Lightest volume day of the year as expected. NASDAQ volume closed at 1 billion shares. No calls for the session, although we got a Comber 13 buy signal on the ES right at the low that worked and we discussed in the Lab.

Net ticks: +0 ticks.

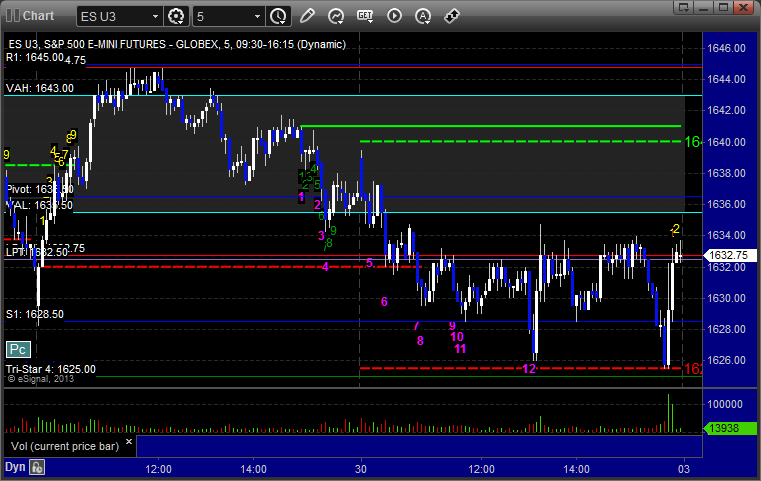

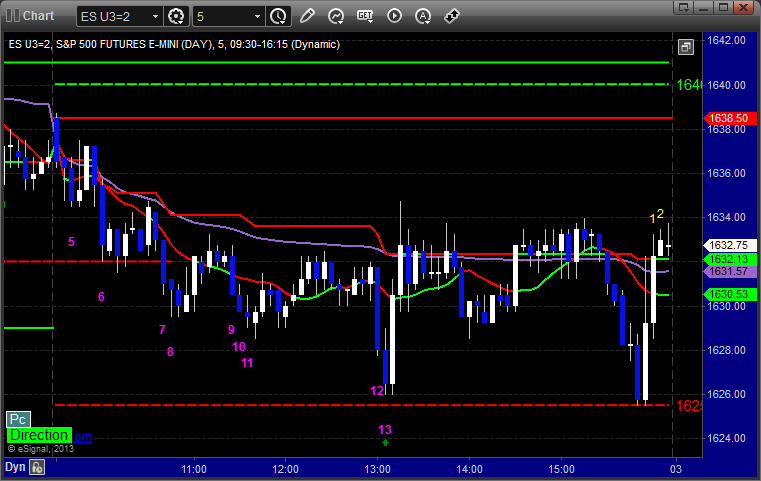

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Note the Comber 13 buy signal: