Stock Picks Recap for 8/22/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CLDX triggered long (without market support due to opening 5 minutes) and worked great:

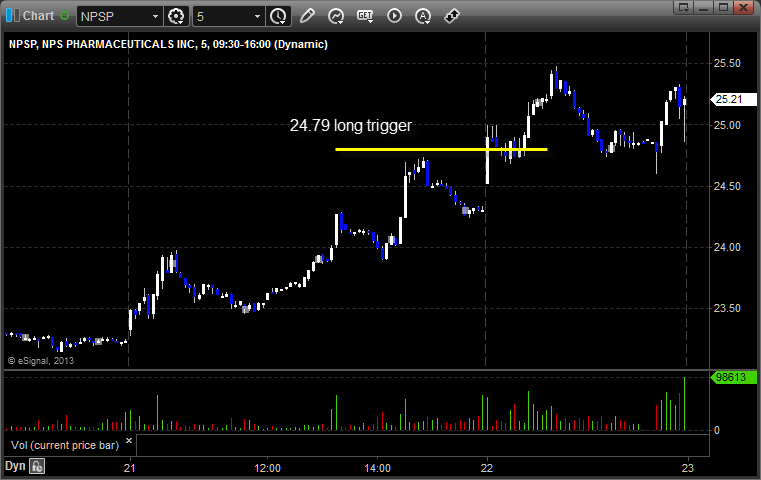

NPSP triggered long (without market support due to opening 5 minutes) and worked:

CDNS triggered short (without market support due to opening 5 minutes) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, TSLA triggered long (with market support) and didn't work:

Another call on TSLA triggered long (with market support) and worked huge:

Rich's ANF triggered long (with market support) and worked enough for a partial:

His JPM triggered long (with market support) and worked enough for a partial:

AMZN triggered long (with market support) and worked:

Rich's FDX triggered long (with market support) and worked:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not, and that doesn't count the top pick off the report, which ran big too.

Futures Calls Recap for 8/22/13

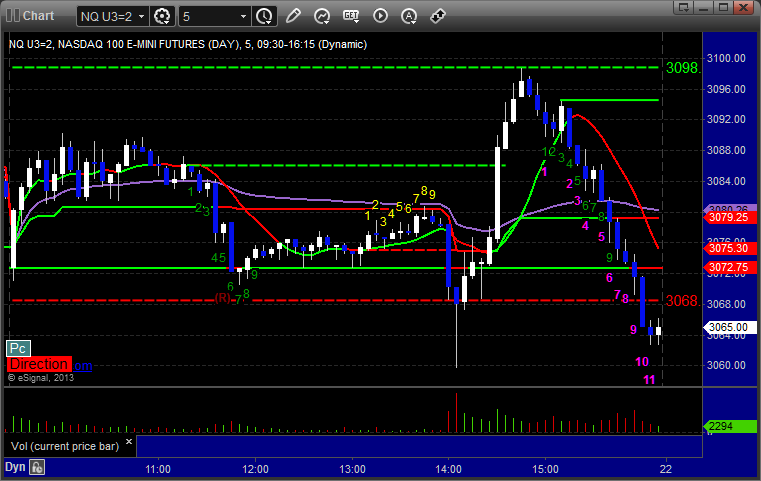

A strange day in the market, one for the books, as the NASDAQ was closed for 3 hours for reasons currently unknown. Volume was light early and there wasn't much to spot, but any chance of playing a gap fill or something like that died when the NASDAQ went down. Volume was less than 900 million because we were closed most of the day.

Net ticks: +0 ticks.

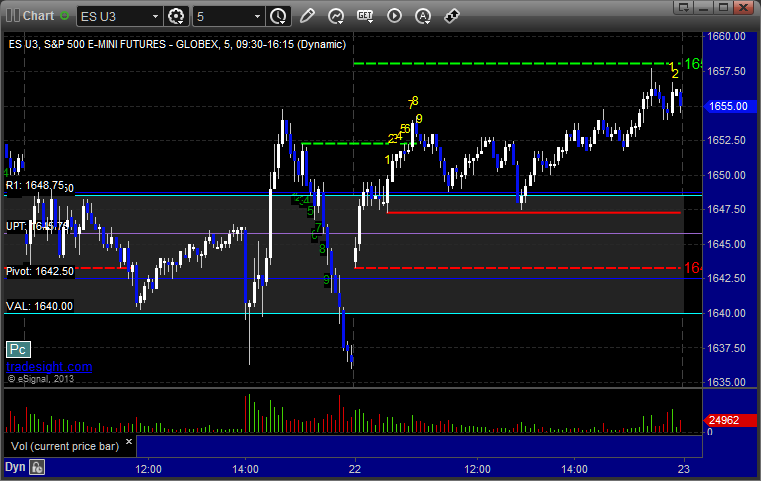

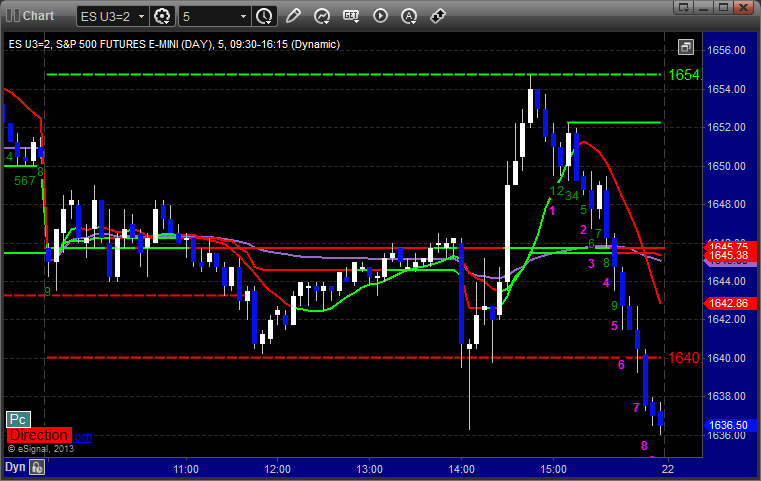

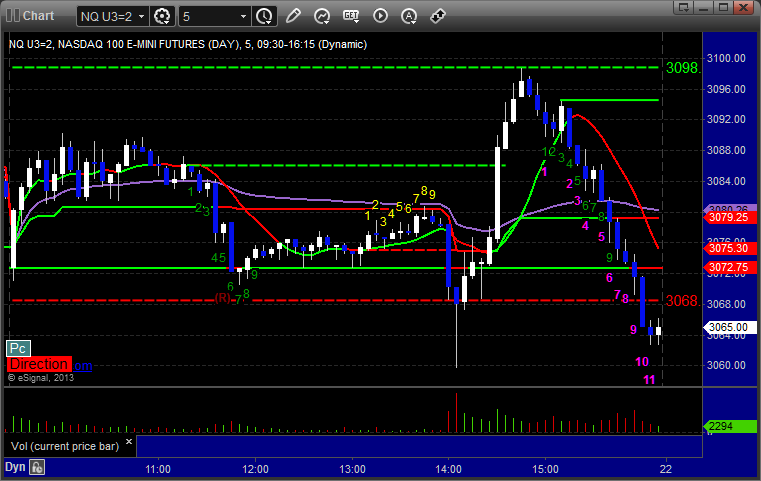

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 8/22/13

Not a very exciting session but the ranges were a bit bigger so we had two winners, one of which we are still holding the second half. See EURUSD and GBPUSD sections below.

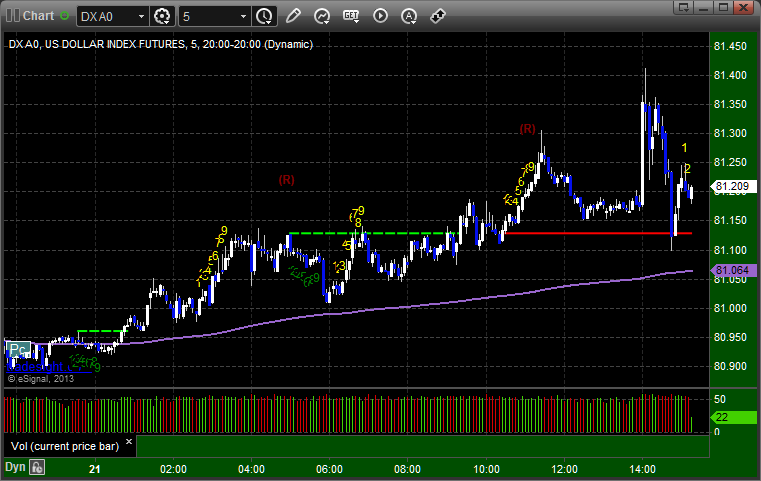

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

The Value Area plays, as we teach in our courses are valid on both major sessions for each pair, so on the EURUSD, that means the European session and the US session. After heading down early, in the US session, the EURUSD set the VAL at A, so we called the long into it, triggered at B, hit our first target at C, and barely stopped us out of the second half under the entry at D:

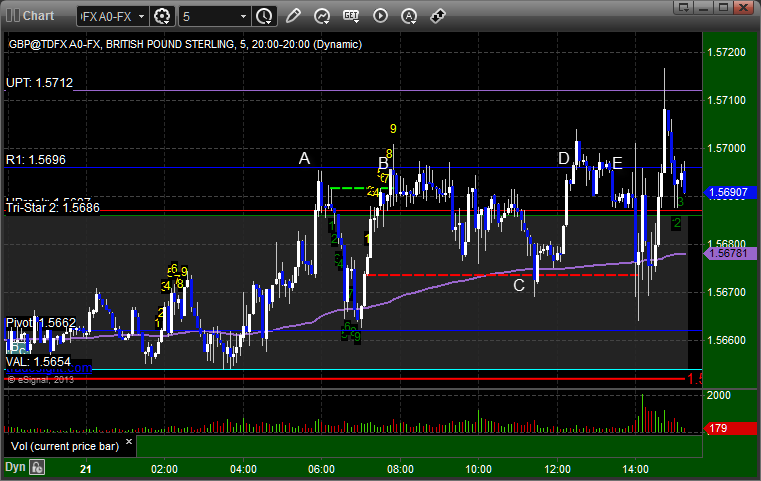

GBPUSD:

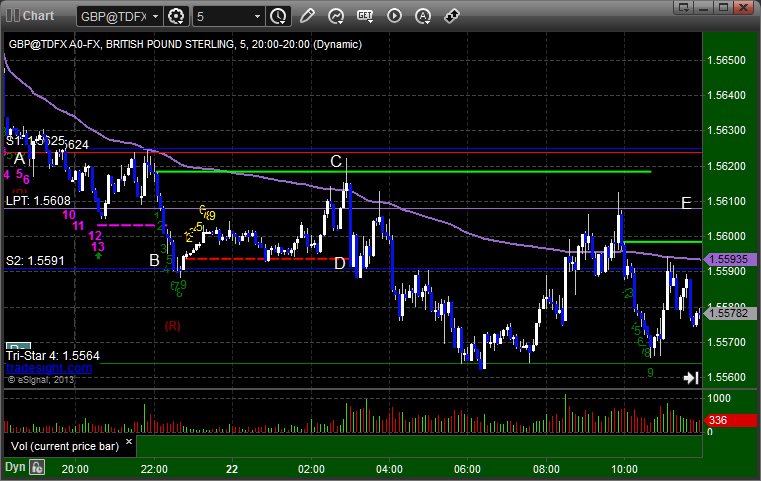

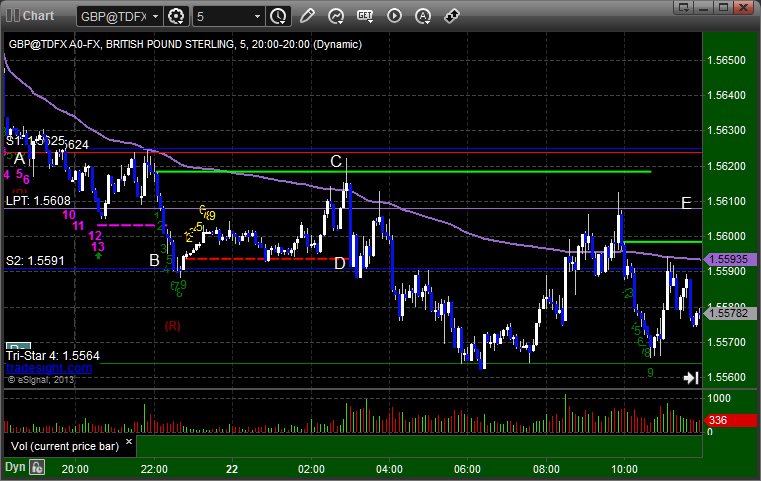

Triggered short at A, hit first target at B, also gave you a chance overnight for the same on a retest from C to first target at D. Either way, still holding the second half with a stop over the LPT at E, which we will adjust tonight:

Forex Calls Recap for 8/22/13

Not a very exciting session but the ranges were a bit bigger so we had two winners, one of which we are still holding the second half. See EURUSD and GBPUSD sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

The Value Area plays, as we teach in our courses are valid on both major sessions for each pair, so on the EURUSD, that means the European session and the US session. After heading down early, in the US session, the EURUSD set the VAL at A, so we called the long into it, triggered at B, hit our first target at C, and barely stopped us out of the second half under the entry at D:

GBPUSD:

Triggered short at A, hit first target at B, also gave you a chance overnight for the same on a retest from C to first target at D. Either way, still holding the second half with a stop over the LPT at E, which we will adjust tonight:

Stock Picks Recap for 8/21/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, GMCR triggered long (with market support) and worked enough for a partial:

KTOS triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's INCY triggered long (with market support) and worked:

Mark's GILD triggered long (with market support) and worked:

Rich's LOW triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, and all 5 of them worked.

Futures Calls Recap for 8/21/13

Looked like nothing was going to happen as NASDAQ volume got even lighter Wednesday (and closed at 1.25 billion again), but a late trigger on the ES gave us something. See that section below.

Net ticks: +4.5 ticks.

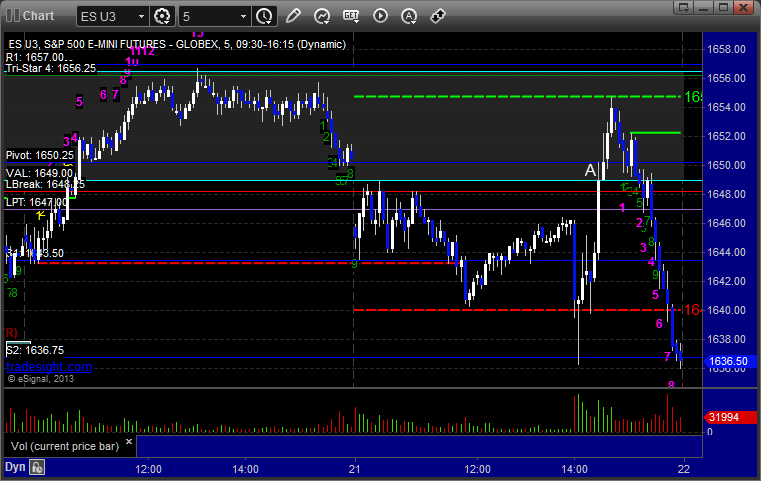

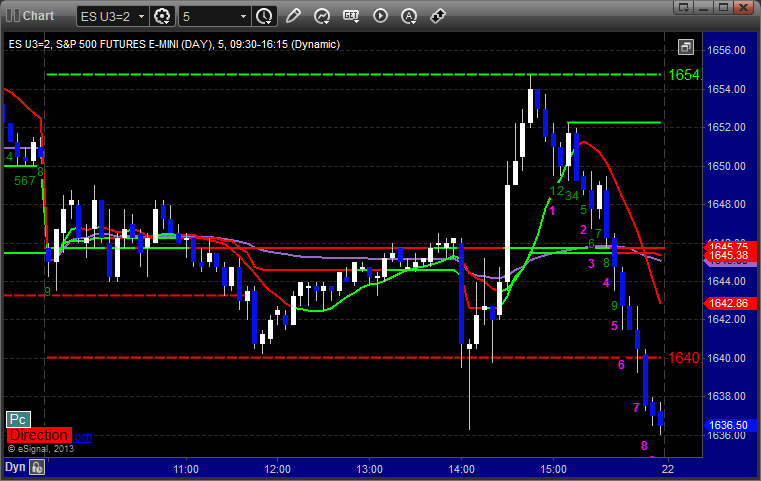

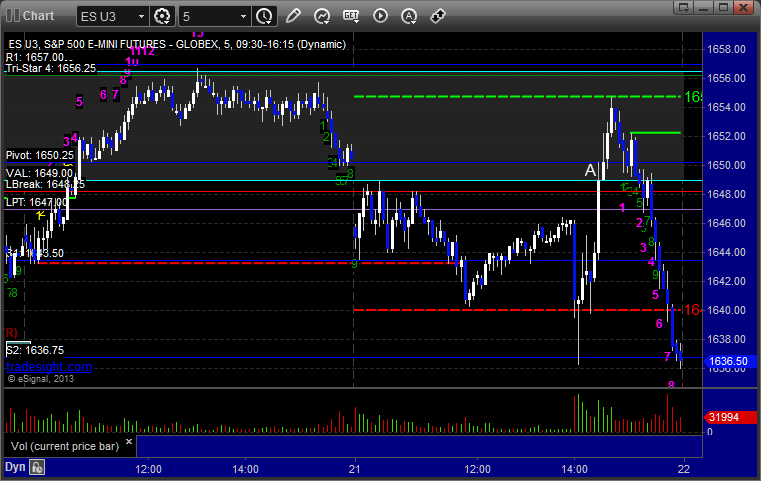

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1649.25, hit first target for 6 ticks, stopped second half under Pivot at 1650:

Futures Calls Recap for 8/21/13

Looked like nothing was going to happen as NASDAQ volume got even lighter Wednesday (and closed at 1.25 billion again), but a late trigger on the ES gave us something. See that section below.

Net ticks: +4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1649.25, hit first target for 6 ticks, stopped second half under Pivot at 1650:

Forex Calls Recap for 8/21/13

Another session, another day without range. GBPUSD was stuck in 60 pips and EURUSD about 80. See GBPUSD section below for triggers. Still half size in this summer environment.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Set the trigger exactly at A, which is good technical action. Then triggered at B (while hitting a 9-bar setup), and eventually stopped at C. Took again at D and closed at E for end of session:

Stock Picks Recap for 8/20/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's HD triggered short (without market support due to opening 5 minutes) and worked:

His SINA triggered short (without market support) and didn't work:

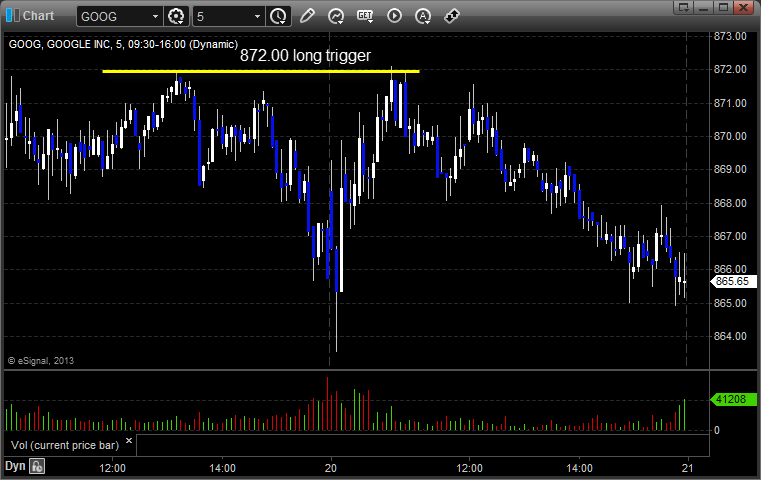

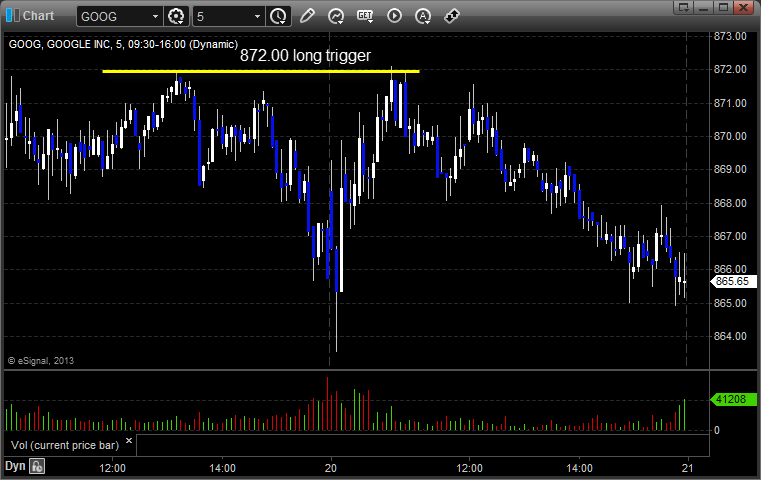

GOOG triggered long (with market support) and didn't work:

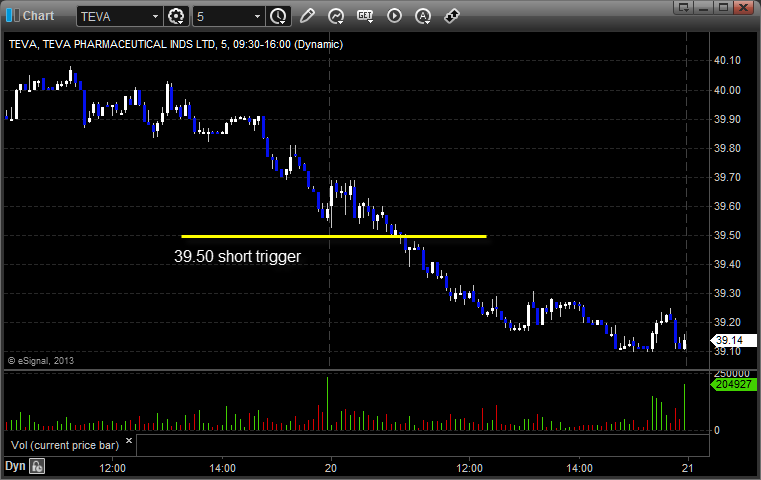

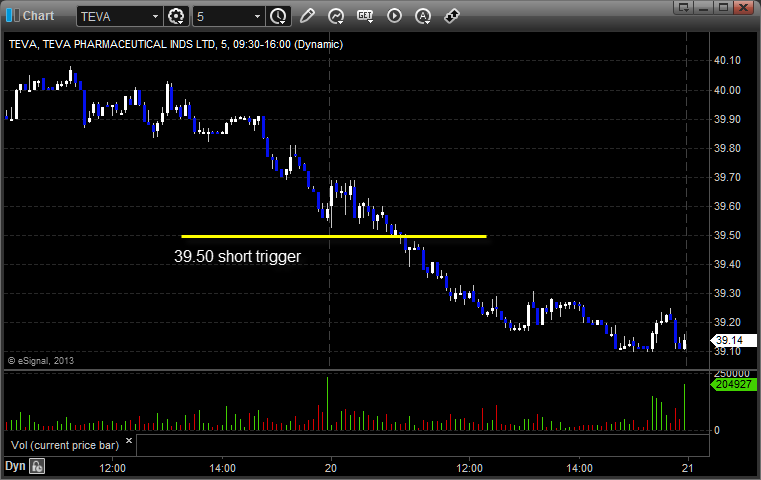

TEVA triggered short (without market support) and worked:

Mark's MCHP triggered long (with market support) and didn't go enough in either direction to count:

Rich's FAS triggered long (ETF, so no market support needed) and didn't work:

In total, that's just 2 trades triggering with market support, neither of them worked, and it's no surprise with the volume. Rich's reciprocal play call on HD was the highlight.

Stock Picks Recap for 8/20/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's HD triggered short (without market support due to opening 5 minutes) and worked:

His SINA triggered short (without market support) and didn't work:

GOOG triggered long (with market support) and didn't work:

TEVA triggered short (without market support) and worked:

Mark's MCHP triggered long (with market support) and didn't go enough in either direction to count:

Rich's FAS triggered long (ETF, so no market support needed) and didn't work:

In total, that's just 2 trades triggering with market support, neither of them worked, and it's no surprise with the volume. Rich's reciprocal play call on HD was the highlight.