Stock Picks Recap for 7/16/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, NVDA triggered short (just barely with market support) and didn't work:

In total, that's 1 trade triggering with market support, and it didn't work.

Futures Calls Recap for 7/16/20

The markets gapped down and put in a big nothing day. Total waste of time. Probably the worst trading day of the year. Everything was flat all day on 4.2 billion NASDAQ shares.

Net ticks: +8.5 ticks.

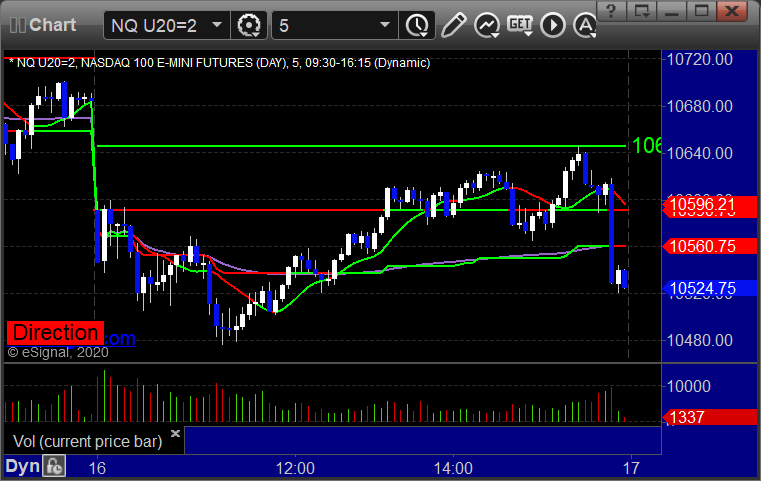

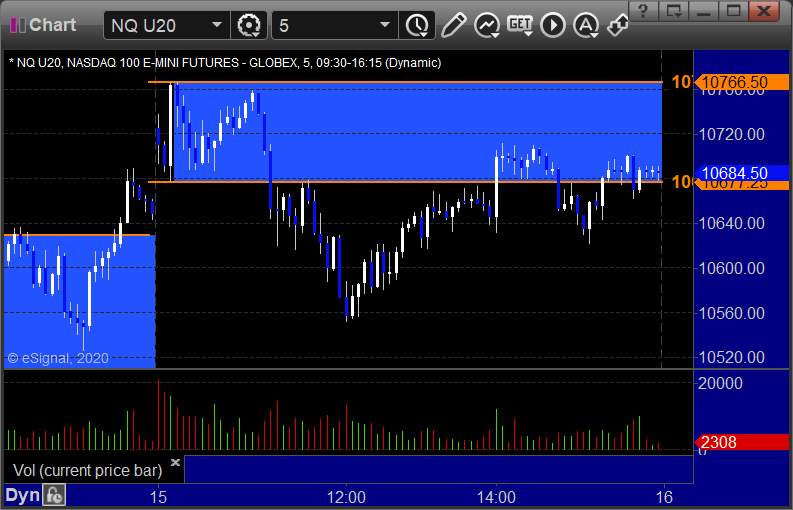

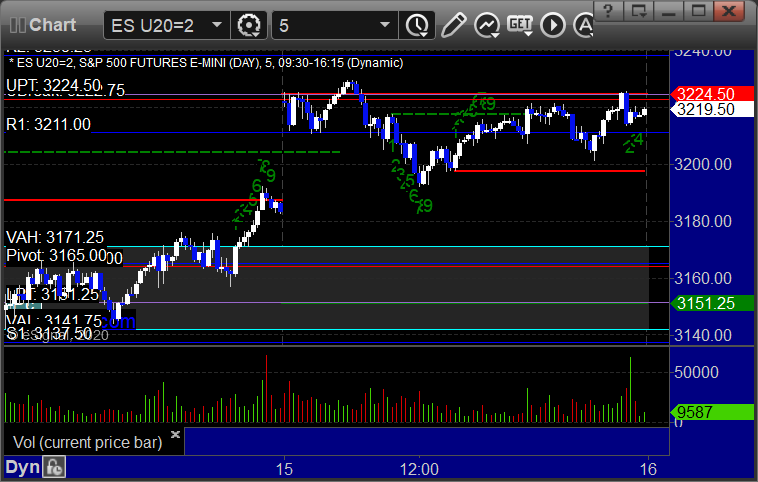

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

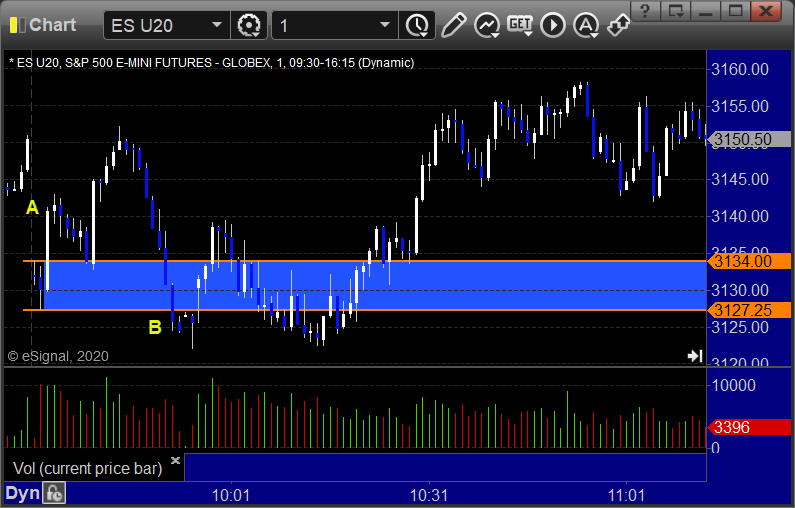

ES Opening Range Play triggered short at A and worked enough for a partial, triggered long at B and worked enough for a partial:

NQ Opening Range Play triggered short at A but too far out of range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 7/16/20

Two small winners for the session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

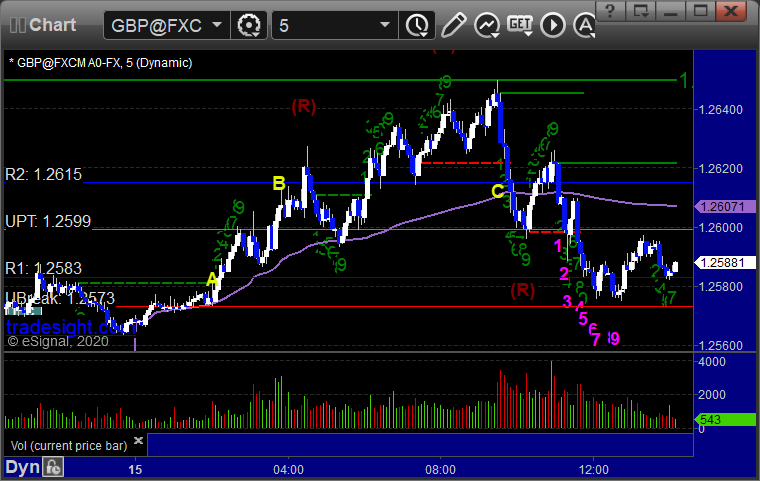

GBPUSD:

Triggered short at A, hit first target at B, stopped second half at C. Triggered long at D, hit first target at E, stopped second half at F:

Stock Picks Recap for 7/15/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no calls.

From the Messenger/Tradesight_st Twitter Feed, nothing triggered on a dead day.

In total, that's 0 trades triggering.

Futures Calls Recap for 7/15/20

The markets gapped up and spent most of the day right where they opened with the exception of a small dip midday on 4 billion NASDAQ shares.

Net ticks: +10 ticks.

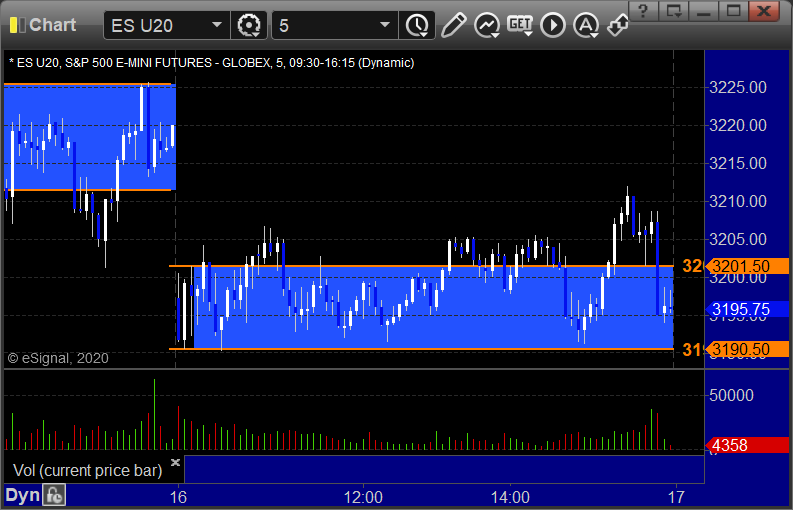

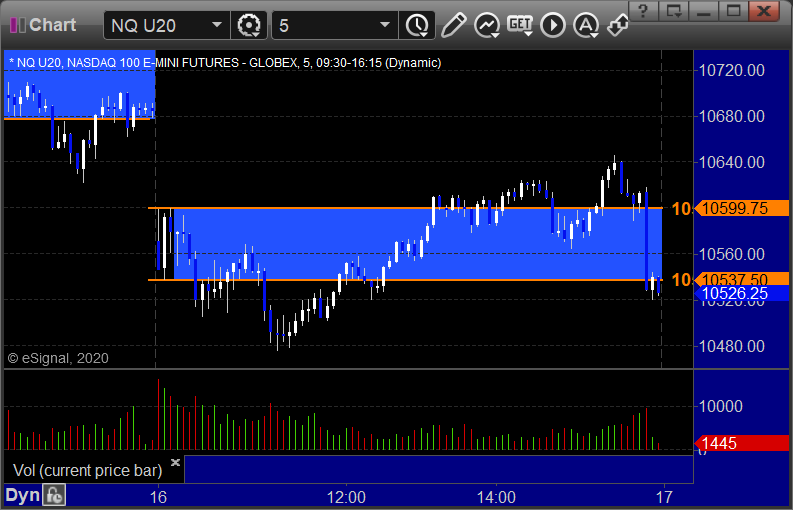

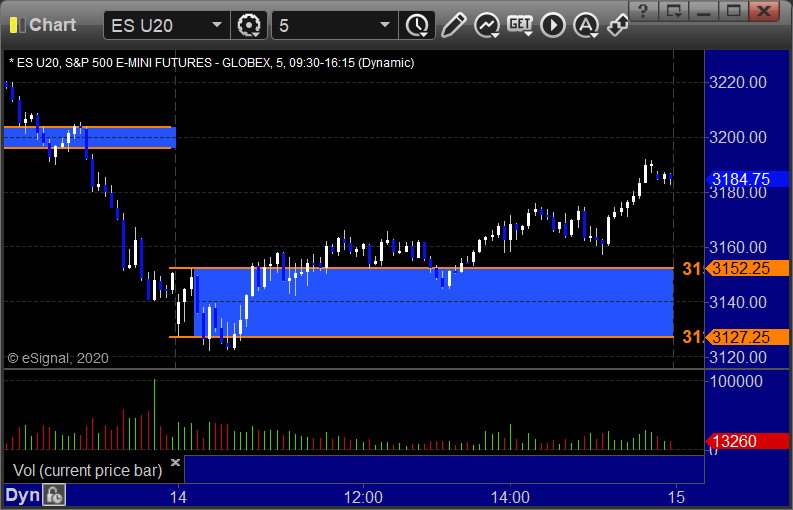

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered short and worked:

NQ Opening Range Play triggered short at A and long at B, both too far out of range to take:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

Forex Calls Recap for 7/15/20

A winner for the session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long at A, hit first target at B, stopped second half in the money at C:

Stock Picks Recap for 7/14/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, no triggers.

From the Messenger/Tradesight_st Twitter Feed, BIDU triggered long (with market support) and didn't work:

BABA triggered short (with market support) and worked enough for a partial:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

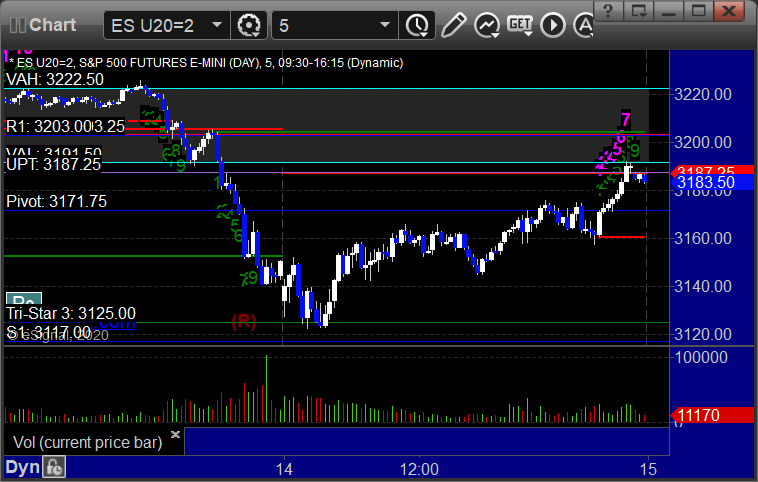

Futures Calls Recap for 7/14/20

The markets gapped down a little, filled, went lower, and then just drifted all day until a late push up. NASDAQ volume was 4.3 billion shares.

Net ticks: +37 ticks.

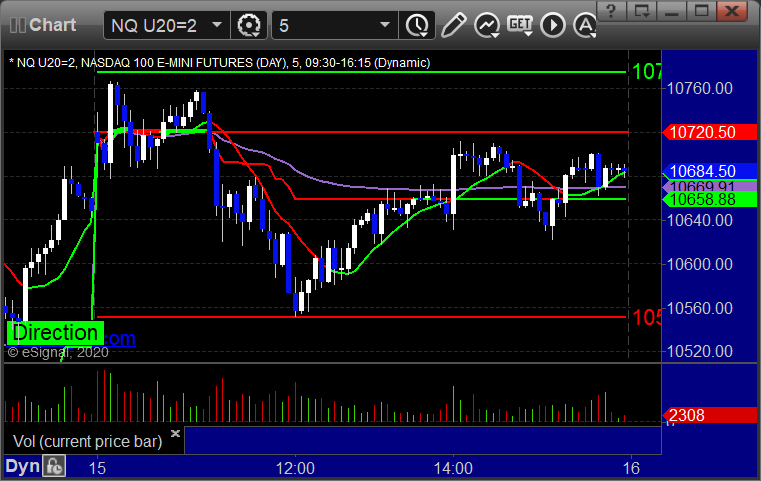

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES and NQ Opening and Institutional Range Plays:

ES Opening Range Play triggered long at A but too far out of range to take, triggered short at B and worked enough for a partial:

NQ Opening Range Play triggered long at A but too far out of range to take, triggered short at B and was actually good for the first time in a while, worked:

ES Tradesight Institutional Range Play:

NQ Tradesight Institutional Range Play:

ES:

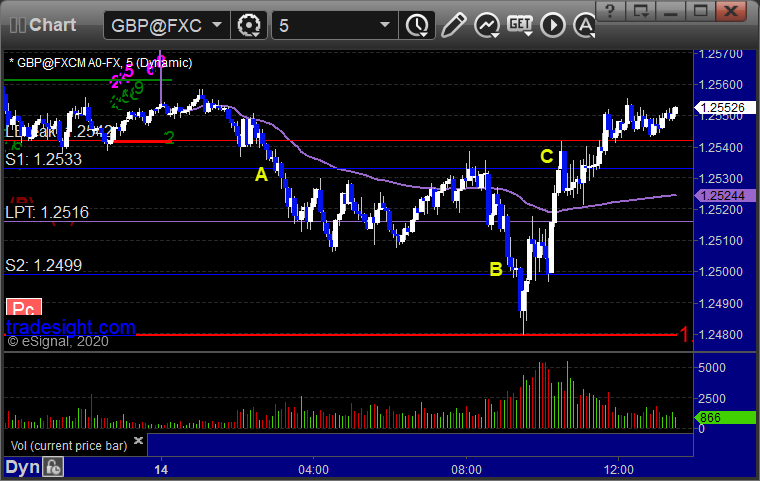

Forex Calls Recap for 7/14/20

A winner for the session. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, stopped second half over entry at C:

Stock Picks Recap for 7/13/20

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CHKP gapped over, no play.

GLUU triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, BYND triggered short (with market support) and worked a little:

Rich's AAPL triggered short (with market support) and worked enough for a partial:

In total, that's 3 trades triggering with market support, 2 of them worked, 1 did not.