Forex Calls Recap for 8/16/13

Closed out the second half of the GBPUSD for a 65 pip gain from the prior session, but a new call triggered and stopped on the EURUSD for options expiration Friday's session. See both sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Again, nothing to see on those charts.

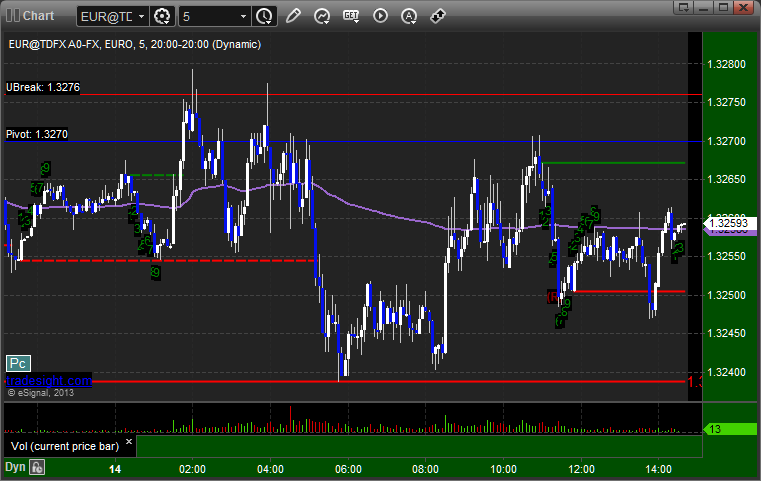

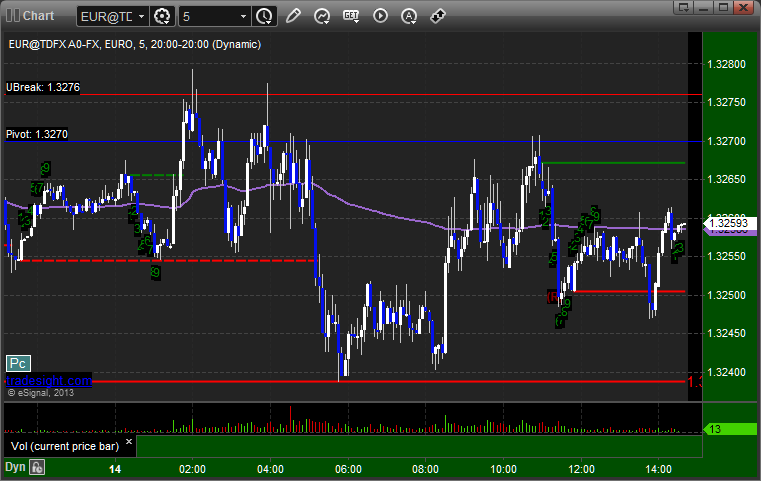

EURUSD:

riggered long at A and stopped:

Stock Picks Recap for 8/15/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered due to the gap down.

From the Messenger/Tradesight_st Twitter Feed, Mark's GILD triggered short (with market support) and worked:

NFLX triggered short (with market support) and worked great:

In total, that's 2 trades triggering with market support, both of them worked nicely.

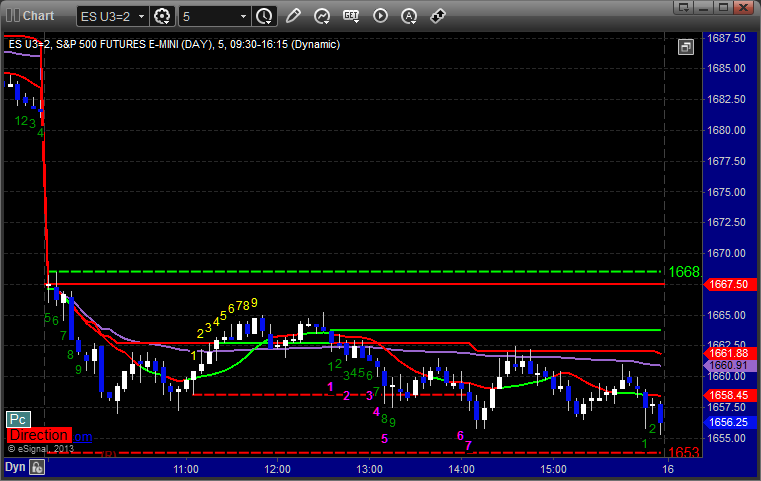

Futures Calls Recap for 8/15/13

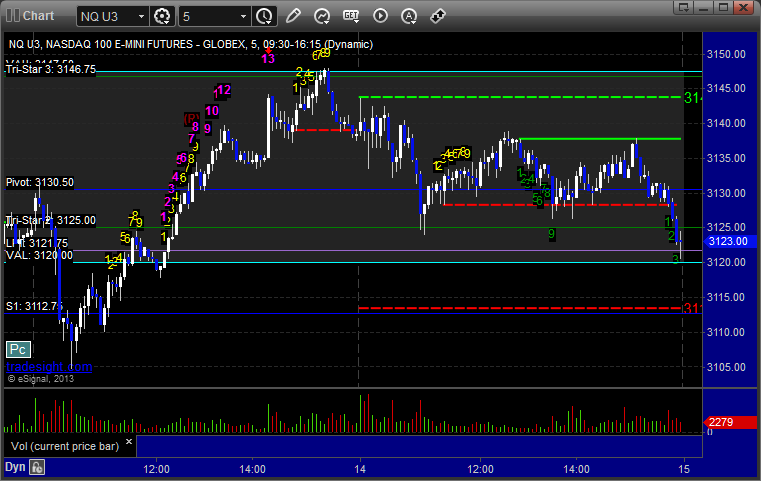

Volume was up, but we got a big "gap and go" day to the downside as the markets gapped under their S2 levels and kept going, closing out at 1.6 billion NASDAQ shares as we head into expiration Friday.

Net ticks: +2.5 ticks.

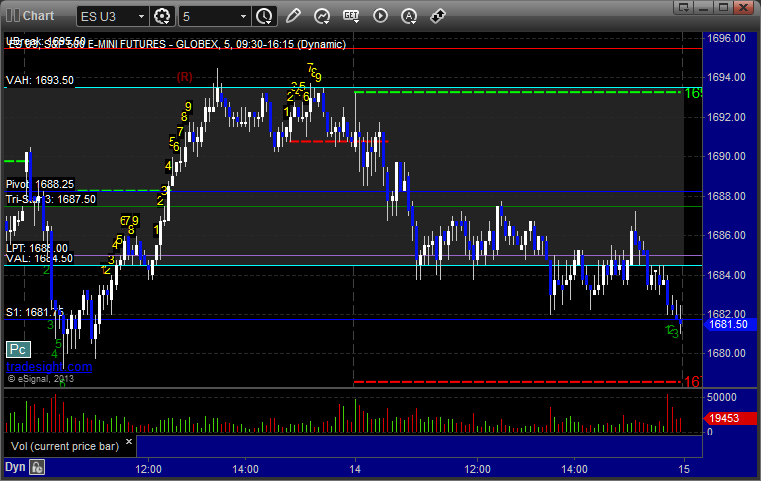

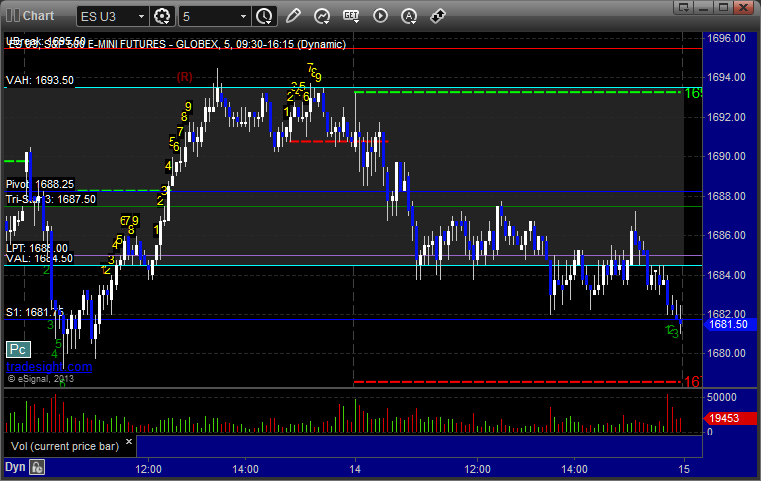

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at 1660.00 at A, hit first target for 6 ticks, and stopped the second half over the entry:

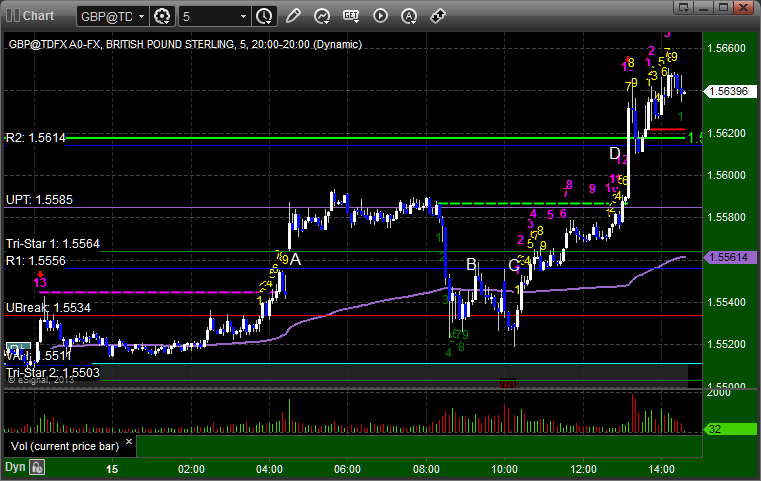

Forex Calls Recap for 8/15/13

If at first you don't succeed, try, try again. Literally. We tried three times and finally got it to work. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

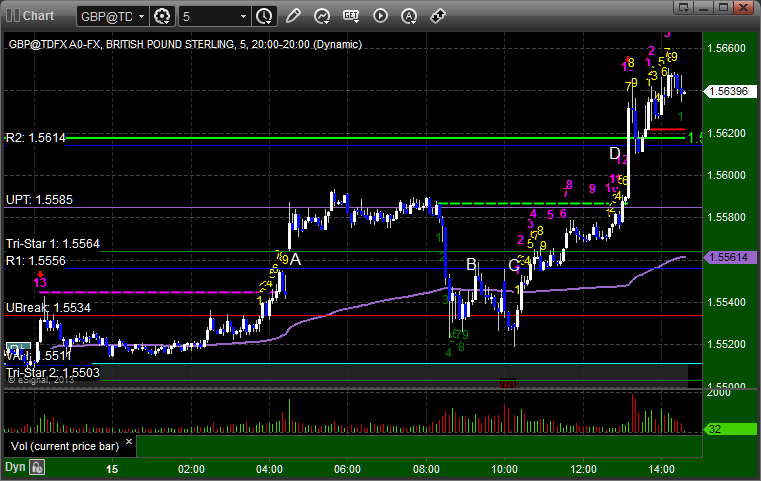

GBPUSD:

Triggered long over R1 overnight at A (although this was a new gap that missed that price, you might not have been filled at all) and stopped. Put it back in in the morning and it triggered at B and stopped. Once more with feeling, we went in at C, hit first target at D, and still holding second half with a stop under R2:

Forex Calls Recap for 8/15/13

If at first you don't succeed, try, try again. Literally. We tried three times and finally got it to work. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered long over R1 overnight at A (although this was a new gap that missed that price, you might not have been filled at all) and stopped. Put it back in in the morning and it triggered at B and stopped. Once more with feeling, we went in at C, hit first target at D, and still holding second half with a stop under R2:

Stock Picks Recap for 8/14/15

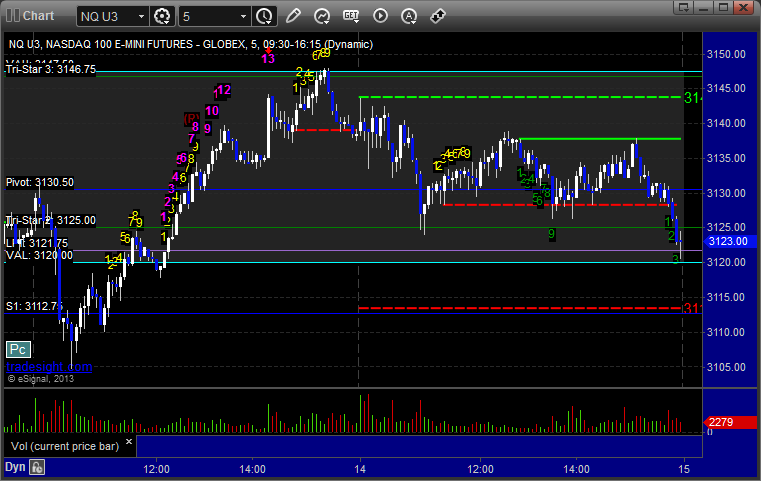

That had the characteristics of options unraveling without doing much at all, and we didn't have a very exciting day because of it. The market opened dead flat and remained in a 4 point ES range for the first hour. After that, volume held up and we started to head lower for 30 minutes, which is what you expect to see from options unraveling, and we did hold down under that level for the rest of the session, including a sell-off late after a failed rally attempt. Overall, you would have to say that this was options unraveling, it wasn't much (which is often the case in August), and it didn't lend itself to good opportunities during the session. Meanwhile, it doesn't bode well for the rest of the week as we head into options expiration if unraveling is done. The NASDAQ side was even worse today, more flat than we've seen it yet, and NASDAQ volume closed at 1.55 billion shares.

ES with Tradesight Levels:

NQ with Tradesight Levels:

ES with Tradesight Market Directional Tool:

Stock Results:

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BDBD triggered long (without market support) and didn't work:

LNCO and LBTYA gapped under the short triggers, no plays.

From the Messenger/Tradesight_st Twitter Feed, Mark's JPM triggered long (without market support) and didn't work:

SINA triggered long (without market support) and didn't work:

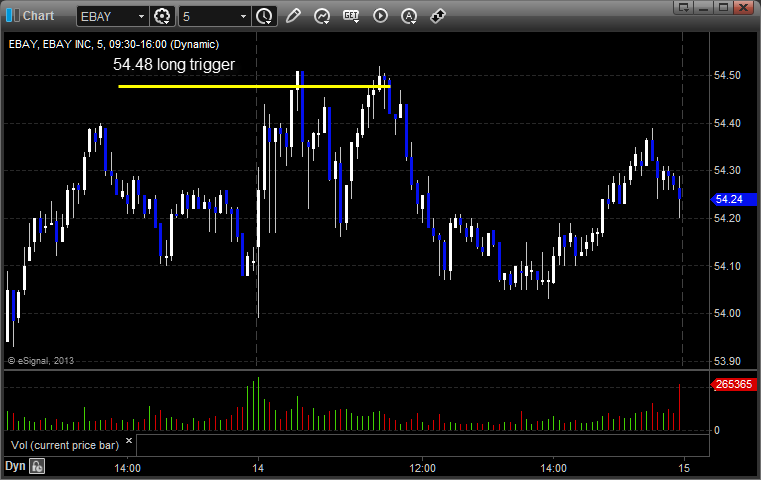

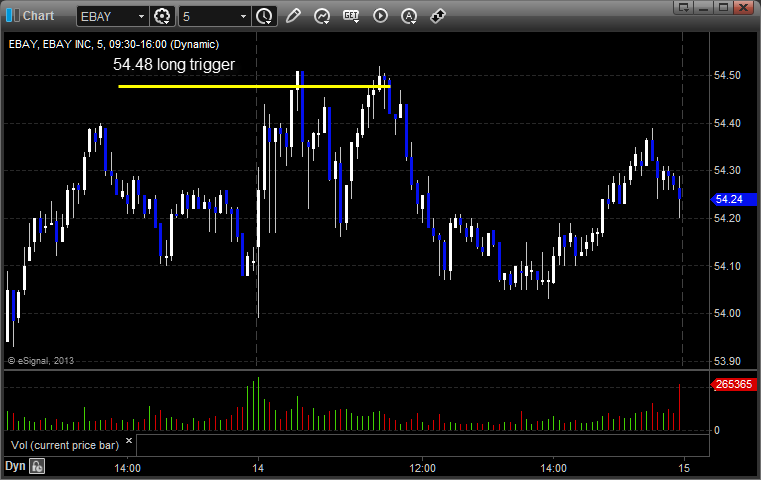

EBAY triggered long (without market support) and didn't work:

GILD triggered long (without market support) and didn't work:

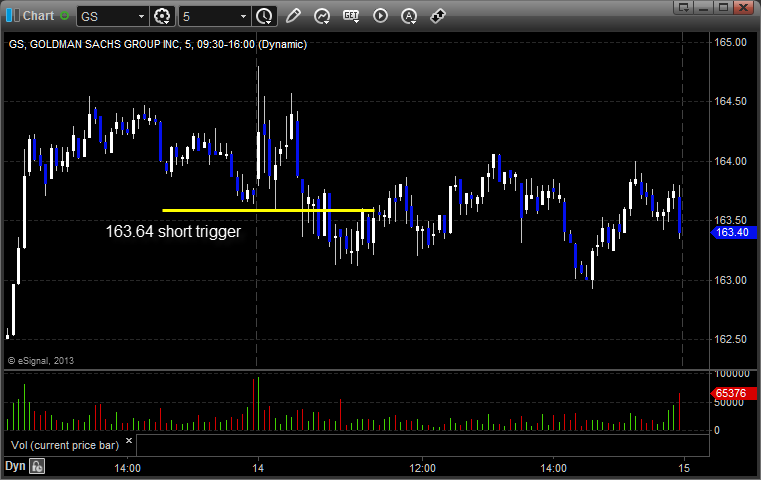

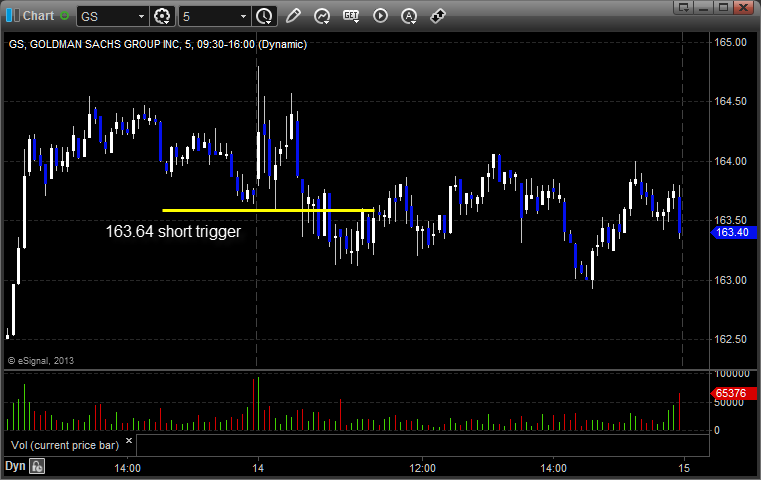

GS triggered short (with market support) and worked enough for a partial:

AMZN triggered short (with market support) and didn't work:

NTAP triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.

Stock Picks Recap for 8/14/15

That had the characteristics of options unraveling without doing much at all, and we didn't have a very exciting day because of it. The market opened dead flat and remained in a 4 point ES range for the first hour. After that, volume held up and we started to head lower for 30 minutes, which is what you expect to see from options unraveling, and we did hold down under that level for the rest of the session, including a sell-off late after a failed rally attempt. Overall, you would have to say that this was options unraveling, it wasn't much (which is often the case in August), and it didn't lend itself to good opportunities during the session. Meanwhile, it doesn't bode well for the rest of the week as we head into options expiration if unraveling is done. The NASDAQ side was even worse today, more flat than we've seen it yet, and NASDAQ volume closed at 1.55 billion shares.

ES with Tradesight Levels:

NQ with Tradesight Levels:

ES with Tradesight Market Directional Tool:

Stock Results:

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BDBD triggered long (without market support) and didn't work:

LNCO and LBTYA gapped under the short triggers, no plays.

From the Messenger/Tradesight_st Twitter Feed, Mark's JPM triggered long (without market support) and didn't work:

SINA triggered long (without market support) and didn't work:

EBAY triggered long (without market support) and didn't work:

GILD triggered long (without market support) and didn't work:

GS triggered short (with market support) and worked enough for a partial:

AMZN triggered short (with market support) and didn't work:

NTAP triggered short (with market support) and didn't work:

In total, that's 3 trades triggering with market support, 1 of them worked, 2 did not.

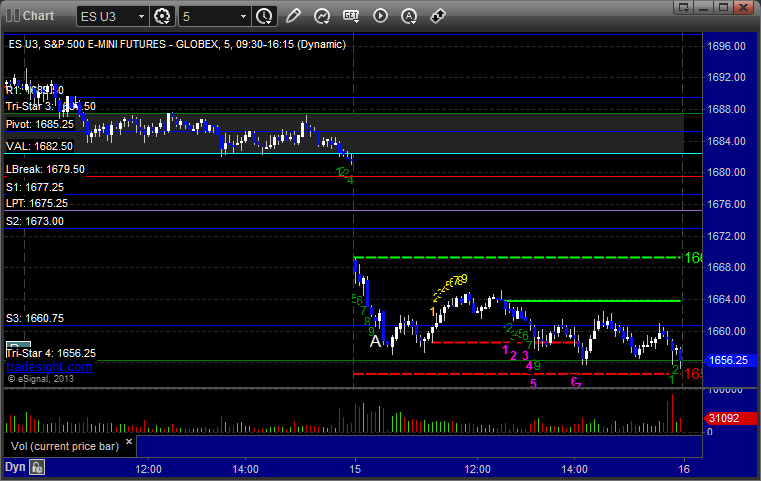

Futures Calls Recap for 8/14/15

The market opened flat and did nothing early. Our ES short under the Pivot missed the first target by a tick and then stopped. I did not suggest a re-entry because volume was light again and the action was poor, although the retrigger would have worked.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1688.00, missed first target by a tick, and stopped for 7 ticks exactly (that was the high of that move) before working:

Forex Calls Recap for 8/14/13

45 pips of range on the EURUSD, and therefore, no triggers for the session. Didn't hit our long or short entry point at all.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Forex Calls Recap for 8/14/13

45 pips of range on the EURUSD, and therefore, no triggers for the session. Didn't hit our long or short entry point at all.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD: