Forex Calls Recap for 8/2/13

An interesting session with a 120-pip winner on the GBPUSD to the final exit to close out the week. See that section below.

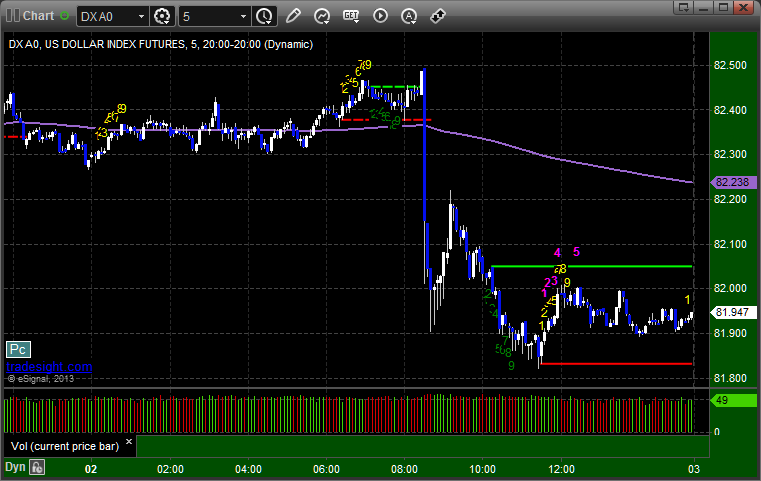

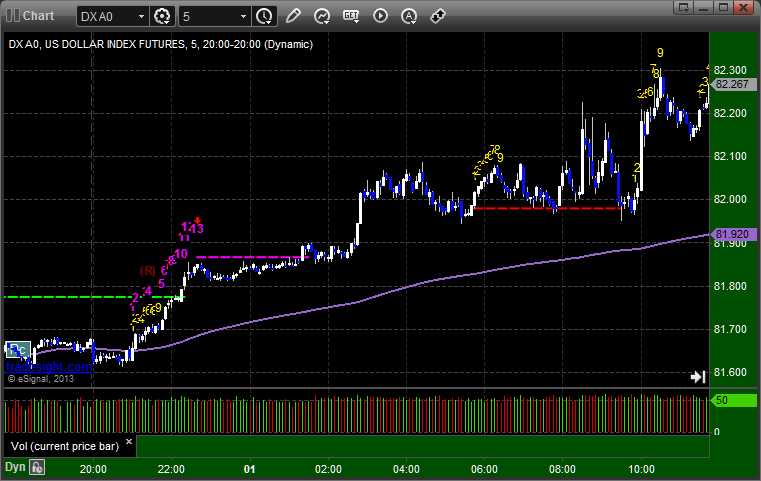

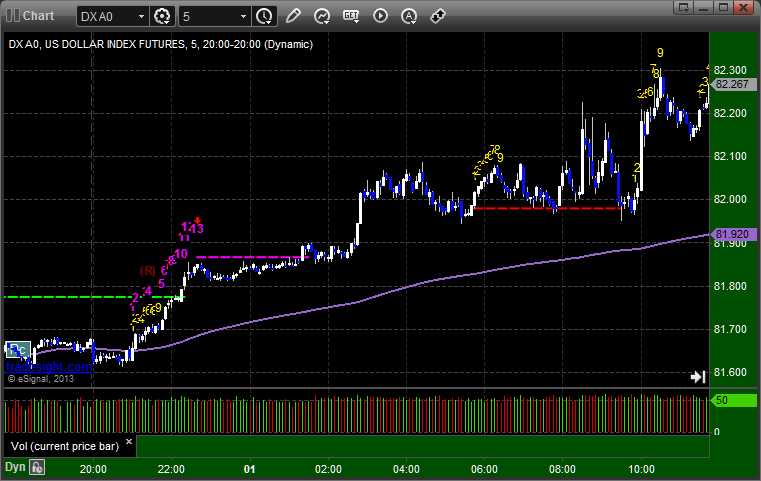

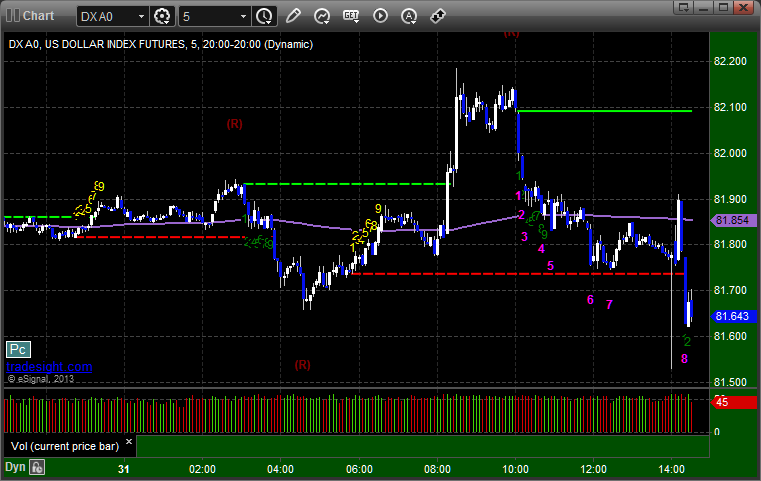

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

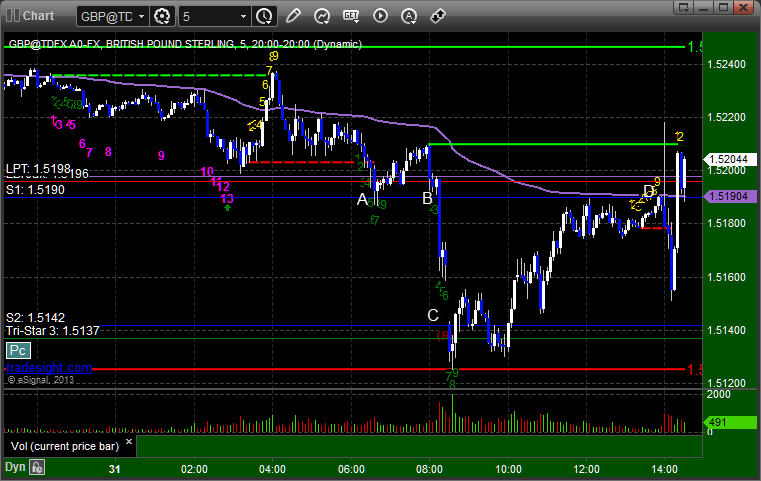

GBPUSD:

We were half size or less ahead of the NFP data (and in August), but the call triggered at A over the Pivot, never stopped, then shot up on the data and blasted through the first target at B, and closed final piece at C for 120 pips or so:

Forex Calls Recap for 8/2/13

An interesting session with a 120-pip winner on the GBPUSD to the final exit to close out the week. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index.

GBPUSD:

We were half size or less ahead of the NFP data (and in August), but the call triggered at A over the Pivot, never stopped, then shot up on the data and blasted through the first target at B, and closed final piece at C for 120 pips or so:

Stock Picks Recap for 8/1/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MPEL triggered long (without market support due to opening 5 minutes) and worked:

ATML triggered long (with market support) and worked enough for a partial:

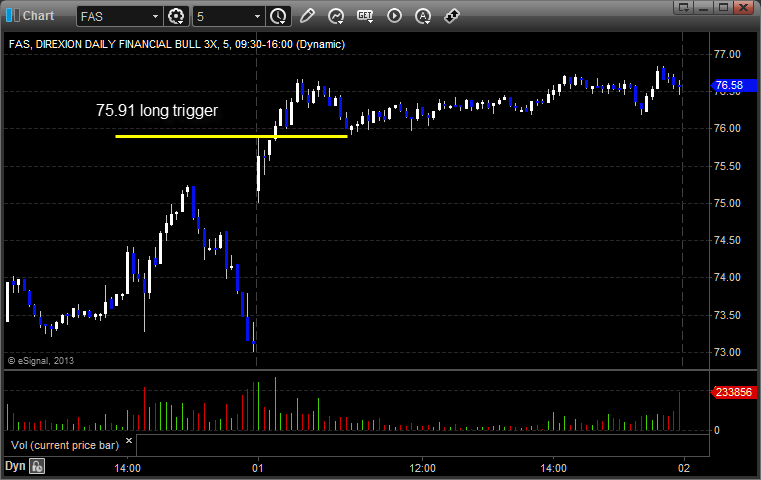

From the Messenger/Tradesight_st Twitter Feed, Rich's FAS triggered long (ETF, so no market support needed) and worked:

His V triggered short (without market support) and worked:

His LNKD triggered long (with market support) and didn't work initially, and worked later:

His EOG triggered long (with market support) and worked:

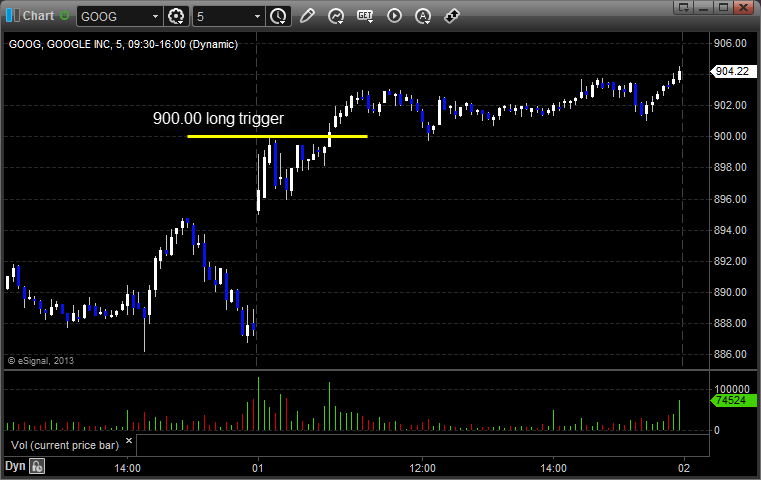

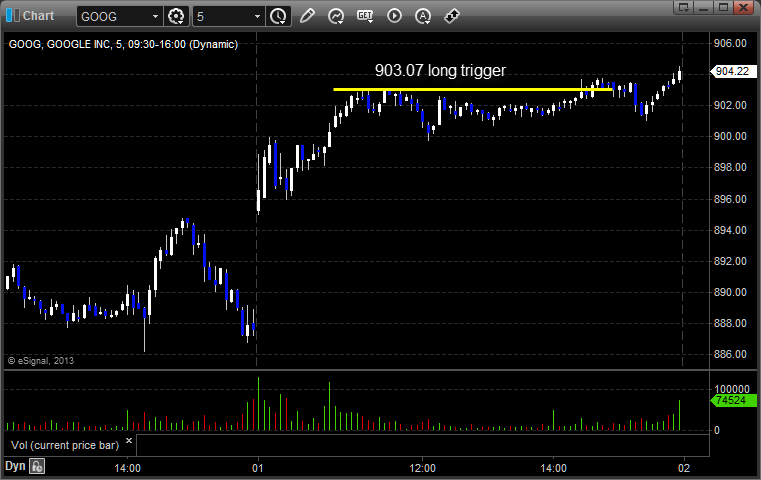

GOOG triggered long (with market support) and worked:

FSLR triggered short (without market support) and worked:

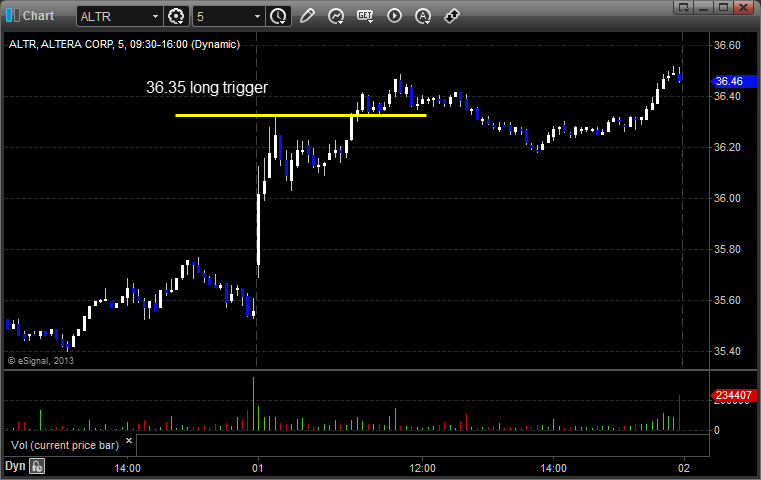

Mark's ALTR triggered long (with market support) and worked:

Rich's GOOG triggered long (with market support) and didn't work:

His SFLY triggered long (with market support) and worked:

In total, that's 8 trades triggering with market support, 6 of them worked, 2 did not.

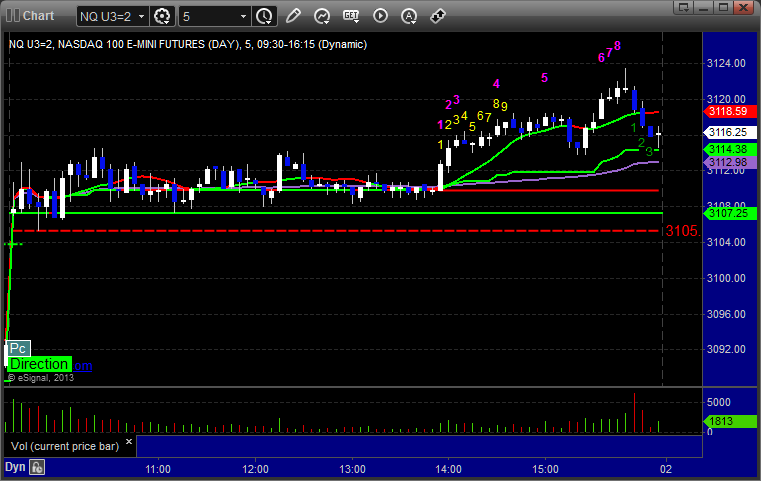

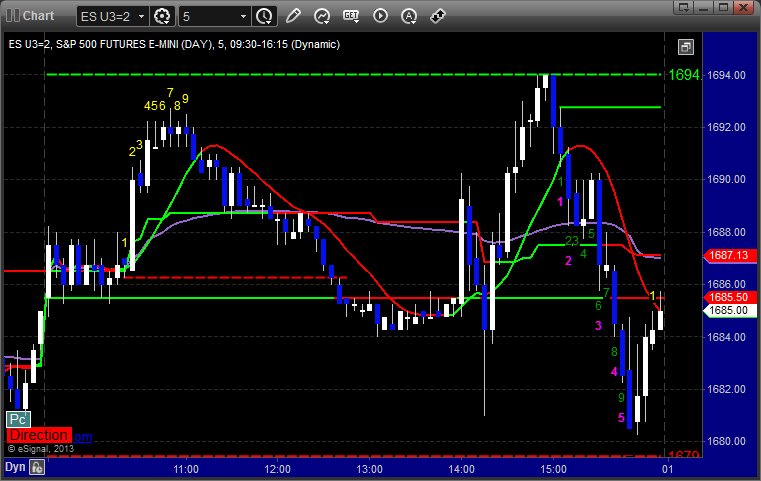

Futures Calls Recap for 8/1/13

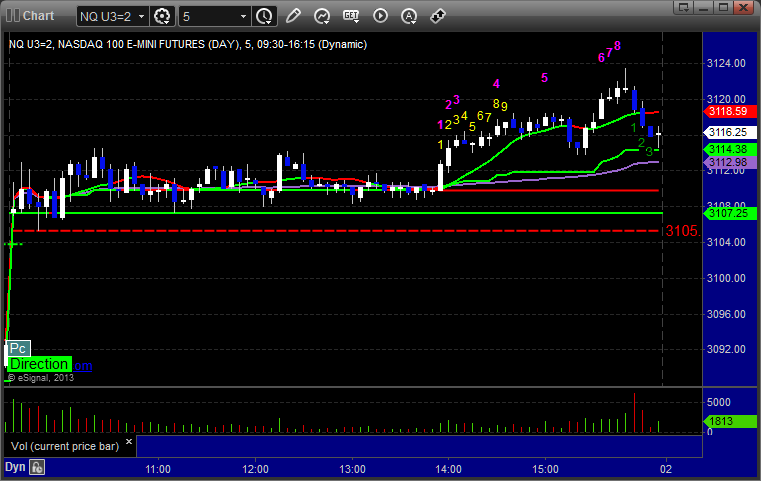

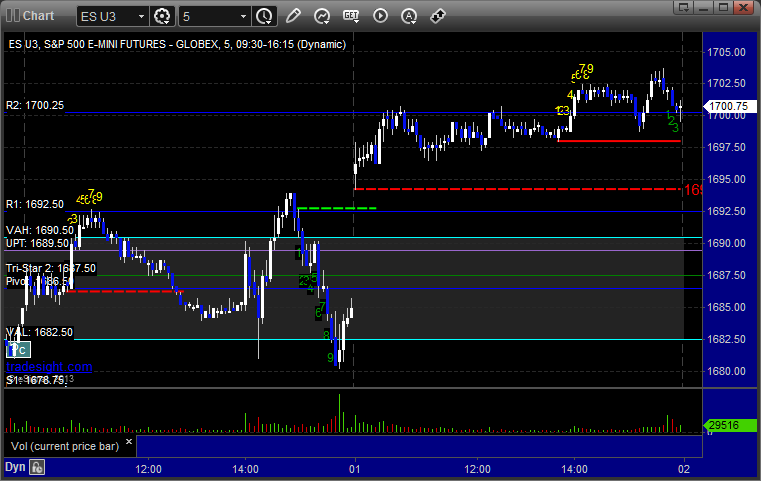

Another day with absolutely no setups. The markets gapped up and never came near the Value Areas or made any real attempts to fill the gaps (fortunately, we didn't try to play the NQ attempt that failed). Almost didn't touch a level for the session, and the ES was basically in a 7 point range. NASDAQ volume closed at 1.8 billion shares which makes the action all the more disappointing.

Net ticks: +0 ticks.

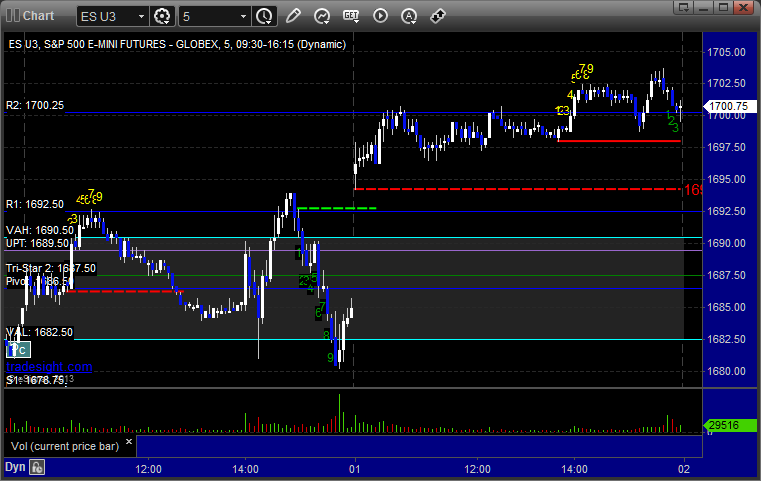

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Futures Calls Recap for 8/1/13

Another day with absolutely no setups. The markets gapped up and never came near the Value Areas or made any real attempts to fill the gaps (fortunately, we didn't try to play the NQ attempt that failed). Almost didn't touch a level for the session, and the ES was basically in a 7 point range. NASDAQ volume closed at 1.8 billion shares which makes the action all the more disappointing.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Forex Calls Recap for 8/1/13

A loser and a winner for barely net gains on the session. Both trades were on the EURUSD, see that section below.

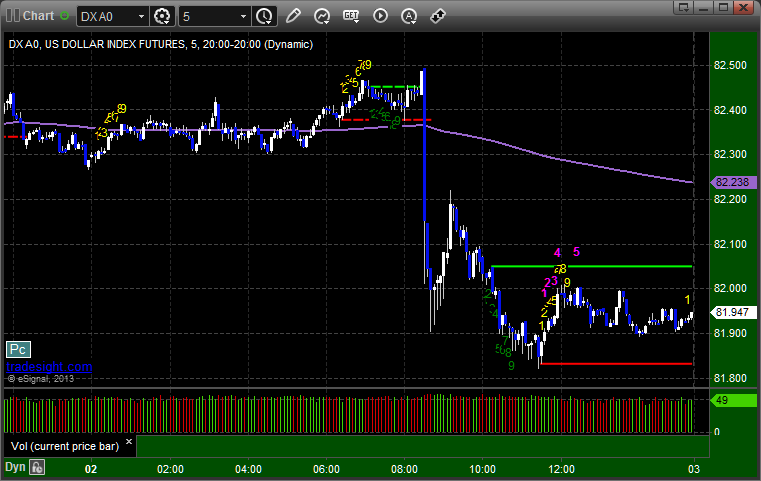

Here's a look at the US Dollar Index intraday with our market directional lines:

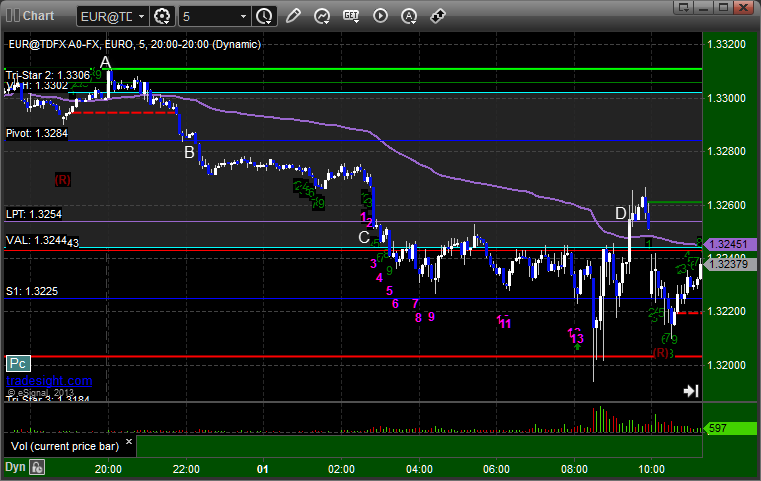

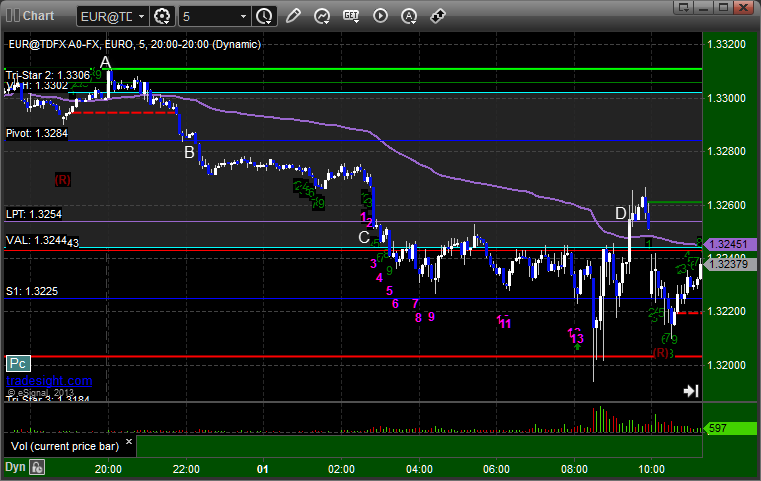

EURUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, lowered stop and stopped second half in the money at D:

Forex Calls Recap for 8/1/13

A loser and a winner for barely net gains on the session. Both trades were on the EURUSD, see that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A and stopped. Triggered short at B, hit first target at C, lowered stop and stopped second half in the money at D:

Stock Picks Recap for 7/31/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CERS triggered long (with market support) and didn't go enough either direction to count:

RBCN triggered long (with market support) and didn't work:

GTAT triggered long (with market support, by a penny) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's TSLA triggered long (without market support due to opening 5 minutes) and worked:

AAPL triggered long (with market support) and didn't work:

MA triggered short (with market support) and worked:

NFLX triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 2 of them worked, 3 did not.

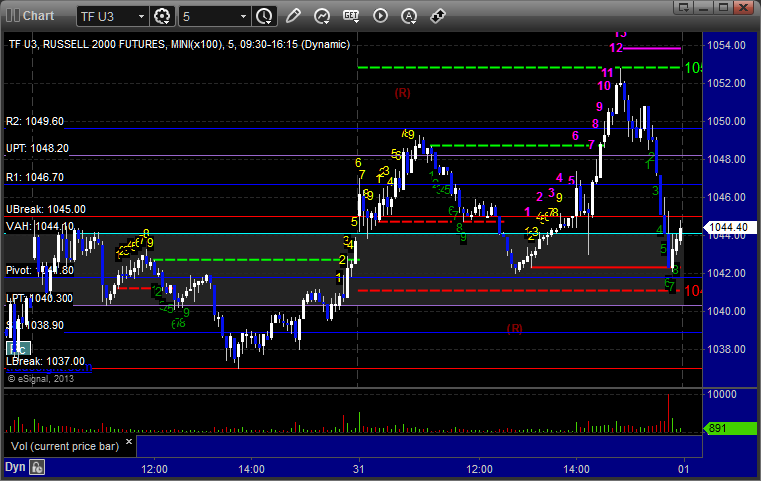

Futures Calls Recap for 7/31/13

No calls with the flat opening (despite the GDP number) and dull early action ahead of the Fed. Frankly, the reaction to the Fed late in the day was a surprise, but have a look at the Russell 2000 chart below, where the Comber tool gave a 13 sell signal right at the high. Back to calls tomorrow to start August.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ER:

Forex Calls Recap for 7/31/13

We came into the session short the second half of the GBPUSD trade from the prior session. That trade continued to work and ultimately closed out for over a 100 pip winner. Meanwhile, the new GBPUSD short idea triggered and worked. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Coming in short from around 1.5300, we had our new trade trigger short at either A or B depending on when you went in. Hit first target at C and lowered stop on second half of the trade over the entry (along with the second half of the 1.5300 entry) and stopped at D: