Stock Picks Recap for 7/24/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VECO triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's FAS triggered short (ETF, so no market support needed) and worked:

GS triggered short (with market support) and worked:

Rich's SRPT triggered short (with market support) and worked huge:

NFLX triggered short (with market support) and worked:

AMGN triggered short (with market support) and worked enough for a partial:

Rich's BIDU triggered long (without market support) and worked great:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Stock Picks Recap for 7/24/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, VECO triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's FAS triggered short (ETF, so no market support needed) and worked:

GS triggered short (with market support) and worked:

Rich's SRPT triggered short (with market support) and worked huge:

NFLX triggered short (with market support) and worked:

AMGN triggered short (with market support) and worked enough for a partial:

Rich's BIDU triggered long (without market support) and worked great:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Futures Calls Recap for 7/24/13

A little more excitement as the markets gapped up, headed lower, the ES filled the gap and more, and the NQ just missed the gap fill before rallying in the last hour. NASDAQ volume was an improved 1.7 billion shares.

Net ticks: +6.5 ticks.

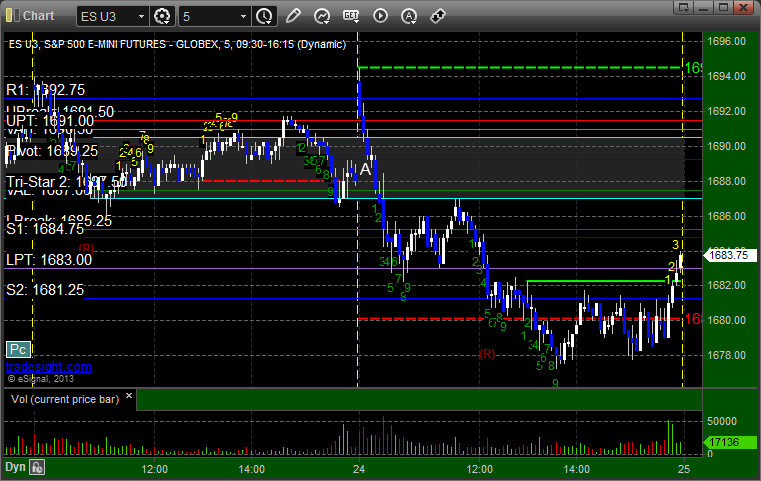

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at 1690.00 at A, hit first target for 6 ticks, and stopped the last piece 7 ticks in the money:

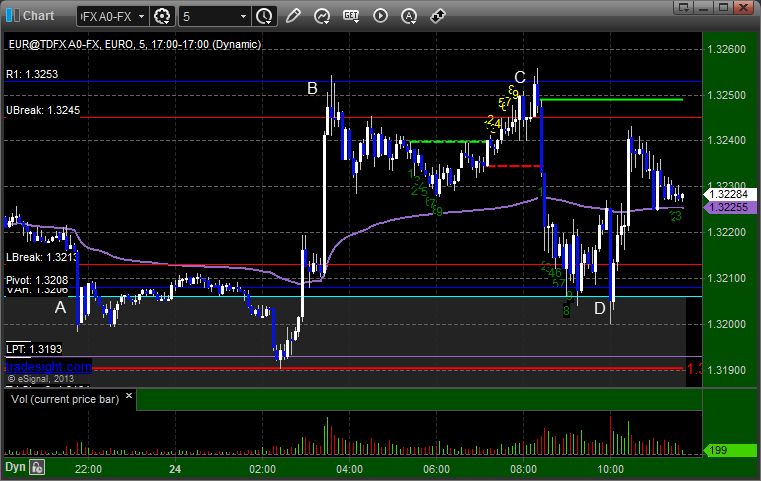

Forex Calls Recap for 7/24/13

Not a good night with a total of three stop outs on the EURUSD. See that section below. First time in a while that has happened. Ranges were bad and we might be getting to the point of half size for summer.

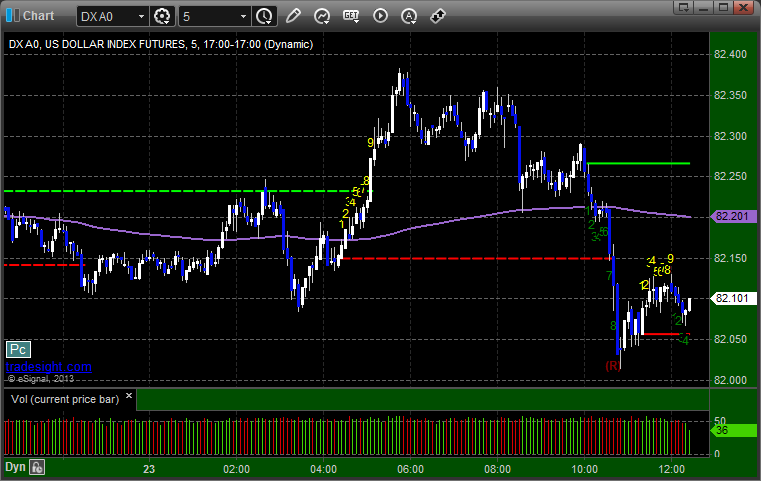

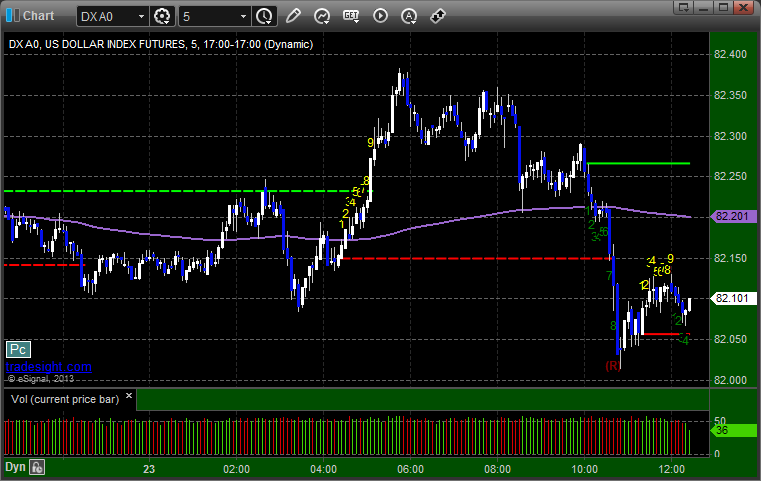

Here's a look at the US Dollar Index intraday with our market directional lines:

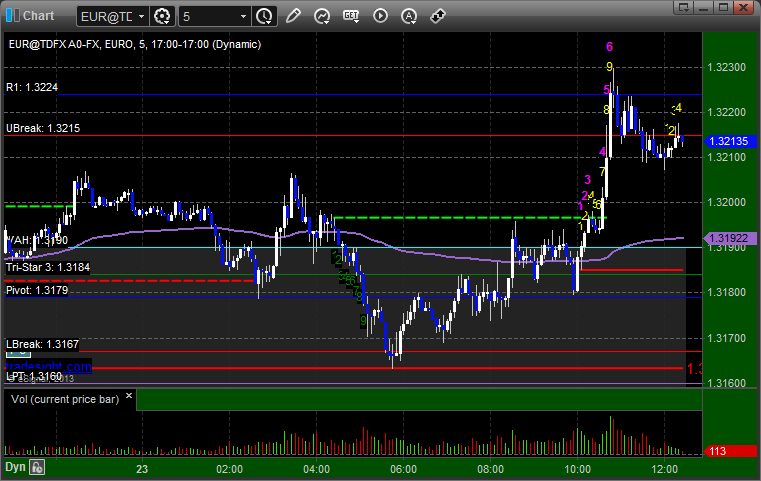

EURUSD:

Triggered short at A and eventually stopped. Part of the long triggered at B if you did your order staggering, and that stopped, and then the rest would have triggered at C and stopped. The short retriggered at D and stopped:

Stock Picks Recap for 7/23/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TROW gapped over, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's SNDK triggered short (with market support) and worked:

His DD triggered short (with market support) and worked:

His AMGN triggered short (with market support) and didn't work:

AMZN triggered short (with market support) and didn't work:

Rich's AAPL triggered short (with market support) and worked:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

Futures Calls Recap for 7/23/13

A false start that stopped and then the retrigger worked on the ES, see that section below. Volume was light again at 1.4 billion NASDAQ shares as we continue through earnings and the core weeks of summer.

Net ticks: +3 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Futures Calls Recap for 7/23/13

A false start that stopped and then the retrigger worked on the ES, see that section below. Volume was light again at 1.4 billion NASDAQ shares as we continue through earnings and the core weeks of summer.

Net ticks: +3 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

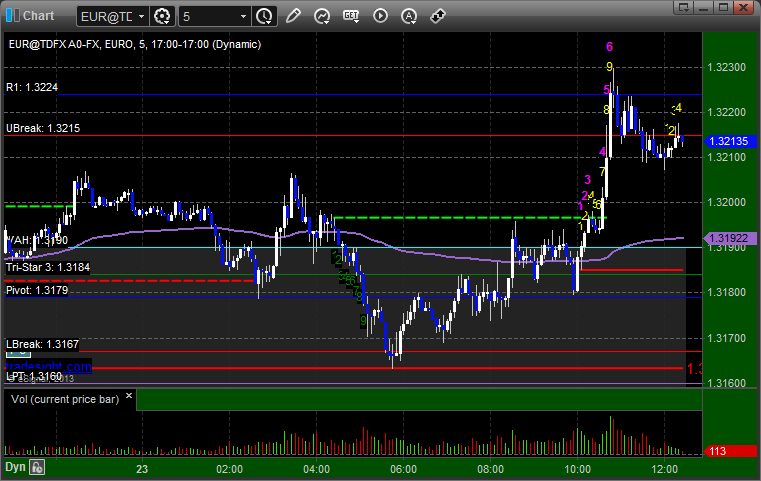

Forex Calls Recap for 7/23/13

Nothing triggered for the session as the EURUSD and GBPUSD stuck in 50 pip ranges. I cancelled the calls a little early when nothing was happening.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Forex Calls Recap for 7/23/13

Nothing triggered for the session as the EURUSD and GBPUSD stuck in 50 pip ranges. I cancelled the calls a little early when nothing was happening.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Stock Picks Recap for 7/22/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, SNDK triggered short (with market support) and didn't work:

Rich's AMZN triggered short (with market support) and worked:

His VXX triggered long (ETF, so no market support needed) and didn't work:

His LNKD triggered short (with market support) and worked:

NFLX triggered short (without market support) and worked:

GOOG triggered long (without market support) and didn't work:

SINA triggered short (with market support) and worked:

Rich's GOOG triggered long (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.