Stock Picks Recap for 7/22/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, SNDK triggered short (with market support) and didn't work:

Rich's AMZN triggered short (with market support) and worked:

His VXX triggered long (ETF, so no market support needed) and didn't work:

His LNKD triggered short (with market support) and worked:

NFLX triggered short (without market support) and worked:

GOOG triggered long (without market support) and didn't work:

SINA triggered short (with market support) and worked:

Rich's GOOG triggered long (with market support) and worked enough for a partial:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

Futures Calls Recap for 7/22/13

Small winner for the session (see ES below) on a light volume session to start the week. NASDAQ volume closed at 1.4 billion shares.

Net ticks: +2.5 ticks.

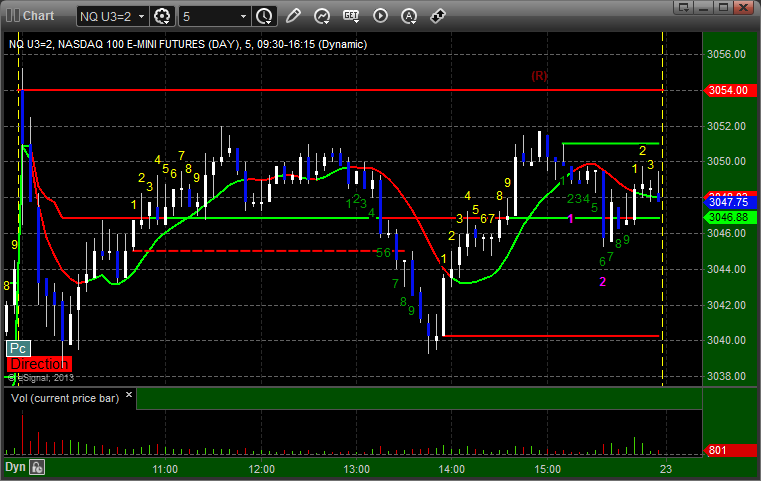

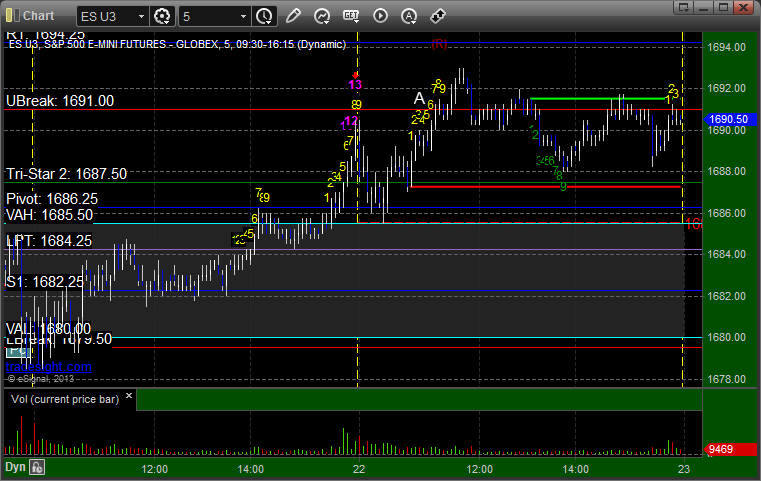

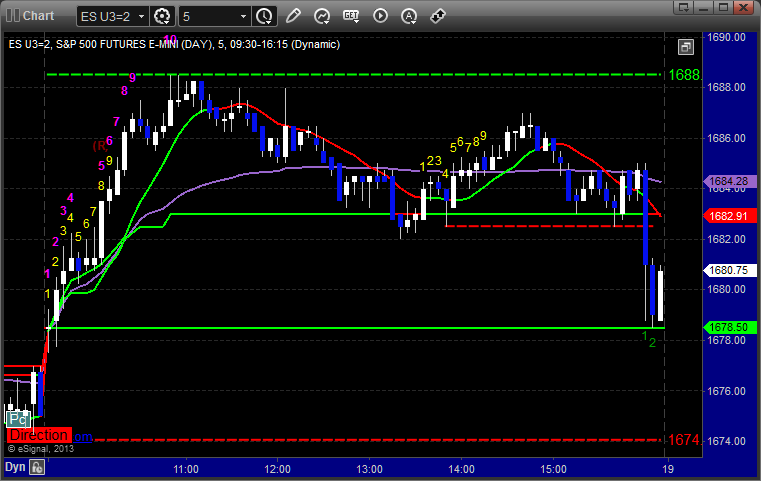

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1691.25, hit first target for 6 ticks, and stopped second half under the entry:

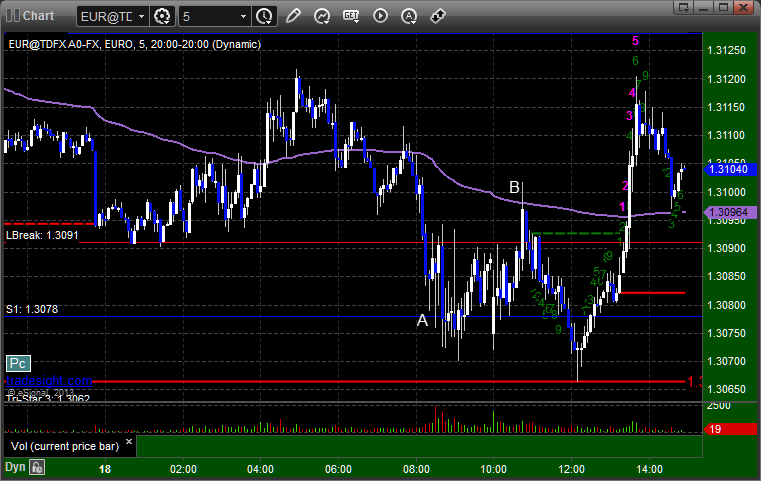

Forex Calls Recap for 7/22/13

Basic session to start the week. See EURUSD for the trade review of our winner.

Here's a look at the US Dollar Index intraday with our market directional lines:

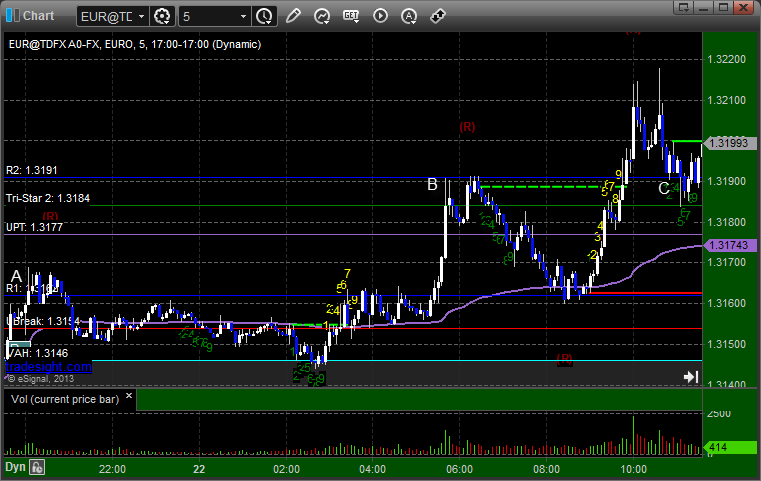

EURUSD:

Triggered long early at A, never stopped, gave you hours to take it later if you missed it that time, hit first target exactly at B, closed final piece at C:

Forex Calls Recap for 7/22/13

Basic session to start the week. See EURUSD for the trade review of our winner.

Here's a look at the US Dollar Index intraday with our market directional lines:

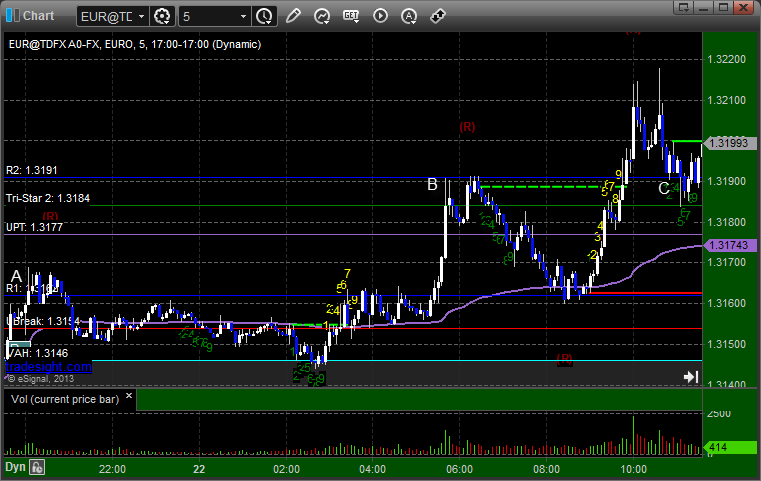

EURUSD:

Triggered long early at A, never stopped, gave you hours to take it later if you missed it that time, hit first target exactly at B, closed final piece at C:

Stock Picks Recap for 7/18/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IACI gapped over, no play.

ACGL triggered long (with market support) and worked enough for a partial, but it was pretty thin:

CTRP triggered long (with market support) and worked great:

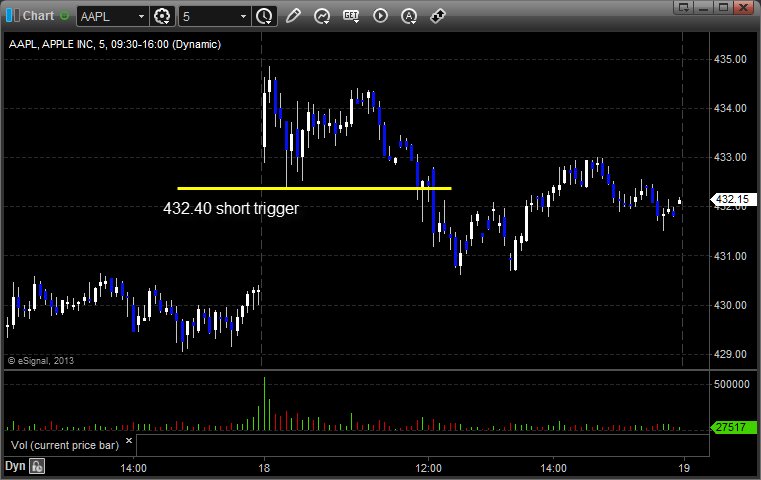

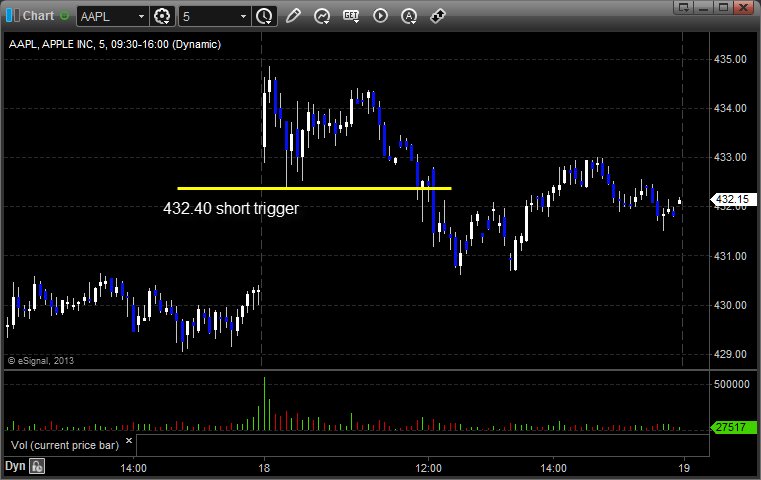

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support) and worked:

His XONE triggered short (with market support at one of the few moments of the day that it was heading down) and worked:

TEVA triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Stock Picks Recap for 7/18/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, IACI gapped over, no play.

ACGL triggered long (with market support) and worked enough for a partial, but it was pretty thin:

CTRP triggered long (with market support) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support) and worked:

His XONE triggered short (with market support at one of the few moments of the day that it was heading down) and worked:

TEVA triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

Futures Calls Recap for 7/18/13

Volume came back and our ES call ended up being a nice winner because of it. We closed with 1.6 billion NASDAQ shares, which is a step up from the rest of the week. See ES section below.

Net ticks: +15 ticks.

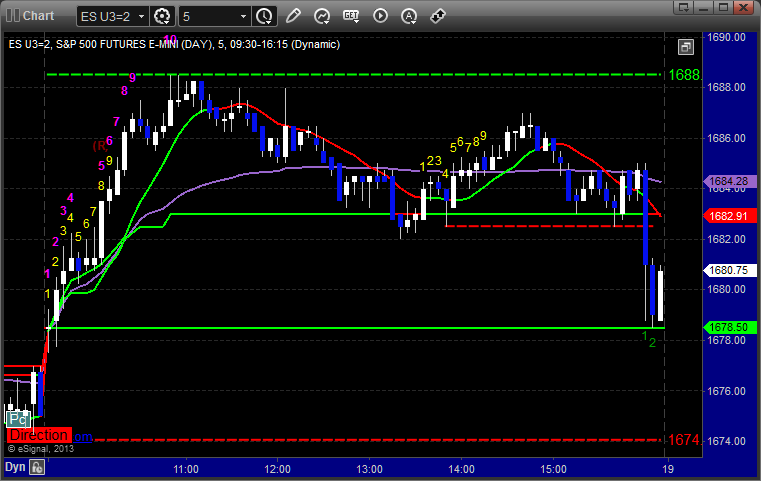

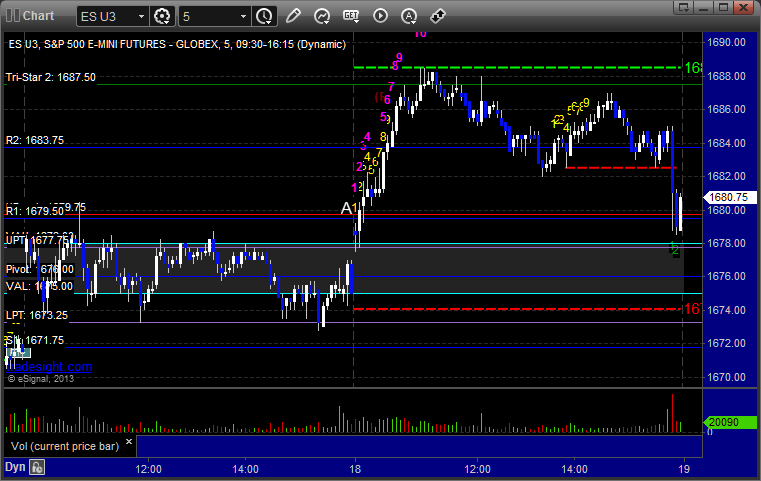

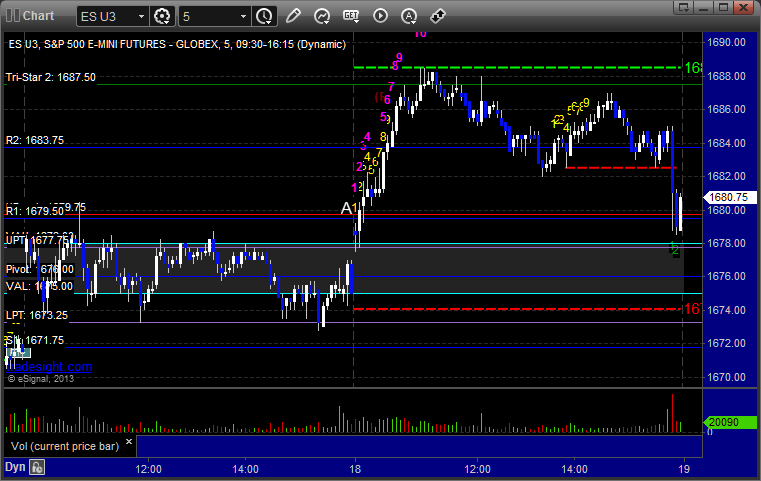

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1680.00, hit first target for 6 ticks, and after adjusting the stop 5 times and hitting the green tri-star level exactly, it stopped at 1686.00 for 24 ticks on the second half:

Futures Calls Recap for 7/18/13

Volume came back and our ES call ended up being a nice winner because of it. We closed with 1.6 billion NASDAQ shares, which is a step up from the rest of the week. See ES section below.

Net ticks: +15 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered long at A at 1680.00, hit first target for 6 ticks, and after adjusting the stop 5 times and hitting the green tri-star level exactly, it stopped at 1686.00 for 24 ticks on the second half:

Forex Calls Recap for 7/18/13

Another slow night for Forex. Our EURUSD triggered heading into the US session and didn't do much. Based on the activity, I posted not to take it again. See that section below. Tomorrow is options expiration, which can slow Forex down as well a bit.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A and stopped at B. We did not take it again:

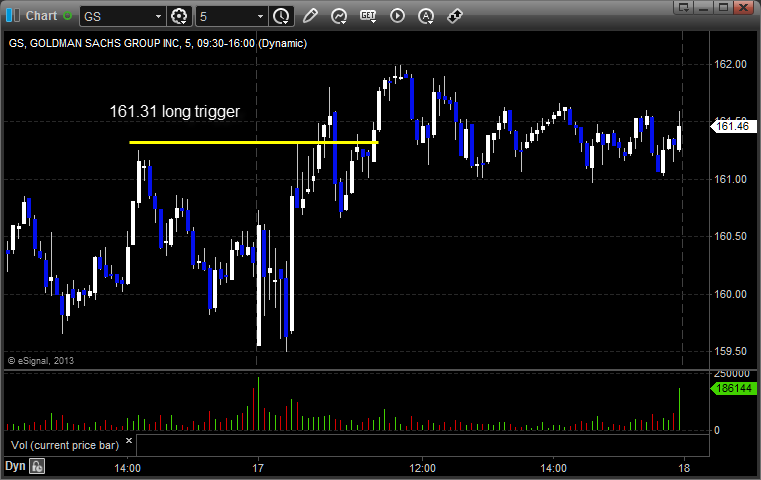

Stock Picks Recap for 7/17/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AMAP triggered long (without market support due to opening 5 minutes) and even though it held in the money for a long time, it didn't go enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, FSLR triggered short (with market support) and worked:

GS triggered long (with market support) and worked enough for a partial:

Rich's NFLX triggered long (with market support) and didn't work:

His EXXI triggered long (with market support) and didn't work:

BIDU triggered long (with market support) and worked great:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.