Stock Picks Recap for 7/17/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AMAP triggered long (without market support due to opening 5 minutes) and even though it held in the money for a long time, it didn't go enough for a partial:

From the Messenger/Tradesight_st Twitter Feed, FSLR triggered short (with market support) and worked:

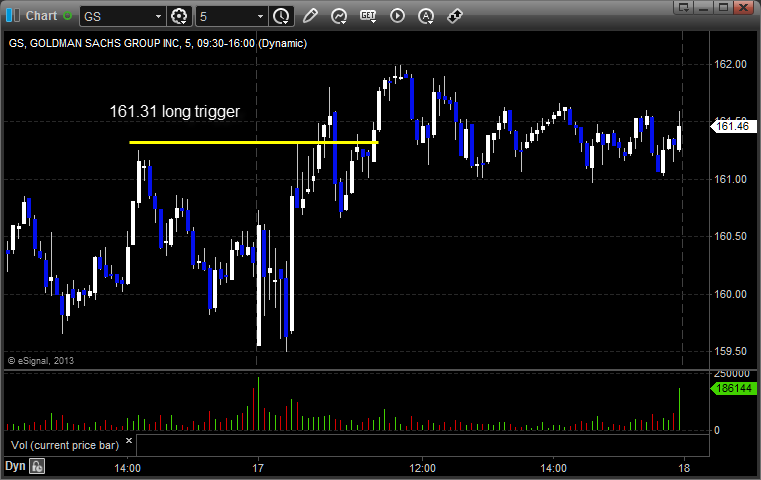

GS triggered long (with market support) and worked enough for a partial:

Rich's NFLX triggered long (with market support) and didn't work:

His EXXI triggered long (with market support) and didn't work:

BIDU triggered long (with market support) and worked great:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

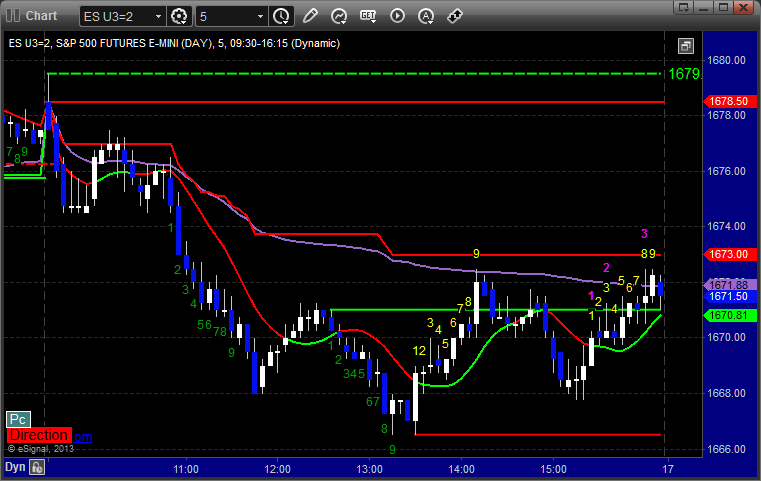

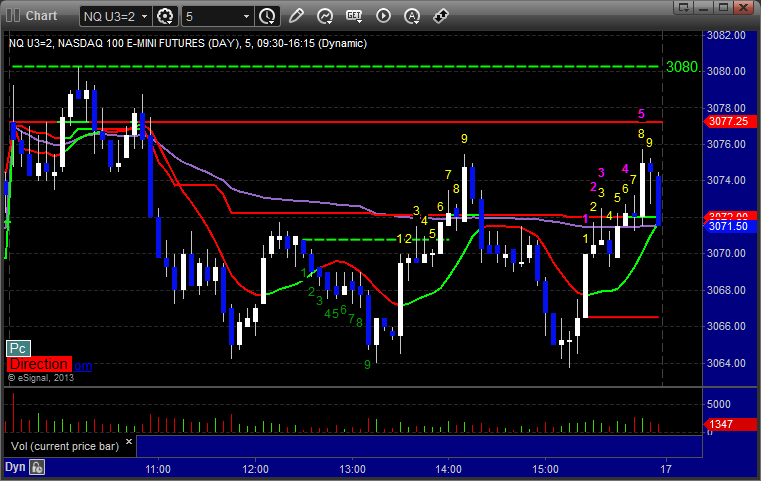

Futures Calls Recap for 7/17/13

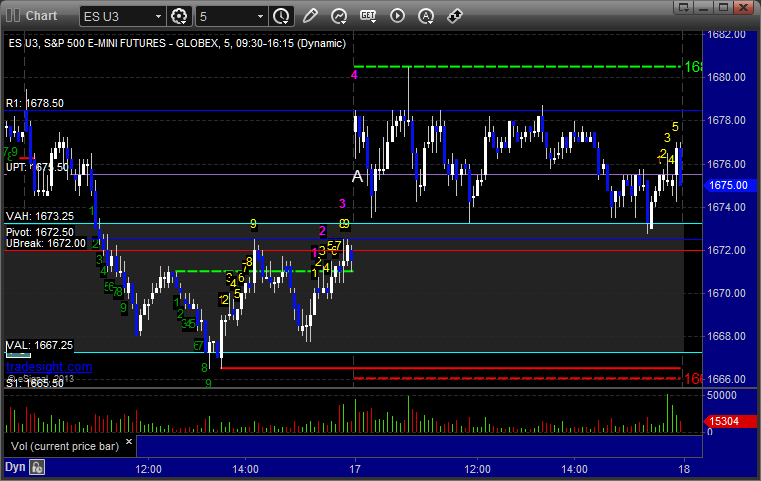

A small winner on an impossibly narrow day with 1.4 billion NASDAQ shares traded. The ES VWAP was a flatline!

Net ticks: +2.5 ticks.

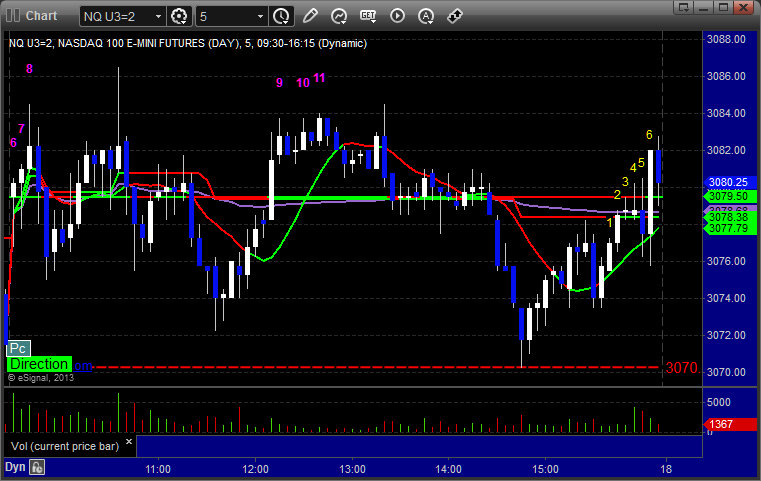

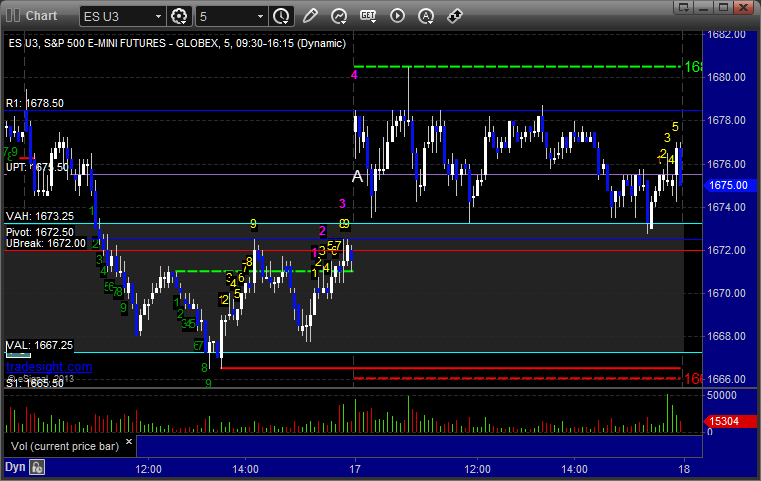

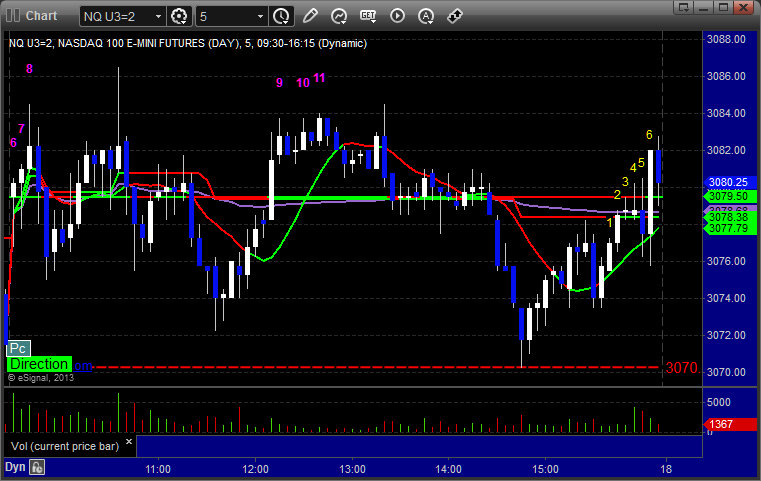

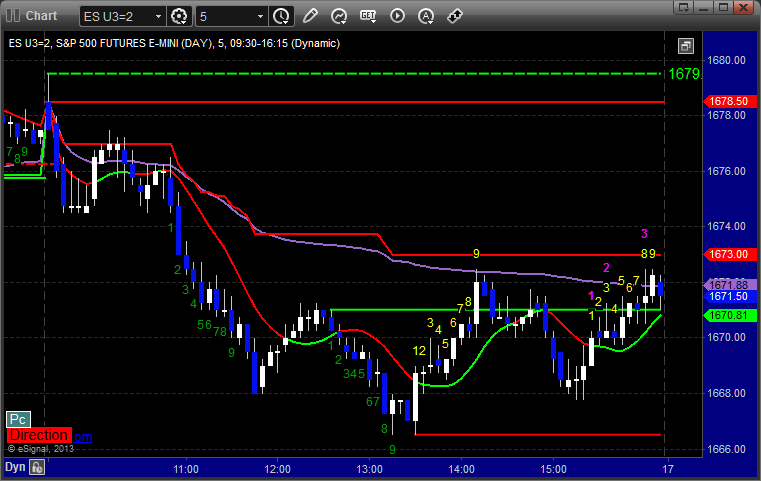

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1675.25, hit first target for 6 ticks, stopped second half over the entry:

Futures Calls Recap for 7/17/13

A small winner on an impossibly narrow day with 1.4 billion NASDAQ shares traded. The ES VWAP was a flatline!

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1675.25, hit first target for 6 ticks, stopped second half over the entry:

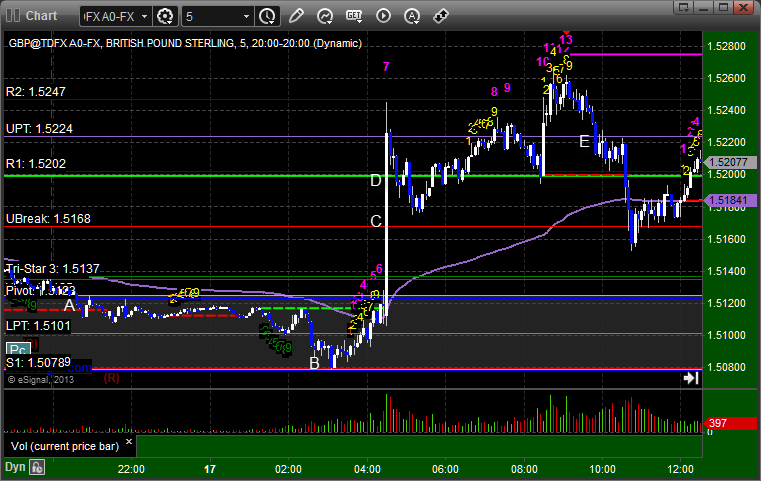

Forex Calls Recap for 7/17/13

A winner on the GBPUSD and then a big news spike that probably prevented you from much of an entry on the long idea, but it worked if you got it. See GBPUSD section below.

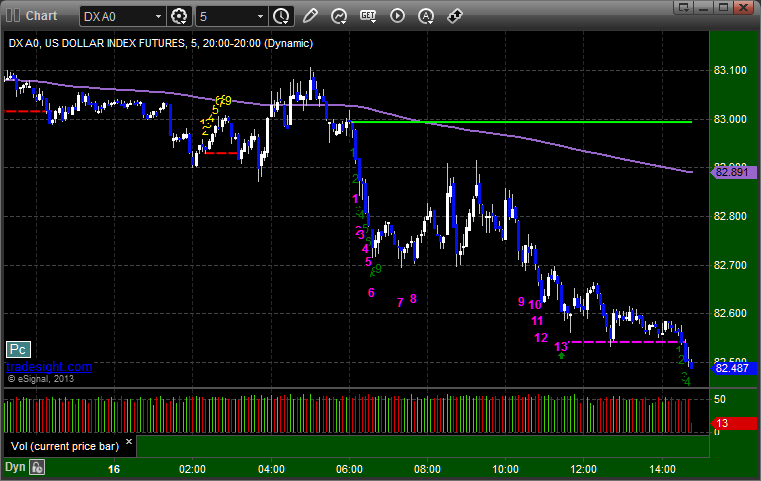

Here's a look at the US Dollar Index intraday with our market directional lines:

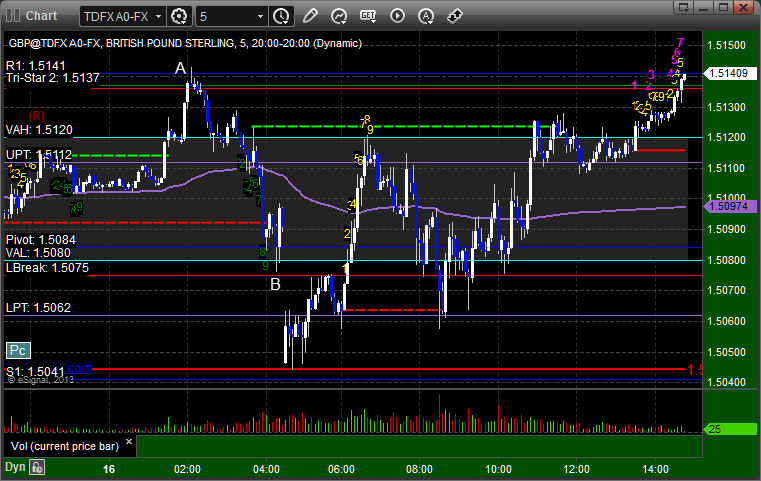

GBPUSD:

Triggered short at A, hit first target at B, stopped second half over the entry. The long trigger was at C, and you can see the big news spike that jumped the GBPUSD 120 pips in a single spike. We used to get these all the time in Forex, but it has been much less frequent lately. Still, hard to get that execution unless you are using a broker that just fills at market, in which case, who knows what price you got. Hit first target at D, stop moved under UPT and stopped at E for those that got it. Funny thing...note the Comber sell signal at the high:

Forex Calls Recap for 7/17/13

A winner on the GBPUSD and then a big news spike that probably prevented you from much of an entry on the long idea, but it worked if you got it. See GBPUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, stopped second half over the entry. The long trigger was at C, and you can see the big news spike that jumped the GBPUSD 120 pips in a single spike. We used to get these all the time in Forex, but it has been much less frequent lately. Still, hard to get that execution unless you are using a broker that just fills at market, in which case, who knows what price you got. Hit first target at D, stop moved under UPT and stopped at E for those that got it. Funny thing...note the Comber sell signal at the high:

Stock Picks Recap for 7/16/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, RJET triggered long (without market support) and worked:

SPPI gapped over, no play.

ZAGG triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's CAT triggered long (without market support) and worked enough for a partial:

AMZN triggered long (without market support) and worked enough for a partial:

GILD triggered short (with market support) and didn't work:

A later second trade under the early lows in GILD triggered short (with market support) and worked:

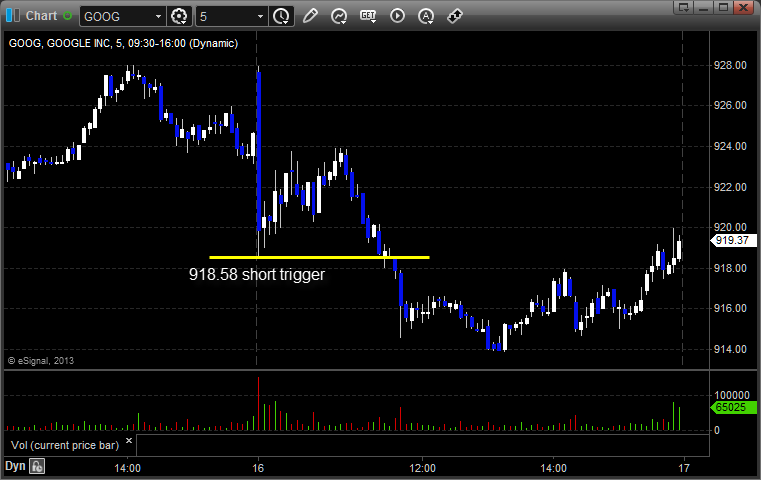

Rich's GOOG triggered short (with market support) and worked:

His LNKD triggered short (with market support) and worked:

COST triggered long (with market support) and worked:

Rich's XONE triggered short (with market support) and worked:

AAPL triggered long (without market support) and I closed it even when it didn't do anything:

FSLR triggered short (with market support) and I closed it via Messenger/Twitter even:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

Stock Picks Recap for 7/16/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, RJET triggered long (without market support) and worked:

SPPI gapped over, no play.

ZAGG triggered long (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's CAT triggered long (without market support) and worked enough for a partial:

AMZN triggered long (without market support) and worked enough for a partial:

GILD triggered short (with market support) and didn't work:

A later second trade under the early lows in GILD triggered short (with market support) and worked:

Rich's GOOG triggered short (with market support) and worked:

His LNKD triggered short (with market support) and worked:

COST triggered long (with market support) and worked:

Rich's XONE triggered short (with market support) and worked:

AAPL triggered long (without market support) and I closed it even when it didn't do anything:

FSLR triggered short (with market support) and I closed it via Messenger/Twitter even:

In total, that's 6 trades triggering with market support, 5 of them worked, 1 did not.

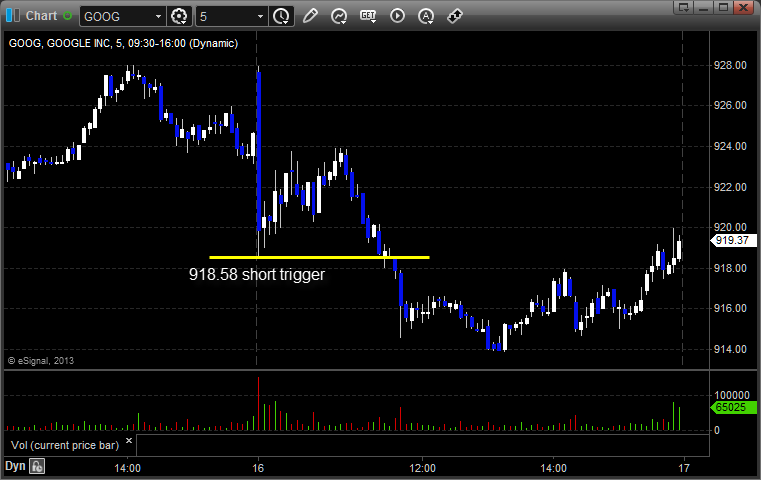

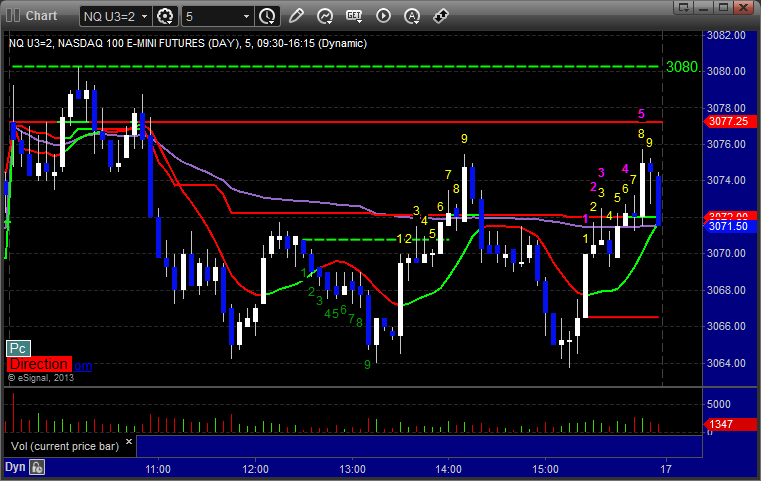

Futures Calls Recap for 7/16/13

Another very light-volume session as we are now feeling the added brunt of core earnings starting today and summer vacations. See ES below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1674.75 and stopped for 7 ticks. He did not re-enter, which, ironically despite the volume, the later entry would have worked nice:

Futures Calls Recap for 7/16/13

Another very light-volume session as we are now feeling the added brunt of core earnings starting today and summer vacations. See ES below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's call triggered short at A at 1674.75 and stopped for 7 ticks. He did not re-enter, which, ironically despite the volume, the later entry would have worked nice:

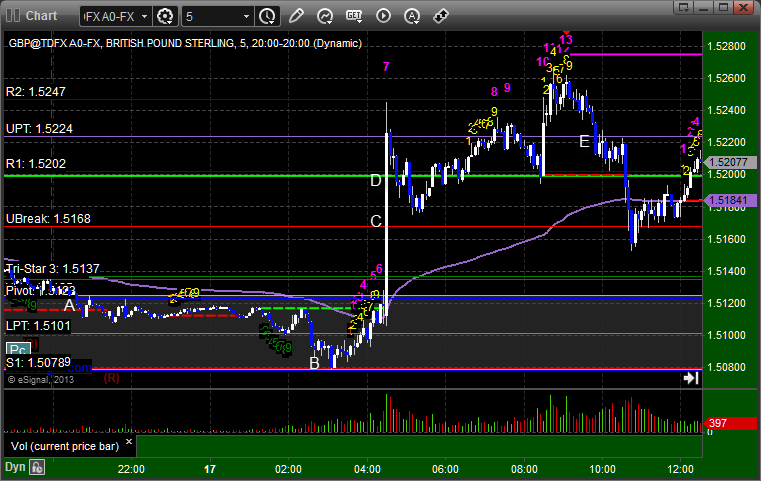

Forex Calls Recap for 7/16/13

A half-size night ahead of the CPI led to not much. See GBPUSD for triggers.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

A partial entry at A stopped. There was a gap in the action for 6 minutes (some sort of news) when the short triggered, and that stopped. Both were half size ahead of CPI, and then we put the trades back in and neither triggered: