Forex Calls Recap for 6/18/13

A nice setup that worked ultimately but barely stopped us out overnight instead. See GBPUSD below.

Here's a look at the US Dollar Index intraday with our market directional lines:

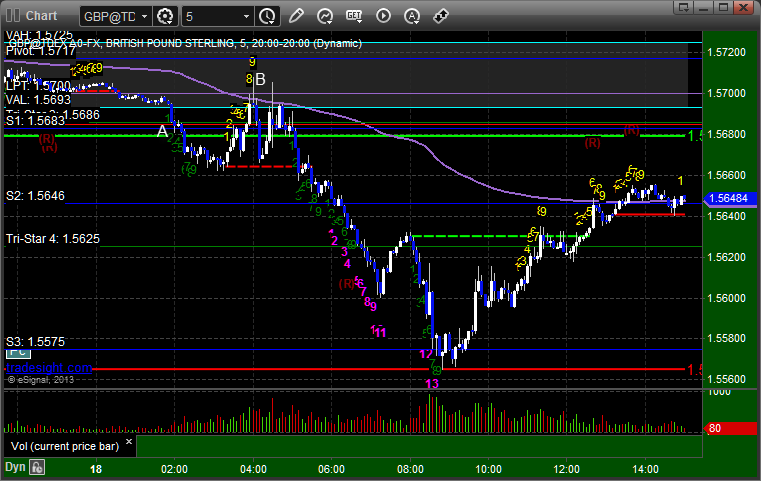

GBPUSD:

Triggered short at A. Unfortunately, stopped just barely at B on a little spike before working great. Note the Comber 13 was the low:

Stock Picks Recap for 6/17/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, AMGN triggered long (with market support) and worked:

Mark's CSIQ triggered long (with market support) and worked enough for a partial:

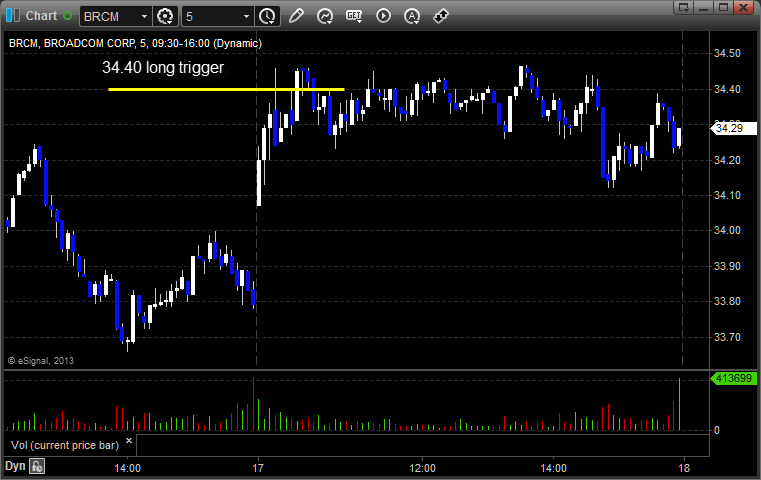

His BRCM triggered long (with market support) and sat even for hours, eventually didn't work:

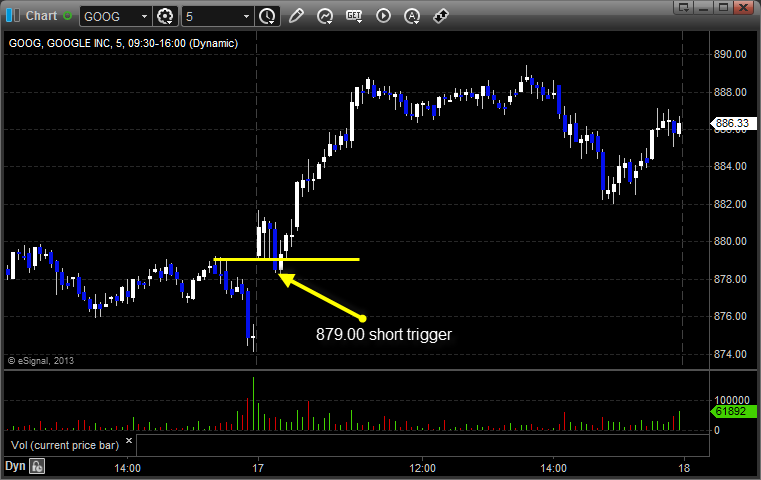

GOOG triggered short (without market support) and didn't work:

COST triggered long (with market support) and worked:

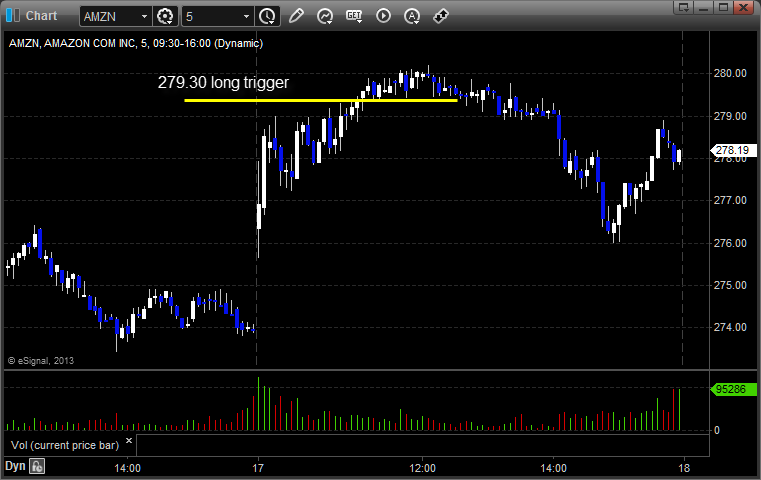

Mark added a separate entry on AMZN that triggered long (with market support) and worked enough for a partial:

BIDU triggered short (with market support) and didn't work:

In total, that's 6 trades triggering with market support, 4 of them worked, 2 did not.

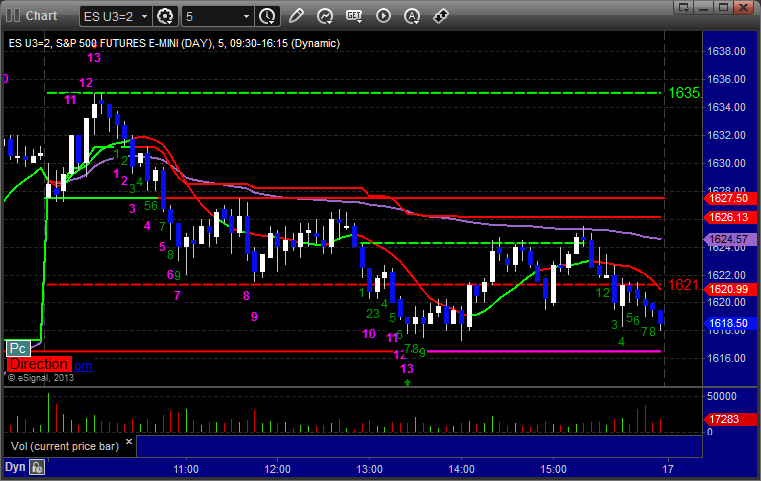

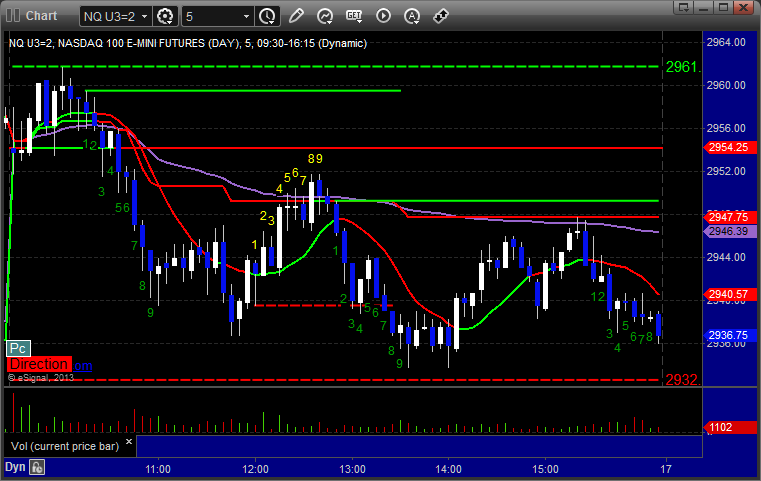

Futures Calls Recap for 6/17/13

A winner on the ES in the afternoon and that was it as we had another 1.5 billion NASDAQ share trading session, this time with a gap up.

Net ticks: +9 ticks.

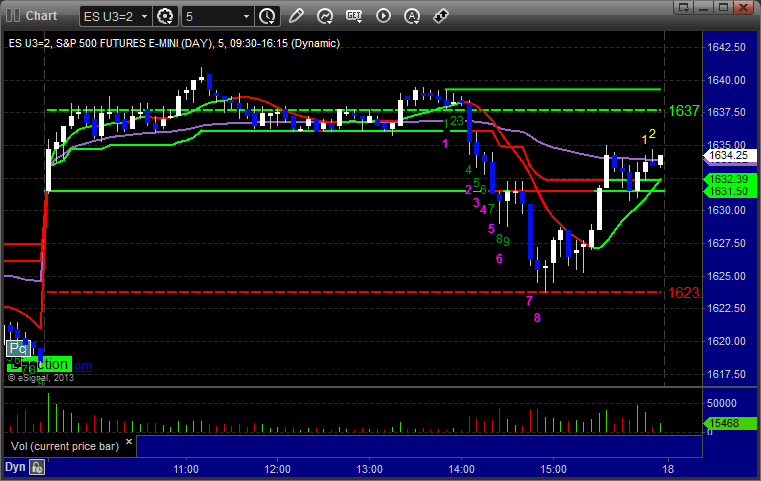

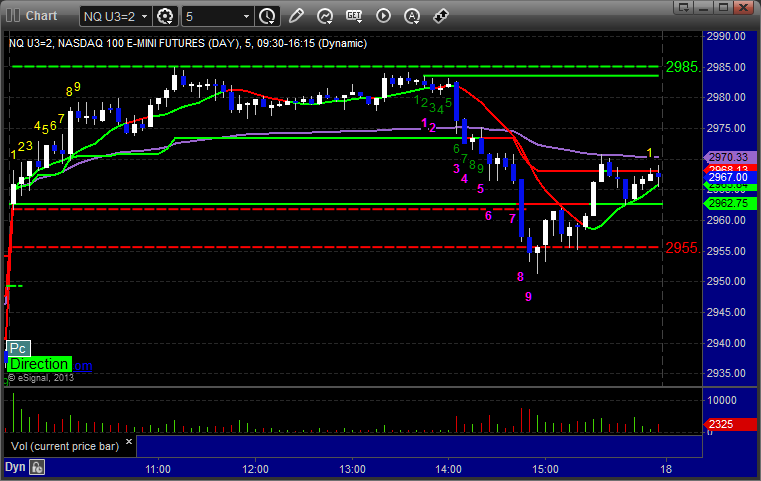

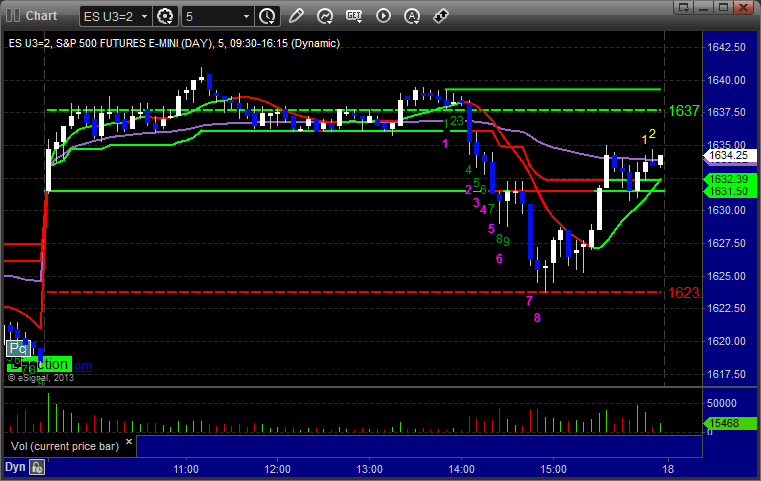

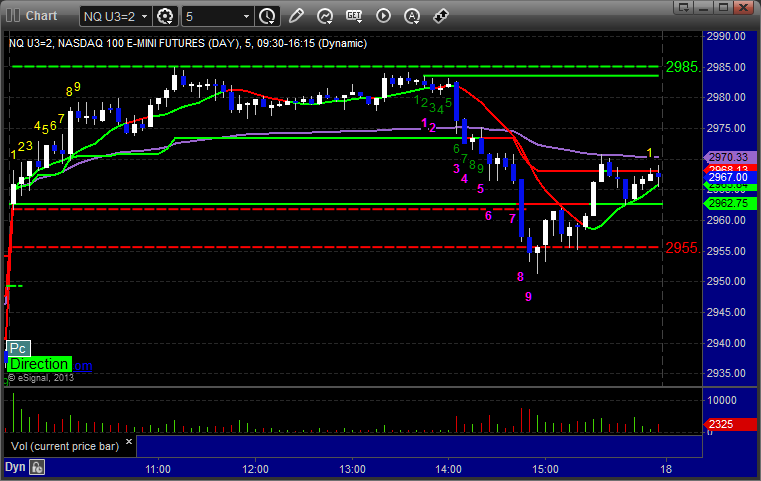

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

After adjusting the entry a few times as the market drifted higher in the morning after a gap up, we finally triggered short after lunch at A at 1634.50, hit first target for 6 ticks, adjusted the stop 3 times, and stopped the final piece at 1631.50 at B for 12 ticks:

Futures Calls Recap for 6/17/13

A winner on the ES in the afternoon and that was it as we had another 1.5 billion NASDAQ share trading session, this time with a gap up.

Net ticks: +9 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

After adjusting the entry a few times as the market drifted higher in the morning after a gap up, we finally triggered short after lunch at A at 1634.50, hit first target for 6 ticks, adjusted the stop 3 times, and stopped the final piece at 1631.50 at B for 12 ticks:

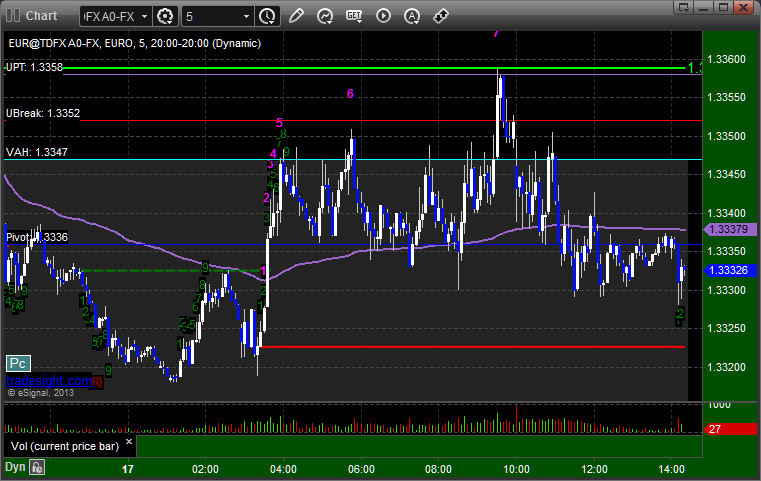

Forex Calls Recap for 6/17/13

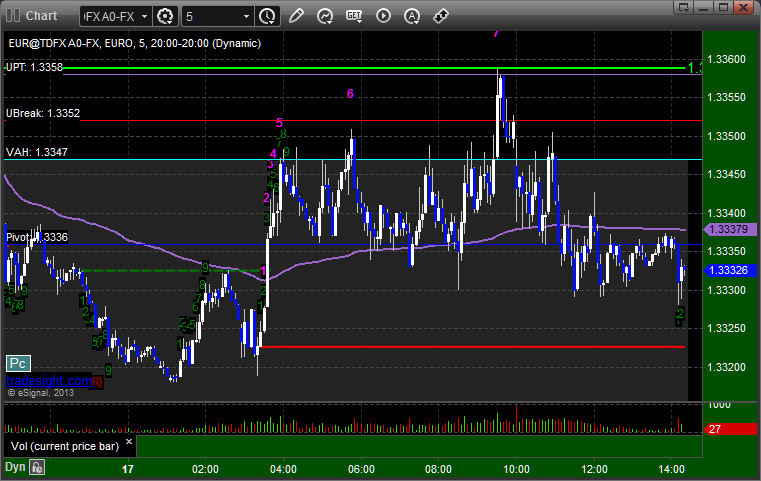

No triggers with the EURUSD in 40 pips of range. Horrible, but no triggers, no losses.

Here's a look at the US Dollar Index intraday with our market directional lines:

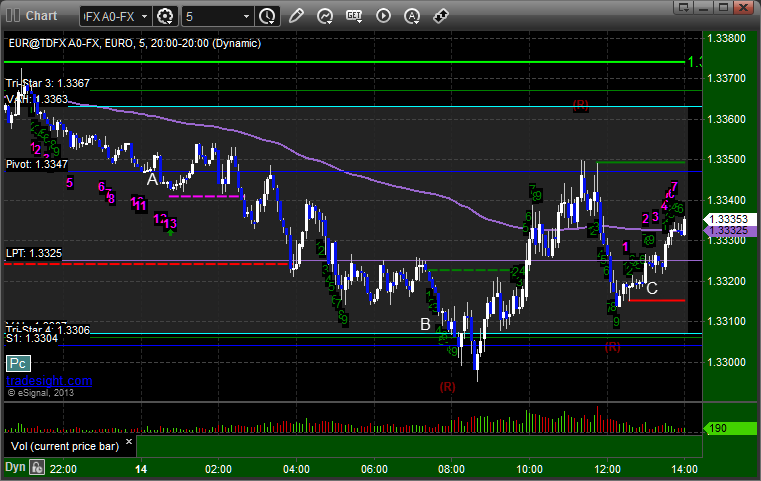

EURUSD:

Note that UPT was the high.

Forex Calls Recap for 6/17/13

No triggers with the EURUSD in 40 pips of range. Horrible, but no triggers, no losses.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Note that UPT was the high.

Stock Picks Recap for 6/14/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing did much today, as expected, due to volume.

From the report, FNSR and PLCM gapped over their triggers, no plays.

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered (without market support) and didn't work:

His X triggered long (with market support) and worked enough for a partial:

And his GS triggered short (with market support) and worked enough for a partial:

In total, that's 2 trades triggering with market support, both of them worked a little.

Stock Picks Recap for 6/14/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

Nothing did much today, as expected, due to volume.

From the report, FNSR and PLCM gapped over their triggers, no plays.

From the Messenger/Tradesight_st Twitter Feed, Rich's NFLX triggered (without market support) and didn't work:

His X triggered long (with market support) and worked enough for a partial:

And his GS triggered short (with market support) and worked enough for a partial:

In total, that's 2 trades triggering with market support, both of them worked a little.

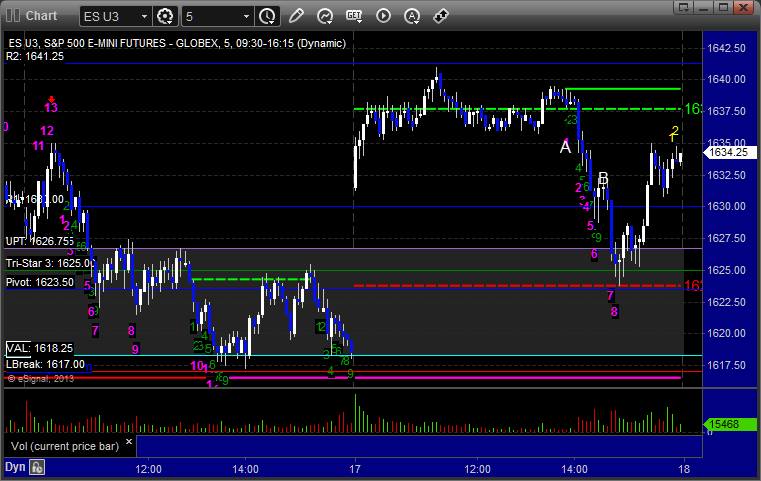

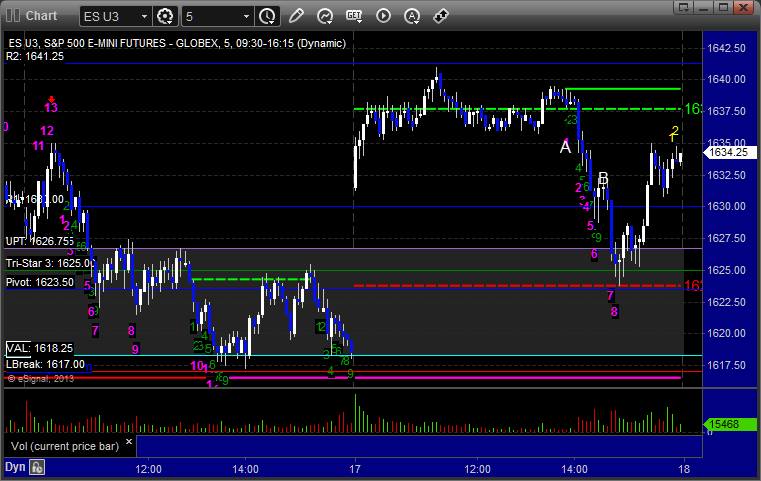

Futures Calls Recap for 6/14/13

No trade calls due to contract roll on a Friday, which led to a 1.3 billion share day on the NASDAQ. Should start getting back to normal Monday. Note that on the ES charts below, we had a Comber 13 sell signal at the high of the session and a Comber 13 buy signal at the low.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 6/14/13

A winner in the EURUSD to close out the week. See that section below. We enter triple expiration week for June...

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. See AUDUSD daily charts in particular.

EURUSD:

Triggered short at A, hit first target at B, closed final piece at C for end of week: