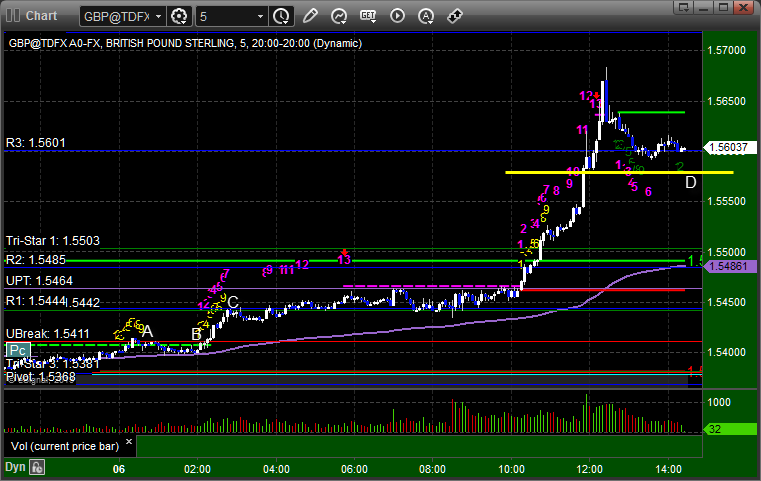

Forex Calls Recap for 6/10/13

A small winner in the GBPUSD after a dull overnight session. See that section below.

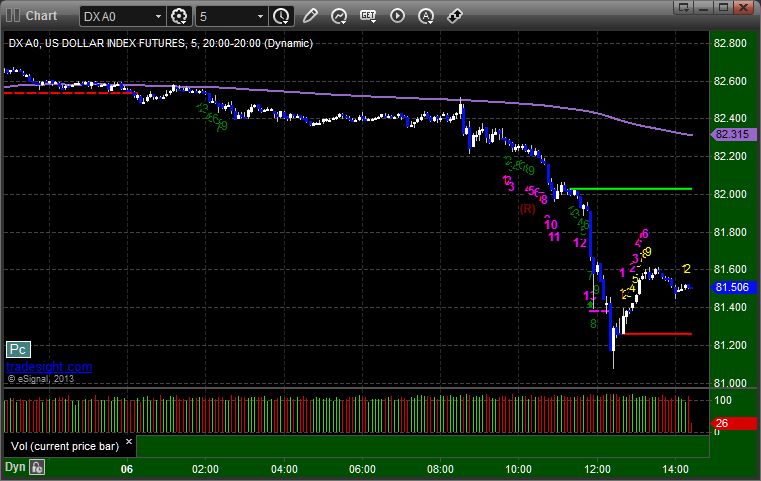

Here's a look at the US Dollar Index intraday with our market directional lines:

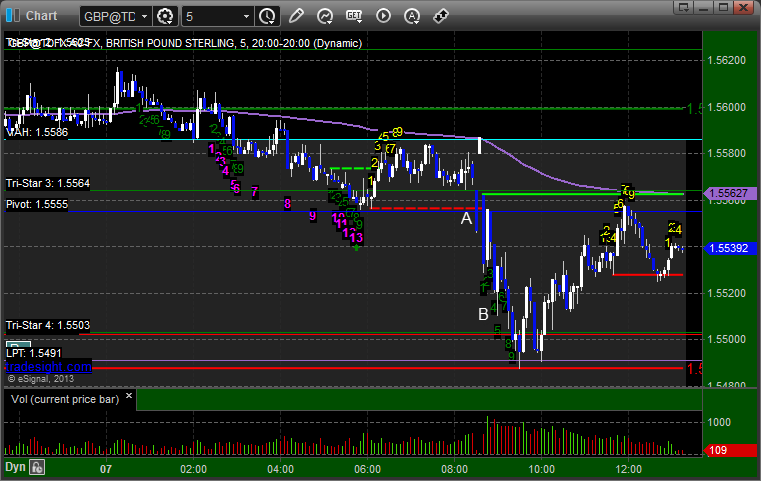

GBPUSD:

Finally triggered long at A and closed at B for 10 pips for end of session as it wasn't going to hit the first target:

Stock Picks Recap for 6/7/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BIDU triggered long (with market support) and worked:

VNET trigger short have been over the prior day's high and worked great but we won't count it as I typo'd it.

CPRT gapped under the short trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's SLB triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

Mark's LRCX triggered long (with market support) and worked:

AMZN triggered long (with market support) and worked:

Rich's OIS triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, and all 4 of them worked.

Stock Picks Recap for 6/7/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BIDU triggered long (with market support) and worked:

VNET trigger short have been over the prior day's high and worked great but we won't count it as I typo'd it.

CPRT gapped under the short trigger, no play.

From the Messenger/Tradesight_st Twitter Feed, Rich's SLB triggered short (without market support due to opening 5 minutes) and worked enough for a partial:

Mark's LRCX triggered long (with market support) and worked:

AMZN triggered long (with market support) and worked:

Rich's OIS triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, and all 4 of them worked.

Futures Calls Recap for 6/7/13

No calls to wrap up an OK week. We got a gap from the data and then didn't really line up against any key levels.

Net ticks: +0 ticks.

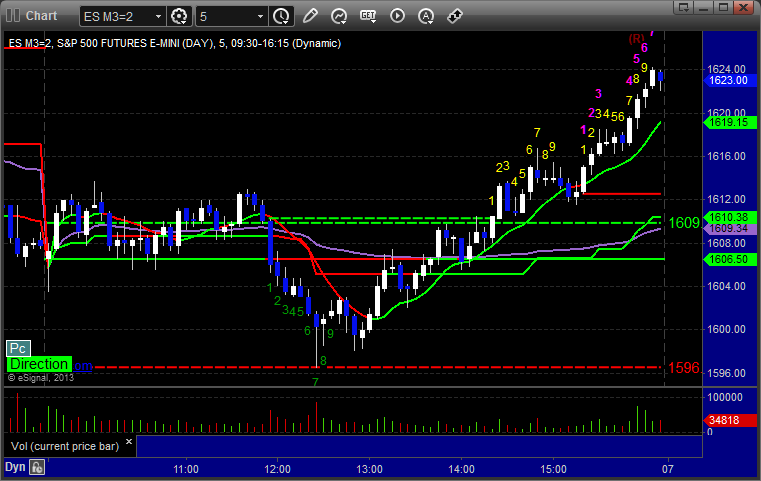

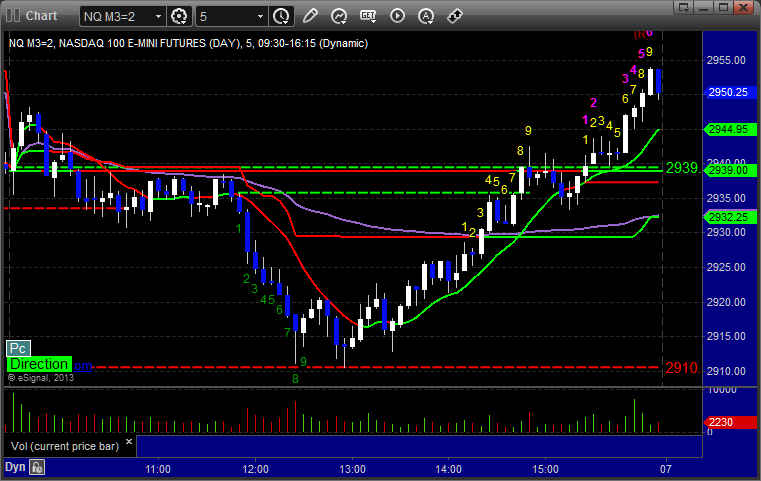

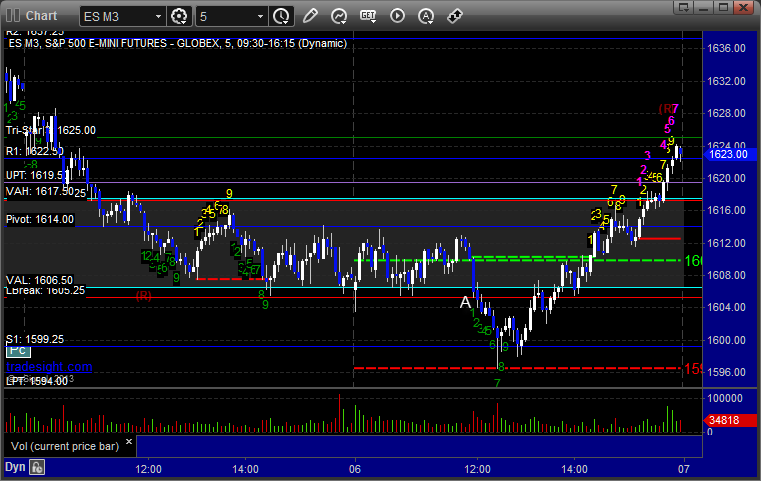

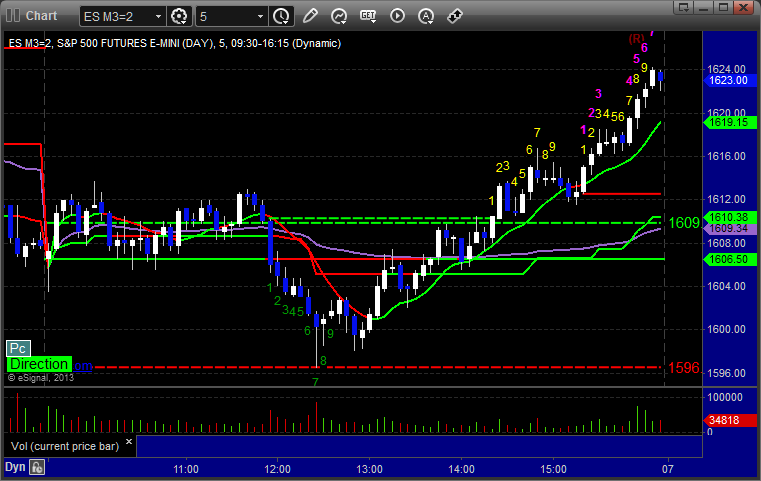

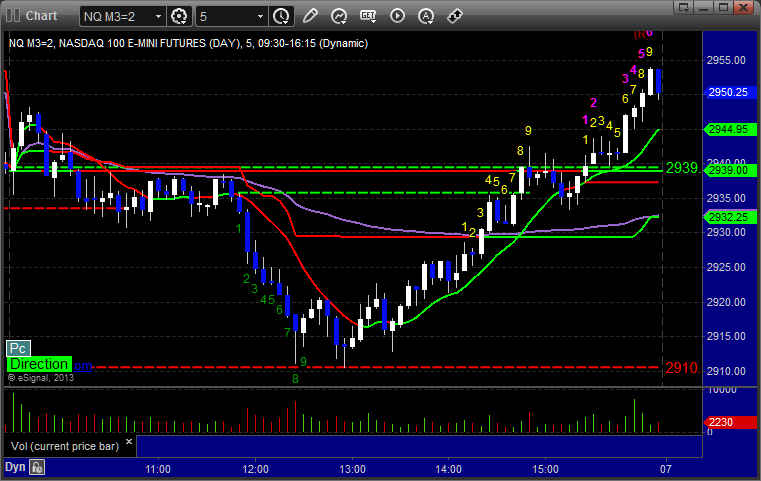

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Futures Calls Recap for 6/7/13

No calls to wrap up an OK week. We got a gap from the data and then didn't really line up against any key levels.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

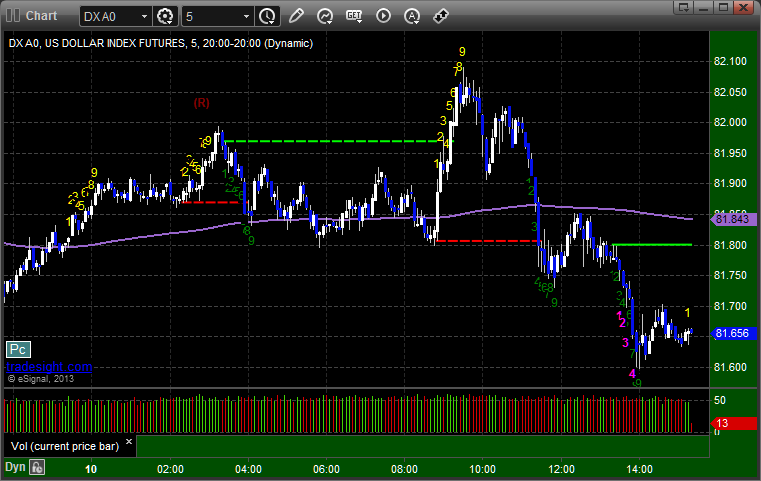

Forex Calls Recap for 6/7/13

An odd session with news and a trigger on the key data (which is why we go half size for the Big Three data releases). See GBPUSD below. Also stopped the second half of the prior day's long 160 pips in the money.

Here's a look at the US Dollar Index intraday with our market directional lines:

As usual on the Sunday report, we will look at the action from Thursday night/Friday, then look at the daily charts of all the pairs with the Seeker and Comber separately for the week ahead, and then glance at the US Dollar Index. Glance at the AUDUSD in particular.

GBPUSD:

We stopped the second half of the prior day's long idea under the VAH for about 160 pips. The new trade triggered short at A, right on the news, so depending on when you got the fill, you might have stopped (also depends on how your broker did). It then hit the first target at B and should have closed anything left for end of week at C:

Stock Picks Recap for 6/7/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, MOVE triggered long (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's CELG triggered long (with market support) and didn't work:

GILD triggered long (with market support) and worked:

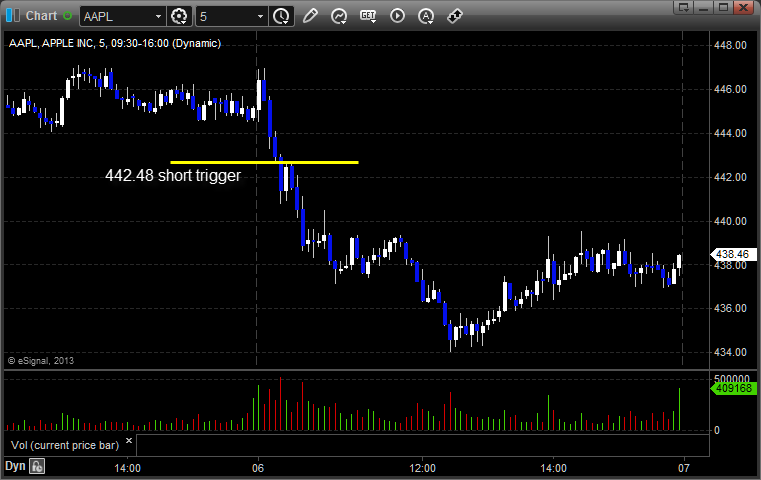

AAPL triggered short (without market support) and worked great, nice winner:

NFLX triggered short (with market support) and didn't work:

Rich's VXX triggered short (ETF, so no market support needed) and worked:

In total, that's 5 trades triggering with market support, 2 of them worked, 3 did not, but the AAPL did well too.

Futures Calls Recap for 6/6/13

Two calls, one triggered, and we got a nice winner on the ES. See that section below. Volume lightened up and was only 1.5 billion NASDAQ shares.

Net ticks: +13.5 ticks.

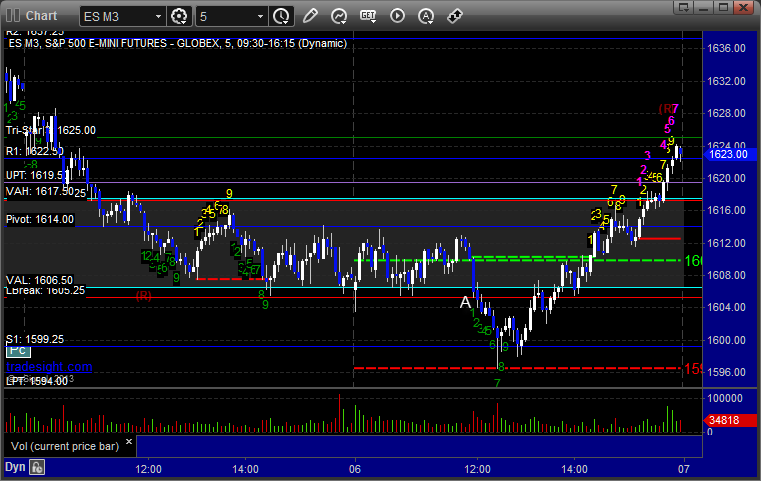

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at 1605.00 at A, hit first target for 6 ticks, lowered stop repeatedly and stopped second half 21 ticks in the money:

Futures Calls Recap for 6/6/13

Two calls, one triggered, and we got a nice winner on the ES. See that section below. Volume lightened up and was only 1.5 billion NASDAQ shares.

Net ticks: +13.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at 1605.00 at A, hit first target for 6 ticks, lowered stop repeatedly and stopped second half 21 ticks in the money:

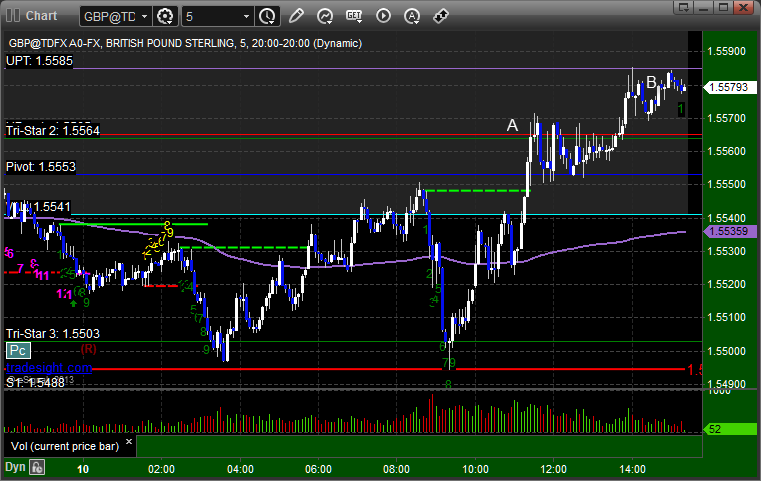

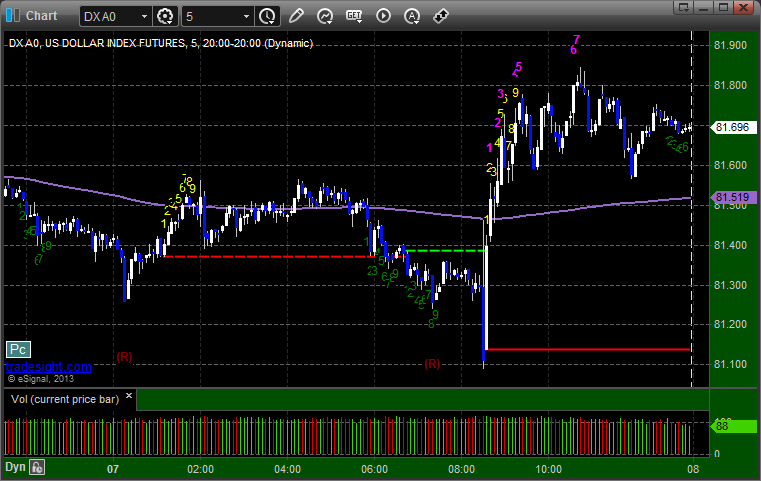

Forex Calls Recap for 6/6/13

A nice big winner still going in the GBPUSD for the session. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

There was a very early trigger (prior to what you see on the chart) that might have triggered one leg of your three entries if you followed our staggering rules, but then closer to the main time, we had a trigger at A that didn't stop and then another chance at B, hit first target at C, and then a big run. Still holding the second half about 200 pips in the money with a stop under the yellow line at D: