Forex Calls Recap for 5/30/13

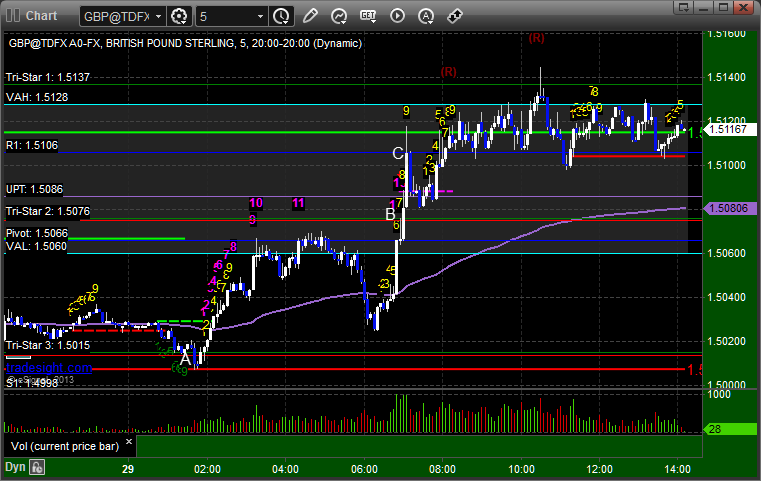

Nice winner and closed out an even bigger winner from the prior session as well. See GBPUSD below.

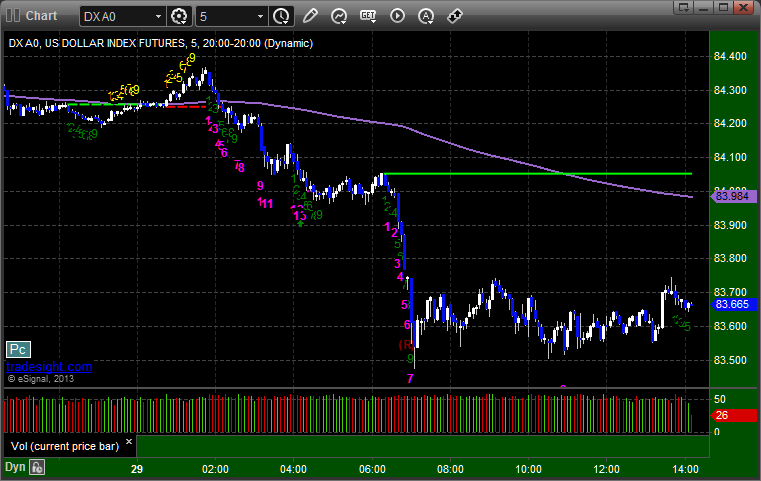

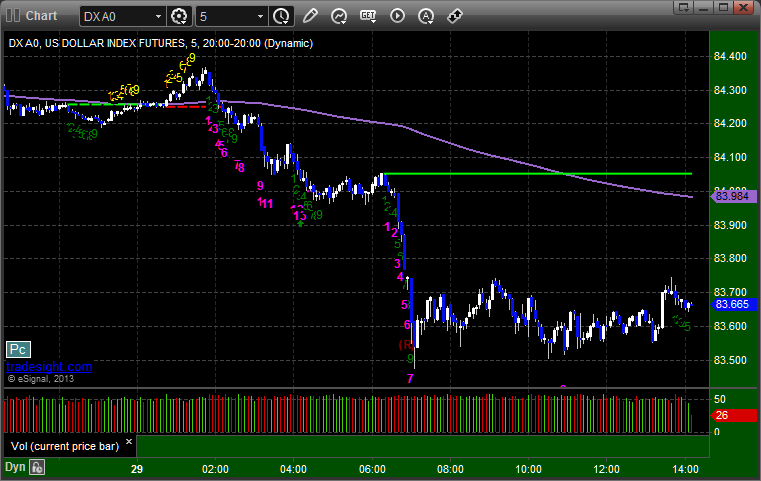

Here's a look at the US Dollar Index intraday with our market directional lines:

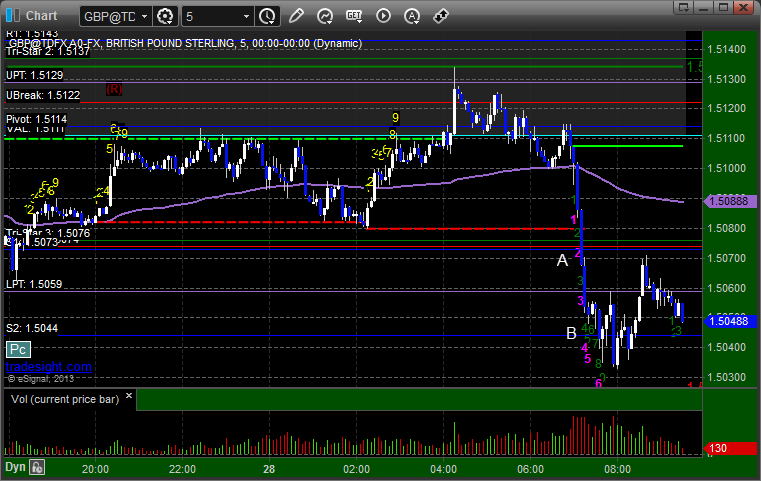

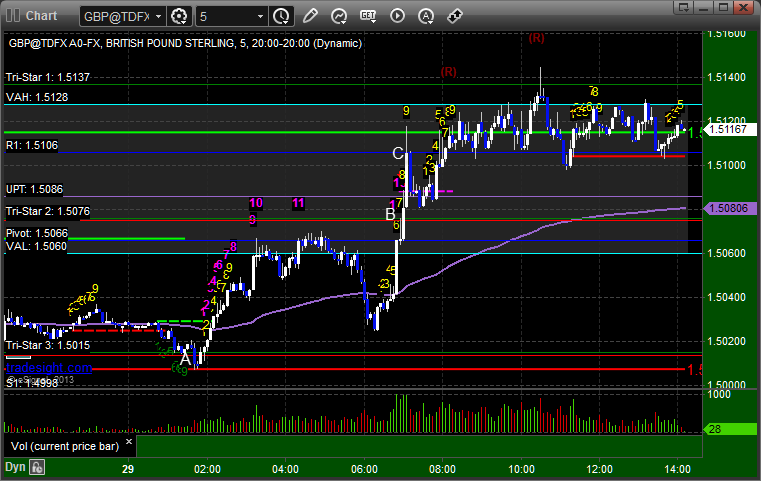

GBPUSD:

We came into the session long the second half of the prior day's trade from 1.5080 or so. The new long triggered at A, hit first target at B, and we moved the stop on everything under the VAH and stopped at C, which was about 70 pips for the prior day's trade:

Stock Picks Recap for 5/29/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, Rich's GDX triggered long (ETF, so no market support needed) and worked:

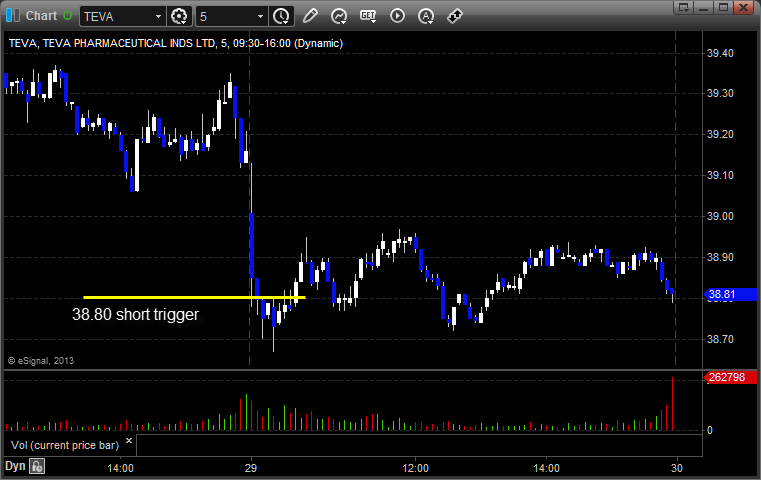

TEVA triggered short (without market support due to opening 5 minutes) and didn't work:

Rich's GOOG triggered short (with market support) and worked great:

His GLD triggered long (ETF, so no market support needed) and worked:

Rich's JPM triggered short (without market support) and worked:

AAPL triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked, most very well.

Futures Calls Recap for 5/29/13

A winner on the QM and NQ, and a loser on the NQ (same trade failed first time). See both sections below.

Net ticks: +23 ticks.

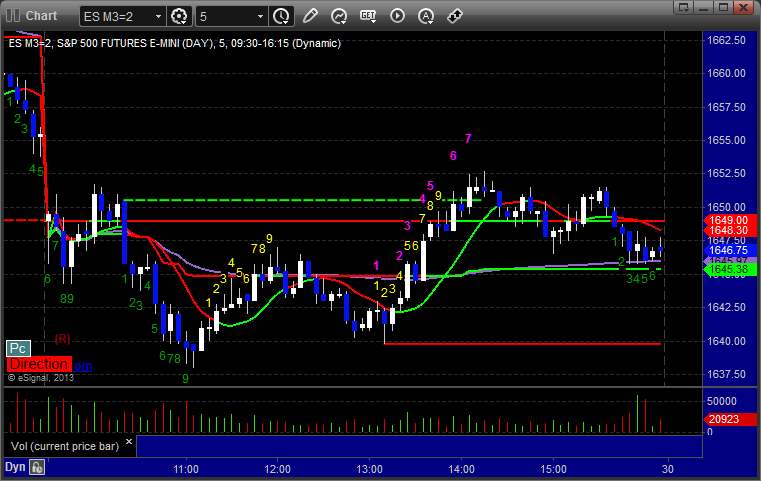

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

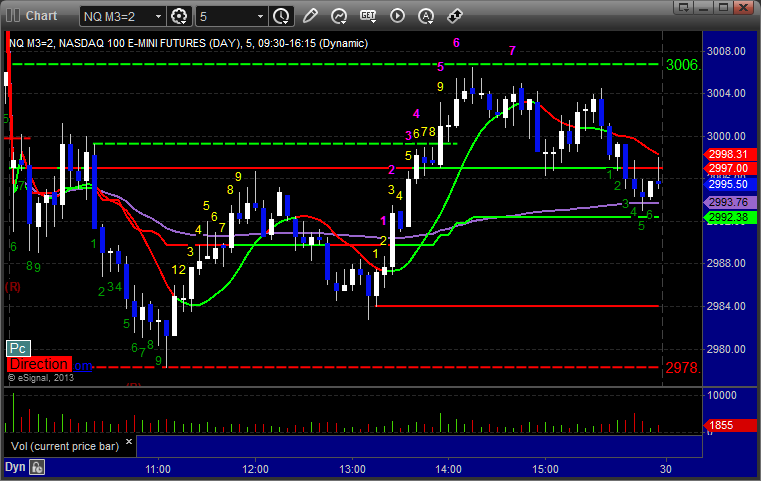

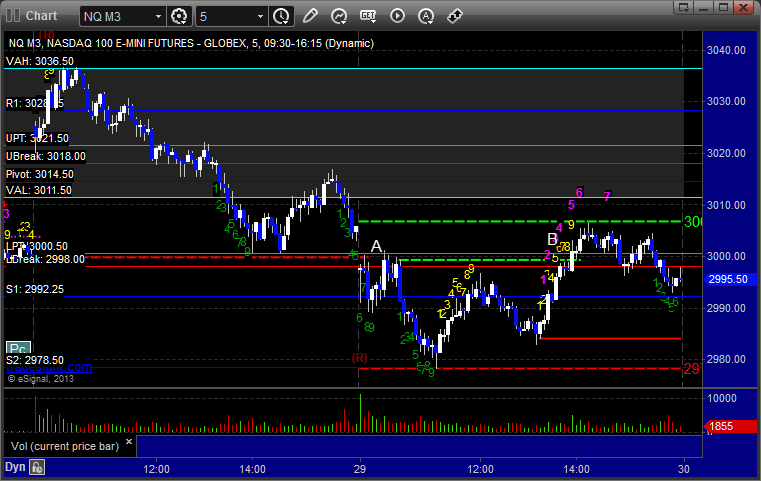

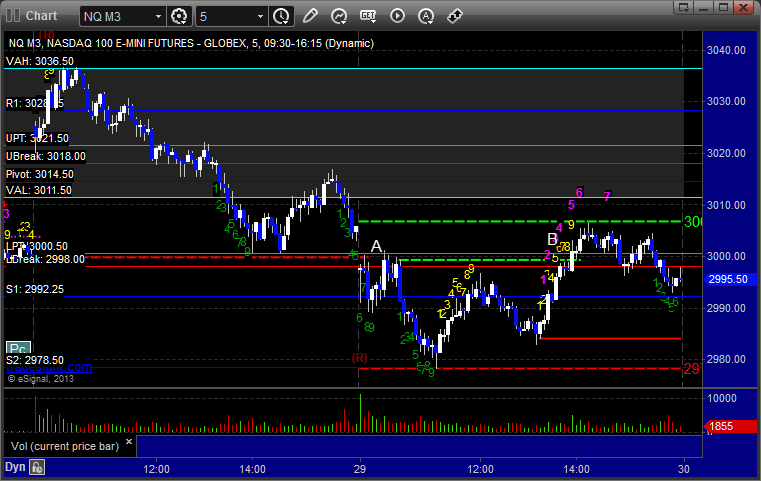

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 3001.00 and stopped for 7 ticks. Put it back in and it triggered again at B, hit first target for 6 ticks and stopped second half under the entry:

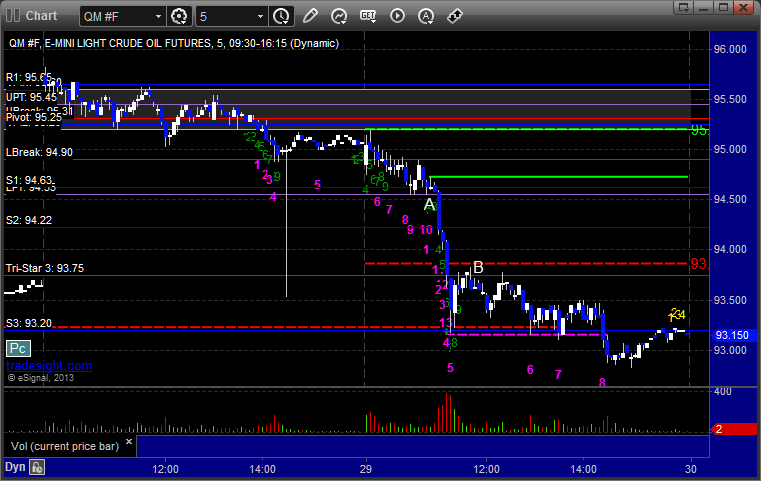

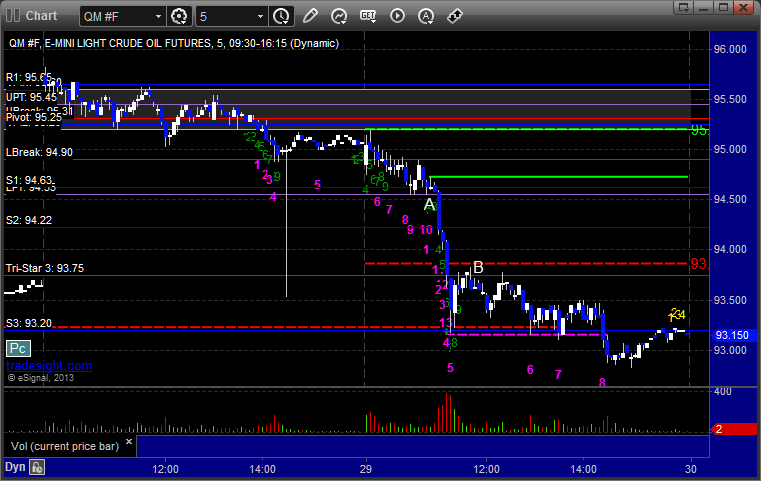

QM:

Very nice setup against LPT triggered short at A, hit first target for 6 ticks, lowered stop three times and stopped final piece at B at 93.775 for 36 ticks to final exit:

Futures Calls Recap for 5/29/13

A winner on the QM and NQ, and a loser on the NQ (same trade failed first time). See both sections below.

Net ticks: +23 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

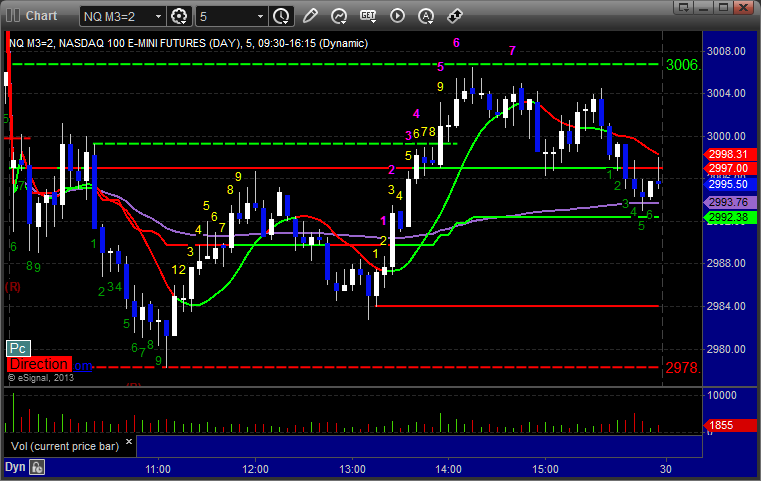

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered long at A at 3001.00 and stopped for 7 ticks. Put it back in and it triggered again at B, hit first target for 6 ticks and stopped second half under the entry:

QM:

Very nice setup against LPT triggered short at A, hit first target for 6 ticks, lowered stop three times and stopped final piece at B at 93.775 for 36 ticks to final exit:

Forex Calls Recap for 5/29/13

A loser and a winner still going on the GBPUSD, see that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, still holding with a stop under R1:

Forex Calls Recap for 5/29/13

A loser and a winner still going on the GBPUSD, see that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A and stopped. Triggered long at B, hit first target at C, still holding with a stop under R1:

Stock Picks Recap for 5/28/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, COST triggered short (with market support) and worked:

Rich's LNKD triggered short (with market support) and worked:

In total, that's 2 trades triggering with market support, both of them worked.

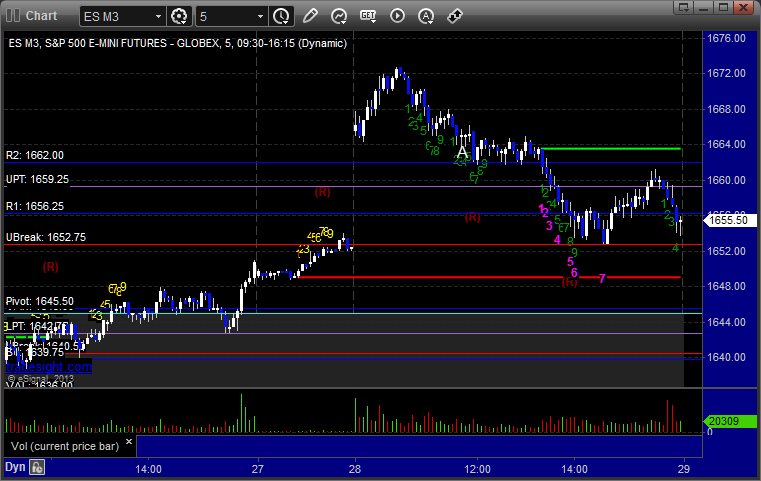

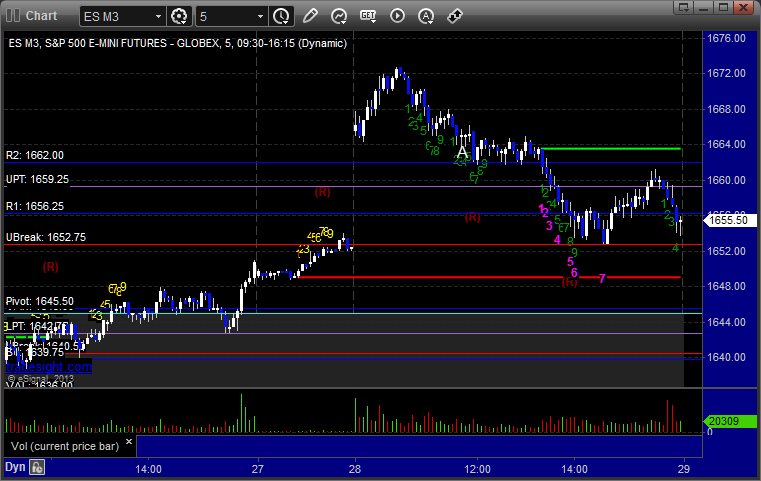

Futures Calls Recap for 5/28/13

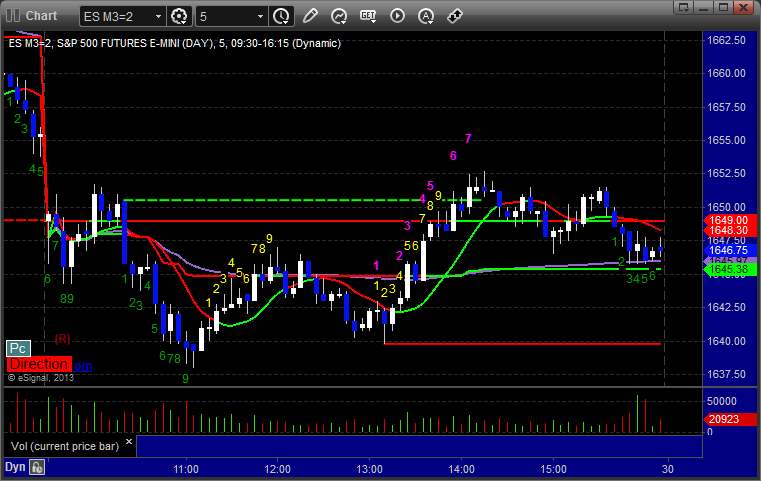

Big gap days are not usually much fun. The markets gapped up big, with the ES clearing the R2 level and traded even higher in early action. We then formed an inverted cup and handle, which finally broke over lunch, sweeping us on one trade before it worked a little on the second entry. Ultimately, we filled the gap for the session in the afternoon. See ES below.

Net ticks: -4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1664.00 and stopped for 7 ticks, then triggered again shortly after, hit first target for 6 ticks and stopped second half over the entry:

Futures Calls Recap for 5/28/13

Big gap days are not usually much fun. The markets gapped up big, with the ES clearing the R2 level and traded even higher in early action. We then formed an inverted cup and handle, which finally broke over lunch, sweeping us on one trade before it worked a little on the second entry. Ultimately, we filled the gap for the session in the afternoon. See ES below.

Net ticks: -4.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at A at 1664.00 and stopped for 7 ticks, then triggered again shortly after, hit first target for 6 ticks and stopped second half over the entry:

Forex Calls Recap for 5/28/13

Took a while, but finally a winner on the GBPUSD in the morning. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

GBPUSD:

Triggered short at A, hit first target at B, currently holding second half with a atop over S1: