Futures Calls Recap for 5/2/13

One small winner that took forever and eventually would have been a big winner but took too long and stopped out the second half first. The market gapped up and never looked back, especially once it broke the UPT on the ES. Volume was 1.7 billion NASDAQ shares.

Net ticks: +2.5 ticks.

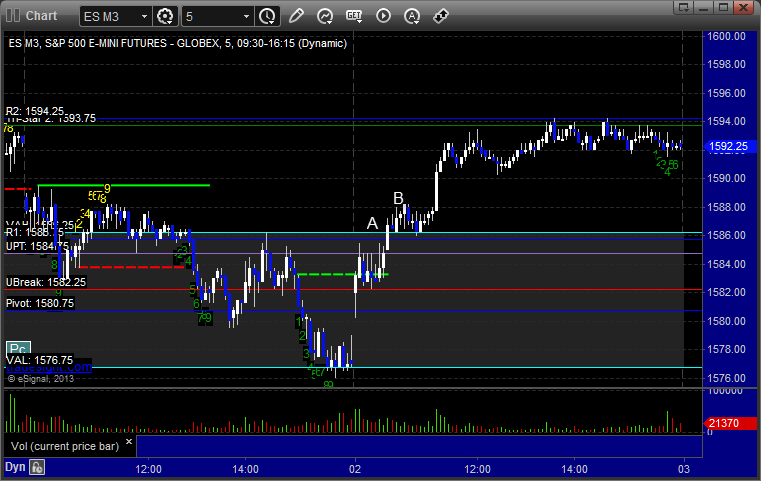

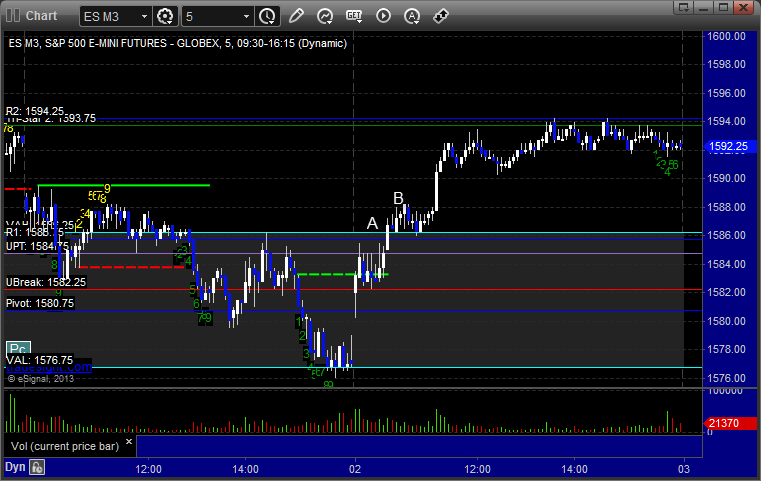

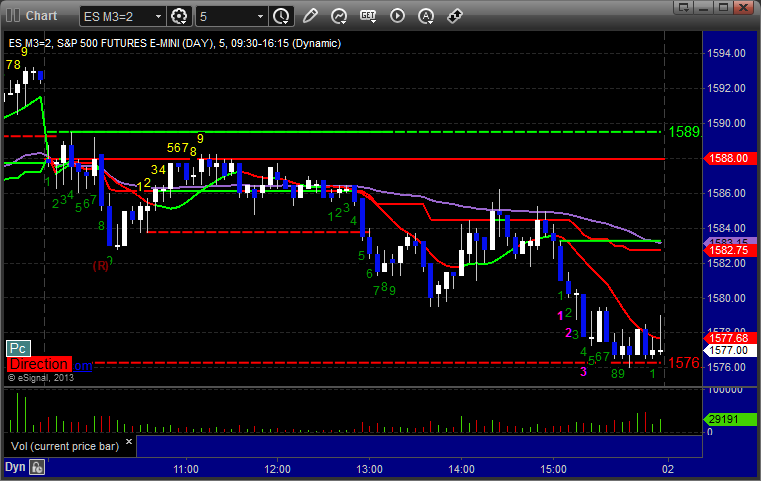

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Well, that's pretty much an example of what's wrong with the market recently. The ES call triggered long at A at 1586.50, hit first target for 6 ticks at B, which took long enough, and then we adjusted the stop on the second half under the entry and it stopped after another 30 minutes, and then finally shot up like we would have wanted in the first place and hit R2:

Futures Calls Recap for 5/2/13

One small winner that took forever and eventually would have been a big winner but took too long and stopped out the second half first. The market gapped up and never looked back, especially once it broke the UPT on the ES. Volume was 1.7 billion NASDAQ shares.

Net ticks: +2.5 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Well, that's pretty much an example of what's wrong with the market recently. The ES call triggered long at A at 1586.50, hit first target for 6 ticks at B, which took long enough, and then we adjusted the stop on the second half under the entry and it stopped after another 30 minutes, and then finally shot up like we would have wanted in the first place and hit R2:

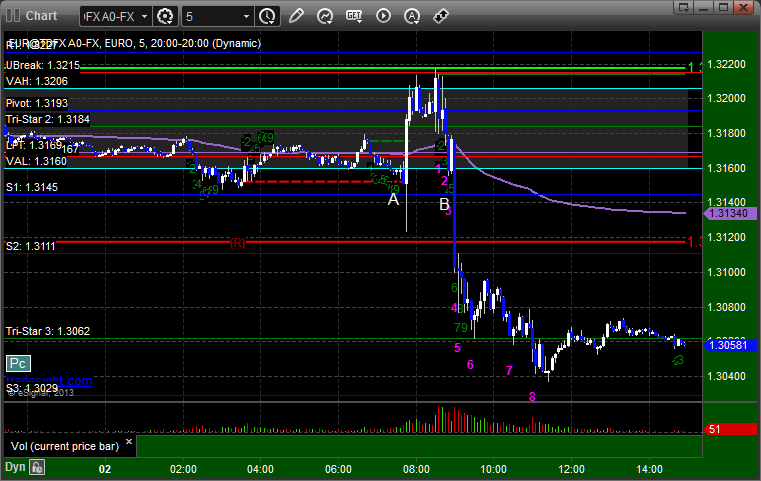

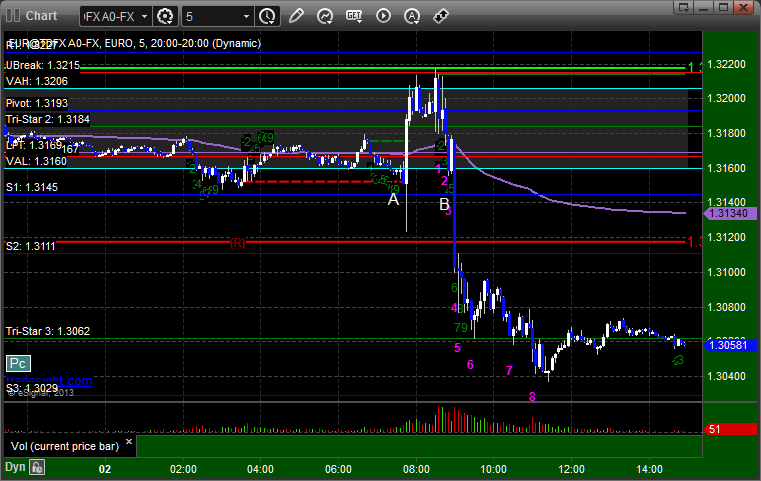

Forex Calls Recap for 5/2/13

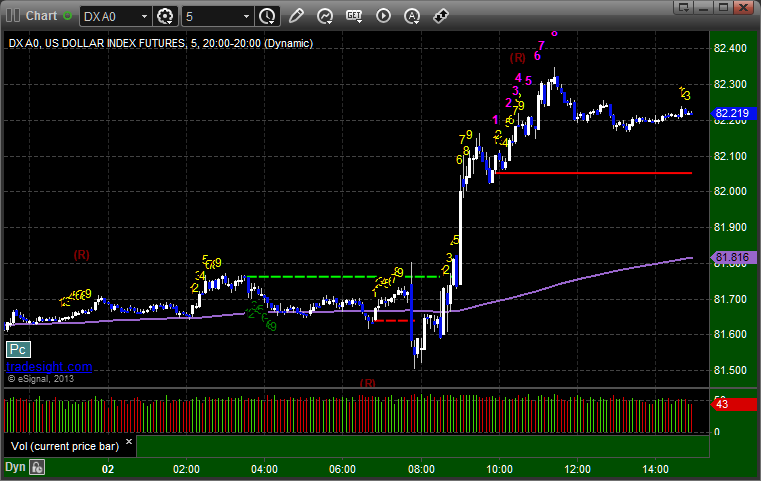

Crazy night on the ECB rate announcement. This is why we go half size ahead of key data, which was really about the Trade Balance number but also the ECB announcement. See EURUSD section below.

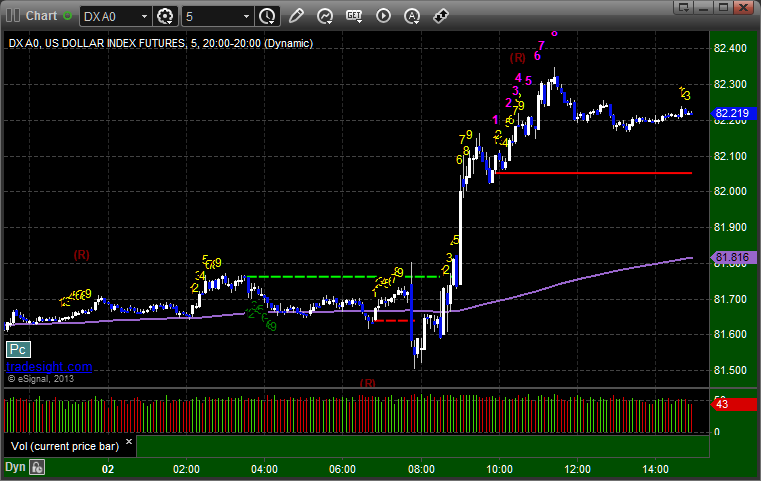

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short on the spike at A, which stopped, and is unfortunate because it would have later triggered at B and worked, although that was another spike and who knows how the fills would have gone:

Forex Calls Recap for 5/2/13

Crazy night on the ECB rate announcement. This is why we go half size ahead of key data, which was really about the Trade Balance number but also the ECB announcement. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short on the spike at A, which stopped, and is unfortunate because it would have later triggered at B and worked, although that was another spike and who knows how the fills would have gone:

Stock Picks Recap for 5/1/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CNQR triggered long (without market support due to opening 5 minutes) and worked great, but wide spread:

VRSK triggered long (without market support) and worked enough for a partial:

CSTR triggered short (without market support due to opening 5 minutes) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's ALXN triggered short (without market support) and didn't work:

His XLNX triggered long (without market support) and didn't work:

His CRM triggered long (with market support) and worked:

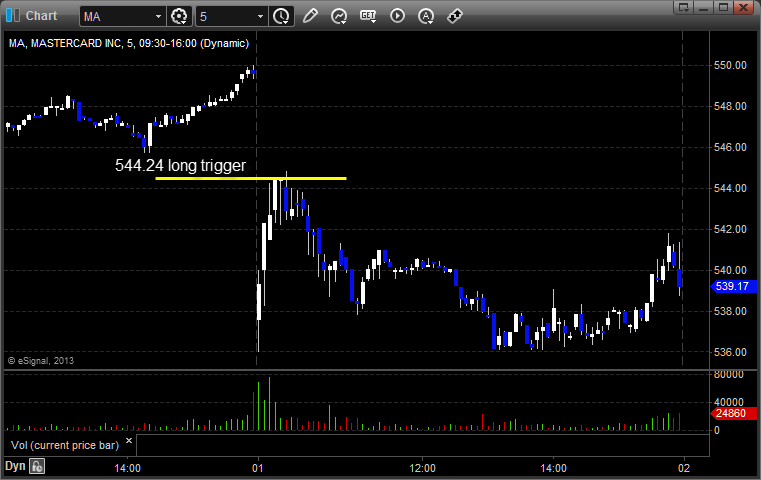

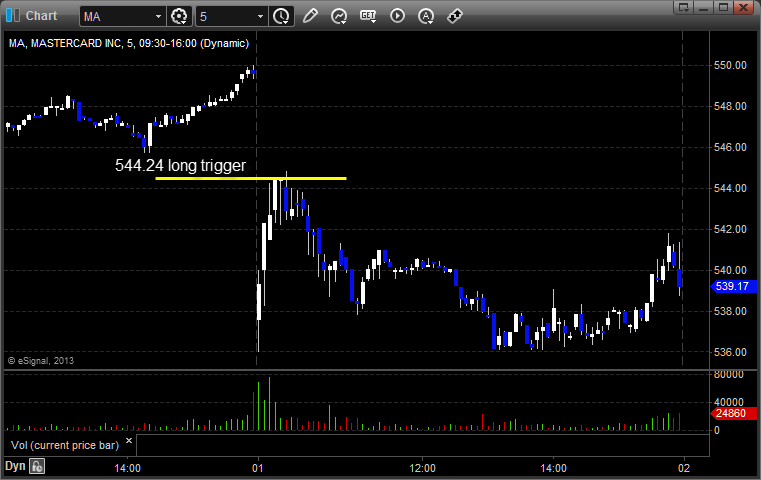

His MA triggered long (with market support) and didn't work:

His AAPL triggered long (without market support) and worked:

EBAY triggered long (with market support) and didn't do enough either way to count, also posted to close at even in the Messenger:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

Stock Picks Recap for 5/1/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, CNQR triggered long (without market support due to opening 5 minutes) and worked great, but wide spread:

VRSK triggered long (without market support) and worked enough for a partial:

CSTR triggered short (without market support due to opening 5 minutes) and worked great:

From the Messenger/Tradesight_st Twitter Feed, Rich's ALXN triggered short (without market support) and didn't work:

His XLNX triggered long (without market support) and didn't work:

His CRM triggered long (with market support) and worked:

His MA triggered long (with market support) and didn't work:

His AAPL triggered long (without market support) and worked:

EBAY triggered long (with market support) and didn't do enough either way to count, also posted to close at even in the Messenger:

In total, that's 2 trades triggering with market support, 1 of them worked, 1 did not.

VWAP Discussion and ES and NFLX Examples

The VWAP (Volume Weighted Average Price) is a powerful tool for traders, but you have to understand the implications of what it means to completely grasp it's use. In the weeks ahead, we will be focusing several articles on the VWAP and how it can be a useful tool in a variety of ways.

If you don't know, the VWAP ends up operating like a moving average, but it does so by weighting the price and size of each trade.

So for example, let's say that we have three prices: 40, 41, and 42. An average of those three would be calculated by adding them up and dividing by 3. That would give you (40 + 41 + 42 = 123) / 3 = 41. A moving average keeps adding data in the form of price and dividing equally by the number of data points.

A VWAP, on the other hand, takes two pieces of information for each price into account before doing the math. It takes the price AND the number of shares for that print. So, now let's say that we have three data points, which is 100 shares traded at 40, 200 shares traded at 41, and 900 shares traded at 42. Note that this is the same 3 prices that we had when calculating the average price example, but now we have size to go with each. What the VWAP does is take each price times size and divide by the total size.

So, we get:

40 x 100 = 4,000

41 x 200 = 8,200

42 x 900 = 37,800

Add those totals up (50,000) and divide by the total number of shares (1200) and you get 41.67, the VWAP. See how the number is far more skewed toward 42, which is where the much bigger print occurred?

So, what do we do with this?

Institutional traders would prefer to buy below the VWAP and sell above the VWAP. Why? Because it means that they got a better price buying or selling their big block of stock for the day than the average trader. A lot of times, that means that if a stock has been moving down and reverses to the upside, it will stall out right at the VWAP. Who wants to be the guy paying more than the average of everyone else? Of course, at some point, someone often does, but that in itself is confirmation that the dynamics of the stock have shifted for the session.

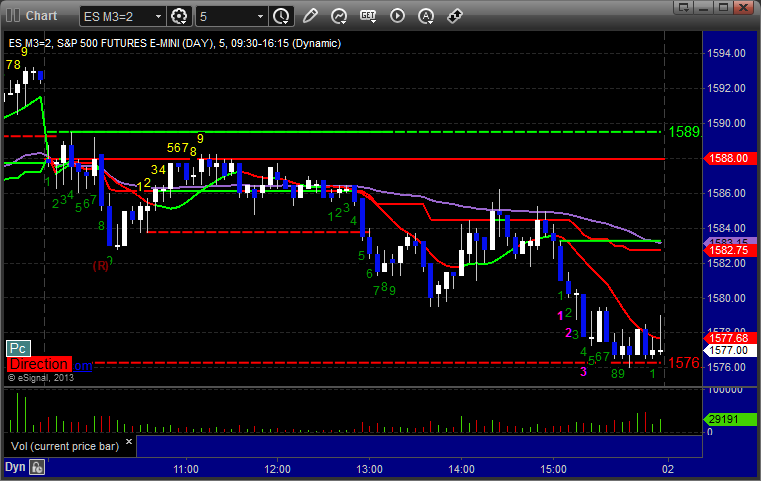

So, let's take a look at today's (Wednesday, May 1, 2013) action in the ES (S&P e-mini futures):

We gapped down for the session at A. The purple line is the VWAP of the day as we go along, starting with the open. Note that we opened right where the VWAP had been at the close of the prior session (even though the price late in the day had been much higher).

The market trades flat for the first 30-40 minutes and finally breaks lower on a pair of bad economic numbers. It doesn't go far on the data, and in fact, after just 15 minutes, seems to be stalling. Keep in mind that this is an FOMC announcement day, which usually means that the market is slow early. So as the small move down fails and the market starts to head up, the ES comes back to the VWAP at B. It then gets blue to the VWAP for hours, really not leaving it either way.

Over lunch, the market starts to drop at C ahead of the Fed announcement. The sellers are banking on something pushing the market lower, and this time the move is bigger. The announcement comes out, and nothing surprisingly negative is in it. Those that were selling ahead of the announcement start to buy back, and it takes the ES once again back to the VWAP at D. Note that this time, the ES uses the VWAP very precisely as resistance and can't close above it on two attempts. No one wants to pay over that price, and there is nothing compelling to make them.

Do individual stocks care about the VWAP? Sure, let's take one of the current market trading favorites, NFLX. This stock sold off sharply today in the morning and spent most of the morning down quite a bit. As it starts to rise after the Fed, does any big trader want to be the first to pay over the VWAP? Let's have a look:

Clearly not.

The VWAP has many terrific uses, but these two charts alone give you a starting point about its validity.

VWAP Discussion and ES and NFLX Examples

The VWAP (Volume Weighted Average Price) is a powerful tool for traders, but you have to understand the implications of what it means to completely grasp it's use. In the weeks ahead, we will be focusing several articles on the VWAP and how it can be a useful tool in a variety of ways.

If you don't know, the VWAP ends up operating like a moving average, but it does so by weighting the price and size of each trade.

So for example, let's say that we have three prices: 40, 41, and 42. An average of those three would be calculated by adding them up and dividing by 3. That would give you (40 + 41 + 42 = 123) / 3 = 41. A moving average keeps adding data in the form of price and dividing equally by the number of data points.

A VWAP, on the other hand, takes two pieces of information for each price into account before doing the math. It takes the price AND the number of shares for that print. So, now let's say that we have three data points, which is 100 shares traded at 40, 200 shares traded at 41, and 900 shares traded at 42. Note that this is the same 3 prices that we had when calculating the average price example, but now we have size to go with each. What the VWAP does is take each price times size and divide by the total size.

So, we get:

40 x 100 = 4,000

41 x 200 = 8,200

42 x 900 = 37,800

Add those totals up (50,000) and divide by the total number of shares (1200) and you get 41.67, the VWAP. See how the number is far more skewed toward 42, which is where the much bigger print occurred?

So, what do we do with this?

Institutional traders would prefer to buy below the VWAP and sell above the VWAP. Why? Because it means that they got a better price buying or selling their big block of stock for the day than the average trader. A lot of times, that means that if a stock has been moving down and reverses to the upside, it will stall out right at the VWAP. Who wants to be the guy paying more than the average of everyone else? Of course, at some point, someone often does, but that in itself is confirmation that the dynamics of the stock have shifted for the session.

So, let's take a look at today's (Wednesday, May 1, 2013) action in the ES (S&P e-mini futures):

We gapped down for the session at A. The purple line is the VWAP of the day as we go along, starting with the open. Note that we opened right where the VWAP had been at the close of the prior session (even though the price late in the day had been much higher).

The market trades flat for the first 30-40 minutes and finally breaks lower on a pair of bad economic numbers. It doesn't go far on the data, and in fact, after just 15 minutes, seems to be stalling. Keep in mind that this is an FOMC announcement day, which usually means that the market is slow early. So as the small move down fails and the market starts to head up, the ES comes back to the VWAP at B. It then gets blue to the VWAP for hours, really not leaving it either way.

Over lunch, the market starts to drop at C ahead of the Fed announcement. The sellers are banking on something pushing the market lower, and this time the move is bigger. The announcement comes out, and nothing surprisingly negative is in it. Those that were selling ahead of the announcement start to buy back, and it takes the ES once again back to the VWAP at D. Note that this time, the ES uses the VWAP very precisely as resistance and can't close above it on two attempts. No one wants to pay over that price, and there is nothing compelling to make them.

Do individual stocks care about the VWAP? Sure, let's take one of the current market trading favorites, NFLX. This stock sold off sharply today in the morning and spent most of the morning down quite a bit. As it starts to rise after the Fed, does any big trader want to be the first to pay over the VWAP? Let's have a look:

Clearly not.

The VWAP has many terrific uses, but these two charts alone give you a starting point about its validity.

Futures Calls Recap for 5/1/13

Another nice setup, another trigger and fail. See ES below.

Net ticks: -7 ticks.

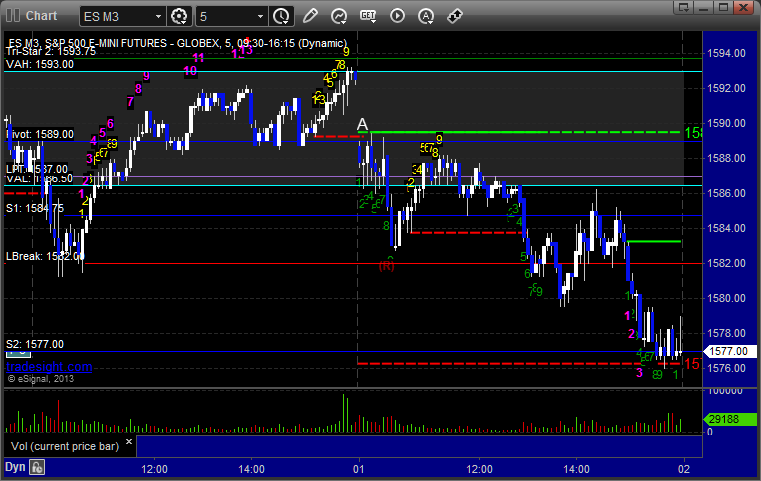

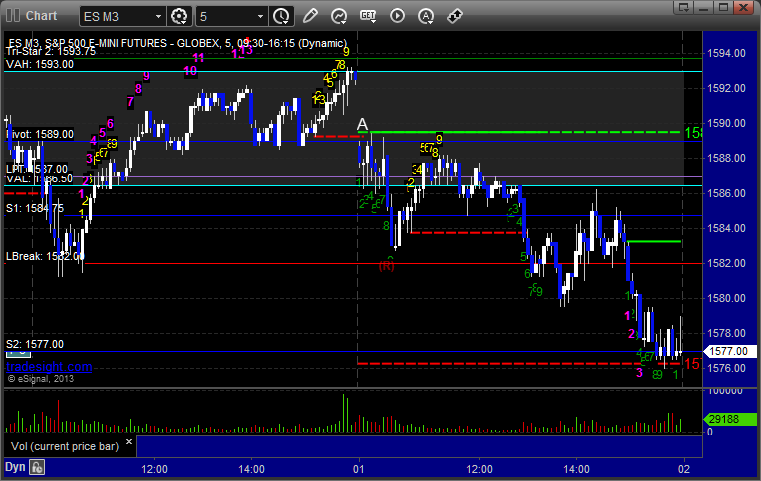

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1589.25 and stopped for 7 ticks. Couldn't break the Pivot and fill the gap inside the Value Area:

Futures Calls Recap for 5/1/13

Another nice setup, another trigger and fail. See ES below.

Net ticks: -7 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered long at A at 1589.25 and stopped for 7 ticks. Couldn't break the Pivot and fill the gap inside the Value Area: