Forex Calls Recap for 5/1/13

One last winner to close out the month of April. See the EURUSD below. The Fed announcement didn't do much to the pairs.

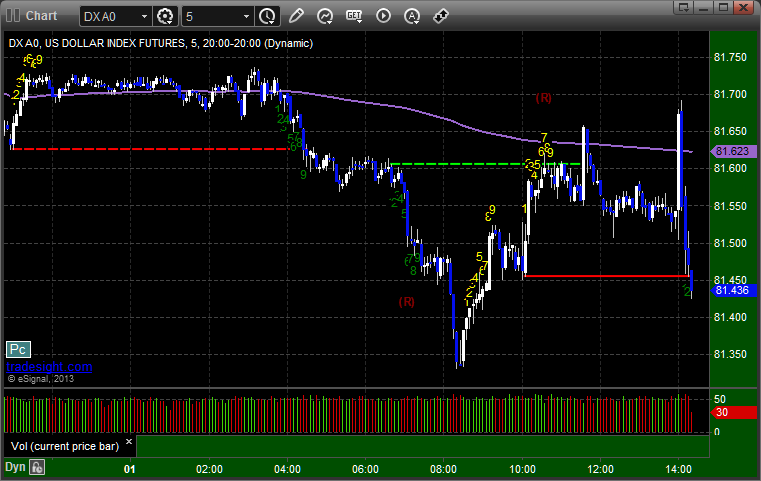

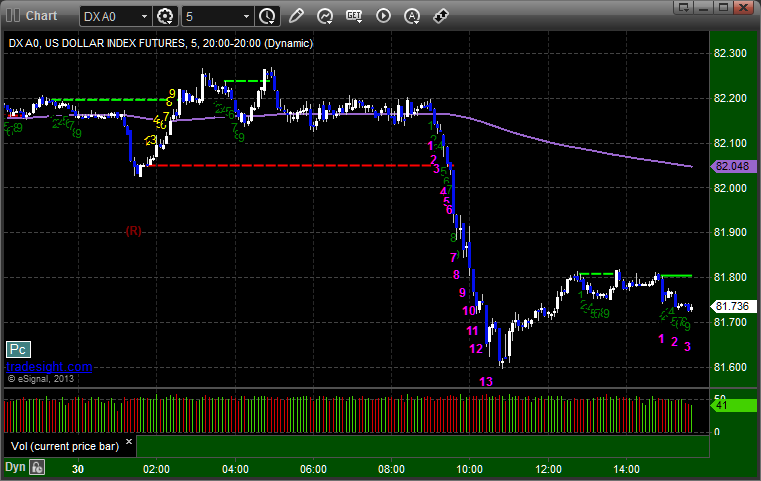

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A, hit first target at B, woke up in the morning and adjusted the stop to C in the money. Note that the Fed announcement late in the session didn't expand the range:

Stock Picks Recap for 4/30/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, TQNT gapped over, no play.

CPRT triggered long (without market support due to opening 5 minutes) and didn't work:

INWK triggered short (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AMGN triggered short (without market support) too late in the day to do anything:

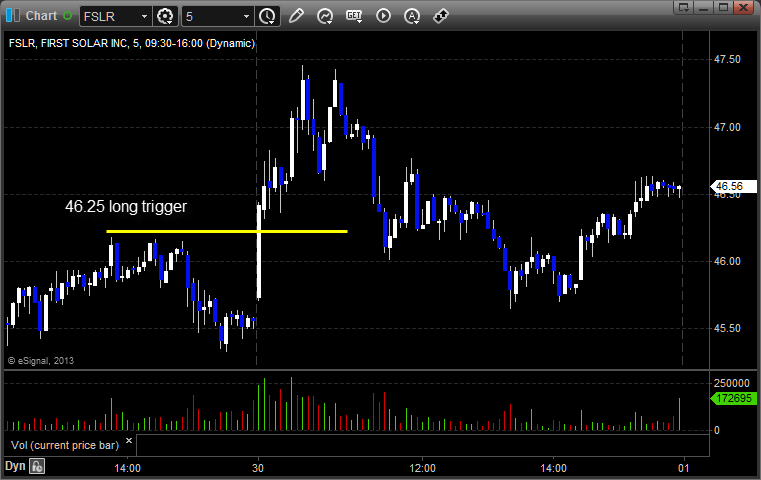

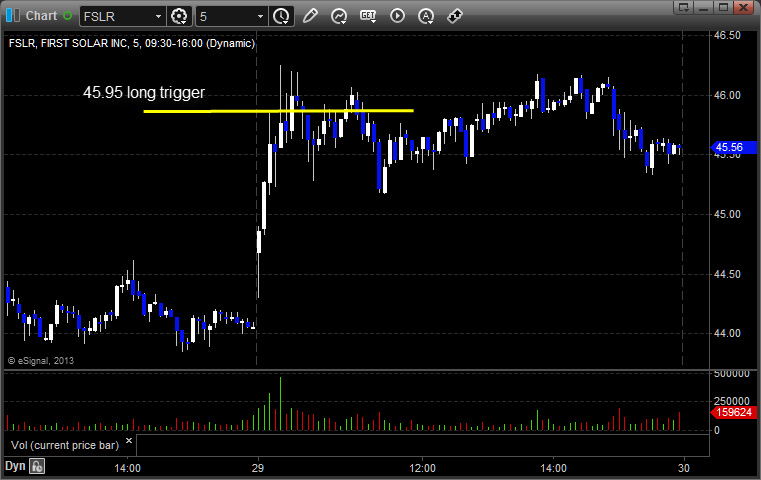

FSLR triggered long (without market support due to opening 5 minutes) and worked:

NFLX triggered long (with market support) and worked:

Rich's VLO triggered short (without market support) and didn't work:

Mark's AKAM triggered long (with market support) and worked:

His BRCM triggered long (with market support) and worked:

In total, that's 4 trades triggering with market support, all 4 of them worked.

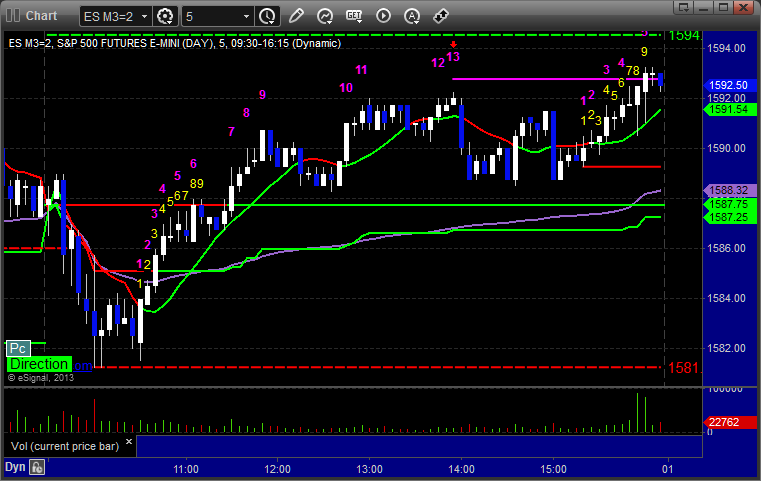

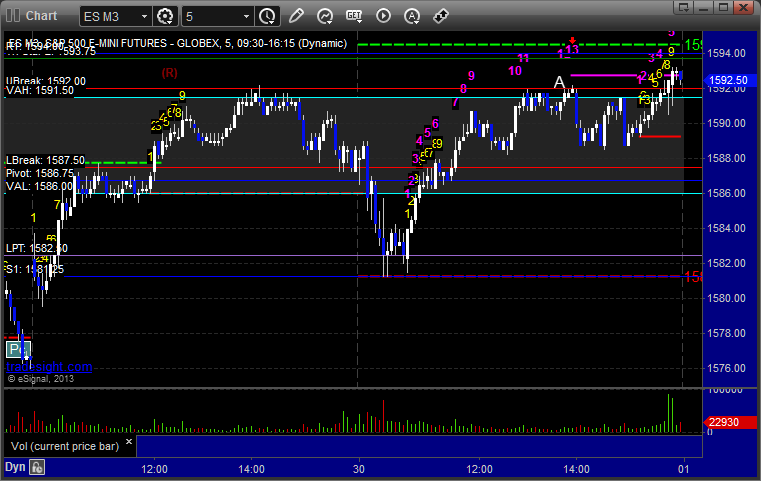

Futures Calls Recap for 4/30/13

See ES and NQ's below to close out the month. NASDAQ volume was strong at 1.8 billion shares, but the futures trading continues to be choppy, and we had one trigger on news. The one thing that did work yet again is that the Comber called the high of the day on the ES midday. See below.

Net ticks: -21 ticks.

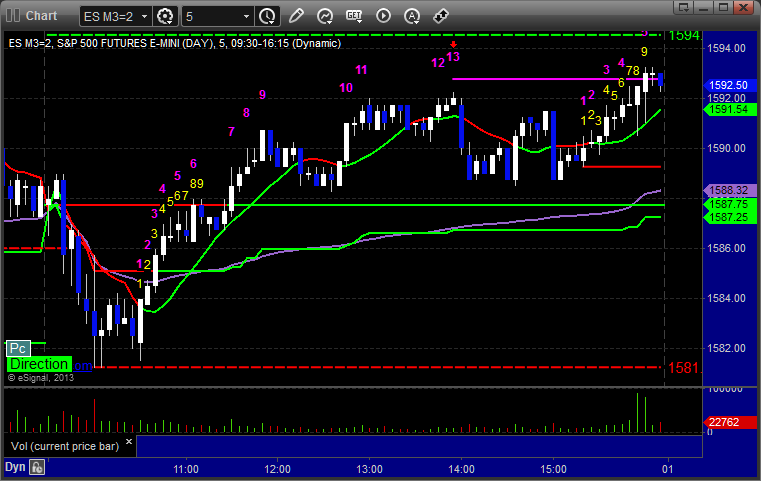

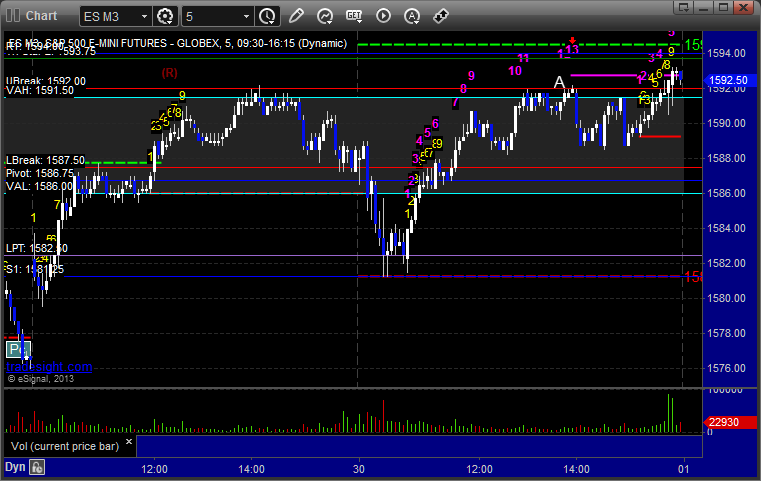

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Note the Comber 13 was the top out point midday.

Mark's long triggered over lunch right at the 13 and stopped for 7 ticks:

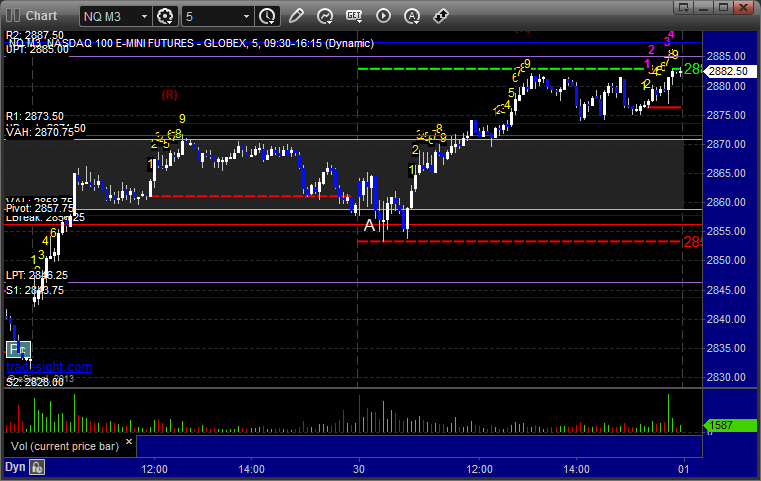

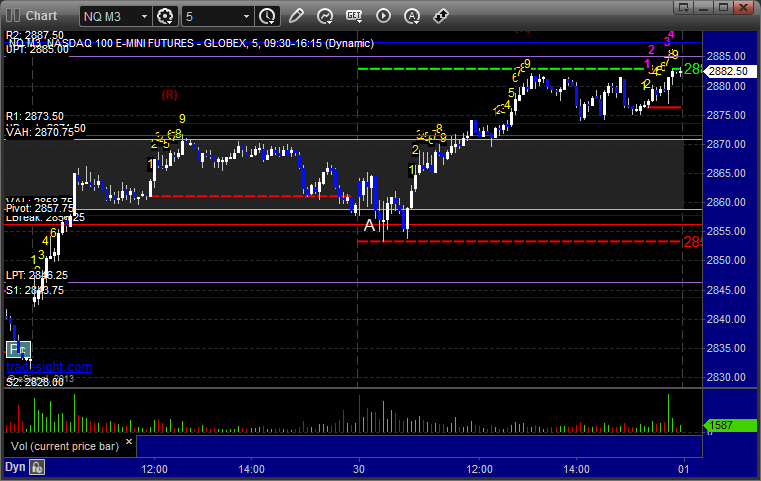

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Meanwhile, my short ended up triggering right before the Consumer Confidence number at A at 2856.00 and stopped on the news (you want to take less size or pass in the minutes before a big news item). Despite the fact that the number beat by a lot, the trade triggered again a few minutes later, came within a 1/4 point of the first target, and stopped. This is the 5th time this month that the NQ, which we use half points as ticks on, has come within a quarter point of the target. Unreal:

Futures Calls Recap for 4/30/13

See ES and NQ's below to close out the month. NASDAQ volume was strong at 1.8 billion shares, but the futures trading continues to be choppy, and we had one trigger on news. The one thing that did work yet again is that the Comber called the high of the day on the ES midday. See below.

Net ticks: -21 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Note the Comber 13 was the top out point midday.

Mark's long triggered over lunch right at the 13 and stopped for 7 ticks:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Meanwhile, my short ended up triggering right before the Consumer Confidence number at A at 2856.00 and stopped on the news (you want to take less size or pass in the minutes before a big news item). Despite the fact that the number beat by a lot, the trade triggered again a few minutes later, came within a 1/4 point of the first target, and stopped. This is the 5th time this month that the NQ, which we use half points as ticks on, has come within a quarter point of the target. Unreal:

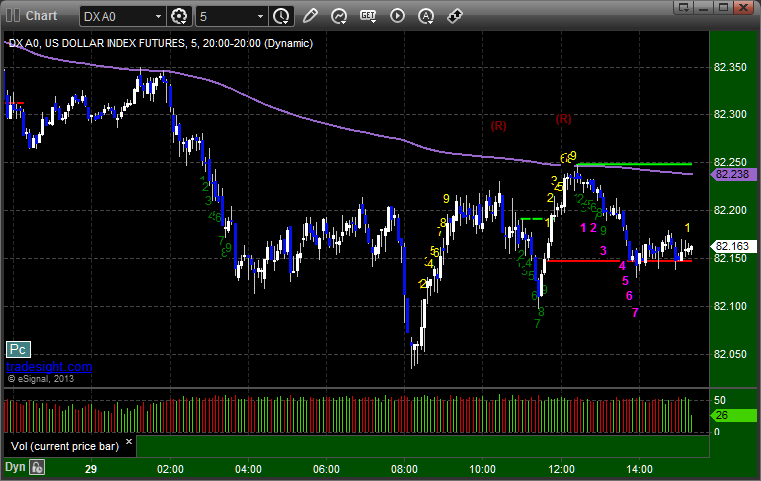

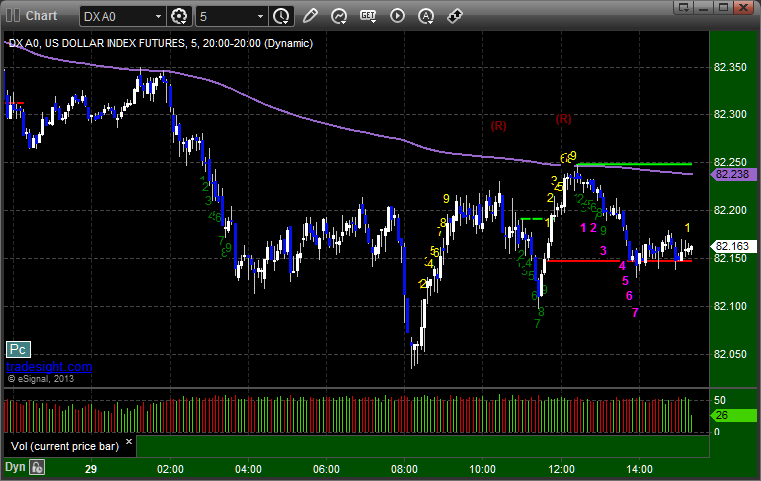

Forex Calls Recap for 4/30/13

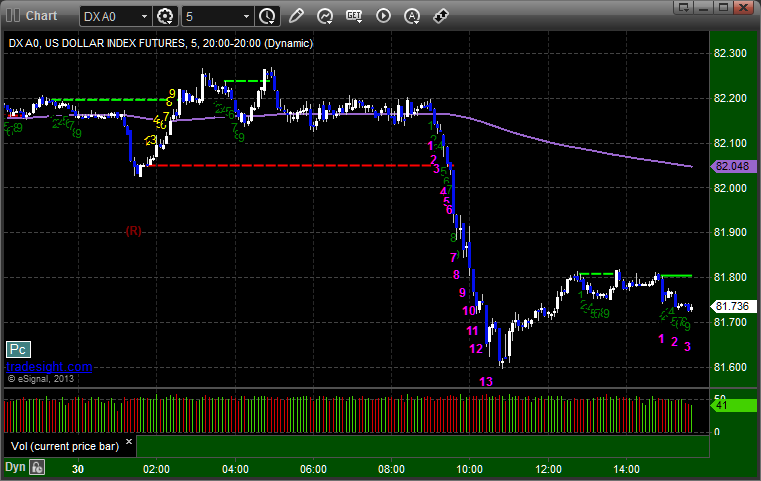

ere's a look at the US Dollar Index intraday with our market directional lines:

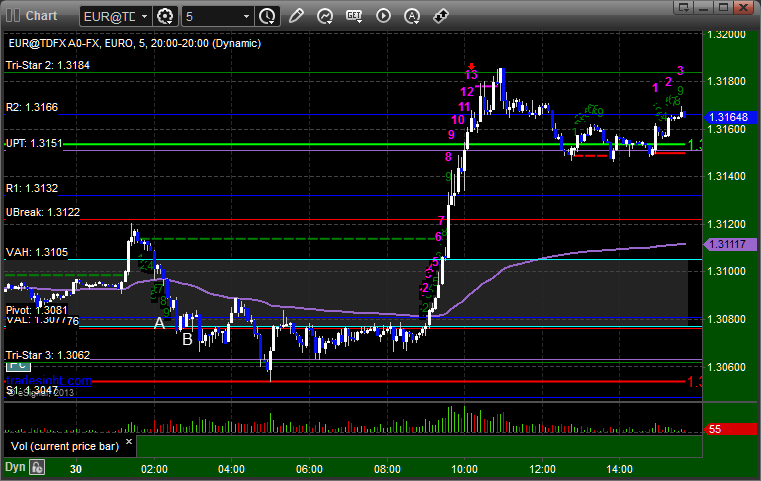

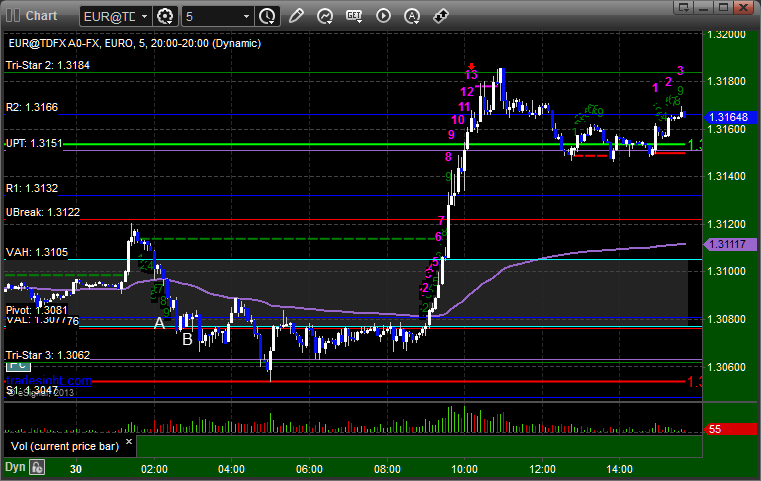

EURUSD:

The long from yesterday stopped at A just around the original entry. New short triggered at B, gave you hours to setup and take, but then stopped:

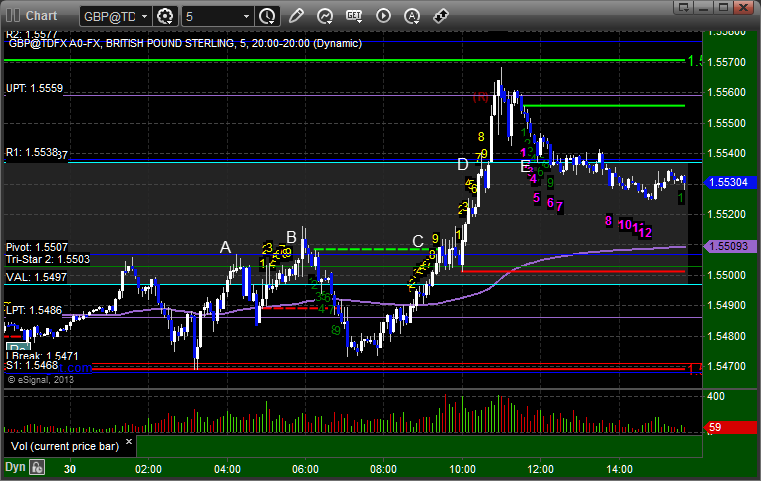

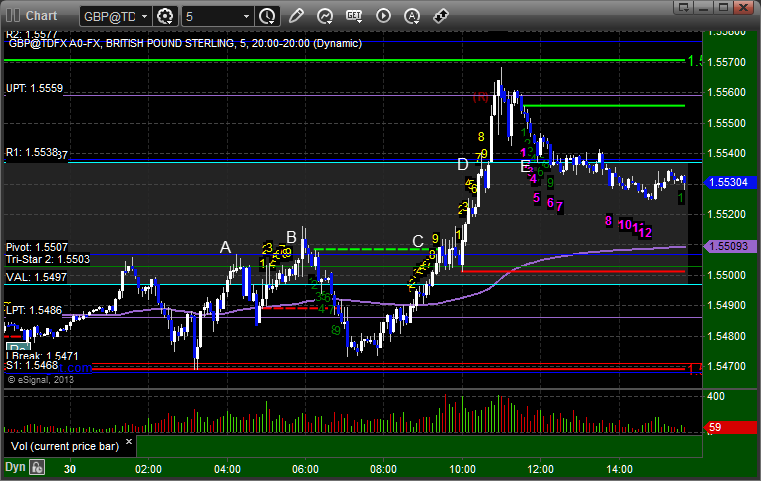

GBPUSD:

Set the Pivot triggered perfectly at A, triggered long at B and stopped. Triggered long again in the morning at C, hit first target at D, raised stop and stopped at E:

Forex Calls Recap for 4/30/13

ere's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

The long from yesterday stopped at A just around the original entry. New short triggered at B, gave you hours to setup and take, but then stopped:

GBPUSD:

Set the Pivot triggered perfectly at A, triggered long at B and stopped. Triggered long again in the morning at C, hit first target at D, raised stop and stopped at E:

Stock Picks Recap for 4/29/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, nothing triggered.

From the Messenger/Tradesight_st Twitter Feed, AMZN triggered short (with market support) and didn't work:

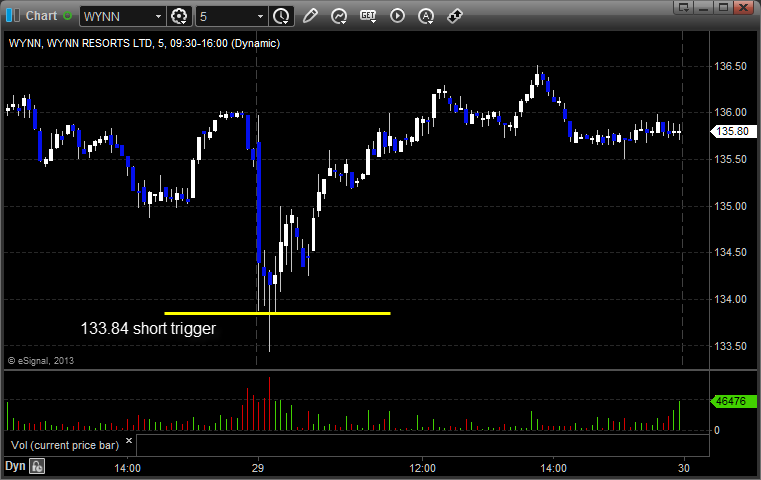

Rich's WYNN triggered short (with market support) and didn't work:

His GOOG triggered long (with market support) and worked big:

FSLR triggered long (with market support) and worked enough for a quick partial:

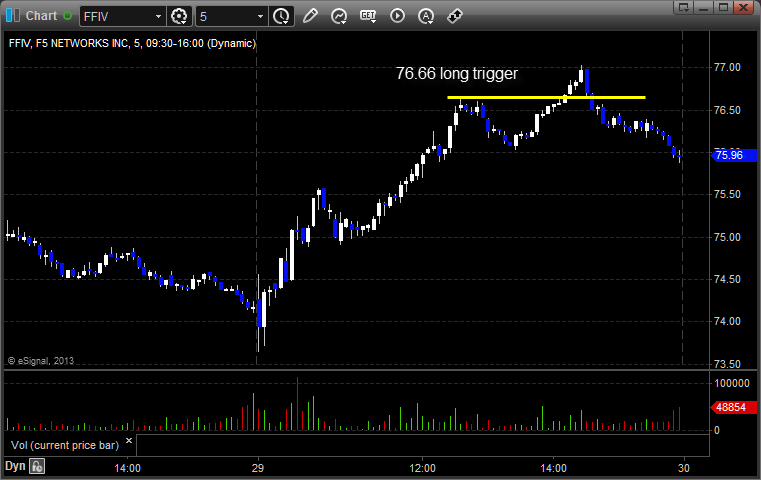

Rich's FFIV triggered long (with market support) and worked enough for a partial:

In total, that's 5 trades triggering with market support, 3 of them worked, 2 did not.

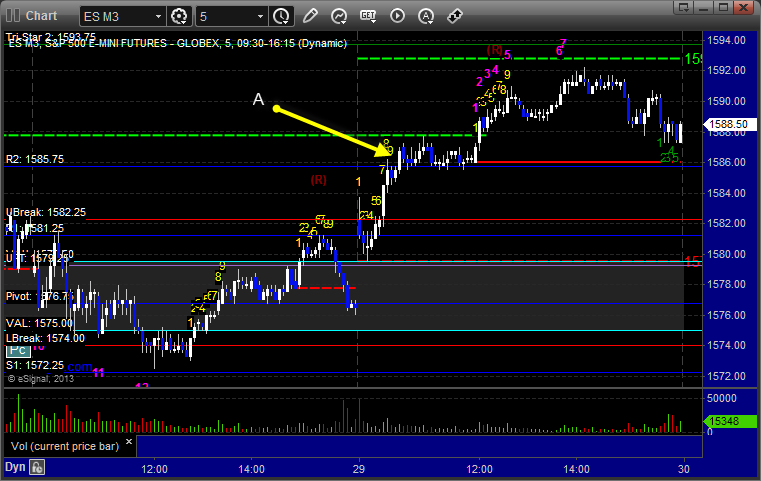

Futures Calls Recap for 4/29/13

Mark's call on the ES triggered long and he finally closed at even after an hour of no movement (it eventually would have worked). NASDAQ volume was horrible at only 1.3 billion shares. Three other calls did not trigger.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Mark's long triggered at A at 1586.50, and he closed it at the same price after almost an hour:

Forex Calls Recap for 4/29/13

See EURUSD section below for the recap as we continue to hold a trade in the money.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Our call triggered long at A and only went about 40 pips at the high, so not quite to our first target. It used the R2 as support all night and morning, and we're still holding with a stop under the entry:

Forex Calls Recap for 4/29/13

See EURUSD section below for the recap as we continue to hold a trade in the money.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Our call triggered long at A and only went about 40 pips at the high, so not quite to our first target. It used the R2 as support all night and morning, and we're still holding with a stop under the entry: