Stock Picks Recap for 4/18/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BRCM triggered short (with market support) and didn't work:

OVTI triggered short (with market support) and didn't quite work initially, worked on the second pass:

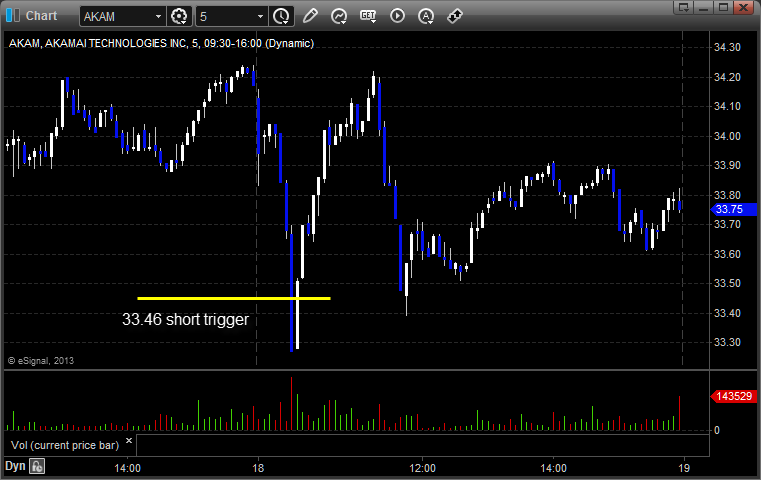

AKAM triggered short (with market support) and didn't work:

SWKS triggered short (with market support) and worked:

MCHP triggered short (with market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's BTU triggered long (with market support) and worked:

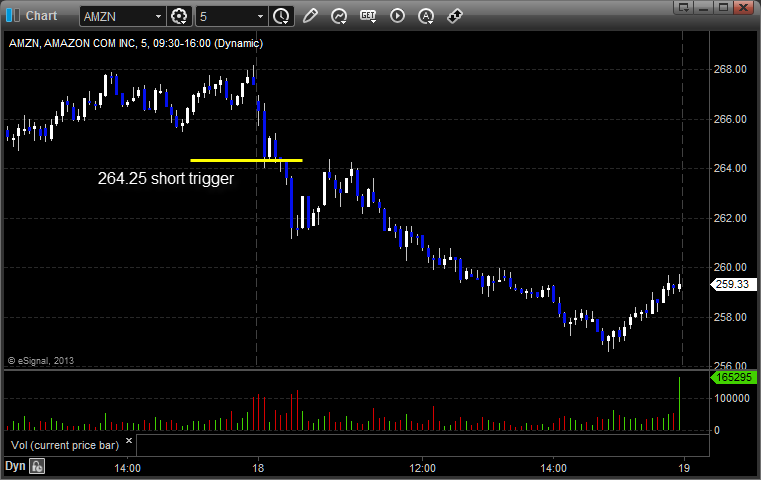

His AMZN triggered short (with market support) and didn't work, worked great on the second pass:

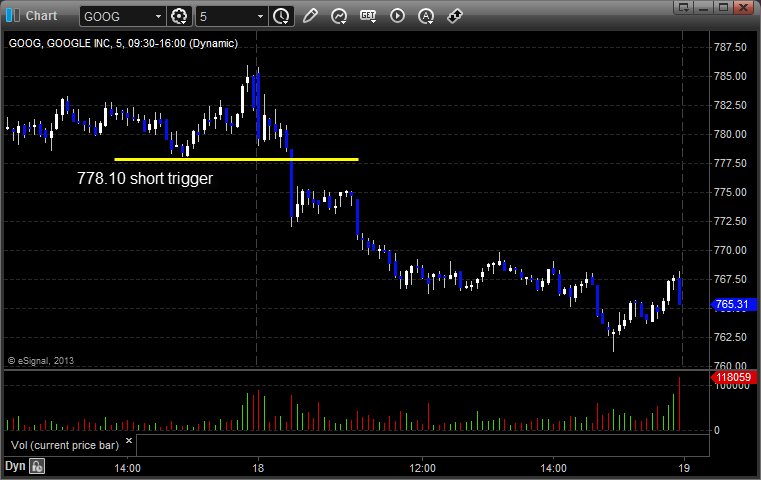

GOOG triggered short (with market support) and worked great:

Rich's ALXN triggered short (with market support) and worked:

Rich's VXX triggered long (ETF, so no market support needed) and worked:

His SNDK triggered short (with market support) and worked:

His AAPL triggered short (with market support) and worked:

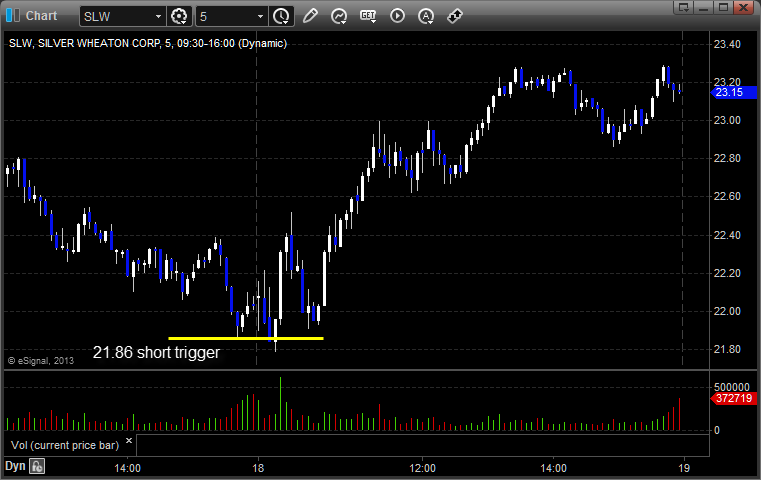

His SLW triggered short (with market support) and didn't work:

His UNP triggered long (with market support) and worked enough for a partial:

RIG triggered long (with market support) and worked:

His DUST triggered short (with market support) and didn't work:

His CELG triggered short (with market support) and didn't work:

His FAS triggered short (ETF, so no market support needed) and worked:

In total, that's 18 trades triggering with market support, 10 of them worked (some really well), 8 did not.

Futures Calls Recap for 4/18/13

What is with the colors? It will all make sense eventually. For now, just understand that at Tradesight moving forward, futures charts will have a blue right and bottom scale background (Forex will be green and stocks will be black).

A nice winner early in the ES and then a loser in the NQ that just missed the first target by a half tick (0.25). See both sections below.

Net ticks: -1 ticks.

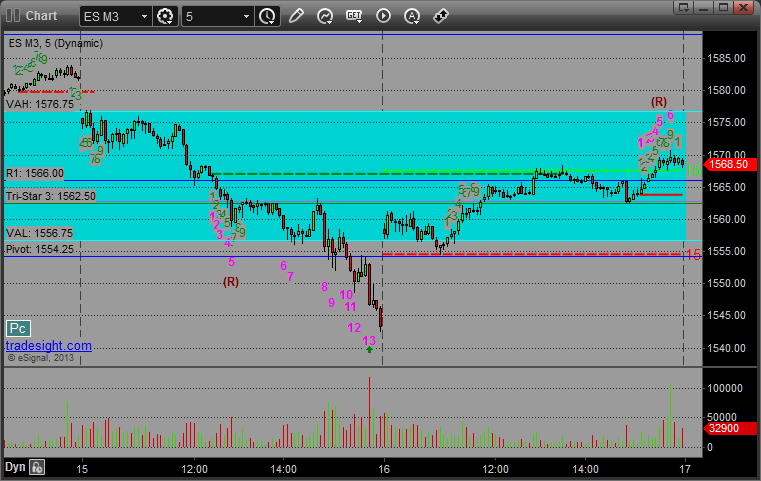

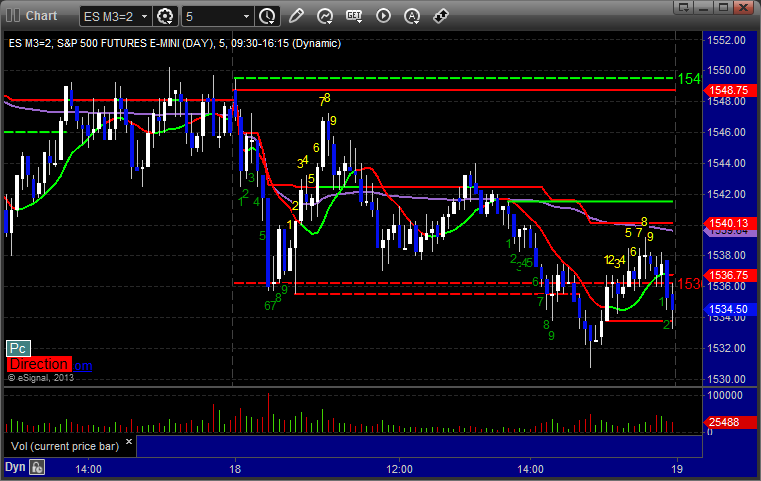

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Triggered short at 1538.75 at A, hit first target for 6 ticks, and stopped final piece at the same 6 tick gain on a lowered stop:

NQ:

Just a reminder that we use half points for ticks on the NQ and not the quarter point measurement that the exchanges switched to in recent years. This allows us to use 6 ticks as a key target as we do on the other contracts. It also keeps the value of a tick at $10, closer to the value of a tick on the other contracts.

Triggered short under LPT in the afternoon at A at 2731.00. First target was 2728.00, and it hit 2728.25 before reversing back to the stop inside of a minute:

Forex Calls Recap for 4/18/13

What in the world is with the colors on the charts? There is a method to the madness, believe it or not. Let's just focus for this report on the fact that FOREX charts at Tradesight from now on should have the green right and lower scale background. Futures will be blue and stocks will be black.

A slow session with the EURUSD in a 60 pip range. One trigger and I finally gave up and closed it out for going nowhere. See that section below.

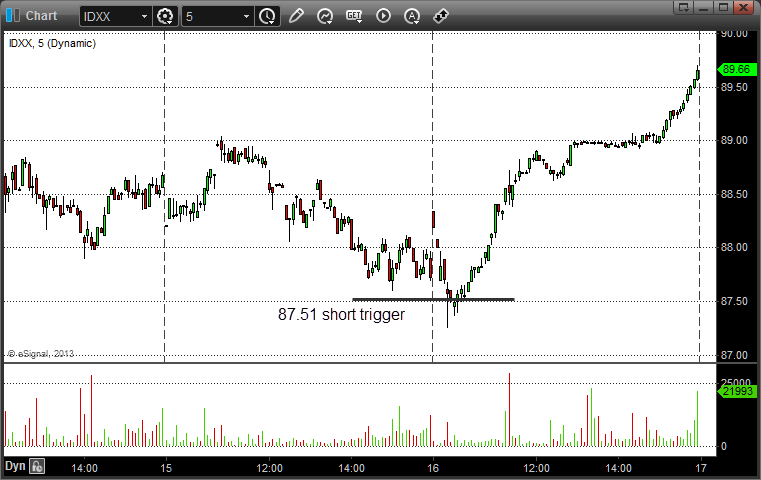

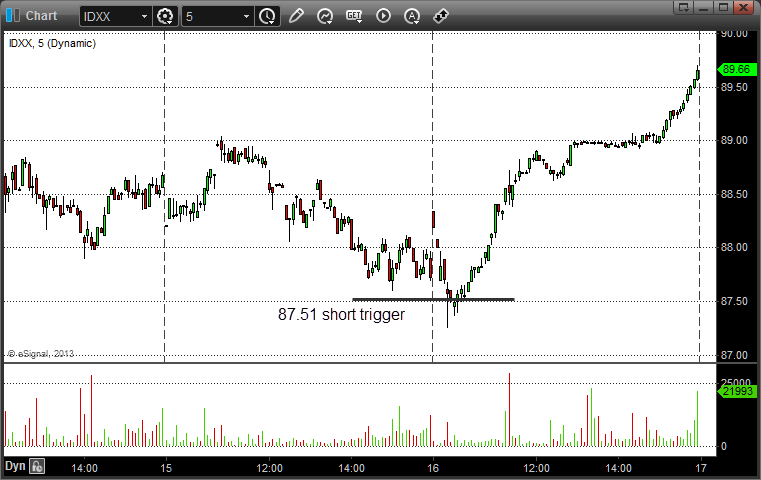

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long at A in the morning finally (no triggers overnight in a horrible range) and never did anything, so I closed it out at the end of the chart at B, which wasn't even our 25 pip stop. Note how it had come up earlier than that to hit the Pivot (our entry) and stalled on a 9-bar setup:

Stock Picks Recap for 4/17/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AREX triggered short (with market support) and didn't work:

XXIA triggered short (without market support due to opening 5 minutes) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's AAPL triggered short (without market support due to opening 5 minutes) and worked huge:

NFLX triggered short (with market support) and worked:

Rich's GDX triggered long (ETF, so no market support needed) and didn't work:

His SNDK triggered short (with market support) and worked:

In total, that's 4 trades triggering with market support, 2 of them worked, 2 did not.

Futures Calls Recap for 4/17/13

A winner on the ER and a loser on the ES created a wash. See both below. Market volume picked up, but the afternoon action was dead flat, and that's when the ES triggered.

Net ticks: +0 ticks.

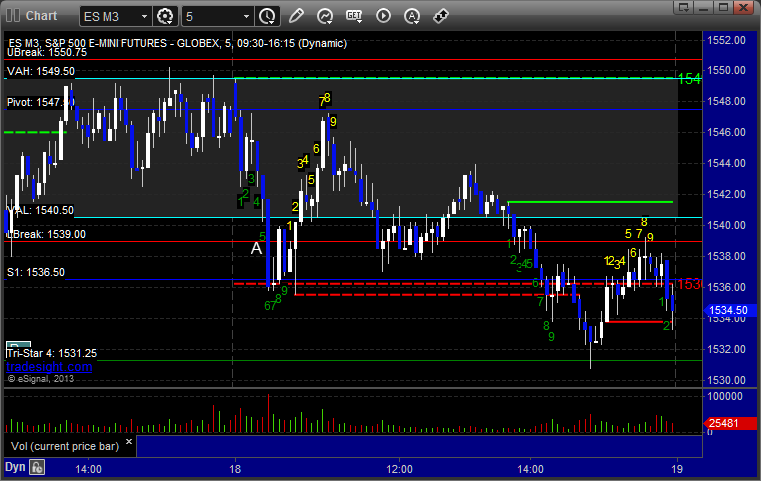

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Afternoon breakout triggered long at A at 1549.50 and stopped for 7 ticks:

ER:

Triggered short under LPT at 909.40 at A, hit first target for 8 ticks and stopped second half 6 ticks in the money. After a bounce, the trade really worked, giving the move that I had originally hoped for:

Forex Calls Recap for 4/17/13

One loser and a better winner on the EURUSD. See that section below.

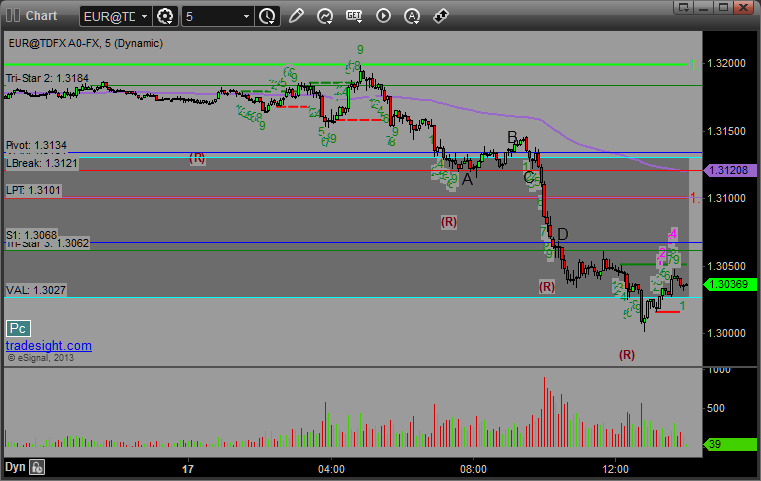

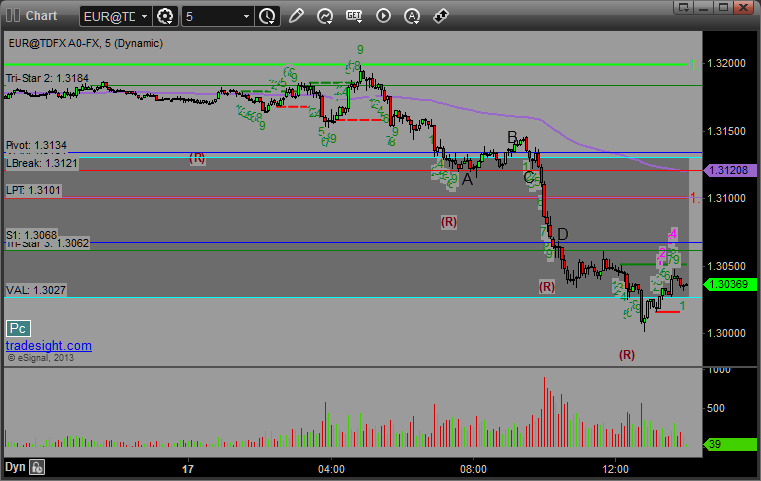

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, barely stopped at B. Triggered short again at C, hit first target at D, currently holding second half with a stop over S1:

Forex Calls Recap for 4/17/13

One loser and a better winner on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered short at A, barely stopped at B. Triggered short again at C, hit first target at D, currently holding second half with a stop over S1:

Stock Picks Recap for 4/16/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AKRX triggered long (with market support) and didn't work:

ROVI gapped over, no play.

IDXX triggered short (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's BIIB triggered short (with market support) and worked enough for a partial:

His RIG triggered short (with market support) and worked:

His SLB triggered short (with market support) and worked:

His GOOG triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Stock Picks Recap for 4/16/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, AKRX triggered long (with market support) and didn't work:

ROVI gapped over, no play.

IDXX triggered short (without market support) and didn't work:

From the Messenger/Tradesight_st Twitter Feed, Rich's BIIB triggered short (with market support) and worked enough for a partial:

His RIG triggered short (with market support) and worked:

His SLB triggered short (with market support) and worked:

His GOOG triggered long (with market support) and worked:

In total, that's 5 trades triggering with market support, 4 of them worked, 1 did not.

Futures Calls Recap for 4/16/13

Another light volume day in the markets with 1.4 billion NASDAQ shares traded. We had an initial stop out (swept the entry) before two winners. See ES below.

Net ticks: +4 ticks.

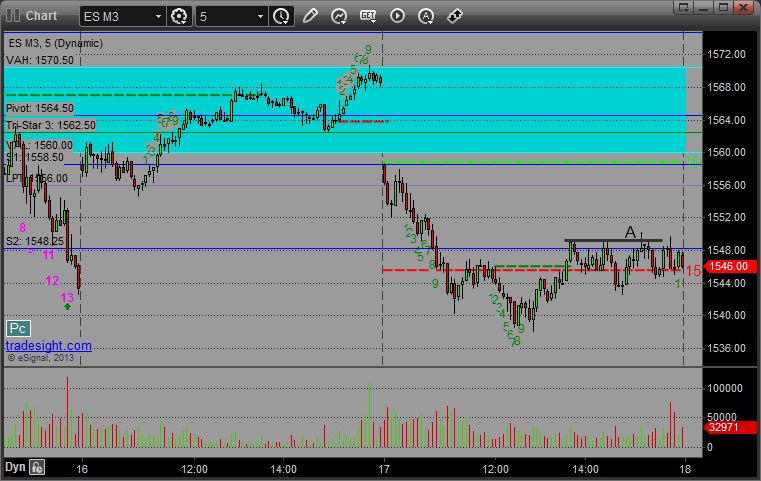

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

The short triggered at A at 1556.50 and stopped, then triggered again at B, hit the first target, stalled at the Pivot, and stopped over the entry for the second half. The long triggered at 1563.00 at C, hit first target for 6 ticks, and I raised the stop a few times and finally stopped under the R1 level at D for 11 ticks: