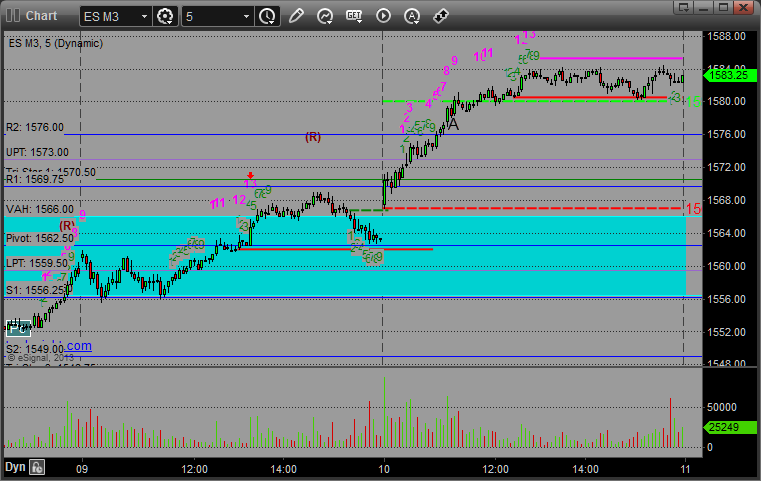

Futures Calls Recap for 4/11/13

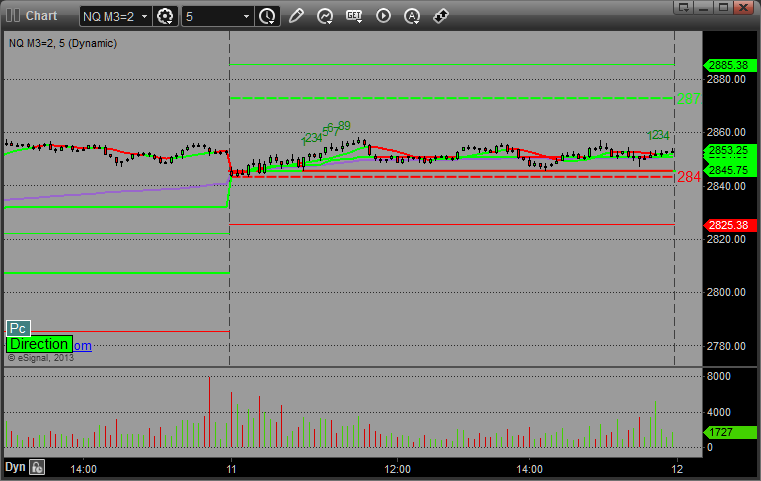

Nothing triggered as the market picked up volume but went flat. The NQs never even touched a level beyond VAH. See the sections below for the recap.

Net ticks: +0 ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

Forex Calls Recap for 4/11/13

Two triggers on the EURUSD. See that section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

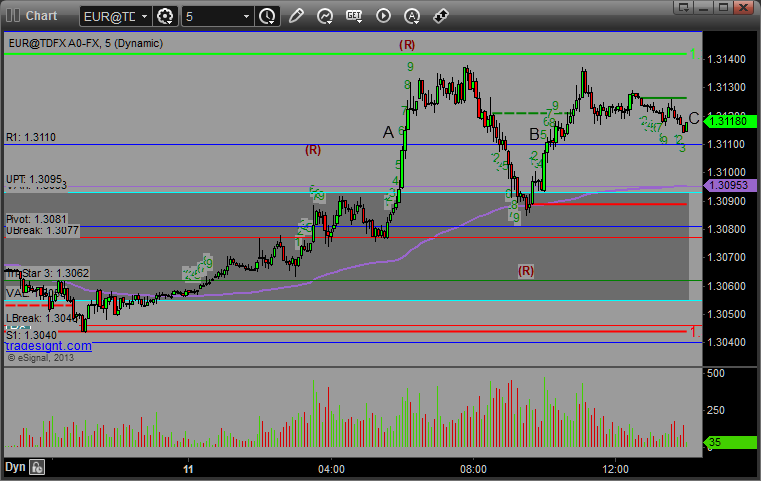

EURUSD:

Triggered long at A and stopped overnight. Triggered long again in the morning at B, never hit first target, finally closed it out for end of session at C just around the entry:

Stock Picks Recap for 4/10/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BLMN triggered long (with market support) and worked:

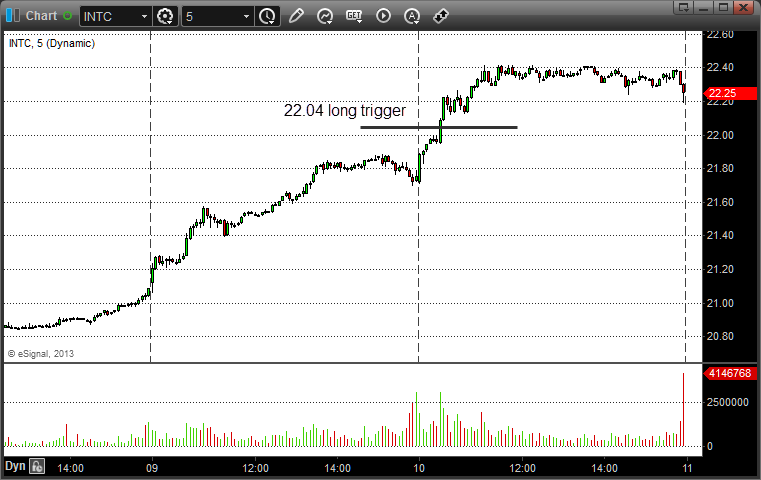

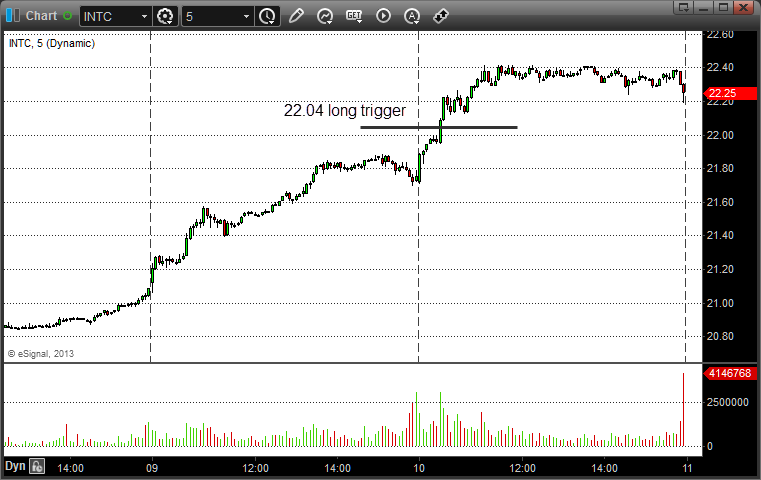

INTC triggered long (with market support) and worked:

CALL triggered long (with market support) and worked:

ONNN triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FSLR triggered long (with market support) and worked:

His GS triggered long (with market support) and worked:

His GOOG triggered long (with market support) and worked:

NFLX triggered short (without market support) and worked enough for a partial:

Rich's BBY triggered short (without market support) and worked:

Mark's AMGN triggered long (with market support) and worked great:

His GILD triggered long (with market support) and worked:

Rich's RGLD triggered long (with market support) and worked:

In total, that's 10 trades triggering with market support, all 10 of them worked.

Stock Picks Recap for 4/10/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, BLMN triggered long (with market support) and worked:

INTC triggered long (with market support) and worked:

CALL triggered long (with market support) and worked:

ONNN triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's FSLR triggered long (with market support) and worked:

His GS triggered long (with market support) and worked:

His GOOG triggered long (with market support) and worked:

NFLX triggered short (without market support) and worked enough for a partial:

Rich's BBY triggered short (without market support) and worked:

Mark's AMGN triggered long (with market support) and worked great:

His GILD triggered long (with market support) and worked:

Rich's RGLD triggered long (with market support) and worked:

In total, that's 10 trades triggering with market support, all 10 of them worked.

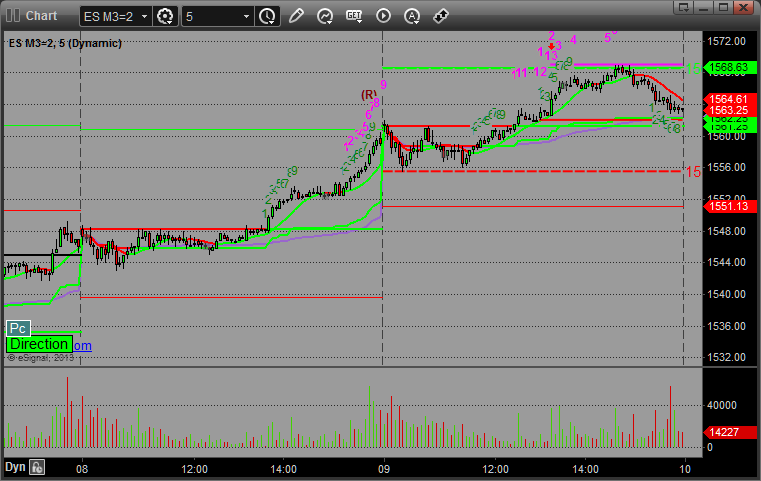

Futures Calls Recap for 4/10/13

Volume picked up a bit, and the market gapped up and kept going early, then flattened out the rest of the session. See the ES below. NASDAQ volume did get to almost 1.7 billion shares, a big improvement over Monday and Tuesday.

Net ticks: -8 ticks.

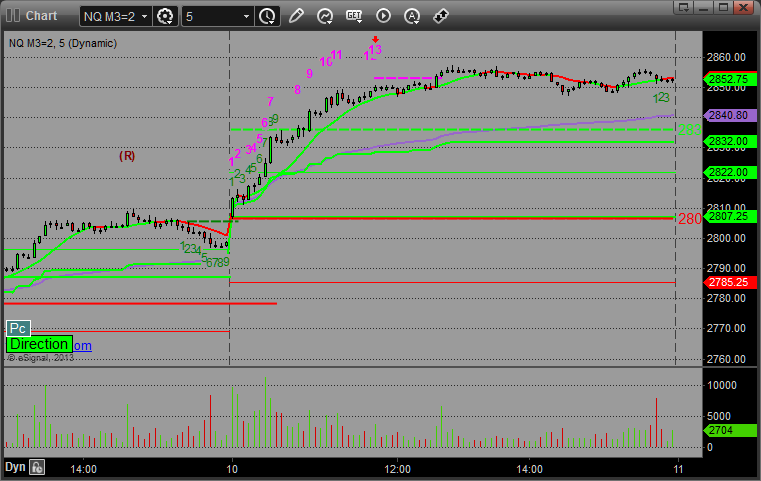

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

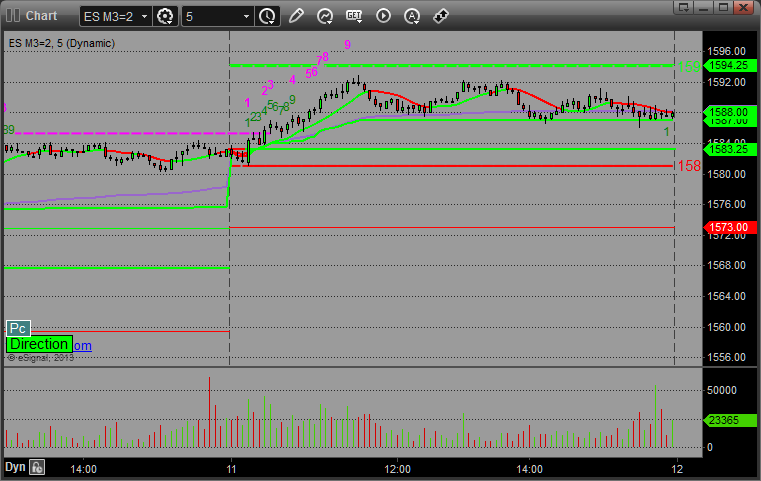

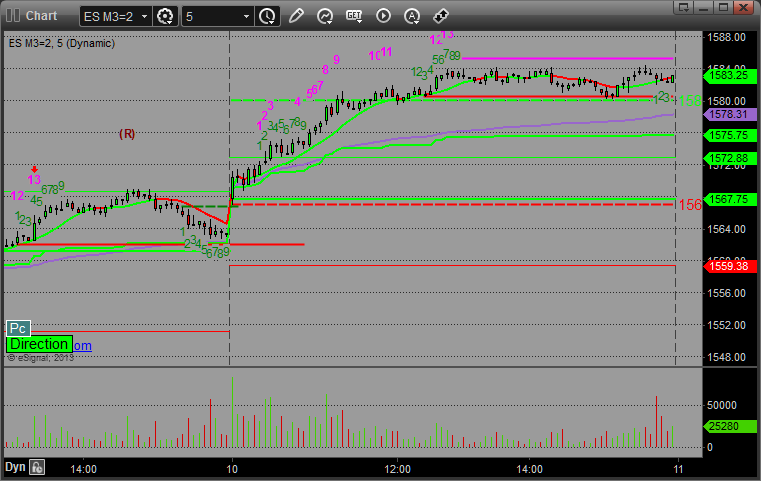

ES:

We got a Comber 13 sell signal on the ES and used it for a short entry at A at 1578.25, which stopped for 8 ticks. Never violated the risk line, but that was too much risk to show on a 15-minute timeframe. Meanwhile, we then got a 13 sell signal on the 5-minute chart below, which again was the high of the session (second day in a row), but we didn't roll over much:

Forex Calls Recap for 4/10/13

Guess we had our triggers right. See EURUSD section below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Very interesting. We had a long over the UBreak/R1 level, which hit exactly but never triggered at A. We had a short under LBreak, which almost hit exactly overnight at B, then finally triggered at C. I closed it at the end of the chart as it hadn't gone anywhere and the session was over (breakeven). Also, the US Dollar Index 5-minute chart had a Comber 13 sell signal:

Stock Picks Recap for 4/9/13

With each stock's recap, we will include a (with market support) or (without market support) tag, designating whether the trade triggered with or without market directional support at the time. Anything in the first five minutes will be considered WITHOUT market support because market direction cannot be determined that early. ETF calls do not require market support, and are thus either winners or losers.

From the report, KERX triggered long (with market support) and worked:

From the Messenger/Tradesight_st Twitter Feed, Rich's NEM triggered long (without market support) and worked:

His RGLD triggered long (without market support) and worked:

His AMZN triggered short (with market support) and didn't work:

His LNKD triggered short (with market support) and worked:

GOOG triggered long (without market support) and worked:

NFLX triggered long (with market support) and worked:

Rich's AMGN triggered short (without market support) and worked:

In total, that's 4 trades triggering with market support, 3 of them worked, 1 did not.

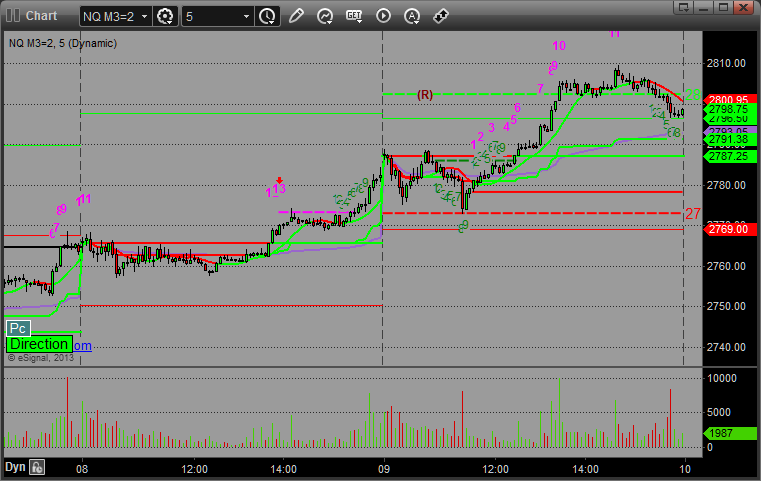

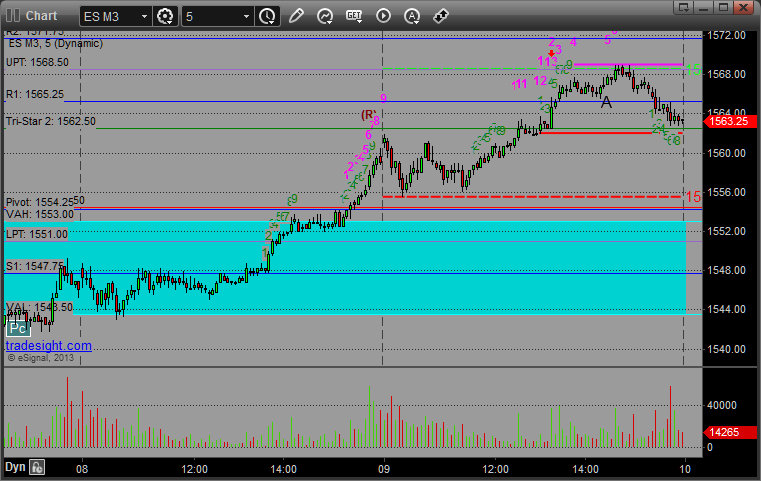

Futures Calls Recap for 4/9/13

All charts for all asset classes in our reports have been shifted to eSignal 11 screenshots effective today. There is a slightly different (but cleaner) look to these charts. They also show as EST.

Not much market volume again. Took an ES short on a Comber sell signal that didn't work, but we will discuss below. Volume was horrible again.

Net ticks: ticks.

As usual, let's start by taking a look at the ES and NQ with our market directional lines, VWAP, and Comber on the 5-minute chart from today's session:

ES:

Note that when we make calls in the Messenger, we try to keep them to calls based on the Levels with 6 ticks of risk (plus one for the spread). We don't typically make calls based on the Comber and Seeker signals because they often require a bit more finesse when it comes to the entry point (not usually a "fixed" number) and a stop (should go over the "risk" level). In this case, since volume was so bad and there wasn't anything else to call, I made a call looking to roll over after the Comber 13 sell signal. It was a short at 1565.50. That triggered at A and stopped out for the 7 ticks, but as you can see on the chart, it used the risk line perfectly and never stopped out if you used that, which is really the stop you should use on any Comber/Seeker call:

Forex Calls Recap for 4/9/13

We're changing the formats of the charts for the reports officially. Starting today, all screenshots will be taken with eSignal 11, which has a slightly different look/feel to it. In addition, I've shifted my charts to EST for consistency in all asset classes.

We closed out the second half of a winner on the GBPUSD for the session, and then had an early trigger loser and a later trigger winner on the EURUSD. See those sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

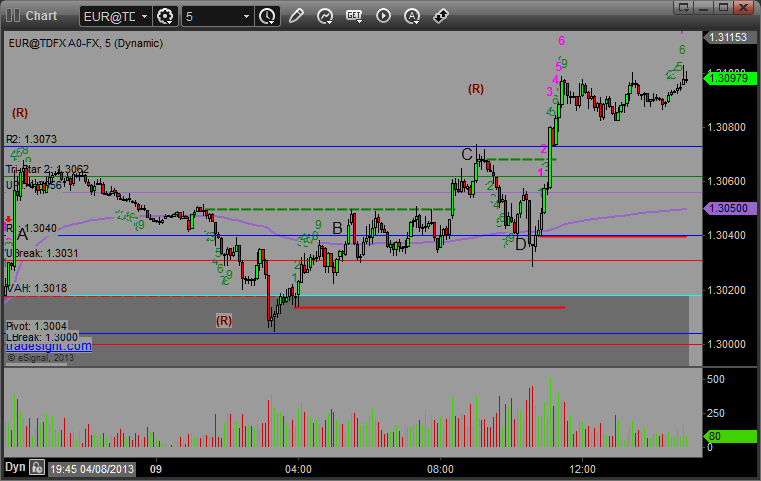

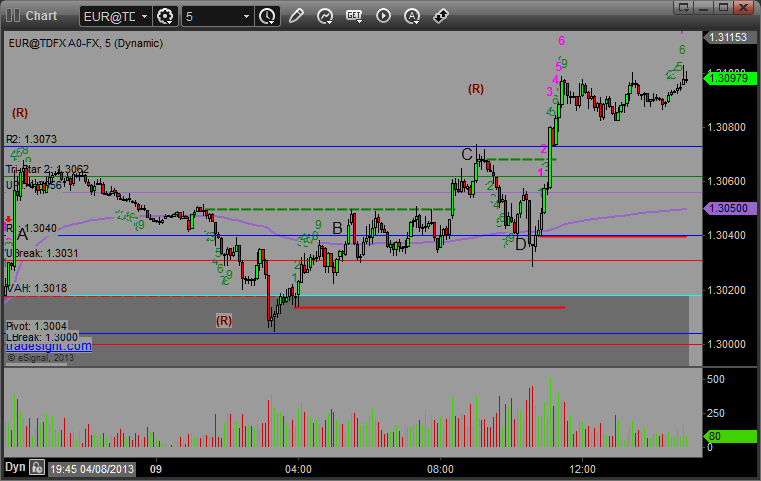

EURUSD:

Triggered long very early (half size) at A and didn't quite make it to the first target. Eventually stopped and was back under the trigger well ahead of the European session. Triggered long at B, hit first target at C, and stopped final piece under the entry at D:

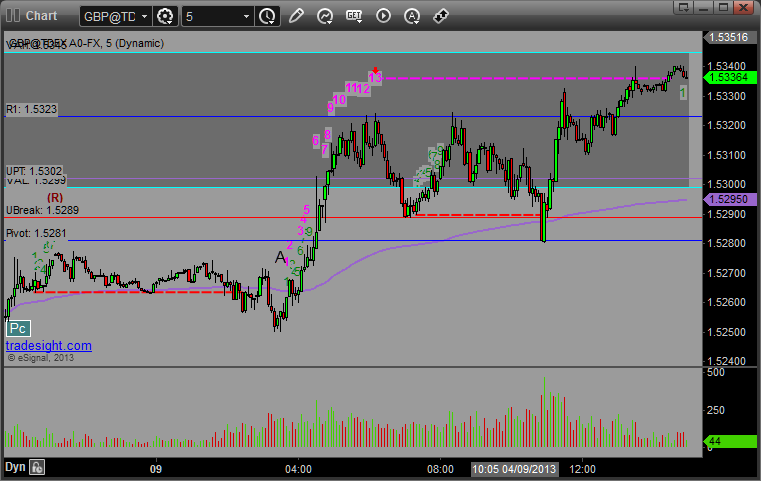

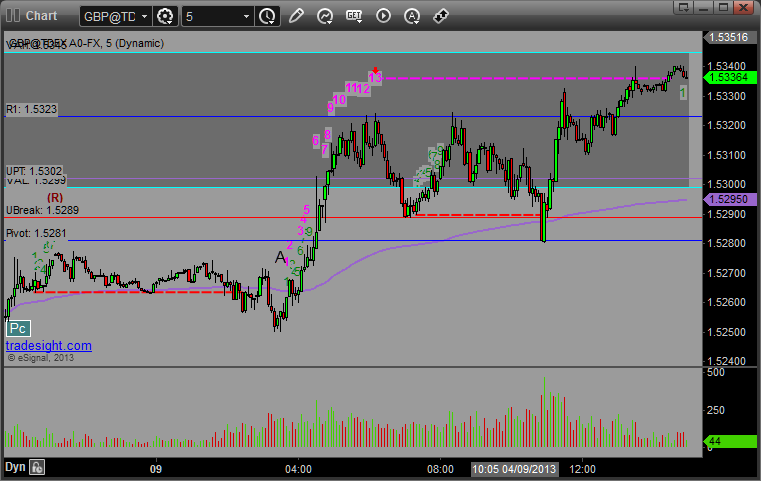

GBPUSD:

The second half of the short from the prior session stopped in the money at A:

Forex Calls Recap for 4/9/13

We're changing the formats of the charts for the reports officially. Starting today, all screenshots will be taken with eSignal 11, which has a slightly different look/feel to it. In addition, I've shifted my charts to EST for consistency in all asset classes.

We closed out the second half of a winner on the GBPUSD for the session, and then had an early trigger loser and a later trigger winner on the EURUSD. See those sections below.

Here's a look at the US Dollar Index intraday with our market directional lines:

EURUSD:

Triggered long very early (half size) at A and didn't quite make it to the first target. Eventually stopped and was back under the trigger well ahead of the European session. Triggered long at B, hit first target at C, and stopped final piece under the entry at D:

GBPUSD:

The second half of the short from the prior session stopped in the money at A: